The Complete Valuation Playbook for HR Tech Businesses

If you’re planning to sell your HR tech business in the next 1–12 months, this playbook shows what buyers actually pay and how to boost your multiple by proving durable, mission-critical revenue.

If you are thinking about selling your HR tech business in the next 1-12 months, valuation is not just a math exercise - it is a negotiation about risk, growth, and how “mission-critical” your product feels to a buyer.

HR tech is also in a moment where consolidation is real: large suites want more modules, payroll and compliance buyers want stickier workflows, and private equity keeps looking for predictable subscription revenue. This playbook is designed to help you turn that reality into a better outcome.

You’ll learn what HR tech businesses actually sell for (based on real transactions and public market data), what drives higher vs lower multiples, and how to quickly self-assess where you sit - plus a practical 6-12 month plan to move up the range.

1. What Makes HR Tech Unique

HR tech looks like “software,” but buyers do not value every HR software business the same way. The sector includes several very different business models, each with its own valuation logic:

- Core HR suites (HRIS, onboarding, payroll, benefits, compliance) - usually subscription SaaS, sometimes with implementation.

- Workforce management (time, attendance, scheduling, rostering) - often sticky, sometimes hardware-adjacent, sometimes services-heavy.

- Talent acquisition tech (ATS, matching, recruiting workflows) - can be SaaS, but demand is more cyclical and competitive.

- Employee experience, learning, wellbeing - can be fast-growing, but outcomes vary wildly depending on scale and proof of ROI.

- Marketplaces, job boards, staffing and outsourcing - often lower multiples because revenue can be cyclical, lower margin, and less recurring.

Three sector-specific valuation considerations show up again and again:

- Regulatory and compliance risk is not optional. Payroll accuracy, labor law changes, data privacy, and audit trails are not “nice to have.” Buyers price in the cost (and risk) of getting this wrong.

- Switching costs matter - but buyers want proof. HR systems touch employee data, approvals, workflows, and integrations. That should create stickiness. In practice, buyers pay up only when you can demonstrate retention, expansion, and low churn.

- Implementation can quietly dominate the economics. Many HR tech businesses are “SaaS + services.” If services are required to go live, buyers will look hard at scalability, delivery margins, and whether growth depends on adding headcount.

Key risks buyers will always check in HR tech:

- Data security and privacy (employee PII, SOC2/ISO readiness, breach history)

- Payroll and compliance reliability (error rates, penalties, auditability)

- Integration dependency (HRIS, accounting, identity, benefits providers)

- Customer concentration (a few big logos can hide fragile revenue)

- Churn drivers (does churn spike after price increases, renewals, or leadership changes?)

2. What Buyers Look For in an HR Tech Business

Most buyers - strategic acquirers and private equity - are trying to answer the same question:

“If we own this business, will revenue keep showing up next year and can we grow it faster than the market?”

They typically focus on:

- Revenue quality

- Subscription vs usage vs services

- Annual contracts vs monthly

- Retention and expansion (customers sticking around and paying more)

- Growth profile

- Is growth repeatable, or dependent on a few partners, a founder, or one channel?

- Are you winning in a clear segment (SMB, mid-market, enterprise, frontline, regulated industries)?

- Profitability and path to profitability

- Gross margin and how much of delivery is human labor

- Whether the cost base is “repeatable” (software) or “variable” (services)

- Product criticality

- Payroll, compliance, scheduling, and background screening often feel more “must-have” than “nice-to-have.”

- Buyers pay more when your product is tied to risk reduction, regulatory need, or operational continuity.

- Durability of differentiation

- HR tech is crowded. Buyers look for why you win: workflow depth, integrations, domain expertise, compliance coverage, or a distribution advantage.

How private equity tends to think

Private equity (PE) usually cares less about the story and more about the plan:

- Entry multiple vs exit multiple

- They buy at one multiple today and aim to sell at an equal or higher multiple in 3-7 years.

- The fastest way to lose value is to buy a business that looks great today but is hard to sell later (weak retention, weak margins, no clear category).

- Who they can sell to later

- A larger PE fund, a strategic acquirer (suite buyer), or occasionally public markets.

- PE loves HR tech when it resembles “infrastructure software” - sticky, predictable, and scalable.

- Levers they expect to pull

- Price increases (if value is clear and churn is low)

- Cross-sell new modules into the installed base

- Improve sales efficiency (repeatable pipeline, clearer ICP)

- Reduce services dependency, improve delivery margin

- Add integrations or compliance coverage that expands addressable market

3. Deep Dive: Why “Suite Breadth” Only Matters If It Improves Retention

In HR tech, founders often assume: “We have more modules, so we should be worth more.” Buyers like suite breadth - but the deal data shows they do not automatically pay for it.

The premium driver is not “more features.” It is suite breadth that creates measurable switching costs and expansion:

- Customers adopt module 1, then add module 2 and 3 over time.

- That raises net retention (customers pay more each year) and lowers acquisition cost (you grow by upselling, not constantly hunting new logos).

But the transactions in the dataset show a warning: suite-like HR platforms can still trade at modest revenue multiples when buyers do not see proof of durable growth, strong recurring gross margins, and retention.

Here is the practical takeaway:

How to move from left to right in 6-12 months:

- Instrument module adoption: show what % of customers use each module and how adoption correlates with churn and expansion.

- Package cross-sell offers: make it easy to add modules with clear pricing and outcomes (not custom quotes every time).

- Prove expansion: even a small cohort where customers expand spend over 6-12 months can change the buyer narrative.

- Reduce “professional services drag”: standardize onboarding, templates, and integrations so growth is less headcount-dependent.

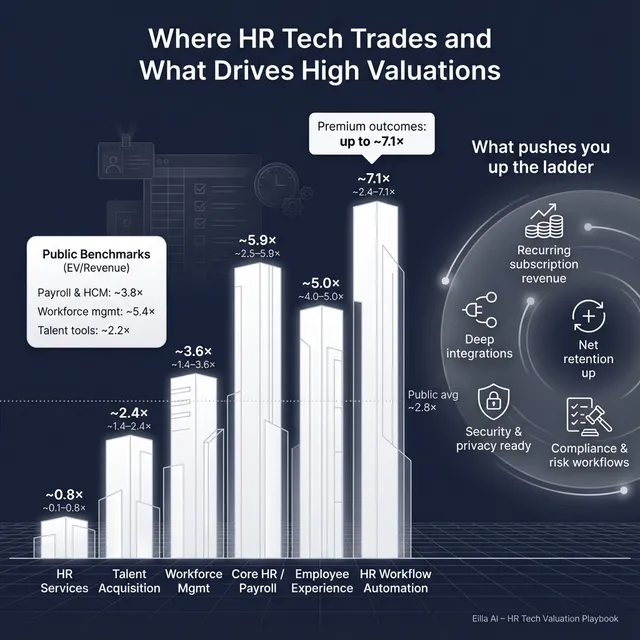

4. What HR Tech Businesses Sell For - and What Public Markets Show

This section is the heart of valuation reality: private deals set the “what buyers will actually pay” baseline, and public markets set the “ceiling and reference band.”

HR tech is not one market. Multiples vary sharply by subsector and by revenue quality.

4.1 Private Market Deals (Similar Acquisitions)

From the precedent transactions provided, a few clear patterns appear:

- Core HR suites (HRIS/payroll/onboarding) SaaS tends to transact in a mid-single-digit revenue multiple band, with outcomes influenced by scale, growth, and how “subscription-like” the revenue is.

- Talent acquisition software tends to be lower, reflecting competition and hiring-cycle sensitivity.

- Workforce compliance and monitoring can be attractive strategically, but the data shows buyers still want proof of recurring revenue and growth before paying “true premium” multiples.

- Services-heavy HR providers tend to trade much lower on revenue multiples.

Illustrative private EV/Revenue ranges from the dataset:

Two important interpretation rules:

- These are illustrative ranges, not a pricing promise. Your specific retention, growth, margins, and deal tension matter more than the category label.

- Some subsectors show outliers (especially where revenue is extremely small). Buyers do not underwrite “headline multiples” without context.

4.2 Public Companies

Public market multiples are a useful compass - but they are not your price tag. Public companies are larger, more diversified, and often have stronger distribution. Private companies typically trade at a discount unless they have scarce strategic value.

As of mid to late 2025, the public HR tech landscape (group averages) shows:

How to use public multiples correctly:

- Treat them as an upper and lower reference band, not a direct valuation.

- Adjust down for smaller scale, higher concentration, weaker margins, weaker retention, or services-heavy delivery.

- Adjust up only when you have something scarce: category leadership in a niche, unique compliance coverage, exceptional retention, or a distribution advantage a buyer can monetize.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes in HR tech usually come from one thing: buyers believe the revenue is durable and will grow without heroic effort.

Based on the observed premium drivers in the dataset (and what buyers consistently reward in HR tech), here are the themes that move you toward the top end.

5.1 Suite breadth that actually drives expansion

A broad modular suite across the employee lifecycle can matter when it increases:

- Switching costs (harder to rip out)

- Cross-sell (customers adopt more modules over time)

- Net retention (customers pay more each year)

Buyer-friendly proof points:

- A clean story on module adoption and attach rates

- Expansion revenue that is not “one-off services”

- Clear packaging that makes upsell repeatable

5.2 Compliance, monitoring, and “risk workflows” that are structurally demanded

Compliance and screening platforms can be strategically valuable because:

- They tie to mandated processes and risk reduction

- Switching costs can be high (audit trails, workflow embedding)

- They can create recurring volumes even when not pure SaaS

But the data shows a nuance: “compliance” alone does not guarantee a premium multiple. Buyers pay up when compliance is paired with:

- Demonstrable recurring revenue structure

- Scale and retention

- Clear buyer synergies (distribution and cross-sell)

5.3 Proof of scale and an engaged user base

User base scale can signal distribution leverage, especially in HR where product spread inside customers matters.

Buyers pay more when “users” translates into monetization:

- Higher revenue per account over time

- Higher attach rates across modules

- Lower churn as adoption rises

5.4 A credible case for “normalized earnings”

Sometimes buyers will underwrite value even when current EBITDA looks weak - if they believe earnings are temporarily depressed (investment phase, one-time costs) and can normalize.

For you, the key is credibility:

- Show a clear margin bridge: what changes, how, and why it is repeatable

- Separate one-time costs from ongoing costs

- Avoid hand-waving - buyers will test this hard

5.5 Deal structure that supports upside (earn-outs and deferrals)

Earn-outs and deferred payments show up in HR tech deals when buyers see upside or uncertainty.

Important nuance: they are not automatically “good.” They can mean:

- Buyer believes in upside and wants alignment, or

- Buyer sees risk and wants protection

The difference is your ability to prove predictable growth and retention.

5.6 The fundamentals that always matter

Even in a hot category, premium outcomes are hard without:

- Clean financials and consistent reporting

- Predictable subscription revenue and renewals

- Diversified customer base

- A leadership bench beyond the founder

- A product roadmap buyers trust (and customers pull forward)

6. Discount Drivers (What Lowers Multiples)

Lower multiples are rarely about one fatal flaw. They are about risk stacking: a buyer sees multiple reasons revenue might not hold up.

Common discount drivers in HR tech:

- Too much services in the revenue mix

- If growth requires hiring more implementation or support staff, buyers apply a “services multiple,” not a SaaS multiple.

- Weak retention or unclear churn

- If you cannot clearly explain churn by cohort, segment, and reason, buyers assume the worst and price it in.

- Customer concentration

- A few large accounts can feel great - until a buyer asks what happens if one leaves.

- Concentration also weakens negotiating leverage in diligence.

- Revenue that is tied to hiring cycles

- Talent acquisition products can be great businesses, but buyers discount cyclicality unless you have clear counter-cyclical value or diversified use cases.

- Integration fragility

- If your product depends on one partner integration, one channel partner, or one data source, buyers price in dependency risk.

- Security and compliance gaps

- In HR tech, diligence will go deep on security, privacy, access controls, and auditability.

- “We will fix it later” often becomes a price chip.

- Founder dependence

- If sales, delivery, key accounts, and product direction all run through you, buyers worry growth stalls post-close.

Each discount driver is fixable - but only if you address it before you launch a sale process.

7. Valuation Example: A Fictional HR Tech Company

This example is designed to show the logic - not to predict your valuation. The company and numbers are fictional.

Step 1: The logic (how you build a realistic multiple range)

For a mid-sized B2B HR software company (not staffing, not a job board), revenue multiples are commonly used as the anchor.

A practical approach:

- Start with the closest private comps for core HR suites (roughly ~2.5x-5.9x EV/Revenue in the dataset).

- Sanity check against public HCM SaaS leaders (which trade higher on revenue because of scale) and regional software peers (often lower-mid range).

- Choose a defensible core range for a 10m revenue, mid-market HR suite.

- Adjust up or down based on premium drivers (retention, expansion, recurring mix, compliance value, scale) and discount drivers (services mix, churn, concentration, dependency risk).

In the provided worked logic, a reasonable core band for a 10m revenue, regional HR suite business lands around:

- ~2.7x-4.5x revenue as a defensible base range

- Up to ~5.0x as a stretch case if metrics are strong

- Downside bounded by lower-quality software or services-like profiles

Step 2: Apply it to the fictional company

Fictional company: “NorthbridgeHR”

- USD 10m annual revenue (fictional)

- Mid-market HRIS + onboarding + basic payroll integrations

- 88% subscription, 12% implementation services

- Solid product, but not a category-defining unicorn

- Reasonable retention, improving sales efficiency

Illustrative valuation scenarios:

What would push NorthbridgeHR into the premium case?

- Strong net retention (customers expanding spend)

- Low churn with clear cohort data

- High gross margin subscription revenue

- Proof that services are optional or shrinking as a % of revenue

- A compelling compliance or risk workflow angle that feels “must-have”

What would push it into the discounted case?

- Services-heavy onboarding required for every deal

- Weak retention or unclear churn drivers

- Customer concentration

- Security/compliance gaps that create diligence risk

Step 3: What this means for you

Two HR tech businesses can both do USD 10m revenue and have wildly different outcomes because buyers are not paying for revenue - they are paying for durable, growing revenue with manageable risk.

This is not investment advice and not a formal valuation. It’s a worked example to help you understand the mechanics buyers use.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this to get a rough sense of whether you are closer to the low end, middle, or high end of HR tech valuation ranges.

Score each factor:

- 0 = weak / unclear

- 1 = okay / improving

- 2 = strong / proven

How to interpret your total:

- High band: You are closer to premium outcomes - focus on running a tight process and widening buyer reach.

- Mid band: You can get a fair market outcome, but a few improvements can materially change offers.

- Low band: Consider whether a 6-12 month prep plan could lift value more than selling now.

The point is not perfection. The point is identifying the 2-3 factors with the biggest payoff.

9. Common Mistakes That Could Reduce Valuation

9.1 Rushing the sale

If you sprint into market without clean numbers, retention data, and a crisp story, buyers fill the gaps with risk assumptions - and risk assumptions lower price.

9.2 Hiding problems

In diligence, issues surface. When buyers discover you hid something (churn, a security incident, customer losses, messy revenue recognition), trust breaks and value drops fast - sometimes the deal dies.

9.3 Weak financial records

This is fixable in 6-12 months more often than founders think:

- Clean subscription vs services revenue reporting

- Consistent gross margin reporting by product line

- Clear churn and retention metrics

- A believable forecast with assumptions buyers can test

9.4 Not running a structured, competitive process with an advisor

A structured process creates competition. Competition creates better terms, not just higher price.There’s also well-known research and market experience suggesting that running a competitive, advisor-led process can lead to meaningfully higher outcomes (often cited around 25% higher purchase prices) because it improves positioning, buyer coverage, and negotiation leverage.

9.5 Revealing the price you want instead of letting the market bid

If you say “we want USD 10m,” many buyers will anchor around it - USD 10.1m, USD 10.2m - rather than showing what they might have paid in a competitive process.

9.6 HR tech-specific mistake: treating security and privacy as paperwork

In HR tech, security is valuation. If you wait until diligence to assemble policies, access controls, and audit trails, you invite discounts, holdbacks, or extended timelines.

9.7 HR tech-specific mistake: unclear services economics

If implementation is required, buyers want to know:

- How long it takes

- How many people it requires

- Whether margins improve with scaleIf you cannot show this clearly, buyers assume it is a bottleneck.

10. What HR Tech Founders Can Do in 6-12 Months to Increase Valuation

Think of this as “build evidence” more than “build hype.”

10.1 Improve the numbers that buyers trust most

- Reduce churn and document why it improved

- Even small improvements matter if you can show it by cohort and segment.

- Increase expansion revenue

- Package add-on modules and track attach rates.

- Improve gross margin

- Reduce custom work, standardize onboarding, tighten support workflows.

- Separate SaaS vs services cleanly

- Make it easy for a buyer to see the subscription engine.

10.2 Reduce buyer-perceived risk

- Security readiness

- SOC2/ISO progress, access controls, incident response, vendor risk management.

- Compliance confidence

- Payroll accuracy, audit trails, and clear responsibility boundaries if you integrate third-party payroll rails.

- De-risk dependencies

- Backup integrations, multi-channel pipeline, documented partner terms.

10.3 Make growth feel repeatable

- Tighten your ideal customer profile (ICP) and show win rates by segment.

- Build a simple, believable sales story: “we win because of X, and we can repeat it.”

- Shorten time-to-value with templates, integrations, onboarding playbooks.

10.4 Build a sale-ready narrative and data room

- A clean KPI pack: revenue mix, retention, churn, expansion, cohort analysis.

- A product roadmap that buyers believe is realistic.

- Customer references aligned to the buyer’s likely thesis (compliance, scale, cross-sell, enterprise readiness).

11. How an AI-Native M&A Advisory Helps

A strong HR tech exit is often less about “finding a buyer” and more about finding the right set of buyers and getting them to compete. That is where an AI-native approach can change outcomes.

Higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, product adjacency, synergies, and financial capacity. More relevant buyers means more competition, better terms, and a higher chance the deal closes if one buyer drops out.

Initial offers in under 6 weeks. AI-driven buyer matching and connecting, faster creation of marketing materials, and better diligence support can compress timelines dramatically compared to manual-only outreach.

Expert advisory, enhanced by AI. The best outcomes still require experienced M&A judgment - positioning, negotiation, and credibility with acquirers. The AI-native model pairs that human expertise with speed and coverage, aiming to deliver Wall Street-grade process quality without traditional “bulge bracket” costs.

If you’d like to understand how our AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.