The Complete Valuation Playbook for Healthy Snack Brands Businesses

A valuation guide for healthy snack brands, showing what buyers pay for them and what drives premium multiples.

If you run a healthy snack brand and you’re thinking about selling in the next 1-12 months, valuation stops being an abstract topic and becomes a practical one: what will buyers actually pay, and what can you do (quickly) to move your business toward the high end of the range?

This playbook is built for founders and CEOs of privately held healthy snack brands. It shows what businesses in and around your space have sold for, how public markets value related companies (as of end-2025), what drives premium outcomes, what drags multiples down, and how to build a 6-12 month plan that buyers will pay for.

1. What Makes Healthy Snack Brands Unique

Healthy snack brands look simple from the outside: make a product, sell it online and in retail, scale distribution. But buyers value these businesses differently than software or services because the value sits in a few specific places: brand trust, repeat purchase, distribution economics, and margin durability.

The main types of businesses in this sector

Most “healthy snack brands” fall into a few common models:

- Protein and performance snacking (bars, shakes, powders crossing into snacks)

- Better-for-you mainstream snacks (cleaner chips, popcorn, baked snacks)

- Plant-based and functional foods (added functional ingredients, “free-from”, wellness-led)

- Refrigerated “fresh” snacks (dips, spreads, fresh prepared snacks)

- DTC-first brands expanding into retail (community and repeat purchase as the wedge)

The valuation reality: you’re not “just a food company”

Buyers usually pay for one or more of the following:

- A brand people seek out, not just a product they tolerate

- Velocity (units per store per week) that proves the product moves

- A repeat engine (the same customer coming back) that reduces reliance on constant promotion

- Gross margin structure that can support scale (and withstand retailer trade spend)

- A credible path to broader distribution without breaking margins or operations

Key risk factors buyers always check

Healthy snack brands have a few “always asked” questions:

- Is the demand real without heavy discounting? (promo addiction kills value)

- Is your supply chain resilient? (single co-manufacturer risk is a big red flag)

- Are your health claims safe and defensible? (regulatory and class-action risk is real)

- Does the brand travel? (new retailers and new geographies often expose weak positioning)

- Is working capital under control? (inventory and trade terms can quietly drain cash)

2. What Buyers Look For in a Healthy Snack Brand Business

Buyers have two simple goals: (1) reduce risk and (2) believe they can grow you faster than you can grow alone. The best valuations happen when you make both easy to believe.

The “obvious” factors (and how buyers interpret them)

- Scale (revenue): Not because bigger is always better, but because scale proves repeatability in manufacturing, distribution, and marketing.

- Growth rate: Buyers pay for growth they believe will continue, not growth that came from one big retailer win or a short-lived trend.

- Gross margin and contribution margin: In snacks, buyers want to see that you can fund growth without constantly raising capital.

- Profitability (EBITDA): Profitable or “near profitable” brands are easier to finance and easier to integrate.

- Customer and channel mix: A brand that works in more than one channel is often less fragile.

Industry-specific nuances buyers obsess over

- Velocity and replenishment: Buyers would rather see strong movement in fewer doors than weak movement in many doors.

- Trade spend discipline: Retail growth is great until it’s bought with endless promotions and slotting fees.

- Product architecture: Do you have one hero SKU, or a platform that can expand into adjacent SKUs without confusing the shopper?

- Brand proof: Reviews, repeat purchase, social proof, retailer renewals, and “we didn’t have to buy demand.”

How private equity thinks about your business

Private equity (PE) buyers tend to be more “math-forward” and process-driven:

- Entry multiple vs exit multiple: They care what they pay now and what they can sell for in 3-7 years.

- Who is the next buyer? They want a clear “exit story” to strategics (big food, big beverage, large snacking platforms) or larger PE.

- Levers they expect to pull:

- Raise price carefully (if brand supports it)

- Improve gross margin (co-man optimization, procurement, mix shift)

- Expand distribution (new retailers, club, international)

- Professionalize operations (forecasting, inventory turns, trade spend control)

- Add adjacent SKUs (without diluting the brand)

If your business already looks “PE-ready” (clean financials, predictable margins, professional reporting, leadership depth), you tend to attract more buyers, which is a valuation advantage by itself.

3. Deep Dive: Why “Distribution Footprint” Doesn’t Equal Value (Velocity Does)

A common founder mistake is assuming that “we’re in a lot of doors” or “we sell in many countries” automatically leads to a premium valuation. It can help, but buyers mostly care about quality of distribution, not the size of your footprint.

Why this matters in the data and in deals

Across healthy snack and better-for-you transactions, premium outcomes tend to show up when distribution expansion is paired with proof that the product actually moves. In other words: distribution without velocity is fragile, and buyers price it that way.

Why buyers care (in plain English)

If your product sells slowly in-store, three things happen:

- Retailers reduce shelf space or discontinue you

- You rely more on promotions to keep doors

- Inventory and returns become messy, which hurts cash and reported margins

Strong velocity does the opposite: it lowers risk and makes growth feel “inevitable.”

How to move from the “lower-value” version to the “higher-value” version

You don’t fix this with a deck. You fix it with proof:

- Track and share units per store per week, by retailer and by region

- Show reorder rates and “time to reorder” on new launches

- Build a plan to improve velocity before adding doors (sampling, tighter SKU set, better shelf placement, better packaging messaging)

- Prove that international expansion is not random: localized flavors, right pack sizes, realistic distributor economics

Quick profile table

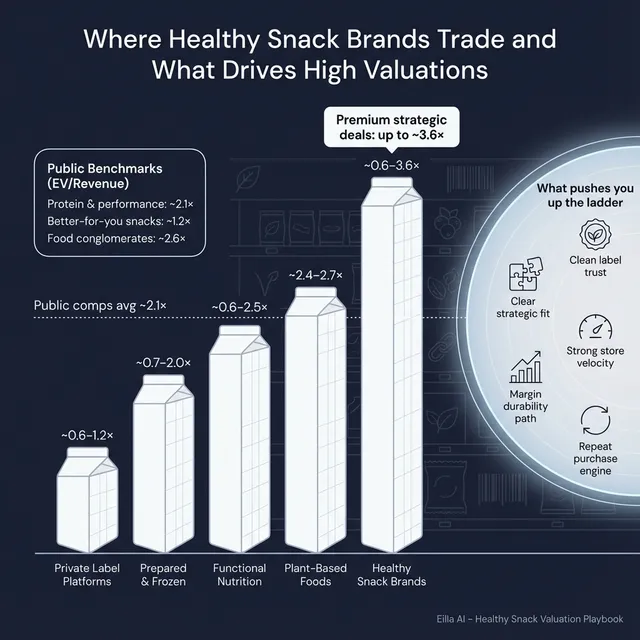

4. What Healthy Snack Brands Sell For - and What Public Markets Show

Let’s ground this in reality. Healthy snack brands tend to be valued primarily on EV/Revenue (revenue multiples), especially when EBITDA is small, inconsistent, or intentionally suppressed to fund growth. When EBITDA is meaningful and reliable, EV/EBITDA becomes more relevant.

A critical point: public market averages can be distorted by outliers, so medians often tell the more useful story. And private deals can include earnouts, partial stakes, or strategic premiums that don’t show up cleanly in one headline multiple.

4.1 Private Market Deals (Similar Acquisitions)

From the deal data, healthy snack and adjacent categories show a wide spread in EV/Revenue. The practical takeaway is this:

- The “middle of the market” for healthy snack brands is often around ~1.0x to ~2.5x revenue

- Premium outcomes can push above that (especially for category leaders with strong brand pull, velocity, and margin structure)

- Lower-end outcomes cluster closer to sub-1.0x when scale is small, margins are weak, or growth is low-quality

Here’s a founder-friendly way to interpret the ranges visible across relevant private deal groupings:

These ranges are illustrative. Where you land inside them depends on a few “deal-shaping” facts: growth quality, gross margin, customer concentration, channel mix, and how credible your next stage of distribution expansion is.

4.2 Public Companies

Public comps (as of end-2025) provide an “outside reference band,” but they are not a direct price tag for your business. Public companies are larger, more liquid, and often valued differently based on scale, stability, and investor sentiment.

At the group level, the public market shows these average multiples:

*That ~17.8x average is not “normal” for the category - it’s distorted by very small or unusual companies. The median for that group is far closer to the 1x-2x reality most founders should anchor on.

How to use public multiples without fooling yourself

Use public comps as guardrails:

- Upper reference: what scaled, stable, proven brands can trade at in good conditions

- Adjust down for smaller scale, customer concentration, supply chain risk, weaker reporting, and heavy reliance on promos

- Adjust up (sometimes) if your brand is scarce, strategically perfect for an acquirer, and you can prove velocity, margins, and repeat purchase

5. What Drives High Valuations (Premium Valuation Drivers)

Premium valuations in healthy snack brands are not magic. They usually come from a small set of proof points that make buyers believe two things:

- the brand has durable demand, and

- scaling it won’t break economics or operations.

Below are the premium drivers that consistently show up in deal narratives for better-for-you snacking, protein-led brands, and functional foods - grouped into practical themes.

5.1 Category leadership and clean label trust

Buyers pay more when your “healthy” positioning is not vague marketing, but a trusted promise.

- Proof looks like: certifications, clean ingredient decks, consistent product quality, and strong retailer acceptance.

- Founder-level examples:

- You can hold shelf space without constant discounting.

- Retailers treat you as a “category builder,” not just another SKU.

- Consumers choose you specifically for ingredient standards.

5.2 Distribution breadth that is backed by velocity

A multi-retailer or multi-country footprint can support premium outcomes, but only when it’s paired with sell-through proof.

- Proof looks like: door productivity, reorder rates, and repeatable playbooks for expansion.

- Founder-level examples:

- You know which two SKUs win first in a new retailer.

- You can show “we entered 300 stores and velocity increased over 90 days.”

5.3 Omnichannel strength (retail + DTC) with real repeat purchase

A brand that performs in more than one channel is often more resilient.

- Proof looks like: strong DTC repeat rates, retail velocity, and clear margin understanding by channel.

- Founder-level examples:

- DTC is not just a launch channel - it is a retention engine and a testing lab.

- Retail doesn’t cannibalize DTC; it expands total demand.

5.4 Strong EBITDA conversion (or a believable path to it)

Buyers will stretch when they see that growth converts into profit over time.

- Proof looks like: gross margin structure, improving contribution margin, controlled trade spend, and clear cost leverage.

- Founder-level examples:

- Your gross margin holds even as you expand distribution.

- You can explain trade spend like an operator, not like a hope.

5.5 Clear strategic fit for large acquirers

Strategic buyers pay up when your brand “plugs in” to their existing system.

- Proof looks like: shared shopper, channel overlap, manufacturing leverage, and obvious adjacency to their current portfolio.

- Founder-level examples:

- A big beverage company can scale you through convenience and grocery immediately.

- A snacking platform can expand your SKUs using their sourcing and retail relationships.

5.6 Brand equity that creates pricing power

Some brands earn a premium because consumers love them enough to tolerate higher pricing.

- Proof looks like: strong reviews, strong social proof, strong retention, and low promo dependence.

- Founder-level examples:

- You can raise price without losing volume.

- Your product is purchased for taste first, health second (that combination is powerful).

6. Discount Drivers (What Lowers Multiples)

Most “low multiple” outcomes are not because the product is bad. They’re because buyers see avoidable risk, or they don’t believe the growth is durable.

Here are the patterns that most often pull valuations down in healthy snack brands:

6.1 Low-quality growth (promo-driven or one-off)

- Heavy discounting to create movement

- A single big customer or one retailer driving most growth

- Big spikes from viral moments that didn’t convert to repeat purchase

6.2 Weak or unstable gross margins

- Ingredient cost volatility with no pricing power

- Co-manufacturing terms that don’t improve with scale

- Trade spend that quietly eats margin (and is poorly tracked)

6.3 Operational concentration risk

- One co-manufacturer, one packaging supplier, or one critical ingredient source

- Limited ability to forecast demand, leading to stockouts or excess inventory

- Shelf-life and returns issues that complicate retailer relationships

6.4 Brand and claims risk

- Health claims that are not tightly substantiated

- Inconsistent product quality across batches

- Brand messaging that confuses “who the customer is” (fitness vs family vs wellness)

6.5 Founder dependency and thin leadership bench

If buyers feel the business cannot run without you, they reduce the price or push harder for earnouts.

6.6 Messy financials and weak reporting

Even if the business is strong, unclear numbers reduce trust. And when trust drops, multiples drop.

7. Valuation Example: A Healthy Snack Brand Company

This example is fictional and designed to show the logic - it is not investment advice or a formal valuation.

The fictional company: “BrightBite”

- Revenue: USD 10.0m (fictional)

- Products: clean-label protein snacks (bars + crunchy bites)

- Channels: 65% retail (grocery + specialty), 35% DTC

- Geography: strong in 2 countries, early in a third

- Gross margin: ~40%

- EBITDA margin: ~12% (USD 1.2m EBITDA)

Step 1: Pick a sensible starting range

For a sub-scale healthy snack brand, revenue multiples are often the cleanest anchor. Based on healthy snack brand precedent ranges, a core band around ~1.2x-2.2x revenue is a defensible starting point for “good but not yet category-leading” brands.

Step 2: Translate that into valuation ranges

On USD 10.0m revenue:

Step 3: What pushes BrightBite up or down?

BrightBite moves toward the premium range if:

- velocity is strong and improving (not promo-driven)

- repeat purchase is visible (especially in DTC)

- trade spend is controlled and margins are stable

- expansion plan is credible (not “we might go everywhere”)

BrightBite slides toward the discounted range if:

- retail movement relies on constant discounts

- one customer drives most revenue

- margins are unclear or shrinking

- supply chain is concentrated or fragile

A simple cross-check using EBITDA

If BrightBite has USD 1.2m EBITDA:

- EV of USD 12-22m implies roughly 10x-18x EV/EBITDAThat’s not crazy for a branded, growing snack business - but it only holds if EBITDA is real, repeatable, and not propped up by under-spending on marketing or by one-time benefits.

Founder takeaway: two brands with the same USD 10m revenue can be worth radically different amounts depending on velocity, margins, and credibility of growth.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this to place yourself roughly within the valuation spectrum. Score each factor 0 / 1 / 2:

- 0 = weak / not proven

- 1 = decent / mixed proof

- 2 = strong / clearly proven

Self-assessment table

How to interpret your total

- Top band: You’re closer to premium outcomes (buyers see durable demand + scalable economics)

- Middle band: You’re in fair-market territory (sellable, but value depends on process quality)

- Lower band: You may still sell, but expect heavier earnouts, tougher diligence, or lower multiples unless you fix the biggest risks

The point is not to judge yourself. The point is to identify what will move the multiple the most in 6-12 months.

9. Common Mistakes That Could Reduce Valuation

9.1 Rushing the sale

If you go to market before your numbers and story are tight, buyers will fill the gaps with skepticism. In snacks, skepticism shows up as: “We like the brand, but we need protection.” That usually means lower price and more earnout.

9.2 Hiding problems

Problems always come out in diligence: customer concentration, margin weakness, supply chain fragility, claim risk. Hiding them destroys trust, and trust is value.

9.3 Weak financial records

You don’t need perfect accounting, but you do need clarity:

- revenue by channel and customer

- gross margin by channel

- trade spend and promo impact

- inventory turns, write-offs, and returns

- a clean bridge from revenue to EBITDA

Many founders can materially improve this in 6-12 months, and it often pays back directly in valuation.

9.4 Not running a structured, competitive process with an advisor

Competition is leverage. A structured process creates it.

Research on M&A processes shows auctions tend to produce higher bid premiums than one-on-one negotiations - one empirical study finds average first-bid premiums of 38.5% in auctions vs 30.5% in negotiations, which is roughly ~25% higher in the auction setting. (analysisgroup.com)Private company deals aren’t identical to public takeovers, but the principle carries: more qualified buyers at the table usually improves price and terms.

9.5 Revealing what price you’re after too early

If you tell buyers “we want USD 10m,” you often kill price discovery. You’ll get USD 10.1m, USD 10.2m… instead of the actual best offer the market might have produced.

9.6 Two industry-specific mistakes that bite snack brands

- Confusing “distribution” with “demand”: doors without velocity lead to discontinuations and margin damage.

- Letting trade spend become invisible: if you can’t clearly explain promotions, slotting, and retailer programs, buyers assume the worst.

10. What Healthy Snack Brands Founders Can Do in 6-12 Months to Increase Valuation

You’re not trying to reinvent the business. You’re trying to remove buyer doubt and make your growth feel more inevitable.

10.1 Improve the numbers buyers pay for

- Build a clean monthly view of revenue by channel, gross margin by channel, and trade spend

- Tighten inventory management: reduce obsolete stock, improve forecasting, document shelf-life performance

- Create a margin plan with 2-3 concrete levers (co-man renegotiation, ingredient sourcing, pack-size optimization)

10.2 Prove demand quality (velocity + repeat)

- Track and package your velocity and reorder story by retailer

- For DTC: document repeat rates, subscription behavior (if any), and cohort performance

- Reduce promo reliance by testing smarter levers (messaging, packaging, sampling, shelf placement)

10.3 De-risk the supply chain

- Add a second source for critical ingredients or packaging where feasible

- If co-man concentration is high, start qualifying a backup now (even if you don’t switch yet)

- Document QA and consistency (buyers love boring reliability)

10.4 Strengthen the “why this buyer” narrative

- Map 30-100 likely acquirers by channel fit and portfolio adjacency

- Show how you plug into them: distribution overlap, shared shopper, manufacturing leverage, innovation pipeline

- Prepare a realistic growth plan that doesn’t depend on miracles

10.5 Reduce founder dependency

- Make sure someone besides you can run key functions (sales, ops, finance, marketing)

- Document playbooks (launch playbook, retailer onboarding, forecasting cadence)

- Buyers pay more when the business looks like a machine, not a founder-powered sprint

11. How an AI-Native M&A Advisor Helps

Selling a healthy snack brand is not just about finding “a buyer.” It’s about finding the right buyers, creating competition, and running a process that protects momentum while surviving diligence.

An AI-native M&A advisor can expand your buyer universe dramatically by using data signals like prior deal history, channel synergies, portfolio fit, and financial capacity to identify hundreds of realistic acquirers, not just the obvious names. More relevant buyers usually means more competitive tension, stronger offers, and more options if one buyer drops late in the process.

Speed matters too. With AI-driven buyer matching, faster outreach, and structured support in building marketing materials and diligence responses, you can often reach initial conversations and early offers in under 6 weeks - much faster than a manual-only process.

The best outcomes still require expert human judgment. AI works best when it supports experienced M&A advisors: sharper positioning, cleaner materials, better buyer targeting, and a process that speaks the buyer’s language. The goal is Wall Street-grade execution without the traditional “bulge bracket” cost structure.

If you’d like to understand how our AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.