The Complete Valuation Playbook for Hospitality Software Businesses

A valuation guide for hospitality software businesses that breaks down real-world multiples and the levers.

If you run a hospitality software business and you might sell in the next 1-12 months, valuation stops being an abstract idea and becomes a set of decisions: what story you tell, what numbers you can prove, which risks you remove, and which buyers you can credibly attract.

This is a sector where consolidation keeps accelerating (POS, ordering, payments, loyalty, guest experience, hotel distribution), but buyers are also more selective than they were a few years ago. The businesses that look mission-critical and “sticky” still command strong outcomes. The ones that look like tools, projects, or services businesses get priced accordingly.

This playbook shows what hospitality software businesses actually sell for, what drives higher vs lower multiples, and how to assess your position and improve it in 6-12 months - without needing an MBA.

1. What Makes Hospitality Software Unique

Hospitality software is “software,” but it doesn’t behave like generic SaaS. Your customers run real-time operations with thin staffing and high urgency. If your product breaks on a Friday night, it’s not an inconvenience - it’s revenue loss, guest experience damage, and operational chaos.

The main types of hospitality software businesses buyers group together:

- Restaurant POS and operations platforms: POS, ordering, kitchen display systems, inventory, labor, reservations, loyalty.

- Hotel distribution and revenue tools: booking engines, channel managers, revenue management, rate intelligence.

- Venue and on-site operations: ticketing, access control, payments at venues, kiosks, parking/entry workflows.

- Hospitality payments and commerce infrastructure: payment processing, terminals, fraud/chargeback tooling, integrated payouts.

- Hardware-plus-software ecosystems: devices, kiosks, terminals plus device management, remote monitoring, and support.

Unique valuation considerations in this sector:

- “Always-on” operational criticality matters more than feature depth. Buyers pay up for reliability, uptime, and support.

- Implementation and support load can quietly turn “SaaS margins” into “services margins.” Buyers will dissect this.

- Payments attachment (if relevant) can meaningfully change value because it adds high-margin revenue and switching costs - but also adds risk.

- Customer concentration and chain dynamics are common. A handful of multi-unit brands can represent a big chunk of revenue.

Key risks buyers will always check:

- Retention and churn (and the real reasons customers leave).

- Product stability and security (PCI and payment security if you touch card data, plus data privacy in general).

- Support model and service intensity (ticket volume, response times, implementation dependency).

- Integration risk (delivery marketplaces, PMS integrations, payment gateways, accounting, loyalty partners).

- Gross margin quality (software margin vs blended margin after hardware, installers, and support).

2. What Buyers Look For in a Hospitality Software Business

At a basic level, buyers care about growth, profitability, and recurring revenue. But in hospitality, “why customers stick” matters as much as the numbers themselves.

Here’s the buyer lens in plain language:

1) Are you tied to revenue generation or operational survival?Software that directly improves throughput, reduces labor, increases table turns, reduces waste, increases direct bookings, or reduces overbooking is easier to underwrite. Buyers will ask for proof: before/after metrics, not just testimonials.

2) Is your revenue predictable and repeatable?Buyers prefer revenue that behaves like a subscription: recurring, contracted, renewing, and expanding. If expansion is real, they’ll want to see it clearly (for example: customers adding modules over time, locations expanding, or payment volume growing).

3) Do you have a defensible “wedge” and a path to being a platform?Hospitality has lots of point solutions. The higher-value businesses either:

- sit at the center of workflows (POS, ordering, distribution), or

- own a mission-critical niche with deep enterprise-grade capability (and strong retention).

4) Can you scale without your team doing heroics?Buyers will pressure test whether growth requires more implementation heads, more support, and more custom work - or whether the product scales cleanly.

How private equity thinks about your business

Private equity buyers tend to be very explicit about their math:

- They care about what they pay today (entry multiple) and what they can sell for later (exit multiple) in 3-7 years.

- They want a clear buyer set for the next exit: a larger software platform, a strategic acquirer, or a larger private equity fund.

- They expect levers like:

- price increases (done carefully in hospitality),

- cross-sell of modules,

- payments attachment,

- moving services costs down,

- improving churn and support efficiency.

If your story is “we’re great, just keep doing what we’re doing,” PE will often push back. They want to see a realistic plan to improve the business - and for valuation, you want that plan to be believable and already underway.

3. Deep Dive: The Valuation Power of Embedded Payments and “Revenue That Scales”

Many hospitality founders underestimate how much valuation can swing based on one question:

Are you a software subscription business - or a software-plus-payments (and loyalty) economics business?

In the data, platforms that successfully monetize payments and loyalty economics (not just software seats) show stronger outcomes. The reason is simple: payments revenue can scale with customer volume, often at high gross margins once integrated and stable.

Why buyers care so much:

- Switching costs go up. If you run POS + ordering + payments, ripping you out is painful.

- Revenue scales with customer success. When your restaurant or hotel grows, you grow.

- The buyer can underwrite upside. If your payment attach rate can go from 30% to 70%, that’s a concrete value creation lever.

But it cuts both ways. Payments introduces new diligence questions: chargebacks, underwriting, compliance, partner dependency, and sometimes greater revenue volatility.

Here’s a simple “lower-value vs higher-value” profile:

How to move right over time (without a massive pivot):

- Start by measuring attach and expansion even if it’s small today.

- Package payments and loyalty in a way customers understand (“fewer vendors, fewer issues, one support line”).

- Build a clean narrative around gross margin quality: show what part is scalable software margin vs pass-through.

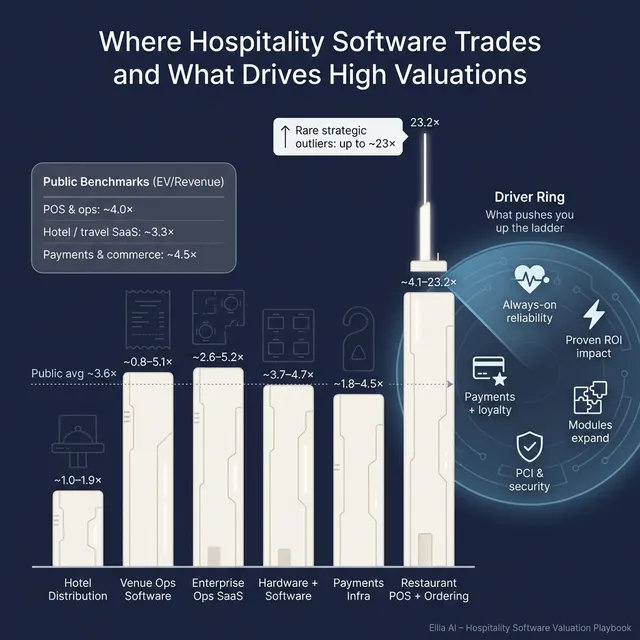

4. What Hospitality Software Businesses Sell For - and What Public Markets Show

Multiples are not a “price list.” They’re a shorthand for how buyers perceive risk, growth, and quality. Still, the data does show clear patterns across hospitality segments.

Below, I’ll break it into (1) private acquisitions and (2) public company trading multiples, then explain how to use both without fooling yourself.

5.1 Private Market Deals (Similar Acquisitions)

Across precedent transactions in this space, the overall average EV/Revenue multiple is ~5.5x (based on the dataset provided). But segment mix matters a lot.

A few practical takeaways from the private deal groupings:

- Restaurant POS and ordering platforms (SaaS) show the widest spread. The median is ~5.0x, but the upper range can explode when a strategic buyer pays for something scarce and mission-critical (especially AI/automation tied to throughput).

- Hotel booking engines and channel managers generally transact at much lower revenue multiples (roughly ~1.0-1.9x in the dataset).

- Venue operations software can be low or moderate depending on how software-heavy and recurring it is (roughly ~0.8-5.1x, with a low median in the dataset).

- Hardware or device-led ecosystems can still achieve meaningful revenue multiples when they include valuable embedded software, distribution power, and lifecycle services (roughly ~3.7-4.7x in the dataset).

A simple way to summarize the private ranges:

These are illustrative ranges, not promises. Where you land depends on your specific growth, margins, retention, and risk profile - and the competitive tension you create in a sale process.

5.2 Public Companies

Public markets provide a “reference band” for what scaled businesses trade at. As of mid-to-end 2025 in the dataset:

- The overall average EV/Revenue is ~3.6x (median ~3.6x).

- For hospitality POS and operations software, average EV/Revenue is ~4.0x (median ~3.1x).

- For hotel distribution and revenue management SaaS, average EV/Revenue is ~3.3x (median ~3.0x).

- For payments infrastructure serving hospitality and retail, the average EV/Revenue is ~4.5x, but the median is much lower (~1.8x), which tells you the category is split between premium platforms and lower-growth, lower-quality businesses.

- Hardware-heavy and services-heavy categories trade much lower on revenue multiples.

Here’s the clean summary founders should internalize:

How to use public multiples correctly:

- Treat them as boundaries and signals, not a direct valuation for your company.

- Private companies are usually adjusted down for smaller scale, less liquidity, higher customer concentration, and higher operational risk.

- But private companies can be adjusted up if they’re scarce strategic assets (for example: a category leader in a niche, or a platform with unusually strong payments economics and retention).

6. What Drives High Valuations (Premium Valuation Drivers)

The patterns behind premium outcomes in hospitality software are remarkably consistent. Buyers pay more when they can confidently say, “This is hard to replace, customers stick, and the economics scale.”

Here are the premium drivers from the dataset, grouped into themes - plus the obvious fundamentals buyers still require.

6.1 Mission-critical operational impact (especially automation)

Buyers pay more when your software measurably improves throughput and service quality - not just reporting.

What “proof” looks like:

- Reduced prep time, fewer order errors, faster table turns.

- Labor savings that are quantified (not “customers say it helps”).

- Clear ROI case studies, ideally with recognizable enterprise or multi-site customers.

6.2 Multi-product expansion and enterprise recurrence

Multi-product hospitality stacks earn premium narratives when expansion is predictable.

What buyers want to see:

- Customers adopting more modules over time (not just buying once).

- Evidence customers “pay more each year” because they expand usage (often called net revenue retention - basically: do existing customers spend more over time?).

- Clear module penetration per account and expansion motion that doesn’t require custom projects.

6.3 Category leadership and enterprise-grade depth

Premium outcomes show up when you’re seen as a leader, not an interchangeable vendor.

Signals that matter:

- Strong installed base in a defined niche or geography.

- Enterprise-grade requirements covered (permissions, reporting, multi-site admin, uptime, support).

- Product depth that reduces buyer fear of churn after acquisition.

6.4 Embedded payments and loyalty monetization

When a platform captures payments and loyalty economics at scale, buyers often underwrite higher value because revenue scales with customer volume.

The “premium version” of this story includes:

- Strong attach rate (customers actually adopt the payments product).

- Evidence of margin contribution and low churn.

- A clean operational risk story (chargebacks, compliance, partner structure).

6.5 Clear synergy value for strategics

Strategic buyers can pay more when they can clearly capture synergies:

- cross-selling your product into their base,

- combining your software with their hardware/payments footprint,

- cost reduction through shared infrastructure.

You don’t need to invent synergy math. But you should be able to describe where it comes from in concrete terms.

6.6 Fundamentals that still matter (even in a “strategic” deal)

Even when buyers love the product, messy fundamentals cap outcomes:

- Clean financials and credible KPIs (growth, retention, gross margin).

- Diversified customer base (or at least a clear plan to reduce concentration).

- A leadership bench that can run the business post-close.

7. Discount Drivers (What Lowers Multiples)

Discount outcomes usually come from buyer fear. Fear that revenue won’t stick, margins won’t improve, or surprises will appear during diligence.

Common discount drivers in hospitality software:

- Low recurring mix or high services dependency. If revenue relies heavily on implementations, custom work, or reseller projects, buyers price it more like a services business.

- Negative or deteriorating profitability without a believable fix. If EBITDA is negative and the path to improvement is vague, multiples compress quickly.

- Weak retention, high churn, or “silent churn.” Hospitality businesses churn for predictable reasons: price sensitivity, poor support, outages, staff turnover, and competitive switching. Buyers want the real story.

- Customer concentration. A single chain can create an outsized risk. Buyers will model downside scenarios.

- Integration fragility. If your product depends on multiple third parties (delivery marketplaces, PMS, payment gateways) and breaks frequently, buyers price in risk.

- Old tech stack and security gaps. Security issues, lack of compliance maturity, or product instability can delay or kill deals.

- Hardware-heavy economics disguised as software. Blended gross margin tells the truth. If margins look like hardware or services, revenue multiples follow.

The good news: many of these are fixable - or at least explainable - in 6-12 months if you prioritize the right work.

8. Valuation Example: A Hospitality Software Company

Let’s apply the logic in a way that’s easy to follow.

Important disclaimers:

- The company below is fictional.

- The USD 10m revenue level is fictional.

- The valuation ranges are illustrative to show how multiples work - not a formal valuation or investment advice.

Step 1: Pick the right “reference bands”

When EBITDA is low or negative, buyers often rely more on EV/Revenue multiples (enterprise value as a multiple of annual revenue). In the dataset:

- Public hospitality POS/ops and travel SaaS businesses cluster in the mid single-digit EV/Revenue range, with lower-quality names closer to ~1x and premium leaders much higher.

- Private deals in restaurant POS and ordering show a very wide range (mid-single-digit is common, with rare strategic outliers much higher).

- For a private company at USD 10m revenue, you generally anchor to the “realistic middle” and then adjust for your strengths and weaknesses.

A practical founder-friendly approach:

- Base case: use a defensible middle band for software-centric hospitality platforms.

- Premium case: add upside if you have clear drivers (payments attachment, strong expansion, proven operational ROI, improving profitability).

- Discount case: compress if growth is slow, churn is high, or EBITDA is materially negative with no clear fix.

Step 2: Apply to a fictional business

Meet HarborOps (fictional):

- USD 10m annual revenue

- Restaurant operations suite (POS + ordering + kitchen + inventory + loyalty)

- 75% gross margin (software-heavy, some support costs)

- Growth 18% year-over-year

- EBITDA margin roughly break-even (0% to -5%)

- Payments product exists but only 35% of customers use it today

Now the scenarios:

Why the core range is wide:In hospitality software, two businesses with the same revenue can be priced very differently based on retention, expansion, payments economics, and margin trajectory.

Step 3: What this means for you

If your business looks like HarborOps, your job isn’t to “argue for a multiple.” Your job is to:

- prove the revenue sticks,

- prove expansion is real (module adoption, locations, payment volume),

- show a believable path to healthy EBITDA.

That’s what moves you from the low end to the high end - even if revenue stays the same.

9. Where Your Business Might Fit (Self-Assessment Framework)

This is a simple tool to get honest about where you are today.

Score each factor 0 / 1 / 2:

- 0 = weak or unclear

- 1 = acceptable but not strong

- 2 = strong and provable with data

How to interpret your total:

- High band: You’re closer to premium outcomes (if you run a competitive process).

- Middle band: You’re in fair-market territory - you can still get a strong result, but you need crisp positioning and risk cleanup.

- Low band: You may be leaving value on the table by selling too soon. Focus on the highest-impact fixes first.

The point isn’t to chase a perfect score. It’s to identify which 2-3 improvements could change buyer perception the most.

10. Common Mistakes That Could Reduce Valuation

These are painful because they’re avoidable.

1) Rushing the saleIf you start a process before your numbers and story are tight, the market will sense it. Buyers will slow-roll you, discount you, or demand unfavorable terms.

2) Hiding problemsEvery deal has issues. What kills value is not the issue - it’s the loss of trust when it surfaces during diligence. A clean explanation and a plan beats a surprise every time.

3) Weak financial recordsMany hospitality software businesses can improve reporting quickly:

- clearer recurring vs services revenue breakdown,

- gross margin by product line,

- churn and expansion tracking,

- implementation profitability and backlog tracking.

If buyers can’t understand the business from your numbers, they price in risk.

4) Not running a structured, competitive process (often with an advisor)A structured process typically drives meaningfully better pricing because it increases competition, creates deadlines, and improves leverage. A common rule of thumb in the industry is that competitive, advisor-led processes can produce purchase prices that are materially higher - often in the ~25% range versus one-off negotiations - because buyers reveal their true willingness to pay when they know they can lose the deal.

5) Revealing what price you’re after too earlyIf you tell buyers you want “USD 10m,” don’t be surprised when offers cluster around USD 10.1m and USD 10.2m. You killed price discovery. Your goal is to let the market tell you what the business is worth - then negotiate.

A hospitality-specific trap: treating implementation and support as “just costs.”In this sector, implementation time and support load are core product attributes. If onboarding takes forever or support is overloaded, buyers will assume churn risk and margin pressure.

11. What Hospitality Software Founders Can Do in 6-12 Months to Increase Valuation

You don’t need a reinvention. You need a focused plan that improves what buyers already care about.

11.1 Improve the numbers buyers underwrite

- Reduce churn (or explain it cleanly). Break churn into buckets: closures, switching, pricing, product gaps. Show what you’re fixing.

- Increase recurring mix and margin clarity. Separate software margin from services/hardware margin so buyers see the scalable core.

- Make EBITDA trajectory believable. Even a modest move toward profitability changes the buyer set and the multiple logic.

11.2 Prove your “stickiness” and expansion

- Track and present:

- cohort retention (do customers stay?),

- expansion (do they add modules/locations?),

- adoption of key workflows (kitchen, ordering, reservations).

- Build 3-5 concrete ROI case studies with numbers:

- table turn improvements,

- labor savings,

- fewer order errors,

- higher direct booking share (for hotels),

- reduced overbooking.

11.3 Build (or tighten) your payments and loyalty story - if relevant

- Improve attach rate through packaging and sales motion, not just “we offer payments.”

- Clarify the operational risk story:

- chargebacks,

- compliance,

- partner dependencies,

- revenue recognition and margin contribution.

- Show how payments economics scale without creating operational chaos.

11.4 Reduce buyer fear in diligence

- Clean up contracts: renewal terms, pricing escalators, and assignment clauses.

- Document security posture and uptime history.

- Reduce key-person risk: build a leadership bench and document critical processes.

11.5 Prepare your sale narrative like a product launch

- Write the story in buyer language:

- “Why customers choose us”

- “Why they stay”

- “What expands”

- “What improves margins over time”

- Make sure your story is backed by data, not vibes.

12. How an AI-Native M&A Advisor Helps

A strong hospitality software exit usually comes down to two things: reaching the right buyers and running a process that keeps leverage on your side. AI-native advisory improves both.

Higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, synergies, and financial capacity. More relevant buyers means more competition, stronger offers, and fewer “single-buyer” dead ends. It also increases the chance the deal closes because you have options if one buyer drops.

Initial offers in under 6 weeks. AI-driven buyer matching and connecting, faster creation of process materials, and structured diligence support can compress timelines. That means you get to real conversations and initial indications of interest much faster than manual outreach alone.

Expert advisory, enhanced by AI. You still want experienced humans driving strategy, positioning, and negotiation. The AI layer strengthens the process: sharper buyer targeting, better materials, cleaner diligence workflows, and “Wall Street-grade” preparation - without traditional bulge-bracket costs.

If you’d like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.