Nordic M&A Is Polarizing: Premium Exits vs. No Exit at All

There's a shift in how Nordic exits work. Some companies are commanding premium outcomes. Many others are struggling to exit at all.

Nordic M&A Is Polarizing: Premium Exits vs. No Exit at All

The Nordic M&A market isn't slowing down. It's splitting in two.

In Denmark last year, deal sizes formed an almost perfect barbell: 34% of transactions were under €10 million, 34% were over €100 million, and the middle was squeezed to just 32%. The top five deals averaged €3 billion each - nearly eight times the overall average for disclosed transactions. Finland showed a similar pattern: half of all deals came in under €10 million, while just 10% cleared €100 million.

This isn't a temporary dip. It's a structural shift in how Nordic exits work. Some companies are commanding premium outcomes. Many others - often strong businesses with solid fundamentals - are struggling to exit at all.

The Data Behind the Split

The clearest signal comes from comparing deal counts to deal values. According to KPMG's Nordic data, the number of transactions has stayed remarkably stable: 3,694 deals in 2021, 3,481 in 2023, 3,772 in 2024. But announced deal value tells a different story: €310 billion in 2021 dropped to €134 billion in 2023 - a 54% decline in value per deal.

When volume holds steady but value collapses, it means one thing: fewer large exits are clearing, while smaller transactions continue at pace. The big outcomes are becoming rarer and more concentrated.

Norway in 2023 offered a stark illustration. Adevinta's €14 billion exit was seven times larger than the next biggest Norwegian deal that year. Remove that single transaction, and the Norwegian M&A market would have looked dramatically different. This kind of concentration - where a handful of transactions account for the vast majority of value - is now the norm, not the exception.

What's Driving the Polarization

Three forces are compressing the market into two extremes.

Buyers are more selective. The Eversheds Nordic M&A Survey found that valuation gaps were cited as the biggest challenge by 73 respondents - far ahead of any other factor. Financing constraints came in at 34, and longer completion times at 21. Buyers aren't just being cautious; they're applying stricter criteria and walking away from deals that don't clear their investment committee bar. Due diligence has deepened, timelines have extended, and "good enough" no longer gets deals done.

The IPO path has effectively closed for most companies. Norway had 19 listings across its marketplaces in 2024, but only one was a traditional IPO on the main market. In the first half of 2025, that number dropped to six total listings, with just one qualifying as a "real" IPO. Sweden accounted for 23 of the Nordics' 36 IPOs last year - meaning if you weren't positioned for the Swedish market specifically, the public exit route was largely theoretical.

Cross-border buyers are driving value, but not volume. In Norway's first half of 2025, Nordic buyers accounted for 86% of deal volume but only around 43% of deal value. The premium exits are increasingly going to companies that attract international capital. Businesses that can only appeal to domestic or regional buyers are competing in a smaller, more crowded pool.

What Separates Premium Exits from No Exit

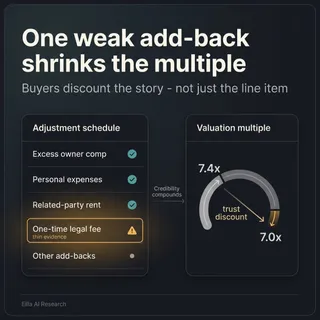

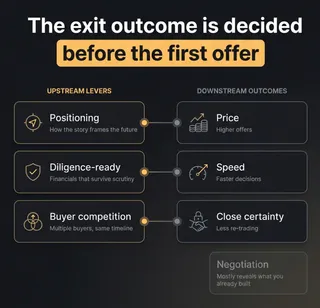

The differences aren't always about fundamentals - they're often about positioning and process readiness.

Companies that exit at premiums typically share a few characteristics: they have a buyer universe that extends beyond the Nordics, they've built materials and data rooms that meet international buyer expectations, and they're willing to consider structures like earn-outs or reinvestment when valuation gaps exist.

Companies that stall often look strong on paper but share common vulnerabilities: their realistic buyer set is limited to domestic strategics who may be sitting on the sideline, they've positioned themselves for an IPO that isn't coming, or they're anchored to 2021 valuations and unwilling to bridge the gap.

The Eversheds survey found that around 41% of respondents expect seller financing to become more common, and 44% expect reinvestments to increase. CMS data shows earn-outs were used in 23% of European deals in 2023. The market is telling founders: flexibility on structure is increasingly the price of liquidity.

The Anchoring Trap

Treating their 2021 valuation - or the multiple a competitor achieved two years ago - as a floor is a mistake. The market has moved. Buyers know it. Sellers often don't, or don't want to accept it.

This isn't irrational behavior. It's human. When you've spent years building a company, the number you've had in your head becomes an anchor. But when buyers can't underwrite that number with today's financing terms and today's risk appetite, processes drag. And in a market where windows open and close quickly, time killed is often window lost.

The data supports this. Roland Berger reports that Nordic PE funds have adapted their capital structures - using more equity, more private credit, more co-investment - but they're also holding assets longer. When exit timing assumptions from 2021 meet 2024 financing reality, deals don't just get delayed. They fail to happen.

Is This Just Cyclical?

A reasonable objection: markets cycle. Valuations compress and expand. Isn't this just a temporary correction that will normalize?

Some of it is cyclical. Rate moves have tightened financing and made buyers more cautious. That will partially reverse as conditions ease. But the structural elements - deeper diligence expectations, the importance of cross-border positioning, the near-closure of IPO as a viable path for most companies, the concentration of value in fewer deals - these appear more durable.

The Nordics had 71 buyout exits in 2024, 15% below the 2019-2023 average. More tellingly, the mix has shifted: trade sales accounted for 40% of exits, while secondary sales (sponsor-to-sponsor) hit 37%. When more than a third of exits are one financial buyer selling to another, the market is telling you something about how premium outcomes are being generated - and it's not through "wait for the IPO window."

What This Means for Founders Considering an Exit

If you're thinking about an exit in the next 12-24 months, the question isn't whether the market is good or bad. It's which side of the polarization you're positioned for.

A few questions worth asking honestly: Is your realistic buyer universe mostly Nordic, or genuinely international? Are you priced for today's buyer expectations, or for 2021? Would you accept structures that bridge a valuation gap, or is your number your number?

The companies getting premium exits today aren't necessarily better businesses than those that aren't. They're better positioned for how the market actually works right now.

If you're uncertain where you stand - or want to pressure-test your assumptions before committing to a process - that's the kind of conversation we have with founders regularly. If you're considering and exit and would like to touch base with use - book a meeting with one of our M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.