The Complete Valuation Playbook for CRM Software Businesses

A valuation guide for CRM founders on what similar businesses sell for and what really moves multiples.

If you are running a CRM software business and considering a sale in the next 1-12 months, valuation should be on your calendar now - not after you start taking buyer calls. CRM is in a phase where buyers are tightening standards (retention, margins, security), while also paying up for the right assets (sticky workflows, clear cross-sell fit, and real AI automation that improves outcomes).

This playbook is built for founders and CEOs of privately held CRM businesses. It shows what similar businesses actually sell for, what pushes multiples up or down, and what you can realistically do in the next 6-12 months to move toward a better outcome.

1. What Makes CRM Software Unique

CRM software looks simple from the outside - “track leads, manage pipelines, automate emails.” Buyers know it is not that simple. CRM sits in the middle of your customer data, revenue forecasting, and sales execution, which makes it both valuable and risky.

The main CRM business types buyers bucket you into:

- Core CRM suites (sales + pipeline + reporting + basic automation)

- CRM plus operational workflows (order management, quoting, invoicing, supplier or project workflows)

- Customer engagement and support layers (ticketing, chat, messaging, contact-center adjacent)

- All-in-one SMB platforms (CRM bundled with scheduling, payments, invoicing, marketing)

- Ecosystem or platform-dependent plays (built around major platforms, integrations, or partner channels)

Unique valuation considerations in CRM:

- Revenue quality is the product. Buyers care less about “booked revenue” and more about whether customers stay, expand, and pay predictably.

- Switching costs matter more than features. A “nice UI” is not a moat. Embedded workflows, data history, and integrations create real stickiness.

- Market noise is high. CRM is crowded. Buyers discount companies that feel like a commodity point solution without a defensible wedge.

Key risks buyers always check (and price accordingly):

- Churn and retention (logos leaving, downgrades, failed onboarding)

- Customer concentration (one customer or one channel driving too much of revenue)

- Implementation dependence (too much services required to make the product work)

- Security and compliance posture (especially if you handle sensitive customer data)

- Integration fragility (does the product rely on third-party APIs or one platform partner?)

2. What Buyers Look For in a CRM Software Business

Think of buyers as paying for one thing: future cash flows they believe will actually happen. In CRM, they translate that into a few practical questions.

The universal fundamentals (buyers still care, even in software):

- Scale: Bigger is safer. Tiny businesses can still sell well, but buyer pools shrink at very small size.

- Growth: Buyers pay more when growth looks repeatable, not spiky.

- Profitability or a clear path to it: Even growth buyers want to see how the model becomes profitable.

- Gross margin: High software gross margin is a strong signal you are truly product-led (not disguised services).

CRM-specific “this is what really moves the needle”:

- Retention and expansion: Are customers sticking around and paying more over time?

- Stickiness drivers: Workflows, data gravity, integrations, and embedded processes.

- Position in the stack: Are you a “nice-to-have” tool, or do you sit on a mission-critical workflow?

- Go-to-market efficiency: Buyers look for a repeatable engine (not heroic founder selling).

How private equity buyers think

Private equity (PE) cares about what they can buy you for today - and what they can sell you for in 3-7 years.

- Entry multiple vs exit multiple: They want to buy at a reasonable multiple and exit at an equal or higher multiple.

- Who they can sell to later: A larger PE fund, a strategic buyer (bigger software company), or occasionally the public markets.

- The levers they expect to pull:

- Price increases (if you have pricing power and low churn risk)

- Packaging and upsell (more modules per customer)

- Channel expansion (partners, marketplaces, agencies)

- Cost discipline (especially in G&A and “nice-to-have” R&D)

If your CRM business has strong retention, clear upsell, and clean reporting, PE becomes a much more credible buyer - and competition improves.

3. Deep Dive: “Commodity CRM” vs Sticky Operational CRM

Here is one of the biggest valuation splitters in CRM: Are you “another CRM,” or are you embedded in how work gets done? This shows up repeatedly in deal outcomes, even when revenue is similar.

When CRM expands into operational modules (order management, supplier workflows, quoting-to-cash, project delivery), it becomes harder to rip out. Buyers will often pay more for that kind of footprint because it reduces churn risk and increases expansion potential.

In the deal patterns and commentary, CRM platforms that extend beyond sales tracking into operational modules are described as “stickier and harder to displace” than pure CRM point solutions. That is exactly the kind of differentiation that turns a multiple from “average” into “upper end.”

Buyers care because:

- Operational workflows create daily usage, not “weekly pipeline updates.”

- Operational modules tend to drive multi-department adoption, which reduces churn.

- They support module attach (customers buy more over time), which makes growth more efficient.

How you move from the “lower-value” to “higher-value” profile in 6-12 months:

- Measure stickiness in simple terms: module usage, module attach rate, and churn by customer cohort.

- Package workflows, not features: sell “quote-to-cash” or “lead-to-order,” not “custom fields.”

- Prove ROI with customer stories: time saved, fewer errors, faster cycle times.

Mini-table to self-diagnose:

4. What CRM Software Businesses Sell For - and What Public Markets Show

Valuation is not a single number - it is a range shaped by your business quality, buyer type, and competitive tension in the process.

To keep this practical, you should use two reference points:

- Private market deals: what real acquisitions in this neighborhood have paid

- Public market multiples: a “ceiling and floor” reference band (not a price tag)

4.1 Private Market Deals (Similar Acquisitions)

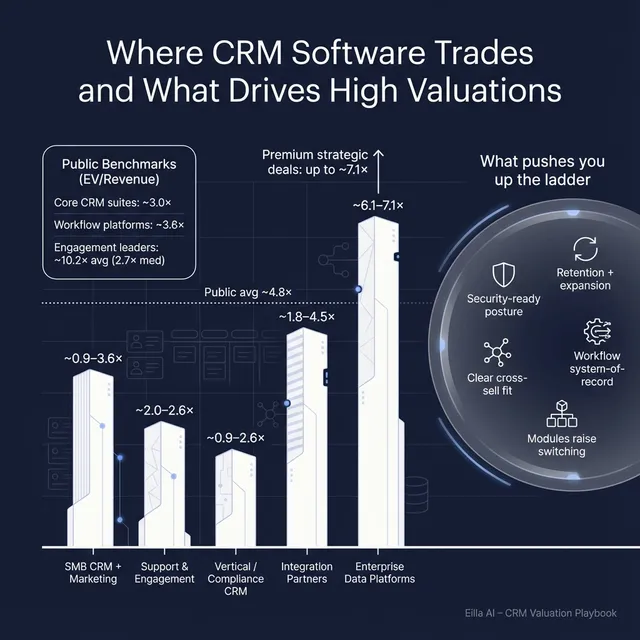

Across the precedent transactions dataset, the overall average EV/Revenue multiple is about 3.3x (and the median is also 3.3x). But CRM-related outcomes vary widely by segment and business quality.

Two patterns matter for founders:

- SMB CRM deals can be low-multiple when churn, services mix, or growth quality is weak - the segment’s median is around 1.0x even though the average is higher (a sign of wide dispersion).

- Adjacency and platform fit can create premium outcomes - especially when the asset plugs into a larger suite (CRM + messaging, CRM + data, CRM + workflow).

A founder-friendly way to interpret the ranges is to group by deal type:

These ranges are illustrative. A well-run CRM business can outperform its “segment average” if it looks scarce, sticky, and easy to scale.

4.2 Public Companies

Public markets give you a sanity check. As of mid-to-end 2025, the grouped public comps show:

- Overall average EV/Revenue: ~4.8x (median ~4.8x)

- Overall average EV/EBITDA: ~28.4x (median ~28.4x)

Within CRM-adjacent groups, there is a clear spread:

- Core CRM & sales/service cloud platforms: ~3.0x average EV/Revenue (median ~2.3x), with EV/EBITDA averages around ~29.4x (median ~19.2x)

- ERP/low-code/workflow platforms: ~3.6x average EV/Revenue (median ~2.2x), EV/EBITDA average ~31.7x (median ~22.4x)

- Marketing automation & omnichannel engagement: a high average EV/Revenue (~10.2x) but a much lower median (~2.7x), which signals outliers - not “typical” outcomes

A simple founder takeaway:

How to use public multiples correctly:

- Treat them as reference bands, not your price.

- Adjust down for smaller scale, customer concentration, weaker retention, or heavy services.

- Adjust up when you have a scarce position (vertical depth, strategic adjacency, or a clear cross-sell fit for a larger platform).

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes are not magic. They are a handful of repeatable themes that show up in buyer behavior and deal narratives.

Below are the most common premium drivers in CRM, including the specific ones observed in the deal patterns.

5.1 High-margin SaaS with visible margin expansion

Buyers pay more when they can see the business getting more profitable as it grows.

- Why: It reduces risk and supports higher valuations on either revenue or EBITDA multiples.

- What it looks like in practice:

- Software gross margins that stay high as you scale

- EBITDA margin improving year over year (not just a one-time cut)

5.2 Product breadth that increases switching costs

CRM platforms that expand into operational modules (orders, suppliers, projects) are harder to replace.

- Why: It improves retention and makes expansion easier.

- Practical examples:

- “Lead-to-order” workflows that touch multiple teams

- Modules that customers adopt after the initial sale (attach)

5.3 Clear adjacency synergy (CRM plus messaging/chat, CRM plus data)

CRM assets can earn premiums when they unlock cross-sell into a larger installed base.

- Why: Strategics (and some sponsors) pay more when there is a credible “sell this to our customers” story.

- Practical examples:

- Messaging/chat layers that plug into CRM workflows

- Data integration or “single customer view” capabilities that strengthen a broader platform

5.4 Scale and strategic fit - even if profitability is not perfect

The data shows that large, high-gross-margin cloud platforms have attracted premium revenue multiples in acquisitions even with negative EBITDA, driven by scale and a well-defined synergy thesis.

- Why: At scale, buyers can justify investment because they can spread costs, cross-sell, and integrate.

- Founder translation: you do not need to be huge, but you do need a believable “this gets bigger” story.

5.5 Vertical depth and compliance-heavy workflows

In regulated or compliance-sensitive verticals, domain depth can attract strategic buyers even if the “headline multiples” look modest.

- Why: Compliance workflows create mission-critical stickiness.

- Practical examples:

- Vertical templates, audit trails, permissioning, certifications

- Higher win rates in one regulated segment vs being “generic CRM”

5.6 Earn-outs that align price with proven post-close growth

Earn-outs show up often in CRM-adjacent deals. They are not “good” or “bad” by default - they are a tool.

- Why: They can bridge valuation gaps when the buyer believes in growth but wants proof.

- Practical examples:

- Earn-outs tied to ARR growth, retention, or cross-sell milestones

5.7 The basics that still matter (and buyers quietly punish when missing)

Even when your product is strong, buyers pay more when the business is easy to diligence and transfer:

- Clean financials and consistent revenue recognition

- Diversified customer base

- A leadership bench that does not collapse without you

- Clear KPIs: retention, expansion, pipeline health, implementation capacity

6. Discount Drivers (What Lowers Multiples)

Discounts usually come from one of two things: uncertainty or fragility. In CRM, buyers are especially sensitive to churn risk and “hidden services.”

Common discount drivers:

- High churn or unclear retention reporting

- If you cannot explain churn simply, buyers assume it is worse than you say.

- Services-heavy delivery

- If implementation or customization is required for every deal, buyers discount the “software multiple.”

- Weak differentiation

- “We are cheaper than the big guys” can work in the market, but it can cap valuation unless you prove stickiness and ROI.

- Customer concentration

- One customer or one channel driving too much revenue creates existential risk.

- Messy product architecture or integration dependence

- If your value depends on one partner API or one platform policy, buyers price that risk in.

- Security and compliance gaps

- CRM is a data product. Weak posture can kill deals or force price chips late in diligence.

- Founder dependency

- If the founder is the sales engine, product brain, and customer success escalation path, buyers worry about transition risk.

The good news: many of these are fixable in 6-12 months if you prioritize the right work.

7. Valuation Example: A CRM Software Company

This is a worked example to show logic - not a prediction and not investment advice.

Step 1: The valuation logic

For a private CRM business, buyers typically triangulate valuation using:

- Private deal ranges in comparable segments (what similar companies actually sold for)

- Public market reference bands (a ceiling/floor sanity check)

- Business quality adjustments (premium drivers vs discount drivers)

A practical way to do this:

- Start with a base multiple range anchored to SMB/mid-market CRM comps.

- Move up for strong SaaS margins, improving profitability, and sticky product breadth.

- Move down for churn risk, services dependence, concentration, or unclear reporting.

- Cross-check against public comps to make sure the result is not unrealistic.

Step 2: Apply it to a fictional company at USD 10m revenue

Meet “NorthBridge CRM” (fictional):

- USD 10.0m annual revenue (fictional)

- 85 percent recurring subscription revenue

- High SaaS gross margin (~85-90 percent)

- EBITDA margin ~8 percent and improving

- Product includes core CRM plus quoting and order-to-invoice workflows

- Moderate SMB/mid-market customer base with growing partner channel

Illustrative multiple ranges (anchored to the CRM private/public bands and refined for quality):

Why these scenarios differ:

- The premium case assumes strong retention, clear module attach, clean reporting, and a believable strategic fit story (CRM plus operational workflows and integrations).

- The discounted case assumes higher churn, heavier services, or unclear metrics that raise buyer uncertainty.

Step 3: What this means for you

Two CRM businesses with the same USD 10m revenue can be worth very different amounts because buyers are not paying for revenue - they are paying for durable, defensible, transferable revenue.

If you want to move your multiple, focus less on “telling a better story” and more on making the story true in the numbers: retention, expansion, margin expansion, and stickiness.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as a blunt internal tool. Score each factor from 0 to 2:

- 0 = weak / unclear

- 1 = decent

- 2 = strong / proven

How to interpret your total score (directionally):

- High band: You are closer to the upper end of typical CRM ranges, and more buyer types will engage.

- Mid band: You can sell, but expect harder questions and more structure (earn-outs, holdbacks).

- Low band: You may be leaving money on the table by selling too early - or you need a very targeted buyer who values your niche.

The goal is not to “get a perfect score.” The goal is to identify the 2-3 upgrades that most directly reduce buyer uncertainty.

9. Common Mistakes That Could Reduce Valuation

These are avoidable - and they show up constantly in CRM deals.

- Rushing the sale

- If you start a process before your numbers and story are clean, you force buyers to assume risk. Risk becomes a lower multiple or tougher terms.

- Hiding problems

- Issues always surface in diligence. Hiding them destroys trust and often triggers late price cuts or a failed deal.

- Weak financial records

- Buyers want clean revenue breakdowns (subscription vs services), retention metrics, and a simple bridge from bookings to revenue. If you cannot produce this quickly, the buyer assumes the worst.

- No structured, competitive sale process with an advisor

- A structured process creates competition. Many practitioners and studies commonly cite that competitive, well-run processes can drive meaningfully higher pricing (often quoted around 25 percent) versus one-off, negotiated deals. Even if your exact uplift varies, the direction is real: competition raises outcomes.

- Revealing what price you want instead of letting the market bid

- If you say “we want USD 50m,” you cap price discovery. Buyers will anchor near your ask instead of telling you what they would have paid.

- CRM-specific mistake: treating retention as an afterthought

- In CRM, churn kills value. If you do not measure churn cleanly and show what you are doing to improve it, buyers will price you like a risky asset.

- CRM-specific mistake: selling “features” instead of “workflow ownership”

- Feature lists do not create a moat. Buyers pay for embedded workflows, integrations, and real ROI.

10. What CRM Founders Can Do in 6-12 Months to Increase Valuation

You do not need a total reinvention. You need focused upgrades that buyers reward.

10.1 Improve the numbers buyers trust most

- Make churn and retention undeniable

- Produce a simple retention dashboard: logo churn, revenue churn, and expansion by cohort.

- Increase recurring mix and reduce “custom work”

- Package repeatable onboarding. Push custom work into standardized modules or paid implementation partners.

- Show margin expansion drivers

- Identify 2-3 levers (pricing, support efficiency, onboarding time, cloud costs) and show progress over multiple quarters.

10.2 Increase stickiness (without a massive product pivot)

- Deepen 2-3 critical integrations

- Buyers pay more when you are embedded in the stack customers already use.

- Drive module attach

- Create a clear upgrade path: core CRM -> workflow module -> automation add-on.

- Prove operational ROI

- Collect 5-10 short customer proofs: cycle time reduction, fewer errors, faster invoicing, better conversion.

10.3 De-risk the business for a buyer

- Reduce concentration

- If one customer, one vertical, or one channel dominates, start balancing now.

- Build a leadership bench

- Buyers need to believe the business runs without the founder in every critical loop.

- Tighten security posture

- Document your controls, permissions, audit trails, and incident processes. In CRM, this is table stakes for many buyers.

10.4 Prepare for a sale process like a product launch

- Build a clean data room

- Financials, KPIs, customer cohorts, contracts, security docs, product roadmap.

- Craft a simple, truthful narrative

- What you own, why customers stick, why you win, and why the next buyer can scale it.

11. How an AI-Native M&A Advisor Helps

A strong outcome in CRM usually comes from two things: reaching the right buyers and running a tight process. That is where an AI-native approach changes the game.

Higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, synergies, financial capacity, and other signals. More relevant buyers means more competition, stronger offers, and a higher chance the deal closes if one buyer drops.

Initial offers in under 6 weeks. AI-driven buyer matching and connecting, faster creation of process marketing materials, and structured support through diligence can compress timelines dramatically compared to manual-only approaches.

Expert advisory, enhanced by AI. You still need experienced M&A professionals to run the process, negotiate, and position the business credibly. The difference is you get Wall Street-grade materials, sharper positioning, and better buyer targeting - without traditional “bulge bracket” costs.

If you would like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.