The Complete Valuation Playbook for Field Service Management Software Businesses

A valuation playbook for FSM software founders - see what deals actually clear and what drives higher multiples.

If you run a Field Service Management (FSM) software business and you might sell in the next 1-12 months, you’re entering a market where outcomes vary wildly. Two companies with the same revenue can sell for very different prices, mostly because buyers value risk and repeatability as much as growth.

This playbook is data-based and built specifically for FSM founders. It will show what FSM businesses actually sell for, decode what drives higher vs lower multiples, and give you a practical self-assessment plus a 6-12 month action plan to improve your outcome.

1. What Makes Field Service Management Software Unique

FSM software looks like “just another SaaS category” until you’re in diligence. Buyers treat FSM differently because it sits right in the middle of messy real-world operations: trucks, technicians, parts, schedules, and customers who get angry when someone doesn’t show up.

The main types of FSM businesses buyers see

- Trades and home services job management: scheduling, dispatch, estimates/quotes, invoicing, customer communications.

- Maintenance and asset service management: work orders, preventive maintenance, inspections, compliance logs, parts/inventory.

- Construction aftercare/defect management: punch lists, snagging, warranty workflows, handover coordination.

- Broader “service commerce suites”: FSM bundled with marketing, CRM, payments, or customer portals.

- Adjacent “ops visibility” layers: telematics, sensors/IoT, route optimization, fleet safety, equipment tracking.

Unique valuation considerations in FSM

- Workflow depth beats feature count. Buyers pay for software that becomes the system of record for jobs and invoices, not “nice-to-have” scheduling.

- Implementation and support intensity matters. A heavy onboarding burden can cap margins and scale - even if top-line growth looks good.

- Mobile reliability is non-negotiable. Offline mode, sync stability, and technician UX show up in churn and support costs.

- Payments, data, and integrations can change your ceiling. If you’re embedded into accounting systems, parts suppliers, or hardware telemetry, you can become harder to replace.

Key risk factors buyers will always check (FSM-specific)

- Customer churn by cohort and by segment (tiny contractors churn differently than multi-branch operators).

- Service delivery dependency (are implementations “one-time and light” or a permanent services business in disguise?).

- Concentration in a single channel/partner (one marketplace, one accounting integration, one reseller).

- Data migration and operational switching risk (how painful is it to leave you, and how painful is it to join you?).

- Security and permissions (techs, subcontractors, back office, customer portals - lots of roles, lots of risk).

2. What Buyers Look For in a Field Service Management Software Business

Buyers value FSM businesses through a simple lens: How predictable is the revenue, and how defensible is the workflow? Everything else ladders up to that.

The obvious fundamentals still matter

- Scale: more revenue generally means more buyer options and less “key person” risk.

- Growth: faster growth usually supports higher multiples, but only if churn and margins are healthy.

- Profitability: not every high-multiple software company is profitable, but buyers want a believable path.

- Gross margin: it’s a proxy for product scalability and for how “SaaS-pure” your revenue really is.

The FSM nuances buyers care about (and will diligence hard)

- Recurring vs non-recurring revenue mix: subscriptions usually get rewarded; services-heavy mixes usually get discounted.

- Stickiness of your position in the workflow: are you scheduling only, or do you touch invoicing, payments, compliance, and reporting?

- Vertical focus: “we serve everyone” often underperforms “we win HVAC maintenance” or “we own multi-site facilities inspections.”

- Expansion motion: can customers start small and grow seats, modules, locations, or usage over time?

How private equity buyers think

Private equity (PE) is usually underwriting a 3-7 year journey:

- Entry multiple vs exit multiple: they care what they pay today and what they can sell it for later. A business that can credibly look “more premium” in 3 years is attractive.

- Who they can sell to later: larger PE funds, strategic buyers, or occasionally public markets. Your job is to look like an obvious “platform” that someone else will want.

- Levers they expect to pull:

- price and packaging discipline

- reducing services drag and improving gross margin

- professionalizing sales and customer success

- add-on acquisitions (“buy and build”) if the category is fragmented

- cross-sell into adjacent workflows (payments, inventory, compliance, analytics)

3. Deep Dive: “SaaS Purity” - Why Services Mix and Gross Margin Swing Multiples

In FSM, one of the biggest valuation swing factors is whether your business is truly scalable software or a blended software + services operation. Many founders underestimate how directly this impacts the multiple.

Buyers use gross margin and services mix as shortcuts for two questions: (1) How efficiently can this grow? (2) How risky is delivery?

How it shows up in deal outcomes

Across FSM and field-ops related transactions, software businesses with strong margins and lighter services tend to cluster at healthier revenue multiples, while services-heavy business models fall into much lower ranges. Even within “software,” the market rewards products that don’t require large, ongoing human effort to implement and support.

Why buyers care

- Services create a hidden ceiling. You can grow revenue, but headcount grows with it, and margins stall.

- Services can mask churn. If customers rely on your team to keep the system working, retention can look better than the underlying product strength.

- Integration risk goes up. A buyer has to integrate your people, not just your code.

Moving from the lower-value version to the higher-value version (in 6-12 months)

You don’t need to eliminate services. You need to productize them:

- standardize onboarding into 2-3 repeatable “implementation packages”

- shorten time-to-value (faster go-live often reduces churn)

- build migrations/templates for your core integrations (accounting, inventory, CRM)

- shift success KPIs from “tickets resolved” to “feature adoption and expansion”

4. What Field Service Management Software Businesses Sell For - and What Public Markets Show

Let’s separate two things:

- Private deals show what acquirers actually pay for businesses like yours.

- Public multiples set a reference band (often higher), but they are not a direct price tag for a smaller private company.

4.1 Private Market Deals (Similar Acquisitions)

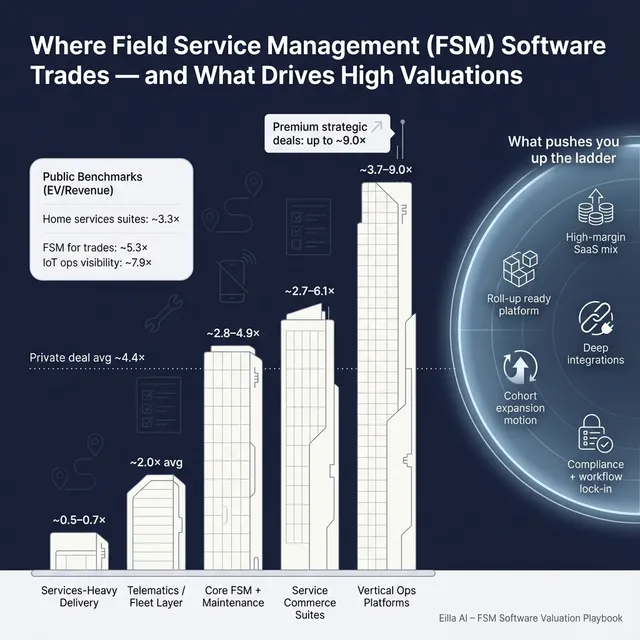

In the private market data, field service and maintenance management SaaS deals cluster around ~2.8x to ~4.9x EV/Revenue, with group averages around ~4.1x. Across the broader precedent set, the overall average is about ~4.4x EV/Revenue.

What pushes outcomes up inside this world: cleaner SaaS mix, visible growth, strong gross margins, and “integration readiness” for consolidators. What pulls them down: services intensity, unclear retention, and limited buyer competition.

A useful way to think about it: private FSM software deals often clear “mid-single digit” multiples when the product is sticky and scalable, and they compress when the business is hard to scale or hard to diligence.

4.2 Public Companies

Public markets (as reflected in this dataset, late 2025) show a wide spread depending on category, growth, and profitability. FSM-focused and field-ops-adjacent public segments show everything from low single digits to high single digits on revenue, with higher bands for construction software, IoT visibility layers, and certain workflow platforms.

How to use this as a private founder:

- Use public multiples as a reference band, not a valuation promise.

- Adjust down for smaller scale, less liquidity, customer concentration, and higher execution risk.

- Adjust up if you’re scarce, very sticky, and strategically valuable (for example, you own a niche workflow that a consolidator needs).

5. What Drives High Valuations (Premium Valuation Drivers)

Here are the premium drivers that consistently show up in FSM and field-ops deal narratives, including the patterns visible in the deal set you provided.

5.1 High-growth vertical SaaS with strong gross margins

Buyers pay more when growth is real and scalable - not growth that requires hiring armies of implementation people.

- Example signals buyers love: fast cohort expansion, improving retention over time, and high gross margin that stays high as you grow.

5.2 “Roll-up readiness” for consolidators

FSM is consolidating. Buyers with repeatable acquisition playbooks pay more when your business is easy to integrate.

- Practical examples:

- clean product architecture and APIs

- standardized pricing and contracts

- low custom code per customer

- clear handover documentation and KPI reporting

5.3 Micro-vertical focus with defensibility

Narrow focus can be a superpower when it creates switching costs.

- If you own a niche like regulated inspections, construction aftercare, or multi-site maintenance workflows, you can look less like “a tool” and more like “infrastructure.”

5.4 Mission-critical workflows and compliance gravity

Premium outcomes cluster where failure is costly: safety audits, preventive maintenance regimes, regulated servicing, and hard compliance requirements.

- Buyers pay up when your product is embedded in “must-do” processes, not “nice-to-do” admin.

5.5 Strategic synergy that a buyer can explain in dollars

If an acquirer can quantify cross-sell, reduced churn, or cost synergies, they justify paying more.

- What helps: integration partnerships, clear attach rates, and a product that compresses sales cycles for a larger platform.

5.6 Data, telemetry, and monetizable adjacency

When FSM connects to devices, parts, payments, or analytics, it can increase ARPU and defensibility.

- Example: adding modules that monetize compliance reporting, asset utilization analytics, or payments/financing add-ons.

5.7 ARR visibility and expansion motion

Predictability is valuable. Buyers pay more when you can clearly show:

- recurring revenue base

- renewals by cohort

- expansions over time (more seats, modules, locations)

Also “boring but critical” premium drivers:

- clean financials and consistent revenue recognition

- diversified customer base

- strong second layer of leadership (not founder-only dependence)

- a credible narrative for why you win in your niche

6. Discount Drivers (What Lowers Multiples)

The low end of the range is usually caused by a small set of buyer fears. Most are fixable - but they take intentional work.

6.1 Weak recurring foundation

- Too much revenue from one-time implementation, set-up fees, or project work.

- Pricing that doesn’t scale with customer value (and forces constant discounting).

6.2 High churn, low stickiness, unclear retention

- Customers leave after busy season.

- Product used by only one role (dispatcher) rather than becoming the operational backbone.

- No clean cohort data to prove retention.

6.3 Services-heavy delivery and margin drag

- Implementation requires bespoke work every time.

- Support load grows faster than revenue.

- Gross margin is capped, so buyers can’t underwrite operating leverage.

6.4 Customer concentration and channel risk

- One large customer or one reseller drives too much revenue.

- One integration partner changes terms and your growth stalls.

6.5 Product and tech risk

- Mobile app reliability issues.

- Security posture not enterprise-ready.

- Roadmap depends on a few engineers who might not stay.

6.6 Unclear metrics and messy financials

If buyers can’t trust the numbers, they protect themselves with:

- lower price

- earn-outs and holdbacks

- slower timelines and higher diligence friction

7. Valuation Example: A Field Service Management Software Company

This is a fictional example to show the logic. The company, numbers, and valuation ranges below are illustrative - not investment advice or a formal valuation.

Step 1: The valuation logic

- Start with relevant market bands:

- Private FSM SaaS deals cluster around ~2.8-4.9x EV/Revenue.

- Public comps and adjacent workflow software can trade higher, but private deals usually price in scale and risk.

- Pick a “core range” for a well-run FSM SaaS business:

- For a solid, SaaS-first FSM company: a defensible core band is often mid-single digits, with upside if premium drivers are proven.

- Adjust up for premium drivers (stickiness, growth, high margin, compliance gravity, integrations).

- Adjust down for discounts (services intensity, churn, concentration, messy numbers).

Step 2: Apply it to a fictional company

Meet FieldFlow (fictional):

- USD 10.0m last-twelve-month revenue

- ~85% subscription recurring revenue

- ~70% gross margin (some implementation services)

- ~20% year-over-year growth

- Customers are multi-crew trade businesses + light facilities maintenance

What changes the scenario?

- FieldFlow moves toward the premium case if it proves strong retention by cohort, reduces services drag, and shows expansion (modules/seats/locations).

- It slides toward the discounted case if churn is high, onboarding is bespoke, or the financial story is unclear.

Step 3: What this means for you

Two FSM businesses can both have USD 10m revenue and still land in very different EV ranges because buyers don’t buy revenue - they buy repeatable, defensible cash flows. Your multiple is largely the market’s vote on how much it trusts your future.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this to estimate where you sit today - and where the highest-ROI fixes are. Score each factor 0-2:

- 0 = weak / unclear

- 1 = okay / improving

- 2 = strong / proven with data

How to interpret your total:

- High band: you look like a premium, scalable software asset (more buyer competition, higher ceiling).

- Mid band: you can sell well, but the story needs to be tight and risks clearly managed.

- Low band: expect more deal friction (earn-outs, holdbacks, lower multiples) unless you improve key drivers first.

9. Common Mistakes That Could Reduce Valuation

9.1 Rushing the sale

If you start a process before your numbers and narrative are ready, buyers will control the pace and the price.

9.2 Hiding problems

Issues will surface in diligence. Hiding them breaks trust and usually costs more in renegotiation than it would have cost to fix (or disclose cleanly) upfront.

9.3 Weak financial records

If your revenue, churn, and margins are hard to reconcile, buyers will assume the worst. In FSM, this often shows up as:

- messy separation of subscription vs services revenue

- inconsistent definitions of churn/retention

- unclear support and implementation costs

9.4 No structured, competitive process with an advisor

A competitive process is “price discovery.” Without it, you risk negotiating against yourself.

There’s also academic evidence that private sellers who retain M&A advisers receive higher deal valuations, with estimates reaching roughly up to ~25% in certain methods after accounting for selection effects.

9.5 Revealing your price too early

If you tell buyers “I’m looking for USD 50m,” many will anchor to that and offer USD 50.1m, USD 50.2m - rather than what they might have paid in a competitive process.

9.6 FSM-specific mistakes that quietly hurt outcomes

- Over-customizing for large customers: you win revenue, but you lose scalability and buyer confidence.

- Neglecting mobile reliability and onboarding time: it raises churn risk and lowers the multiple even if growth looks fine.

10. What Field Service Management Founders Can Do in 6-12 Months to Increase Valuation

You don’t need to reinvent the company. You need to remove buyer doubts and prove the premium drivers with data.

10.1 Improve the numbers buyers trust most

- Make retention undeniable: cohort-based churn, renewals, and expansion (show it by segment).

- Reduce services drag: standardize implementation, trim custom work, push onboarding into product.

- Improve gross margin: even a few points can change buyer confidence in scalability.

- De-risk concentration: diversify top customers and channels where possible.

10.2 Increase stickiness in the workflow

- Move “upstream and downstream” in the job lifecycle:

- upstream: quoting/estimates, scheduling, customer comms

- downstream: invoicing, payments, compliance logs, reporting

- Double down on integrations that reduce switching:

- accounting, inventory/parts, CRM, payroll, fleet/telematics where relevant

10.3 Build a buyer-ready data room narrative

- Clean, consistent KPI definitions: ARR (if applicable), recurring revenue %, churn, gross margin, services margin.

- Simple explanations of your vertical focus and why you win.

- Customer stories that show ROI (faster job completion, fewer missed appointments, higher technician utilization).

10.4 Run a process that creates competition

- Build a list that includes strategics and consolidators (not just “obvious” buyers).

- Sequence outreach and diligence so multiple buyers stay in the race at the same time.

- Use structure to protect leverage: deadlines, clear materials, and controlled information flow.

11. How an AI-Native M&A Advisor Helps

A strong outcome often comes down to reaching the right buyers and running a process that creates real competition - without burning months of founder time.

Higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, synergy fit, financial capacity, and other signals. More relevant buyers means more competition, stronger offers, and more options if one buyer drops.

Initial offers in under 6 weeks. AI-driven buyer matching and outreach, faster creation of marketing materials, and structured diligence support can compress timelines versus fully manual processes.

Expert advisory, enhanced by AI. Human M&A advisors still drive the strategy and negotiations - AI strengthens the execution: tighter positioning, cleaner materials, and better targeting. The result is Wall Street-grade process quality without traditional “bulge bracket” costs.

If you’d like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.