The Complete Valuation Playbook for Employee Engagement Businesses

A valuation playbook for Employee Engagement founders - what similar companies sell for and the metrics buyers look at.

If you run an Employee Engagement business and you are thinking about selling in the next 1-12 months, valuation is not a single number - it is the output of a story buyers believe, backed by metrics they trust.

This is a data-based playbook built specifically for Employee Engagement founders: what similar businesses have sold for, what public markets imply, what drives premium outcomes, what drags multiples down, and what you can realistically do in 6-12 months to move your price up.

The sector is also at an important moment. Buyers are consolidating “workforce tech” stacks (engagement, comms, wellbeing, payroll, scheduling, financial wellness), but they are stricter than a few years ago about proof: adoption, retention, gross margin, and a credible path to profitability.

1. What Makes Employee Engagement Businesses Unique

Employee Engagement is an unusual category because the buyer is not the user - and the “real” buyer value is often indirect.

Most Employee Engagement businesses fall into a few overlapping types:

- Engagement and pulse platforms (surveys, feedback loops, recognition, analytics)

- Frontline communication and training apps (multi-site comms, microlearning, task execution)

- Wellbeing and benefits-adjacent platforms (mental health, fitness access, wellbeing content, employer benefit hubs)

- Digital adoption and productivity overlays (guidance layers that sit on top of business software)

- Financial wellness / earned wage access adjacencies (often packaged as retention and engagement tools)

That overlap matters because valuation is often set by the buyer’s nearest “mental comp set.” A platform that looks like “core engagement software” can price very differently from one that looks like “financial wellness fintech” - even if both sell to HR.

Why valuation is different here

1) Adoption is the product.Employee Engagement businesses win or lose based on employee usage, not just HR buying intent. Buyers will obsess over activation, weekly usage, manager participation, and multi-site rollout success.

2) ROI is often soft - so proof matters.“Improved culture” is not enough in M&A. Buyers want measurable outcomes: reduced turnover, lower absenteeism, faster onboarding, higher training completion, fewer safety incidents, better internal mobility, better employee NPS. If you cannot quantify it, buyers discount it.

3) The data is sensitive.You handle employee data, sentiment data, sometimes health and payroll-adjacent data. Buyers will always check privacy, security, retention policies, and compliance readiness.

Key risk factors buyers will always check

- Churn and budget risk: engagement tools can be seen as “nice-to-have” in downturns unless you are tied to retention, compliance, or operations.

- Low penetration risk: HR might buy, but employees do not adopt. That kills renewal and expansion.

- Services creep: implementations, program design, facilitation, or consulting can quietly turn a SaaS story into a services story, lowering multiples.

- Platform dependence: if you rely on one distribution partner, one app store, one integration, or one channel, buyers price that concentration risk.

- Claims risk: if your marketing promises outcomes you cannot substantiate, diligence becomes painful.

2. What Buyers Look For in an Employee Engagement Business

Buyers typically fall into two camps: strategic acquirers (bigger software or services platforms) and private equity (PE). Both care about the same fundamentals, but they frame them differently.

The obvious fundamentals - in plain English

- Recurring revenue quality: subscriptions renew predictably, with clear contracts and low one-off revenue.

- Growth that is not “one big customer”: steady new customer adds and expansion within customers.

- Gross margin strength: the more of your revenue is true software, the higher and cleaner your gross margin tends to be.

- Customer stickiness: customers stay and ideally pay more over time.

- A credible path to profitability: you do not need to be profitable today, but buyers want a believable plan.

Employee Engagement-specific nuance buyers care about

- Usage depth: not just “licenses sold,” but active users, weekly usage, and manager engagement.

- Multi-site rollout playbook: can you land in 20 stores and expand to 2,000? Buyers pay for repeatable rollout, not custom heroics.

- Proof of outcomes: retention improvements, absenteeism reduction, training completion, time-to-productivity - ideally measured and repeatable.

- Integration readiness: “does it plug into payroll, HRIS, scheduling, and comms tools without drama?”

- Category positioning: are you a point solution, or a “must-have module” in a broader workforce stack?

How PE buyers think (and why it affects your valuation)

PE is buying with an exit in mind - usually in 3-7 years. They care about:

- Entry multiple vs exit multiple: if they pay a high multiple, they need a credible story that the business can sell later at an equal or higher multiple.

- Who they can sell to later: a larger PE fund, a strategic platform, or (rarely) a public market path.

- Levers they expect to pull: price increases, cross-sell, reducing churn, improving sales efficiency, productizing onboarding, and sometimes add-on acquisitions in adjacent categories.

A PE buyer can pay well if your business is “fixable” in predictable ways. But if your business requires a complete reinvention, PE usually discounts it or passes.

3. Deep Dive: The Valuation Nuance That Matters Most Here - Adoption Quality, Not Just Revenue

In Employee Engagement, two companies can have the same revenue and wildly different valuations because one has “real adoption” and the other has “HR shelfware.”

Buyers care because adoption predicts everything that matters to them: renewal, expansion, and defensibility.

How this shows up in deal outcomes

In the deal data, some Employee Engagement and frontline engagement assets achieved strong revenue multiples despite negative EBITDA when they demonstrated large installed bases, deep usage, and broad penetration in frontline-heavy sectors. The story becomes: “this is a durable footprint buyers can monetize and expand,” not “this is a tool we hope customers keep.”

On the other end, engagement-like businesses with weaker durability, services-heavy delivery, or unclear usage can transact at much lower revenue multiples - even if they have decent revenue.

Why buyers pay more for “adoption quality”

- Lower churn risk: usage is the best leading indicator of renewals.

- Expansion engine: a used product can expand sites, modules, and user groups.

- Strategic scarcity: if you own employee attention (especially frontline), you become a gateway for other products (training, scheduling, benefits, pay).

- Cleaner diligence: adoption metrics reduce “trust gaps” in diligence.

How to move from lower-value to higher-value adoption profile

If your adoption is not where it needs to be, you do not need magic. You need focus:

- Tighten your activation funnel (time-to-first-value, onboarding completion).

- Build manager rituals into the product (weekly check-ins, recognition cycles, team huddles).

- Prove site-level rollout mechanics (how you go from 1 site to 100 sites).

- Instrument usage like a product company: weekly active users, cohort retention, feature adoption by segment.

Here is a simple way buyers often think about it:

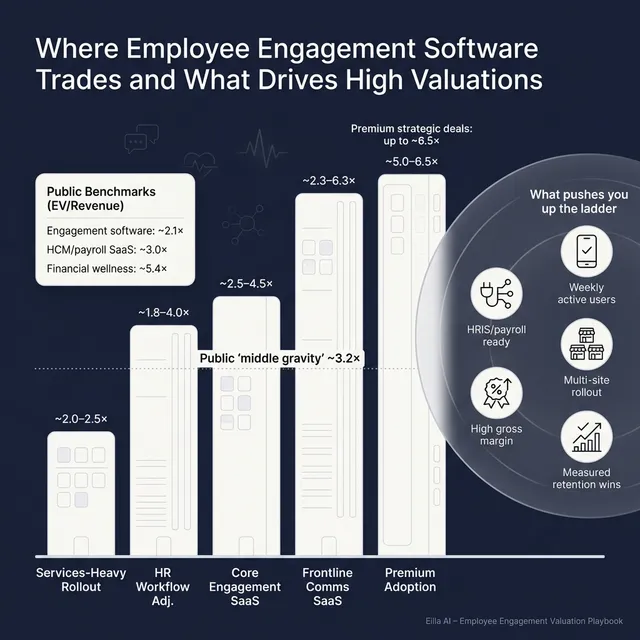

4. What Employee Engagement Businesses Sell For - and What Public Markets Show

Valuation in this sector is best understood as a band, not a point. Private deals reflect negotiation, buyer strategy, and scarcity. Public multiples reflect daily market sentiment and scale, but they provide a useful reference frame.

A practical way to read the data is:

- Public markets set the “gravity” for what scaled platforms trade at.

- Private deals show what buyers will pay for specific strategic fits, adoption footprints, or adjacency value.

- Your multiple moves within the band based on proof: retention, margin, growth, and risk.

4.1 Private Market Deals (Similar Acquisitions)

Using the private deal groupings and the revenue multiple bands observed in comparable acquisitions, Employee Engagement-related SaaS transactions commonly cluster in a few ranges depending on product type and strategic fit:

Two founder-friendly takeaways:

- The same “Employee Engagement” label hides very different businesses. Multiples are often set by the closest adjacent category buyers compare you to.

- Strategic context matters. A buyer filling a critical product gap can pay above what a financial buyer would.

These ranges are illustrative - your outcome depends on your growth, margins, retention, and deal dynamics.

4.2 Public Companies

Public multiples in and around this space (as of mid-to-late 2025) show meaningful differences by segment. The grouped averages are a helpful guide:

How to use these public multiples correctly:

- Treat them as reference bands, not your price tag.

- Private businesses are usually adjusted downward for smaller scale, customer concentration, or higher risk.

- But private deals can adjust upward when your asset is scarce, strategically important, or proves unusual adoption and retention.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes in Employee Engagement tend to come from a few repeatable themes. The deal patterns point to the same idea: buyers pay more when they believe your platform is durable, scalable, and strategically “hard to replace.”

Theme 1: Frontline depth and installed base penetration

Buyers pay up when you own a real footprint in frontline-heavy sectors (retail, hospitality, logistics, healthcare) - not just a few pilots.

Practical signals founders can show:

- Store or site penetration (how many locations per customer)

- Cohort retention by location type

- Clear proof that adoption holds after initial rollout

Theme 2: Ultra-high gross margins and low services dependency

High gross margin is not just a finance metric - it signals a product that scales without proportional headcount.

What buyers like to see:

- Most onboarding is standardized, not custom

- Customer support costs do not rise linearly with revenue

- The product is “software-first” rather than a bundled consulting program

Theme 3: Category leadership and “must-have module” positioning

Premium valuations often appear when buyers see you as a missing puzzle piece in a larger platform.

What helps your story:

- You are a “system of engagement” used weekly, not a quarterly survey

- You have a clear wedge and a clear expansion path

- You win consistently in a defined ICP (industry + workforce type)

Theme 4: Wellbeing and retention outcomes that are measurable

Wellbeing and health adjacency can attract premiums when it is tied to measurable employer outcomes.

What matters:

- You can quantify impact on turnover, absenteeism, or time-to-productivity

- You can tie outcomes to specific product behaviors (not vague culture claims)

- You can show repeatability across customers, not one showcase case study

Theme 5: Integration readiness and ecosystem leverage

Buyers pay more when your product drops into existing HRIS, payroll, scheduling, and collaboration stacks with minimal friction.

Signals that help:

- Pre-built connectors and clear APIs

- Fast implementation timelines

- Partner-led distribution that actually produces pipeline (not just logos on a slide)

Theme 6: Improving growth with a believable path to profitability

The data shows that improving margins and operating leverage can support strong revenue multiples even before profitability.

What you want to demonstrate:

- Growth that does not require “burning more per dollar” each quarter

- Improving EBITDA trend or a credible plan to get there

- Sales motion that is repeatable (clear conversion rates, stable payback periods - explain simply in your materials)

Theme 7: Clean fundamentals that reduce buyer fear

Even in premium deals, the basics matter:

- Clean financials and consistent revenue recognition

- Predictable recurring revenue

- Diversified customer base

- Strong leadership bench beyond the founder

- A product roadmap that does not depend on one person in engineering

6. Discount Drivers (What Lowers Multiples)

Most “low multiple” outcomes are not because the product is bad. They happen because buyers see risk they cannot price confidently.

Common discount drivers in this sector

- Weak retention or unclear renewal drivers: if customers churn or downgrade, buyers assume the category is discretionary.

- Low product adoption: sold seats do not translate into active usage. Buyers fear “silent churn.”

- Services-heavy delivery: if implementation, content creation, facilitation, or consulting is doing the work, buyers lower your revenue multiple because services are harder to scale.

- Customer concentration: one or two customers drive too much revenue, or one channel partner controls pipeline.

- Security, privacy, or compliance gaps: employee data increases perceived risk, and buyers will discount for remediation cost and reputational exposure.

- Unclear positioning: “We do engagement, wellbeing, comms, and a bit of everything” can sound like “we are not the best at anything.”

- No credible path to profitability: not “must be profitable,” but “must be believable.” If margins are not improving as you scale, buyers discount.

The founder-friendly reality

Buyers do not hate risk - they hate unbounded risk. Your job is to turn unknowns into measurable truths: adoption data, retention cohorts, margin trends, and clear contracts.

7. Valuation Example: A Fictional Employee Engagement Company

This is a worked example to show the logic - not investment advice, not a formal valuation, and not a prediction of what your business will sell for.

Step 1: The valuation logic in plain English

- Start with relevant reference bands from both private deals and public comps in adjacent segments.

- Pick a “core” multiple range that fits your business model and stage (SaaS vs services, growth rate, margins, retention).

- Move up for premium drivers (frontline penetration, very strong gross margin, integration readiness, improving profitability, category leadership).

- Move down for discount drivers (weak adoption, churn, services mix, concentration, unclear path to profitability).

A defensible “core” band for an early-to-mid stage, software-first Employee Engagement platform with negative EBITDA often sits in the ~2.5x-4.5x revenue zone when you are not yet proving extreme strategic scarcity. That range aligns with observed private engagement SaaS bands and sits within broader workforce and HCM-adjacent ranges.

Step 2: Apply it to a fictional business

Meet BrightLoop (fictional):

- Employee Engagement + frontline comms app

- Mostly subscription revenue, limited services

- USD 10m annual revenue (fictional)

- EBITDA currently negative, but improving

- Decent adoption in multi-site retail and hospitality

Now look at how outcomes can diverge:

Why the premium case is plausible in this sector: private engagement SaaS deals show that buyers can pay into the 6x-ish zone when the asset has deep penetration and strategic value - even if near-term profitability is not yet there.

Step 3: What this should mean for you

Two businesses with the same USD 10m revenue can be worth 2-3x different amounts because buyers are really buying:

- How durable your revenue is

- How scalable your delivery is

- Whether your footprint is strategically valuable to a larger platform

- How risky diligence will feel

8. Where Your Business Might Fit (Self-Assessment Framework)

This is a simple scoring tool to estimate where you likely sit in the valuation spectrum. Be honest - the goal is to spot the few changes that can move your outcome most.

Score each factor 0 / 1 / 2:

- 0 = weak or unproven

- 1 = decent but not best-in-class

- 2 = strong and well-documented

How to interpret your total

- Mostly 2s: you are closer to the top end of your relevant multiple band.

- A mix of 1s and 2s: you are in “fair market” territory - a good process can still drive a strong outcome.

- Many 0s: you are likely to be priced defensively unless you fix the highest-impact gaps before selling.

The point is not to “score high.” The point is to identify the 2-3 levers that buyers will actually pay for.

9. Common Mistakes That Could Reduce Valuation

These are avoidable - and they show up constantly in founder-led sale processes.

Rushing the sale

If you go to market before your numbers and story are ready, buyers will anchor low. Fixing the narrative mid-process is hard because first impressions stick.

Hiding problems

Buyers will find issues in diligence - churn spikes, customer disputes, weak contracts, messy revenue recognition, security gaps. Hiding problems destroys trust and can kill the deal or force a price cut late in the process.

Weak financial records

Employee Engagement businesses often have messy splits between subscription, onboarding, services, and pass-through costs. Buyers pay more when you can clearly show:

- Recurring revenue vs one-time revenue

- Gross margin by product line

- Retention and expansion by cohort

- A believable path to profitability

Not running a structured, competitive process with an advisor

A structured competitive process typically leads to meaningfully higher purchase prices - often cited around ~25% - because it improves positioning, reaches more credible buyers, and creates real competitive tension.

Revealing what price you are after too early

If you say “we want USD 10m,” many buyers will come back with USD 10.1m or USD 10.2m instead of telling you what they would actually pay. You kill price discovery and cap your upside.

Two industry-specific mistakes to avoid

- Selling “engagement” as a feeling instead of as an outcome. If you cannot quantify impact, buyers treat you as discretionary.

- Ignoring privacy and security readiness. Employee sentiment data is sensitive. If you do not have clean controls, buyers either discount for remediation or walk.

10. What Employee Engagement Founders Can Do in 6-12 Months to Increase Valuation

You do not need a reinvention. You need targeted work on what moves multiples.

1) Improve the numbers buyers trust most

- Reduce churn and prove it by cohort. Even small churn improvements can materially shift valuation because buyers price durability.

- Increase expansion revenue. Add modules, add sites, add manager workflows - show customers paying more over time.

- Push gross margin up by productizing delivery. Reduce custom onboarding, standardize rollouts, and make services optional.

2) Turn adoption into a core asset

- Build a simple adoption dashboard: activation rate, weekly active users, manager participation, cohort retention.

- Create a repeatable “land and expand” rollout plan (site-by-site playbook).

- Package adoption proof into diligence-ready materials: customer case studies with usage charts and outcome metrics.

3) Make your strategic fit obvious

- Clarify your “who” and “why you win” (frontline retail? hospitality? healthcare?)

- Build and document integrations into the systems buyers expect (HRIS, payroll, scheduling, collaboration tools).

- Identify your natural strategic buyers and map your product as a missing module in their stack.

4) De-risk diligence before it starts

- Clean up contracts: renewal terms, price escalation, data processing terms.

- Tighten security posture and documentation (policies, access controls, incident response).

- Prepare clear financial reporting: recurring revenue definitions, margin splits, customer concentration analysis.

5) Prepare a sale narrative that is credible, not hype

Buyers pay for believable trajectories. The story that wins is usually:

- “Here is the durable base we have built” (retention, adoption, footprint)

- “Here is why it will scale” (margin profile, repeatable sales motion)

- “Here is why you, as the buyer, can accelerate it” (distribution, cross-sell, ecosystem fit)

11. How an AI-Native M&A Advisor Helps

Most valuation upside in a sale comes from two things: running a better process and reaching the right buyers. That is exactly where an AI-native M&A advisor can change outcomes.

First, higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, product fit, financial capacity, and synergy signals. More relevant buyers means more competition, stronger offers, and a higher chance the deal closes even if one buyer drops.

Second, initial offers in under 6 weeks. AI-driven buyer matching, faster outreach, and accelerated creation of marketing materials can compress timelines. When combined with strong process management and diligence support, you can reach serious conversations and initial offers much faster than manual-only approaches.

Third, expert advisory, enhanced by AI. The best outcomes still require experienced human advisors: framing your story, positioning your metrics, running a competitive process, and managing diligence pressure. AI amplifies that expertise - delivering Wall Street-grade process quality without traditional “bulge bracket” cost structures.

If you would like to understand how an AI-native process can support your exit, book a demo with one of Eilla AI’s expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.