The Complete Valuation Playbook for ERP Software Businesses

A valuation guide showing what ERP businesses sell for, what drives higher or lower multiples, and the steps founders can take to get buyer-ready.

If you are a founder or CEO of an ERP software business thinking about a sale in the next 1-12 months, valuation is not a mystery - it is a pattern. The pattern is driven by what buyers can underwrite: recurring revenue, customer stickiness, and how essential your product is to running operations.

ERP is also in a very “buyer-active” phase. Consolidation is ongoing (both by strategic software groups and private equity), and buyers are more selective than they were a few years ago. The good news: if you show the right proof points, buyers will still pay up.

This playbook will:

- Show what ERP businesses actually sell for (private deals) and what public markets imply (as of late 2025).

- Decode what pushes you to higher or lower multiples.

- Give you a self-assessment framework and a practical 6-12 month action plan.

1. What Makes ERP Software Unique

ERP is not “just software.” It is the system that runs payroll, purchasing, inventory, production, project delivery, compliance, and financial close - often all at once. That changes valuation, because switching is painful, and buyers love pain (for your customers) when it creates retention.

The main types of ERP businesses (and why they value differently)

Most privately held ERP businesses fall into a few buckets:

- Horizontal ERP platforms: broad suites (finance, supply chain, HR, etc.) that sell across many industries.

- Vertical ERP / industry-specific operations software: purpose-built for one industry (manufacturing niche, field services, logistics, hospitality, laundry/textile rental, etc.).

- ERP “modules”: finance, treasury, procurement, planning, BI dashboards that sit beside a core ERP.

- Services-led ERP businesses: implementation, customization, integration, and managed services (sometimes with a software layer).

Buyers pay very different multiples depending on whether you look like a product business with recurring revenue or a services business with project revenue.

Unique valuation considerations in ERP

ERP valuation hinges on a few sector-specific realities:

- Implementation is both a moat and a risk. It creates stickiness, but it can also create delivery dependency on a few people (you, or a handful of consultants).

- Your “real product” is often the workflow + data model. ERP is valuable when it becomes the source of truth, not when it is a thin UI over a database.

- Buyers care deeply about upgrade cycles and technical debt. An ERP that is hard to modernize (or hard to integrate) can look like future churn.

Key risk factors buyers will always check

Expect diligence to focus on:

- Revenue quality: recurring vs one-time services, renewals, churn, expansions.

- Customer concentration: one or two big logos can quietly dominate risk.

- Implementation capacity and backlog: can the business scale delivery without breaking?

- Product roadmap realism: can you keep up with cloud expectations, security, and integrations?

- Support burden: if support is a hidden “services tax,” margins may not scale.

2. What Buyers Look For in an ERP Software Business

Buyers rarely “buy revenue.” They buy durable cash flows and strategic positioning. In ERP, those come from being embedded, hard to replace, and easy to expand.

The basics still matter

Most buyers start with:

- Scale: revenue size matters because small ERP businesses carry key-person and customer risks.

- Growth: not just “topline up,” but whether growth is repeatable without heroic effort.

- Profitability: EBITDA matters more when you are not pure SaaS. Many ERP businesses are mixed software/services, so buyers want to see a clear path to margin expansion.

ERP-specific nuances that move valuation

In ERP, buyers will quickly pressure-test:

- Recurring mix: maintenance, subscriptions, support retainers, managed hosting/private cloud.

- Customer stickiness: renewal rates, churn, and “are customers expanding?”

- Time-to-value: does implementation reliably succeed, on time and on budget?

- Integration footprint: payroll providers, e-commerce, EDI, banking, tax, industry devices (RFID/scanning), BI tools.

- Mission-criticality: are you tied to audited workflows, compliance, and day-to-day operations?

How private equity thinks about your ERP business

Private equity (PE) is usually underwriting a 3-7 year journey:

- Entry multiple vs exit multiple: they care about buying at a reasonable multiple and selling at a higher one later. If your business can evolve from “services-led” to “recurring software-led,” exit multiples can improve.

- Who they can sell to later: strategics, larger PE funds, or a public market story (rare, but possible at scale).

- Levers they expect to pull:

- Price increases (especially on maintenance/support)

- Reducing custom work and standardizing implementation

- Cross-sell more modules (finance planning, BI, compliance)

- Expanding partners/channel to scale sales

- Improving gross margin by shifting delivery mix

3. Deep Dive: The Biggest ERP Valuation Nuance - Recurring Revenue vs Services Mix

Here is the uncomfortable truth: in ERP, two companies can have the same revenue and wildly different valuations because one is recurring and scalable, and the other is project-heavy and people-bound.

Buyers will still buy services-heavy ERP businesses - but they will value them more like an IT services firm unless you prove your services are tightly tied to a defensible product, with a clear path to more recurring revenue.

How it shows up in the data

Across comparable transactions, software-heavy vertical ERP outcomes tend to sit above services-heavy integration outcomes on revenue multiples. The deal data also shows that services-led categories (integration, consulting, broad digital services) cluster materially lower than software platforms and vertical ERP.

Why buyers care

- Services revenue is harder to scale. Growth requires hiring, training, and managing more billable people.

- Software revenue is easier to defend. If customers renew and pay every year, buyers can underwrite future cash flows with more confidence.

- Services introduces key-person risk. If implementations depend on a few individuals, buyers discount for fragility.

How to move from “lower-value” to “higher-value” over time

You do not need to eliminate services. You need to change what services mean:

- Turn implementation into a repeatable playbook (templates, industry-specific configurations).

- Shift more activity into standard product modules and fewer custom projects.

- Productize support into tiered SLAs and recurring retainers.

- Use services as the engine to expand ARR (more users, more modules, more sites).

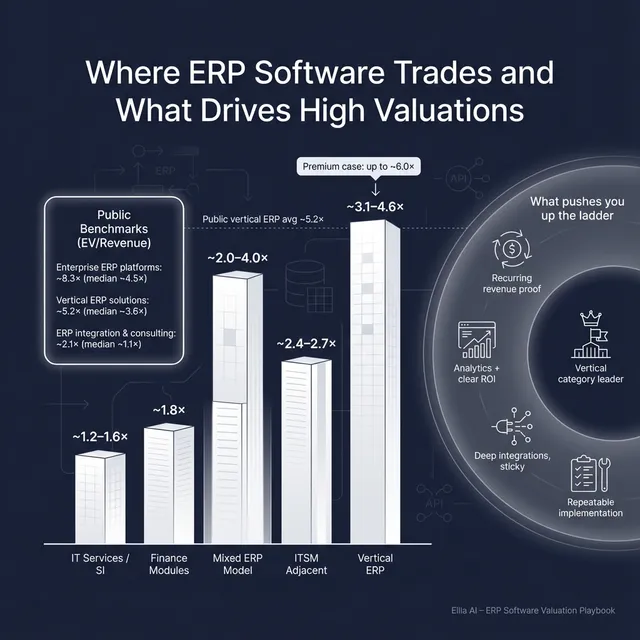

4. What ERP Software Businesses Sell For - and What Public Markets Show

ERP valuation is usually discussed in “multiples” - most commonly EV/Revenue (enterprise value divided by revenue) and sometimes EV/EBITDA.

Use the numbers below as reference bands, not a price tag. Your actual multiple depends on revenue quality, growth, margins, and risk.

4.1 Private Market Deals (Similar Acquisitions)

When you look at precedent transactions, a simple pattern appears:

- Vertical ERP / industry-specific software tends to achieve stronger revenue multiples than services-heavy ERP integrators.

- ERP modules (finance-focused) can trade lower than full platforms unless they are deeply embedded and sticky.

- IT services / integration deals typically clear at lower revenue multiples, with valuation anchored more to EBITDA.

A practical way to view private-market valuation is by deal type:

Averages hide dispersion. The data includes examples where software-like vertical businesses clear meaningfully higher on EBITDA multiples, while services-heavy transactions cluster lower.

4.2 Public Companies (as of late 2025)

Public markets provide an “outer boundary” for valuation logic. Private companies usually trade at a discount to public peers because of smaller scale and higher risk - but strategic scarcity can offset that.

Here are the public segment averages/medians from the data:

How to use these public multiples:

- Treat them as reference rails, not targets.

- Expect downward adjustments for smaller scale, customer concentration, heavy services mix, or technical debt.

- In rare cases (true category leadership, deep vertical dominance, strategic synergy), buyers may justify outcomes closer to higher public bands.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium valuation in ERP is not random. It is usually a story buyers can defend with evidence. Based on the deal patterns, here are the themes that consistently show up.

5.1 Category leadership in a clear vertical

Buyers pay more when you are not “one of many ERP vendors,” but the recognized system for a specific industry.

What to show:

- Installed base scale (active customers/sites)

- Vertical market share signals (even if directional)

- Proof that your workflows are hard to replicate (compliance, industry devices, specialized processes)

Practical example:

- “We are the default ERP for X industry segment, with prebuilt workflows and integrations no horizontal suite offers out of the box.”

5.2 SaaS-like operating model (even if you have services)

Premium outcomes correlate with recurring support, subscription, and managed hosting/private cloud that behaves like SaaS.

What to show:

- Contracted recurring revenue (ARR), renewal rates, support SLAs

- Clear product gross margins by line (software vs services)

- Migration path from on-prem to cloud/private cloud

Practical example:

- “Implementation is a one-time event. The real relationship is a recurring subscription + support model with predictable renewals.”

5.3 Data, analytics, and measurable ROI

ERP becomes “sticky” when it drives decisions, not just transactions. Buyers love analytics because it creates expansions and reduces churn.

What to show:

- Adoption of BI/analytics modules

- Outcomes customers care about (inventory turns, DSO reduction, production uptime, close time)

Practical example:

- “Customers renew because dashboards and alerts are embedded in daily operations - not because they like our UI.”

5.4 High gross margins with scalable economics

Premium valuation is easier when each incremental dollar of revenue creates high contribution margin. Buyers pay for operating leverage.

What to show:

- Gross margin by product line

- Support margin and hosting margin

- A believable path to margin expansion as services become more repeatable

Practical example:

- “We can grow 20% without growing headcount 20% because implementation is standardized.”

5.5 Mission-critical positioning and switching costs

If your ERP is tied to audited workflows, compliance, payroll, inventory accuracy, or production uptime, it is harder to replace - and buyers know it.

What to show:

- Compliance dependencies

- Embedded integrations and workflows

- Time/cost of replacement (customer testimonials help)

5.6 Strategic synergy narrative (without hand-waving)

Strategic buyers pay up when they can clearly cross-sell you into a larger installed base, unify data models, or consolidate platforms.

What to show:

- Proven integration patterns (APIs, connectors, migration playbooks)

- Examples of cross-sell or module attach growth

- A clear map of likely strategic buyers and “why you fit”

6. Discount Drivers (What Lowers Multiples)

Low multiples usually come from uncertainty. Buyers discount what they cannot underwrite.

Here are the most common discount drivers in ERP:

- Services-heavy revenue with weak repeatability: if delivery looks bespoke every time, buyers treat growth as headcount-dependent.

- Unclear recurring metrics: if you cannot clearly show renewal rates, churn, and recurring revenue, buyers assume the worst.

- Customer concentration: a single large customer can dominate risk, especially if they also influence roadmap.

- Technical debt or fragile architecture: outdated tech stacks, limited APIs, security gaps, or hard-to-upgrade deployments.

- Key-person dependency: the founder (or 2-3 senior consultants) holds the customer relationships and implementation knowledge.

- Messy product boundaries: “ERP plus everything” with unclear modules, pricing, and roadmap can feel like a services firm wearing a software hat.

- Weak financial clarity: inconsistent revenue recognition, unclear project profitability, or inability to separate software gross margin from services gross margin.

The good news: many of these are fixable in 6-12 months if you focus.

7. Valuation Example: An ERP Software Company

Let’s make this real with a worked example. This company is fictional, and the numbers are illustrative - the goal is to show how valuation logic works.

Step 1: The logic

A buyer will typically:

- Classify your business model (software platform vs mixed software/services vs services-led).

- Anchor to a defensible revenue multiple band using public comps and private transactions for similar models.

- Adjust up for strong proof (recurring revenue dominance, retention, vertical leadership, margins).

- Adjust down for risks (services dependency, concentration, technical debt, unclear metrics).

In the provided data, an established, mixed software/services ERP business at this scale most defensibly anchors around a ~2.0x-4.0x EV/Revenue band unless it can prove “SaaS-like” metrics and margins. Upside exists if recurring revenue and retention are strong and well-documented.

Step 2: Apply it to a fictional company at USD 10m revenue

Meet ForgeFlow ERP (fictional):

- USD 10.0m revenue

- Mid-market ERP for a specific industrial niche (vertical lean)

- 65% recurring (subscriptions + support + managed hosting), 35% implementation/services

- Solid renewals, but not yet best-in-class reporting

- Good integrations, but some technical debt from legacy deployments

Here is how the valuation could shake out:

If ForgeFlow could clearly prove ARR dominance, high gross margins, and strong retention, it could start to argue closer to higher bands seen in software platform and vertical software reference ranges - but that requires evidence, not optimism.

Step 3: What this means for you

Two ERP companies can both be “USD 10m revenue,” yet one is worth USD 20m and another USD 60m. The difference is not buzzwords - it is what buyers believe about:

- How much of your revenue repeats on its own

- How hard you are to replace

- Whether margins can scale

- Whether risks are understood and manageable

This is not investment advice or a formal valuation - it is a worked example to make the mechanics concrete.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as a quick diagnostic. Score each item 0/1/2:

- 0 = weak or unclear

- 1 = decent but not proven

- 2 = strong and well-documented

Self-assessment table

Interpreting your score (roughly)

- High score across High Impact factors: you are more likely to land in the upper half of revenue multiple ranges for ERP software.

- Mixed scores: expect “fair market” outcomes unless you tighten proof points quickly.

- Low High Impact scores: buyers will default to lower multiples until risk is reduced and revenue quality is proven.

The point is not perfection. The point is to identify the 2-3 changes that move the multiple the most.

9. Common Mistakes That Could Reduce Valuation

Rushing the sale

If you go to market before your numbers and narrative are ready, buyers will use uncertainty as leverage. In ERP, uncertainty gets priced harshly because implementation and retention risk are real.

Hiding problems

Every issue surfaces in diligence: churn, failed implementations, security gaps, customer concentration, messy financials. Hiding destroys trust, and trust is value.

Weak financial records

Common ERP pain points:

- You cannot clearly separate software gross margin from services gross margin.

- Implementation profitability is unclear by project.

- Deferred revenue, renewals, and support revenue are inconsistently tracked.

Fixing these often takes weeks, not years - but only if you start early.

Not running a structured, competitive sale process with an advisor

A structured process expands the buyer universe, creates competition, and forces buyers to put real offers on the table. Practitioner research is often cited as showing meaningfully higher outcomes (commonly referenced around ~25%) when a competitive process is run well, versus a single-buyer negotiation.

Revealing what price you’re after too early

If you tell buyers you want “USD 40m,” many offers will cluster at USD 40-42m even if the market might have paid USD 55m. You kill price discovery. Let the market speak first.

ERP-specific mistake: letting services define your identity

If your story sounds like “we implement ERP,” buyers will value you like an integrator. You want your story to sound like “we own a product that runs operations, and services accelerate adoption.”

ERP-specific mistake: ignoring technical debt until diligence

ERP buyers will inspect architecture, security, and upgrade paths. If you wait until diligence to explain legacy complexity, you will lose leverage at the worst moment.

10. What ERP Software Founders Can Do in 6-12 Months to Increase Valuation

Think in three workstreams: improve the numbers, de-risk the business, and sharpen the story.

10.1 Improve the numbers buyers underwrite

- Make recurring revenue undeniable: define ARR (even if you are not pure SaaS), track renewals, and separate recurring vs one-time cleanly.

- Improve gross margin clarity: report gross margin by product line (subscription/support/hosting vs implementation).

- Standardize implementation: reduce custom work, increase templates, track project margins.

If you move your mix toward recurring and show better margin discipline, you move closer to the profiles that earn higher software-like outcomes.

10.2 Reduce the risks that trigger discounts

- Cut customer concentration: target new wins to dilute the largest account, and lock in longer renewals where possible.

- Reduce key-person dependency: document implementation playbooks, elevate delivery leaders, and spread customer relationships.

- Get ahead of tech diligence: security review, penetration testing, cloud roadmap, and integration documentation.

10.3 Build a buyer-ready narrative (with proof)

- Define your category: “ERP for X industry” or “operations platform for Y workflow,” not “custom ERP.”

- Prove switching costs: integrations, compliance workflows, customer testimonials on replacement pain.

- Show expansion paths: modules, sites, users, and analytics upsells.

10.4 Prepare for diligence like a product company

- Customer cohort view (renewals, churn, expansions)

- Backlog and implementation capacity

- Product roadmap with resourcing

- Clean KPIs presented simply

11. How an AI-Native M&A Advisor Helps

Selling an ERP business is a lot of moving parts: buyer targeting, story, materials, outreach, negotiation, and diligence. The biggest valuation swings usually come from two things: more buyer competition and better proof.

An AI-native M&A advisor helps you reach a broader set of qualified buyers by matching your business to acquirers based on deal history, strategic fit, and capacity. More relevant buyers creates real competition, improves offer quality, and reduces deal risk because you have alternatives if one buyer drops.

It also compresses timelines. With AI-supported buyer matching, marketing materials, and diligence workflows, you can often reach initial conversations and offers in under 6 weeks - faster than manual-only processes that depend on narrow lists and slow outreach.

Most importantly, it combines speed with credibility: experienced human M&A advisors still run the process, frame the deal properly, and negotiate like professionals - with AI making the work higher-leverage and more data-driven.

If you’d like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.