The Complete Valuation Playbook for Financial Management Software Businesses

A practical valuation guide for Financial Management Software founders on what drives valuation multiples.

If you are a founder or CEO of a Financial Management Software business and you might sell in the next 1-12 months, valuation stops being an abstract topic. It becomes a series of choices: what story you tell, what risks you remove, and what proof you can show buyers.

This sector is also going through steady consolidation. CFO teams are buying more software, but buyers are pickier: they pay up for products that are embedded in real workflows (and hard to rip out), and they discount anything that looks like “nice reporting” without stickiness.

This playbook is built to do three things: show what similar businesses actually sell for, decode what drives higher vs lower multiples, and give you a practical self-assessment plus a 6-12 month action plan.

2. What Makes Financial Management Software Unique

Financial Management Software is not one thing. Buyers segment it because the business models, buyer personas, and risk profiles differ:

- SMB cloud accounting and back-office SaaS: bookkeeping, close, invoice-to-cash, AP/AR, spend management, light FP&A for SMBs.

- Finance close, consolidation, reporting, and FP&A: month-end close automation, consolidation, budgeting, forecasting, management reporting, performance management.

- Enterprise ERP and finance platforms: broader suites with finance modules and longer sales cycles.

- Compliance, regulatory reporting, and GRC: audit trails, controls, tax/reg reporting, governance workflows.

- Payments/financing adjacencies: invoice payments, bill pay, embedded financing, or “software + financial services.”

- Services-heavy integration and digital transformation: implementation, connectors, data migration, consulting.

What makes valuation unique in this sector is that buyers are underwriting trust + switching costs as much as they underwrite growth.

- You handle sensitive data and produce “official” numbers. Finance software lives close to bank feeds, payroll, tax, audit, controls, and reporting. That creates defensibility when done right - and risk when done wrong.

- Integration is part of the product, not just a feature. Many finance tools win or lose based on whether they connect cleanly to accounting systems, ERPs, banks, data warehouses, and compliance tools. Integration depth often determines churn.

- Services can help you grow but hurt your multiple. Implementation-heavy models can be necessary in finance workflows, but if services are large, lumpy, or low-margin, buyers start valuing you more like a services firm than a software firm.

- Regulatory and auditability matter. Buyers look for evidence you can withstand scrutiny: clean logs, permissioning, approvals, data lineage, and security practices.

Key risk factors buyers will always check (and that can move valuation fast):

- Customer stickiness: churn, renewals, and whether customers expand usage over time.

- Revenue quality: recurring vs one-time, contract terms, and how predictable revenue is.

- Implementation risk: time-to-go-live, support burden, and whether deployments scale.

- Platform dependency: reliance on third-party APIs or marketplaces (and the risk of rule changes).

- Security and controls: how you protect financial data, and how you handle access, approvals, and audit trails.

3. What Buyers Look For in a Financial Management Software Business

Most buyers - strategic acquirers and private equity - are trying to answer a simple question:

“If we buy you, will your customers keep paying, will they pay more over time, and can we grow this without the whole thing breaking?”

They translate that into a handful of practical lenses.

3.1 The “obvious” valuation inputs (but viewed through a finance-software lens)

- Scale: Not just revenue size - also number of customers, breadth of deployments, and how repeatable onboarding is.

- Growth: Buyers want to see that growth is durable (not a one-off spike from a channel partner or a single vertical trend).

- Gross margin: Finance SaaS is expected to look like software. If margins are compressed, buyers assume hidden services, support burden, or pricing pressure.

- Profitability or a clear path to it: You do not need to be highly profitable, but buyers want to understand what profit looks like when you stop “pushing the growth pedal.”

3.2 The industry-specific things that matter more than founders expect

- Where you sit in the workflow: Are you a “system of record” (or close to it), or a bolt-on reporting layer?

- Implementation complexity: Counterintuitively, more complex products can be more valuable if complexity creates switching costs and you can implement reliably.

- Integration depth: How many connectors are truly production-grade? Are they two-way? How often do they break?

- Buyer persona strength: Tools owned by the CFO/controller team, tied to month-end close, controls, or compliance are harder to replace than “nice-to-have” dashboards.

- Proof of auditability and trust: In finance, reliability is a feature - and a moat.

3.3 How private equity thinks about your business (in plain English)

Private equity buyers typically underwrite two valuations:

- What they pay today (entry multiple) and what they can sell for later (exit multiple).

- They care deeply about the “who buys this next?” question: a larger software company, a bigger private equity fund, or (rarely) public markets.

They also look for levers they can pull in 3-7 years:

- Pricing and packaging: raising prices, shifting tiers, bundling modules.

- Expansion: moving from one module to a platform, or from one segment (SMB) to a more complex segment (mid-market).

- Add-on acquisitions: buying smaller tools to expand features or customer base.

- Cost efficiency: reducing support burden, making implementation repeatable, tightening go-to-market.

If your business is easy to understand and easy to scale, PE appetite tends to be stronger. If it is services-heavy or founder-dependent, they price that risk in.

4. Deep Dive: Integration Depth vs Services Drag (The Finance Software Valuation Trap)

Finance founders hear “integration” praised constantly. But in M&A, integration is only valuable when it produces two outcomes: switching costs and predictable expansion.

At the same time, the work required to integrate (and implement) can quietly turn your model into a services business. This is one of the biggest valuation forks in the road in Financial Management Software.

4.1 Why buyers care so much about integration in finance

In the deal data, one of the clearest premium patterns is complex integration / ecosystem embed that raises switching costs and defensibility. The nuance is important: “integrates with X” is not a premium by itself. It becomes premium when it is hard to replicate, embedded in daily workflows, and visibly drives retention and expansion.

In finance workflows, strong integration can mean:

- Your product becomes the planning layer across departments (budget owners, finance, leadership).

- You sit between invoices, payments, ERP/accounting, and reporting, acting like connective tissue.

- You create operational dependence: if you are removed, month-end close slows down or controls break.

That is why two companies with the same revenue can sell at very different multiples: one is a “tool,” the other is “part of the operating system.”

4.2 The counterweight: services-heavy implementation can lower your multiple

The same integration story can hurt you if it comes with:

- Long, bespoke implementations

- High-touch customer success

- Large one-time fees relative to subscriptions

- Gross margin pressure or delivery bottlenecks

Buyers then worry that growth is constrained by headcount. That usually pushes valuation down - even if customers love the product.

4.3 A simple profile comparison

4.4 How to move from the left column to the right (without a massive pivot)

If you are selling in 1-12 months, you are not rebuilding your product. But you can improve how buyers perceive integration and implementation risk:

- Pick 2-3 “must-win” ecosystems (for your ICP) and make them bulletproof: fewer integrations, better quality.

- Measure integration depth: adoption per connector, number of synced objects, sync reliability, time saved.

- Productize onboarding: shrink time-to-go-live, reduce custom work, create templates for common chart-of-accounts structures.

- Separate services economics: if services exist, show they are profitable, optional, and do not constrain software growth.

- Show workflow dependency: map how customers use you in month-end close, audit prep, or budgeting cycles.

5. What Financial Management Software Businesses Sell For - and What Public Markets Show

Here is the most founder-useful way to interpret multiples:

- Private market multiples show what buyers have been willing to pay for similar assets.

- Public market multiples show the “reference band” for scaled businesses - but private deals adjust for size, risk, and growth.

The ranges below are illustrative, not a formal valuation.

5.1 Private Market Deals (Similar Acquisitions)

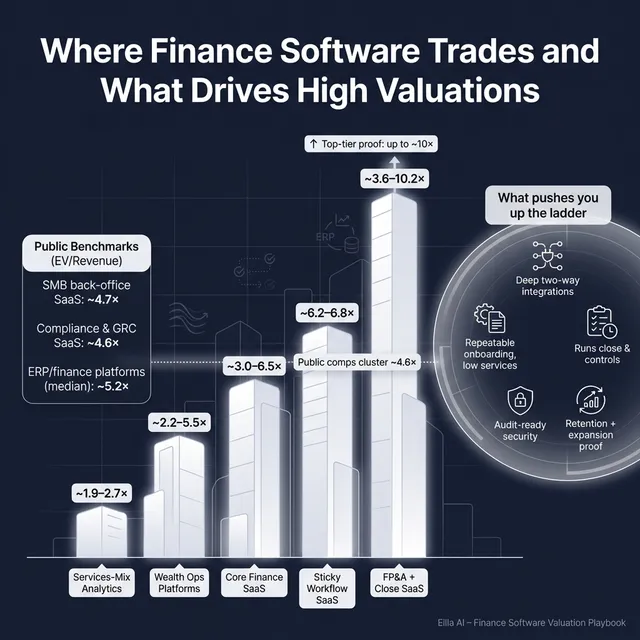

Across relevant private software acquisitions, EV/Revenue outcomes vary widely by subsector and business quality. In the data, software-centric finance platforms (especially FP&A, reporting, and performance management) show a broad range - from mid-single-digit revenue multiples up to low-double-digit multiples in stronger cases.

Two practical patterns show up repeatedly:

- Higher multiples tend to require either clear growth or clear profitability inflection (buyers pay for “proof,” not just a story).

- Earnouts show up often when growth is real but not fully de-risked - buyers will pay for upside, but only if performance is achieved.

A simple way to think about private deal “neighborhoods”:

How to use this as a founder:

- If you are pure SaaS with sticky workflows, you want to argue you belong in the software-centric bands, not the services bands.

- If your revenue includes meaningful services or “human labor,” expect buyers to anchor lower unless you can prove services are scalable and high-margin.

5.2 Public Companies

Public market multiples provide a sanity check - especially for buyers who must justify price to investment committees.

As of mid to late 2025, the sector-level public trading data shows a clear cluster for many finance-software segments in the ~4x-5x EV/Revenue neighborhood, with meaningful differences by subsector and profitability.

A founder-friendly snapshot by segment:

Two interpretation rules matter:

- Public multiples are not your price tag. Public companies are larger, more liquid, and usually lower-risk. A private business often trades at a discount to public comps because of smaller scale, higher customer concentration, and less predictable forecasting.

- Scarce, strategic assets can trade above public references. If you own a niche with deep integration, high retention, and clear expansion, buyers may pay up - especially strategic acquirers who see synergy or cross-sell.

6. What Drives High Valuations (Premium Valuation Drivers)

High multiples are rarely about one metric. They are about a buyer believing you are a durable asset that can keep growing without surprises.

Below are the premium drivers that show up in deal narratives and the observed patterns in the data, grouped into themes.

6.1 Embedded in the ecosystem (switching costs you can prove)

A repeated premium pattern is complex integration / ecosystem embed that makes you hard to replace.

Why buyers pay more:

- Embedded finance workflows are “sticky.” If you are deeply integrated, churn drops and expansion rises.

Practical examples:

- Two-way sync with core accounting/ERP systems (not just CSV export).

- Workflow dependency: close checklists, approvals, audit trails, consolidation logic.

- Evidence: customers with integrations stay longer and buy more modules.

6.2 Revenue that is predictable (and forecasting that feels real)

When your growth is strong but still “emerging,” buyers often use earnouts or contingent payments to bridge uncertainty. That can raise the headline valuation, but it also signals that the buyer is not fully convinced yet.

Why buyers pay more for de-risked growth:

- Certainty reduces the need for earnouts.

- Cleaner KPIs lead to better offers and fewer deal protections.

What to show:

- Cohort retention, renewal rates, expansion behavior.

- Sales pipeline hygiene (simple, consistent, trackable).

- Implementation capacity that scales.

6.3 Profitability proof or a credible inflection

The data also highlights a premium theme: demonstrated profitability or a clear profitability inflection. Buyers may accept low EBITDA today if they believe it is intentionally depressed by smart growth investment with visible payback.

Why buyers pay more:

- Profitability reduces downside risk.

- It gives PE buyers confidence they can use leverage and still sleep at night.

Founder-friendly proof points:

- Stable gross margin consistent with software.

- A believable path to profitability without “magic.”

- Clear separation of R&D investment vs customer delivery cost.

6.4 Scale and breadth (platform asset vs nice product)

Another premium pattern is category scale + broader footprint, which reduces concentration risk and increases strategic value.

Why buyers pay more:

- More customers and more use cases lower dependency on any one segment.

- Platforms are easier to cross-sell and harder to displace.

Examples:

- Multi-region presence (if done profitably and compliantly).

- Partner ecosystem (accounting firms, ERP implementers, marketplaces).

- Multiple modules that expand share of wallet.

6.5 Software economics (high gross margin and operating leverage)

The data shows that high gross margin software models can support strong EV/EBITDA outcomes even when EV/Revenue is not extreme. The point is simple: buyers will pay for durable earnings - but only if margins are real and repeatable.

What founders can do:

- Reduce support burden through product changes and better onboarding.

- Keep services optional and profitable.

- Show how margins improve as you grow (not worsen).

6.6 Clean fundamentals that buyers quietly reward

Even when not called out explicitly, these basics matter in almost every premium deal:

- Clean financial statements and clear revenue recognition

- Diversified customer base

- Low founder dependency

- Strong second layer of leadership

- Well-documented security and controls

7. Discount Drivers (What Lowers Multiples)

Discounts usually come from one of two buyer fears:

- “This could break after we buy it.”

- “We might not be able to grow it without spending a lot.”

Here are the most common discount drivers in Financial Management Software:

7.1 Revenue quality issues

- Too much one-time revenue vs recurring subscriptions.

- Short contracts with easy cancellation.

- Discounts that are not controlled (buyers fear pricing power is weak).

What improves it:

- Move customers to longer commitments where possible.

- Show renewal discipline (no surprise churn, no “save deals” as your model).

7.2 Customer retention and stickiness concerns

- High churn, low product usage, or unclear expansion behavior.

- Customers treat you as a reporting add-on rather than a core workflow.

What improves it:

- Show usage tied to month-end close, budgeting cycles, approvals, or compliance routines.

- Make retention a board-level metric now, not after the sale process starts.

7.3 Services drag and delivery bottlenecks

- Implementations that require heavy customization.

- Low-margin services attached to every deal.

- Support load rising faster than revenue.

What improves it:

- Productize onboarding and reduce time-to-value.

- Prove services are profitable and not the growth constraint.

7.4 Integration and platform dependency risk

- Reliance on one ecosystem partner or one API.

- Frequent connector breakage or manual workarounds.

What improves it:

- Reliability metrics, redundancy plans, and clear contracts where possible.

7.5 Compliance, security, and “trust gap”

Finance buyers are sensitive to risk. Gaps in security posture, audit trails, or access controls can slow deals and reduce price.

What improves it:

- Document policies, controls, and incident response.

- Be ready to explain how you protect financial data in simple terms.

7.6 Founder dependency

If the buyer believes the product, sales motion, and customer relationships run through you personally, they price that risk in.

What improves it:

- A clear leadership bench, documented playbooks, and customer success that does not rely on the founder.

8. Valuation Example: A Financial Management Software Company

This example is fictional. The company and the USD 10.0m revenue level are made up to show how valuation logic works. The valuation ranges are illustrative - not investment advice and not a formal valuation.

Step 1: The plain-English logic

- Start with relevant public and private “reference bands.” For finance software, many relevant public SaaS segments cluster around mid-single-digit EV/Revenue, while private deals in finance-adjacent SaaS show a wide range (mid-single digits up to low double digits in stronger cases).

- Pick a “core range” based on comparability. A typical SMB or mid-market finance SaaS product with solid software economics often anchors in a ~3.0x-6.5x neighborhood, with the best outcomes requiring strong proof of stickiness, growth, and scalability.

- Adjust up for premium drivers and down for discount drivers.

- Up: deep workflow embed, integration defensibility, proven retention/expansion, clear profitability path.

- Down: services drag, churn risk, weak predictability, platform dependency, security gaps.

- Translate the multiple into enterprise value (EV). EV is the value of the operating business (before thinking about cash, debt, or working capital mechanics).

Step 2: Apply it to a fictional company

Meet LedgerBridge (fictional):

- SMB-to-mid-market financial close + reporting SaaS

- Two strong integrations (accounting platform + ERP connector), with measurable adoption

- Revenue: USD 10.0m (fictional)

- Gross margin: software-like, but with some implementation support

- Growth: healthy but not hypergrowth

A practical set of scenarios:

Step 3: What this means for you

Two companies can both be “USD 10m revenue finance SaaS” and still land in very different outcomes because buyers are paying for confidence.

- If you can prove your integrations are embedded, your retention is strong, and implementation is repeatable, you move toward the top end.

- If your story is vague, your delivery is bespoke, or your churn risk is unclear, buyers protect themselves with lower multiples or earnouts.

9. Where Your Business Might Fit (Self-Assessment Framework)

This is a simple tool to locate yourself on the spectrum and identify the highest-payoff improvements.

Score each factor 0 / 1 / 2:

- 0 = weak or unclear

- 1 = acceptable but not strong proof

- 2 = strong proof

Self-assessment table

How to interpret your total

- Mostly 2s in High Impact: You are closer to premium outcomes (assuming the market is healthy).

- A mix of 1s and 2s: You are likely in the “core fair market” band.

- Many 0s (or unknowns): Expect discounts, earnouts, or slower diligence - and consider delaying the sale to fix the highest-impact gaps.

The goal is not to “score well.” The goal is to find the 2-3 improvements that could change buyer confidence the most in 6-12 months.

10. Common Mistakes That Could Reduce Valuation

10.1 Rushing the sale

If you launch a process before your numbers and narrative are ready, buyers control the conversation. In finance software, that usually means they focus on risk: churn, compliance, implementation, and platform dependency.

10.2 Hiding problems

Issues will surface in diligence. When buyers discover surprises late, trust breaks - and price, structure, or certainty suffers.

A better approach: disclose issues early with a plan (what happened, what you changed, how you monitor it now).

10.3 Weak financial records

This is common in founder-led SaaS, and it is fixable.

Low-hanging improvements that matter:

- Clean revenue breakdown (recurring vs services vs one-time)

- Gross margin clarity (support costs, hosting, services delivery separated)

- Cohort retention and churn reporting

- Simple forecasting that ties to pipeline reality

10.4 Not running a structured, competitive sale process

When you run a structured process, you create competition - and competition drives price discovery.

Practitioner benchmarks often cite ~10%-30% higher outcomes in competitive processes vs single-buyer negotiations, with ~25% as a common rule-of-thumb, though results vary by asset quality and market conditions. Academic work also shows outcomes can be comparable in some settings, which is exactly why process design and buyer selection matter.

10.5 Revealing the price you are after too early

If you tell buyers “we want USD 10m,” you often kill price discovery. Instead of learning what they would truly pay, you invite a narrow range of offers just above your number.

A better approach: let the market come back with initial indications, then negotiate from real demand.

10.6 One finance-software-specific mistake: treating integrations as marketing, not evidence

Founders often say “we integrate with everything,” but buyers ask:

- how reliable

- how deep

- how many customers use it

- whether it reduces churn and increases expansion

If you cannot prove it, it is not a valuation driver.

10.7 Another sector-specific mistake: underestimating security and audit expectations

In finance workflows, security posture and auditability are not “nice to have.” If you treat them as a late-stage cleanup item, diligence slows and leverage shifts to the buyer.

11. What Financial Management Software Founders Can Do in 6-12 Months to Increase Valuation

This is the practical action plan - focused on what you can realistically improve without rebuilding the company.

11.1 Improve the numbers buyers trust

- Tighten retention proof: cohort renewals, churn drivers, and a clear “why customers stay” story.

- Increase recurring clarity: separate subscription revenue from services and one-time fees.

- Show operating leverage: even if you are not profitable, show what margin looks like at a slightly lower growth pace.

11.2 Reduce the biggest buyer risks

- Productize implementation: shorten time-to-go-live, publish onboarding playbooks, reduce bespoke work.

- Make integrations defensible: focus on fewer, deeper, more reliable connectors and quantify adoption/reliability.

- Security readiness: document controls, access rights, audit trails, incident response, and data handling.

11.3 Make your story simple and buyer-shaped

Buyers do not buy features - they buy outcomes.

In finance software, strong narratives usually anchor on:

- “We accelerate close / reduce errors / strengthen controls.”

- “We are embedded in X workflow, so customers do not leave.”

- “We expand from module A to B to C inside the same finance team.”

Turn your product into a before/after story with proof.

11.4 Build a sellable organization, not a founder-dependent machine

- Put a “second layer” in place: head of finance, product lead, sales lead, customer success lead (even if part-time).

- Document key processes: onboarding, customer support escalations, roadmap prioritization, pipeline reviews.

11.5 Prepare deal materials early

If you might sell in 6-12 months, start now:

- A clear KPI pack (monthly)

- Customer references ready (and permissioned)

- Diligence folder hygiene (contracts, security docs, IP assignments)

These steps reduce friction and help you hold price through diligence.

12. How an AI-Native M&A Advisor Helps

Selling a Financial Management Software business is not just about finding “a buyer.” It is about finding the right buyers - the ones who value your workflow position, integrations, and customer base enough to pay a premium.

Higher valuations through broader buyer reach. An AI-native approach can expand the buyer universe to hundreds of qualified acquirers based on deal history, synergies, financial capacity, and other signals. More relevant buyers means more competition, stronger offers, and a higher chance the deal closes even if one buyer drops.

Initial offers in under 6 weeks. AI-driven buyer matching and outreach, faster creation of marketing materials, and systematic diligence support can compress timelines - getting you to initial conversations and offers much faster than a manual-only process.

Expert advisory, enhanced by AI. You still want experienced human M&A advisors running negotiations and positioning. AI simply makes the work sharper and faster: stronger buyer targeting, cleaner materials, and deal framing that speaks the buyer’s language - with Wall Street-grade advisory quality without traditional bulge bracket costs.

If you would like to understand how Eilla AI’s AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.