The Complete Valuation Playbook for Construction Software Businesses

A valuation playbook for construction software founders on what buyers actually pay and what drives higher multiples.

If you run a construction software business and you are thinking about selling in the next 1-12 months, valuation is not just a number - it is a story backed by proof.

This is a good time to get serious about that story. Construction tech has been consolidating for years, buyers have become more selective, and the bar for "quality revenue" (sticky, recurring, defensible) has gone up. The result: two businesses with the same revenue can sell for wildly different prices.

This playbook is built for construction software founders. It will (1) show what similar businesses actually sell for, (2) decode what drives higher vs lower multiples, and (3) give you a practical self-assessment and a 6-12 month action plan to improve your outcome.

1. What Makes Construction Software Unique

Construction software is not "generic SaaS." Buyers value it differently because the end market behaves differently.

The main types of construction software businesses buyers see

- Project execution platforms (GC/owner workflows): field management, RFIs, submittals, scheduling, cost control, progress tracking, change orders, closeout.

- Aftercare and defect management: handover, warranty, punch lists, service tickets, subcontractor coordination post-completion.

- Trades and contractor ops (SMB): job scheduling, time, invoicing, compliance checklists, safety and quality workflows for subcontractors.

- Design/BIM and digital twin ecosystems: design collaboration, model-based workflows, engineering data platforms.

- Document management and regulated workflow adjacencies: controlled documents, approvals, audit trails, permitting-heavy workflows.

- Property operations and facilities layers: maintenance, energy monitoring, building operations - often the "post-construction" revenue engine.

Unique valuation considerations in this sector

- Cyclicality is real - but avoidable. New-build volume moves with rates and macro. Buyers pay more when your revenue is tied to ongoing operations, compliance, and recurring workflows instead of purely new projects.

- Multi-stakeholder buying creates both upside and friction. Owners, GCs, subs, designers, and operators can all touch the same platform. If you truly connect them, switching costs rise. If you don’t, churn rises.

- Implementation and workflow change are part of the product. In construction, "software + rollout" is often required. Buyers will discount you if services and customization are doing the heavy lifting instead of the product.

Key risk factors buyers will always check

- Retention and adoption by role: Are field users actually using it weekly, or is it an office tool that gets renewed on autopilot until budgets tighten?

- Proof your platform reduces risk: compliance, quality, safety incidents, change order leakage, schedule slippage.

- Data integrity and auditability: construction is messy. Buyers want evidence your system produces reliable records (because disputes, claims, and audits happen).

- Customer concentration: many construction software companies start with a few anchor contractors. Buyers will push hard on concentration.

- Integration reality: if your product lives next to accounting/ERP, payroll, time tracking, BIM, or document systems, the "glue" matters. Weak integrations are a common deal friction point.

2. What Buyers Look For in a Construction Software Business

Most buyers are looking for the same basic things - but in construction, the "why" behind those things matters.

The obvious stuff (still matters a lot)

- Size and growth: buyers pay more when revenue is growing and the growth looks repeatable.

- Recurring revenue: more subscription, less one-time setup and custom work.

- Gross margin and scalability: productized software economics usually win.

- Customer retention: if customers stick around and expand, buyers assume your product is embedded.

Construction-specific nuances that move valuation

- Mission-critical placement: buyers pay more when your software sits in workflows that teams cannot skip - daily logs, inspections, RFIs, pay apps, safety, compliance checklists, closeout.

- Workflow breadth across the lifecycle: platforms that cover more of the project lifecycle (and ideally into operations) tend to be valued more highly because they become a system teams standardize on.

- Proof of outcomes: "we save time" is not enough. Buyers want evidence: fewer defects, faster closeout, lower rework, fewer safety incidents, less cost leakage.

- Land-and-expand in a fragmented market: construction is famously fragmented. Buyers reward a company that has a repeatable go-to-market motion across many small and mid-sized customers, not just a few large accounts.

How private equity buyers think (in plain English)

Private equity (PE) is often buying with a plan to sell again in 3-7 years.

They focus on:

- What they pay today vs what they can sell for later. If they pay a high multiple today, they need a believable path to a high multiple later - usually through scale, growth, and profitability.

- Who the next buyer could be. A larger PE fund, a strategic buyer (industry platform), or in rare cases a public-market path. If your business looks like something a strategic buyer would fight over, PE gets more confident.

- The levers they expect to pull:

- Increase pricing (only if you have strong retention and clear ROI)

- Expand modules (field -> financials -> compliance -> aftercare -> operations)

- Professionalize sales (repeatable pipeline, better conversion)

- Reduce services intensity (productize onboarding)

- Improve margins (better support model, more self-serve, cleaner deployments)

3. Deep Dive: The Valuation Power of Post-Construction Revenue

A big valuation divider in construction software is simple:

Are you tied mainly to new projects - or do you monetize the building after handover?

Why it matters: new builds can slow down. But buildings still need maintenance, warranty work, compliance, inspections, energy optimization, and ongoing operations. Buyers pay up for revenue streams that stay strong even when construction starts soften.

How this shows up in deal outcomes In the deal data, businesses with credible post-construction monetization (defect management, aftercare workflows, building operations, energy data) show strong buyer interest and, in some cases, higher revenue multiples than "project-only" tools. The pattern is not that every aftercare product gets a premium - it is that recurring workflows after handover can reduce cyclicality and increase retention.

Why buyers care

- Longer customer lifetime: if you stay relevant after closeout, you are not fighting for each new project cycle.

- More stakeholders, more stickiness: operations teams, facility managers, and owners can become steady users, not just project teams that disband.

- Clear ROI and risk reduction: warranty and defect workflows are painful and expensive. If you reduce that pain measurably, renewal becomes easier.

How to move from the lower-value version to the higher-value version You do not need to pivot your entire company. You need to create a believable, measurable post-handover product wedge:

- Start with aftercare workflows (punch lists, warranty tickets, subcontractor coordination).

- Add SLA reporting (time-to-resolution, backlog, root-cause categories).

- Connect to maintenance scheduling and asset records over time.

- Package it as a clean module with its own pricing and metrics.

A simple profile shift

4. What Construction Software Businesses Sell For - and What Public Markets Show

This section is intentionally data-first. Private deals show what buyers have actually paid. Public markets show what scaled peers trade at (often a reference band, not a direct price tag).

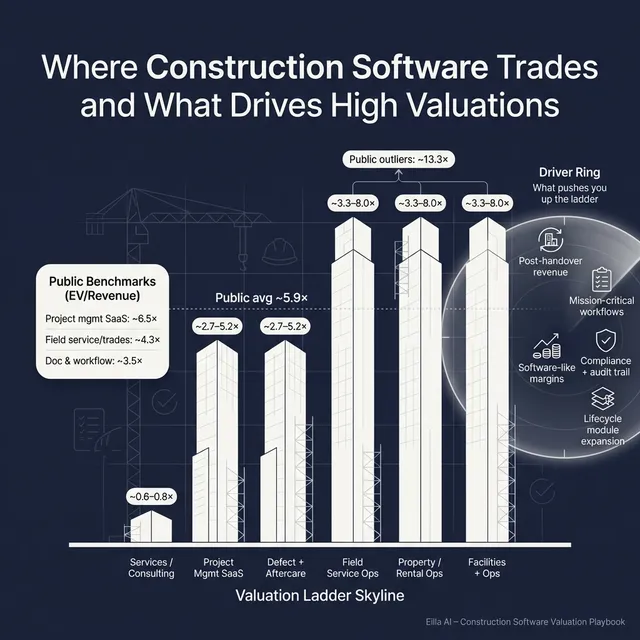

Across the dataset:

- Public construction software and adjacencies show a wide range of EV/revenue multiples, with group averages around 5.9x EV/revenue overall and meaningful variation by segment.

- Private construction software transactions in the dataset average around 5.4x EV/revenue overall, but that average hides big differences between pure software, services-heavy models, and premium outliers.

4.1 Private Market Deals (Similar Acquisitions)

Private deals in construction software often cluster by product type and business model.

What the private deal data shows (illustrative ranges)

- Construction project and defect management SaaS: roughly 2.7-5.2x EV/revenue in the observed set, with group averages around the mid-4x range.

- Property, rental, and field service management software: wider spread, roughly 3.3-8.0x EV/revenue with a higher average driven by premium outcomes and outliers.

- Construction project management services/consultancy (non-software): typically 0.6-0.8x EV/revenue - a different animal, usually valued more like a services business.

A practical way to read this: buyers are usually paying "software-like" multiples when the product is sticky and recurring, and "services-like" multiples when delivery and people drive the economics.

Private comps table (founder-friendly summary)

These ranges are illustrative. Your multiple will move based on growth, retention, margins, and how defensible your position is.

4.2 Public Companies

Public markets give you a "reference band" - what investors pay for scaled platforms in and around construction software (as of mid-to-late 2025 in the provided data).

What the public segment data shows

- Construction project management SaaS trades at higher EV/revenue multiples on average than trades/job management and document management, reflecting mission-critical workflows and platform breadth.

- Field service and trades job management tends to be more moderately valued, often because SMB customer bases can be churnier and pricing power varies.

- Some "other software for construction management" categories show very high averages and medians, but those groups can include niche outliers and may not be a realistic benchmark for a typical private business.

Public comps table (segment averages from the dataset)

How to use public multiples without fooling yourself

- Use them as reference bands, not price tags.

- Adjust down for smaller scale, weaker growth, higher customer concentration, heavier services, or less proven retention.

- Adjust up only when you have a scarce asset: clear category leadership in a niche, deep workflow entrenchment, post-handover monetization, or a data advantage that strategic buyers cannot easily build.

A simple rule of thumb from the dataset logic: for many smaller, private construction SaaS companies, a realistic public-comparable corridor often sits in the mid-single-digit EV/revenue area, with meaningful exceptions in both directions depending on quality and scope.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes usually come from a small set of themes. The deal narratives in the data reinforce that buyers pay up when the software is recurring, embedded, and expanding across the lifecycle.

Below are the highest-impact premium drivers, grouped into practical themes.

5.1 Post-construction monetization and operations value

Buyers pay more when your product is still "alive" after the ribbon-cutting.

- Aftercare and defect workflows can create recurring subscriptions tied to warranty and ongoing coordination.

- Property operations and energy or maintenance data can turn a project tool into an operating platform.

What founders can do:

- Track adoption for aftercare modules (active sites, tickets per unit, closure time).

- Prove renewals and expansion tied to post-handover usage.

- Package ops modules separately so the market can see the recurring engine.

5.2 Owner-operator workflow depth across the project lifecycle

Platforms that sit deeply in owner workflows (not just GC execution) often feel more strategic to buyers because owners have longer time horizons and more stable budgets.

- End-to-end coverage (planning -> procurement -> delivery -> handover) increases switching costs.

- Multi-module attach rates show you can expand accounts over time.

What founders can do:

- Show module attach by customer cohort.

- Measure where you are embedded: cost control, contract management, compliance, handover.

- Build clear ROI metrics owners care about (risk reduction, auditability, schedule confidence).

5.3 Compliance, quality, and audit trails that people rely on

In construction, compliance is not a "nice to have." It is tied to safety incidents, legal exposure, insurance, and reputation. Buyers love workflows that:

- Produce audit-ready records

- Reduce quality failures and rework

- Improve accountability across subcontractors

What founders can do:

- Turn compliance into measurable outcomes (inspection completion rates, defect leakage, time-to-close).

- Show that customers keep paying because the workflow is mandatory, not optional.

- Demonstrate margin improvement as you scale (buyers like seeing software economics emerge).

5.4 Software-like gross margins and scalable delivery

Premium valuations tend to go to businesses that look like pure software:

- High gross margins

- Product-led onboarding

- Support that scales without headcount growth matching revenue growth

What founders can do:

- Separate services revenue clearly from subscription revenue.

- Productize implementation with templates, checklists, and repeatable rollout playbooks.

- Show gross margin trends over time, not just a single point.

5.5 Clear growth quality and clean deal readiness

Buyers pay up when growth is both strong and believable:

- Multi-year growth trends

- Strong retention

- Clean contracts, clean revenue recognition, clean customer data

What founders can do:

- Publish a simple internal dashboard: growth, churn, retention, expansion.

- Tighten contract terms and renewal mechanics.

- Prepare a clean data room early so buyers trust the numbers.

5.6 The basics that still move price

Even in a sector-specific deal, fundamentals matter:

- Clean financials and clear KPIs

- Diversified customer base

- A leadership bench that can run without the founder doing everything

- A product roadmap that is coherent and funded, not a pile of custom requests

6. Discount Drivers (What Lowers Multiples)

Discounts happen when buyers see risk - or when they suspect the revenue is not as durable as it looks.

Here are the most common discount drivers for construction software businesses.

1) Too much services and customization If implementation, consulting, or custom development is required to make customers succeed, buyers worry the business will not scale. That can push you closer to services-like valuation behavior.

2) Weak retention or low real usage Construction teams churn when software is not embedded in daily workflows. Buyers will ask: do field users log in weekly? Are projects consistently managed in the system, or only reported at month-end?

3) Customer concentration One or two large contractor groups can create an illusion of scale. Buyers will discount heavy concentration because losing one account can break the forecast.

4) Revenue tied to new-build cycles If your revenue rises and falls with project starts, buyers price in cyclicality. This is one reason post-handover workflows and operations modules can matter so much.

5) Integration and data friction If your product does not integrate cleanly with accounting/ERP, payroll, BIM, or document systems, it can slow sales cycles and raise churn. Buyers hate surprises here.

6) Security, reliability, and audit gaps You do not need to be a Fortune 500 security program, but you do need credible basics. Weak access controls, unreliable audit trails, or messy data permissions create due diligence risk.

7) Messy financial reporting If you cannot clearly explain:

- subscription vs services revenue

- churn and net retention

- gross margin by product line …buyers will assume the worst and protect themselves with a lower price, earn-outs, or tougher terms.

7. Valuation Example: A Construction Software Company

This is a worked example to show how the logic works. The company and numbers below are fictional. The multiples are illustrative, based on the ranges and patterns in the provided construction software deal and public comps data. This is not investment advice or a formal valuation.

Step 1: The plain-English valuation logic

Most buyers triangulate value using two anchor points:

- Public market reference bands (what comparable segments trade at, usually as EV/revenue).

- Private transaction ranges (what similar companies were acquired for).

Then they narrow to a "core range" based on your profile:

- Are you pure software or services-heavy?

- Are you growing?

- Are customers sticky?

- Do you have lifecycle depth and post-handover revenue?

- Do you look like a smaller version of the better public comps, or something structurally different?

A common outcome for a smaller, pure-play construction SaaS with partial lifecycle coverage but without proven enterprise scale is a mid-single-digit EV/revenue core range. In the dataset’s example logic, a 3.0-6.0x EV/revenue band was used as a defensible base corridor for a small vertical SaaS profile with limited disclosed growth/margins.

Step 2: Apply it to a fictional company at USD 10m revenue

Meet SiteFlow (fictional):

- USD 10.0m annual revenue (fictional)

- Construction project workflows + defect/aftercare module

- 80% subscription, 20% implementation

- Mid-market GC and owner clients, growing but not yet enterprise-scale

- Solid product, but retention metrics are only partially tracked today

Scenario table (illustrative)

What pushes SiteFlow toward the premium case?

- Aftercare module shows strong adoption and renewals (post-handover recurring value).

- Clear proof of workflow depth (field + financial + compliance + handover).

- Strong retention and expansion (customers pay more over time).

- Software-like margins and productized onboarding.

- Diversified customers and clean reporting.

What pushes it toward the discounted case?

- Services-heavy delivery and customization.

- Weak retention visibility or high churn in SMB customers.

- Concentration in a few contractor groups.

- Limited integrations creating sales friction.

- Messy financials or unclear revenue breakdown.

Step 3: What this should tell you as a founder

Two construction software businesses can both be "USD 10m revenue" and still be worth very different amounts. The multiple is your market’s judgment of:

- how long your revenue will last,

- how reliably it will grow,

- and how risky it is to own.

Your job in the next 6-12 months is not to "argue for a higher multiple." It is to reduce perceived risk and increase proven durability.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as a rough positioning tool. Score each factor 0-2:

- 0 = weak / unclear

- 1 = decent but not proven

- 2 = strong and proven with data

Self-assessment table

How to interpret your score (quick and honest)

- Top band: you look like a premium candidate - your story is supported by metrics.

- Middle band: fair market outcome - likely in the core range, with specific improvements that can lift value.

- Lower band: you will still get interest, but buyers will protect themselves with price, structure (earn-out), or both.

The point is not to "win the quiz." The point is to see where effort will pay off most before you go to market.

9. Common Mistakes That Could Reduce Valuation

These are avoidable. And in a sale process, avoidable mistakes are expensive.

1) Rushing the sale If you run a process before your numbers, story, and data room are ready, buyers will anchor on uncertainty. Uncertainty lowers price and worsens terms.

2) Hiding problems Every deal has issues. What kills deals is not the issue - it is the surprise. Due diligence will surface problems. If you hide them, buyers lose trust, and price drops late in the process.

3) Weak financial records Construction software buyers want clarity on:

- subscription vs services revenue

- churn and renewals

- gross margin trends If you cannot show clean reports, buyers assume risk. In many cases, cleaning this up in 6-12 months is one of the highest ROI valuation projects you can do.

4) Not running a structured, competitive process with an advisor A single-buyer process often produces "good enough" offers. A competitive process forces buyers to show their real number. In practice, well-run competitive processes often lead to meaningfully higher purchase prices - frequently cited around 25% better outcomes versus one-off negotiations.

5) Revealing what price you’re after too early If you tell buyers "we want USD 10m," you cap price discovery. Many buyers will come back with USD 10.1m, USD 10.2m, not the best price they could justify. Let the market speak first.

Two construction-software-specific mistakes

- Treating integrations as an afterthought: buyers will ask how you connect to accounting/ERP, payroll, BIM, document tools. Weak integration reality creates late-stage deal friction.

- Not proving adoption beyond champions: one strong internal champion can drive a sale, but buyers pay more when usage is broad across roles and sites (field, office, subs, owners).

10. What Construction Software Founders Can Do in 6-12 Months to Increase Valuation

This is the practical part. Focus on improvements that change buyer perception fast.

10.1 Improve the numbers buyers anchor on

- Track retention properly: logo retention and, ideally, net retention (do customers pay more over time?).

- Increase recurring mix: tighten packaging so one-time work shrinks as a percentage of revenue.

- Protect gross margin: reduce custom work, standardize onboarding, improve support efficiency.

- Reduce concentration risk: even modest diversification before selling can materially reduce buyer anxiety.

10.2 Strengthen the "durability" story

- Make your product mission-critical: improve workflows that teams must run weekly (quality, safety, inspections, RFIs, closeout).

- Build a post-handover wedge: defect management, warranty workflows, maintenance scheduling, SLA reporting.

- Prove ROI with simple metrics: time-to-close defects, inspection completion, fewer rework loops, faster closeout.

10.3 De-risk diligence before you go to market

- Clean revenue reporting: subscription vs services, renewal timing, cohort performance.

- Document security basics: access controls, audit logs, data handling practices.

- Prepare customer references: buyers trust what customers say more than what founders say.

10.4 Tighten your go-to-market and product narrative

- Pick a clear buyer persona: GC vs owner vs operator vs trades. "Everyone" sounds like "no one."

- Clarify why you win: faster deployment, better mobile field adoption, compliance strength, lifecycle coverage.

- Create a credible growth plan: not a 50-slide deck - a simple, believable plan with the levers that already work.

10.5 Run the right process

- Start preparation early: a rushed process leaks value.

- Create real competition: more qualified buyers usually means better price and better terms.

- Control the message: lead with strengths, be transparent about risks, and show the improvement plan.

11. How an AI-Native M&A Advisor Helps

Selling a construction software business is not only about "finding a buyer." It is about finding the right set of buyers and running a process that makes them compete for a scarce asset.

Higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, strategic fit, financial capacity, and synergy signals. More relevant buyers means more competition, stronger offers, and a higher chance the deal closes even if one buyer drops out.

Initial offers in under 6 weeks. AI-driven buyer matching and outreach, faster creation of marketing materials, and structured diligence support can compress timelines. The goal is to reach serious conversations and initial offers much faster than a manual-only approach.

Expert advisory, enhanced by AI. You still need experienced humans running the process - framing the story, managing buyers, negotiating terms, and protecting you through diligence. The advantage is delivering Wall Street-grade advisory quality with AI acceleration, often without traditional bulge-bracket costs.

If you would like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.