The Complete Valuation Playbook for Dental Services Businesses

A data-driven guide for dental services founders to understand what buyers reward vs discount and what different types of dental businesses trade at.

If you are running a dental services business and thinking about a sale in the next 1-12 months, valuation is not a guessing game - it is a pattern-recognition exercise. Buyers pay predictable prices for predictable cash flows, and they discount anything that looks hard to scale, hard to defend, or hard to verify.

This playbook is built for dental services founders: it shows what similar businesses have sold for, how public markets value adjacent categories, what consistently drives higher vs lower outcomes, and how to pressure-test your own valuation with a simple framework and a worked example.

You will not get a single “right number” from any blog post. You will get the logic that makes buyers lean up or down - and a practical 6-12 month plan to move your business toward the top end of the range.

1. What Makes Dental Services Unique

Dental services is unusual because the “product” is delivered by licensed professionals, in physical locations, under strict clinical and regulatory standards - and the biggest asset is often people and patient relationships, not software or IP.

The main business models buyers see

Most privately held dental services businesses fall into a few common shapes:

- Single clinic with a strong owner-operator dentist (often high clinical quality, but key-person risk).

- Multi-clinic group (2-30+ locations) with varying degrees of centralization.

- Dental support organization-style platform (central ops + clinician partners, with scalable back office).

- Hybrid models (services + lab, services + membership plan, services + proprietary tech/workflow).

Unique valuation considerations in dental

Valuation is less about “cool story” and more about repeatability:

- Clinic-level economics matter: chair utilization, hygiene recall, case acceptance, and provider productivity.

- People risk matters more than in many sectors: associate dentist retention, hygienist availability, and leadership depth.

- Payer and pricing structure matters: fee-for-service vs managed care mix, discount plans, and your ability to take price responsibly.

- Capex and leases matter: equipment, buildouts, lease terms, and how much reinvestment is required to keep clinics competitive.

Risk factors buyers will always check

Expect deep diligence on:

- Clinical compliance and quality systems (sterilization protocols, incident handling, complaint trends).

- Licensing and ownership rules in your jurisdictions (and how your structure complies).

- Provider concentration (what happens if your top dentist leaves).

- Location concentration (what happens if your top clinic has a bad year or a lease issue).

- Consistency of earnings across clinics and across months.

2. What Buyers Look For in a Dental Services Business

Buyers are not buying “revenue.” They are buying durable cash flow with a believable path to more of it.

The obvious fundamentals still matter

- Scale: Multi-clinic groups with professional management are easier to underwrite than a single-site practice.

- Growth: Not just top-line growth - buyers care whether growth is coming from repeatable drivers (new patients, recall, added providers, better scheduling).

- Profitability: Stable EBITDA (earnings before interest, taxes, depreciation, and amortization) with clear bridges from revenue to profit.

- Clean financials: Buyers pay more when your numbers are easy to trust.

Dental-specific “tell me you can scale” signals

- A real patient acquisition engine: consistent new patient flow by channel, not just “word of mouth.”

- Retention and recall discipline: hygiene recall, reactivation, and repeat visits that do not depend on one star clinician.

- Standardization: how consistent clinical offerings, pricing policies, procurement, and staffing models are across sites.

- Clinic roll-out playbook: if you open or acquire clinics, can you integrate them with predictable timelines and outcomes?

How private equity (PE) thinks about your deal

PE is usually modeling a 3-7 year hold. Their core questions are simple:

- What multiple do we pay today, and what multiple can we sell at later? If the business becomes bigger, more stable, and more professional, it may justify a better exit.

- Who is the likely buyer later? Another PE fund, a larger dental platform, or a broader healthcare services buyer.

- What levers can we pull? In dental services these are typically:

- clinic performance improvement (scheduling, chair utilization, recall)

- procurement and lab savings

- adding providers and extending hours

- adding high-value procedures where clinically appropriate

- smart M&A tuck-ins and integration

3. Deep Dive: Recurring Revenue and Patient Stickiness in a Fee-for-Service World

This is one of the biggest valuation separators in dental services: how predictable your future revenue is without heroic assumptions.

A buyer will always ask: “If we own this business next year, how much of next year’s revenue is already ‘in the bag’ because patients reliably come back?”

How this shows up in deal logic

In the broader healthcare deals data, buyers lean into higher valuations when revenue has visibility - for example, when there is clear recurring revenue disclosure or deal structures that share performance risk (like earn-outs). In dental services, the “recurring” analog is not usually a SaaS contract. It is your recall system, membership plan economics, and retention behavior.

Why buyers care

Predictability reduces buyer downside. If revenue is highly dependent on constant new patient acquisition, one marketing channel, or one superstar producer, buyers underwrite more conservatively and push harder for holdbacks or earn-outs.

How to move from lower-value to higher-value

You rarely need to “pivot the business.” You need to make your existing revenue more provably repeatable:

- tighten recall and reactivation workflows

- measure retention by cohort (patients who started in Jan vs Feb)

- build a membership or preventive plan where it makes clinical and business sense

- diversify acquisition channels so one channel cannot break your forecast

4. What Dental Services Businesses Sell For - and What Public Markets Show

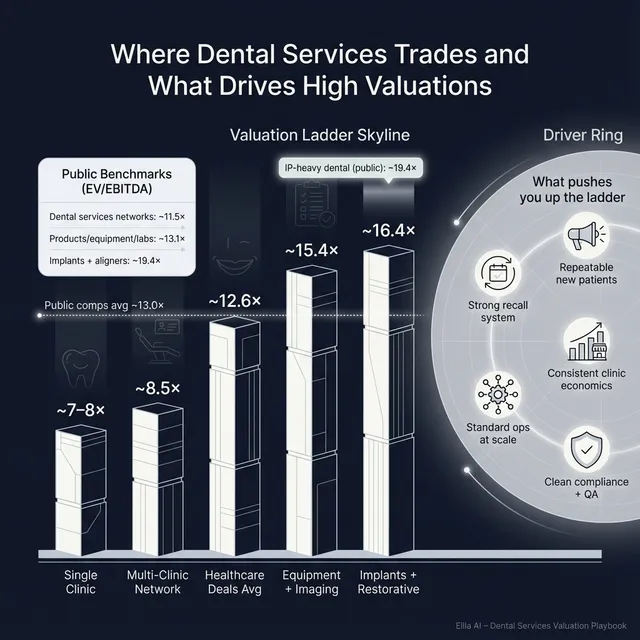

Here’s the clean takeaway from the data: dental services networks are usually valued like services businesses (often EBITDA-driven), while dental products, implants, and tech-enabled platforms can trade more like “product + IP” businesses.

Use the ranges below as reference bands, not price tags. Your multiple moves based on risk, growth, and how scalable your operating model is.

4.1 Private Market Deals (Similar Acquisitions)

Private transaction data for multi-clinic dental services networks shows average multiples around 3.4x EV/Revenue and 8.5x EV/EBITDA. Across all healthcare-related precedent deals in the dataset, the overall average is around 3.5x EV/Revenue and 12.6x EV/EBITDA - but dental services networks tend to be lower on EBITDA multiples than software-heavy healthcare workflows.

A practical interpretation: many dental services deals are underwritten on clinic earnings power and integration risk, not on “top-line excitement.”

How to use this: if you are a pure dental services operator, your closest “gravity” is the multi-clinic services band. If you have real proprietary tech, unusually high-margin productized revenue, or a platform-like workflow component, you may earn a different conversation - but you will need proof, not adjectives.

4.2 Public Companies

Public markets (as of late 2025) provide another reference point. In the dataset:

- Multi-clinic dental services networks trade around ~2.0x EV/Revenue on average (median ~1.9x) and ~11.5x EV/EBITDA on average (median ~14.0x).

- Dental implants and orthodontic aligner manufacturers trade higher on revenue (average ~4.4x) and around ~19.4x EV/EBITDA.

- Dental products, materials, equipment and lab solutions average ~2.7x EV/Revenue and ~13.1x EV/EBITDA.

- Integrated healthcare groups that include dental can trade much lower on revenue and EBITDA, reflecting mix and complexity.

How founders should use public multiples:Public multiples are a sanity check, not a direct valuation for your business. Private businesses are usually adjusted downward for smaller scale, key-person risk, and less liquidity. But private deals can also be adjusted upward when an asset is scarce, strategically important, or runs a strong competitive process.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes usually come from one thing: buyers feel they are taking less risk for more upside.

Below are the premium themes that show up in the deal patterns and translate cleanly into dental services.

5.1 Strategic adjacency and distribution pull-through

Buyers pay more when acquiring you unlocks distribution - meaning they can drive more patient volume, referrals, or cross-sell through their existing reach.

For dental services, the premium version looks like:

- a demonstrated patient acquisition engine that can scale

- strong referral density across locations

- partnerships (employers, insurers, affinity groups) that competitors cannot easily replicate

5.2 Enterprise-like profitability and repeatable clinic economics

In the broader data, higher EV/EBITDA outcomes are associated with businesses that look “enterprise-like” in their profitability - predictable margins, clean reporting, and low volatility.

In dental services, buyers look for:

- consistent clinic-level EBITDA profiles (not one superstar clinic carrying the group)

- central cost leverage that grows as you scale

- evidence you can maintain margins while adding providers and locations

5.3 High-margin, productized economics (pricing power and operating leverage)

High gross margins are a gating factor for premium valuation behavior in product and tech deals. For dental services, you mimic this by proving you have operating leverage:

- standardized procurement and lab utilization

- optimized scheduling and chair productivity

- high hygiene utilization and strong recall

5.4 “Platform-ness” and switching costs (even without being software)

Software platforms get premium outcomes because customers stick and switching is painful. Dental services can create a softer version of switching costs through:

- membership plans and recall systems that keep patients returning

- strong patient experience and brand trust across locations

- integrated specialist services that keep treatment in-network

5.5 Brand trust, quality proof, and scale

In medtech, clinical evidence and portfolio breadth reduce adoption friction. In dental services, the closest equivalent is proof that your model delivers consistently:

- patient satisfaction and retention metrics by clinic

- consistent clinical protocols and QA processes

- leadership depth that does not rely on the founder’s daily presence

5.6 Revenue visibility and deal structures that reduce buyer downside

Where forecasts are harder to underwrite, buyers often use earn-outs or deferred consideration. You improve outcomes by making performance easier to trust:

- clear KPIs and cohort tracking

- documented retention and recall performance

- conservative forecasting with evidence

6. Discount Drivers (What Lowers Multiples)

Discounts are not moral judgments. They are buyer math: “What could go wrong, and how likely is it?”

The most common dental services valuation discounts

- Key dentist dependence: If one clinician drives a large share of production, buyers will discount or require retention structures.

- Clinic concentration: If one location drives most profit, the business is fragile.

- Unclear financials or noisy EBITDA: If add-backs are aggressive or reporting is inconsistent, buyers assume the worst.

- Staffing instability: hygienist shortages, high turnover, or weak recruiting pipelines create earnings risk.

- Weak compliance and clinical governance: anything that could become a reputational or regulatory issue can crater price and deal certainty.

- Capex and lease risk: short leases, landlord risk, deferred equipment replacements, or heavy upcoming buildouts reduce value.

- Overreliance on one acquisition channel: if volume is tied to one marketing source, a policy change or cost spike can hit earnings fast.

A common pattern in lower-end outcomes

When buyers cannot confidently underwrite durable earnings, they protect themselves with:

- lower headline multiples

- more holdbacks or earn-outs

- tougher terms (working capital targets, reps and warranties)

7. Valuation Example: A Dental Services Company

This example is fictional. The company, metrics, and outcomes below are illustrative - meant to show how buyers think, not to predict a sale price.

Step 1: The logic in plain English

- Start with the right comp set. For a dental services operator, the closest reference is multi-clinic dental services networks (services economics), not implant manufacturers or dental software.

- Anchor on a core multiple band. The data suggests multi-clinic dental services networks often sit around low-to-mid teens EV/EBITDA in public markets and high single-digit EV/EBITDA in private deals, with revenue multiples commonly in the low single digits.

- Adjust up or down based on risk and quality. Premium drivers push you up (repeatability, scale, diversified earnings, strong retention). Discount drivers push you down (key-person risk, volatility, weak reporting).

- Cross-check with revenue multiples. For services businesses, revenue multiples can mislead if margins are not considered, so EBITDA is usually the “truth serum.”

Step 2: Apply it to a fictional business

Meet BrightHarbor Dental Group (fictional):

- 8 clinics in one region

- USD 10m revenue (fictional)

- 15% EBITDA margin (USD 1.5m EBITDA)

- good retention and recall, but still founder-heavy clinically

Now apply scenarios:

What moves BrightHarbor toward premium?

- reducing reliance on the founder dentist

- proving clinic-level consistency and central ops leverage

- documenting patient acquisition, retention, and recall performance

- strengthening leadership bench and reporting

Step 3: What this means for you

Two dental groups with the same USD 10m revenue can have very different values because buyers are pricing risk and repeatability, not “size.” Your job in the next 6-12 months is to turn your earnings story into something a buyer can underwrite with confidence.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as a quick, honest diagnostic. Score each factor 0-2:

- 0 = weak or unclear

- 1 = acceptable but not strong

- 2 = strong and well-documented

How to use the score

- High total score: you are closer to premium outcomes because buyers see durability and scalability.

- Middle score: you are in fair-market territory - process quality and narrative matter a lot.

- Low score: you may still sell, but expect tougher terms unless you fix the biggest risks.

Interpretation guide (rough):

- 18-24: closer to premium conversation

- 10-17: fair-market with clear fix-it list

- 0-9: expect discounts unless risks are addressed

9. Common Mistakes That Could Reduce Valuation

Rushing the sale

If you go to market before your numbers and story are ready, you force buyers to price uncertainty. In services businesses, uncertainty gets punished quickly.

Hiding problems

Due diligence is designed to find issues. If buyers discover something late (provider disputes, compliance gaps, KPI inconsistencies), the problem becomes less about the issue and more about trust - and trust is value.

Weak financial records

Many dental founders underinvest in reporting until it is time to sell. But buyers pay more when they can clearly see:

- clinic-level P&Ls

- normalized EBITDA with reasonable add-backs

- consistent KPI tracking tied to financial performance

No structured, competitive process with an advisor

Running a structured process (tight positioning, broad buyer outreach, controlled timelines) typically improves outcomes because it creates competition. Practitioner datasets often show structured competitive processes can lift purchase prices by around 20-30% versus one-off negotiations - mainly because buyers bid differently when they know they are not alone.

Revealing your price too early

If you tell buyers “we want USD 10m,” many will anchor to that and offer USD 10.1m or USD 10.2m - even if they could have justified more. Let the market discover price through offers.

Dental-specific mistake: not de-risking the founder dentist

If your clinical production or patient loyalty is inseparable from you personally, buyers will assume churn risk post-close and push for retention-heavy structures, discounts, or both.

10. What Dental Services Founders Can Do in 6-12 Months to Increase Valuation

Think in three lanes: improve the numbers, reduce buyer fear, and run a process that creates competition.

10.1 Improve the numbers (without fantasy projects)

- Clinic performance playbook: tighten scheduling, reduce downtime, improve chair utilization.

- Recall and reactivation: increase hygiene recall rates and track reactivation cohorts.

- Procurement and lab discipline: standardize suppliers, monitor lab spend, and reduce variability across sites.

- Add providers thoughtfully: expand capacity where demand is proven (not just hope).

10.2 Reduce key risks buyers price heavily

- De-risk provider concentration: build an associate bench and formal retention plans.

- Operationalize compliance and QA: documented protocols, training logs, incident tracking, and continuous improvement.

- Fix lease and capex surprises: extend key leases, document capex needs, and show a maintenance plan.

10.3 Make your performance easy to underwrite

- Build a simple KPI pack that ties to economics:

- new patients by channel

- recall rate and reactivation

- case acceptance (by category)

- provider productivity

- clinic-level EBITDA consistency

- Upgrade financial clarity:

- clean add-back logic

- consistent accounting policies

- clinic-level reporting that matches bank statements and payroll

10.4 Prepare for a competitive sale process

- Write a clear story: why your clinics win, and why performance is repeatable.

- Pre-answer diligence questions before buyers ask them.

- Run a buyer outreach process that maximizes competitive tension while protecting confidentiality.

11. How an AI-Native M&A Advisor Helps

An AI-native M&A advisor combines experienced bankers with software that expands reach and speeds execution - which matters when your goal is to get the strongest offer, not just any offer.

Higher valuations through broader buyer reach: AI can map hundreds of relevant acquirers based on deal history, strategic fit, and ability to pay. More qualified buyers means more competition, better terms, and more options if one buyer drops late.

Initial offers in under 6 weeks: AI-supported buyer matching, outreach, and marketing materials can compress timelines. Faster does not mean sloppy - it means fewer dead weeks and a tighter process that maintains momentum.

Expert advisory, enhanced by AI: you still need credible humans who know how buyers think, how to frame your story, and how to manage diligence. The AI layer helps deliver Wall Street-grade materials, buyer targeting, and process discipline without traditional bulge-bracket costs.

If you would like to understand how our AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.