The Complete Valuation Playbook for HVAC Services Businesses

A data-driven valuation playbook for HVAC services founders - what similar companies sell for, what drives multiples up or down.

If you’re running a privately held HVAC services business and thinking about a sale in the next 1-12 months, valuation is not just a math problem - it’s a “how do buyers see risk and future cash flow?” problem.

This playbook is built for HVAC services founders: it shows what similar businesses have sold for, what public markets imply, what pushes multiples up or down, and how to take practical steps in the next 6-12 months to improve your outcome. (All ranges are illustrative, not a formal valuation or investment advice.)

1. What Makes HVAC Services Businesses Unique

Most HVAC services businesses are a mix of a few revenue “engines,” and buyers value each one differently:

- Project work: design-build installation, replacements, retrofits, new construction.

- Service work: break/fix, emergency response, on-call labor.

- Maintenance contracts: planned preventive maintenance, compliance checks, multi-site agreements.

- Specialty niches: data center/server room cooling, filtration/indoor air quality, humidity control, regulated environments.

What’s unique about HVAC services valuation is that buyers aren’t just buying your trailing revenue - they’re buying the repeatability of your future gross profit.

Unique valuation considerations in HVAC services

- Recurring vs one-time mix matters a lot. A dollar of maintenance revenue is usually “worth more” than a dollar of one-off install revenue because it’s more predictable.

- Labor capacity is the constraint. If the business depends on a small number of key technicians or the founder, buyers see concentration risk.

- Working capital and cash flow timing can swing results (project billing, change orders, retention, seasonality, warranty reserves).

- Compliance and safety are not optional. If you have regulatory exposure (especially in commercial, public sector, or safety-driven environments), buyers will diligence it hard.

Key risks buyers always check

- Customer concentration (one property manager, one GC, one public sector client)

- Technician churn and recruiting pipeline

- Job costing discipline (do you actually know which jobs make money?)

- Warranty/claims history and callback rates

- Dependence on the founder to sell, estimate, or run ops

2. What Buyers Look For in an HVAC Services Business

Buyers (strategic acquirers and private equity) usually pay more when they believe they’re buying a system, not just a crew.

The “obvious” stuff still matters

- Scale (revenue size and ability to add branches or crews)

- Growth rate (is demand growing in your footprint and segments?)

- Profitability (EBITDA margin) and consistency through seasons

- Clean financials (separation of personal expenses, consistent reporting)

HVAC-specific nuances buyers care about

- Service agreement penetration: how much revenue is under contract vs “call us when it breaks”

- Dispatch and response performance: speed, first-time fix rates, callback rates

- Customer type mix: residential replacement vs commercial service vs industrial/specialty

- Pricing power: do you push annual price increases, trip fees, after-hours rates?

- Permitting, licensing, safety record: especially relevant in commercial/industrial

How private equity thinks about your business (in plain English)

PE is usually underwriting two things:

- Entry price vs exit price: if they buy at (say) 7-9x EBITDA, can they sell at 8-10x in 3-7 years?

- Operational improvements they can reasonably execute:

- Increase maintenance contract base

- Improve dispatch efficiency and technician utilization

- Standardize pricing and reduce unprofitable work

- Add bolt-on acquisitions to expand footprint

- Who buys it next: a larger strategic, a bigger PE fund, or a national platform.

This is why “platform potential” (repeatable process + strong management bench) can matter almost as much as today’s margin.

3. Deep Dive: Recurring Service Contracts vs Project-Based Revenue

Here’s the uncomfortable truth buyers rarely say plainly: project revenue is often treated as less reliable unless it’s backed by repeat customers and strong job-level data.

Why this matters:

- HVAC project work can be lumpy and sensitive to construction cycles.

- Maintenance contracts create a “base load” of predictable work and can feed replacement and retrofit sales.

- Buyers will pay more when they believe next year’s revenue is already “in motion.”

How it shows up in the data and buyer behavior:

- In HVAC services deals, revenue multiples tend to cluster around sub-1.0x to ~1.0x revenue for many services-heavy contractors, with better outcomes when the model looks repeatable and contract-like (more on ranges in Section 5). Your “recurring share” is one of the biggest reasons two similar-sized HVAC firms sell for very different prices.

How to move from the lower-value version to the higher-value version:

- Build service agreements into every install and replacement workflow (default, not optional).

- Report retention like a subscription business: renewal rate, churn, expansion (more sites, more assets).

- Productize maintenance tiers (good/better/best) with clear deliverables and pricing.

Mini-table - what buyers mean by “higher quality revenue”:

4. What HVAC Services Businesses Sell For - and What Public Markets Show

Valuation in this sector is often triangulated using:

- Private M&A multiples (what similar companies were acquired for)

- Public market multiples (what larger, diversified peers trade at)

- A reality check for size, risk, and repeatability

The key is interpretation: public markets can set a “ceiling,” but private deals reflect what buyers actually pay for businesses your size.

4.1 Private Market Deals (Similar Acquisitions)

In the precedent deals for HVAC services businesses focused on design, installation, maintenance, and compliance, the group averages imply:

- EV/Revenue: around 0.8x average and 1.0x median

- EV/EBITDA: around 7.7x average and 7.1x median

And when EBITDA was disclosed in several services-oriented deals, the observed EV/EBITDA outcomes often landed in the mid-to-high single digits up to ~10x - typically when the business looked predictable and “plug-in” for the acquirer.

A simple way to think about it: most HVAC services outcomes are driven by EBITDA quality, but because many smaller firms don’t present clean EBITDA at first pass, revenue multiples are often used as a practical shortcut.

Two important warnings from the data:

- There are extreme outliers in HVAC-adjacent transactions that are likely driven by unique IP or data reporting anomalies (for example, currency/unit mismatches) - don’t anchor your expectations to outliers without verifying the underlying numbers.

- Deal structure matters: earn-outs and deferred payments can make a headline multiple look better than the cash you actually receive.

4.2 Public Companies

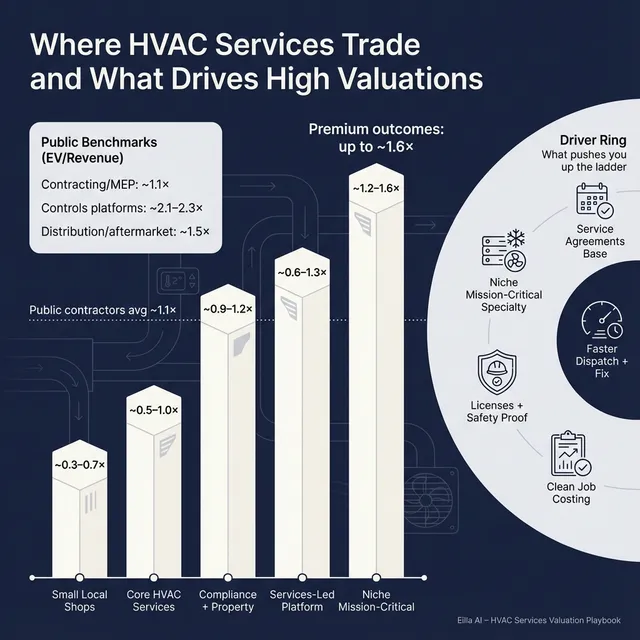

Public multiples (as reflected in the sector dataset used here, broadly aligned with mid-to-end 2025 public market conditions) show wide dispersion by business model:

- HVAC contracting, installation & MEP services: about 1.1x average EV/Revenue and 0.6x median, with ~11.1x average EV/EBITDA and ~7.6x median.

- Building automation, controls & smart HVAC platforms: higher on revenue (about ~2.1x-2.3x EV/Revenue) with ~15x EV/EBITDA, reflecting more technology and product-like economics.

- Distribution, rental & aftermarket sits in between at about ~1.5x EV/Revenue on average, with EBITDA multiples that vary depending on mix.

How to use public multiples correctly:

- Treat them as a reference band, not a price tag.

- Smaller private firms typically see a discount for size, customer concentration, and reliance on a few people.

- You can sometimes earn a premium if you have scarce niche capability (e.g., mission-critical cooling) that a strategic buyer urgently needs - especially as data center cooling demand rises.

5. What Drives High Valuations (Premium Valuation Drivers)

Below are the premium drivers that show up across HVAC services and HVAC-adjacent deals - grouped into themes you can act on.

5.1 Strategic buyer fit - you “fill a gap”

Buyers pay more when acquiring you immediately expands their capability:

- New geography (they can add your branch network)

- New customer channel (property management, multi-site retail, healthcare)

- New specialty (mission-critical environments)

In the deal data, strategic fit outcomes vary widely depending on whether the target brings something truly scarce (unique capability, differentiated tech, or hard-to-build contracts) versus “more of the same.”

5.2 Niche specialization with proof, not slogans

Specialized HVAC services (data center/server room cooling, filtration, humidity control) can attract premium interest when you can show:

- Real engineering depth and certifications

- Repeat customers and multi-year service agreements

- Strong unit economics (high margin per technician hour)

This is especially relevant as data center-related HVAC demand has become a visible growth driver.

5.3 Platform appeal - buyers can build on you

Financial sponsors often look for a “platform” they can grow through add-on acquisitions and shared systems. In the dataset’s premium-driver commentary, recurring contract revenue and footprint matter because it supports consolidation playbooks.

In human terms: they want a company that can absorb other small shops without breaking.

5.4 High-quality EBITDA - predictable and accretive

Even when revenue multiples are modest, buyers care deeply about whether your EBITDA is:

- Real (not accounting noise)

- Repeatable

- Likely to improve post-close

If your service mix is higher-margin and you can document it cleanly, you give buyers confidence to pay toward the top of the range.

5.5 “Bankable” operations - fewer surprises in diligence

These are boring, but they move price:

- Clean financial statements and clear add-backs

- Strong KPIs (service agreement renewal, technician utilization, job gross margin)

- A leadership bench beyond the founder

- Low customer and supplier concentration

6. Discount Drivers (What Lowers Multiples)

Most discounts are not about “bad businesses” - they’re about uncertainty and transferability.

Common HVAC services discount drivers:

- Founder dependence: you sell every job, price every job, resolve every dispute.

- Low recurring mix: revenue resets to zero each month.

- Weak job costing: buyers can’t tell what’s actually profitable.

- Customer concentration: one GC, one facilities contract, one landlord.

- Labor fragility: key technicians could leave; no recruiting engine.

- Messy working capital: large unbilled WIP, disputed receivables, inconsistent billing.

- Compliance gaps: licensing, safety record, documentation weaknesses.

And a big one many founders underestimate:

- “We can’t produce clean monthly financials.” If buyers can’t trust the numbers, they price that risk in immediately (or demand earn-outs that shift risk back to you).

7. Valuation Example: A HVAC Services Company

This is a worked example to show the logic. The company and numbers are fictional. The valuation ranges are illustrative - not a formal valuation.

Step 1 - Start with the most relevant comp “bands”

For a services-led HVAC contractor (not an OEM, not a software platform), the most relevant bands in the provided valuation logic cluster around:

- ~0.6x-1.3x EV/Revenue (practical peer band)

- A tighter “base” range often used for small regional services businesses: ~0.7x-1.2x EV/Revenue

That’s consistent with:

- Private HVAC services transaction outcomes clustering around sub-1.0x to ~1.0x revenue (and mid-to-high single digit EBITDA multiples)

- Public services contractors often trading at sub-1.0x revenue unless they’re scaled and diversified

Step 2 - Apply it to a fictional company (USD 10m revenue)

Fictional company: NorthPeak Mechanical ServicesRevenue: USD 10.0m (fictional)Profile (fictional but realistic):

- 60% maintenance/service agreements, 40% install/retrofit

- Commercial focus (multi-site light industrial + healthcare)

- Documented job costing, low callbacks, strong safety record

- EBITDA margin: ~9% (so ~USD 0.9m EBITDA)

Now three scenarios:

How this ties back to EBITDA:

- In the base case (USD 7-12m EV) with ~USD 0.9m EBITDA, you’re roughly in the neighborhood of ~8x-13x EBITDA. That’s not a promise - it’s a reminder that your multiple depends heavily on how confident buyers are that EBITDA is real and sustainable.

Step 3 - What this means for you

Two HVAC businesses with the same USD 10m revenue can be worth very different amounts because buyers are really buying:

- How repeatable the revenue is

- How transferable the operations are

- How confident they are in the margins

This is why the next section (self-assessment) matters more than memorizing “the multiple.”

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as a simple, honest tool. Score each item:

- 0 = not true today

- 1 = partially true / inconsistent

- 2 = clearly true and documented

How to interpret your total (rough guide):

- Top band: you’re closer to premium outcomes (buyers see repeatability + low risk)

- Middle band: fair-market outcomes (good business, but some transfer risk)

- Lower band: likely discounted outcomes unless you address the biggest red flags first

The goal isn’t a perfect score. It’s identifying the 2-3 changes that most improve buyer confidence.

9. Common Mistakes That Could Reduce Valuation

9.1 Rushing the sale

If you start a sale process before your numbers, KPIs, and story are ready, buyers will control the narrative. That usually means more discounting, more earn-outs, and more “we’ll decide later” terms.

9.2 Hiding problems

Every business has problems. The issue is trust: if buyers discover issues late (tax, safety, margin instability, customer loss), they re-trade price or walk.

9.3 Weak financial records

In HVAC services, “close enough” bookkeeping is common - and costly during a sale. The fix is often achievable in 6-12 months:

- monthly financials that tie out

- job costing that matches reality

- clear add-backs and owner comp normalization

9.4 No structured, competitive sale process

A structured process creates competition. Competition creates price discovery.

Market education sources regularly cite that using sell-side advisors and running a competitive process can increase sale price outcomes, often described in the mid-single digits up to ~25% range in the lower middle market. And finance training materials consistently note that auction-like processes often drive higher purchase prices than one-off negotiated sales.

9.5 Revealing your “number” too early

If you tell buyers you want “USD 10m,” many will anchor just above it instead of offering what they’d pay in a competitive environment. You’re doing their negotiating for them.

9.6 HVAC-specific mistake - not proving service agreement quality

Many founders say “our customers always call us.” Buyers want proof:

- renewal rates

- contract terms

- attach rates after installs

- response times and performance SLAs

10. What HVAC Services Founders Can Do in 6-12 Months to Increase Valuation

Think of this as three workstreams: improve the numbers, reduce perceived risk, and sharpen the story.

10.1 Improve the numbers buyers price

- Increase service agreement penetration (make it the default offer)

- Fix job costing and make it a weekly operating rhythm

- Tighten pricing: trip charges, after-hours, minimums, annual increases

- Reduce callbacks (they quietly destroy margin and confidence)

10.2 Reduce diligence friction (and buyer fear)

- Produce clean monthly financials within 10-15 days of month-end

- Document compliance: licenses, safety training, incident logs

- Build a hiring pipeline and show technician retention metrics

- Reduce customer concentration where possible (even modestly helps)

10.3 Build a “transferable” company

- Train a GM/ops lead who can run day-to-day

- Document how estimates are priced and approved

- Standardize vendor relationships and rebate programs

- Show a repeatable go-to-market motion (not just “relationships”)

10.4 Upgrade your deal narrative

Buyers don’t pay for potential - they pay for credible proof. Package:

- where growth comes from (retrofit demand, IAQ, compliance, multi-site)

- why you win (speed, uptime, specialization, contract structure)

- why margins are sustainable (process, pricing, utilization)

11. How an AI-Native M&A Advisor Helps

The biggest driver of sale outcomes is usually not the first valuation conversation - it’s how many qualified buyers see the deal, and how well the story and data hold up under pressure.

An AI-native M&A advisor can expand buyer reach dramatically by identifying hundreds of relevant acquirers based on deal history, synergy fit, financial capacity, and strategy. More relevant buyers usually means more competition, stronger offers, and more backup options if one buyer drops late in the process.

AI also compresses timelines. With AI-assisted buyer matching, outreach, marketing materials, and diligence support, many sellers can get to initial conversations and early offers far faster than manual-only processes - often in under 6 weeks.

And it doesn’t replace humans - it upgrades them. You still want experienced M&A advisors running strategy, positioning, negotiations, and process control, with credibility that buyers respect - but with AI doing the heavy lifting on coverage, speed, and execution quality.

If you’d like to understand how an AI-native process can support your HVAC services exit, book a demo with one of Eilla AI’s expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.