The Complete Valuation Playbook for Freight Transportation Businesses

A practical guide showing freight transportation founders what buyers actually pay and what drives higher multiples.

If you are a freight transportation founder thinking about a sale in the next 1-12 months, valuation is not a mystery - but it is a system. The price buyers will pay is usually a mix of (1) what your segment tends to trade for, and (2) how “buyable” your specific business looks under stress.

This playbook is built from real private deal patterns and public market multiples across freight transportation and logistics - then translated into plain English. You will see what businesses like yours actually sell for, what pushes multiples up or down, and a practical way to self-assess and improve value in the next 6-12 months.

Freight is also in a “buyer-selective” phase: consolidation is ongoing, but buyers are more focused on resilience, contract quality, safety, and clean numbers than they were during frothier cycles. That is good news if you prepare - and painful if you do not.

1. What Makes Freight Transportation Businesses Unique

Freight transportation is not valued like most other industries because it is both essential and brutally competitive. Buyers are underwriting real operational risk: trucks on the road, drivers, insurance, claims, fuel, regulations, and customer churn that can spike when capacity loosens.

The main business types buyers see

Most private freight businesses land in one of these buckets (or a mix):

- Asset-based carriers (truckload, dedicated, regional fleets, specialized, refrigerated)You own or lease equipment and drivers. Value depends heavily on utilization, pricing discipline, safety, and contract quality.

- Asset-light brokerage / managed transportationYou manage capacity through carrier networks. Value depends on margin stability, shipper stickiness, and the “depth” of your carrier bench.

- Freight forwarding / multimodal 3PLAir/ocean/road coordination plus customs and value-added services. Value depends on network strength, repeatability, and operational excellence.

- Warehousing / contract logisticsOften more stable than pure linehaul, but operationally complex. Value depends on contract length, labor management, and service performance.

- Tech-enabled logistics and fleet software (telematics, TMS, marketplaces)Different economics: higher gross margins, more recurring revenue, and often higher multiples - but only if it is real software, not “IT-assisted services.”

Unique valuation considerations in freight

Buyers will almost always pressure-test:

- Cyclicality: how much your profit swings with freight rates, capacity, and fuel.

- Capex and fleet health: the “hidden tax” of replacing equipment and maintaining uptime.

- Customer concentration: freight revenue can disappear fast if 1-2 shippers leave.

- Claims, safety, and compliance: one bad year can change a buyer’s risk appetite overnight.

- Working capital: payables/receivables timing can create cash stress even in “profitable” businesses.

Key risk factors buyers will always check

Even if your growth is strong, buyers will dig into:

- Insurance history and loss runs

- CSA scores (or your local safety/regulatory equivalents), driver training, maintenance documentation

- Customer contracts, rate reset clauses, and termination rights

- True profitability by lane, customer, and service line (not blended averages)

- “Single points of failure”: one dispatcher, one salesperson, one customer, one key carrier relationship

2. What Buyers Look For in a Freight Transportation Business

Buyers pay for confidence. Not optimism - confidence. They want to believe your cash generation will hold up even if the market turns against you.

The universal basics (still matter a lot)

Most buyers start with:

- Scale: larger revenue and fleet/network size usually improves buyer interest and financing options.

- Stable profitability: not just one good year - repeatable performance.

- Clean financials: clear revenue recognition, add-backs that are defensible, and consistent reporting.

- Predictable demand: repeat customers, repeat lanes, clear reasons customers stick.

Freight-specific “buyability” factors

In freight, buyers care deeply about:

- Contracted vs spot exposureContracted, dedicated operations are easier to underwrite and finance.

- Customer and lane qualityCommodity spot lanes feel interchangeable. Specialized lanes with service requirements are stickier.

- Operational disciplineDispatch efficiency, empty miles, detention management, accessorial capture, and on-time performance.

- Safety cultureSafety is not a “soft” item - it directly drives insurance cost and legal risk.

- People and process depthIf the business collapses when you step away, buyers will price that risk in.

How private equity thinks (in normal words)

Private equity (PE) buyers are not just buying your past - they are buying a plan they can execute.

- Entry multiple vs exit multiple: they care what they pay today and what someone else will pay in 3-7 years.

- Who is the next buyer?A larger strategic carrier, a bigger 3PL, another PE fund, or (rarely) public markets.

- The levers they expect to pull:

- Improve pricing discipline and contract structure

- Professionalize dispatch, maintenance, and KPI routines

- Reduce claims and insurance leakage

- Add “adjacent” services (brokerage, warehousing, forwarding)

- Acquire bolt-ons (if you are a platform-quality asset)

If your story does not support a credible “next chapter,” you will usually land closer to the lower end of your segment’s multiple range.

3. Deep Dive: Contract Mix and Dedicated Operations - The Highest-Impact Valuation Lever in Freight

If there is one valuation lever that shows up repeatedly across freight deals, it is this:

How much of your revenue is contracted, predictable, and operationally “embedded” with customers - vs how much is exposed to spot rates and weekly churn.

Why this matters

Freight buyers have lived through cycles. They know spot-driven revenue can look amazing in a tight market and collapse when capacity loosens. Contracted and dedicated revenue does not eliminate risk, but it reduces the “cliff edge.”

How it shows up in deal outcomes

Across comparable transactions, dedicated and contracted operations tend to support stronger outcomes than generic, spot-heavy carrier revenue. In private transactions for asset-heavy truckload and dedicated carriers, the typical EV/Revenue range clusters around ~0.5x to ~1.7x, with “upper-band” outcomes generally tied to higher quality revenue (often dedicated, niche, or embedded operations). By contrast, public-market reference bands for more commoditized regional asset-based road freight can sit closer to ~0.3x to ~0.4x EV/Revenue on average.

Why buyers pay more for dedicated and contracted revenue

Because it changes the buyer’s core fear:

- Lower customer churn risk

- Easier forecasting and staffing

- Better equipment utilization

- More stable margins (even if not “high” margins)

- Better financing support (lenders prefer predictability too)

How to move from “lower-value” to “higher-value” profile

You do not need to reinvent the business. You need to repackage and rebalance it:

- Convert top customers from informal repeat loads into written agreements (even 12-month terms help)

- Sell service-level outcomes (on-time %, drop trailer programs, consistent capacity) rather than “rate only”

- Build “embeddedness”: dedicated equipment, dedicated dispatch, documented SOPs, weekly performance reviews

- Price contracts correctly with fuel and accessorial mechanisms so margins do not silently erode

Mini-table: what buyers see

If you only fix one thing before a sale, fix this.

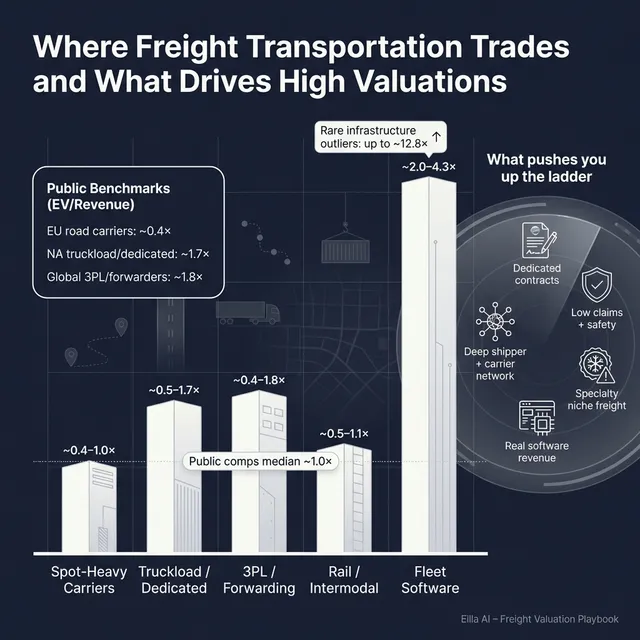

4. What Freight Transportation Businesses Sell For - and What Public Markets Show

Valuation is usually discussed as a “multiple.” For freight businesses, two multiples matter most:

- EV/Revenue: enterprise value divided by revenue (common when margins vary or EBITDA is noisy)

- EV/EBITDA: enterprise value divided by EBITDA (common when profitability is stable and comparable)

Private deals can differ from public trading because private buyers may pay for synergy, control, or a strategic footprint - but public markets still set the gravity.

4.1 Private Market Deals (Similar Acquisitions)

Here is what the private data shows at a segment level. These are illustrative ranges - your exact multiple will depend on contract quality, margins, customer concentration, safety, and growth.

A simple way to interpret this: carriers and ops-heavy businesses trade lower than software-like or scarcity assets, unless you have contracted, specialized, or strategically embedded revenue.

4.2 Public Companies

Public markets give you a reference band - not a price tag. The grouped public multiples below (as of mid-to-end 2025) show how different freight models trade relative to each other.

How to use these public multiples

- Treat them as reference rails: “What does my business resemble economically?”

- Adjust down for smaller scale, customer concentration, weaker margins, and higher risk.

- Adjust up (sometimes meaningfully) if you are a scarce asset: specialty niches, contracted dedicated fleets, strategic nodes, or real tech-enabled differentiation.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes usually come from a clear story: “This business is hard to replace, predictable, and has multiple paths to grow.”

Below are the premium drivers that show up repeatedly across observed deals in freight and logistics, grouped into practical themes.

5.1 Contracted, embedded revenue (dedicated operations)

Why buyers pay more:

- Predictable cash flow is easier to finance and easier to scale.

- Dedicated fleets reduce churn and improve planning.

Founder examples:

- A 3-year dedicated agreement with a shipper where you run a drop-trailer program

- Multi-site contracts where switching carriers is operationally painful for the customer

- Clear retention metrics and average remaining contract life

5.2 Specialization and scarcity (hard-to-replicate freight)

Why buyers pay more:

- Specialized equipment, regulated flows, or tight capacity niches create pricing power.

- “Scarcity value” can override commodity multiple norms.

Founder examples:

- Temperature-controlled, pharma-like compliance, high-value automotive components

- Specialized handling, hazmat, or time-critical networks

- Documented service-level performance that customers cannot easily get elsewhere

5.3 Software economics layered onto operations

Why buyers pay more:

- Software-like revenue can lift gross margins and customer stickiness.

- Proprietary systems that customers rely on increase switching costs.

Founder examples:

- A real subscription module (tracking portal, compliance workflows, analytics) customers pay for

- A transportation management system offering that is embedded in customer workflows

- Telematics-driven safety and utilization improvements that are provable in KPIs

Important nuance: buyers can tell the difference between “we have software” and “we sell software.”

5.4 Network effects and marketplace-style scalability (for asset-light models)

Why buyers pay more:

- Platforms scale without adding trucks at the same pace.

- Liquidity (many shippers + many carriers) can create defensibility.

Founder examples:

- A broker with strong carrier coverage and consistent margin capture

- A shipper-focused managed transportation layer that becomes “the system of record”

- A hybrid model: owned assets for reliability plus a vetted carrier network for overflow

5.5 Multimodal and cross-border capability (forwarding and 3PL breadth)

Why buyers pay more:

- More services per customer increases stickiness and wallet share.

- Modal diversity helps smooth cycles.

Founder examples:

- Adding forwarding, customs, or international lanes where you can earn higher-value coordination margins

- A multi-country footprint that is hard for a competitor to replicate quickly

5.6 Warehousing and contract logistics mix (more stable revenue)

Why buyers pay more:

- Warehousing and value-added logistics can reduce pure linehaul cyclicality.

- Longer-term contracts can anchor the business.

Founder examples:

- Cross-dock and short-term warehousing bundled with transportation

- Contract logistics with clear KPIs and renewal history

5.7 The “boring” premium drivers that still move price

Even in freight, fundamentals can create real valuation lift:

- Clean books, consistent KPIs, credible forecasts

- Diversified customer base and clear retention story

- Strong second layer of management (ops leader, safety lead, finance lead)

- Documented compliance and safety culture

- Proven pricing discipline and accessorial capture

6. Discount Drivers (What Lowers Multiples)

Discounts happen when buyers see uncertainty or fragility - especially in a business that must run smoothly every day.

Common deal-killers in freight

- Heavy spot exposure with no story: “We ride the market” is not a sellable thesis.

- Thin or volatile margins: buyers fear a downcycle will wipe out profits.

- Customer concentration: one customer leaving can destroy the underwriting.

- Weak safety and claims profile: even if revenue is strong, risk scares buyers.

- Aging fleet or deferred maintenance: future capex becomes the buyer’s problem.

- Key-person dependence: if you run dispatch, sales, and pricing, buyers price in transition risk.

- Unclear profitability by customer/lane: buyers assume the worst when data is missing.

- Working capital surprises: slow-paying customers, disputed accessorials, messy accruals.

A note on “low EV/Revenue” outcomes

In public markets, some ops-heavy transport businesses trade at very low revenue multiples when margins are thin and risk is high. That is not a death sentence - it is a signal: buyers pay for resilience, not just volume.

7. Valuation Example: A Freight Transportation Company

This is a worked example to show the logic - not investment advice, and not a formal valuation.

Step 1: The valuation logic (plain English)

For a typical asset-based regional carrier (not a software company), a simple approach is:

- Start with segment reference bands from public comps and private deals

- Pick a core EV/Revenue range that matches your business model and risk profile

- Adjust up for premium drivers (contracted revenue, specialization, operational excellence)

- Adjust down for discount drivers (spot exposure, concentration, safety issues, weak reporting)

In the observed data, a reasonable “base” band for a small asset-based carrier often clusters around ~0.6x-0.8x EV/Revenue, with a downside guardrail around ~0.4x for more commoditized or riskier profiles, and an upside guardrail around ~0.9x-1.0x unless you have real specialty/dedicated characteristics. Exceptional niche and dedicated businesses can exceed that, but you need proof.

Step 2: Apply it to a fictional company

Meet HarborLine Freight (fictional):

- Asset-based regional truckload carrier

- USD 10.0m annual revenue (fictional)

- Mix: 60% contracted, 40% spot

- EBITDA margin: 7% (stable but not premium)

- Customer concentration: top customer is 18%

- Safety: clean loss history, strong compliance documentation

- No proprietary software product (basic tools only)

Now apply scenarios:

Why might HarborLine reach the premium scenario?

- Contracted mix rises to 80%+ with multi-year dedicated agreements

- It proves niche specialization (refrigerated, hazmat, high-service requirements)

- It adds warehousing or managed transportation that stabilizes margins

Why might it fall to the discounted end?

- Customer churn is high, heavy spot exposure, messy claims, unclear lane profitability, or weak financial reporting.

Step 3: What this means for you

Two companies can both have USD 10m revenue and still be worth very different amounts. Buyers are not paying for revenue - they are paying for quality and confidence.

If you can show contracted stability, specialty defensibility, and clean operations, you move up the range. If buyers see commodity risk and messy data, you slide down fast.

8. Where Your Business Might Fit (Self-Assessment Framework)

This is a simple scoring tool to locate yourself roughly within the valuation spectrum and identify the highest-payoff fixes.

How to use it

Score each factor from 0 to 2:

- 0 = weak / unclear

- 1 = decent but improvable

- 2 = strong and provable

Interpreting your score (rule of thumb)

- Top band: you look like a premium-quality asset in your segment. You are more likely to get serious buyer competition.

- Middle band: fair-market outcomes, but you may need a strong process to avoid being anchored down.

- Lower band: you can still sell, but expect tougher diligence and more price pressure unless you fix the biggest risks first.

The point is not perfection. The point is knowing which 2-3 fixes move valuation the most.

9. Common Mistakes That Could Reduce Valuation

These are painfully common - and avoidable.

Rushing the sale

If you go to market before your numbers, story, and data room are ready, buyers will assume you are hiding something or that you are unsophisticated. Either way, they reduce price or slow-roll you.

Hiding problems

In freight, issues always surface: safety, claims, customer churn, margin leakage, maintenance gaps. If you try to bury them and they come out in diligence, trust breaks - and price drops.

Weak financial records

Buyers do not expect perfection, but they do expect clarity:

- Monthly P&Ls that tie to bank statements

- Clear add-backs that are real (not “wishful”)

- Profitability by customer and service line

- Clean working capital trends and explanations

If you can improve reporting and margin clarity in 6-12 months, do it. The ROI is usually high.

Not running a structured, competitive process with an advisor

A structured process is how you avoid being anchored by the first serious buyer. Research and market experience commonly show that running a competitive process with strong advisory support can increase purchase prices materially - often cited around ~25% - because you create real price discovery and better terms.

Revealing what price you are after too early

If you tell buyers “we want USD 10m,” you often cap the upside. Buyers will come back with offers clustered just above your number instead of telling you what they would really pay. Let the market speak first.

Freight-specific mistakes that hurt outcomes

- No proof of contract quality (handshake agreements, no renewal history, unclear termination clauses)

- Not having a credible fleet and maintenance plan (buyers fear capex surprises)

10. What Freight Transportation Founders Can Do in 6-12 Months to Increase Valuation

You do not need a total reinvention. You need focused upgrades that reduce risk and improve confidence.

Improve the revenue quality (biggest payoff)

- Convert repeat business into written agreements with duration, volume expectations, and pricing mechanics

- Push toward dedicated where it fits (even if only for your top 1-2 customers)

- Document retention: renewal history, churn, and reasons customers stay

Improve the operational story buyers underwrite

- Build a dashboard that tracks: on-time %, claims, empty miles, utilization, driver turnover, accessorial capture

- Prove lane/customer profitability (even a simple model is better than none)

- Tighten safety and compliance documentation so diligence is smooth and fast

Improve the “finance readiness” that prevents price chips

- Clean up add-backs and owner compensation logic

- Normalize one-time expenses and separate personal items cleanly

- Prepare a simple monthly reporting pack you can hand to any buyer

De-risk the business beyond the founder

- Promote or hire a true ops leader (or document who runs what)

- Document SOPs for dispatch, maintenance, safety, billing, collections

- Create a transition plan: “what happens Day 1 after close”

Add selective value-added services (only if realistic)

If you can do it without blowing up focus:

- Pilot small warehousing/cross-dock services

- Add managed transportation or brokerage to smooth utilization

- Build customer-facing visibility tools that improve stickiness

Tie every initiative back to one question: Does this make the business more predictable and harder to replace?

11. How an AI-Native M&A Advisor Helps

Selling a freight business is not just about finding “a buyer.” It is about finding the right set of buyers, creating competition, and making your business easy to underwrite. That is where an AI-native M&A advisor can change outcomes.

First, higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, strategic fit, synergy logic, and financial capacity. More relevant buyers means more competition, stronger offers, and a higher chance the deal actually closes if one buyer drops.

Second, initial offers in under 6 weeks. AI-driven buyer matching and connecting, fast creation of process marketing materials, and structured diligence support can compress timelines dramatically versus manual-only outreach and slow, unstructured processes.

Third, expert advisory, enhanced by AI. The best outcomes still require experienced human advisors who know buyer psychology, negotiation, and how to frame your story. AI makes that expertise more scalable: better materials, tighter positioning, faster iteration, and “buyer-ready” preparation - often delivering Wall Street-grade quality without traditional bulge bracket costs.

If you would like to understand how our AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.