The Complete Valuation Playbook for Investment Platform Businesses

A data-driven guide to how investment platform businesses are valued and how founders can improve outcomes.

If you run an investment platform and you are considering a sale in the next 1-12 months, you are selling something unusual: a regulated trust business wrapped inside a software-and-distribution engine. Buyers will not value you like a normal SaaS company - and they also will not value you like a REIT, a fund, or a traditional asset manager.

This playbook is a data-based guide for investment platform founders. It will show what businesses like yours actually sell for, decode what drives higher vs lower multiples, and give you a simple self-assessment plus a practical 6-12 month action plan to improve valuation outcomes.

Consolidation is picking up across financial services and fintech, and buyer appetite is increasingly focused on quality (durable revenue, compliance strength, and predictable growth) rather than hype. That’s good news if you know how buyers think - and if you prepare.

1. What Makes Investment Platforms Unique

Investment platforms sit in a “hybrid” category. You may look like software on the surface, but your valuation is heavily influenced by how money moves through your system and what risks you take on.

The main types of investment platform businesses (and how they make money):

- Retail brokerages and trading platforms: commissions, spreads, payment for order flow (where legal), margin lending, securities lending, subscriptions.

- Micro-investing and robo-style multi-asset platforms: recurring platform fees, AUM-based fees (a percent of assets), interchange (cards), partner revenue.

- Marketplace platforms for specific assets (real estate crowdfunding, private credit marketplaces, alternative assets): origination/listing fees, servicing fees, AUM-based fees, performance fees, secondary transaction fees.

- Digital assets and tokenized product platforms: custody/wallet fees, spreads, tokenization issuance fees, management fees on products, staking/earn revenue (where allowed).

- B2B investment infrastructure (portfolio management / IBOR / middle-back office software): subscription fees, implementations, usage-based modules.

Unique valuation considerations (why this sector is different):

- Regulation and trust are core value drivers, not “overhead.” Licenses, audits, custody setup, and compliance controls change how risky your cash flows feel to a buyer.

- Revenue quality matters more than revenue size. AUM-linked, recurring fees generally value better than revenue that swings with trading volume or one-off deals.

- Your “take rate” can compress. Platforms often face fee pressure over time unless they have differentiated distribution, a strong product wedge, or sticky workflows.

- Your customer acquisition can be expensive and cyclical. Many platforms grow fastest in bull markets - buyers will stress-test what happens in a downturn.

Key risks buyers will always check (expect deep diligence here):

- Regulatory status (licenses, approvals, history of issues).

- Custody and safeguarding of client assets (who holds what, where, and under what controls).

- AML/KYC and fraud controls (and how often you detect and resolve issues).

- Revenue recognition and “what the revenue really is” (fees vs pass-through vs interest income).

- Concentrations (one channel partner, one issuer, one custody bank, one geography, one regulator).

- Market-cycle sensitivity (how revenue and churn behave when markets drop).

2. What Buyers Look For in an Investment Platform Business

Most buyers are trying to answer one question: “Is this a durable, compounding fee stream - or a volatile growth story?”

The universal fundamentals still matter:

- Scale (revenue, users, AUM, transaction volume).

- Growth rate (and whether it’s repeatable).

- Profitability path (even if you are not profitable today).

- Gross margin (how much of each dollar of revenue is yours to keep).

But in investment platforms, a few sector-specific factors dominate:

- AUM and net flows quality: Buyers want to see AUM growing because customers stick around and add money, not just because markets went up.

- Retention by cohort: Do customers from 2-3 years ago still fund accounts and generate fees today?

- Revenue mix durability:

- Higher confidence: AUM-based fees, subscription fees, recurring servicing fees.

- Lower confidence: volume-based trading revenue, one-time origination, promotional partner revenue.

- Unit trust and brand: In finance, trust compounds. A platform with strong trust and low incident rates can be worth meaningfully more than a “similar” product with shaky controls.

- Operational maturity: reporting, reconciliations, incident management, complaint handling, and audit readiness.

How private equity (PE) thinks about you

PE buyers are not just buying your business - they are buying an entry price and a future exit story.

They typically underwrite:

- Entry multiple vs exit multiple: If they buy at 6.0x revenue, can they plausibly sell at 7.0x later? Or will the next buyer only pay 4.0x?

- Who buys it next in 3-7 years:

- Strategics (banks, brokers, wealth managers, exchanges).

- Larger PE funds (if you reach scale and predictable cash flow).

- Public markets (rare, but possible if you become a category leader).

- Levers they expect to pull:

- Pricing discipline (reduce discounting; simplify plans).

- Cross-sell (new products to existing funded accounts).

- Cost efficiency (support automation, compliance tooling, vendor consolidation).

- “Platform expansion” (new geographies, new asset classes, new distribution partners).

- Sometimes: add-on acquisitions (only if the core platform is stable).

3. Deep Dive: The #1 Valuation Nuance - Revenue That Behaves Like a “Fee Stream” vs Revenue That Behaves Like “Trading”

Two companies can both have USD 10m of revenue and be worth radically different amounts because buyers value predictability more than excitement.

In the data, platforms and marketplaces with more durable, asset-linked revenue profiles tend to support higher EV/Revenue outcomes than purely transactional, volume-driven models. You also see very high revenue multiples in asset-backed models (like REITs and royalties), largely because long-duration, contract-backed cash flows can look extremely predictable - but most platforms should not assume they “deserve” those premiums unless their revenue truly behaves that way.

Why buyers care so much:

- Transactional revenue can drop fast when markets cool, customers trade less, or spreads compress.

- AUM-linked fees, subscriptions, and servicing fees usually decline more slowly (and can even grow during weak markets if customers keep contributing).

- Predictability lowers perceived risk, and lower risk usually increases valuation multiples.

A practical way to think about this is:

How you move from the left column to the right (without a total pivot):

- Rebalance your revenue mix toward recurring fees (subscription tiers, AUM-based pricing, servicing fees on longer-duration products).

- Prove net flow quality: report gross inflows, outflows, and net flows by cohort, not just “total AUM.”

- Reduce “promotion-driven” growth: buyers discount growth that depends on incentives that are hard to sustain.

- Build sticky hooks: tax reporting, automation, recurring deposits, model portfolios, employer/channel partnerships, integrations that make switching painful.

4. What Investment Platform Businesses Sell For - and What Public Markets Show

Valuation in this sector is usually discussed as a multiple of revenue (EV/Revenue) because many platforms reinvest heavily and EBITDA (profit) can be temporarily low or negative.

A quick translation:

- Enterprise value (EV) is the value of the whole business (think: the value a buyer is paying for the operating company).

- A revenue multiple answers: “How many dollars of value does the market pay per dollar of annual revenue?”

The best way to use multiples is as a reference band, then adjust based on your revenue quality, regulatory strength, growth, and risk.

4.1 Private Market Deals (Similar Acquisitions)

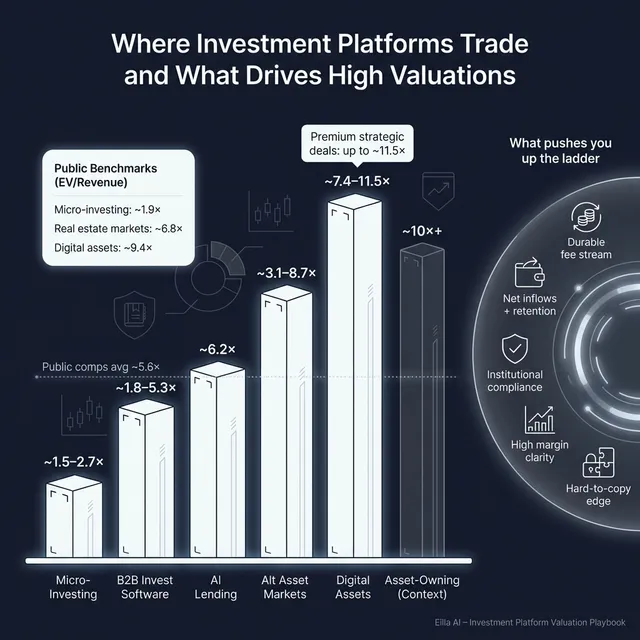

Private deal data across investment platforms and adjacent models shows a wide spread - largely explained by business model differences.

Here is a founder-friendly way to interpret the observed ranges (illustrative, depends on your exact profile):

How to read this:

- Platforms usually live in low-to-high single-digit revenue multiples, depending on how recurring and defensible the revenue is.

- Asset-owning vehicles can trade at double-digit multiples because their “revenue” is tied to long-duration cash flows and often has very high gross margins - but a typical platform should treat this as context, not a target.

4.2 Public Companies (late-2025 snapshot)

Public markets provide a sanity check - but you must adjust because public companies are larger, more liquid, and priced daily (and sometimes “revenue” is not comparable across financial models).

Based on grouped public comps:

Two important takeaways:

- Use public multiples as reference bands, not a price tag. Your company is smaller and less liquid, so buyers often discount for scale and risk.

- Sometimes private assets can beat public comps if they are scarce, strategic, and de-risked (clean compliance, durable fees, high trust). That is when competition matters.

5. What Drives High Valuations (Premium Valuation Drivers)

When investment platforms sell at the top end, it is rarely because of one metric. It is because the buyer believes: “This is a durable, scalable fee stream with manageable risk.”

Below are the premium drivers that show up consistently in observed deals and buyer behavior, grouped into practical themes.

5.1 Durable, asset-linked revenue (fee streams that scale)

Buyers pay more when revenue scales with customer wealth and participation over time.

- AUM-linked pricing that grows as customers add money.

- Clear proof that fee rates do not collapse as you scale.

- Strong retention by cohort (older cohorts are still paying).

Practical examples:

- You can show AUM growth broken into market impact vs net flows.

- You can show that customers who funded accounts 24 months ago still contribute and still generate fees.

- You can show take-rate stability even as you lower headline fees (because attach improves).

5.2 High gross margin plus visibility (even if EBITDA is not perfect yet)

In financial platforms, buyers can accept temporarily compressed EBITDA if:

- Gross margins are strong (your revenue is not mostly pass-through).

- The cost base is “build once, scale many” (tech, automation, compliance tooling).

- The revenue is predictable enough that they can underwrite operating leverage.

What founders can do:

- Separate true platform revenue from pass-through.

- Show gross margin by product line (some lines may be much more valuable than others).

5.3 Regulatory strength that reduces buyer fear

In this sector, compliance is not a box-check - it is a valuation lever.

Buyers pay more when:

- Licenses are in place, clean, and transferable (or at least not fragile).

- Audits are credible and recurring.

- Controls are documented and tested (AML/KYC, safeguarding, reconciliations, incident management).

- The business looks “institutional-grade,” which reduces closing risk.

5.4 Strategic buyer fit and synergy potential

Strategic buyers pay up when you accelerate something they already want:

- New distribution (your customers, your channels, your brand trust).

- New product rails (your infrastructure makes new products easier to launch).

- Lower cost-to-serve through integration (their balance sheet + your UX, for example).

Your job is to show, in plain language, why your platform makes them faster or cheaper.

5.5 Scarcity and “can’t easily replicate” advantages

Premium outcomes are more likely when you have something that is hard to copy:

- Exclusive access to assets or issuers.

- A regulated structure that would take years to rebuild.

- Deep integrations that create switching costs.

- A brand that customers trust with money (measured by low incident rates and high funded-account retention).

6. Discount Drivers (What Lowers Multiples)

Most low-multiple outcomes are not because the product is bad. They are because buyers see risk, fragility, or unclear economics.

Common discount drivers in investment platforms:

- Revenue volatility: heavy reliance on trading volume, bull-market activity, or one-time origination fees.

- Unproven retention: lots of sign-ups, but weak funded accounts or weak cohort retention.

- High customer acquisition cost without proof of payback: if you spend heavily to acquire users, buyers want to see that those users stick and generate fees for years.

- Regulatory uncertainty: pending issues, weak documentation, fragile licensing pathways, or complex cross-border exposure.

- Concentration risk: one bank partner, one custody provider, one channel partner, one product, or one geography driving most revenue.

- Operational control gaps: weak reconciliation processes, unclear safeguarding, incomplete incident logs, or messy complaint handling.

- Thin gross margins: too much pass-through or promotional economics that won’t survive buyer scrutiny.

- Founder dependency: if key relationships, approvals, or decision-making live in one person’s head, risk goes up and valuation goes down.

The pattern is simple: buyers discount what they cannot underwrite with confidence.

7. Valuation Example: An Investment Platform Company

This is a worked example to show the logic - not investment advice, and not a formal valuation.

Step 1: The logic (plain English)

- Start with the most comparable platform segments (not REITs, not royalties, not pure asset managers unless you truly are one).

- Use those to define a base range of EV/Revenue.

- Adjust up if you can prove premium drivers (durable fee stream, retention, regulatory strength).

- Adjust down if there are real risks (volatility, concentration, compliance uncertainty, unclear margins).

Step 2: Apply it to a fictional company

Meet NorthBridge Invest (fictional):

- Regulated multi-asset investment marketplace

- Mix of AUM-based fees + subscriptions + some transaction revenue

- USD 10.0m annual revenue (fictional)

- Strong cohort retention, improving net inflows, clean audits, diversified partners

Using platform-relevant reference bands, a reasonable base platform range often sits in the mid single-digits, with upside if the “fee stream” characteristics are proven and downside if revenue is fragile.

Here is one simple way to frame scenarios:

Step 3: What this means for you

Two platforms with the same revenue can be valued very differently because:

- One has revenue that behaves like a durable fee stream (retained assets, stable pricing, low incident risk).

- The other has revenue that behaves like market activity (volume-driven, promotion-driven, partner-concentrated).

If you want a higher multiple, focus less on “telling a big story” and more on proving durability, predictability, and risk control.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as a quick, honest diagnostic. Score each factor:

- 0 = weak / unclear today

- 1 = acceptable / improving

- 2 = strong / proven with data

Self-assessment table

How to interpret your total (roughly):

- Mostly 2s: you are closer to premium outcomes - your job is to run a strong process and avoid unforced errors.

- Mixed 0s and 1s: you can still sell well, but your valuation will depend on how many risks you can remove in 6-12 months.

- Many 0s: expect low-end multiples unless you pause and fix the fundamentals buyers will diligence anyway.

9. Common Mistakes That Could Reduce Valuation

Rushing the sale

If you go to market before your numbers and narrative are ready, buyers will price uncertainty. In finance, uncertainty is expensive.

Hiding problems

Issues nearly always surface in diligence (compliance, revenue recognition, customer complaints, partner dependencies). Hiding them destroys trust and can collapse a deal late in process.

Weak financial records

Founders often underestimate how much value is trapped behind unclear reporting:

- messy revenue categorization (fees vs pass-through)

- no margin visibility by product line

- inconsistent KPI definitions (active, funded, retained)

- no cohort retention reporting

Fixing these can materially improve how a buyer underwrites risk.

Not running a structured, competitive process with an advisor

Competition is not just about “more meetings.” It is price discovery.

One large dataset on M&A processes shows that auction-style processes have meaningfully higher initial bid premiums than one-on-one negotiations - roughly a 25% higher starting point (38.5% vs 30.5% first-bid premiums). (analysisgroup.com) While every deal is different, the principle holds in private company sales: more credible buyers in the process usually improves leverage, terms, and certainty.

Revealing what price you’re after (too early)

If you say you want USD 50m, buyers often anchor there. You kill true price discovery. Let the market come back with offers - then negotiate from evidence and competition.

Two industry-specific mistakes that hit investment platforms hard

- Treating compliance like a back-office detail: buyers will discount hard if licensing, safeguarding, AML/KYC, or audit posture is anything less than crisp.

- Not proving funded-account retention: sign-ups are not value. Retained funded accounts that generate fees are value.

10. What Investment Platform Founders Can Do in 6-12 Months to Increase Valuation

You do not need a total reinvention. You need to improve what buyers can underwrite.

10.1 Improve the numbers buyers actually price

- Shift revenue mix toward recurring where possible: subscriptions, AUM-based tiers, servicing fees.

- Show net flows and retention by cohort: prove that growth is not just marketing spend or market beta.

- Clean up gross margin reporting: separate pass-through vs true platform revenue; report margin by product.

- Build a credible profitability path: even if you keep investing, show what EBITDA could look like at scale.

10.2 De-risk the business (this is often the fastest multiple lift)

- Document licenses, approvals, audits, and compliance controls in a buyer-ready format.

- Reduce single points of failure: add backup partners (custody, banking rails, key vendors) where feasible.

- Tighten incident management and reporting (buyers want evidence, not reassurance).

10.3 Strengthen the “buyer story” with proof, not adjectives

- Write a clear narrative: “We are a platform that converts X distribution into Y durable fee streams.”

- Back it with 6-12 core KPIs: AUM composition, net flows, retention, fee rates, funded accounts, churn, margin, compliance metrics.

- Prepare a simple “downturn case” that shows how revenue behaves if markets drop.

10.4 Prepare to run a real process

- Build a tight data room early (financials, KPIs, contracts, compliance, product, security).

- Identify 30-100 credible buyers (strategic and PE) who would truly value your asset.

- Decide your non-negotiables (deal structure, role, timeline) before you are in live negotiations.

11. How an AI-Native M&A Advisor Helps

Selling an investment platform is a high-stakes process: the buyer is underwriting not just growth, but trust, regulation, and operational maturity. Small missteps can cost real money.

Higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, strategic fit, financial capacity, and synergy signals. More relevant buyers means more competition, stronger offers, and more options if one buyer drops late.

Initial offers in under 6 weeks. AI-driven buyer matching and outreach, faster creation of marketing materials, and tighter diligence support can compress timelines - which reduces deal risk and keeps momentum.

Expert advisory, enhanced by AI. The best outcome is still driven by experienced human M&A leadership: positioning, negotiation, and credibility with buyers. AI strengthens the process by improving preparation, speed, and coverage - helping you get “Wall Street-grade” execution without traditional bulge bracket costs.

If you’d like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.