The Complete Valuation Playbook for Accounting Software Businesses

A data-driven breakdown of how accounting software businesses are valued today

If you run an accounting software company, you’re in one of the most active M&A pockets in software right now. Cloud accounting, AP/AR automation, e-invoicing, .and financial management platforms are seeing steady consolidation from strategics (Intuit, Xero, Visma, Sage, IRIS, etc.) and increasingly from private equity funds building platforms around the office of the CFO.

If you’re thinking about selling, valuation is probably your biggest question:

- What are businesses like mine actually selling for?

- Why did that competitor get 6–7x revenue when others barely cleared 3x?

- What could I realistically improve before going to market?

This playbook is designed to answer those questions by anchoring on real private and public data from recent deals in accounting and finance software, explain what pushes multiples up or down, walk through a worked valuation example on a fictional USD 10m revenue business, and give you a practical self-assessment and 6–12 month action plan.

1. What Makes Accounting Software Unique

“Accounting software” is a broad label. Buyers slice this space into several sub-segments, each with slightly different valuation behaviour:

- SMB cloud accounting & back-office SaaS:

Tools like general ledger, invoicing, payroll, and back-office automation for small businesses and practices. (Think QuickBooks-/Xero-like, but more niche or regional.) - AP/AR automation, payments & e-invoicing platforms

Specialized tools that handle payables, receivables, invoice exchange, and sometimes embedded payments. - Mid-market cloud financial management & ERP platforms

Broader financial suites or vertical ERPs with accounting at the core. - Regional accounting/ERP vendors

Often strong local players in specific countries/regions, usually with a mix of legacy and cloud. - Services & consulting-oriented enterprise software

Implementation partners, outsourced finance providers, or software + services models around financial processes.

Why valuation here is not generic

A few features of this sector make valuation different from, say, generic project management tools:

- Mission-critical workflows

You sit at the heart of how money is booked, reported, and often moved. Buyers pay more for systems that are hard to rip out once embedded. - Regulation and localisation

Tax and accounting rules vary by country. Products deeply localised (e.g. GST in India, e-invoicing regimes in the EU, Saudi e-invoicing, etc.) can be very defensible - but also add product and compliance complexity. - Channel and ecosystem dependencies

Many products are wrapped around ecosystems (e.g. Salesforce-native accounting, Microsoft Dynamics / Business Central, NetSuite, or accountant-led distribution). These ecosystems heavily influence who might buy you and at what multiple. - Services mix

Implementation, migration, and outsourcing work are often bundled with software. High-margin recurring SaaS is valued very differently to project-based services, even if total revenue is similar. - Customer concentration & stickiness

Accounting software is famously sticky - if your customers run their month-end and tax filings on you, churn can be low. But if you’re a “nice-to-have” reporting or add-on tool, stickiness can be weaker and multiples drop fast.

Key risk factors buyers always check

Expect every serious buyer to drill into:

- Quality and durability of recurring revenue

True subscription vs usage-only vs one-off licence + maintenance. - Regulatory and compliance risk

Are you actually compliant in every country you serve? Any exposure if rules change? - Platform dependency

How exposed are you to one ecosystem (QuickBooks, Xero, Microsoft, local tax authorities’ APIs)? - Data security & auditability

You handle financial data; any security or audit issues can be valuation killers. - Key-person risk

Is product knowledge concentrated in a few founders/early engineers or is there a stable team?

2. What Buyers Look For in an Accounting Software Business

At a high level, buyers care about the same basics you’d expect in any software deal:

- Scale of revenue (how big you are today).

- Growth rate (how fast you’re growing).

- Profitability (or credible path to it).

- Quality and predictability of revenue.

But in accounting software, they apply a very specific lens.

Core things most buyers focus on

- Recurring vs non-recurring mix Pure subscription or contractual recurring revenue will always attract better multiples than licence + maintenance, one-off projects, or ad-hoc services.

- Customer segments and use cases

- Deeply embedded in SMB accounting workflows (GL, payroll, compliance) can be very attractive thanks to stickiness and cross-sell potential.

- Vertical or regulated niches (non-profit fund accounting, public sector, IFRS 16 lease accounting, etc.) can command premiums due to limited competition and specialised know-how.

- Unit economics & margins

- Gross margins above ~70% and limited services drag are a strong positive signal.

- Heavy implementation or outsourcing revenue with 30–40% gross margins drags multiples down.

- Retention and net revenue expansion

- Buyers care more about whether customers stay and pay more over time than about growth from constant new-logo acquisition.

- Product architecture & integration

- Cloud-native, API-first, multi-entity, multi-country support is a plus.

- Heavy legacy on-prem or outdated tech stacks require more capex post-deal and lower valuation.

How strategic buyers think

Strategic buyers (e.g. larger software vendors, payroll players, banks/fintechs, regional champions) ask:

- Does this help us own more of the finance stack for our target segment?

- Does it give us new geographies, verticals, or distribution channels (e.g. accountants, banks)?

- Can we bundle this into our existing suite and push ARPU up?

- Can we eliminate a competitor or accelerate a roadmap by 3–5 years?

If the answer is “yes” on several of these, you move towards the top end of valuation ranges.

How PE buyers think

Private equity buyers are more formulaic. They look at:

- Entry multiple vs target exit multiple

- If they buy you on 4.5x revenue, can they credibly exit at 6–7x after scale, roll-ups, and margin improvements?

- Levers they can pull over 3–7 years:

- Price optimisation (e.g. pushing ARPU via packaging and upsell).

- Sales efficiency and go-to-market improvements.

- M&A roll-up: bolt-on acquisitions to expand product, geography, or segment.

- Cost efficiency: streamlining G&A, rationalising overlapping products.

- Exit routes Who will buy this from them later? A strategic consolidator, a larger PE fund, or public markets? The clearer the future buyer set, the more confident they are on paying a higher multiple today.

3. Deep Dive: Revenue Quality and Services Mix – The Biggest Valuation Swing Factor

One of the most important nuances in accounting software valuation is how much of your revenue is high-margin, recurring software vs lower-margin, one-off or services revenue.

Two businesses can both be at USD 10m revenue, but if one is 90% SaaS with 80% gross margins and the other is 40% SaaS / 60% implementation & consulting at 40% gross margins, the first will usually command a much higher multiple.

What the data shows

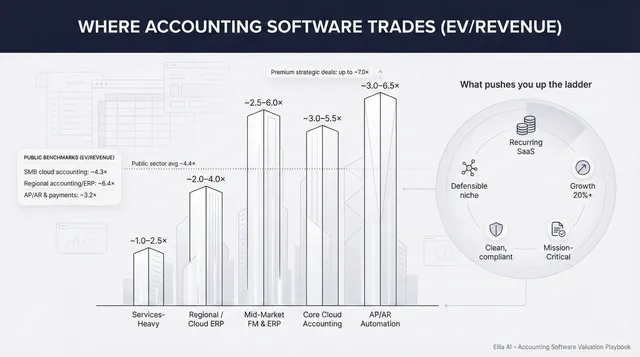

Looking across private deals and public comps:

- Pure or high-SaaS players in accounting and AP/AR automation often trade and transact in a ~3.0–6.0x EV/Revenue band, sometimes higher when growth and margins are strong.

- Services-heavy or implementation-heavy models tend to be closer to 1.0–2.5x revenue in private transactions, even when total revenue is similar, because buyers effectively “look through” low-margin revenue and focus on the annuity.

Why buyers care

- Services revenue is harder to scale without adding headcount.

- Margins are structurally lower and more volatile.

- Buyers want to pay a high multiple for cash flows they can grow without proportionally increasing cost.

How to move from low-value to high-value profile

You usually can’t flip a switch, but over 6–24 months you can:

- Productise implementation Turn custom projects into fixed-scope packages, templated configurations, or guided onboarding. This raises implementation margin and makes revenue more predictable.

- Shift to subscription where possible

- Convert maintenance/upgrade fees into clear subscription tiers.

- Introduce add-on modules (e-invoicing, advanced reporting, analytics, payroll, FP&A) with recurring upsells.

- Invest in in-product onboarding and support Better docs, training, partner ecosystems, and self-serve features reduce the need for billable support.

A simple “before vs after” view:

If you recognise yourself mainly in the left column but want top-quartile multiples, closing that gap is often priority #1.

4. What Accounting Software Businesses Sell For - and What Public Markets Show

This section translates the numbers into plain language. All ranges below are illustrative, not a formal valuation opinion, but they reflect patterns seen in recent public trading multiples and private deals across accounting and finance software.

4.1 Private Market Deals (Similar Acquisitions)

Private deals are usually not public about exact multiples, but where revenue is disclosed, several patterns emerge:

- Core cloud accounting and SME-focused SaaS: B2B payments/invoicing and others often imply EV/Revenue in the mid-single digits, typically ~3.0–6.5x, with the higher end reserved for:

- Strong growth,

- High recurring revenue,

- Mission-critical workflows, and

- Strategic acquirers (Visma, Exact, Amadeus, etc.) paying up.

- AP/AR automation & e-invoicing: deals show a wide band, but good assets land around ~3.0–7.0x revenue, occasionally more when revenue is substantial and strategic value is high.

- Mid-market & enterprise financial management SaaS: platforms often transact in the ~2.5–7.0x revenue range depending on vertical focus, growth, and profitability.

- Services & implementation-heavy partners: finance/ERP outsourcing and implementation firms are commonly closer to ~1.0–2.5x revenue because buyers are effectively paying for cash-generating service lines, not scalable product IP.

A simplified view:

Remember: where EBITDA is positive and healthy (20%+ margins), EV/EBITDA can also be a cross-check. For solid, profitable accounting software, you often see low-20s to low-30s EV/EBITDA in quality assets; services-heavy firms can be lower teens or single-digit.

4.2 Public Companies

Public markets give you a live “upper bound” reference for what the best, scaled players are worth.

From the grouped data for listed companies in and around accounting software (as of ~2025):

These are large, diversified businesses. When you compare your company to them, keep a few principles in mind:

- Public leaders enjoy scale, liquidity, and diversification, so private sellers usually see a discount to these multiples, especially below USD 50–100m revenue.

- If you’re profitable, growing fast, and strategically important, your multiple can sit closer to these bands.

- If you’re sub-scale, slower-growth, or services-heavy, your valuation is more likely to be materially below the public averages.

Think of these public multiples as reference posts, not price tags.

5. What Drives High Valuations (Premium Valuation Drivers)

Here’s where we translate the data and buyer behaviour into a clear checklist of what pushes you towards the higher end of those ranges.

1) High-quality recurring revenue

Buyers pay a premium when:

- 80–90%+ of revenue is contracted recurring (subscription, term licences with strong renewals).

- Churn is low and net revenue retention is healthy (e.g. customers expand over time).

Why? Because this makes future cash flows more predictable and reduces the risk of revenue disappearing post-acquisition.

Practical moves:

- Migrate legacy perpetual licences into subscription where possible.

- Reduce exposure to one-off implementation fees as % of total revenue.

2) Strong growth on a meaningful base

A 40% growth rate on USD 1m is less interesting than 25% growth on USD 10m. Buyers look at both the percentage and the absolute dollar growth.

Premium profiles usually have:

- Double-digit growth (often 20%+).

- Clear growth levers ahead: new modules, geographies, verticals, or channel expansion.

Practical moves:

- Document and demonstrate where growth is coming from (segments, cross-sell, geographies).

- Cleanly separate organic growth from any inorganic (M&A) in your reporting.

3) Mission-critical workflow depth

Platforms that sit at the core of accounting operations command higher multiples than tools at the edge. Examples:

- Systems used to submit statutory reports, manage ledger, or process payroll accurately and on time.

- AP/AR platforms that actually move money and integrate deeply with ERPs and banks.

- Specialized compliance modules (IFRS 16, multi-entity consolidation, tax compliance, etc.) that are hard to replicate.

Practical moves:

- Show exactly how your product is embedded in daily, monthly, and year-end workflows.

- Highlight where customers would face operational or regulatory pain if they tried to switch.

4) Attractive unit economics and services mix

From the deep dive:

- High gross margins (70–85%+) and a balanced services mix (≤20–25% of revenue from low-margin services) are clear green flags.

- Efficient customer acquisition (reasonable payback periods, even if you don’t express it in “LTV/CAC” jargon) also helps.

Practical moves:

- Raise prices where justified (particularly under-monetised modules).

- Productise and streamline services; focus your team on repeatable, scalable engagements.

5) Defensible market position and focus

Premium valuations tend to flow to businesses that are:

- Category leaders in a clear niche (e.g. non-profit accounting, lease accounting, a particular region’s tax regime).

- Deep in one ecosystem (e.g. “the” go-to accounting add-on in a large platform marketplace).

- With a strong brand and trusted relationships with accountants or channels.

Practical moves:

- Clarify your “wedge”: who do you serve better than anyone else?

- Collect and present evidence — win-rates, NPS, partner endorsements, awards.

6) Clean financials and low risk

Even great businesses lose value if the financial picture is messy.

Premium deals often feature:

- Clean, auditable revenue recognition and consistent accounting policies.

- No nasty surprises in tax, IP ownership, or compliance.

- Clear evidence that reported metrics (MRR, churn, ARR) reconcile to financial statements.

Practical moves:

- Run an internal or light external “pre-sale” financial clean-up.

- Fix known issues before you invite buyers to diligence.

6. Discount Drivers (What Lowers Multiples)

Now the other side of the coin: why some businesses transact at the low end of the range (or below).

Common discount drivers in accounting software include:

- Low or unclear recurring revenue

- High share of project/services income with no ongoing commitment.

- Difficult for buyers to separate one-offs from true recurring revenue.

- Weak growth or declining segments

- Flat or single-digit growth with no clear strategy to re-accelerate.

- Exposure to shrinking tech stacks (e.g. legacy on-prem platforms with no cloud roadmap).

- Heavy dependence on a few customers or a single channel

- One or two large enterprise clients making up 30–40%+ of revenue.

- Reliance on a single reseller or accountant network without diversification.

- High churn or short contract terms

- Annual logo churn in the teens or higher without explanation.

- Month-to-month contracts in segments where competitors lock in multi-year terms.

- Messy product architecture / tech debt

- Outdated codebase, limited APIs, fragile integrations.

- Buyers anticipate high post-deal capex and discount the price.

- Regulatory and security risk

- Poor handling of tax/regulatory changes.

- Lacking certifications or weak security protocols in a finance-sensitive segment.

- Unclear or overstated financials

- Inconsistent ARR numbers vs financial statements.

- Adjusted EBITDA that strips out too many “one-time” items.

None of these are automatic deal-killers, but they pull your multiple down unless mitigated or transparently explained.

7. Valuation Example: A Fictional Accounting Software Company

To make this concrete, let’s walk through a fictional example.

Meet “LedgerFlow” (fictional)

- Business: Cloud accounting platform for multi-entity SMEs and mid-market groups, with strong consolidation and reporting tools.

- Revenue (fictional): USD 10m current run-rate.

- Revenue mix: 85% SaaS, 15% implementation services.

- Growth: 25% year-on-year.

- Gross margin: 78%.

- EBITDA: Slightly positive, reinvesting in growth.

- Customers: 1,000+ customers, good spread across regions, no one customer >3% of revenue.

This company is not real and the numbers below are illustrative, designed to show how valuation logic works - not to produce a formal fairness opinion.

Step 1: Choose relevant comps and a core multiple range

Based on our sector data, LedgerFlow sits in between:

- SMB cloud accounting & back-office SaaS, and

- Mid-market cloud financial management / consolidation platforms.

Public comps in those segments trade at around 4.0–4.3x EV/Revenue on average, with some higher-growth or regional winners above that. Private deals for comparable assets cluster around ~3.0–6.0x revenue, with the best businesses and highly strategic deals occasionally above 6x.

Given LedgerFlow’s profile (good growth, high recurring %, strong margins, but still relatively small at USD 10m), we might start with a core private-market range of ~4.0–5.5x revenue as a rational anchor.

Step 2: Adjust for premium and discount factors

Premium factors LedgerFlow has:

- 85% recurring SaaS.

- 25% growth on a meaningful base.

- High gross margin (~78%).

- Low customer concentration.

- Mission-critical financial close and consolidation workflows.

Potential discount factors:

- Still small (USD 10m) vs public leaders at hundreds of millions or billions.

- Product footprint might be narrower than full-suite ERP players.

- Some implementation dependency in complex deployments.

Realistically, buyers might view LedgerFlow something like:

- Conservative / lower end: 3.5x revenue

- Assumes buyer is cautious on growth durability, sees some execution risk, or uses it more as a bolt-on rather than a core platform.

- Core range: 4.0–5.5x revenue

- Reflects the heart of the market for this profile given current sector data.

- Premium case: ~7.0x revenue

- Achievable if there is a very strong strategic fit (e.g. a large ERP vendor that sees LedgerFlow as the missing cloud consolidation layer) and if competitive tension in a sale process is high.

Step 3: Translate multiples into enterprise value

On USD 10m revenue:

This a worked example to show how the same USD 10m in revenue can be worth USD 35m in one set of hands and USD 70m in another, depending on:

- Who the buyer is.

- How strong your premium drivers are.

- How competitive and well-run your sale process is.

8. Where Your Business Might Fit (Self-Assessment Framework)

Here’s a simple tool to help you roughly place yourself on the valuation spectrum.

Score each factor from 0 to 2:

- 0 = weak or negative,

- 1 = average,

- 2 = strong.

Interpreting your score (out of 24):

- 18-24: You likely sit closer to premium multiples for your size and segment – think upper half of the ranges in Section 5, potentially competitive tension around your process.

- 11-17: You’re in the core market band – solid asset, with room for narrative and minor improvements to push you up.

- 0-10: There is probably significant value to unlock by improving fundamentals before running a full process (or at least by framing the story carefully).

9. Common Mistakes That Could Reduce Valuation

Some valuation drag is structural (e.g. legacy tech), but a lot of value is lost due to avoidable mistakes.

- Rushing the sale

Entering a process without cleaned-up metrics, a clear narrative, or basic data room preparation leads to confusion, slower buyer work, and lower offers. - Hiding problems

Trying to “gloss over” churn, outages, tax issues, or product gaps is almost always worse than being upfront. Due diligence will surface issues; if buyers feel misled, they react with price chips or walk away. - Weak financial records

Inconsistent revenue recognition, missing cohort data, and messy ARR bridges force buyers to assume the worst. This is particularly damaging when simple clean-ups could have fixed it. - Not separating software from services

Bundling everything into a single revenue line hides how valuable your SaaS is. Buyers then benchmark you as a services firm and anchor their multiple lower. - Lack of a structured, competitive sale process

Running an informal, one-buyer negotiation often leaves meaningful money on the table. Research across sectors shows that structured, competitive sale processes with experienced advisors typically lead to materially higher purchase prices (around 25%) versus one-off inbound deals. - Revealing your target price too early

If you tell buyers “we’re looking for USD 20m” they will anchor there. You’ll get offers at USD 20–21m instead of discovering whether the market would have paid USD 30m+. - Ignoring regulatory risk

Ignoring upcoming regulatory changes (e-invoicing, tax rules) that affect your roadmap and cost base. - Ignoring the importance of integrations

Neglecting key integration partners or marketplaces just as acquirers are valuing ecosystem presence highly.

10. What Accounting Software Founders Can Do in 6-12 Months to Increase Valuation

You probably don’t have time for a full strategic reset before a sale - but you can move the needle if you focus on the right levers.

A. Improve the numbers (within reason)

- Tidy the revenue mix

- Where possible, convert recurring maintenance and support into clearer subscription tiers.

- Package implementation into high-margin, productised services and de-emphasise custom work.

- Lift gross margin by a few points

- Standardise implementation playbooks.

- Reduce manual support by improving onboarding journeys, help centre content, and partner training.

- Stabilise churn and demonstrate retention

- Identify at-risk cohorts and run targeted save programs.

- Lock in key customers with multi-year terms in exchange for modest discounts or value-add features.

Even modest improvements here can shift you from “average” to “upper-middle” in buyer eyes.

B. Strengthen the narrative and reduce perceived risk

- Clarify your strategic position

- Define your core ideal customer profile (ICP) and where you win.

- Map how your product fits alongside other tools in the accounting stack.

- Clean up technical and regulatory risk

- Address known security gaps, certifications, or codebase issues that are likely to come up in diligence.

- Document how you handle key regulations (tax rules, e-invoicing, data residency).

- Prepare a data-backed story

- Cohort charts, retention curves, ACV by segment, payback periods – all in simple visuals.

- This builds confidence and shortens diligence.

C. Get “data-room ready” early

- Financials: 3–5 years of clean P&L, balance sheet, cash flow, and revenue breakdowns (by product, segment, geography).

- KPIs: ARR/MRR, churn, expansion, cohorts, gross margin, customer counts.

- Legal/HR: Contracts, IP assignments, employment agreements, option plans.

11. How an AI-Native M&A Advisory Helps

Selling an accounting software business is not just about “finding a buyer.” It’s about finding the right buyer set, crafting the right story, and running the right process - all while you still have a company to run. This is where an AI-native M&A advisor like Eilla AI can tilt the odds in your favour.

1) Broader buyer reach

AI allows us to map a far wider buyer universe than a traditional rolodex approach. Instead of calling the same 20 names everyone else does, we can identify hundreds of qualified acquirers based on:

- Deal history in accounting and finance software.

- Company strategic fit based on plausible investment theses

- Financial capacity and appetite for your size and profile.

More relevant buyers means more competition, stronger offers, and a higher chance the deal closes even if one buyer drops late in the process.

2) Initial offers in under 6 weeks

AI doesn’t replace human judgement, but it accelerates the process:

- Auto-matching your profile with likely buyers.

- Drafting process marketing materials and deal teasers.

- Structuring and analysing inbound interest and early offers.

The result is that you can often move from “we’re thinking about selling” to serious conversations and initial offers in well under the timelines of a traditional, manual-only process, without sacrificing quality or thoroughness.

3) Expert advisory, enhanced by AI

Behind the AI, you have experienced human M&A advisors driving your process - people with decades experience who understand the thinking of strategic and PE buyers.

You get Wall Street-grade advisory quality - professionally prepared materials, a narrative that speaks your buyers’ language and due diligence support - without traditional “bulge bracket” costs or bureaucracy.

If you’d like to understand how an AI-native process could support your exit - book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.