The Complete Valuation Playbook for Inventory Management Software Businesses

A practical guide to valuing inventory management software companies - with multiple ranges, key value drivers, and a clear plan to raise your outcome before selling.

If you run an inventory management software business and you are thinking about selling in the next 1-12 months, you are not alone. This corner of software keeps consolidating because inventory sits at the intersection of cash, customer experience, and operational chaos - and buyers know that once a tool becomes “the system of record,” it is hard to replace.

This playbook is built to be practical and data-driven. It will show what similar businesses sell for, decode what pushes multiples up or down, and give you a simple self-assessment plus a concrete 6-12 month action plan.

1. What Makes Inventory Management Software Unique

Inventory management software is not “just another SaaS.” Buyers value it differently because it often becomes a daily workflow tool tied to real-world consequences: stockouts, backorders, spoilage, working capital pressure, and missed revenue.

The main types of businesses in this sector

Most inventory management software companies fall into a few familiar shapes:

- SMB and mid-market inventory ops SaaS: inventory planning, purchase orders, supplier management, basic forecasting, and reporting - often tied to Shopify or similar commerce ecosystems.

- Omnichannel retail ops platforms: inventory plus orders, channels/marketplaces, POS, and sometimes returns - “merchant operating stack” adjacency.

- Enterprise supply chain platforms: planning, control tower, WMS/TMS orchestration, compliance, and broader execution workflows.

- Vertical ops suites: retail/hospitality systems where inventory is a key module, bundled into a broader operational suite.

- ERP suites and back-office platforms: inventory is part of a large suite, not the center of gravity.

Unique valuation considerations buyers care about

Inventory software valuation tends to hinge on a few sector-specific realities:

- Workflow embed matters more than “nice-to-have features.” If your product is used daily to decide what to buy, when to replenish, and how to allocate inventory across channels, buyers see stickiness.

- Integrations are not optional. Shopify, marketplaces, 3PLs, WMS/POS, accounting systems - your integration surface area can be a moat or a liability.

- Inventory accuracy and trust are everything. If customers do not trust the numbers, they churn - even if your UI is great.

- A big portion of “value” is risk removal. Good inventory tools reduce stockouts and overstocks, which is real money. Buyers pay for measurable outcomes.

Key risks buyers will always check

Inventory management software has a few recurring risk checks in diligence:

- Platform dependency risk: if one ecosystem change (API limits, policy shifts, partnership rules) can damage your product, buyers will discount you.

- Implementation and support burden: inventory touches messy reality. If every customer needs heavy services to succeed, your margins and scalability take a hit.

- Data and reconciliation risk: “inventory truth” is hard. Buyers will scrutinize how you handle edge cases (returns, bundles, kitting, multi-warehouse, split shipments, backorders).

- Customer concentration and seasonality: many brands are seasonal, and some segments are fragile during demand downturns.

2. What Buyers Look For in an Inventory Management Software Business

Most buyers - strategic acquirers and private equity alike - are trying to answer one question: Will this revenue be there next year, and can we grow it without breaking the business?

The obvious (still important) stuff

Even in a niche like inventory, classic value signals matter:

- Scale: revenue size and customer count reduce “key person” and product risk.

- Growth rate: buyers pay for momentum because it de-risks the future.

- Profitability or a clear path to it: if you are not profitable, buyers want to see how you get there without fantasy assumptions.

- Gross margin: software-like margins are a strong positive signal; services-heavy economics are not.

Inventory-specific nuances that change valuations

Buyers get very specific in this sector:

- Recurrence and stickiness: subscription revenue is best, but “sticky usage” is the multiplier. A tool that touches purchase orders and replenishment is harder to replace than a reporting add-on.

- Integration depth: “we integrate” is not enough. Buyers look for how deep you sit in workflows (orders, catalog, supplier lead times, fulfillment events, accounting entries).

- Decisioning and automation: the more you automate (reorder points, channel allocation, supplier scheduling), the more you become mission-critical.

- Customer ROI proof: if you can quantify reduced stockouts, improved in-stock rate, lower carrying costs, or higher conversion, you become a revenue enabler - and buyers value that.

How private equity thinks about your business

Private equity (PE) buyers typically underwrite your deal with a simple mental model:

- Entry multiple vs exit multiple: they worry about paying too much now and not being able to sell later at a similar (or higher) multiple.

- Who buys it in 3-7 years: a bigger software platform, a larger PE fund, or occasionally public markets.

- Levers they expect to pull (and they will ask you directly):

- Pricing improvements and packaging (especially if you have legacy pricing)

- Cross-sell and upsell (adding modules like forecasting, supplier portal, multi-location, returns)

- Reducing services burden (standardized onboarding, better product-led implementation)

- Expanding channels/verticals (new integrations that unlock new customer pools)

- Operational discipline (sales process, churn reduction, better reporting)

3. Deep Dive: The Biggest Valuation Nuance in Inventory Software - “Workflow Embed” vs “Peripheral Tool”

In inventory management, the highest-value businesses are rarely the ones with the longest feature list. They are the ones that become hard to remove because the customer’s day-to-day operations depend on them.

Why this matters

When buyers see “inventory software,” they immediately ask: Is this a core operational backbone, or a layer on top that could be replaced in a weekend? That single distinction often separates mid-range outcomes from premium outcomes.

How it shows up in the deal data

Across comparable transactions in commerce ops and supply chain software, the highest multiples cluster around products that are deeply embedded into the merchant operating stack - especially when they can be attached into a broader suite (POS/commerce platforms, wholesale networks, omnichannel stacks). More basic inventory and logistics point solutions transact in more moderate ranges, especially when they are earlier-stage or services-heavy.

Why buyers pay for embed

- Switching costs become real: if your tool is the source of truth for purchase orders, supplier lead times, replenishment, and allocation, switching means operational risk.

- You become a “control point”: once you sit at a control point, it is easier to sell adjacent modules and expand revenue per customer.

- The buyer can monetize faster: suite buyers love assets they can cross-sell into an existing customer base.

How you move from “peripheral” to “embedded” in 6-12 months

You usually do not need a massive rebuild. You need to strengthen 3 things:

- Own a workflow, not a dashboard: tighten the loop from demand signals -> replenishment decision -> purchase order -> receiving -> allocation.

- Make your integrations operationally deep: not “sync products,” but “sync orders, inventory events, supplier states, and accounting outcomes.”

- Prove daily usage: buyers love usage evidence because it predicts retention.

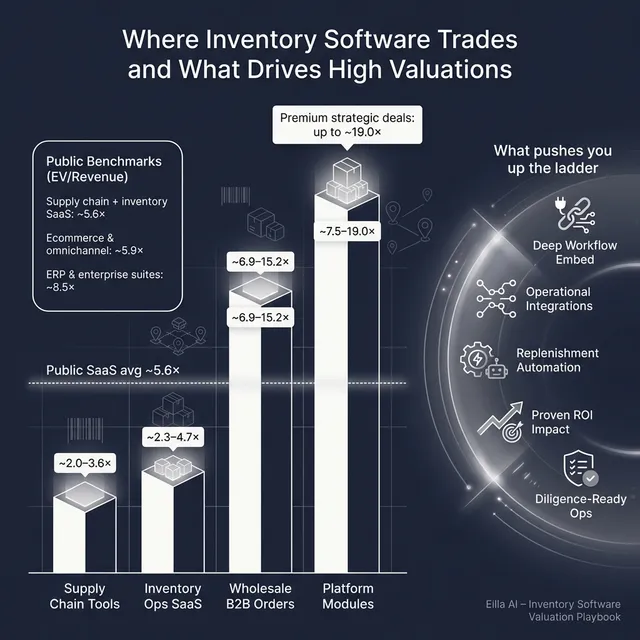

4. What Inventory Management Software Businesses Sell For - and What Public Markets Show

Valuation in this sector typically uses EV/Revenue (enterprise value divided by revenue) when profitability is still developing, and EV/EBITDA when the business has stable, meaningful EBITDA.

The important takeaway: the market is not one number. It is a band - and where you land depends on how “mission-critical, scalable, and dependable” your revenue looks.

4.1 Private Market Deals (Similar Acquisitions)

Private-market outcomes in this space show a clear pattern:

- Core inventory/commerce ops SaaS tends to trade in mid-single-digit revenue multiples when it is credible SaaS (good gross margin, recurring revenue, sticky usage).

- Supply chain and logistics software often shows moderate revenue multiples, especially when growth is slower or the model includes more services.

- Platform-attached modules (products that slot into a larger merchant operating system) can command premium revenue multiples when the strategic fit is obvious.

Here is a practical way to read the comparable private deal ranges (illustrative, deal-specific):

A simple founder-friendly interpretation: the “default” range for a good inventory SaaS is often mid-single digits, but true platform embed can push you into premium territory.

4.2 Public Companies

Public market multiples set the outer reference points, but you should not treat them like a price tag. Public companies are bigger, more liquid, and often have broader suites - which generally supports higher multiples than a smaller private company.

As of mid-to-end 2025, the relevant public segment averages look like this:

A few practical realities when translating public comps to your private valuation:

- Scale discount is real: smaller companies usually trade below public leaders unless they are scarce strategic assets.

- Risk adjustment matters: customer concentration, churn, platform dependence, and services mix all push you down.

- Strategic scarcity can override scale: if you own a control point in an ecosystem and a buyer needs it, you can outperform “what comps say.”

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes in inventory management software tend to cluster around a few repeatable themes. You do not need to be perfect in all of them - but the more you can credibly claim, the closer you get to the top of the range.

5.1 Deep embed into the merchant operating stack

Buyers pay more when your product is not “inventory reporting,” but the operating backbone for purchasing and replenishment.

Practical signals buyers love:

- Customers run purchase orders and supplier workflows inside your system.

- Your system is the “source of truth” for available-to-sell inventory across channels.

- Your product is used daily by operators, not just managers.

5.2 Clear strategic fit for suite buyers

Strategic acquirers pay up when your product unlocks cross-sell, bundling, and faster monetization.

Founder-facing examples:

- A POS or commerce platform can bundle your inventory module into its base plan.

- A broader supply chain platform can attach you to expand into SMB/mid-market.

- A payments or procurement-adjacent platform can use your workflows to capture more transactions.

5.3 Multi-channel data advantage that compounds over time

Inventory businesses with broader channel coverage (marketplaces, storefronts, 3PLs) can build defensibility if they turn that breadth into better decisions.

What “compounding” looks like:

- More integrations -> better allocation and forecasting -> better results -> higher retention.

- Standardized product and order data that makes onboarding faster for the next customer.

5.4 Proof that you drive measurable revenue outcomes

Inventory is one of the rare software categories where you can tie your product to revenue:

- fewer stockouts

- higher in-stock rate

- higher conversion

- fewer cancelled orders

- better fulfillment speed

If you can quantify that impact with credible customer stories and metrics, you move from “cost” to “profit driver” in the buyer’s mind.

5.5 Software-like margins and disciplined operations

Premium valuations favor businesses that look like scalable software:

- High gross margin (software-like, not services-like)

- Low support burden per customer as you scale

- Predictable recurring revenue

- Credible retention (customers stick around and expand)

5.6 “Diligence-ready” fundamentals

Even strong products can get discounted if the basics are messy. Buyers pay more when:

- financials are clean and explainable

- revenue is well-defined and recurring

- customer contracts are clear

- leadership is not a single point of failure

6. Discount Drivers (What Lowers Multiples)

The low end of the range is rarely about “bad product.” It is usually about risk - and how hard the buyer thinks it will be to stabilize the business post-close.

6.1 Too much services and implementation dependency

If onboarding feels like consulting, buyers see a scaling ceiling. It also raises “what happens when the founder stops doing it” risk.

What to watch:

- Large share of revenue from one-time implementation

- Customer success costs growing faster than revenue

- Highly customized deployments that are hard to maintain

6.2 Weak retention or unclear customer health

Inventory software churn is painful because it signals mistrust. Buyers will ask whether churn is driven by:

- bad outcomes (inventory accuracy, forecasting quality)

- poor onboarding

- customers “graduating” to ERP/WMS

- customer segment fragility (small brands, seasonal volatility)

6.3 Platform dependency with no mitigation

If you are tightly tied to one ecosystem, buyers will underwrite platform risk:

- API policy changes

- partner program rules

- marketplace dynamics

- integration stability

Platform exposure can still be fine - but you need clear mitigation (multiple channels, deeper relationships, adaptable integration architecture).

6.4 Customer concentration and revenue quality issues

A few big customers can feel great - until buyers model churn risk. Concentration discounts are common when:

- one customer drives a large % of revenue

- one vertical dominates and is cyclically exposed

- pricing is inconsistent and hard to defend

6.5 Messy product, messy data, messy numbers

Inventory software is judged on trust. If product logic is inconsistent, or financial reporting is unclear, buyers assume “hidden problems” and price accordingly.

7. Valuation Example: A Fictional Inventory Management Software Company

This is a worked example to show how the logic works. The company and numbers are fictional, and the valuation ranges are illustrative - not investment advice or a formal valuation.

Step 1: The plain-English valuation logic

For inventory management SaaS, a reasonable approach is:

- Start with the most relevant public reference bands (supply chain planning/inventory SaaS and retail ops software), because they show how the market values similar revenue streams at scale.

- Cross-check with private deal ranges for commerce ops SaaS and supply chain software, because private deals reflect what acquirers actually pay for businesses closer to your size.

- Pick a core multiple range based on your profile (growth, retention, gross margin, platform risk, services mix).

- Adjust up or down based on premium drivers (embed, strategic fit, data advantage, ROI proof) and discount drivers (services dependence, churn, concentration, platform risk).

Step 2: Apply it to a fictional business

Meet StockPilot (fictional): a Shopify-focused inventory planning + purchase order SaaS for DTC and omnichannel brands.

Assumptions (fictional):

- USD 10.0m last-twelve-month revenue

- 90% subscription, 10% implementation

- 75% gross margin

- Mid-teens growth

- Good retention, but still scaling the management team

A practical “football field” for StockPilot might look like:

Step 3: What this means for you

Two inventory software businesses with the same USD 10m revenue can be worth very different amounts because buyers are not buying revenue - they are buying confidence.

If you want a higher multiple, your job is to reduce buyer fear and increase buyer urgency:

- reduce churn risk

- reduce platform risk

- prove embed and outcomes

- show scalable margins and a clean operating cadence

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this to pressure-test where you likely land: low end, core range, or premium range. Score each factor from 0 to 2:

- 0 = weak / unclear today

- 1 = decent but inconsistent

- 2 = strong and provable

How to interpret your total score (rough guide):

- Top band: you are closer to premium outcomes (buyers see a scalable, embedded asset)

- Middle band: you are in fair-market territory (good business, but some risks to tighten)

- Lower band: expect discounted offers unless you fix 2-3 core issues before selling

9. Common Mistakes That Could Reduce Valuation

9.1 Rushing the sale

If you go to market before your numbers and story are coherent, buyers will lead the narrative - and they will lead it downward.

9.2 Hiding problems

Diligence will surface issues. When buyers discover surprises late, they lose trust and protect themselves with price cuts, earnouts, or tougher legal terms.

9.3 Weak financial records

Inventory software buyers care about revenue quality: recurring vs services, churn, gross margin, and cohort behavior. If you cannot clearly answer basic questions, they assume the worst.

9.4 Skipping a structured, competitive process (often with an advisor)

A competitive “market check” is not just theater. Research on the private phase of dealmaking shows that actively finding alternative bidders can materially increase what sellers receive - on the order of ~20%+ in measured outcomes in some datasets. (CLS Blue Sky)The founder-friendly translation: more credible buyers in the process usually means better price and better terms.

9.5 Revealing the price you want (instead of letting the market bid)

If you say “I want USD 50m,” you just anchored the process. Many buyers will respond with USD 50.1m, USD 50.5m - not because that is the fair value, but because you killed price discovery.

9.6 Two inventory-software-specific mistakes that hurt

- Letting services quietly become the product: if outcomes depend on your team doing custom work, buyers value you more like services than software.

- Ignoring platform risk optics: being Shopify-focused is fine, but if you cannot articulate mitigation (architecture, roadmap, diversification, partner posture), buyers will apply a platform dependency discount.

10. What Inventory Management Software Founders Can Do in 6-12 Months to Increase Valuation

Think of this as “remove fear, add proof.” You are not trying to reinvent the company. You are trying to make it easier for a buyer to say yes - at a higher multiple.

10.1 Improve the numbers that buyers actually pay for

- Reduce churn and prove retention: tighten onboarding, build a health score, and document why customers stay.

- Increase subscription mix: separate implementation, standardize packages, and make recurring value obvious.

- Lift gross margin: reduce support load per customer, stabilize integrations, and improve product reliability.

10.2 Make the product more “embedded” without a rebuild

- Expand from “inventory visibility” into replenishment decisioning.

- Strengthen the loop: demand signals -> PO -> receiving -> allocation.

- Add “operational muscle” features buyers recognize: supplier portal, lead-time tracking, stockout prevention, multi-warehouse rules.

10.3 Build integration credibility

- Improve integration monitoring (break detection, data reconciliation).

- Deepen 2-3 anchor integrations that buyers view as strategic.

- Document the integration architecture so it looks maintainable post-close.

10.4 Package your proof like a buyer would

- Create 5-10 short case studies with numbers: stockout reduction, in-stock lift, time saved, fewer cancellations.

- Build a simple KPI pack: recurring revenue, churn, expansion, gross margin, cohort retention, services mix.

- Make financials “explainable in one sitting.”

10.5 De-risk the business operationally

- Build a leadership bench so the business is not founder-dependent.

- Clean up contracts, IP assignments, and security posture.

- Prepare a realistic operating plan that a buyer can underwrite.

11. How an AI-Native M&A Advisor Helps (Soft CTA)

A strong deal outcome is rarely just “who offered the most.” It is who showed up, how competitive the process was, how credible your story looked, and how smoothly diligence ran.

An AI-native M&A advisor can expand your buyer universe far beyond your personal network. By matching your company to hundreds of relevant acquirers based on deal history, product fit, and financial capacity, you create more competition - and more competition usually leads to stronger offers and a higher chance the deal closes (because you have options if one buyer drops).

Speed also matters. AI-driven targeting, outreach, and material preparation can help you get to initial conversations and offers in under 6 weeks, instead of waiting months for a manual-only process to ramp.

Finally, you still need real advisory judgment. The best model is expert human M&A leadership, enhanced by AI: tighter positioning, stronger materials, better buyer-fit, and Wall Street-grade process discipline - without traditional “bulge bracket” costs.

If you’d like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.