The Complete Valuation Playbook for Compliance Management Software Businesses

A guide for compliance management software founders to benchmark valuation ranges and boost outcomes.

If you run a compliance management software business and you are thinking about a sale in the next 1-12 months, valuation is not just a math problem. It is a buyer psychology problem - and in this sector, the story buyers tell themselves about trust, risk, and “mission-critical” matters as much as your revenue.

This playbook is built for founders and CEOs in compliance management software (GRC, regulatory intelligence, sector-specific compliance workflows, RegTech adjacencies). It shows what similar businesses have sold for, what public markets imply, what drives premium vs discounted outcomes, and how to pressure-test your own valuation with a simple framework and a worked example.

The goal is not to predict your exact price. It is to help you understand the rules of the game - and what you can realistically improve in 6-12 months to move up the range.

1. What Makes Compliance Management Software Unique

Compliance software is “software,” but it is not valued like generic SaaS.

The main company types you see in this sector

Most businesses that get grouped under “compliance management software” fall into a few real buckets:

- Horizontal GRC and policy platforms: frameworks, controls, audits, incident management, policy workflows, and reporting across many industries.

- Regulatory intelligence and monitoring: content, alerts, rule mapping, and continuous change management (often with subscription content).

- Vertical compliance platforms: built around a specific regulatory context (financial services, healthcare, public sector, education, etc.).

- Boardroom and governance workflows: board portals, due diligence “data rooms,” approvals, attestation, and governance evidence trails.

- Compliance-adjacent security and identity tooling: exposure management, configuration integrity, IAM, KYC/AML - sometimes more “security” than “compliance,” but buyers overlap.

- Services-heavy compliance providers with a software layer: training, consulting, managed compliance, audits, and monitoring plus a platform.

Unique valuation considerations

Buyers pay unusually close attention to three things in this sector:

- Trust and proof: Can a regulated customer rely on your system as evidence? Is it audit-ready? Are your controls and certifications credible?

- Mandated demand: Are you tied to regulatory obligations with deadlines and penalties, or are you a “nice-to-have” best practice tool?

- Workflow embeddedness: Are you part of the customer’s operating rhythm (approvals, attestations, reporting cycles), or just a dashboard?

A compliance platform can look similar to another on a product page. In diligence, buyers will try to determine whether your product is a “system of record” for compliance (higher value) or an “overlay” (lower value).

Risks buyers will always check

Compliance software businesses also carry specific buyer concerns:

- Liability and mis-selling risk: If you imply compliance outcomes you cannot guarantee, buyers get nervous fast.

- Regulatory change risk: Are you resilient to rule changes, or does every change require heavy services work?

- Security posture and data handling: You often hold sensitive records, evidence, personal data, and audit trails.

- Customer concentration in regulated verticals: A small number of large regulated customers can be great - until one churns.

- Implementation complexity: If deployments are slow, bespoke, or services-heavy, buyers discount predictability.

2. What Buyers Look For in a Compliance Management Software Business

Buyers generally value compliance software through one question:

“How predictable and defensible is the revenue stream, and how essential is the product to the customer’s compliance posture?”

Here is how that translates into what they look for.

The obvious fundamentals still matter

- Scale: Revenue size matters because it reduces perceived risk and improves buyer financing options.

- Growth: Buyers pay more when growth is consistent and explainable.

- Gross margin: Higher gross margin signals software leverage and product maturity.

- Retention: In this category, retention is often the loudest signal of “mission-critical.”

- Sales efficiency and repeatability: A buyer wants to believe growth can continue without heroic founder effort.

Industry-specific “what matters more here”

- Auditability and evidence trails: Can the system produce defensible artifacts a regulator or auditor would accept?

- Certifications and governance credibility: ISO-style security certifications, SOC-style assurance, and strong controls translate into buyer confidence.

- Regulatory-grade integrations: Connections into ERP, HRIS, identity systems, document management, and reporting pipelines reduce churn and increase stickiness.

- Content and monitoring depth: In regulatory intelligence, buyers value usage depth (alerts acted upon, rules mapped, submissions automated), not just content volume.

- Clear positioning: “We reduce compliance risk and save time” is not enough. Buyers want a crisp answer to: what compliance workflow do you own?

How private equity buyers think (in plain English)

Private equity (PE) tends to be very structured:

- They care about entry price vs exit price: If they buy at a high multiple, they need confidence they can sell at a similar or higher multiple in 3-7 years.

- They plan the next buyer on Day 1: usually a larger PE fund, a strategic buyer in an ecosystem, or (rarely) public markets.

- They expect to pull specific levers:

- Price increases justified by ROI and risk reduction

- Cross-sell of adjacent modules (audit, policy, training, reporting, vendor risk, etc.)

- Reducing services burden by standardizing implementation

- Tightening churn by improving onboarding, integrations, and customer success

- They love “platform potential”: compliance is fragmented, so PE often likes businesses that can be a base for add-on acquisitions.

3. Deep Dive: The Valuation Nuance That Matters Most - “Trust + Mandated Workflow” vs “Nice-to-Have Tooling”

In compliance software, the biggest valuation divider is often not your feature list. It is whether the buyer believes your product sits in a mandated workflow and is trusted as a source of truth.

A platform tied to board governance, due diligence, regulatory reporting, or required frameworks tends to be valued differently than training libraries, generic checklists, or tools customers can “pause for a year.”

How it shows up in real deals (pattern, not promises)

Across comparable transactions and public comps, higher outcomes tend to cluster around businesses that can credibly say:

- “Our software is part of a regulated process.”

- “Our software produces evidence.”

- “Our software is trusted by auditors, boards, and compliance teams.”

Buyers will often accept lower short-term profitability for mandated workflow ownership, because they believe retention will be stronger and pricing power will increase over time.

Why buyers care

This nuance maps directly to three buyer fears:

- Churn risk: “Nice-to-have” tools churn when budgets tighten. Mandated tools get renewed because the risk of not renewing is greater than the cost.

- Pricing pressure: If you reduce risk, you can price to outcomes. If you “help manage tasks,” you price into competition.

- Diligence risk: Buyers can get comfortable faster when there is a clear compliance chain-of-custody and strong governance posture.

How to move from the lower-value profile to the higher-value profile (within 6-12 months)

You do not need a total product rewrite. You need sharper evidence:

- Turn outcomes into proof: show renewal cohorts, audit pass rates where appropriate, time-to-report reductions, and concrete “evidence trail” outputs.

- Strengthen assurance: improve security posture and certifications (or credible progress toward them), tighten controls, and document governance processes.

- Anchor to a mandated cycle: map your product to the customer’s real compliance calendar (board meetings, reporting cycles, audits, certifications, regulatory filings).

- Reduce “optional” usage: build features that customers must touch (attestation, approvals, evidence upload, automated submissions).

A quick way to sanity-check where you sit:

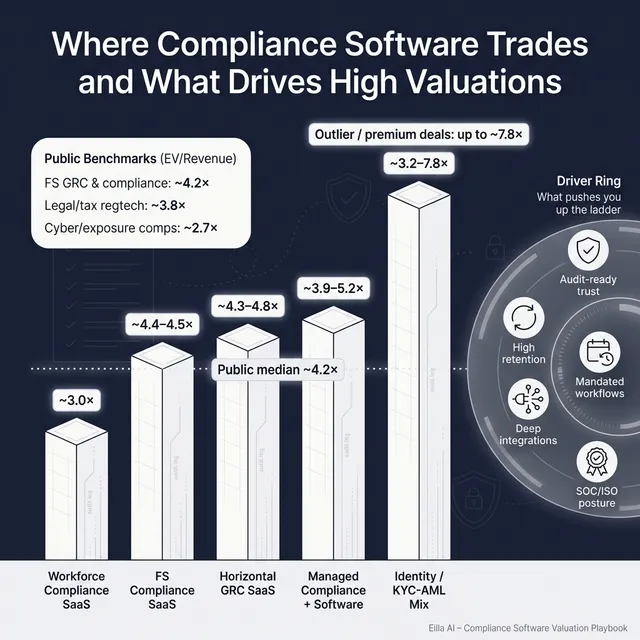

4. What Compliance Management Software Businesses Sell For - and What Public Markets Show

This section is intentionally data-first. You should treat multiples as reference bands, not price tags. Your valuation will move based on growth, retention, margins, risk, and buyer fit.

4.1 Private Market Deals (Similar Acquisitions)

Across precedent transactions in this broader compliance software universe, typical outcomes cluster around mid-single-digit revenue multiples, with meaningful variation by segment and software-vs-services mix.

Two simple rules show up repeatedly:

- Software-led, recurring revenue businesses trade higher than services-heavy models.

- Mission-critical, trust-heavy compliance workflows can pull multiples up, especially when a strategic acquirer sees ecosystem fit.

Here is a practical way to think about the private market ranges implied by the deal groups:

A few deals in horizontal/vertical GRC have cleared high-single-digit revenue multiples, often with earn-outs tied to recurring revenue growth - a sign that buyers will pay up when they believe the revenue is durable and can keep compounding.

4.2 Public Companies

Public markets provide context, not a direct valuation for a private business. But they do set “gravity” - especially when a buyer is benchmarking your deal internally.

As of mid-to-late 2025 in the provided dataset, public trading multiples by group show clear clustering:

Two takeaways matter for a private founder:

- The “central band” for quality compliance SaaS is often around mid-single-digit revenue multiples in public markets, with exceptions at the high end for scarce, strategic platforms.

- Outliers exist and can distort averages (especially in ESG-like groups), so you should anchor more on medians and the “sane middle” than on headline averages.

How to use this as a founder:

- Treat public multiples as a reference ceiling and floor, not a direct conversion.

- Adjust downward for smaller scale, customer concentration, weaker margins, or higher risk.

- Adjust upward when you are scarce (unique workflow ownership), highly trusted, and strategically relevant to a buyer’s product suite.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes in compliance software are usually not about one magic metric. They come from a set of reinforcing signals that reduce buyer fear and increase buyer ambition.

Below are the premium drivers that show up most clearly in the deal narratives and sector patterns, grouped into themes.

5.1 Regulatory-grade trust that shows up in the numbers

Buyers pay more when trust is not just claimed - it is demonstrated.

What that looks like in practice:

- Recognized security and assurance posture (for example ISO-style or SOC-style certifications, or credible progress toward them)

- Strong auditability: evidence trails, immutable logs, permissioning, approvals, and defensible reporting outputs

- Mature governance: policies, incident response, and a clean “how we operate” story

Why it gets rewarded: trust reduces diligence friction, increases retention confidence, and supports premium pricing.

5.2 Mission-critical workflow positioning (especially “boardroom” and mandated reporting)

Certain compliance workflows are budget-non-discretionary:

- Board governance and approvals

- Due diligence and controlled data rooms

- Required reporting cycles (regulatory, financial, ESG-adjacent disclosures where relevant)

- Mandated frameworks (where failure carries real penalties)

Why it gets rewarded: these workflows reduce churn risk and tend to expand over time via more modules and more seats.

5.3 Vertical depth where compliance is woven into the customer’s operating system

Vertical compliance platforms often win when they are embedded into core workflows (especially in financial services and other heavily regulated industries).

Founder-friendly examples:

- You are integrated into core systems (ERP, identity, case management, reporting pipelines)

- You map directly to supervisory regimes and internal accountability frameworks

- You have credible references and repeatable deployments in a specific regulated niche

Why it gets rewarded: switching costs increase, and “domain credibility” becomes a moat.

5.4 Regulatory intelligence and ongoing monitoring that drives daily usage

Platforms that combine workflow with continuous monitoring tend to become “always-on” systems rather than quarterly tools.

Signals buyers like:

- High engagement metrics tied to real outcomes (alerts acted upon, submissions automated, issues resolved)

- Content or intelligence that is difficult to replicate quickly

- Clear expansion path into adjacent compliance modules

Why it gets rewarded: daily usage correlates with stickier revenue and better expansion.

5.5 Strategic acquirer fit inside a compliance ecosystem

Some buyers are consolidators. They will pay more when your product clearly fits their suite and can be cross-sold quickly.

What founders can do:

- Make integrations and adjacency explicit (who you plug into, what you unlock)

- Package your roadmap as “attachable modules,” not scattered features

- Show customer overlap with likely acquirers’ installed base

Why it gets rewarded: buyers underwrite synergies, not just your standalone plan.

5.6 High recurring revenue visibility and retention

In plain terms: buyers pay more when your future revenue looks “already sold.”

What helps:

- High recurring mix and clear renewals

- Strong net retention (customers not only renew, they expand)

- Long-term contracts or embedded usage that makes renewal the default

5.7 Clean fundamentals that reduce buyer fear

Even in a premium narrative, basics still matter:

- Clean financials and clear revenue recognition

- Predictable pipeline and customer acquisition motion

- Diversified customer base

- A leadership bench that can run the business without the founder doing everything

6. Discount Drivers (What Lowers Multiples)

Most discounted outcomes are not because the product is “bad.” They happen because buyers see uncertainty - and uncertainty gets priced.

Here are the common discount drivers in compliance management software:

6.1 Too much services in the mix

If revenue depends heavily on consulting, audits, or bespoke implementation:

- Revenue is less predictable

- Gross margin is lower

- Growth often requires headcount growth

Buyers may still like the business, but they usually pay lower multiples unless there is a clear path to software-led delivery.

6.2 Weak retention, unclear product stickiness, or “optional” usage

Buyers will press hard on:

- Churn (logo churn and revenue churn)

- Whether usage is broad or limited to a few power users

- Whether the product is used only during audits or reporting windows

If your platform is used intermittently, buyers worry customers can pause or replace you.

6.3 Customer concentration and regulatory dependency risk

A few large regulated customers can create a valuation ceiling. Buyers will ask:

- What happens if your largest customer leaves?

- Are you over-exposed to one regulation, one country, or one enforcement trend?

6.4 Security posture gaps or compliance claims that feel risky

If you hold sensitive data and your security program is immature, it can become a deal blocker or a price haircut.Also, if your marketing implies guaranteed compliance outcomes, buyers worry about liability.

6.5 Founder-dependent sales and delivery

If the business requires you personally to:

- Close deals

- Manage key relationships

- Run implementations…then a buyer underwrites a risky transition.

6.6 Messy numbers and unclear unit profitability

You do not need perfect accounting, but you do need clarity:

- Revenue by product line

- Gross margin by product vs services

- Retention cohorts

- Implementation economics and time-to-value

When the numbers are unclear, buyers assume the worst and protect themselves with lower multiples, earn-outs, or tougher terms.

7. Valuation Example: A Compliance Management Software Company

This is a fictional example to show how the logic works. The company, metrics, and valuation range are illustrative - not investment advice or a formal valuation.

Step 1: The simple valuation logic (plain English)

A practical way buyers triangulate value in this sector is:

- Anchor on relevant bands from:

- Public compliance SaaS comparables (as a sanity check)

- Private precedent deals in your closest segment

- Start with a “core” multiple range for a business of your size and risk profile

- Adjust up if you have clear premium drivers (trust, mandated workflow ownership, strong retention, scale economics, strategic fit)

- Adjust down if you have clear discount drivers (services mix, churn risk, customer concentration, security gaps, messy numbers)

Step 2: Apply it to a fictional business

Meet LedgerShield (fictional): a financial-services-focused compliance management SaaS platform.

Assumptions (fictional but realistic):

- USD 10.0m last-twelve-month revenue

- Mostly recurring software revenue, limited services

- Strong retention, improving margins

- Deep integrations into risk/compliance workflows at mid-market financial institutions

Using the sector bands from comparable public and private groups, a founder-friendly way to frame scenarios is:

Why these ranges make sense in this sector:

- Public compliance SaaS comps often cluster in a mid-single-digit revenue multiple band (useful as sanity check).

- Private deals in horizontal and vertical compliance SaaS show similar central tendencies, with premium outcomes when the “trust + mandated workflow” story is real and provable.

Step 3: What this means for you

Two compliance software businesses can both be at USD 10m revenue and be worth very different amounts because:

- One looks like a durable system of record with low churn risk.

- The other looks like a services-dependent tool that customers can replace.

If you want a higher multiple, the biggest lever is not a prettier pitch deck. It is reducing buyer uncertainty with proof: retention, auditability, security posture, and a credible expansion story.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as a quick, honest tool. Score each factor 0, 1, or 2:

- 0 = weak or unclear

- 1 = decent but not proven

- 2 = strong and provable with data

How to interpret the total:

- High band (mostly 2s): you are closer to premium outcomes if you run a competitive process.

- Middle band (mix of 1s and 2s): you likely sit in the core range - improvements can move you meaningfully.

- Low band (many 0s): selling is still possible, but expect discounts or heavier earn-outs unless you fix the biggest risks.

The point is not to “score high.” The point is to identify the 2-3 changes that will move you the most in 6-12 months.

9. Common Mistakes That Could Reduce Valuation

These are avoidable. And in a sale, avoidable mistakes are painful because they permanently change buyer perception.

9.1 Rushing the sale

If you start outreach before your numbers and story are ready, buyers control the narrative. They will frame your business as risky, and you will spend the process defending rather than driving price.

9.2 Hiding problems

Issues will surface in diligence. When buyers discover surprises, the outcome is usually:

- price reduction, or

- earn-out expansion, or

- deal fatigue and lost trust

It is better to disclose a known issue with a plan than to “hope it does not come up.”

9.3 Weak financial records (and fixable reporting gaps)

In this sector, buyers want to clearly see:

- recurring vs services split

- retention and expansion

- gross margin profile

- implementation economics

If your reporting is messy, buyers assume the underlying business is messy.

9.4 Not running a structured, competitive process with an advisor

A structured competitive process typically drives meaningfully higher prices (research often cited around ~25% higher outcomes) because it creates:

- buyer competition

- faster timelines

- better terms (not just price)

9.5 Revealing what price you want too early

If you tell buyers “we want USD 50m,” you cap your upside. Many buyers will simply aim for USD 50-52m rather than showing you what they would truly pay in a competitive environment. Price discovery dies when you anchor first.

9.6 Industry-specific mistake: vague compliance claims

In compliance software, buyers are hypersensitive to liability risk. If your materials imply guaranteed compliance outcomes without clear boundaries, buyers will either:

- discount valuation, or

- demand heavy legal protection, or

- walk away

Be precise: show what you enable, what you evidence, and what remains the customer’s responsibility.

10. What Compliance Management Software Founders Can Do in 6-12 Months to Increase Valuation

You rarely have time for a massive pivot before selling. The highest ROI work is tightening proof, reducing risk, and making the story easier for buyers to believe.

10.1 Improve the numbers buyers will underwrite

- Retention proof: build simple renewal and expansion cohorts that you can explain in 2 minutes.

- Recurring clarity: separate recurring software revenue from services and one-time fees.

- Margin story: show gross margin trends and your path to operating leverage (even if you are not there yet).

- Customer concentration plan: if concentration is real, show pipeline and account expansion that reduces risk.

10.2 Upgrade “trust” and diligence readiness

- Tighten security posture and document controls (even before formal certifications are complete).

- Build a clean evidence trail story: audit logs, permissions, approvals, data retention.

- Write a short “what we do and do not guarantee” positioning statement to reduce liability fear.

10.3 Increase “mandated workflow” signal

- Map your platform to real compliance cycles: audits, filings, attestations, board reporting.

- Productize features that customers must use (approvals, attestations, submissions, evidence capture).

- Expand integrations that reduce replacement risk.

10.4 Make your buyer story sharper (without hype)

- Define the workflow you own in one sentence.

- Show why switching costs are real (integrations, governance adoption, audit history, embedded process).

- Build a clear “expansion roadmap” that looks like attachable modules, not scattered features.

10.5 Prepare for a clean process

- Build a data room early with clean customer contracts, retention metrics, and product/security documentation.

- Reduce founder dependency by delegating key relationships and documenting the sales process.

- Decide what you will and will not accept in terms (earn-out structure, rollover equity, employment expectations) before negotiations start.

11. How an AI-Native M&A Advisor Helps

In compliance software, the best outcomes usually come from running a competitive process with the right buyers - not just “finding one interested party.” An AI-native M&A advisor can materially improve that process while staying founder-friendly.

Higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, product adjacency, financial capacity, and synergy signals. More relevant buyers creates more competition, stronger offers, and more options if one buyer drops.

Initial offers in under 6 weeks. AI-driven buyer matching and faster creation of marketing materials, outreach, and diligence support can compress timelines dramatically compared to manual-only processes - without sacrificing quality.

Expert advisory, enhanced by AI. You still want senior human judgment: positioning, negotiation, process control, and credibility with acquirers. The AI layer improves speed, breadth, and consistency, helping you present “Wall Street-grade” materials and deal framing without traditional bulge-bracket costs.

If you would like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors at Eilla AI.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.