The Complete Valuation Playbook for Gym and Sports Management Software Businesses

A playbook for gym and sports management software founders and what drives valuation multiples.

If you run a gym and sports management software business and you might sell in the next 1-12 months, valuation stops being a theoretical topic and becomes a scoreboard. Small differences in how buyers perceive your product - “nice-to-have” vs “mission-critical” - can change your multiple more than a year of hard work on features.

This playbook is built for your sector: vertical software that runs membership businesses and sports organizations (gyms, boutique studios, club networks, leagues, federations, and multi-site operators). It will show what similar businesses have sold for, how public markets value adjacent companies, what actually drives premium outcomes, and a simple way to self-assess and improve valuation in 6-12 months.

Everything below is illustrative, not investment advice or a formal valuation. But it will help you think like a buyer and prepare like a seller.

1. What Makes Gym and Sports Management Software Unique

Gym and sports management software sits in a rare spot: it looks like software, but it lives inside a physical, operational business. Your users aren’t “knowledge workers” - they’re GMs, front-desk teams, coaches, finance teams, and regional operators trying to keep clubs running daily.

That creates a few common business models in the sector:

- Gym/studio management SaaS: membership management, scheduling, billing, collections, access control, staff/coach scheduling, reporting.

- Sports club and league management: registration, team management, competitions, communications, payments, safeguarding.

- Hospitality-adjacent wellness: spa and resort scheduling, yield management, CRM, POS integrations.

- Payments + software bundles: software tied to payment processing, where the “take rate” can matter as much as subscription fees.

And it creates valuation considerations that are unusually “operational” for software:

- Collections and billing reliability matter more than you think. If your platform improves successful billing, reduces chargebacks, and shrinks overdue balances, buyers will treat you as financial infrastructure - not admin tooling.

- Switching costs are real but uneven. A single-site yoga studio can switch systems. A 200-club chain with integrations, pricing rules, and reporting standards often cannot.

- Your churn is tied to your customers’ churn. Fitness and sports organizations can be seasonal, cyclical, and sensitive to local competition. Buyers will ask whether your retention is structural (product value) or incidental (market timing).

Key risk factors buyers will always check in this sector:

- Revenue quality: percent recurring, contract structure, payment failure rates, refunds, discounts, one-time setup revenue.

- Retention and expansion: whether customers stick around and whether they buy more modules over time.

- Payment and data risk: data privacy, security posture, chargeback exposure, and any local compliance (especially if you touch fiscalization, invoicing rules, or regulated data).

- Concentration: a few big gym chains can drive most of revenue - and most risk.

2. What Buyers Look For in a Gym and Sports Management Software Business

Most buyers start with the basics: scale, growth, margins, and a believable path to more of each. But in your sector, “how you grow” matters almost as much as “how fast you grow.”

Here’s how strategics and private equity typically see your business:

The core checklist buyers use

- Recurring revenue: buyers pay more for subscription revenue and contracted payment volumes than for one-time implementation.

- Sticky workflows: billing, access control, collections, staff scheduling, and multi-site reporting tend to be “hard to rip out.”

- Proof of value: buyers love metrics that show you create money, not just save time (higher collections, fewer failed payments, reduced admin headcount, lower churn for gyms).

- Multi-product adoption: the more modules a customer uses, the less likely they leave. This shows up in deal narratives where integration breadth and ecosystem lock-in are highlighted as premium factors.

- Customer mix: enterprise and multi-location customers usually carry higher perceived value than very small SMBs - if you can prove retention and expansion.

What strategic buyers care about (software, payments, or fitness ecosystems)

Strategic acquirers often want one of three things:

- A vertical beachhead: your product gives them credibility and distribution into fitness/sports operators.

- A workflow wedge: billing, scheduling, or member engagement that can be expanded into payments, marketing, or analytics.

- A platform to standardize operations: especially for multi-site chains where corporate wants control, reporting consistency, and fewer local “workarounds.”

How private equity (PE) thinks about your valuation

PE buyers are less emotional about “strategic fit.” They focus on what they can do in 3-7 years.

- Entry multiple vs exit multiple: they buy at one multiple and hope to sell at a similar or higher one. They prefer businesses where they can grow into a higher multiple by improving predictability and margins.

- Who they can sell to later: a larger PE fund, a strategic, or a vertical roll-up buyer. Your job is to look “easy to underwrite” for that next buyer.

- Levers they expect to pull:

- price increases (if you have pricing power and low churn),

- cross-sell more modules,

- expand from SMB into multi-location (or into adjacent verticals like wellness hospitality),

- reduce services-heavy delivery,

- improve collections, reduce support burden, and expand EBITDA margin (operating leverage).

3. Deep Dive: The Valuation Nuance That Matters Most Here - “Mission-Critical Ops and Collections” vs “Nice-to-Have Admin”

In this sector, valuation often hinges on one question:

Are you a system that runs the business, or a tool that helps manage it?

This shows up repeatedly in premium deal commentary: category-specialist vertical software embedded into daily operations, with deep integrations and multi-location control, earns higher outcomes than software that feels replaceable.

Why buyers care (in plain terms)

If your software controls billing, collections, access, and multi-site reporting, replacing it is painful. That creates:

- higher switching costs,

- lower churn,

- easier price increases,

- more module adoption over time.

If your product is mostly registration, schedules, and basic admin, it can still be a solid business - but buyers model more churn risk and more pricing pressure.

How this shows up in deal patterns

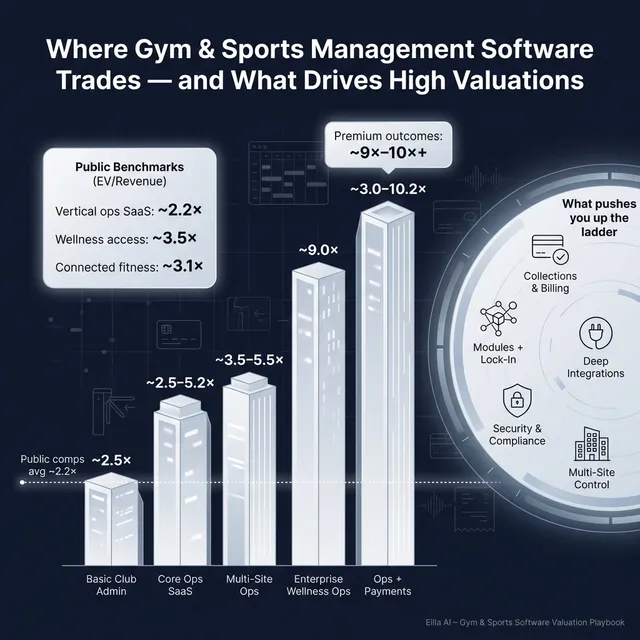

In similar vertical software deals, buyers paid up when the product was framed as embedded infrastructure with integrations and operational reliance (examples in the sources include enterprise hospitality wellness software with many integrations and round-the-clock support, and operational software where acquirers underwrote measurable efficiency and margin expansion). That’s the narrative behind premium outcomes like the ~9.0x EV/Revenue deal for a category-specialist platform in enterprise hospitality wellness, and even higher outliers for deeply embedded enterprise platforms in other verticals.

By contrast, bolt-on acquisitions of simpler admin platforms can clear at much lower multiples - for example, a sports club admin platform transaction implies ~2.5x EV/Revenue. Those can still be good exits, but they’re valued more like “add-on product lines” than “category platforms.”

Moving from the lower-value profile to the higher-value profile

You don’t have to reinvent your product. You have to climb the “criticality ladder”:

Practical steps that move perception quickly:

- Package and sell collections outcomes (failed payment recovery, dunning automation, debt collection workflows).

- Make multi-site reporting and standardization a headline: fewer manual spreadsheets for regional ops.

- Build an integration story around the systems buyers recognize: payment processors, access control, marketing automation, accounting, BI.

4. What Gym and Sports Management Software Businesses Sell For - and What Public Markets Show

Valuation in your space is best understood as a band of outcomes, not a single number. Private deals tell you what buyers actually paid. Public markets tell you what investors think businesses like this are worth today - and those public multiples act like a “gravity field” for private pricing.

The key is to triangulate:

- private software deals closest to your workflow and customer type,

- public vertical operations software (not gym operators),

- and then adjust based on your growth, margins, retention, and risk.

4.1 Private Market Deals (Similar Acquisitions)

From the precedent transactions data, vertical software deals around fitness/sports/hospitality operations show a wide spread:

- In fitness/sports/hospitality operations software, observed EV/Revenue spans roughly ~2.5x to ~5.2x in the disclosed examples.

- Premium vertical SaaS outcomes can go higher when the product is deeply embedded in enterprise operations and integration-heavy - for instance ~9.0x for enterprise hospitality wellness software, and a separate enterprise vertical platform outlier at ~17.2x (not fitness-specific, but useful as “what premium looks like when mission-critical embedding is proven).

- Lower outcomes exist when the product is more bolt-on, SMB-oriented, or when buyers perceive higher churn and weaker defensibility (the ~2.5x example is a good “floor reference” for that profile).

A simple way to read the private market: most “good” vertical SaaS in this orbit tends to clear mid-single-digit revenue multiples when it’s credible infrastructure, and closer to low-single-digits when it’s lighter admin tooling.

These ranges are illustrative. Your specific growth, retention, margins, and customer mix will move you up or down inside (or outside) them.

4.2 Public Companies

Public comps are imperfect for you because most listed “fitness” companies are operators or hardware businesses, not pure gym-management software. Still, the public set creates helpful reference points.

From the public group averages:

- Vertical SaaS for service SMBs (ops, payments, marketing) trades around ~2.2x EV/Revenue and ~12.8x EV/EBITDA on average.

- At-home/connected fitness platforms (hardware + content) average ~3.1x EV/Revenue and ~14.8x EV/EBITDA - but that’s a different business model with hardware risk.

- Employee wellness access platforms average ~3.5x EV/Revenue and ~13.3x EV/EBITDA - closer in “membership” feel, but still not your workflow.

- Public fitness operators (low-cost chains and boutique franchisors) trade at lower revenue multiples than software because they carry real estate and labor costs.

Here’s the cleanest way to use the public data (as of mid-to-end 2025, per the provided multiples):

How you should interpret this:

- Public multiples are reference bands, not price tags. Private companies are smaller and riskier, so they often trade at a discount to public software.

- But scarce, highly strategic assets can trade above public averages if buyers see mission-critical embedding, deep integrations, and a platform they can scale.

- The public data also warns you not to anchor on fitness operators. Your buyers will compare you to software businesses that run physical-service operations, not to gym chains.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes in this sector don’t come from “being in fitness.” They come from being hard to replace and easy to scale.

Based on the premium drivers observed in the deals data - and how buyers typically think about this category - the strongest valuation levers cluster into a few themes:

5.1 Deep vertical focus + enterprise-grade embedding

Buyers pay more when you’re a category specialist and your software sits inside enterprise workflows. In the data, category-specialist platforms in enterprise hospitality wellness and other mission-critical verticals achieved premium revenue multiples, driven by operational reliance and specialization.

What this looks like in your world:

- You power multi-site reporting, pricing rules, membership plans, staff permissions, and corporate governance for chains.

- You’re not “a scheduling tool.” You’re “the operating system” for membership revenue.

5.2 Integration breadth and ecosystem lock-in

Integration density is one of the clearest premium signals in the data (notably in the enterprise hospitality wellness example with 60+ integrations). Buyers translate integrations into stickiness and lower churn.

Founder-friendly examples:

- Tight integrations with payment processors, access control hardware, marketing automation, accounting systems, and BI.

- Multi-module adoption that clearly increases net retention (customers expanding spend over time).

- A partner ecosystem where third parties build around you (even small signs help).

5.3 Multi-location operational control + financial automation

This is a sector-specific superpower: software that standardizes operations across many locations and improves financial discipline. In the premium driver notes, buyers valued platforms that reduce “leakage” and improve collections.

Practical “premium narrative” proof points:

- Reduced failed payments and improved recovery rates.

- Faster cash collection (even if you don’t use the term “DSO,” you can show “days to collect” improving).

- Consistent reporting and controls across sites, reducing fraud, discounts, and manual overrides.

5.4 Demonstrated growth trajectory with improving economics

Buyers discount execution risk. In the data, businesses showing clear revenue growth and improving EBITDA margins presented stronger stories (for example, the sports admin platform with margin expansion over time).

For you, the cleanest story is:

- steady double-digit growth,

- stable or improving gross margin,

- a believable plan for margin expansion as you scale (support efficiency, repeatable onboarding, less custom work).

5.5 Compliance readiness and trust

In vertical software, compliance can be a valuation lever when it’s real and relevant (in the data, compliance features like fiscalization in hospitality were part of premium positioning). For gym and sports management, “compliance” usually means:

- privacy and security posture (especially if you store health-related data, minors’ data, or payment data),

- local invoicing/fiscal rules in certain countries,

- audit trails for refunds, discounts, and membership freezes.

5.6 The obvious but underestimated drivers

Even in a vertical SaaS niche, buyers will still pay more for:

- clean financials and clear revenue recognition,

- diversified customer base,

- strong second-line leadership (not just founder-driven operations),

- predictable churn and retention reporting you can explain without hand-waving.

6. Discount Drivers (What Lowers Multiples)

Most valuation disappointment is not about “market conditions.” It’s about buyer confidence.

Here are the discount drivers that push businesses toward the low end:

6.1 Revenue that isn’t truly recurring

Buyers discount when:

- a large share of revenue is implementation, training, or custom development,

- contracts are month-to-month with easy cancellation,

- “recurring” revenue is actually usage that can drop quickly (for example, transaction fees without stable volume).

Fix: separate recurring vs non-recurring clearly, and show a path to shifting mix.

6.2 Weak retention, or retention you can’t explain

In this sector, churn can be messy (clubs close, owners sell locations, seasons change). Buyers will still expect you to answer:

- Do customers leave because they fail as businesses, or because your product fails them?

- Do multi-location customers retain better than single-site?

- Does adopting more modules reduce churn?

If you can’t answer with data, buyers assume the worst.

6.3 Too much customization and fragile delivery

If every new customer needs heavy configuration, custom integrations, or founder-led onboarding, buyers see risk:

- harder to scale sales,

- higher support load,

- more “project business” feel than software.

6.4 Customer concentration in a few large chains

A few enterprise logos can be a strength - until one can renegotiate pricing or threaten to churn. Buyers will model downside scenarios.

6.5 Unclear product moat

If your product looks similar to many vendors and the only reason customers stay is “inertia,” you’ll be valued like a commodity platform. Integration depth and operational embedding are the antidote - but you have to prove it.

6.6 Profitability that isn’t credible

Loss-making companies can still sell at good multiples if growth and retention are exceptional. But if you have losses and unclear growth efficiency, buyers discount hard.

7. Valuation Example: A Gym and Sports Management Software Company

This is a worked example to show how the logic works. The company is fictional and the numbers are illustrative.

Step 1: The valuation logic (plain English)

- Start with the closest private deal range for fitness/sports/hospitality operations software: roughly ~2.5x–5.2x EV/Revenue in disclosed examples.

- Use public comps as sanity checks, not anchors:

- Vertical ops SaaS for service SMBs averages ~2.2x EV/Revenue.

- Fitness operators and hardware businesses are not good anchors for software.

- Adjust for your profile:

- enterprise multi-location control, deep integrations, and collections automation push you up,

- heavy services, weak retention, and concentration push you down.

- Create scenarios rather than one “answer”:

- base case (solid vertical SaaS),

- premium case (mission-critical embedding proven),

- discounted case (key risks unresolved).

Step 2: Apply it to a fictional company

Meet ForgeClub OS (fictional):

- Gym and sports management SaaS for multi-location gym chains and sports club networks.

- USD 10.0m last-twelve-month revenue (fictional).

- 85% recurring subscription + transaction fees.

- Strong product in billing, collections automation, access control integrations, and corporate reporting.

- Moderate services component for onboarding.

- Retention is good, but reporting is not yet world-class.

A reasonable illustrative range, using the sector logic provided:

Why those bands map to the data:

- ~3.0x reflects a cautious floor that’s still above the lowest public SMB ops software averages, recognizing fitness exposure and real switching costs, but assuming limited proof of premium drivers.

- ~3.5x–5.5x fits the disclosed private fitness/sports/hospitality ops software range (~2.5x–5.2x) while giving credit for enterprise-leaning features.

- Up to ~6.0x gives additional credit for premium drivers (mission-critical multi-location control, integrations, financial automation) but stays below the very high premium outliers seen in other verticals unless you can prove enterprise-grade compliance, exceptional net retention, and margin expansion.

Step 3: What this means for you

Two businesses can both have USD 10m revenue and sell for very different prices because buyers are not buying revenue - they are buying confidence in future cash flow.

In this sector, that confidence is earned by:

- sticky workflows (billing, collections, access, reporting),

- integration depth,

- multi-location standardization,

- and retention you can explain cleanly.

This example is not a forecast. It’s a map.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this to pressure-test where buyers will likely place you today. Score each factor 0 / 1 / 2:

- 0 = weak or unclear

- 1 = acceptable but improvable

- 2 = strong and proven with data

How to interpret your total (rough guide):

- High band: most High Impact factors are 2s - you’re closer to premium outcomes.

- Middle band: mixed 1s and 2s - you can still run a strong process, but you’ll need a tight narrative.

- Low band: many 0s - consider delaying a sale or running a process only if you’re comfortable with lower-end pricing.

The point isn’t to “grade yourself.” It’s to identify which 2-3 upgrades would move valuation the most in 6-12 months.

9. Common Mistakes That Could Reduce Valuation

9.1 Rushing the sale

If you start a process before your numbers and story are ready, buyers smell it. You lose leverage, you accept worse terms, and diligence becomes painful.

9.2 Hiding problems

Issues always come out in diligence: churn spikes, customer concentration, security gaps, messy revenue recognition. Hiding them doesn’t protect value - it destroys trust and usually lowers price later.

9.3 Weak financial records

This is fixable faster than most founders realize. The biggest “easy wins”:

- clean revenue split (subscription vs services vs payments),

- cohort retention reporting,

- margin by product line,

- predictable monthly reporting cadence.

Buyers don’t demand perfection. They demand clarity.

9.4 No structured, competitive sale process with an advisor

A structured competitive process usually drives meaningfully better outcomes because it creates competition and deadlines. Research often cited in M&A circles suggests that running a structured process with an advisor can lift purchase prices by around ~25% versus one-off negotiations - not because of magic, but because more buyers compete and the story is framed correctly.

9.5 Naming your price too early

If you tell buyers “we want USD 10m,” you often cap the upside. Instead of discovering what they would truly pay, you invite offers like USD 10.1m and USD 10.2m. Price discovery dies, and so does leverage.

9.6 Industry-specific mistake: treating payments as “just a feature”

If payments are part of your business, buyers will look hard at:

- take rate sustainability,

- chargebacks and fraud risk,

- dependency on one processor,

- how sticky payment adoption is.

If you can’t explain payments cleanly, buyers discount it - even if it’s a growth engine.

10. What Gym and Sports Software Founders Can Do in 6-12 Months to Increase Valuation

You don’t need a reinvention. You need targeted upgrades that reduce buyer risk and strengthen the premium narrative.

10.1 Improve the numbers buyers underwrite

- Build a retention dashboard: logo retention, revenue retention, and expansion by cohort (by customer size: single-site vs multi-location).

- Reduce services mix: productize onboarding, standardize integrations, and move toward repeatable deployments.

- Show operating leverage: even small margin improvements matter if you can explain why they will continue as you scale (support efficiency, fewer custom projects).

10.2 Move up the “mission-critical” ladder

- Double down on billing + collections automation outcomes. Track “recovered revenue” and “reduced failed payments.”

- Package multi-location control as a premium tier: corporate reporting, role-based permissions, standardized pricing rules, audit trails.

- Tighten “switching cost” proof: number of integrations per customer, modules adopted, and the operational processes you run.

10.3 De-risk the story buyers worry about

- Reduce customer concentration where possible (even a few new mid-sized logos can help the narrative).

- Build a clear security and privacy posture document. If certifications exist, surface them. If not, show concrete controls and a roadmap.

- Put a leadership bench in place so the business is not founder-dependent on day one after closing.

10.4 Run a “sale-readiness” process before the sale process

- Prepare a clean monthly KPI pack that mirrors what buyers will ask for.

- Draft a simple, credible growth plan for the next 24 months that doesn’t rely on miracles.

- Identify weaknesses that will come up in diligence and fix or explain them now - on your terms.

11. How an AI-Native M&A Advisor Helps

Selling well is less about finding “a buyer” and more about creating a market around your business. AI-native advisory improves outcomes by widening the buyer universe and running a tighter process.

First, higher valuations through broader buyer reach. AI can map hundreds of relevant acquirers based on deal history, product adjacency, synergy logic, and financial capacity - not just the obvious names. More qualified buyers means more competition, stronger offers, and a higher chance the deal closes even if one buyer drops out.

Second, initial offers in under 6 weeks. AI-driven buyer matching, faster outreach, and quicker preparation of marketing materials can compress timelines versus manual-only processes. That speed matters because momentum is leverage.

Third, expert advisory, enhanced by AI. You still need experienced M&A leadership: framing the story, running negotiations, and managing diligence. AI helps deliver “Wall Street-grade” materials and buyer targeting without traditional bulge bracket costs - while keeping human credibility in the room when it matters.

If you’d like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.