The Complete Valuation Playbook for Landscaping Services Businesses

A data-driven valuation playbook for landscaping services founders.

If you run a landscaping services business and you might sell in the next 1-12 months, valuation is not a mysterious formula - it is the story buyers believe about your future cash profits, minus the risks they think could break that story.

This playbook is built for landscaping founders: it shows what similar businesses actually sell for, what drives higher vs lower multiples, and how to improve your valuation in the 6-12 months before you go to market.

One more reason to focus now: landscaping and grounds maintenance is consolidating. Scaled operators and facilities services platforms are actively buying smaller providers, but they are picky - they pay up for contract stability, operational discipline, and routes they can plug into a bigger footprint.

1. What Makes Landscaping Services Unique

Landscaping services is not “just another services business.” Buyers value it differently because the economics are shaped by labor, routes, seasons, and contracts.

The main company types inside “landscaping services”:

- Recurring maintenance: mowing, pruning, turf care, beds, litter pick, irrigation checks (often commercial, HOA, municipal).

- Design-build and construction: installs, hardscapes, drainage, lighting (project-based, lumpy).

- Tree services: trimming, removals, storm response (higher safety risk, often higher pricing power when done well).

- Snow and ice: seasonal revenue smoothing, but weather-driven.

- Plant displays / plantscaping: interiors, seasonal rotations, rentals (often more “programmatic” and contract-like).

Unique valuation considerations buyers care about:

- Recurring vs project mix: recurring maintenance is usually easier to underwrite than one-off installs.

- Route density and branch footprint: a business with tight routes and local density can be meaningfully more profitable than one with the same revenue spread thin across geography.

- Labor availability and wage inflation: if you cannot recruit/retain crews, your growth story is fragile.

- Fleet and equipment intensity: capex needs, maintenance discipline, and replacement cycles matter more than founders expect.

- Working capital: project work and municipal contracts can create cash timing issues (slow payers, retainage, upfront materials).

Key risk factors buyers will always check:

- Customer concentration (one campus, one municipality, one property manager).

- Contract terms (auto-renewal, termination rights, pricing escalation clauses).

- Safety and claims history (workers’ comp, vehicle incidents, pesticide handling).

- Seasonality and weather exposure (and whether you have a plan for down months).

- Owner dependency (if the business runs “through you,” buyers discount it).

2. What Buyers Look For in a Landscaping Services Business

Buyers usually look through two lenses at once:

- “Is this a good standalone business?”

- “Does it become more valuable inside our platform?”

The basics still matter:

- Scale (revenue), growth, and profitability (EBITDA margin).

- Consistent performance (not one great year and one weak year).

- Clean financials and evidence that profits are real (not just accounting).

But landscaping-specific “tells” often drive the final multiple:

- Contract quality: longer terms, auto-renewals, predictable scopes, and clear price escalation.

- Customer type: commercial/multi-site accounts and institutional customers tend to be valued for stability (if margins are protected).

- Service mix that reduces seasonality: snow/ice, enhancements, irrigation, tree care, pest control adjacency.

- Operational system: scheduling, QA, routing, crew productivity, and job costing.

Private equity buyer thinking (in plain English)

Private equity (PE) is usually buying with a 3-7 year horizon. They care about:

- Entry multiple vs exit multiple: if they buy at 7x EBITDA, they want a believable path to sell at 8-10x later (often by building a larger, more “institutional” platform).

- Who they can sell to later: strategic consolidators, larger PE funds, or occasionally public markets.

- Levers they expect to pull (the “playbook”):

- Pricing discipline and contract repricing

- Procurement savings (plants, mulch, fuel, equipment)

- Route density and branch optimization

- Centralized admin (billing, HR, recruiting)

- Add-on acquisitions to build scale and coverage

If your business already looks “platform-ready” (processes, second-layer leadership, KPIs), PE can move faster and may pay more because execution risk is lower.

3. Deep Dive: Contract Stickiness and Route Density - The Hidden Multiplier

Two landscaping businesses can have the same revenue and the same EBITDA margin today - and still sell for very different prices. A big reason is whether the buyer believes your profits are repeatable and scalable.

In the deal data, premiums show up most clearly when a buyer is underwriting value from scale and footprint (route density, procurement, overhead leverage, and cross-selling into an existing platform) rather than valuing the target as a standalone operator.

Why buyers care

Route density is the simplest version of operating leverage in a labor-heavy business:

- Shorter drive time means more billable hours per crew per day.

- Dispatching gets easier.

- Supervisors can oversee more work with fewer layers.

- Equipment utilization improves.

Contract stickiness is what protects that density:

- If accounts churn, routes break.

- If pricing can’t keep up with wages, margin erodes even if routes are tight.

How to move from “lower-value” to “higher-value” profile

Practical shifts you can make in 6-12 months:

- Add price escalation clauses on renewals (even modest ones).

- Track and sell enhancements separately (so maintenance margin stays clean).

- Measure route profitability by branch/zip code (so you stop growing “bad miles”).

- Lock in multi-site customers where possible (one relationship, many properties).

5. What Landscaping Services Businesses Sell For - and What Public Markets Show

Valuation in this sector is usually discussed in two ways:

- EV/Revenue: enterprise value divided by annual revenue.

- EV/EBITDA: enterprise value divided by EBITDA (a proxy for operating cash profit).

Most private landscaping services businesses get valued like services contractors: buyers anchor on profits and risk, then sanity-check against revenue multiples.

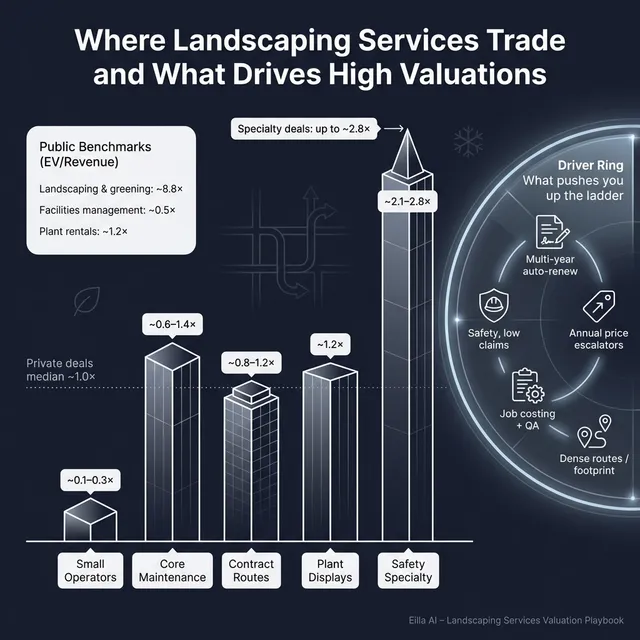

5.1 Private Market Deals (Similar Acquisitions)

In the precedent transaction set most relevant to field-based exterior services (commercial cleaning, grounds, exterior maintenance), the typical multiples cluster around:

- ~1.0x EV/Revenue (median) and ~1.2x EV/Revenue (average)

- ~3.9x EV/EBITDA (average/median)

That’s the “core contractor” zone. Within the same dataset, specialized, safety- and compliance-heavy field services reached materially higher EV/Revenue (roughly ~2.1x-2.8x in the observed deals), reflecting differentiation and stronger margins.

Separately, the worked example data for landscaping/grounds maintenance transactions shows very low lower-quartile revenue multiples (~0.1x-0.2x EV/Revenue at the 25th-75th percentile), which is consistent with smaller, lower-quality, or lower-margin outcomes - and also a reminder that “headline ranges” can be dragged down by weaker operators.

A practical way to interpret these private comps:

These ranges are illustrative. The same buyer will pay very different prices for “10% EBITDA with renewals” vs “3% EBITDA with annual rebids.”

5.2 Public Companies

Public markets are useful as a reference band - not a price tag for your private business.

In the public peer grouping for Commercial Landscaping, Grounds Maintenance & Urban Greening Services, the reported median multiples are roughly:

- ~8.8x EV/Revenue (median)

- ~9.3x EV/EBITDA (median)

But the average EV/Revenue (~24.4x) in that same group is heavily skewed by outliers, including businesses with negative EBITDA and very high revenue multiples. In other words: the broad “landscaping” public bucket mixes together very different economics (maintenance contractors vs design/build vs development-like profiles).

Public peer groups adjacent to landscaping services also provide sanity checks:

- Integrated facilities management businesses often trade around ~0.5x EV/Revenue (median) and ~7.9x EV/EBITDA (median).

- Plant rentals / horticulture display businesses show around ~1.2x EV/Revenue and ~6.9x EV/EBITDA.

A simple way to use this as a founder:

How to apply public multiples to your private sale:

- Treat public comps as an upper reference band that includes liquidity and scale premiums.

- Expect adjustments downward for smaller scale, customer concentration, weaker processes, or margin volatility.

- In rare cases, a scarce asset in a strategic geography (or with specialist capability) can get pulled upward toward public-like thinking - but you need evidence, not just a story.

6. What Drives High Valuations (Premium Valuation Drivers)

Across the observed deals, “premium outcomes” were not magic - they clustered around a few repeatable patterns.

1) Scale and footprint that a platform buyer can plug in

Strategic consolidators pay up when your routes, branch footprint, or customer relationships create immediate density and cross-sell opportunities.

- Example: you cover a metro area they are weak in.

- Example: you already serve multi-site customers they want access to.

- Example: you run multiple outdoor services that can be bundled into one contract.

2) Differentiated delivery model (specialty, safety, compliance)

In the deal data, specialty field services with strong training, equipment, and compliance systems escaped commodity pricing and supported higher revenue multiples.In landscaping, the analogs are:

- Certified arborist-heavy operations with strong safety records

- High-end commercial enhancement programs with repeatable playbooks

- Irrigation/drainage teams that reduce callbacks and win renewals

3) Quality of earnings - stable EBITDA that buyers trust

A clear pattern: buyers pay more when profits are stable and explainable.

- Clean job costing and branch-level margin visibility

- Evidence you can reprice contracts to keep up with wages

- Consistent performance across seasons (or a proven seasonal plan)

4) Deal structures that enable higher headline pricing (without full risk transfer)

Earn-outs and deferred payments show up when buyers see upside but want protection if profits wobble. Equity rollovers show up when sellers align with a consolidation story.As a founder, this matters because “headline multiple” and “cash at close” are not the same thing.

5) Low friction diligence - clean financials and a credible bench

Even if it doesn’t increase your multiple on paper, it often increases the number of serious bidders (and that can increase price).

- Monthly financials that tie out

- Clear add-backs and one-time expenses

- A second-in-command who can run operations

7. Discount Drivers (What Lowers Multiples)

Discounts tend to come from one thing: buyer fear. Fear that profits are overstated, unstable, or too dependent on you.

Common landscaping-specific discount drivers:

- Margin compression or volatility (especially if you can’t explain it as temporary and fixable).

- Project-heavy revenue with weak repeatability (big installs, inconsistent backlog).

- Annual rebids and easy-cancel contracts (routes can evaporate).

- Customer concentration (one property manager or municipality dominates revenue).

- Operational chaos (no job costing, weak QA, inconsistent crews, high callbacks).

- Safety and claims risk (workers’ comp, vehicle incidents, pesticide compliance).

- Underinvested fleet (buyers see future capex and downtime).

- Owner dependency (key relationships, estimating, scheduling, and hiring all run through you).

None of these make a sale impossible. They just move you toward: lower multiple, more escrow, more earn-out, more diligence pain.

8. Valuation Example: A Landscaping Services Company

This is a fictional example to show how valuation logic works. The company and numbers are illustrative - not a formal valuation or investment advice.

Step 1: Build the “reference band” from public and private comps

From the most relevant public landscaping/grounds maintenance set, the observed EV/Revenue range (25th-75th percentile) is about ~0.8x-1.2x.

From private transactions and the landscaping/grounds maintenance “football field,” smaller and more commodity outcomes can clear much lower (the provided quartiles imply roughly ~0.1x-0.2x EV/Revenue), while more typical contractor deals in adjacent exterior services cluster around ~0.6x-1.4x EV/Revenue.

So the real work is choosing where your business sits between:

- “Small private contractor risk” and

- “Scaled, better-capitalized public platform”

Step 2: Apply it to a fictional business

Fictional company: “Evergreen Site Services”

- Revenue: USD 10.0m

- Mix: 75% commercial maintenance contracts, 15% enhancements, 10% snow/ice

- EBITDA margin: 7% (USD 0.7m) - decent, but not “specialty high-margin”

- Geography: one metro area plus nearby suburbs (good density)

- Customer concentration: top customer is 12% of revenue (manageable)

Now three scenarios:

Cross-check with EV/EBITDA (because most buyers think this way):

- If EV is USD 4.0m-6.0m and EBITDA is USD 0.7m, that implies ~5.7x-8.6x EV/EBITDA - very plausible for a solid, labor-heavy contractor.

- To justify the premium EV range, buyers usually need to believe EBITDA is durable and expandable (or that your routes and contracts unlock synergy for them).

Step 3: What this means for you

Two USD 10m landscaping businesses can be worth very different amounts because buyers are not paying for revenue - they are paying for repeatable, defensible profit and the risk-adjusted story behind it.

If you want a higher valuation, “improving the story” usually means improving the parts of the business buyers fear (contract churn, margin volatility, operational dependence on you).

9. Where Your Business Might Fit (Self-Assessment Framework)

Use this as a simple honesty tool. Score each factor 0-2:

- 0 = weak / not true today

- 1 = mixed / improving

- 2 = strong / clearly true

How to interpret your total (rough guidance):

- Top band: you’re closer to premium outcomes (more bidders, cleaner offers).

- Middle band: fair market contractor valuation (process and buyer fit matter a lot).

- Low band: expect more discounting, more earn-outs, and more buyer pushback - unless you fix a few high-impact issues.

10. Common Mistakes That Could Reduce Valuation

These are avoidable - and they show up constantly in founder-led sales.

- Rushing the sale

- Going to market before your numbers, KPIs, and story are clear usually leads to fewer bidders and weaker terms.

- Hiding problems

- Issues will surface in diligence. If a buyer finds them before you frame them, trust drops and so does price.

- Weak financial records

- Landscaping buyers want to see job costing, branch performance, and a clean bridge from revenue to EBITDA.

- If you can’t explain margin changes simply, buyers assume the worst.

- Not running a structured, competitive process with an advisor

- Competition is the cleanest driver of price. In practitioner analysis, structured competitive processes have shown meaningfully higher outcomes versus accepting a single negotiated offer - sometimes dramatically higher. (Matrix Capital Markets Group)

- Even in public take-private markets, auction dynamics are associated with higher implied multiples and premiums compared to less competitive processes. (Houlihan Lokey)A practical founder rule of thumb: a real competitive process can be worth ~25% in outcome versus a quiet, one-buyer negotiation (sometimes more, sometimes less).

- Revealing what price you’re after instead of letting the market bid

- If you tell buyers you “want USD 10m,” many will anchor at USD 10.1m and USD 10.2m instead of showing what they could truly pay in a competitive environment.

- Price discovery only works when bidders feel they must stretch to win.

Two industry-specific mistakes that often bite landscaping founders:

- Selling “growth” without proving pricing power (buyers worry wage inflation will eat your growth).

- Growing into bad routes (revenue up, profit flat - buyers value profit).

11. What Landscaping Services Founders Can Do in 6-12 Months to Increase Valuation

Think in three buckets: improve earnings quality, improve revenue quality, and reduce key-person risk.

A) Improve earnings quality (the “trustable profit” work)

- Install simple job costing by contract and by branch (you want to know where profit is made).

- Reprice renewals with escalators tied to labor/fuel (even partial clauses help).

- Tighten route density intentionally (stop chasing revenue that adds drive time and supervisor load).

- Standardize QA to reduce callbacks and rework (buyers love repeatable processes).

B) Improve revenue quality (make it stickier)

- Push for 2-3 year terms on commercial accounts where possible.

- Bundle maintenance + enhancements + irrigation into “programs” instead of ad hoc quotes.

- Reduce customer concentration by winning a few mid-sized accounts rather than one giant one.

- Build a winter plan (snow/ice, indoor plants, off-season services) so staffing is steadier.

C) Reduce buyer fear (make diligence easy)

- Document SOPs for estimating, scheduling, QA, and safety.

- Build a second layer: ops leader, sales/estimating lead, branch manager.

- Clean up insurance, claims history narrative, and safety training records.

- Prepare a simple data room: contracts, renewals, customer list, fleet list, KPIs, monthly financials.

The goal is not to “transform” the business. The goal is to remove the top 3 reasons a buyer would discount you.

12. How an AI-Native M&A Advisor Helps

A great exit outcome is often less about finding “a buyer” and more about creating enough qualified buyer tension that the best buyer has to stretch to win.

Higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, strategic fit, financial capacity, and adjacency. More relevant buyers usually means more competition, better terms, and more backup options if one party drops.

Initial offers in under 6 weeks. AI-driven buyer matching, outreach, and process material creation can compress timelines dramatically compared to manual-only processes - while still keeping the process controlled.

Expert advisory, enhanced by AI. You still need experienced humans running the deal: shaping the story, anticipating diligence landmines, and negotiating terms. The AI layer helps those advisors move faster, be broader, and stay organized - delivering “Wall Street-grade” process quality without traditional bulge bracket costs.

If you’d like to understand how our AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.