The Complete Valuation Playbook for Facilities Management Software Businesses

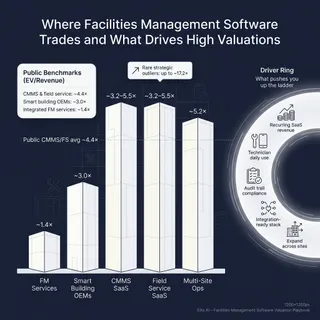

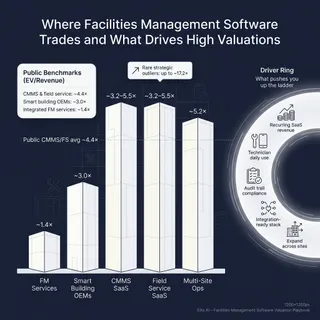

A valuation playbook for facilities management software founders - showing what buyers actually pay and what moves multiples.

A valuation playbook for facilities management software founders - showing what buyers actually pay and what moves multiples.

A valuation playbook for construction software founders on what buyers actually pay and what drives higher multiples.

A practical valuation guide for Financial Management Software founders on what drives valuation multiples.

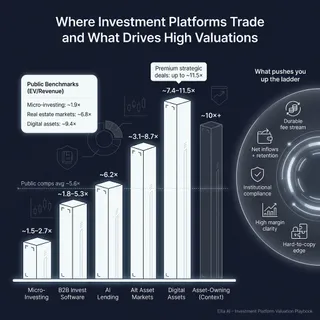

A data-driven guide to how investment platform businesses are valued and how founders can improve outcomes.

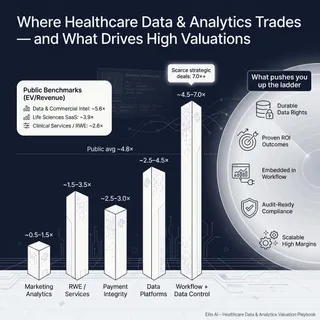

A sector-specific valuation playbook for healthcare data and analytics businesses.

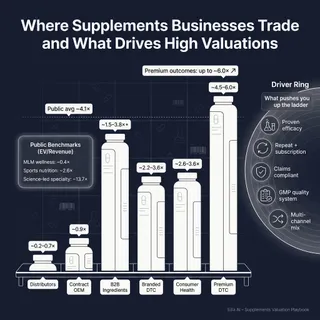

A valuation guide for supplements founders showing what real buyers pay and what drives premium multiples.

A guide for compliance management software founders to benchmark valuation ranges and boost outcomes.

A sector-specific playbook showing what project management software businesses sell for and what drives higher multiples.

A voluation playbook on what property management software businesses sell for and what drives higher multiples.

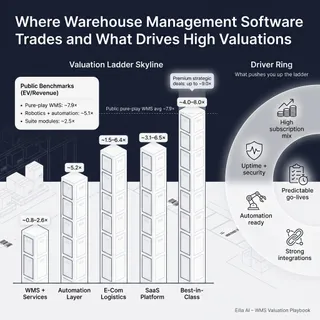

A data-driven playbook for WMS founders on what buyer actually pay and how to improve in the next 6-12 months.

A practical guide to valuing inventory management software companies - with multiple ranges, key value drivers, and a clear plan to raise your outcome before selling.

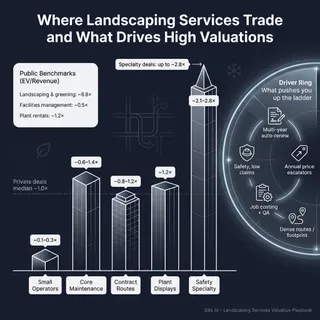

A data-driven valuation playbook for landscaping services founders.