The Complete Valuation Playbook for Booking and Reservations Software Businesses

A valuation guide to what booking and reservations software businesses really sell for.

If you run a booking and reservations software business and you are thinking about a sale in the next 1-12 months, you are walking into a market where outcomes vary wildly - even for companies with similar revenue.

That is not because buyers are irrational. It is because this sector sits at the intersection of software, distribution, and revenue generation. When you look “mission-critical” and sticky, buyers pay up. When you look like a replaceable booking widget or a services-heavy agency tool, multiples compress fast.

This playbook is built for founders and CEOs in booking and reservations software. It will (1) show what similar businesses actually sell for, (2) decode what drives higher vs lower multiples, and (3) give you a practical self-assessment plus a 6-12 month action plan.

1. What Makes Booking and Reservations Software Unique

Booking and reservations software looks like “just SaaS” on the surface, but buyers treat it as something more specific: it is software that sits directly on top of revenue.

Most businesses in the sector fall into a few common shapes:

- Hospitality booking and channel management SaaS: booking engines, channel managers, direct booking tools, property distribution, guest comms.

- Tours, activities, attractions, and venue ticketing/experience platforms: ticketing, queuing, on-site ops, experience management.

- Travel tech infrastructure and analytics: demand data, pricing intelligence, performance analytics, distribution plumbing.

- Travel aggregators and marketplaces: demand aggregation and distribution (often with meaningful services or marketing spend).

- Hospitality POS and venue ops adjacencies: on-site operational systems that may include booking, but often behave like a different category in valuation.

A few valuation realities are unusually important here:

- Distribution is part of the product. Integrations into channels, PMS/POS systems, payment rails, and partner ecosystems can be a real moat - or a mirage if they do not drive retention and revenue.

- Software vs marketplace matters. Marketplaces can trade high publicly, but private buyers discount them heavily if growth depends on paid acquisition or low-margin take rates.

- “Revenue impact” features change the buyer’s mindset. Yield management, dynamic pricing, conversion optimization, and analytics that drive measurable uplift tend to re-rate a company from “tool” to “revenue engine.”

- Seasonality and concentration are common. Many end-markets (tours, attractions, hospitality) are seasonal, and customer bases can be concentrated by geography, vertical, or a few large accounts.

Risk factors buyers will always pressure-test in this sector:

- Customer stickiness: churn, retention, contract terms, and switching costs (integrations and operational dependency).

- Channel and platform dependency: reliance on a few OTAs, app stores, payment providers, or PMS partners.

- Data security and reliability: downtime, incident history, and data handling (especially where payments and identity are involved).

- Services intensity: if implementations and custom work drive delivery risk, buyers underwrite lower multiples.

2. What Buyers Look For in a Booking and Reservations Software Business

Buyers usually start with the obvious: revenue scale, growth rate, gross margin, and profitability (or credible path to it). But in booking and reservations software, they quickly move to a second layer of questions that determine whether you look like a premium asset or a “fine business at a fair price.”

The “software quality” questions buyers ask

- How recurring is your revenue, really? Not just “subscription vs usage,” but whether the revenue renews predictably and expands over time.

- How embedded are you in daily operations? If your tool touches inventory, pricing, guest communications, staff workflows, and payments, buyers assume higher stickiness.

- Do customers grow with you? Buyers love expansion - additional locations, additional modules, higher transaction volume, higher pricing tiers.

The “revenue engine” questions buyers ask

- Can you prove ROI in dollars? “We improved revenue per available slot” beats “customers like the UI.”

- Do you control, influence, or optimize pricing and conversion? Yield management and conversion tools move you closer to the premium end of the market.

The “distribution defensibility” questions buyers ask

- How strong is your integration network? Breadth matters, but dependence matters more: do those integrations reduce churn and increase adoption?

- Are you a hub in the ecosystem? Buyers pay for platforms that sit between multiple systems and orchestrate operations, not for point solutions that can be replaced.

How private equity (PE) thinks about your business

PE buyers usually underwrite your business as a 3-7 year hold. They care about three things:

- Entry multiple vs exit multiple

- They want confidence that they can sell to a larger buyer later at an equal or higher multiple.

- That means they care deeply about whether you are “category-leading” in a niche and whether your revenue is durable.

- Who they can sell to later

- Strategics (hotel tech suites, venue systems, PMS/POS platforms, travel infrastructure companies) often pay for synergy and product fit.

- Larger PE funds will pay for scale, margin, and predictable retention.

- What levers they expect to pull

- Price increases (if you have pricing power and clear ROI).

- Cross-sell (more modules, more locations, more usage).

- Operational efficiency (reduce service burden, standardize onboarding).

- Selective add-on acquisitions (buy small competitors or adjacent products if the market is fragmented).

3. Deep Dive: Integrations and Yield Features - The Difference Between “Tool” and “Platform”

In booking and reservations software, the single biggest valuation question often boils down to this:

Are you a replaceable booking interface, or are you the operational platform that revenue runs through?

Two factors tend to decide how buyers answer that: integration depth and yield/revenue management embedded in workflows.

How this shows up in the deal patterns

Across the deals and commentary, premiums cluster where products are deeply vertical, integrated into broad ecosystems, and directly tied to revenue outcomes. Integration breadth shows up repeatedly as a “moat,” and yield/revenue management shows up as the kind of feature that makes ROI obvious and pricing power real. Examples in the data point to integration-heavy, vertically anchored platforms being associated with premium outcomes, while thinner tools and services-heavy models anchor the lower ranges.

Why buyers care

- Integrations create switching costs. Once you are connected to PMS/POS, channel managers, payment providers, and operational tools, replacing you becomes painful.

- Yield features prove you pay for yourself. If your system can help a hotel, tour operator, or venue earn more per booking or raise utilization, buyers underwrite lower churn and higher pricing.

- Platforms scale better than projects. A product that works “out of the box” across many customers without heavy services is worth more than one that relies on custom work to deliver outcomes.

How to move from the “worse” version to the “better” version

If your company is more “tool-like” today, you do not need a massive pivot to improve the story before a sale. You need proof.

- Turn integration count into integration impact

- Show what percent of customers use key integrations.

- Show churn differences: “Customers with 2+ integrations churn X% less.”

- Show revenue expansion differences: “Customers using channel + payment modules expand faster.”

- Productize yield and revenue outcomes

- Even simple yield levers (dynamic availability rules, price tiers, upsell flows, conversion optimization) can be framed as revenue management if you quantify the impact.

- Package analytics as paid modules, not free dashboards.

A simple profile comparison:

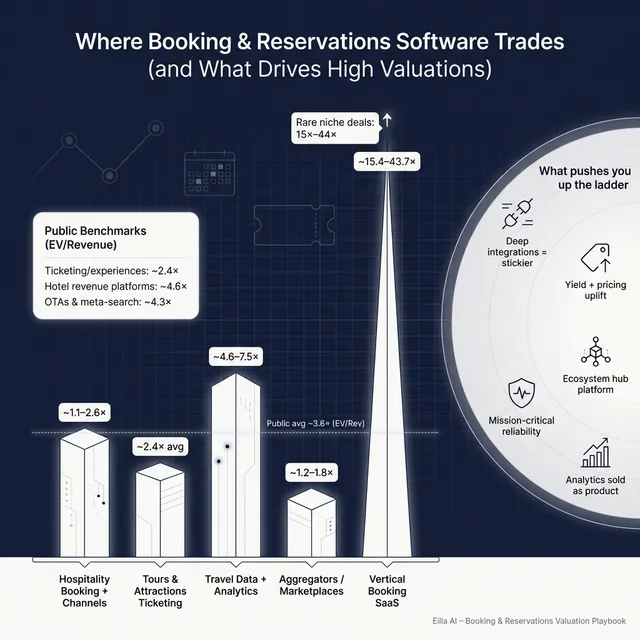

4. What Booking and Reservations Software Businesses Sell For - and What Public Markets Show

Here is the key truth: this sector has a very wide valuation spread. Public markets show everything from sub-1.0x revenue for services-heavy or slower-growing models to mid-to-high single-digit revenue multiples for higher-growth, software-heavy platforms. Private deals also span from low single digits to very high multiples in niche vertical SaaS cases.

Use the data as a reference band - not a price tag.

4.1 Private Market Deals (Similar Acquisitions)

From the precedent transactions provided, typical EV/Revenue ranges by deal group look like this (rounded for readability):

A few patterns founders should take seriously:

- Infrastructure/analytics can price higher than “booking tools” when it is clearly monetized and defensible.

- Marketplace/aggregator models tend to price lower in private deals even when public comps trade higher - because buyers worry about marketing dependence and margin volatility.

- The extreme vertical SaaS multiples exist, but they are not “normal.” They usually come with unusually sticky demand, very high margin profiles, and strategic buyer urgency.

These ranges are illustrative. Your exact multiple depends on your growth, margins, retention, and risk profile - and on whether multiple buyers want you at the same time.

4.2 Public Companies

Public trading multiples in and around this sector (as of mid-to-end 2025 in the provided data) show clear segmentation:

How to interpret this without fooling yourself:

- Public multiples are a reference band, not your valuation. Public companies have more scale, liquidity, and often more diversified revenue.

- Smaller private companies usually trade at a discount to public comps for size, customer concentration, and key-person risk.

- But scarce, highly strategic assets can trade above public references if multiple buyers see you as “the missing piece” in a consolidation thesis.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes in booking and reservations software tend to cluster around a few themes. Below are the drivers that show up in the deal commentary - translated into what buyers are really paying for.

5.1 Deep vertical focus with high-margin software economics

Buyers pay more when your product is not generic scheduling, but deeply tailored to a category’s workflows - and it produces a high gross margin profile.

What that looks like in practice:

- Purpose-built modules (yield tools, guest messaging, resource management) that generalist tools cannot replicate easily.

- A clear path to scale without adding headcount linearly.

- Proof that customers adopt multiple modules and stay for years.

5.2 Integration breadth that actually creates switching costs

Integration portfolios show up as a recurring premium driver: buyers value platforms that already “plug in” across fragmented stacks, because it lowers churn and speeds up expansion.

Practical examples:

- Dozens of channels, PMS/POS, payment, and CRM integrations - but you can show adoption and retention lift tied to them.

- Partnerships that drive inbound leads (not just logos on a page).

- Integration-driven cross-sell: “once connected, customers expand into new modules.”

5.3 Clear strategic fit for a consolidator

Premium deals often reflect strategic urgency more than “spreadsheet math.” If you are an adjacency that completes a platform, buyers can justify paying more.

Examples of strategic fit narratives:

- “This adds spa/ancillary booking to a hotel tech suite.”

- “This connects venue access and payments into one workflow.”

- “This expands distribution reach in a geography or segment.”

Your job is to quantify the synergy: where revenue grows, where costs drop, and why you are hard to replicate.

5.4 Yield and revenue management embedded in workflows

When your product directly increases revenue, you gain pricing power and reduce churn. Buyers love features where ROI is measurable.

Examples:

- Dynamic pricing or availability controls.

- Conversion optimization in booking flows.

- Upsell and packaging features that lift average order value.

- Inventory controls that increase utilization.

5.5 Data and analytics sold as a product

Analytics as a “nice dashboard” rarely gets you paid. Analytics as a paid product that improves decisions often does.

Examples:

- Demand forecasting and benchmarking.

- Pricing intelligence.

- Channel performance optimization packaged as a paid module.

5.6 Mission-critical operations and reliability

Even in non-regulated environments, mission-critical software earns premiums when the customer cannot operate without it.

Proof points buyers respect:

- SLA performance and uptime history.

- Dependency metrics: “X% of customer revenue is processed through us.”

- Downtime impact analysis.

5.7 The boring but decisive basics

Even when your product is great, deals get priced higher when you remove uncertainty:

- Clean, consistent financials.

- Predictable recurring revenue and clear retention.

- Diversified customer base (not 5 customers driving 50% of revenue).

- A leadership bench that can run the business through and after a sale.

6. Discount Drivers (What Lowers Multiples)

Most “low multiple” outcomes are not because buyers are mean. They are because buyers see risk - and they price risk.

Here are the discount drivers that matter most in this sector:

- Services-heavy delivery

- If onboarding and customization drive a big chunk of revenue, buyers worry about scalability and margin durability.

- Fix: productize implementations, standardize packages, reduce custom work.

- Weak retention or unclear stickiness

- If customers churn because switching is easy, buyers assume a lower long-term value.

- Fix: show cohort retention, expand module usage, prove integration-driven stickiness.

- Dependency on a few channels or partners

- If a platform policy change could hurt your business, buyers discount you.

- Fix: diversify distribution, strengthen direct sales motion, build multi-channel resilience.

- Marketplace-like economics without marketplace defensibility

- If growth requires heavy marketing spend or low-margin transactions, private buyers compress multiples.

- Fix: increase recurring software revenue share, raise take rates with clear value, reduce paid acquisition dependence.

- Unproven margins

- If gross margin is low or unclear, buyers assume “this is not real SaaS.”

- Fix: report gross margin cleanly, separate services from software, and show improvement trends.

- Customer concentration and seasonality risk

- Common in hospitality and attractions.

- Fix: show diversification by customer size, geography, and segment; show stable off-season retention.

7. Valuation Example: A Booking and Reservations Software Company

This is a worked example to show how valuation logic works. The company and the USD 10m revenue number are fictional. The valuation ranges are illustrative - not investment advice, and not a formal valuation.

Step 1: The plain-English logic

- Start with relevant public and private reference bands.

- Public comps in travel software show wide revenue multiple dispersion (roughly sub-1.0x to mid/high single digits depending on model).

- Private deals for booking/channel SaaS cluster lower (low single digits), while infrastructure/analytics clusters higher.

- Pick a “core” multiple range that fits your business model.

- If you are software-first (not a marketplace), you should not blindly apply OTA/marketplace public multiples.

- If you lack clear proof of premium metrics (gross margin, retention, pricing power), you should not assume the highest software comps.

- Adjust up for premium drivers, down for discount drivers.

- Integrations, vertical depth, mission-criticality, and revenue impact features push you up.

- Services mix, churn, channel dependency, and unclear margins push you down.

Step 2: Apply it to a fictional company

Meet HarborReserve (fictional):

- Booking and reservations SaaS for tours and attractions operators

- USD 10m annual revenue (fictional)

- Strong integration footprint (channels + payments + ops tools)

- Mixed customer base (SMB and mid-market)

- Moderate growth, good but not best-in-class margins

- Some revenue-impact features (upsells, conversion tools), but limited proof of full dynamic pricing impact

Using the valuation synthesis logic from the provided framework, a defensible revenue multiple band for a software-first bookings platform of this size is:

- Discounted case (services-heavy onboarding, weaker retention, unclear gross margin): ~1.5–2.5x

- Base case (software-first, integrations matter, reasonable retention): ~2.5–4.5x

- Premium case (clear ROI/yield uplift, monetized analytics, high gross margin, very strong retention): ~4.5–7.0x (harder, but possible when multiple buyers see strategic fit)

Illustrative math on USD 10m revenue:

Step 3: What this means for you

Two companies can both have USD 10m revenue and sell for radically different prices because buyers are not just buying “this year’s revenue.” They are buying a view of future revenue that feels durable, expandable, and defensible.

The fastest way to improve valuation is not to chase vanity growth. It is to reduce perceived risk (retention, dependency, services mix) and prove your product creates measurable revenue impact.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as a quick, honest way to locate yourself on the spectrum. Score each factor 0, 1, or 2:

- 0 = weak / unclear

- 1 = solid

- 2 = strong, provable

How to interpret your total score:

- High band: You are closer to premium outcomes. Focus on running a competitive process and telling the story clearly.

- Middle band: You can still get a strong deal, but you will be priced more on “execution confidence.” Fix the biggest two risk flags.

- Low band: Consider whether a 6-12 month prep period could materially change your outcome.

The goal is not a perfect score. The goal is knowing which 2-3 improvements will move the needle the most.

9. Common Mistakes That Could Reduce Valuation

Rushing the sale

A rushed process usually means messy numbers, unclear story, and fewer buyers engaged. That creates weak leverage and weaker terms.

Hiding problems

Every deal has issues. The mistake is pretending they do not exist. Buyers will find them in diligence, and when trust breaks, valuation drops or the deal dies. You are better off surfacing issues early with a credible plan.

Weak financial records

If your reporting cannot clearly separate software revenue from services, show gross margin consistently, and tie performance to key metrics (retention, growth, expansion), buyers will assume the worst.

In this sector, messy revenue recognition and unclear “what is recurring vs project” is especially damaging.

Not running a structured, competitive sale process with an advisor

A structured process typically increases purchase prices because it creates competition and forces buyers to put their best offer forward. Research often cited in M&A circles suggests competitive processes can drive meaningfully higher outcomes (around 25% in many studies and practitioner estimates) because buyers bid against each other rather than negotiating one-on-one.

Revealing what price you are after instead of letting the market bid

If you tell buyers “we want USD 40m,” you cap price discovery. Many buyers will anchor near your number instead of bidding what they could have paid.

Two industry-specific mistakes that show up often

- Bragging about integration count without showing integration value: buyers want adoption, churn impact, and revenue impact - not a logo wall.

- Claiming revenue uplift without proof: “we increase conversion” is not enough. Show case studies, cohorts, or controlled comparisons.

10. What Booking and Reservations Software Founders Can Do in 6-12 Months to Increase Valuation

Think of this as three workstreams: improve the numbers, reduce risk, and sharpen the story.

10.1 Improve the numbers buyers underwrite

- Make revenue quality obvious

- Separate recurring software vs services cleanly.

- Show retention by cohort and by customer segment.

- Improve gross margin clarity and trajectory

- Reduce services burden in onboarding.

- Standardize packages and implementations.

- Prove expansion

- Track module adoption and upsells.

- Show expansion in multi-location customers.

10.2 Reduce the risks that create valuation discounts

- Reduce channel dependency

- Diversify acquisition sources and partnerships.

- Show resilience if a key partner changes terms.

- Address customer concentration

- If a few customers dominate, create a plan (and progress) to diversify.

- Document reliability and security

- Uptime history, incident log, and how you handle data and payments.

10.3 Upgrade from “tool” to “platform” in your narrative - with proof

Tie your story directly to the premium drivers seen in deals:

- Integrations as a moat

- Publish metrics: adoption, churn impact, and revenue impact of integrations.

- Yield and revenue management

- Even if you cannot build full dynamic pricing fast, you can productize conversion and upsell levers and quantify uplift.

- Analytics as a paid product

- Package insights into a paid tier or module with clear buyer outcomes.

10.4 Prepare for diligence like you expect scrutiny

- Clean customer contracts and renewal terms.

- Document product roadmap and technical risks in plain language.

- Create a data room structure early so you do not lose momentum mid-process.

11. How an AI-Native M&A Advisor Helps

Selling a booking and reservations software business is not only about “finding a buyer.” It is about finding the right set of buyers - the ones who see you as strategic - and getting them to compete.

An AI-native advisor can expand the buyer universe far beyond a manual list. AI can map hundreds of qualified acquirers based on deal history, product adjacency, synergy fit, and financial capacity. More relevant buyers means more competitive tension, better offers, and more options if one buyer drops out.

AI also speeds up the early phase of the process. With AI-supported buyer matching, outreach, and the creation of strong process materials, initial conversations and offers can often happen in under 6 weeks - instead of dragging for months.

The best outcome still depends on expert judgment. The advantage is combining experienced M&A advisors (who know how buyers think and how to run a tight process) with AI that improves speed, coverage, and consistency. The result is Wall Street-grade advisory quality without traditional “bulge bracket” costs.

If you would like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.