The Complete Valuation Playbook for Commercial Cleaning Businesses

A data-driven valuation guide for commercial cleaning founders and what drives high multiples.

If you are thinking about selling your commercial cleaning business in the next 1-12 months, valuation stops being a theory and becomes a set of decisions you can control. This is a consolidating sector - strategic buyers and private equity keep looking for scale, repeatable contracts, and specialist capabilities, but they are also quick to discount businesses that look like “replaceable labor” with fragile accounts.

This playbook is built for you: data-based, practical, and specific to commercial cleaning. We will cover what commercial cleaning businesses actually sell for, what drives higher vs lower multiples, a worked valuation example at USD 10m revenue, and a simple self-assessment plus a realistic 6-12 month action plan.

1. What Makes Commercial Cleaning Unique

Commercial cleaning is not valued like a typical “local services” business - and it is definitely not valued like software.

The main business models buyers see

Most commercial cleaning companies fall into a few common shapes:

- Contract janitorial (daily/weekly cleaning under 1-3 year contracts)

- Facilities services bundles (cleaning plus minor maintenance, supplies, waste, porter services)

- Specialist cleaning (high-access/window, façade, controlled environments, post-construction, emergency response)

- Compliance-adjacent hygiene services (water/air hygiene testing, disinfection programs, pest/sanitation in regulated settings)

Valuation is heavily influenced by which of these you are - and what percent of revenue comes from higher-skill, higher-risk, or compliance-critical services.

What’s unique about valuation in this sector

Commercial cleaning has three features that shape value more than founders expect:

- People are the product: labor availability, wage inflation, turnover, and supervision quality directly affect service quality and margins.

- Contracts are the asset: buyers pay for the durability of revenue - not just this year’s sales.

- Customer concentration and churn hit hard: losing one large site can drop EBITDA quickly, so buyers model “what happens if we lose the top 1-3 accounts?”

The risk checks buyers will always do

Even strong businesses get discounted if these are messy:

- Contract terms: pricing, renewals, termination rights, scope creep clauses

- Quality control: rework rates, complaint volume, inspection scores, incident history

- Labor compliance: overtime, subcontractor classification, training, safety certifications

- Working capital and cash: payroll timing, customer payment terms, supply cost pass-through

- Customer concentration: how much revenue sits in the top 5 accounts

2. What Buyers Look For in a Commercial Cleaning Business

Buyers are not just buying “revenue.” They are buying a machine that produces reliable cash flow from recurring contracts - and one that can be scaled without breaking.

The universal basics (still matter)

- Size: more scale usually means more buyer options and better process leverage

- Growth: a clear, believable growth path matters even in mature services

- Profitability: stable EBITDA, not “this year was weird”

- Clean financials: consistent reporting, job-level margins, and normal owner add-backs

The sector-specific nuances that matter most

- Contract quality: longer terms, auto-renewals, and sticky “mission-critical” accounts are worth more

- Service mix: specialist services can move you out of commodity pricing dynamics

- Delivery repeatability: training, standard operating procedures, supervisor ratios, and route density

- Pricing power: the ability to raise price annually without losing accounts

- Customer diversification: many sites across many customers beats “three whales”

How private equity thinks (in plain English)

Private equity buyers usually have a 3-7 year plan:

- They buy at one multiple and want to sell later at a similar or higher multiple.

- They ask: “Who will buy this from us later?” Often a larger facilities platform, a bigger PE fund, or a strategic consolidator.

- They expect to pull levers like:

- price increases (especially annual escalators tied to wages/inflation)

- cross-selling more services into the same customer base

- add-on acquisitions (buying smaller operators and integrating them)

- operational efficiency (scheduling, supervision, procurement, route density)

If your business already looks like a scalable platform - documented processes, strong managers, durable contracts - you fit the PE model better.

3. Deep Dive: Contract Quality and Service Mix - The Biggest Multiple Swing

In commercial cleaning, two businesses with the same revenue can have very different valuations because buyers are really valuing contract durability and defensibility.

Why this matters

If your work is easy to rebid and easy to replace, buyers price it like a fragile cash flow stream. If your work is specialist, safety-led, or compliance-critical, buyers see more pricing power and lower churn - and pay up accordingly.

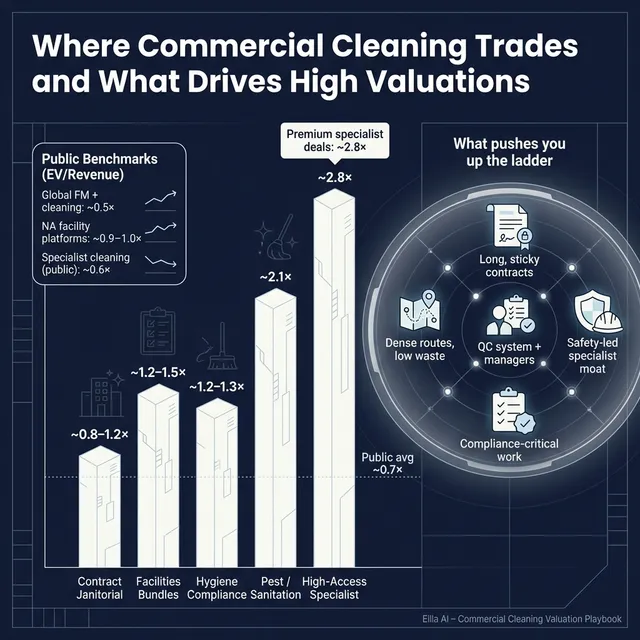

How it shows up in the data

The deal data shows a clear split:

- Integrated, general contracted cleaning tends to transact around ~0.8–1.2x EV/Revenue in private deals used as services-specific comps.

- Specialist exterior/high-access cleaning shows a much higher outcome around ~2.8x EV/Revenue and ~7.1x EV/EBITDA in the precedent set available.

- Compliance-heavy hygiene and sanitation niches show higher outcomes than general cleaning (for example, ~1.3x EV/Revenue for regulatory water/air hygiene services in the private comp grouping, and ~2.1x EV/Revenue for pest/environmental sanitation). These are “moatier” categories than general janitorial. (All from the provided precedent transaction groupings and examples.)

Why buyers care (buyer psychology)

- Contracts: Longer, stickier contracts reduce the “what if we lose a client?” discount.

- Service mix: Specialist services reduce pure price competition and require certifications, training, equipment, and safety systems that are harder to replicate.

- Risk management: Buyers pay for businesses that can deliver high-risk work without incidents (and prove it).

Moving from “lower-value” to “higher-value” profile (in 6-12 months)

You rarely need a full pivot. You need a deliberate shift:

- Re-contract key accounts with better terms (longer duration, clearer scope, annual escalators).

- Increase specialist mix where you already have capability (high-level cleaning, controlled environment cleaning, post-construction, emergency response).

- Document and prove your safety and quality moat (certifications, incident rates, audit results, training hours).

A quick way to frame it:

4. What Commercial Cleaning Businesses Sell For - and What Public Markets Show

Here is the practical truth: private deal multiples are often higher than public trading multiples for this sector, because private deals can price in specific synergies, local density, and buyer-specific strategy. Public comps are still useful as guardrails.

4.1 Private Market Deals (Similar Acquisitions)

From the precedent transaction groupings provided, the private market ranges for services-heavy businesses are:

- Integrated commercial cleaning services (contracted FM-oriented): ~0.8–1.2x EV/Revenue

- Specialist exterior/window/high-access: ~2.8x EV/Revenue and ~7.1x EV/EBITDA

- Regulatory compliance (water & air hygiene): ~1.2–1.3x EV/Revenue and ~8.5x EV/EBITDA

- Pest/environmental sanitation: ~2.1x EV/Revenue (more regulated, higher perceived moat than general cleaning)

These are not “price tags.” They are patterns by deal type - and your contract quality, service mix, and margins determine where you land.

4.2 Public Companies (as of mid-to-end 2025)

Public market multiples for core facilities management and commercial cleaning services cluster much lower on EV/Revenue - often around ~0.4–0.8x for large, mixed facilities providers. The public group averages provided show:

- Global integrated FM & commercial cleaning services: ~0.5x EV/Revenue and ~7.9x EV/EBITDA

- Comprehensive facility & environmental service conglomerates (North America): ~0.9–1.0x EV/Revenue and ~11.1x EV/EBITDA

- Extreme/specialist cleaning: ~0.6x EV/Revenue and ~7.8x EV/EBITDA (note: public comps here may include broader mixes and different economics than the specialist private deal example)

- Overall public average across the provided set: ~1.3x EV/Revenue and ~10.8x EV/EBITDA (this “overall” includes non-comparable high-multiple categories like products, uniforms, and other services)

A simple founder takeaway: public markets often price “big, mature, labor-heavy services” conservatively, while private deals can price specific advantages more aggressively.

How to use public multiples correctly

Use public multiples as a reference band, not a valuation outcome:

- Smaller businesses usually trade below public multiples if they have higher customer risk, weaker reporting, or less durable contracts.

- Private deals can exceed public comps when your business is scarce (hard to replicate), strategically important, or creates immediate synergy for the buyer (route density, cross-sell, procurement).

5. What Drives High Valuations (Premium Valuation Drivers)

Premium multiples in commercial cleaning are not magic. They are the market paying more for businesses that feel harder to disrupt and easier to scale.

Below are the premium drivers observed in the deal data, grouped into founder-friendly themes, plus the “table stakes” that always matter.

5.1 Specialist services with safety-led moats

When you operate in high-risk, high-skill niches (high-access window/facade, rope access, MEWP work, controlled environments), buyers pay more because fewer competitors can deliver safely and consistently. The data shows premium outcomes for specialist exterior/high-risk services.Practical examples:

- You can show certifications, training hours, and incident rates.

- Specialist work is a meaningful share of revenue (not just occasional add-ons).

- You win contracts where safety and compliance are deciding factors.

5.2 Compliance-critical services inside facilities ecosystems

Regulatory intensity creates stickiness. Buyers like services where the customer must keep paying or faces real operational/regulatory risk (water hygiene testing, air hygiene, sanitation compliance). The data explicitly links compliance niches to stronger valuation narratives and, in some cases, premium EBITDA multiples.Practical examples:

- You have recurring audits or mandated testing schedules.

- Your reporting is part of the customer’s compliance file.

- You have documented outcomes and renewal patterns.

5.3 Scale and breadth across business-critical services

Bigger platforms with multiple service lines can be more resilient and can cross-sell. The data highlights scale and breadth supporting premium outcomes in facilities services platforms, particularly when “business-critical” services are bundled.Practical examples:

- One customer buys cleaning + hygiene + waste + supplies under one relationship.

- You can show cross-sell rates and retention benefits from bundling.

5.4 Margin quality from an efficient, asset-light model

Premium outcomes show up when margins are structurally higher - often due to specialist mix, efficient labor deployment, route density, and disciplined pricing. The data includes examples of very high gross margin and EBITDA margin businesses achieving premium multiples in specialist categories.Practical examples:

- You can break down gross margin and EBITDA margin by service line.

- You can show scheduling efficiency and reduced overtime/rework.

- You have proven price discipline on renewals.

5.5 Technology and automation as a margin story (not a buzzword)

Pure-play robotics/automation companies trade at very high revenue multiples, which are not directly comparable to services. But the valuation lesson still applies: buyers pay for proof that technology makes delivery more scalable and margins more durable.Practical examples:

- You can quantify labor savings or quality consistency from automation.

- You use tech to reduce churn (better reporting, faster issue resolution).

5.6 Demonstrated EBITDA growth plan (sometimes via earn-outs)

Some deals use performance-based payouts tied to EBITDA growth - effectively rewarding the seller for proving the plan works. The data shows earn-out structures linked to EBITDA milestones in at least one acquisition example.Practical examples:

- You have a clear plan to expand higher-margin services.

- You can show a track record of margin improvement, not just forecasts.

5.7 Table stakes that still move value

Even if they are not “unique,” they are decisive in outcomes:

- Clean financials and job-level margin visibility

- Diversified customer base and low churn

- Strong management bench beyond the founder

- Professional contracts, documented SOPs, and quality control

6. Discount Drivers (What Lowers Multiples)

Most low multiples are not about “bad businesses.” They are about buyer-perceived risk - especially contract fragility and margin uncertainty.

Here are the common discounts in this sector, aligned to what the data implies and what buyers consistently flag.

6.1 Customer concentration and contract fragility

- One or two accounts dominate revenue.

- Contracts are short, frequently rebid, or easily terminated.

- Price increases trigger churn because the value proposition is undifferentiated.

How to improve: diversify accounts, re-contract with better terms, and prove renewal momentum.

6.2 “Commodity janitorial” positioning

If buyers believe you can be replaced by the next bidder with low switching cost, they discount the multiple.

How to improve: build specialist mix, demonstrate safety/quality moat, add compliance-adjacent services.

6.3 Weak margin visibility and messy reporting

If you cannot clearly explain margins by site/service line, buyers assume the worst.

How to improve: implement job costing, consistent margin reporting, and explain one-time items.

6.4 Labor risk and compliance uncertainty

- High turnover, weak training, safety incidents

- Misclassified contractors, wage/hour risk

- Over-reliance on a small group of supervisors

How to improve: document training and compliance, strengthen supervision layers, reduce incident risk.

6.5 Working capital surprises

Cleaning businesses can look profitable but cash-poor if payroll timing and payment terms are mismatched.

How to improve: tighten billing, reduce DSO, and be ready to show clean working capital trends.

6.6 Overdependence on the founder

If the business requires you personally to retain customers or manage quality, buyers see integration risk.

How to improve: build account management, ops leadership, and standardized QC processes.

7. Valuation Example: A Commercial Cleaning Company

This example is fictional. The company, numbers, and valuation ranges are illustrative - designed to show how valuation logic works, not to predict your sale price.

Step 1: The logic (plain English)

- Start with comparable segments:

- For a services-heavy commercial cleaning company, the most relevant private comp group is integrated contracted cleaning (~0.8–1.2x EV/Revenue).

- Public comps for big integrated FM/cleaning are lower (~0.4–0.8x EV/Revenue range for core peers), but serve as a downside reference.

- Adjust based on your profile:

- Premium drivers (specialist, compliance-critical, margin quality, durable contracts) can push you toward the top of the range.

- Discount drivers (customer concentration, short contracts, commodity positioning, messy reporting) pull you toward the bottom - or below it.

- Avoid false comps:

- Ignore very high multiples from categories that are not directly comparable (uniform rental, product companies, pure-play hygiene products, or security-heavy platforms).

Step 2: Apply it to a fictional business

Meet NorthBridge Commercial Cleaning:

- USD 10.0m revenue (fictional)

- Mix: 70% contracted janitorial, 20% post-construction, 10% high-access window/facade

- Customers: diversified across office, light industrial, and healthcare clinics (no hospital systems)

- Contracts: average 18 months remaining, 60% have annual price escalators

- EBITDA margin: mid-single digits (typical for generalist cleaning), with higher margins in specialist work

- Operations: documented SOPs, supervisor structure, and QC inspection program

Now apply scenarios using EV/Revenue multiples consistent with the services-focused data set:

Why the premium-leaning case is still modest: NorthBridge has some specialist mix, but it is not a pure specialist high-access business (which is where the ~2.8x precedent outcome sits). To justify going materially above ~1.2x, the specialist or compliance-critical share would usually need to be much larger and clearly proven in margins and contract stickiness.

Step 3: What this means for you

Two USD 10m cleaning businesses can be worth very different amounts. The gap is usually explained by:

- contract durability (terms, renewals, pricing power)

- service mix and defensibility

- margin quality and reporting credibility

This is why your “last 12 months” performance matters - but your “next 12 months preparation” often matters more.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this to honestly place yourself in the valuation spectrum. Score each factor 0-2:

- 0 = weak / not in place

- 1 = decent but inconsistent

- 2 = strong and provable in data

How to interpret your total:

- High band (mostly 2s): you are closer to the top end of typical private ranges, and buyers will compete if you run a good process.

- Middle band (mix of 1s and 2s): fair market outcomes - with a few targeted upgrades you can move meaningfully.

- Low band (many 0s): consider delaying 6-12 months if possible; risk discounts will dominate.

9. Common Mistakes That Could Reduce Valuation

9.1 Rushing the sale

If you sprint into market without clean numbers, customer story, and contracts organized, buyers control the narrative - and discounts show up fast.

9.2 Hiding problems

In due diligence, buyers will find churn, contract issues, payroll problems, or margin leaks. Hiding them destroys trust, and trust is a valuation input.

9.3 Weak financial records (especially fixable ones)

For commercial cleaning, buyers want:

- clean P&Ls by month

- EBITDA bridge that makes sense

- customer/site margin visibility

- clear add-backs (owner expenses that won’t continue)

If you cannot show it, buyers assume risk and lower offers.

9.4 Not running a structured, competitive process with an advisor

A competitive process (multiple buyers, clear timeline, controlled information flow) is one of the most reliable ways to increase purchase price. Research often cited in M&A circles shows that advisor-led competitive processes can raise outcomes meaningfully - commonly referenced around ~25% higher purchase prices in many situations.

9.5 Naming your price too early

If you say “we want USD 10m,” you kill price discovery. Buyers anchor near your number instead of telling you what it is worth to them. Let the market make the first serious move.

9.6 Industry-specific mistake: ignoring contract cleanup

In cleaning, contract details are the asset. Sloppy scopes, unclear pass-throughs for wage inflation, and weak termination protections directly reduce value.

9.7 Industry-specific mistake: treating specialist work as “marketing fluff”

If you claim specialist capability but cannot show mix, margins, certifications, and safety track record, buyers will ignore it in valuation.

10. What Commercial Cleaning Founders Can Do in 6-12 Months to Increase Valuation

You do not need to reinvent your business. You need to reduce buyer-perceived risk and prove defensibility.

10.1 Improve the numbers buyers trust

- Build monthly reporting that cleanly ties revenue, gross margin, and EBITDA.

- Implement site/customer-level margin tracking (even if imperfect at first).

- Normalize add-backs with documentation (owner comp, one-time legal, unusual repairs).

10.2 Upgrade contract quality (highest ROI work)

- Push renewals early: aim to enter a sale with contracts “freshened.”

- Add annual escalators tied to wages/inflation where possible.

- Tighten scopes and change-order processes to stop margin bleed.

10.3 Shift mix toward higher-value services (without a risky pivot)

- Double down on specialist services you already deliver well (high-level, post-construction, controlled environments).

- Package add-on compliance-style services if relevant (testing/reporting partnerships).

- Track and report the specialist share of revenue and margins.

10.4 Build a quality and safety moat you can prove

- Formalize training programs and certification records.

- Track incident rates, near-misses, and audit outcomes.

- Implement QC inspections with documented scores and corrective actions.

10.5 Reduce customer and founder dependence

- Add account management layers so retention does not depend on you.

- Strengthen ops leadership (area managers, site leads, scheduling).

- Document SOPs so a buyer sees a system, not tribal knowledge.

10.6 Prepare the buyer story (so you control the narrative)

- Why you win: not “we work hard,” but “we retain clients because X.”

- Why contracts stick: renewal stats, escalators, compliance needs, specialist capability.

- Why margins will hold: labor plan, route density, pricing discipline.

11. How an AI-Native M&A Advisor Helps

Selling well is not just “finding a buyer.” It is running a process that creates competition, protects your leverage, and reduces surprises. An AI-native M&A advisor like Eilla AI is built to do that faster and at broader scale.

First, higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, strategic fit, financial capacity, and synergy signals. More relevant buyers means more competition and stronger offers - and if one buyer drops, you still have options, which increases the odds your deal closes.

Second, initial offers in under 6 weeks. AI-driven buyer matching and outreach, combined with fast creation of marketing materials and diligence support, can compress the early timeline dramatically versus manual-only processes.

Third, expert advisory, enhanced by AI. You still get experienced human M&A advisors running the process - shaping the story, preparing professional materials, and negotiating from credibility. The difference is AI helps you do it with Wall Street-grade execution without traditional “bulge bracket” costs.

If you would like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.