The Complete Valuation Playbook for Flooring Businesses

A practical guide to how flooring businesses are actually valued today and what founders can do to drive better outcomes.

If you are considering selling your flooring business in the next 1-12 months, valuation is not just a number - it is the output of how buyers perceive your risk, your durability, and your ability to keep making money through the next construction cycle.

This playbook is built from real-world deal data and public market reference points in and around flooring, building products, and installation services. It will show what flooring businesses actually sell for, what drives higher vs lower multiples, and how to improve your outcome in the 6-12 months before a sale.

1. What Makes Flooring Businesses Unique

Flooring is a “real economy” category: physical products, real jobsites, real logistics, and real working capital. Buyers value it differently than pure services or software because cash gets tied up in inventory, projects can be lumpy, and demand is linked to residential turnover, remodeling, and commercial construction cycles.

Most privately held flooring businesses fall into a few models:

- Product-led: manufacturing (wood, vinyl, laminate, carpet, tile, underlay) and branded product distribution.

- Distributor/wholesaler: regional supply, relationships with contractors and retailers, often strong logistics capabilities.

- Installer/contractor: labor-heavy installation, often project-based with job costing and scheduling as core capabilities.

- Interior finishes platforms: broader “floors plus” (flooring + cabinets/counters) with procurement + installation, often tied to homebuilders and property managers.

Unique valuation considerations buyers focus on in flooring:

- Margin structure and pricing power: flooring can look “commoditized” unless you prove differentiation or specification pull-through.

- Working capital intensity: inventory, receivables, and supplier terms can materially change the real economics.

- End-market exposure: residential remodel vs new build vs commercial spec drives stability (and risk).

- Claims, warranties, and installation liability: one quality issue can erase a year of profit if controls are weak.

Key risk factors buyers will always check:

- Customer concentration (one builder, one dealer network, one GC)

- Supplier dependence (single mill, single overseas source, single raw material exposure)

- Job costing discipline (especially in installation-heavy businesses)

- Safety and labor compliance (workers comp, subcontractor classification, site safety record)

- Product quality systems (returns, claims rate, warranty reserve logic)

2. What Buyers Look For in a Flooring Business

Buyers typically pay for confidence. Confidence that your earnings are real, repeatable, and not dependent on heroics from you personally.

The universal factors still matter:

- Scale: size helps with purchasing terms, logistics efficiency, and buyer interest.

- Growth: not just “up and to the right,” but explainable growth (share gains, new channels, spec wins).

- Profitability: stable EBITDA with a clear bridge from gross margin to operating profit.

- Cash conversion: strong earnings that actually turn into cash after inventory and receivables.

But flooring has “extra” buyer filters:

- Channel strength: installers, builders, retailers, multifamily owners, commercial specifiers - each comes with different risk.

- Mix of product vs labor: labor-heavy businesses often price lower unless job costing and utilization are world-class.

- Operational maturity: inventory accuracy, purchasing discipline, freight management, and claims control matter more than founders expect.

How private equity buyers think (in plain English)

Private equity (PE) is usually asking: “If we buy your business today, can we sell it for more in 3-7 years?”They focus on:

- Entry multiple vs exit multiple: if they pay 8x EBITDA today, they want a believable path to sell at a similar or higher multiple later.

- Who the next buyer is: a larger strategic buyer, a bigger PE fund, or a platform consolidator.

- The levers they expect to pull:

- Pricing and mix improvements (raise gross margin without losing volume)

- Cost discipline (freight, waste, overtime, purchasing terms)

- Roll-up potential (add-on acquisitions in new geographies or capabilities)

- Cross-sell (product + installation + maintenance contracts)

If you cannot show a realistic improvement story, PE will price you like a steady but cyclical building product - not like a premium “platform.”

3. Deep Dive: Why “Specification Pull-Through” Changes Multiples

Here’s the question that matters more than most founders realize:

Are you chosen because you are the cheapest available option - or because you are specified, trusted, and hard to replace?

In the data, higher outcomes cluster around businesses that are more “specialty” and less “commodity.” Deals tied to performance materials, specialty chemistries, and durability-critical applications tend to command stronger revenue multiples and EBITDA multiples because switching costs are higher and failure is expensive for the customer.

Buyers care because specification pull-through creates:

- More stable demand (you are in the plan, not in a last-minute bid war)

- Better pricing power (you are compared on performance, not just price per square foot)

- Stickier relationships (architects, facility managers, national accounts, preferred installer programs)

How to move from “bid business” to “specified business”:

- Build a commercial specification strategy: target verticals where performance matters (healthcare, education, industrial, hospitality).

- Invest in proof: test results, certifications, documented install systems, clear warranty policies.

- Make repeatability easy: standardized SKUs, fast samples, spec documents, training for installers, and field support.

A simple way to think about it:

You do not need to become “luxury.” You need to become reliably chosen.

4. What Flooring Businesses Sell For - and What Public Markets Show

The cleanest way to interpret valuation in flooring is to triangulate:

- Private market deals (what buyers actually paid)

- Public trading multiples (what the market pays for scale and liquidity)

- Your business profile (margin, mix, concentration, and risk)

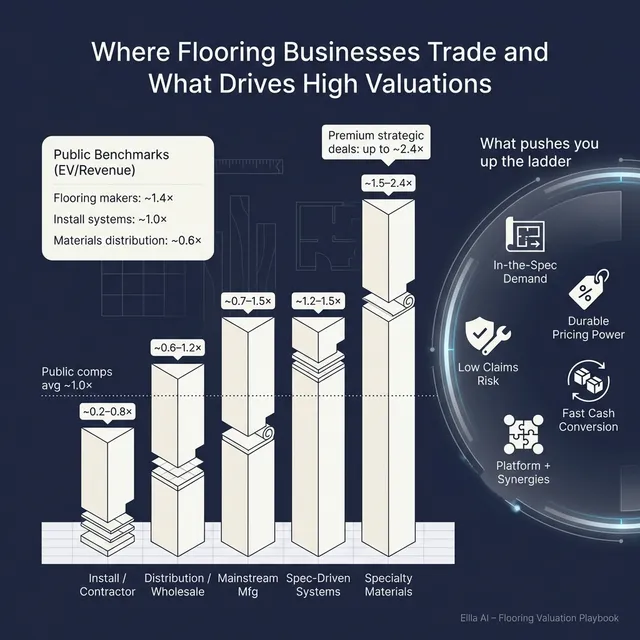

The big headline from the data: mainstream flooring manufacturers and distribution-like businesses often sit below 1.0x revenue unless margins or strategic synergies justify more. Premium outcomes show up when the business looks more like specialty materials, higher-margin systems, or a consolidation platform.

4.1 Private Market Deals (Similar Acquisitions)

Private deals in and around flooring show clear clustering by business type:

- Mainstream flooring and interior surface manufacturers tend to transact around ~0.7x to ~1.5x revenue, with EBITDA multiples around the high single digits when profitability is solid.

- Distribution and contractor-like businesses often clear lower revenue multiples (project risk and labor intensity push down valuation).

- Higher-multiple outcomes tend to be tied to specialty materials or clear strategic adjacency where buyers can underwrite synergies.

Illustrative private-market ranges (from the provided deal groupings):

These are illustrative ranges, not a price tag. Your end-market mix, customer concentration, and margin quality can move you materially up or down.

4.2 Public Companies

Public markets set a reference band, not a direct “private valuation.” In flooring and adjacent building product categories, public EV/Revenue multiples commonly cluster around ~0.8x-1.4x on average for global flooring manufacturers (with a lower median), while EV/EBITDA shows wider dispersion because profitability varies widely.

As of mid-to-end 2025, the grouped public averages in the data look like this:

How to use this as a founder:

- Treat public multiples as an outer reference band, not a promise.

- Private businesses often trade at a discount to publics because they are smaller, less liquid, and riskier.

- You can trade at a premium to the “typical” band if you are scarce, differentiated, and strategically important (especially if a strategic buyer can underwrite synergies).

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes in the data do not come from “good vibes.” They come from buyers believing your margin structure and demand durability are structurally better than the average flooring business.

Below are the premium drivers that show up across deals and adjacent building products - translated into flooring terms.

5.1 Sustainability and energy-related tailwinds that actually show up in margins

Buyers pay more when sustainability is not just marketing, but tied to real pricing power and higher margins (for example, eco-led materials or specialized systems that customers need to meet standards).

What this looks like in flooring:

- Products with credible certifications and performance claims that win specs

- Materials that support healthier indoor environments (low VOC, durability, hygiene)

- Documented ability to maintain gross margin through raw material swings

5.2 High gross margins and durable pricing power

The data shows higher multiples where gross margins and EBITDA margins are consistently strong. Buyers love businesses that can raise prices, hold share, and defend margin.

In flooring, that usually means:

- You sell systems and solutions, not just boxes (product + underlay + adhesive + install protocol)

- You have a brand or channel position that reduces price shopping

- Claims and rework are low because quality control is disciplined

5.3 “Platform value” and synergy logic

Premium outcomes cluster when the buyer can clearly explain: “We can combine this with what we own and make more money quickly.”

In flooring, synergy narratives often include:

- Procurement leverage (raw materials, freight contracts, overseas sourcing)

- Manufacturing footprint optimization (capacity, lines, scrap)

- Channel expansion (bringing products into a new dealer/installer network)

- Cross-sell into builders, multifamily, or commercial accounts

5.4 Specification pull-through and switching costs

When your product is “in the spec,” you are harder to replace. That reduces revenue risk, which raises valuation.

Founders can make this tangible by showing:

- Repeat wins in specific verticals

- A pipeline of specs and conversions

- Installer certification programs that protect performance in the field

5.5 Clean financials and a business that runs without you

Even if your growth is modest, buyers pay up for low surprises:

- Monthly financials that tie out

- Job costing and margin by line/channel

- A leadership bench that can stay post-close

6. Discount Drivers (What Lowers Multiples)

Most “low multiple” outcomes happen for understandable reasons: buyers see risk they cannot price confidently, so they protect themselves by paying less (or using earn-outs, holdbacks, and tighter terms).

Common discount drivers in flooring:

- Commodity positioning: if you win mainly by being cheapest, buyers assume margins can compress overnight.

- Customer concentration: one builder, one GC, one retailer, one national account that can renegotiate hard.

- Project lumpiness: revenue depends on a handful of large jobs with uncertain timing.

- Labor dependence: installation-heavy models without strong scheduling, utilization, and job costing discipline.

- Weak cash conversion: inventory bloat, slow receivables, unclear rebates, messy supplier terms.

- Quality and claims risk: high returns, inconsistent install quality, under-reserved warranties.

- Founder dependency: if you are the estimator, the closer, and the operations brain, buyers see continuity risk.

None of these are fatal - but if they are unresolved, they push you toward the lower end of the range.

7. Valuation Example: A Flooring Company

Let’s walk through a worked example using a fictional company to show how the logic works.

Fictional company: NorthPeak FlooringRevenue: USD 10.0m (fictional)Business model: regional flooring manufacturer + distributor mix, selling into dealers and light commercial accounts

This is not investment advice and not a formal valuation. It is an illustrative framework.

Step 1: Build a “core” multiple range from market reality

From the provided flooring and building products reference points:

- Public market “center” for relevant flooring/product adjacencies tends to cluster around ~0.6x-1.1x revenue for mainstream profiles.

- Private market ranges for similar segments often overlap that same band, with higher outcomes when the business looks more like specialty materials or a strategic platform.

So the base case starts with ~0.6x-1.1x revenue.

Step 2: Apply premium and discount logic

- If NorthPeak has stronger margins, more specification pull-through, and a clear strategic fit, the multiple can push up toward the upper end (or beyond).

- If NorthPeak is project-heavy, concentrated, or contractor-like, the multiple compresses.

Step 3: Put numbers on it (USD 10m revenue)

What this means for you:

- Two flooring businesses with the same USD 10m revenue can be worth 2-5x different depending on durability, margins, and risk.

- The “work” of valuation is not memorizing multiples - it is proving why your cashflows are safer and more defensible than the buyer’s default assumptions.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this quick scoring tool to estimate whether you are closer to the low, middle, or high end of typical flooring outcomes. Score each factor 0 / 1 / 2 (weak / okay / strong). Be brutally honest - this is for you, not for marketing.

How to interpret your total:

- Top band: you have the ingredients for premium interest (and stronger terms).

- Middle band: fair market outcome - focus on 1-2 improvements that de-risk the story.

- Low band: you can still sell, but you will likely get tougher terms (earn-outs/holdbacks) unless you fix the biggest risks first.

9. Common Mistakes That Could Reduce Valuation

These mistakes are avoidable - and they regularly cost founders real money.

- Rushing the sale

- If you launch a process before your numbers and story are ready, buyers anchor low and stay there.

- Hiding problems

- Issues will surface in diligence. Hiding destroys trust, slows the deal, and often leads to price cuts late in the process.

- Weak financial records

- Flooring businesses need clean reporting on gross margin by channel, freight, claims/warranty reserves, and working capital. Many founders can improve this meaningfully in 6-12 months.

- Not running a structured, competitive process

- A competitive process with a strong advisor often drives meaningfully higher purchase prices (research commonly cites around ~25% uplift) because it creates real bidding pressure.

- Revealing what price you’re after

- If you tell buyers “I want USD 10m,” don’t be surprised when you get USD 10.1m and USD 10.2m offers. You just killed price discovery.

Two flooring-specific mistakes that show up a lot:

- No proof on claims and install quality

- If you cannot quantify claims rate and show controls, buyers assume the worst.

- Letting working capital look unmanaged

- Bloated inventory or messy receivables can reduce price directly (or become a painful working capital adjustment at close).

10. What Flooring Founders Can Do in 6-12 Months to Increase Valuation

You do not need a complete reinvention. You need a targeted plan that improves buyer confidence.

Improve the numbers buyers actually pay for

- Tighten pricing discipline and product mix to lift gross margin (even modest improvements matter if they are repeatable).

- Reduce claims and rework with clearer install protocols, training, and supplier quality checks.

- Make cash conversion a KPI: inventory turns, aged receivables, freight as % of sales.

Reduce “buyer fear” in your customer base

- Diversify away from any single builder, GC, or dealer that dominates revenue.

- Convert more of your pipeline into repeatable channels: multi-site accounts, property managers, facility networks.

- Document your funnel: where leads come from, win rates, and repeat order patterns.

Make your business easier to underwrite

- Monthly financial package that ties out (P&L, balance sheet, cash, working capital).

- Job costing discipline if you install: margin by job, labor productivity, and change order tracking.

- Clear narrative: why you win, why customers stay, and why margins hold.

Create a “strategic buyer” angle even if you are small

- Map the buyers who could get synergy from you (channel access, geography, product adjacency).

- Package the proof: procurement opportunities, freight savings, warehouse footprint leverage, cross-sell.

11. How an AI-Native M&A Advisor Helps

Most valuation upside in flooring comes from running a tight process that reaches the right buyers and creates competitive tension. An AI-native advisor helps by widening the buyer universe far beyond the “usual suspects.”

Higher valuations through broader buyer reach: AI can expand the buyer list to hundreds of qualified acquirers based on deal history, adjacency, financial capacity, and fit. More relevant buyers means more competition, stronger offers, and a higher chance the deal closes because you are not dependent on one shaky bidder.

Initial offers in under 6 weeks: AI-driven buyer matching, faster outreach, and rapid creation of strong process materials can compress timelines so you reach real conversations and initial offers much faster than manual-only approaches.

Expert advisory, enhanced by AI: You still need experienced humans to run the process, handle buyer psychology, and position the story. AI makes that advisory more effective by improving speed, buyer targeting, materials quality, and diligence readiness - delivering “Wall Street-grade” outcomes without traditional bulge-bracket costs.

If you’d like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors at Eilla AI.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.