The Complete Valuation Playbook for Logistics Management Software Businesses

A guide for logistics management software businesses that shows what companies like yours actually sell for and how to earn higher multiples.

If you are considering a sale in the next 1-12 months, valuation is not a mystery - it is a pattern-recognition exercise. The pattern in this sector is especially clear: buyers pay SaaS multiples for SaaS economics, and they pay services multiples for services economics - even if you call it “a platform.”

This playbook is built for founders of logistics management software (TMS/WMS/OMS, visibility, execution, orchestration, and adjacent workflows). It shows what businesses like yours actually sell for, what drives higher vs lower multiples, and how to run a practical self-assessment plus a 6-12 month action plan to move your outcome up the range.

1. What Makes Logistics Management Software Unique

Logistics management software sits in the messy middle of the real economy: physical goods, tight timelines, human operations, and constant exceptions. That shapes valuation.

The main business “types” you see in this sector

- Execution software: TMS/WMS/OMS, parcel/shipping, yard, dispatch, slotting, last-mile, carrier management.

- Visibility and “control tower” software: multi-party tracking, exception workflows, ETAs, analytics, orchestration.

- Network-style platforms: EDI or carrier connectivity, marketplaces, multi-tenant data networks, shared integrations.

- Tech-enabled services with a software layer: managed transportation, brokerage, fulfillment, freight forwarding with internal tools.

Why valuation is different here

- Revenue quality varies wildly under the same label. Two companies can each report USD 10m “revenue” - one is mostly subscription software, the other is mostly pass-through freight or labor-heavy implementation. Buyers value those very differently.

- Switching costs can be extremely high - or surprisingly low. If your product is deeply embedded in daily operations (dispatch, shipping labels, compliance docs, invoice audit), churn risk is low. If you are “nice-to-have reporting,” churn risk is higher.

- Integration risk is real. Buyers will pressure-test your dependencies: carriers, EDI partners, ERPs, telematics devices, maps, customs, marketplaces, and the stability of those relationships.

Key risk factors buyers will always check

- Gross margin and services mix (how much of your revenue is truly software margin).

- Implementation scalability (do you need armies of people per go-live, or is onboarding repeatable).

- Data reliability and auditability (customers rely on you for operational truth).

- Security and compliance posture (especially if you touch regulated goods, healthcare, or cross-border).

- Customer concentration (a single large shipper can distort the story).

- Retention and expansion (do customers stick and grow, or churn after “project completion”).

2. What Buyers Look For in a Logistics Management Software Business

Buyers generally fall into two camps: strategics and private equity (PE). They overlap on basics, but their “why” differs.

The basics (still matter a lot)

- Scale: not just revenue size, but repeatability - how easily you can sell and deliver the next 20 customers.

- Growth: consistent growth beats “one big year.” Buyers pay for confidence.

- Profitability: EBITDA matters, but in software, buyers also care about how quickly you could be more profitable if you chose to.

- Retention: if customers stay, buyers can underwrite the future. If they leave, you are selling a leaky bucket.

Industry-specific nuances buyers care about

- Where you sit in the workflow: the closer you are to “money and movement” (tenders, dispatch, proof of delivery, invoice audit, payments), the more mission-critical you are.

- Your integration footprint: buyers love products that plug into major ERPs, e-commerce platforms, carriers, and telematics - and can prove those integrations drive sales.

- Unit economics disguised as operations: in logistics, “software” businesses often hide delivery labor. Buyers will separate software gross margin from services gross margin quickly.

- Dataset defensibility: if your platform has unique carrier performance data, lane benchmarks, or ETA accuracy advantages, it can become a moat.

How PE buyers think

PE is usually buying a future sale, not just your current cash flow.

- Entry multiple vs exit multiple: they underwrite what they pay today, and what they can plausibly sell it for in 3-7 years.

- Who they can sell to later: a larger software platform, a strategic logistics tech buyer, or a larger PE fund that wants a “bigger, cleaner” version of the same asset.

- The levers they expect to pull:

- Raise prices (especially if you are underpriced vs the value you create).

- Reduce services burden (productize onboarding, templates, implementation partners).

- Expand modules (WMS to TMS, or execution to visibility).

- Add bolt-on acquisitions (adjacent features or regional coverage).

- Improve reporting discipline (monthly KPIs, cohort retention, margin by product).

3. Deep Dive: The Biggest Valuation Nuance - “Is Your Revenue Actually Software?”

In this sector, the single most important valuation question is often not “how fast are you growing?” It is: what portion of your revenue has software economics (high gross margin, recurring, scalable) vs services economics (labor-heavy, project-based, pass-through).

The data pattern is consistent: software-led logistics businesses cluster at meaningfully higher EV/Revenue multiples than services-heavy logistics providers. Even within “logistics tech,” buyers punish revenue that behaves like freight volume or labor.

Why buyers care

- Software revenue is valued for future profits (it can scale without scaling headcount 1:1).

- Services revenue is valued for current profits (and often discounted if it is volatile or dependent on a few people).

- Mixed models are fine - but only if you can clearly show the engine: software drives retention and pricing power, services support adoption and become less important over time.

How this shows up in deal conversations

- Buyers will “rebuild” your P&L: software gross margin vs services gross margin, recurring vs non-recurring, and how much of implementation is truly required.

- If you cannot prove it with clean reporting, they assume the conservative version.

Lower-value profile vs higher-value profile

How to move from “worse” to “better” in 6-12 months

- Split your revenue reporting into software vs services (and show gross margin for each).

- Standardize onboarding into packages and templates.

- Shift to annual contracts where possible.

- Build “expansion hooks” (more sites, more users, more modules, more shipment volume tiers) so customers naturally grow.

4. What Logistics Management Software Businesses Sell For - and What Public Markets Show

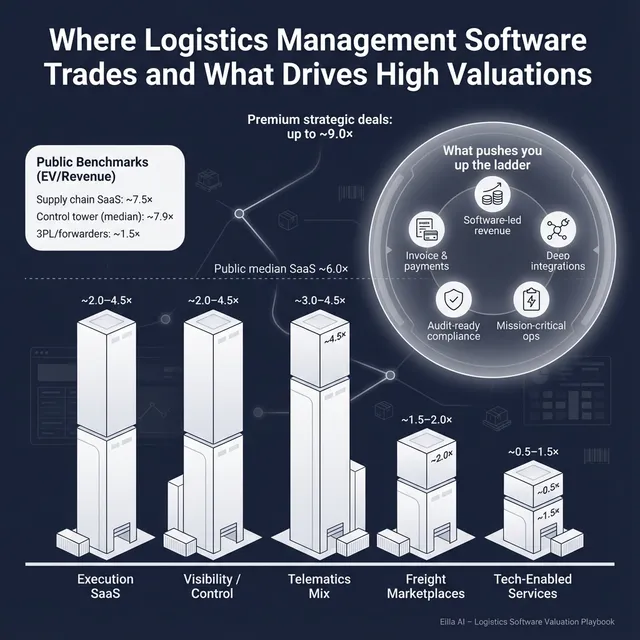

Here is the practical takeaway: private market deals set the reality check for what most founder-led companies can achieve, while public markets set the “ceiling” reference - especially for scaled, high-growth, high-margin leaders.

4.1 Private Market Deals (Similar Acquisitions)

Across precedent transactions, the overall private-market averages show:

- Supply chain and logistics software deals cluster around ~2.3x to 2.6x EV/Revenue (median to average), and roughly ~10.6x to ~12.1x EV/EBITDA (average to median).

- There are clear examples of software-led logistics platforms achieving higher revenue multiples (often in the ~3x to ~5x+ neighborhood) when the business looks and performs like software (recurring, high gross margin, scalable delivery).

The big driver in private markets is not your category label - it is your revenue quality and proof of durability.

Important: these are illustrative ranges drawn from grouped deal patterns and examples. Your result depends on your growth, margins, customer concentration, and how “software-first” your economics really are.

4.2 Public Companies (reference points, not price tags)

Public markets (as of mid-to-late 2025) show a wide spread:

- Supply chain software and SaaS tends to trade around ~6.0x median EV/Revenue and ~30x+ EV/EBITDA on average/median measures.

- Orchestration and control tower style groups show a high median (~7.9x EV/Revenue) but a very high average (~62x) because a few extreme outliers pull the average up.

- Logistics services and asset-light networks generally trade around ~0.9x to ~1.5x EV/Revenue and high single-digit to low-teens EV/EBITDA.

How to use this as a private founder

- Treat public multiples as a reference band (a ceiling and a sanity check), not a direct valuation.

- Private companies usually trade at a discount for smaller scale, higher customer risk, and less liquidity.

- You can still get “public-like” outcomes when you are scarce and strategic - but you must prove software economics and defensibility.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes in this sector usually happen when buyers can tell a simple story: high-quality recurring revenue, strong margins, mission-critical workflow, and clear paths to expansion. Based on observed deal patterns, here are the premium drivers that show up again and again:

Theme 1: Software-led economics (not just software branding)

Buyers pay more when your business has clear SaaS traits: recurring subscription revenue, high gross margin, and low capital intensity.

- Practical examples:

- You can show subscription ARR separate from implementation.

- Gross margin is consistently strong and understandable.

- Onboarding does not require bespoke engineering every time.

Theme 2: Embedded in revenue-critical workflows (especially e-commerce operations)

When your product sits inside workflows that directly affect revenue or customer experience - shipping promises, returns, inventory availability - switching becomes painful.

- Practical examples:

- Returns, delivery experience, marketplace ops, carrier selection, parcel execution.

- “If this breaks, the business loses money today” use cases.

Theme 3: Strategic synergy and cross-sell fit to larger platforms

Strategic buyers pay more when they can plug your product into a broader suite and sell it to an existing base.

- Practical examples:

- You integrate cleanly into major TMS/WMS/parcel stacks.

- You can prove attach rates (customers buy you as an add-on module).

- Your roadmap aligns with what bigger platforms need next.

Theme 4: Regulated or compliance-heavy vertical specialization

Solutions that reduce regulatory burden and increase auditability (healthcare, cold chain, traceability, customs) can earn premiums because they reduce risk for customers.

- Practical examples:

- Validation, audit trails, serialization/traceability, temperature compliance, chain-of-custody reporting.

Theme 5: Payments and financial workflow adjacency

When you touch carrier invoices, audit, dispute resolution, or payment rails, you increase switching costs and monetization options.

- Practical examples:

- Automated carrier invoice audit and recovery.

- Approved-pay workflows that shorten cash cycles.

- Chargeback and exception resolution loops.

Theme 6: Durable EBITDA and “clean” profitability

Even in software, buyers reward profits they trust.

- Practical examples:

- EBITDA margin is not a one-time spike.

- You can explain cost structure simply (R&D, sales, support, hosting).

- Customer retention supports forward cash flow.

Theme 7: Operational credibility (the “boring” stuff that boosts value)

These are not glamorous, but they move outcomes:

- Clean financials and consistent monthly reporting.

- Diversified customer base.

- A leadership bench beyond the founder.

- Security posture and strong customer references.

6. Discount Drivers (What Lowers Multiples)

Low-end outcomes are not random. They usually come from uncertainty: “Will this revenue still be here in 18 months?” or “How much work is hidden in delivering it?”

Common discount drivers in logistics management software:

- Services or pass-through revenue dominates and gross margin is unclear.

- Low retention or “project churn” (customers leave after the implementation phase).

- Customer concentration (one or two shippers drive most revenue).

- Heavy customization (every deal becomes a bespoke build).

- Integration fragility (key carrier/EDI/ERP connections are brittle or undocumented).

- Security or compliance gaps (buyers fear hidden risk in customer data and operations).

- Founder dependency (sales, product, and key accounts all run through you).

- Volatile margins (support costs spike, hosting costs surprise, implementation overruns).

- Unclear KPI truth (if metrics are messy, buyers assume the conservative case).

The good news: most of these are fixable in 6-12 months if you focus on clarity and repeatability, not reinvention.

7. Valuation Example: A Logistics Management Software Company (Fictional)

This is a worked example to show the logic. The company and numbers are fictional and are not investment advice or a formal valuation.

Step 1: The logic

- Start with the right comp “universe.”

- If you are software-led (TMS/WMS/OMS/visibility), you anchor to software deal ranges and software public comps.

- If you are services-heavy (managed transportation, brokerage-like pass-through), you anchor to services ranges.

- Pick a realistic base multiple band for a private company at your scale.

- For a software-leaning private logistics platform at ~USD 10m revenue, a ~3.0x-7.0x EV/Revenue band can be defensible when software economics are present but not “public-market perfect.”

- Move up or down based on proof.

- Push up if you can prove high software gross margins, high recurring revenue share, strong retention, and strategic integration value.

- Push down if services/pass-through dominates, margins are low, or retention is weak.

Step 2: Apply it to a fictional company

Company: HarborFlow (fictional)

What it does: TMS + parcel execution + dock scheduling for mid-market distributors

Revenue: USD 10.0m LTM (fictional)

Assume three scenarios:

What changes the multiple in this example

- HarborFlow moves toward the premium case if:

- Software revenue is >70% of total revenue and clearly reported.

- Gross margin is strong and stable (software-like).

- Retention is strong and expansion is visible (more sites, more modules).

- Integrations create pull-through demand with bigger platforms.

- HarborFlow falls toward the discounted case if:

- Services and pass-through costs dominate.

- Gross margin is low or blended.

- Customers behave like projects, not subscriptions.

Step 3: What this means for you

Two businesses with the same USD 10m revenue can be worth dramatically different amounts in this sector. The difference is not branding - it is proof:

- proof your revenue repeats,

- proof it is profitable in a scalable way,

- proof customers cannot easily replace you.

8. Where Your Business Might Fit (Self-Assessment Framework)

This is a simple tool to locate yourself in the valuation spectrum. Score each factor 0 / 1 / 2:

- 0 = weak or unproven

- 1 = decent but inconsistent

- 2 = strong and well-evidenced

Self-assessment table

How to interpret your total

- High band: you look like a premium software asset - more buyers, more competition, better terms.

- Middle band: fair market software valuation - you can still do well with a strong process.

- Low band: buyers will anchor you closer to services or “mixed-quality” software - consider a 6-12 month value-building sprint before selling.

9. Common Mistakes That Could Reduce Valuation

These mistakes are avoidable - and they cost real money.

- Rushing the sale

- If you go to market before your numbers and story are clean, buyers will price the uncertainty.

- Hiding problems

- Issues always surface in diligence. Hiding them destroys trust and usually leads to retrades (price cuts) later.

- Weak financial records

- If you cannot clearly show revenue split (software vs services), gross margin by segment, and retention, buyers assume the conservative case.

- Skipping a structured, competitive process

- A competitive process forces buyers to put their best foot forward. Multiple sources cite studies suggesting sellers who use investment bankers can see valuation premiums around ~25% versus going it alone (methodology varies).

- Separate from the “25%” headline, the core logic is simple: more qualified buyers and tighter process discipline usually means better outcomes.

- Revealing what price you want instead of letting the market bid

- If you tell buyers “we want USD 50m,” many will anchor right above it (USD 50.1m, USD 50.2m) instead of showing what they would actually pay in a competitive process.

Two industry-specific mistakes (logistics software edition)

- Not separating software economics from operational labor. If implementation and support are messy, you will get valued like a services company.

- Under-investing in integration reliability and documentation. If a buyer fears your carrier/EDI/ERP connections will break under scale, they discount you heavily.

10. What Logistics Management Software Founders Can Do in 6-12 Months to Increase Valuation

You do not need a massive pivot. You need targeted upgrades that reduce buyer uncertainty and improve revenue quality.

A. Make revenue quality undeniable

- Report software vs services revenue every month, with gross margin for each.

- Move more customers to annual contracts (even if billed monthly).

- Productize onboarding: fixed packages, templates, “go-live in X weeks” playbooks.

B. Improve stickiness and expansion

- Build expansion paths: more sites, more users, more modules, more shipment tiers.

- Add “daily operations hooks” (exceptions, dispatch workflows, invoice audit) that make the product hard to remove.

- Tighten customer success: reduce churn, improve time-to-value, document case studies.

C. Build defensibility buyers can understand quickly

- Deepen integrations with the systems your customers already live in.

- Strengthen security posture and auditability (especially if you touch regulated data or compliance workflows).

- If relevant, pick one regulated or compliance-heavy niche where you can win repeatedly.

D. Prepare for diligence like a grown-up company

- Monthly KPI dashboard (revenue, retention, churn, margin by segment, pipeline).

- Clean data room: contracts, product roadmap, security docs, customer references, integration documentation.

- Reduce founder dependency: delegate key accounts and sales motion.

E. Run the process to create competition

Logistics and supply chain markets have remained active in M&A, including continued consolidation momentum into 2025. (Deloitte)Your job is to create enough buyer tension that the best strategic fit pays a premium - and the deal still closes if one buyer drops.

11. How an AI-Native M&A Advisor Helps

Selling a logistics management software business is a data and process game: the right buyers, the right story, the right timing, and tight execution. An AI-native M&A advisor like Eilla AI is designed to improve those inputs without making the process feel like a black box.

Higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, synergy fit, financial capacity, and other signals. More relevant buyers means more competition, stronger offers, and more options if one buyer drops.

Initial offers in under 6 weeks. AI-driven buyer matching, faster outreach, and accelerated creation of process materials can compress the timeline to first conversations and initial offers - while keeping the process organized and professional.

Expert advisory, enhanced by AI. You still need experienced human advisors to run strategy, negotiation, and buyer psychology. The AI layer improves speed and coverage, while the humans ensure credibility, tight positioning, and “buyer-ready” materials - giving you Wall Street-grade execution without traditional bulge bracket costs.

If you would like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.