The Complete Valuation Playbook for Fire Safety Services Businesses

A practical, data-backed playbook for fire safety services founders to understand what drives valuation.

If you run a fire safety services business and you might sell in the next 1-12 months, valuation is not just a number - it’s the output of how buyers see your risk, your cash generation, and how “must-have” your services are to customers.

This guide is built for founders in fire protection installation, inspection, maintenance, testing, monitoring, training, and risk/compliance services. It uses real patterns from private M&A deals and public market multiples in and around the sector to show what businesses sell for, what drives higher vs lower multiples, and what you can realistically improve in 6-12 months.

A quick note: valuation ranges here are illustrative - they’re meant to help you think clearly and prepare well, not to act as a formal valuation or investment advice.

1. What Makes Fire Safety Services Unique

Fire safety services looks like “just another services category” until you see what actually drives pricing power and buyer confidence.

The main business types buyers see

Most businesses in this sector fall into one (or a blend) of these models:

- Fire protection integrators: design, installation, commissioning, maintenance, testing, and ongoing service of fire alarms, sprinklers, suppression, and life safety systems.

- Inspection, testing, and compliance specialists: recurring inspections, certifications, documentation, and risk assessments (often tied to local codes, insurance requirements, and landlord obligations).

- Training providers: fire safety training, drills, risk programs, often attached to broader compliance contracts.

- Hybrid fire + security providers: integrated systems (access control, CCTV, alarms, monitoring) plus fire compliance.

- Contractor-heavy turnkey providers: larger project work (new builds, refits), sometimes bundled with M&E/HVAC/electrical.

Why valuation is different here

Fire safety services is “non-discretionary” for many customers - but that doesn’t automatically mean premium valuations. Buyers will pay up only when the non-discretionary demand translates into predictable revenue and controlled delivery risk.

The big valuation nuance: two companies can have the same revenue, but wildly different value depending on whether revenue is driven by:

- recurring inspection/maintenance and monitoring contracts, or

- one-off installation projects with lumpy schedules and margin swings.

Key risks buyers always check

Buyers will almost always pressure-test:

- Compliance and certification credibility: licenses, code compliance, training credentials, and audit readiness.

- Quality systems and liabilities: rework rate, incident history, warranty claims, and how you manage documentation.

- Customer concentration and contract structure: who can cancel, how fast, and under what terms.

- Delivery capacity: technician availability, subcontractor reliance, and whether the business breaks when one person leaves.

- Working capital dynamics: especially for project-heavy businesses where cash can get trapped in receivables and retentions.

2. What Buyers Look For in a Fire Safety Services Business

Buyers are not only buying your past performance - they are buying the confidence that your future cash flow is durable.

The “core” stuff buyers care about

Even in this niche sector, the basics matter:

- Scale and stability: size, multi-site coverage, and repeatable delivery.

- Growth: steady growth beats “spiky” growth, especially if it comes from contract wins you can renew.

- Profitability: consistent EBITDA margins matter a lot in services because labor is the cost base.

- Cash conversion: clean invoicing, low disputes, and predictable collections.

The sector-specific lens

In fire safety, buyers tend to care more than usual about:

- Recurring vs project mix: maintenance, inspection, testing, and monitoring revenue is generally valued more highly than one-off installs.

- Regulated and high-consequence environments: utilities, critical infrastructure, healthcare, airports, government sites, and similar settings can create higher switching costs.

- Evidence of “qualification barriers”: certifications, approved vendor status, and long-term frameworks that are hard to replicate.

- Attach rate: how often your installation work turns into multi-year service and inspection contracts.

How private equity thinks about your business

Private equity buyers are usually asking three simple questions:

- What multiple am I paying today, and what multiple can I sell at in 3-7 years?If your business looks like a contract-heavy, recurring, well-run platform, they may believe the exit multiple will be higher than entry.

- Who can I sell this to later?The best outcomes usually have multiple credible “next buyers”: strategic acquirers (bigger safety platforms), larger private equity funds, or regional consolidators.

- What levers will I pull to create value?Common PE levers in this sector:

- price increases and better contract terms

- cross-sell fire + security + compliance services

- improving technician utilization and scheduling

- acquisitions of smaller local providers (only if integration is repeatable)

3. Deep Dive: The Valuation Nuance That Matters Most - Recurring Compliance Revenue vs Project Installs

If you only take one idea from this playbook, make it this: buyers pay for predictability and controllability.

A fire safety business that is 60 percent recurring inspections, testing, and maintenance will often be valued differently than a business that is 60 percent installation projects - even at the same revenue.

How it shows up in the data

Across both public and private data in this space, services-heavy integrators and contractors tend to trade and transact at modest revenue multiples, often around the 1x-ish range, while more “tech-like” or differentiated parts of the ecosystem can trade higher. But within services, the companies that get the best outcomes are usually the ones that can prove recurring demand, renewals, and stable margins.

Why buyers care

Project installs create three buyer fears:

- Revenue timing risk: delays, permitting, construction schedules.

- Margin volatility: change orders, rework, subcontractor slippage.

- Cash flow risk: retention, disputes, and slow collections.

Recurring inspection/maintenance and monitoring tends to reduce those fears by:

- smoothing revenue across months and quarters

- making staffing and scheduling easier to optimize

- creating “embedded” customer relationships that renew

How to move from “project-first” to “recurring-first” over time

You don’t need a total pivot. The best moves are usually operational:

- Convert installs into service contracts: make service the default offer, not an optional add-on.

- Bundle compliance deliverables: documentation, certification, digital records, and audit-ready reporting can make renewals easier.

- Increase multi-site agreements: regional chains and facility portfolios reduce sales cost and improve retention.

- Add monitoring (where it fits): monitoring can increase stickiness, but only if service levels and response are reliable.

Lower-value vs higher-value profile

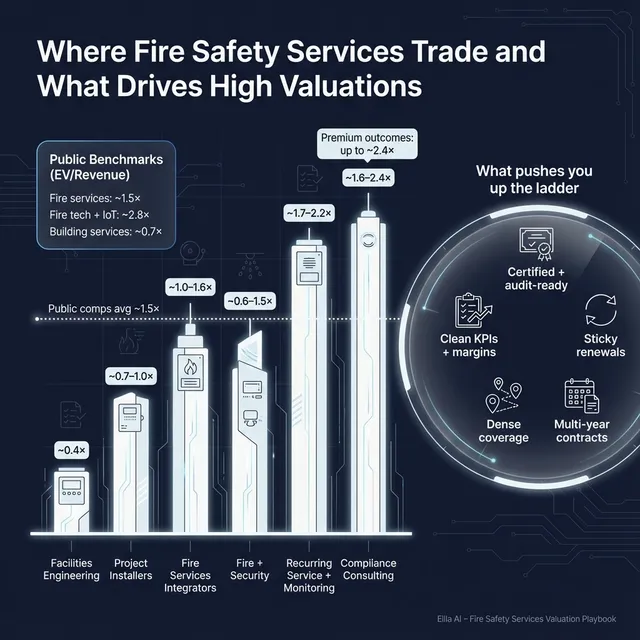

4. What Fire Safety Services Businesses Sell For - and What Public Markets Show

Here’s the key: private deals reflect what real acquirers paid for comparable businesses, while public markets set a “reference band” - but public multiples are not a direct price tag for your company.

4.1 Private Market Deals (Similar Acquisitions)

In private M&A for fire safety services integrators (design, install, maintenance, risk and training), the group-level averages cluster around ~1.3x EV/Revenue and ~11-15x EV/EBITDA. In practice, individual deals span a wide range depending on profitability, contract structure, and how much risk the buyer takes at closing vs via earn-outs.

A practical founder takeaway: if you’re a services integrator, expect buyers to anchor on a revenue multiple around the low-to-mid 1x range unless you can clearly prove recurring revenue, clean margins, and low customer risk.

Illustrative private deal ranges by adjacent segment (based on observed group patterns):

These ranges are illustrative. A competitive process, strong financials, and a clear “why us” story can move you meaningfully within the band.

4.2 Public Companies

Public companies in and around fire safety services show a similar story: service and contractor-heavy models tend to trade at lower revenue multiples, while more differentiated technology or security-adjacent models can trade higher. The public group averages below are best treated as late-2025 reference points, not rules.

How to use this as a private founder:

- Treat public multiples as a reference band, not a valuation answer.

- Smaller scale, customer concentration, founder dependence, or margin volatility typically pushes you below comparable public multiples.

- Scarcity and strategic value (dense footprint, critical end-markets, differentiated offering) can sometimes pull you above a simple public “rule of thumb”.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes in fire safety services rarely come from hype. They come from reducing buyer fear and increasing buyer confidence.

Below are the premium drivers that show up clearly in this sector, including patterns observed in real deals.

5.1 Mission-critical and regulated end-markets

When your customers operate in high-consequence environments (critical infrastructure, utilities, government, healthcare, airports, industrial sites), switching can be painful. Buyers like that.

What helps turn “regulated” into “premium”:

- documented certifications and approved vendor status

- repeat inspection cycles tied to regulation or insurance

- multi-year frameworks and renewal history

5.2 Recurring revenue that is truly sticky

In fire safety, “recurring” matters most when it renews with minimal drama.

Practical signals buyers love:

- multi-year service agreements

- high renewal rates and low churn

- growing revenue per site (more devices, more services, more locations)

5.3 Scale and density (platform value)

A multi-location footprint can matter even when revenue multiples stay modest, because density improves:

- technician routing and utilization

- procurement and purchasing power

- cross-sell across service lines

- ability to absorb tuck-in acquisitions

5.4 Differentiation beyond commoditized installation

In the dataset, truly differentiated technology or high-spec product franchises are rarer - but when they exist, they tend to be valued more like “defensible solutions” than generic labor.

In services, “differentiation” can still exist if you have:

- specialized suppression expertise

- high-integrity testing capability

- proprietary documentation workflows customers rely on

- strong brand in a niche (marine, petrochemical, healthcare, etc.)

5.5 Clean financials and clear KPIs

This is not glamorous, but it is one of the biggest value unlocks.

Buyers pay more when you can clearly show:

- consistent EBITDA margins

- service vs project gross margin separation

- backlog, renewals, and attach rates

- low disputes and clean collections

5.6 Less earn-out dependence (more cash at close)

A pattern in this sector: when buyers feel integration or margin risk, they often use performance-linked deferred consideration (earn-outs) to justify a headline price while protecting themselves.

Earn-outs can still produce good outcomes - but “premium” in founder terms usually means more certainty and more cash at close. Strong consistency is how you earn that.

6. Discount Drivers (What Lowers Multiples)

Discounts usually come from one theme: buyers can’t get comfortable that profits and cash flow will hold up after closing.

Common discount drivers in fire safety services

- Project-heavy revenue with weak service attachment: lumpy revenue, hard-to-forecast delivery, higher working capital drag.

- Thin or unstable margins: buyers worry margins are “accidental” or will compress after integration.

- Customer concentration: one or two contracts drive most profit.

- Founder dependence: key relationships, quoting, compliance knowledge, or delivery lives in your head.

- Subcontractor dependence: quality, scheduling, and liability risks increase.

- Compliance/documentation gaps: missing certifications, inconsistent inspection records, weak audit trail.

- Messy financial reporting: unclear add-backs, inconsistent recognition, no clean split between service vs install profitability.

A special warning: very high EV/EBITDA multiples sometimes show up in data sets simply because EBITDA is temporarily low. Buyers typically do not reward that. They either value you on revenue, or they protect themselves with deferrals.

7. Valuation Example: A Fire Safety Services Company

This is a fictional worked example to show the logic. The company and numbers below are illustrative.

Step 1: The valuation logic in plain English

A buyer typically triangulates value from two angles:

- Revenue multiple anchored to comparable fire safety services integrators (private deals and public comps), adjusted for your growth, recurring mix, and risk.

- EBITDA multiple if you have stable profitability, adjusted for margin quality and cash conversion.

If EBITDA is weak or negative, buyers lean more on EV/Revenue and/or structure the deal with earn-outs.

Step 2: Apply it to a fictional USD 10m revenue business

Meet HarborShield Fire Services (fictional):

- Revenue: USD 10.0m

- Mix: 55% recurring inspections/maintenance, 25% monitoring, 20% installs

- EBITDA margin: 12% (USD 1.2m EBITDA)

- Customers: diversified across property managers, healthcare, and light industrial

- Operations: strong service scheduling, documented compliance workflows

Illustrative valuation scenarios (using sector patterns):

Sanity check using EBITDA:

- If HarborShield can credibly support, say, 8-12x EBITDA, that implies USD 10-14m EV (on USD 1.2m EBITDA).In this example, revenue-based and EBITDA-based ranges broadly overlap in the base case - a good sign the story is coherent.

Step 3: What this means for you

Two businesses with the same USD 10m revenue can be worth very different amounts because buyers aren’t paying for revenue - they’re paying for confidence:

- confidence the revenue repeats

- confidence the margins hold

- confidence liabilities are controlled

- confidence the business scales beyond the founder

Again: this is not a formal valuation. It’s a framework to help you think and prepare.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this to self-score where you likely sit in the valuation spectrum today, and where improvements will pay off most.

Score each factor 0 / 1 / 2:

- 0 = weak / unproven

- 1 = decent / mixed

- 2 = strong / consistent

How to interpret your total:

- Top band: you’re closer to premium outcomes because risk is lower and predictability is higher.

- Middle band: fair market - you’ll do well with a strong process, but expect buyers to negotiate structure.

- Lower band: you may still sell, but value will often be constrained unless you fix 2-3 big issues first.

9. Common Mistakes That Could Reduce Valuation

9.1 Rushing the sale

If you start a process before your numbers and story are ready, buyers will fill the gaps with doubt - and discount you accordingly.

9.2 Hiding problems

Issues will surface in diligence (contracts, compliance, claims, customer concentration). Hiding them doesn’t remove them - it destroys trust and leverage later.

9.3 Weak financial records

In this sector, weak records are especially costly because buyers already worry about:

- project margin swings

- labor and scheduling efficiency

- working capital and collections

A few months of cleanup can materially change how “buyable” your business looks.

9.4 Not running a structured, competitive process with an advisor

Founders often underestimate how much process structure matters. Research and deal experience consistently suggest that a well-run competitive process with a credible advisor can drive meaningfully higher prices (often cited around 25% uplift) because it improves buyer competition and reduces execution risk.

9.5 Revealing your target price too early

If you say “I want USD 10m,” you often get offers clustered around USD 10m. You kill price discovery. Let the market tell you what the business is worth, then negotiate from strength.

9.6 Industry-specific mistake: treating documentation as “back office”

In fire safety, documentation is product. Inspection trails, compliance certificates, service logs, and proof of standards adherence can be the difference between “trusted provider” and “risky contractor.”

10. What Fire Safety Services Founders Can Do in 6-12 Months to Increase Valuation

This is the part you can actually execute before a sale.

10.1 Improve the numbers buyers anchor on

- Grow recurring revenue mix: push installs into service agreements by default.

- Stabilize margins: separate reporting for installs vs service so you can manage each one properly.

- Reduce customer concentration: even one new anchor account can change the story.

- Improve cash conversion: tighten invoicing cadence, reduce disputes, shorten collections cycles.

10.2 De-risk the business for a buyer

- Build a second layer of leadership: service ops lead, sales lead, finance lead - someone other than you who runs the machine.

- Reduce subcontractor fragility: lock in capacity, improve QA, document training and process.

- Codify compliance: make certifications, audit trails, and documentation easy to hand over.

10.3 Build a buyer-ready story that is true and provable

- Track 6-8 KPIs consistently (renewals, churn, attach rate, service gross margin, utilization, backlog, DSO/collections, customer concentration).

- Create a simple narrative: “Here’s why customers choose us, why they stay, and why margins are stable.”

10.4 Prepare for diligence like it’s a product launch

- Clean contracts and standardize terms where possible.

- Document liabilities, warranties, and claims history transparently.

- Make your operational playbook easy to understand: scheduling, QA, escalation, certification handling.

11. How an AI-Native M&A Advisor Helps

Selling a fire safety services business is partly about valuation - and partly about running a process that makes buyers compete and feel confident. An AI-native advisor helps on both dimensions.

First, higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, synergies, financial capacity, and other signals. More relevant buyers usually means more competition, stronger offers, and a higher chance the deal closes even if one buyer drops out.

Second, initial offers in under 6 weeks. AI-driven buyer matching and outreach, faster creation of marketing materials, and structured support through early diligence can compress timelines compared to a fully manual process - helping you get to real conversations and early bids much faster.

Third, expert advisory, enhanced by AI. You still want experienced human M&A advisors running the process, framing the narrative, and negotiating terms. AI strengthens that work by improving buyer targeting, tightening execution, and raising the overall quality of materials and preparedness - closer to “Wall Street-grade” outcomes without traditional bulge-bracket costs.

If you’d like to understand how Eilla AI’s AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.