The Complete Valuation Playbook for Fulfilment Services Businesses

A valuation guide on what fulfilment services businesses actually sell for - and the clear levers you can improve to earn a higher multiple.

If you run a fulfilment services business (pick-pack, warehousing, returns, kitting, cross-border, last-mile add-ons) and you might sell in the next 1-12 months, valuation is not just a formula - it is a story backed by proof.

This playbook is built to be practical and data-based. It will show what fulfilment services businesses actually sell for, decode what pushes multiples up or down, and give you a simple self-assessment plus a realistic 6-12 month action plan to improve your outcome.

1. What Makes Fulfilment Services Unique

Fulfilment is a hybrid business. You are selling a service (people + process + space) but buyers also want to believe they are buying a system (repeatable operations + software integration + a scalable network).

That hybrid nature is why fulfilment valuations swing so widely. Two businesses with the same revenue can be valued very differently depending on:

- How “repeatable and scalable” the operation looks (standardized playbooks, multi-site consistency).

- How much of your revenue behaves like recurring revenue (contracts, minimums, embedded customer workflows).

- Whether your tech layer is a real product advantage or just “a WMS plus some dashboards.”

Most fulfilment businesses also have a very specific cost structure that buyers obsess over:

- High fixed costs (leases, warehouse labor base, equipment).

- Pass-through costs that can inflate revenue without inflating value (shipping, packaging, duties).

- Service-level risk (SLA penalties, chargebacks, returns fraud, inventory accuracy).

Key risks buyers will always check in this sector:

- Customer concentration and “volume cliffs” (a single brand leaving can crater utilization).

- Unit economics by customer (some accounts look great on revenue but destroy margin).

- Capacity utilization and lease exposure (empty space is expensive).

- Operational quality (inventory accuracy, on-time performance, shrink, claims).

- People risk (how dependent you are on a founder or a few operators).

2. What Buyers Look For in a Fulfilment Services Business

Buyers are trying to answer one core question: “Is this a reliable cash-flow engine that can grow without breaking?”

They typically look for:

- Scale and consistency: not just revenue size, but how repeatable the operation is across clients and sites.

- Growth quality: growth that comes from customer retention, expansion, and predictable onboarding - not one-time spikes.

- Profitability and visibility: clear gross margin by service line, clean EBITDA, and a believable path to improvement.

- Customer stickiness: contracts, integrations, and embedded workflows that make switching painful.

- Risk control: diversified customers, disciplined pricing, and pass-throughs that are truly pass-through.

Industry-specific nuances that matter a lot in fulfilment:

- Mix of DTC vs B2B: DTC can be higher-touch (returns, peak season volatility). B2B can be steadier but more price-competitive.

- Value-added services (kitting, customization, light assembly): can lift margins if you price correctly and standardize.

- Returns and reverse logistics: can be a margin driver or a margin trap, depending on your process and fraud controls.

- International/cross-border complexity: can add defensibility if you truly handle the hard parts (customs, landed cost, duties, compliance).

How private equity (PE) thinks about your business

PE buyers are usually underwriting a 3-7 year plan:

- Entry multiple vs exit multiple: they care what they pay now and what they can sell it for later.

- Who the next buyer is: a larger PE fund, a strategic 3PL, or a platform consolidator.

- Levers they expect to pull:

- Pricing discipline and better contract terms (minimums, indexation).

- Operational efficiency (labor planning, automation, slotting).

- Add-on acquisitions (bolting on regional capacity or specialized capabilities).

- Cross-sell (moving customers into more services: returns, kitting, freight management).

The simplest PE lens is: “Can we make EBITDA more predictable and bigger - without adding proportionate complexity?”

3. Deep Dive: The Most Important Valuation Nuance in Fulfilment - Utilization and Contract Quality

In fulfilment, utilization is the silent driver of everything. When your warehouses are full and stable, your margins look great. When volumes swing, the same cost base can crush EBITDA.

This is why buyers push hard on:

- How much of your revenue is protected by contracts (term length, minimums, price indexation).

- Whether volume is forecastable (stable reorder cycles vs influencer-driven spikes).

- Whether you have the ability to reprice when costs rise (labor, rent, packaging).

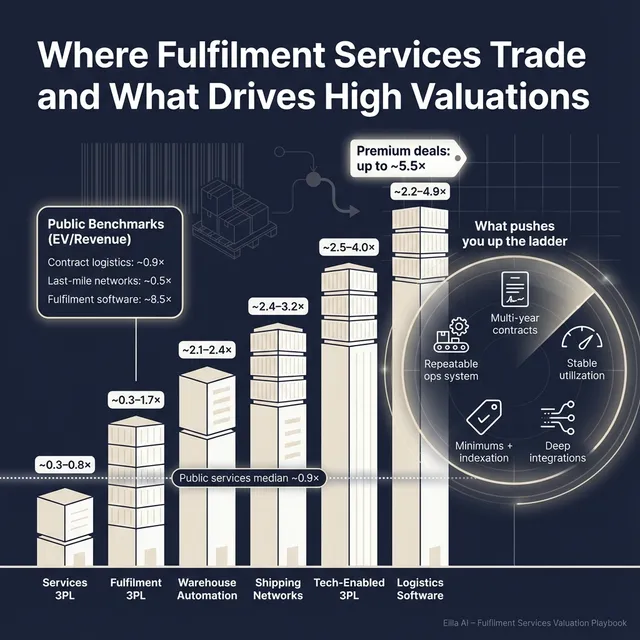

In the data, “pure” logistics operators tend to trade at much lower revenue multiples than software-centric businesses, reflecting this operational and fixed-cost risk. Public “Global Contract Logistics & 3PL” groups cluster around ~0.9x median EV/Revenue and ~8.8x median EV/EBITDA, while logistics software trades far higher (median EV/Revenue ~8.5x and median EV/EBITDA ~35.3x). That gap is basically the market pricing the difference between variable services and durable, scalable, software-like earnings.

Here’s the practical way to think about it:

If you look more like the left column today, the goal is not to “become SaaS.” The goal is to make your fulfilment cash flows behave more predictably - so buyers can underwrite a higher multiple with less fear.

4. What Fulfilment Services Businesses Sell For - and What Public Markets Show

A useful rule: private markets often anchor to what public markets imply, then adjust for size, risk, and growth.

Your valuation will usually be triangulated from:

- Private deal comps (what similar businesses sold for).

- Public trading comps (what listed peers trade at).

- Your specific profile (contracts, margins, growth, customer mix, defensibility).

4.1 Private Market Deals (Similar Acquisitions)

Across the precedent transactions provided, fulfilment-centric 3PL deals show wide dispersion. The group averages are ~2.2x EV/Revenue (average) and ~0.9x EV/Revenue (median), with ~12.0x EV/EBITDA (median) - which tells you something important: there are a few higher-multiple outcomes pulling the average up, but many deals clear closer to the “classic 3PL” range.

From the individual deal set, fulfilment-centric transactions commonly land somewhere between roughly ~0.3x to ~1.7x EV/Revenue, with higher outcomes typically associated with stronger positioning, scale, or a more defensible network/profile.

Illustrative ranges by “deal type” from the provided data:

These ranges are illustrative, not a promise. The “same segment” can produce radically different prices depending on risk and predictability.

4.2 Public Companies

Public markets give you a reality check on what investors pay for different “shapes” of logistics businesses. As of mid-to-end 2025 in the provided dataset, the average/median multiples by group look like this:

How to use this as a private founder:

- Treat public multiples as reference bands, not a price tag.

- Smaller private businesses usually trade below the best public comps because they have more concentration and key-person risk.

- However, scarce or highly strategic assets (specialized capabilities, unique customer access, strong tech enablement) can trade above the “plain 3PL” band.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes in fulfilment tend to happen when buyers believe you are not “just selling warehouse labor” - you are selling a repeatable operating system for fulfilment with durable customer demand.

Using the premium drivers observed in the data, here are the themes that push you toward the top end.

5.1 Scale that creates lock-in (not just “more revenue”)

In the comps, scaled ecosystems and high throughput are repeatedly associated with premium narratives: large customer counts and heavy transaction volume reduce go-to-market risk and make cross-sell easier.

What this looks like in fulfilment:

- You can prove retention and expansion (customers stay, then add SKUs, channels, or sites).

- You can show volume density (orders per client rising, not just new client logos).

- You have a reputation flywheel (brands refer other brands, or platforms recommend you).

5.2 Integration-first workflows that raise switching costs

A repeated premium pattern is “integration-first productization” - APIs and integrations that embed you into customer workflows and make switching painful.

In fulfilment terms:

- Your WMS/OMS integrations are not “nice to have” - they’re operationally critical.

- Onboarding is standardized and fast, so growth does not break your team.

- Your customers rely on your reporting, inventory visibility, returns rules, and carrier logic to run their business day-to-day.

The key: buyers pay for dependency, not for “we have integrations.”

5.3 Software-like economics (or at least a credible path toward them)

The highest revenue multiples in the dataset cluster around businesses with software-grade gross margins and meaningful EBITDA margins. Fulfilment is rarely pure-software - but you can still earn a premium if you:

- Separate pass-throughs cleanly.

- Monetize high-margin value-added services.

- Show margin expansion from process, automation, or pricing discipline.

5.4 Strategic adjacency to “control planes” of commerce

Buyers pay up when your business sits close to a control point: shipping decisioning, order routing, inventory visibility, marketplace/ERP connections.

For a fulfilment operator, this is usually a narrative like:

- “We are the operating layer that coordinates multi-warehouse execution.”

- “We can plug into multiple channels and route intelligently.”

- “We reduce cost and delivery time through network logic, not just labor.”

5.5 PE-underwriteable profitability (durable, improvable cash flow)

Even if you are services-first, a strong profitability profile can command a higher EV/EBITDA outcome if buyers believe:

- The earnings are real (not founder add-backs and one-time wins).

- Margin improvement is achievable (labor planning, pricing, automation).

- The business is not dependent on heroic execution.

Also worth saying plainly: clean financials, predictable reporting, diversified customers, and a strong leadership bench are “boring” drivers - but they are often the difference between a smooth, premium process and a discounted one.

6. Discount Drivers (What Lowers Multiples)

Discounts usually come from one of two fears: earnings volatility or hidden risk.

Common valuation killers in fulfilment:

- Customer concentration (one or two accounts drive most volume or profit).

- No contract protection (short term, no minimums, no price indexation).

- Pass-through revenue masking low value (big top line, thin contribution margin).

- Low utilization or fragile capacity (warehouse leases that don’t match demand).

- Operational fragility (inventory accuracy issues, SLA penalties, high claims/shrink).

- Founder dependency (key customers and ops sit in one person’s head).

- Messy service-line profitability (you cannot explain margin by customer and by service).

- Churn masked by new sales (you grow, but only because you replace lost customers).

The honest truth: buyers can live with problems. What they discount is uncertainty - especially when they find it late.

7. Valuation Example: A Fulfilment Services Company

Let’s walk through a fictional example to show how buyers apply the logic. This is not investment advice and not a formal valuation - it’s a worked illustration using the ranges and framework in the provided data.

Step 1: The plain-English logic

- Start with the “services-first” benchmarks: traditional 3PL public comps cluster around roughly ~0.9x-1.3x EV/Revenue for quality operators (and lower for challenged ones), and private fulfilment-centric deals often clear in a broad ~0.3x-1.7x EV/Revenue range.

- Ask whether the business deserves a premium to that range:

- Is there real tech enablement that reduces churn, speeds onboarding, and increases wallet share?

- Is the revenue protected by contracts/minimums and stable utilization?

- Use software and automation multiples as an upper bound reference, not a direct comp (because fulfilment is not pure SaaS).

- Triangulate into a “defensible core range,” then create premium and downside cases.

Step 2: Apply it to a fictional company (USD 10m revenue)

Fictional company: NorthHarbor Fulfilment

- USD 10.0m revenue

- 2 warehouses, DTC-heavy, also does returns + kitting

- Strong integrations with Shopify/ERP, but still services-first

- Mixed contract coverage (some minimums, some month-to-month)

Here’s how valuation can swing:

Why the core range can be materially higher than “plain 3PL”:

- The provided valuation logic for a tech-enabled fulfilment operator suggests a defensible midpoint that can sit above traditional 3PL bands when the business has clear tech enablement and e-commerce focus, but stays below pure software multiples because it remains services-heavy.

Step 3: What this means for you

Two fulfilment businesses with the same revenue can be worth very different amounts because buyers are pricing:

- How stable earnings are likely to be.

- How hard it is for customers to leave.

- Whether growth will require messy headcount growth or can come from repeatable systems.

Your job in the next 6-12 months is to move the buyer’s view from “labor + leases” to “system + contracts + predictable cash flow.”

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as a quick, honest scoring tool. Give yourself a 0 / 1 / 2 on each item:

- 0 = weak / inconsistent

- 1 = decent but not proven

- 2 = strong and provable in data

How to interpret your total (directionally):

- Mostly 2s: you are closer to premium outcomes because buyers can underwrite stability.

- Mostly 1s: you are in “fair market” territory - good business, but you need sharper proof.

- Mostly 0s: expect buyers to anchor to the lower end until you reduce uncertainty.

This isn’t about being perfect. It’s about knowing which improvements have the biggest valuation payoff.

9. Common Mistakes That Could Reduce Valuation

Rushing the sale

If you go to market before your numbers and story are clean, you force buyers to assume risk. Risk becomes a lower multiple, tougher terms, or both.

Hiding problems

Buyers will find issues in diligence - inventory accuracy, customer churn, margin leakage, claims, taxes, leases. Hiding them destroys trust and usually destroys value later in the process.

Weak financial records

Fulfilment businesses get discounted when you cannot clearly explain:

- Gross margin by customer and by service line.

- Pass-through vs value-added revenue.

- True labor and occupancy costs.Fixing this is often very doable in 6-12 months, and it can change the buyer’s confidence dramatically.

Not running a structured, competitive process with an advisor

In both research and real-world deal dynamics, competition drives higher prices. Academic takeover literature consistently shows contested/competitive situations are associated with higher premiums, often in the 25%range versus less competitive outcomes. A good sell-side process is designed to create that competition in a controlled way.

Revealing what price you’re after too early

If you say “I’m looking for USD 10m,” many buyers will magically land near USD 10.1m-10.2m - because you killed price discovery. Let the market tell you what it will pay before you anchor it downward.

Two fulfilment-specific mistakes founders often underestimate

- Letting pass-throughs inflate the story: sophisticated buyers re-cut revenue to focus on value-added margin. If your narrative is built on “big top line” but not on contribution profit, you’ll get reset mid-process.

- Underpricing complexity: returns, kitting, customization, cross-border compliance - these can be premium services, but only if priced and measured properly. Otherwise they look like operational risk.

10. What Fulfilment Founders Can Do in 6-12 Months to Increase Valuation

Think in three tracks: improve the numbers, reduce perceived risk, and sharpen the story.

10.1 Improve the numbers buyers actually pay for

- Build customer-level profitability reporting (revenue, direct labor, occupancy allocation, claims/shrink, contribution margin).

- Reprice or restructure the bottom 10-20% of accounts (the ones that steal capacity and profit).

- Separate pass-throughs cleanly so you can show true value-added margin.

10.2 Make revenue more predictable

- Push for multi-year contracts on your top accounts.

- Add minimums (space, orders, or monthly fees) where you have leverage.

- Add indexation clauses tied to labor/rent/fuel where appropriate.

- Reduce “volume cliff” risk by diversifying channels and customer segments.

10.3 Turn your operation into a repeatable system

- Standardize onboarding (timeline, integration checklist, SOPs).

- Document and measure operational quality (inventory accuracy, on-time ship, returns cycle times).

- Build a real leadership bench: ops lead, finance lead, commercial lead who can run without you.

10.4 Make the tech story real (without pretending you’re SaaS)

- Prove integrations reduce churn and increase wallet share (before/after data).

- Productize what you can: reporting, routing logic, returns rules, exception handling.

- Show that adding a new site/customer does not require “reinventing the wheel.”

If you do only one thing: make your earnings and utilization feel predictable. That is the fastest path from “discounted services multiple” toward the top end of the fulfilment range.

11. How an AI-Native M&A Advisor Helps

Most valuation upside in fulfilment comes from two things: the right buyers seeing your deal, and those buyers believing your story because it is backed by clean proof.

An AI-native M&A advisor expands the buyer universe far beyond a manual list. By using signals like deal history, synergy fit, and financial capacity, AI can surface hundreds of relevant acquirers - which increases competition, strengthens offers, and reduces closing risk if one buyer drops.

It also compresses timelines. With AI-assisted buyer matching, outreach, marketing materials, and diligence support, initial conversations and offers can often happen in under 6 weeks, instead of dragging for months.

And you still need real advisory judgment. The best outcome comes from experienced M&A advisors running the process - with AI improving speed, coverage, and precision - so you get “Wall Street-grade” positioning and materials without the traditional bulge-bracket cost structure.

If you’d like to understand how our AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.