The Complete Valuation Playbook for Genetic Diagnostics Businesses

A valuation playbook for genetic diagnostics founders - showing what deals actually trade for and what drives higher multiples.

If you are considering selling your genetic diagnostics business in the next 1-12 months, valuation is not just a math exercise - it is a story about risk, clinical credibility, and how “replaceable” you look to a buyer.

This sector is also in a very “buyer-inquisitive, but picky” moment: strategics are still acquiring, private equity is active in lab services, but reimbursement scrutiny, evidence standards, and platform consolidation mean the best assets separate quickly from the rest.

This playbook will (1) show what genetic diagnostics businesses actually sell for, (2) decode what reliably drives higher vs lower multiples, and (3) give you a self-assessment and a practical 6-12 month action plan to move up the range.

1. What Makes Genetic Diagnostics Unique

Genetic diagnostics businesses are not valued like “normal” healthcare services companies, and they are not valued like pure software companies either. Buyers are pricing a blend of lab operations, clinical evidence, reimbursement durability, and IP/data advantage - with regulatory and quality risk sitting in the background of every diligence question.

The main business types inside genetic diagnostics

Most founders fall into one (or a mix) of these models:

- Clinical genetic testing labs (services): hereditary disease panels, oncology panels, exome/genome sequencing, pharmacogenomics, prenatal screening. Revenue is driven by test volume and payer mix.

- Specialty diagnostics franchises: a deep niche with high clinical importance (for example transplant matching/HLA, guideline-linked oncology decision tests). Often higher switching costs.

- Data-and-software-enabled diagnostics: interpretation platforms, variant curation, clinical decision support, workflow integrations. Often sold alongside lab services.

- Point-of-care/home genetics devices and platforms: typically valued very differently (and the public multiples can be extreme outliers).

- Preventive/predictive genetics programs: risk scoring + coaching or care pathways. These can trade at higher multiples when clinically validated and reimbursed, but “wellness-only” versions are discounted.

Why valuation is different here

Genetic diagnostics valuation hinges on questions buyers obsess over:

- Is your test clinically defensible? Clinical validity, utility, guideline support, published evidence, and real-world outcomes all matter.

- Is reimbursement durable? Coverage policies change. Buyers pay up for proof that payment is stable and scalable.

- Is the lab execution risk low? Turnaround time, quality systems, accreditation, error rates, and scaling reliability.

- Do you have a moat? Unique content (proprietary assay/panel), proprietary data, or workflow lock-in - or are you a commodity lab with a fancy website?

Key risk factors buyers will always check

Expect deep diligence on:

- Regulatory and quality (CLIA/CAP or local equivalents, proficiency testing, validation packages, change control).

- Payer concentration and denials (who pays you, how reliably, and what happens if a major payer changes policy).

- Test performance + clinical claims (are you over-promising; can you substantiate claims).

- Data governance (consents, privacy, cross-border data transfer, retention, secondary use).

- Dependence on a few KOLs, channels, or referral sources (and whether that can survive post-acquisition).

2. What Buyers Look For in a Genetic Diagnostics Business

Buyers (strategics and private equity) are not buying “revenue.” They are buying a future cashflow stream - and they are discounting that stream based on how fragile it looks.

The universal basics (still matter a lot)

- Scale and growth: predictable volume growth beats “spiky” growth.

- Gross margin and path to EBITDA: genetics often has attractive gross margins, but buyers care whether you can convert that into durable EBITDA (or have a clear plan).

- Customer stickiness: repeat ordering, embedded workflows, multi-year relationships with health systems or clinics.

- Clean financials: clear revenue recognition, test-level margin visibility, and realistic normalization (no “one-time miracle” adjustments).

Genetic diagnostics-specific “buyer lenses”

- Clinical differentiation: buyers will pay more if your test changes clinical decisions (not just “interesting information”).

- Reimbursement advantage: coverage, coding strength, appeals outcomes, and payer narrative.

- Menu and channel fit: how your assays/panels extend a buyer’s catalog and installed base (more on this in the premium drivers).

- Operational maturity: capacity, automation, TAT, sample logistics, QC, and reporting consistency.

- Data assets that compound: curated variant databases, longitudinal outcomes, and evidence generation engines.

How private equity thinks

PE is usually underwriting two things at once:

- Entry multiple vs exit multipleThey ask: “If we buy at X, can we sell at X or higher in 3-7 years?” They like sectors where scaled assets trade well and where they can reduce perceived risk over time.

- Who they can sell to laterTypically: larger strategics, larger PE funds, or occasionally a public listing route. They will prefer business models that look “simple and financeable” later (predictable reimbursement, repeat ordering, diversified accounts).

- The levers they expect to pull

- Improve payer contracting and collections discipline

- Reduce COGS through automation, batching, vendor renegotiation

- Increase test utilization (clinical pathway adoption, cross-sell)

- Add-on acquisitions (bolt-on labs, niche panels, regional footprint)

- Professionalize sales and account management

If your business cannot clearly support these levers, you usually land closer to the lower end of market ranges.

3. Deep Dive: The Biggest Valuation Nuance in Genetic Diagnostics - “Clinical Moat” vs Commodity Lab

Here is the uncomfortable truth: two genetic diagnostics companies with the same revenue can be worth radically different amounts depending on whether buyers believe they are buying a clinical moat or a replaceable lab.

Why this matters so much

In this sector, a large portion of “valuation spread” comes from perceived durability:

- If you look like a clinical decision asset (guideline-linked, outcomes-backed, high switching costs), buyers model a longer, safer revenue stream.

- If you look like a test processing service (low differentiation, easy to replicate), buyers model price pressure, payer risk, and churn.

How it shows up in the data

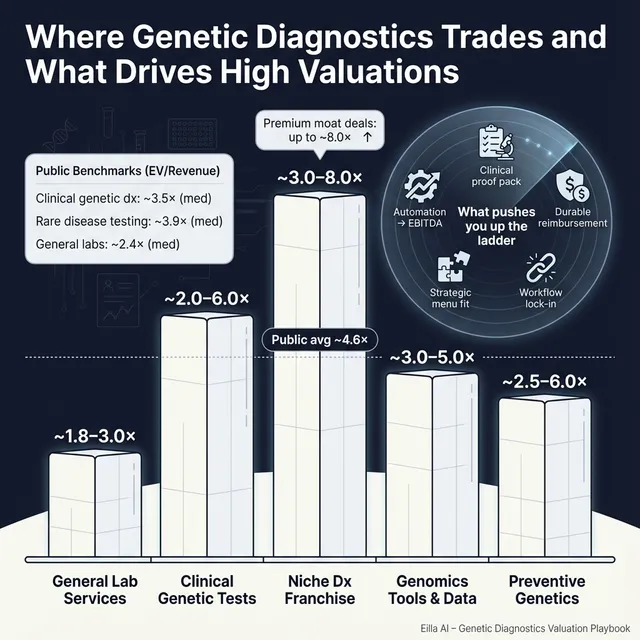

On the public side, segments tied to high-value genomic testing platforms often show higher revenue multiples than general lab services, while broad diagnostic service models tend to cluster lower. In the provided market snapshot, “clinical genomic testing & genetic diagnostics” trades around mid-single-digit EV/Revenue on average, while general lab services show lower median revenue multiples. Meanwhile, high-growth or highly strategic genomics categories can show much higher revenue multiples, but those can include outliers and companies with negative EBITDA, so you need to interpret them carefully.

On the private side, relevant genetic testing and molecular diagnostics deals cluster around a core band of roughly 2.0x-6.0x EV/Revenue, with a tail that can reach ~8.0x when the asset looks more defensible and strategically important (for example niche leadership or proprietary, clinically valued assays).

Why buyers pay more for “clinical moat”

Because it reduces three fears:

- Reimbursement fragility - evidence and guideline support make payment harder to take away.

- Competitive replaceability - unique content and clinical reliance reduce “race to the bottom.”

- Post-deal integration risk - differentiated assets integrate into catalogs and pathways more predictably.

How to move from “commodity” to “moat” over 6-12 months

You usually do not have time to reinvent your entire company before selling. But you can materially change how buyers perceive you by:

- Evidence packaging: turn scattered studies, internal outcomes, and clinical feedback into a buyer-ready clinical dossier.

- Reimbursement proof points: show payer wins, denial trends, appeal success, coding discipline, and a credible reimbursement roadmap.

- Niche focus: be “the best” at a clinically important slice instead of “okay at many things.”

- Workflow embedding: integrations into EMR ordering flows, reference lab workflows, or clinic pathways reduce churn risk.

Mini-table: lower-value vs higher-value profile

4. What Genetic Diagnostics Businesses Sell For - and What Public Markets Show

The cleanest way to think about valuation is triangulation:

- Private deals tell you what buyers have actually paid for businesses like yours.

- Public multiples tell you what the market pays for scaled versions of similar models - usually a reference band, not a direct price tag.

- Your company’s risk profile determines where you land within (or outside) those bands.

4.1 Private Market Deals (Similar Acquisitions)

Across precedent transactions most relevant to clinical genetic testing services and assays, the data clusters in a practical band:

- Core range: ~2.0x-6.0x EV/Revenue for genetic testing and molecular diagnostics clinical services/assays

- Upper tail: up to ~8.0x EV/Revenue when the target has a stronger proprietary assay position, niche leadership, or unusually attractive strategic fit

Importantly, this range is not “what you deserve.” It is what the market has shown for comparable deal types, with the spread largely explained by differentiation, profitability trajectory, and strategic fit.

Private comps summary (illustrative):

These are illustrative founder guideposts, not a formal valuation.

4.2 Public Companies (Reference Multiples - Mid/End 2025 Snapshot)

Public markets provide “boundary markers,” but they can be noisy because many companies have negative EBITDA, and some categories include tiny-revenue outliers that inflate EV/Revenue.

Still, the grouped data is useful if you interpret it correctly:

- Clinical genomic testing & genetic diagnostics shows average EV/Revenue around ~4.6x and median around ~3.5x, with EV/EBITDA medians around the high-20s where EBITDA is meaningful.

- Rare disease & exome/genome testing specialists show a higher average EV/Revenue (pulled up by high-growth/high-expectation names), but a median closer to ~3.9x, highlighting how wide the dispersion is.

- General diagnostics labs tend to trade at lower median revenue multiples (~2.4x), reflecting maturity, pricing pressure, and slower growth.

- Oncology liquid biopsy/MRD categories can trade much higher on EV/Revenue (growth and strategic value), but they are often not comparable to a services-led genetic testing business.

Public comps summary (group-level, mid/end 2025):

How to use public multiples (the right way)

- Treat them as an upper/lower reference band, not a “price tag.”

- Adjust downward for smaller scale, higher payer risk, less evidence, and a more services-heavy mix.

- Adjust upward for scarce assets: proprietary assays with clinical impact, niche leadership, high switching costs, or unusually strong strategic fit.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium valuation in genetic diagnostics is usually not about “being optimistic.” It is about removing buyer doubt and making your asset feel strategically important.

Below are the premium drivers that show up repeatedly in deal outcomes in this space, grouped into practical themes.

5.1 Clear strategic fit: “Your menu makes my platform better”

Buyers pay more when your assays or test menu clearly expand their offering and can be sold into their existing channels.

What that looks like in practice:

- Your panels complement a strategic’s installed base and roadmap (not a random side project).

- You can articulate cross-sell motions: “Here are the customer segments, here is how the combined catalog gets pulled through.”

- Your product line reduces time-to-market for the buyer.

Founder actions:

- Build a one-page “integration thesis” for each buyer type: what they gain, what they can sell, and why it is hard to replicate quickly.

5.2 Defensible clinical value: guideline recognition, outcomes, and reimbursement strength

Premium outcomes are associated with tests that:

- Support treatment decisions or high-stakes clinical workflows

- Have credible evidence packaging (published studies, real-world outcomes)

- Show reimbursement defensibility and demand visibility

Founder actions:

- Package a buyer-grade evidence library (even if you are not fully “guideline supported” yet).

- Show payer narrative momentum: coverage wins, denial improvement, coding discipline.

5.3 Niche leadership with high switching costs

Some niches are “mission-critical” and sticky: switching is painful, clinical risk is high, and workflows are entrenched. Buyers pay more for niche leadership even at modest scale if it is profitable and durable.

Founder actions:

- Make your niche dominance measurable: share, ordering frequency, retention, reference accounts.

- Reduce key-person dependency: document processes, strengthen clinical ops bench.

5.4 Strong unit economics and visible EBITDA conversion

Even if buyers start with revenue multiples, many anchor their willingness to pay on whether they believe your EBITDA can become real and durable.

Founder actions:

- Show test-level gross margin and COGS drivers.

- Demonstrate operating leverage (automation, batching, procurement improvements).

- Be honest about what is fixed vs variable in your cost structure.

5.5 “Consumer-to-clinical bridge” that actually drives clinical conversion

Some businesses blend a consumer digital layer with clinical testing. This can earn a premium if it is a real engine (technology, data pipelines, conversion, and retention) and not just marketing spend.

Founder actions:

- Prove conversion economics in plain English: CAC is fine, but buyers mainly want to see “customers stick and keep ordering and paying.”

- Show why your data flywheel improves interpretation or outcomes.

5.6 Clean company fundamentals that buyers can trust

These are not glamorous, but they move deals materially:

- Clean financials and KPI discipline

- Diversified customer base and referral sources

- Strong leadership bench

- Low legal/regulatory surprises

6. Discount Drivers (What Lowers Multiples)

Discounts happen when buyers see fragility, uncertainty, or extra work they do not want to own.

The most common valuation killers in genetic diagnostics

- Thin differentiation: panels that look interchangeable with multiple competitors.

- Reimbursement uncertainty: high denials, unclear coding, dependency on a single payer decision, or policy risk without mitigation.

- Services-heavy mix without operational excellence: high manual labor, inconsistent TAT, limited automation, scaling pain.

- Customer concentration: a handful of hospital systems, clinics, or channel partners driving most revenue.

- Unclear clinical claims: marketing language that is not supported by evidence invites diligence friction.

- Negative EBITDA without a believable path: buyers can accept losses, but only if the roadmap is credible and the market rewards it.

“Soft” discounts that still cost you real money

- Messy data governance or consent posture

- Founder-centric relationships with KOLs or accounts (hard to transfer)

- Weak reporting: you cannot explain what drives volume, margin, and churn

The good news: many of these can be improved meaningfully in 6-12 months without reinventing the business.

7. Valuation Example: A Genetic Diagnostics Company (Fictional)

This example is fictional and purely illustrative. It is designed to show how valuation logic works using the market ranges and patterns in the provided data - not to predict your sale price.

Step 1: The logic (plain English)

For a services-led genetic diagnostics company around USD 10m in revenue:

- Start with relevant market bandsThe most applicable private and public reference points cluster around ~2.0x-6.0x EV/Revenue for clinical genetic testing services, with occasional outcomes up to ~8.0x when the asset looks more proprietary and strategically important.

- Pick a “base case” rangeIf you look like a solid clinical services lab with some differentiation but not a full clinical moat, a practical base band is often ~3.0x-5.0x.

- Move up for premium driversIf you have clear assay defensibility, evidence packaging, reimbursement strength, and strategic fit, you can justify pushing toward the upper end (and in premium cases into the ~6.0x-7.0x neighborhood).

- Move down for discountsIf reimbursement is shaky, differentiation is weak, or operations are immature, buyers will compress you toward the lower end (around ~2.0x-3.0x).

Step 2: Apply it to a fictional company

Fictional company: HelixBridge Diagnostics

- USD 10.0m revenue (fictional)

- Mix: hereditary cancer and pharmacogenomics panels + clinician ordering portal

- Channel: 70% clinician/referral, 30% consumer intake that routes to clinical testing

- Differentiation: good variant interpretation workflows and a growing internal dataset, but limited guideline-level recognition today

- Profitability: near break-even EBITDA with a credible path to positive EBITDA through automation and payer ops improvements

Illustrative valuation scenarios (on USD 10m revenue):

Step 3: What this means for you

- Two businesses can both have USD 10m revenue, and one can be worth 2-3x the other, purely based on clinical moat, reimbursement durability, and strategic fit.

- The fastest path to a higher outcome is rarely “grow revenue at all costs.” It is making the revenue feel safer, stickier, and more defensible.

This is not investment advice and not a formal valuation - it is a worked example to illustrate the logic.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as a quick, honest diagnostic. Score each factor 0 / 1 / 2:

- 0 = weak / unclear today

- 1 = decent but not buyer-grade

- 2 = strong and provable

Scoring table

How to interpret your score (roughly)

- Mostly 2s: you are closer to premium outcomes because buyers believe the cashflows are durable.

- Mix of 1s and 2s: you are in fair-market territory - strong process and positioning matter a lot.

- Many 0s: you are likely to get compressed offers unless you spend 6-12 months reducing buyer fear.

The point is not self-criticism. The point is identifying which improvements create the biggest valuation lift per unit of effort.

9. Common Mistakes That Could Reduce Valuation

These are avoidable - and they show up constantly.

9.1 Rushing the sale

If you start outreach before your numbers, evidence, and narrative are ready, buyers will form an early “risk impression.” It is hard to reverse later.

Fix: build a tight data room, clean KPIs, and a clear story before you talk to serious buyers.

9.2 Hiding problems

Issues will surface in diligence - payer problems, quality gaps, customer concentration, messy consents. Hiding them destroys trust and can trigger re-trades (price cuts late in the process).

Fix: disclose early, but pair disclosure with a mitigation plan and progress proof.

9.3 Weak financial records

In genetic diagnostics, buyers want to understand what drives:

- test volume

- revenue per test

- denials and collections

- test-level margin

- capacity and utilization

Fix: simplify your reporting into a few buyer-friendly dashboards that reconcile to the financial statements.

9.4 No structured, competitive sale process with an advisor

A structured process with multiple credible buyers tends to increase price because it creates real competition and reduces the risk of a single-buyer “take it or leave it” dynamic. Industry research is often cited as showing meaningfully higher outcomes (commonly quoted around ~25%) when sellers run a competitive process with experienced advisors - the exact uplift varies, but the directional effect is real.

Fix: run a disciplined timeline, staged diligence, clear buyer communications, and real parallelism.

9.5 Revealing what price you want instead of letting the market speak

If you tell buyers “we want USD 10m,” you often cap your own upside. Many buyers will respond with USD 10.1m, USD 10.2m - instead of revealing what they would pay if they had to compete.

Fix: anchor on business quality and buyer fit first; let offers create the pricing reality.

9.6 Two industry-specific mistakes founders make in genetics

- Over-claiming clinical impact: buyers and their diligence teams will test every claim. Conservative, provable messaging wins.

- Under-investing in reimbursement storytelling: you might be “getting paid today,” but buyers want to know why that stays true at scale.

10. What Genetic Diagnostics Founders Can Do in 6-12 Months to Increase Valuation

You do not need a massive pivot. You need a targeted plan that reduces risk and increases defensibility.

10.1 Improve the numbers buyers trust

- Build a test-level economics view: revenue per test, COGS per test, gross margin by panel, and trends over time.

- Reduce revenue volatility: stabilize ordering patterns through account management and clinical pathway adoption.

- Show a credible EBITDA path: automation roadmap, procurement wins, batching, staffing model improvements.

10.2 Upgrade clinical and reimbursement defensibility

- Create a buyer-ready clinical evidence package (even if imperfect): studies, outcomes, case series, KOL feedback, utility narrative.

- Tighten reimbursement operations: coding, documentation, appeals process, denial reduction plan with measurable progress.

- Clarify what is reimbursed vs cash-pay and how that mix evolves.

10.3 Make differentiation undeniable (without pretending)

- Choose a “wedge” where you can plausibly be top-tier in 6-12 months (a niche, a workflow, a panel cluster).

- Turn your data asset into a story: what is unique, how it improves interpretation, and why it compounds.

- Strengthen workflow lock-in: EMR ordering, reporting integration, and clinic/lab operational embedding.

10.4 Prepare for diligence like a product launch

- Fix consent and data governance gaps now.

- Document quality systems, validations, and change control.

- Reduce founder dependence: build a second layer of leadership and make key relationships transferrable.

10.5 Build a buyer map and position to it

- Identify buyer archetypes: large diagnostics platforms, specialty genomics players, lab services consolidators, PE-backed platforms.

- For each archetype, write your “why us” in one page: strategic fit, cross-sell logic, and integration plan.

If you do the above well, you move from “please take a risk on us” to “this is a clean, defensible asset that fits your roadmap.”

11. How an AI-Native M&A Advisor Helps

In genetic diagnostics, better outcomes usually come from two things: more qualified buyers seeing the deal, and a clearer, lower-risk story when they do. This is where an AI-native M&A advisor can change the result.

First, higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of relevant acquirers based on deal history, strategic fit, synergy logic, and financial capacity. More real buyers means more competition, stronger offers, and a higher chance the deal actually closes if one party drops.

Second, initial offers in under 6 weeks. AI-driven buyer matching and connecting, faster creation of marketing materials, and systematic diligence support compress timelines compared to manual-only outreach. Speed matters because it reduces fatigue and keeps buyers engaged.

Third, expert advisory, enhanced by AI. You still want experienced human deal leadership - but AI can help that team move faster and cover more ground: sharper positioning, cleaner materials, better buyer targeting, and tighter process execution. The goal is “Wall Street-grade” process quality without traditional bulge bracket costs.

If you would like to understand how our AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.