The Complete Valuation Playbook for Facilities Management Software Businesses

A valuation playbook for facilities management software founders - showing what buyers actually pay and what moves multiples.

If you run a Facilities Management Software business and you are considering a sale in the next 1-12 months, your valuation will not be set by a single “market multiple.” It will be set by the story buyers believe - and the risk they still see after due diligence.

This playbook is built around real market data from recent acquisitions in adjacent facilities and property operations software, plus public market reference points as of mid-to-late 2025. It shows what businesses in this world actually sell for, what drives higher vs lower multiples, and how you can take practical steps in the next 6-12 months to push toward the top of the range.

1. What Makes Facilities Management Software Unique

Facilities management software sits in a messy reality: buildings, assets, technicians, vendors, compliance checks, and a constant stream of work orders. That mess is exactly why great software can become mission-critical - and why weak software gets replaced.

Most facilities management software businesses fall into a few common “shapes”:

- CMMS / maintenance operations SaaS: asset registry, preventive maintenance, work orders, inspections, technician mobile, parts, vendor coordination.

- Field service and trade operations: dispatch, scheduling, quoting, invoicing, customer comms (often adjacent to CMMS).

- Property and community operations platforms: resident + manager workflows, building services, communications, payments, and broader property ops.

- IoT/sensors/robotics-first operations: software tied to devices (cleaning, occupancy, monitoring), often with a hardware or services mix.

- Tech-enabled services platforms: “software + people” bundles that blur the line between SaaS and facilities services.

Why this matters for valuation: buyers are not just buying “software.” They’re buying whether you own an operational workflow inside a building. That creates valuation nuances you don’t always see in horizontal SaaS:

- Workflow depth beats feature breadth. A CMMS that runs daily inspections and closes audit loops is usually stickier than a “dashboard” product.

- Services and hardware mix matter a lot. The more your revenue depends on people or devices, the more buyers will value you like a services or mixed business, not pure SaaS.

- Implementation risk is real. Facilities teams have thin bandwidth. If deployment is painful, churn risk goes up - buyers will pressure your multiple.

- Data quality is everything. If your system becomes the “source of truth” for assets and maintenance history, switching costs rise sharply.

Key risks buyers will always check in this sector:

- Customer concentration (one big portfolio owner, one national FM provider, one public contract).

- Retention and expansion (do sites stick, and do they add more sites/assets/modules over time?).

- Proof that the product is embedded (daily/weekly usage by technicians and supervisors, not just monthly reporting).

- Integration readiness (BMS, ERP/accounting, access control, IoT platforms, procurement, vendor networks).

- Professional services dependence (if every deployment needs custom work, your margins and scalability get discounted).

2. What Buyers Look For in a Facilities Management Software Business

In plain terms, buyers pay for two things:

- How predictable your future revenue is

- How confident they are you can keep growing without nasty surprises

The obvious fundamentals still matter:

- Scale (revenue level matters because smaller businesses feel riskier).

- Growth rate (buyers pay up when growth is clearly durable).

- Gross margin (software-like margins signal scalability).

- Retention (logos staying and spending more over time).

- Profitability or a believable path to it (especially for private equity).

But in facilities management software, a few sector-specific details often decide where you land within the range:

- Who the user is: technician-led daily workflows tend to be stickier than manager-only reporting layers.

- Where the product sits in the stack: “system of record for assets + work orders” is more valuable than a lightweight add-on.

- Multi-site expandability: buyers love “land in one building, expand across a portfolio.”

- Compliance hooks: inspections, audit trails, safety checklists, critical maintenance logs - these reduce switching.

- Deployment model: faster time-to-value and templated rollouts reduce churn risk and increase buyer confidence.

How private equity thinks about your business

Private equity (PE) buyers are often your most likely acquirers in this space, either directly or through a software “platform” they already own.

They typically think like this:

- Entry price vs exit price: If they buy you at, say, ~4-6x revenue, they want a believable story to sell in 3-7 years at a similar or higher multiple.

- Who buys it next: larger PE funds, strategic software consolidators, or a larger vertical software platform.

- The levers they expect to pull:

- raise prices (carefully, with proof you are mission-critical)

- cross-sell modules (inspections, vendor management, analytics, energy reporting)

- expand from site to portfolio

- reduce services-heavy delivery

- improve sales efficiency and tighten churn

If your business already looks “integration-ready” and repeatable, PE confidence rises - and so can your multiple.

3. Deep Dive: “Workflow Embeddedness” - The Valuation Multiplier Inside the Multiplier

Two facilities management software businesses can have the same revenue and very different valuations because one is truly embedded in daily operations and the other is “nice-to-have.”

This factor shows up indirectly in the deal data through premium outcomes tied to workflow criticality and compliance/process control (buyers paying up for software embedded in daily operations) and through acquisitions where the buyer explicitly values operational workflow fit and synergy. In the source set, workflow-heavy ops products with strong margins and compliance adjacency achieved very high revenue multiples in strategic acquisitions, even at smaller scale - because they were clearly “must run” inside the buyer’s platform story.

Why buyers care:

- Embedded workflows reduce churn. If your technicians live in your mobile app and your supervisors run weekly schedules and audits through your system, switching is painful.

- Embedded workflows expand naturally. Once you run preventive maintenance, it’s easier to sell inspections, vendor coordination, inventory, SLAs, analytics, and portfolio reporting.

- Embedded workflows create defensibility. Facilities teams don’t want to gamble on a new system that breaks maintenance history and audit trails.

How to move from “less embedded” to “more embedded” within 6-12 months:

- Make one or two workflows undeniable: preventive maintenance, inspections, compliance logs, or vendor work orders.

- Prove usage with simple metrics: weekly active technicians, work orders closed per site, inspection completion rates, time-to-close.

- Reduce friction: templates by building type, fast onboarding, pre-built asset libraries, barcode/QR flows, and clean mobile UX.

- Add “audit trail” features: timestamps, approvals, photo proof, signatures, and change logs.

A simple way to think about it:

4. What Facilities Management Software Businesses Sell For - and What Public Markets Show

Valuation in this sector is a “tug of war” between:

- Software-like outcomes (recurring revenue, high margins, strong retention, workflow embeddedness)

- and services/mixed-business gravity (implementation-heavy, hardware revenue, low margins, lumpy revenue)

The data you provided includes both private acquisitions and public market comps across adjacent segments. The trick is using the right reference set for a pure facilities software business (especially CMMS/maintenance SaaS), rather than accidentally benchmarking yourself against services-heavy or hardware-heavy peers.

4.1 Private Market Deals (Similar Acquisitions)

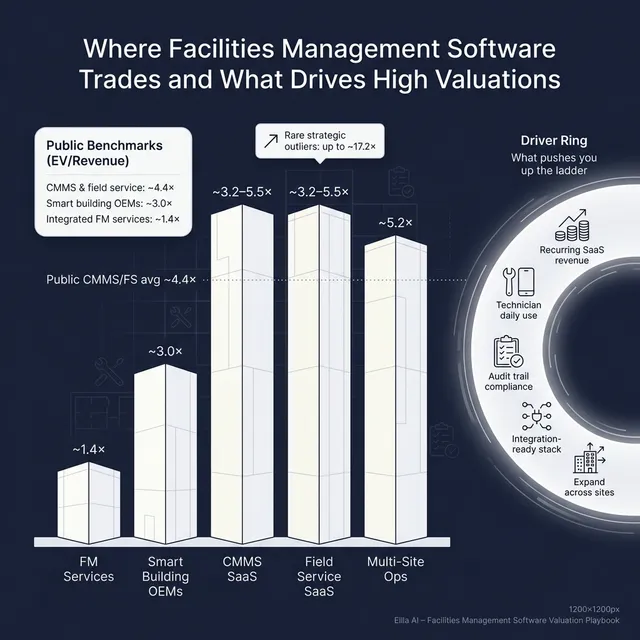

Across the relevant private deal groupings, CMMS & field service management SaaS for maintenance operations clusters around a mid-single-digit revenue multiple band, with higher outcomes when there’s clear growth, domain depth, and strategic fit. In the sources, the median EV/Revenue for CMMS & maintenance operations SaaS deals is ~4.2x, with an average around ~6.0x (averages get pulled up by premium outcomes). The broader “enterprise service/work management” and “multi-site operations software” references sit in a similar general band when you strip away outliers.

Here’s a founder-friendly way to translate the deal group patterns (illustrative ranges based on the provided deal sets):

A key point: the 17x+ outcomes are real in the data, but they are not the default. They tend to reflect category leadership, exceptional strategic fit, and buyer urgency - not something you should assume without strong evidence.

4.2 Public Companies

Public markets are a reference band, not a price tag. They matter because strategic buyers and PE buyers both look at them - especially when deciding what is “reasonable” vs “rich.”

From the public grouped multiples you provided (as of mid-to-late 2025):

How to interpret this as a private founder:

- Public multiples can help you set upper and lower reference points.

- Private companies are usually discounted vs public peers for smaller scale, higher customer concentration, and more risk.

- But private companies can sometimes get a premium vs public comps when they are scarce assets (strategic gap-fill, clear cross-sell, or category leadership in a niche).

If you’re a pure-play facilities CMMS SaaS, the cleanest public “anchor” in your data is the CMMS/field service group, with context from construction lifecycle software on the high end and hardware/services groups on the low end.

5. What Drives High Valuations

The premium valuation drivers in your sources map cleanly to what sophisticated buyers consistently reward in this sector. Below are the biggest themes that move you toward the top end - explained in buyer language, not banker language.

5.1 Vertical specialization with proof (not vibes)

Premium outcomes show up when the product is deeply specialized in property, construction, or facilities workflows - and you can prove growth or retention, not just claim it. In the deal set, vertical depth paired with strong performance signals was associated with higher multiples than generic SMB software.

What this looks like in practice:

- You can say exactly which workflows you own (preventive maintenance, statutory inspections, vendor SLAs, asset lifecycle).

- You show customer outcomes: reduced downtime, fewer missed inspections, faster work order close times.

- You win in a niche where horizontal tools struggle (multi-site maintenance, compliance-heavy environments, complex assets).

5.2 SaaS-like margin structure and recurring revenue

Buyers pay more when your economics scream “software.” In the source examples, high gross margin and recurring revenue profiles were explicitly tied to premium outcomes - because they scale and because they reduce downside risk.

What to strengthen:

- Subscription revenue as the clear majority of revenue

- High gross margins (software delivery, not services delivery)

- Clean recurring billing and contract structure

- Easy-to-explain retention and expansion metrics

5.3 Workflow criticality and compliance hooks

Premium valuation patterns show up when the software is embedded in daily operations, especially when there are compliance, audit, or process-control elements. Buyers like businesses that are hard to rip out.

Examples that matter in facilities:

- Inspection checklists with audit trails (photos, signatures, timestamps)

- Safety and compliance reporting that managers rely on

- Standard operating procedures that reduce operational risk

- Controls for vendor work, approvals, and SLA tracking

5.4 Integration value and clear synergy story

Several premium drivers in the source set relate to integration value to a strategic platform - when a buyer can clearly cross-sell your product or plug it into an existing suite and grow faster.

For facilities management software, synergy is most believable when you can show:

- Pre-built integrations (ERP/accounting, procurement, BMS, access control, IoT hubs)

- A modular product that can be bundled

- Clear “why us” inside a buyer’s platform narrative

- Concrete upsell paths across a building portfolio

5.5 M&A-friendly profile (consolidator-ready)

Serial acquirers pay up when your business is easy to integrate and scale through a larger distribution engine. In the provided data, consolidator behavior shows that even smaller assets can achieve strong outcomes if they “slot in” cleanly.

Consolidator-ready often means:

- Clean codebase, API readiness, clear packaging

- Repeatable onboarding and implementation

- Metrics discipline (retention, margin, ARR clarity)

- A product roadmap that complements a buyer’s suite

5.6 The “boring” drivers that still move price

Even in a sector-specific deal, these basics still matter more than founders want to believe:

- Clean financials and consistent revenue recognition

- Low customer concentration

- A leadership bench beyond the founder

- Predictable pipeline and a clear go-to-market motion

- No hidden operational fires

6. Discount Drivers (What Lowers Multiples)

Lower multiples are rarely about a buyer “not liking your space.” They’re usually about the buyer pricing in risk - or pricing in work they’ll have to do after closing.

In facilities management software, the most common discount drivers look like this:

6.1 Too much services or “custom work” in the revenue

If a meaningful portion of revenue depends on implementation projects, onsite work, or ongoing customization, buyers worry about scalability. They may still buy you - but they will value you closer to services or mixed businesses, not pure SaaS.

What to do: separate services revenue clearly, standardize onboarding, and show that the software can be deployed repeatedly with minimal custom work.

6.2 Weak retention or unclear stickiness

Facilities teams are often resource-constrained and change-averse. If your churn is meaningful or poorly understood, buyers will assume the worst.

Common causes buyers see:

- slow time-to-value

- product not used by technicians

- unclear ROI

- weak customer success motion

6.3 Customer concentration and “single channel” dependence

It’s common in this sector to land one big FM provider or one major property owner - and then grow around them. That can still sell, but buyers will haircut the multiple unless you can show diversification or a strong path to it.

6.4 Hardware and IoT mix without clear margins

If you sell devices, sensors, or robotics bundles, you can still build a great business - but revenue multiples often compress because margins, supply chain, and working capital risk enter the story. The public market comps for hardware/OEM-tilted businesses in your dataset trade at lower revenue multiples than software platforms, reflecting that “hardware gravity.”

6.5 Messy metrics and financial reporting

If you can’t clearly explain:

- recurring vs non-recurring revenue

- gross margin by line (software vs services)

- retention and expansion

- pipeline and sales cycle

…buyers either slow down or price down. Uncertainty is expensive.

7. Valuation Example: A Facilities Management Software Company

This is a worked example to show the logic of valuation - not investment advice, not a fairness opinion, and not a promise of what your business will sell for.

Step 1: The valuation logic in plain English

A practical way to value a facilities CMMS SaaS business is:

- Pick the right “peer set.” For pure facilities software, the best anchors are CMMS/field service SaaS comps and relevant private acquisitions. Avoid benchmarking yourself to facilities services providers or hardware/OEM businesses.

- Start with a core multiple band from private SaaS deals. In your source set, private SaaS comps cluster roughly around ~3.2x-5.5x revenue for relevant CMMS/work management software deal types.

- Adjust up or down based on premium and discount drivers.

- Premium: sticky vertical workflows, SaaS margins, integration/synergy story, clear ARR growth.

- Discounts: services-heavy mix, unclear retention, concentration, messy metrics.

- Use public comps as a reasonableness check. Public CMMS/field service SaaS averages around ~4.4x revenue in the data, with higher bands for scaled construction lifecycle software and lower bands for hardware/services mixes.

Step 2: Apply it to a fictional company

Let’s create a fictional business: BeaconCMMS.

- Pure SaaS CMMS for building maintenance (no hardware sales)

- Focus on multi-site commercial portfolios (office, retail, light industrial)

- Strong technician mobile usage

- USD 10.0m annual revenue (fictional)

- Mostly subscription revenue, moderate services for onboarding

We’ll use three scenarios to illustrate how the same revenue can produce different enterprise values (EV).

Why these numbers are grounded in the sources:

- The core band reflects the private SaaS deal clustering in the sources (roughly ~3.2x-5.5x).

- The premium case reflects a modest uplift toward the upper end when your product looks consolidator-ready and mission-critical - without assuming extreme outlier outcomes.

- The discount case reflects what happens when buyers see risk (services mix, weak retention visibility, concentration).

Step 3: What this means for you

Two businesses can both be at USD 10m revenue and be worth very different amounts because buyers are paying for:

- confidence in future recurring revenue

- confidence that churn won’t spike

- confidence that growth is repeatable

- confidence the product is hard to replace

If you’re selling within 12 months, you usually get more valuation lift by reducing buyer-perceived risk than by trying to “invent” a brand-new growth strategy.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as a quick reality check. Give yourself a score of 0 / 1 / 2 on each factor:

- 0 = weak / unclear today

- 1 = decent but not proven

- 2 = strong and provable with data

Self-assessment table

How to interpret your total score (simple heuristic):

- High band: you’re closer to premium outcomes - you’ve reduced the main risks buyers price.

- Mid band: fair-market outcomes - you’ll likely land in the core multiple range unless a strategic buyer sees special synergy.

- Low band: expect pressure on multiple - not because your space is bad, but because buyers will “charge” you for uncertainty.

The point is not to judge yourself. It’s to identify the 2-3 changes that move the number the most.

9. Common Mistakes That Could Reduce Valuation

9.1 Rushing the sale

If you start a process before your metrics and narrative are ready, buyers will drive the timeline and the valuation. In facilities software, rushed sales often lead to shallow diligence early, followed by painful surprises later - which means repricing.

9.2 Hiding problems

Churn, a failed deployment model, customer concentration, security gaps, messy code - these always surface in diligence. When buyers feel misled, they don’t just lower price. They lose trust, add harsh deal terms, or walk.

9.3 Weak financial records

You don’t need “perfect” reporting, but you do need clarity:

- recurring vs services revenue split

- gross margin by line

- customer retention and expansion metrics

- bookings and pipeline discipline

If you can’t answer these cleanly, buyers assume risk and discount value.

9.4 Not running a structured, competitive process with an advisor

A competitive process (multiple credible buyers moving on the same timeline) is one of the most reliable ways to increase valuation because it creates real price discovery. There is also research commonly cited in M&A that suggests structured, advisor-run processes can lead to meaningfully higher purchase prices (often quoted around ~25%) - the exact uplift varies, but the direction is consistently true.

9.5 Revealing what price you want too early

If you tell the market “I want USD 10m,” you often get USD 10.1m and USD 10.2m offers - because you killed the upside of true price discovery. Your job is to let buyers compete to tell you what it’s worth, not the other way around.

9.6 Industry-specific mistakes (facilities software)

- Under-investing in implementation repeatability. If every rollout is bespoke, buyers will treat you like a services org with software on top.

- Not proving technician adoption. Facilities buyers care deeply about whether the frontline actually uses the tool. Weak adoption is silent churn risk.

10. What Facilities Management Software Founders Can Do in 6-12 Months to Increase Valuation

You don’t need a massive pivot. You need focused upgrades that reduce buyer risk and strengthen your premium narrative.

10.1 Improve the “quality of revenue”

- Increase subscription share (separate services clearly and reduce dependency over time).

- Push for longer contract terms where appropriate (with sensible renewals).

- Build a clean ARR and retention dashboard (monthly, consistent definitions).

- Reduce customer concentration where possible (or at least show a plan and pipeline).

10.2 Make retention and embeddedness undeniable

- Track and show technician and supervisor usage (weekly active users, work orders closed, inspection completion).

- Improve time-to-value: templates, onboarding playbooks, asset import tooling.

- Strengthen audit trail features: photos, signatures, timestamps, approvals.

- Build “portfolio expansion” motion: land one building, expand across sites with a repeatable rollout.

These actions directly support the premium driver patterns around workflow criticality, recurring revenue, and strategic value.

10.3 Strengthen your strategic buyer story

- Map integrations that matter (ERP/accounting, procurement, BMS, IoT hubs).

- Package your roadmap as “modules” a platform buyer can bundle and cross-sell.

- Quantify synergy outcomes in plain language: “If a buyer sells us into their property portfolio base, here’s the expected site expansion path.”

This aligns with the observed premium driver of integration value and synergy visibility.

10.4 De-risk diligence before buyers show up

- Clean up revenue recognition and customer contracts.

- Make security posture and data policies easy to explain.

- Document product architecture and APIs for buyer technical review.

- Build a leadership bench so the business is not “founder-only.”

11. How an AI-Native M&A Advisor Helps

A strong exit outcome is not just about having a good business - it’s about running a process that creates real competition and removes buyer uncertainty.

An AI-native M&A advisor can expand your buyer universe materially by matching your business to hundreds of qualified acquirers based on deal history, strategic fit, financial capacity, and product adjacency. More relevant buyers means more competitive tension, stronger offers, and a better chance the deal closes even if one buyer drops out.

Speed also matters. With AI-driven buyer matching, faster outreach, and tighter support on marketing materials and diligence, it’s realistic to reach initial conversations and indications of interest in under 6 weeks - instead of waiting months for a purely manual process to ramp.

Finally, AI works best when paired with experienced human advisors. The combination can deliver “Wall Street-grade” positioning - clear materials, crisp metrics, and a narrative that speaks the buyer’s language - without forcing you into traditional bulge-bracket costs.

If you’d like to understand how our AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.