Fees Don’t Just Fund the M&A Process - They Shape the Outcome

M&A fee models don’t just change what you pay. They shape what your advisor is incentivized to do next.

A founder told us something interesting recently:

“They ran the process for almost two months. We got two NDAs. Then they said we needed to pay a retainer to continue.”

If you’ve never sold a company, that might sound normal.

If you have, you know what it triggers instantly: wasted time and loss of control.

This is the part of M&A people don’t say out loud enough - fee models don’t just change what you pay. They shape what your advisor is incentivized to do next.

And that’s why we believe the future of M&A advisory is AI-native.

Not because AI is trendy, but because AI changes the cost structure enough that different rules of the game become viable.

What retainers are - and why they became normal

Most founders eventually learn the vocabulary:

- Retainer: a monthly or upfront fee paid during the process, whether or not the company sells.

- Success fee: a fee paid only if a deal closes.

Retainers exist for a rational reason. A sell-side process has real work up front: financial clean-up, materials, buyer research, outreach, managing NDAs, calls, Q&A, and keeping momentum while the business still has to perform.

In our CEE conversations, the numbers we’ve heard recently range from €3,000 per month up to €150k in total as a minimum retainer.

In other markets, publicly available fee guides and advisor commentary commonly cluster SMB/lower-mid-market retainers around:

- $5k-$10k per month as a common monthly work fee, and

- $25k-$50k as a common upfront engagement fee (with $25k-$100k not unusual depending on deal size and complexity).

- For some mid-market deals, however, the value can go to hundreds of thousands.

Those numbers vary, but the underlying structure is consistent: founders are asked to fund the process early, before an outcome is guaranteed.

That’s the trade: retainers shift risk from the advisor to the founder.

The question is what that does to behavior.

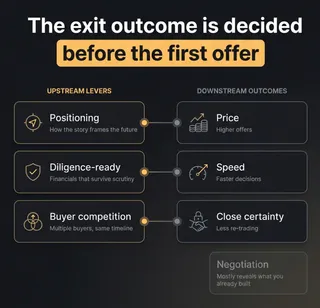

A fee model is not pricing. It’s process design.

Here’s the blunt truth: in M&A, pricing is a behavioral contract.

People optimize for what they’re paid for. Not because they’re bad. Because they’re human.

So different fee models predictably create different incentives:

Retainers aren’t automatically wrong. Success-only isn’t automatically perfect.

But each model pushes the process in a direction - especially when things get hard.

The moment founders start feeling played

The “two NDAs in 1.5-2 months” story matters because it shows a common failure pattern:

- The process moves slowly.

- The buyer funnel stays thin.

- The advisor asks for additional fees to continue.

Is that always malicious? No.

Sometimes it’s a legacy operating model: the firm can’t justify continuing without being paid because their cost base is heavy.

But for the founder, it often feels like a paywall: “We’ll show you a little progress, then you pay to see the rest.”

Now contrast that with what happened when we stepped in on that deal.

Within a few weeks, the company saw eight NDAs.

Not because NDAs are the goal. They’re not.But because NDAs are a real early signal that outreach is landing and the funnel is forming.

A well-run process builds a buyer funnel deliberately:

- Outreach to a curated list

- NDAs signed by serious parties

- First calls that surface fit and objections

- Early indications of interest and follow-up diligence

- Overlapping timelines so buyers feel the market moving

That overlap - when multiple buyers are in motion at the same time - is what creates competitive tension. Competitive tension is what gives the founder leverage on both price and terms.

And this is where pacing becomes everything.

Why AI changes the retainer debate

Traditional advisory economics were built around expensive labor - especially junior labor. Drafting, formatting, research, coordination, follow-ups, logging, and endless back-and-forth consumed weeks.

AI doesn’t replace judgment. It compresses the operational burden:

- first drafts of materials and outreach assets

- structured buyer research and matching

- process operations (tracking outreach, NDAs, scheduling, follow-ups)

- synthesizing buyer feedback into clear next steps

When the cost-to-deliver drops, the need to fund the machine with retainers drops too.

That’s the core belief we’re willing to put our name on:

AI-native advisory makes success-only pricing viable at scale - and the market will re-sort around that.

Our view on pricing: success-only is the cleanest forcing function

We charge a success fee only. No retainer.

We do that because it forces the simplest contract possible:

- If we don’t produce an outcome, we don’t get paid.

- We’re not rewarded for stretching time.

- We’re rewarded for building a real market around the company.

Founders tell us they appreciate the lack of upfront exposure because it removes a specific anxiety: “What if I pay for months and still don’t get a real shot?”

We can’t eliminate deal risk. Nobody can.

But we can remove the dynamic where the advisor makes money whether or not the process is producing real outcomes.

The fair pushback: “Success-only means you’ll push me to accept a bad deal.”

That’s a smart concern.

A success-only advisor can be tempted to optimize for a close - any close.

So the real question becomes: what guardrails exist when the first offer is not the right offer?

Our answer is that we don’t rely on good intentions. We rely on process design and transparency:

- Buyer coverage targets up front (not vague “we’ll reach out broadly”)

- A visible weekly funnel: outreach, NDAs, first calls, feedback themes

- Clear stop rules: what market signal would make us recommend pausing rather than dragging

- A disciplined timeline so buyers don’t feel like they’re the only one at the table

When the process is broad and overlapping, speed doesn’t reduce quality - it creates leverage. The founder isn’t negotiating from fatigue. They’re negotiating from options.

The part nobody likes to admit: a lot of engagements don’t close

Across market surveys and industry reporting we’ve reviewed, a recurring benchmark in SMB/lower-mid-market is that 30%-70% of engagements end without a closed transaction (it varies by segment and market cycle).

That matters because it reframes the retainer question:

If non-close risk is real - and it is - then who should carry that risk by default?

Retainers place more of it on the founder. Success-only places more of it on the advisor.

Our view is that if an advisor believes they can execute, they should be willing to carry more of that risk - especially now that AI-native delivery changes the economics.

What founders should ask in week 2-4 to avoid wasting a quarter

Regardless of who you hire, ask for a simple early dashboard.

- How many buyers have been contacted? (Not “identified.” Contacted.)

- How many NDAs are signed - and by whom? (Quality over vanity logos.)

- How many first calls are booked?

- What’s the weekly cadence? Outreach, follow-ups, buyer feedback loop.

- What’s the bottleneck right now? A serious advisor can name it.

- What happens if the process stalls? Do fees continue? Are there caps? What changes?

And if there’s a retainer:

- Is it credited against the success fee? Many are, many aren’t - the difference matters.

- Is it capped and tied to a clear term? We’ve seen models where retainers cap after 3-6 months. That shape is often healthier than “open-ended until we decide.”

These questions aren’t aggressive. They’re basic governance.

Accessibility is not a side benefit. It’s the shift.

Retainers quietly exclude a lot of great companies from running a real process - especially SMBs and founder-led businesses that don’t want to gamble cash on uncertainty.

AI-native economics make it possible to:

- serve smaller deals traditional advisors often under-resource

- move faster without turning the process into chaos

- price in a way that removes the upfront barrier

That’s not a marketing claim. It’s what happens when the underlying cost structure changes.

If you’re thinking about selling in the next 6-12 months

If an exit is on your mind - even if it’s early - we’re happy to talk through your M&A process with you.

Have a clear conversation with one of our M&A advisors about:

- what a buyer funnel should look like in the first month

- how to structure fees so you don’t pay for motion

- whether a success-only model is appropriate for your situation

If that’s useful, book a meeting with us and we’ll pressure-test it together.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.