The Complete Valuation Playbook for Managed IT Services Businesses

A practical, data-backed guide to what MSPs really sell for - and how to raise your multiple by improving revenue quality, margins, retention, and security proof.

If you run a Managed IT Services business (MSP) and you might sell in the next 1-12 months, valuation is not just a “multiple” - it’s a story about risk, revenue quality, and how confident a buyer feels about your cash flow 12-24 months from now.

This matters right now because the sector is still consolidating, buyers are more selective than they were in the frothiest years, and many MSPs are being judged on operational quality (retention, margin discipline, security capability) more than “growth at all costs.”

This playbook shows what Managed IT Services businesses actually sell for, what drives higher vs lower outcomes, and how to pressure-test where your business likely fits - plus a practical 6-12 month plan to improve your leverage before you go to market.

1. What Makes Managed IT Services Unique

Managed IT Services sits in a valuation “middle zone” between pure services and pure software.

- You have recurring revenue (managed services contracts), but much of the delivery is people-based.

- You may resell hardware/software and cloud licenses (lower-margin pass-through), while also delivering higher-margin managed support and security.

- Your value is often tied to relationships, operational execution, and trust - not intellectual property.

Common MSP business models (and why they value differently)

- Core MSP (SMB to mid-market): Helpdesk + endpoints + M365/Google + backup/DR + network + basic security.

- Cloud-first MSP: Migration + managed cloud + ongoing optimization.

- Security-heavy managed services: MDR/SOC, identity/access, compliance services, managed detection.

- Telecom-integrated MSP: Connectivity/voice bundled with IT services.

- VAR / integrator with managed attach: Projects and resale plus some managed contracts.

These models show up in the data as different public trading multiples and different deal outcomes. For example, project-led integrators tend to trade at lower revenue multiples than recurring-heavy MSPs because the revenue is less predictable and more dependent on winning the next project.

Unique valuation considerations in MSPs

- Revenue quality beats revenue size. A USD 10m MSP with sticky contracts and clean margins can outvalue a USD 20m MSP that is project-heavy with churn.

- Margins are a credibility signal. Buyers use margin profile and margin trend as proof that your pricing, delivery, and customer base are healthy.

- Security capability increasingly acts like “revenue insurance.” Security-heavy offerings can reduce churn and increase wallet share because customers see you as mission-critical.

Key risk factors buyers will always check

- Customer concentration (one client can sink a deal).

- Churn and contract structure (monthly cancellable vs multi-year with renewal discipline).

- Tool sprawl and weak documentation (delivery risk).

- Overreliance on the founder or 1-2 “hero” engineers.

- Security posture and incident history (including your own internal controls).

2. What Buyers Look For in a Managed IT Services Business

Think of buyers as buying future confidence, not past effort. They care about whether your next 3 years look predictable.

The “obvious” buyer filters (still matter)

- Scale: Buyers pay more for businesses that are big enough to absorb overhead and invest in tools/process.

- Growth: Not just top-line growth, but whether growth is repeatable.

- Profitability: EBITDA margin and, just as importantly, whether it’s stable or improving.

- Cash conversion: Are you collecting fast and managing working capital cleanly?

MSP-specific buyer filters (usually decide the multiple)

- Recurring revenue mix: The more revenue is contracted managed services vs project/resale, the more “bond-like” it feels.

- Retention and expansion: Buyers want to see customers stick around and buy more over time.

- Service delivery maturity: Documented processes, consistent SLAs, a real service desk, and standardized tooling.

- Security depth: Not just “we sell security,” but measurable attach rates, packaged offerings, and proof customers renew them.

- Pricing power: Evidence you can raise prices without losing customers (indexation, tiering, packaging).

How private equity tends to think

Private equity (PE) is typically asking three simple questions:

- What multiple am I paying today - and what multiple could I sell at later?In MSP land, PE usually anchors to EBITDA multiples and cash generation. The data shows MSP/IT services EV/EBITDA outcomes often land in mid-single digits to low-teens depending on quality and trajectory.

- Who can I sell this to in 3-7 years?

- Larger PE funds that want more scale

- Strategic buyers (bigger MSPs, integrators, telco/IT platforms)

- Less commonly, public markets (usually only for larger regional leaders)

- What levers will I realistically pull?

- Pricing discipline and packaging (reduce “custom” work)

- Tool consolidation and vendor rebates

- Cross-sell security and cloud optimization

- Add-on acquisitions to build scale in a geography or vertical

If you want a higher multiple from PE, you need to make the “levers” feel real and already in motion - not a PowerPoint wish list.

3. Deep Dive: The Most Important Valuation Nuance in MSPs - Revenue Quality vs Revenue Quantity

Most founders think valuation starts with revenue. In MSPs, valuation starts with revenue quality.

Why? Because your revenue is only valuable to buyers if it is likely to still be there after the deal closes - and if it can produce healthy EBITDA without heroics.

How this shows up in the data

Across public MSP/infrastructure-style peers, EV/Revenue often sits below high-growth software levels, frequently around sub-1.0x to ~1.8x depending on profile. In the dataset, “mid-market managed IT & cloud MSPs (UK/EU focus)” show average EV/Revenue around 1.3x and median 0.9x, while EV/EBITDA is around 9.1x average and 8.1x median. Those are not “software multiples” - they reflect a services delivery reality.

On the private side, Managed IT Services & MSPs precedents show average EV/Revenue around 1.2x (median 0.9x) and EV/EBITDA around 9.6x (median 9.4x). The message is consistent: MSP value is usually earned through dependable cash flow, not hype.

Why buyers care so much

Buyers have learned that two MSPs with identical revenue can behave completely differently:

- MSP A renews smoothly, raises prices annually, has standardized delivery, and keeps margins steady.

- MSP B “re-sells time,” discounts to win business, suffers customer churn, and margin swings wildly.

Buyers will pay materially more for MSP A because it’s easier to finance, easier to integrate, and less likely to blow up post-close.

How to move from lower-quality to higher-quality revenue (fast enough to matter)

You don’t need to reinvent the company in 6-12 months. You need to tighten the parts buyers price.

- Move more customers onto standard packages (even if you grandfather some legacy terms).

- Add annual price indexation or structured repricing at renewal.

- Track and prove retention and expansion (even simple cohort reporting helps).

- Reduce the “project roulette” by building recurring security and cloud optimization offers.

Quick profile check: lower vs higher value MSP

4. What Managed IT Services Businesses Sell For - and What Public Markets Show

Here’s the cleanest way to use market data: treat it as guardrails, not a price tag. Public market multiples show how investors value comparable models at scale. Private deals show what real buyers pay for smaller, messier, real-world businesses.

4.1 Private Market Deals (Similar Acquisitions)

Across the precedent transactions dataset, Managed IT Services & MSPs show:

- Typical EV/Revenue around ~0.9x median and ~1.2x average

- Typical EV/EBITDA around ~9.4x median and ~9.6x average

But outcomes vary a lot based on mix, margins, and perceived defensibility. Some deals lean higher on EBITDA multiples even when revenue multiples look modest - especially where niche positioning and margin profile are strong.

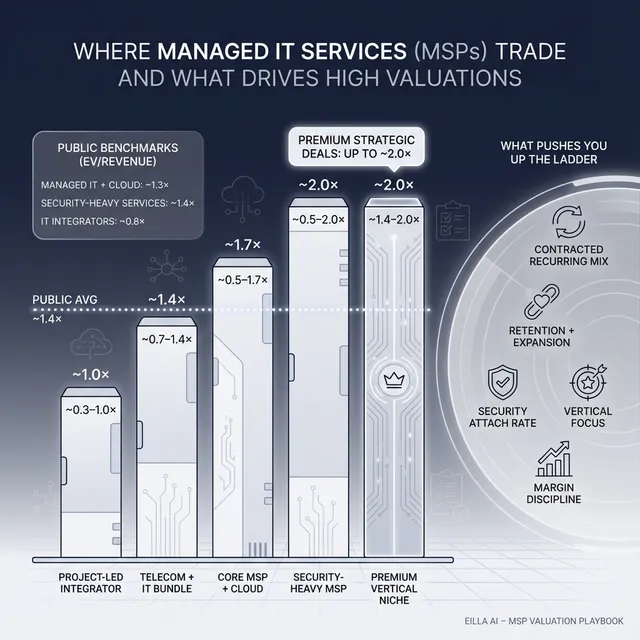

Illustrative private valuation ranges by deal type (from the provided data):

These ranges are illustrative. Your actual outcome depends heavily on the proof you can show around retention, pricing power, and sustainable EBITDA.

4.2 Public Companies

Public markets (as of mid-to-late 2025, per the dataset) provide a useful “reality check” for founders. Across the overall public peer set, the dataset shows:

- Overall average EV/Revenue ~1.4x and EV/EBITDA ~11.1x

- MSP-focused groups cluster around similar levels, with meaningful differences by mix

Public multiples by segment (from the provided group averages):

How to use this:

- Public multiples are reference bands, not your valuation.

- Private businesses typically get discounted for smaller scale, customer concentration, and founder dependence.

- But scarce, high-trust assets (strong vertical niche, security depth, great margins) can sometimes price at the top end of private ranges because strategics compete.

5. What Drives High Valuations (Premium Valuation Drivers)

You don’t get a premium multiple by asking for it. You earn it by removing buyer fear and increasing buyer imagination. The data highlights several patterns that show up again and again in higher outcomes.

Theme 1: Vertical focus with entrenched client relationships

Deals in the dataset show that vertical specialization can support premium outcomes (often more visible in EBITDA multiples than revenue multiples) when it comes with durable relationships and repeatable delivery.

What buyers pay for:

- “We are the default MSP for X industry” is easier to sell and easier to defend.

- Vertical knowledge reduces onboarding cost and reduces churn.

What you can do:

- Build 2-3 packaged offerings for your vertical (compliance, tooling stack, standard onboarding).

- Publish case studies that show business outcomes (uptime, incident reduction, audit readiness).

- Track renewal rates within the vertical as a separate KPI.

Theme 2: Cybersecurity-led service mix and packaged security revenue

Cyber-centric providers in the data often command elevated value because security revenue tends to be stickier and more mission-critical.

What buyers pay for:

- Security offerings that are clearly packaged (MDR/SOC, identity, compliance) with measurable attach rates.

- Proof customers renew security, not just buy a one-time assessment.

What you can do:

- Report “security recurring revenue” as its own line.

- Track attach rate: what % of managed customers buy your security bundle.

- Standardize incident response playbooks and show outcomes.

Theme 3: Strategic buyer synergies (and your ability to prove them)

Premium clusters often appear when the buyer can clearly expand margins or cross-sell through an existing platform. Strategics pay up when synergies are obvious and credible.

What buyers pay for:

- Clear cost take-outs (tool consolidation, vendor rebates, duplicated overhead).

- Revenue synergies (your vertical + their broader platform, or vice versa).

What you can do:

- Map your services to likely acquirers’ gaps: “We fill X capability in Y vertical.”

- Show margin improvement already underway (even a few quarters matters).

- Document your vendor economics and rebate potential.

Theme 4: Demonstrated margin trajectory and resilience

The data repeatedly rewards margin improvement or stable margin profiles. In MSPs, margin is a proxy for operational maturity.

What buyers pay for:

- EBITDA margins that are steady or improving.

- Evidence that pricing and delivery are under control.

What you can do in 6-12 months:

- Tighten utilization and ticket handling metrics.

- Reduce low-margin resale emphasis in your narrative (even if you keep it in practice).

- Reprice legacy accounts at renewal with a simple, defensible rationale.

Theme 5: Proof you can integrate bolt-ons (or at least run change well)

Where buyers see evidence that a business can integrate acquisitions or new service lines cleanly, they underwrite growth with less fear.

What buyers pay for:

- Repeatable integration playbooks and real synergy capture.

- Stable service quality through change.

What you can do:

- Create an integration checklist: tooling, SLAs, pricing, customer communication, team retention.

- Show cross-sell wins from past additions (even small ones).

6. Discount Drivers (What Lowers Multiples)

Most low outcomes are not “bad luck.” They are predictable buyer objections that were never addressed.

The most common MSP discount drivers

- Falling margins or “mystery margins.” If your EBITDA margin is volatile or unclear, buyers assume risk and lower price.

- Too much project or resale revenue. Buyers fear a revenue cliff when projects slow or vendors change incentives.

- Weak retention data. If you can’t show churn and renewals clearly, buyers assume churn is worse than you say.

- Customer concentration. A single big client can dominate your future - buyers price that risk.

- Founder dependency. If customers stay “because of you,” buyers see a transition problem.

- Tool sprawl and messy delivery. Too many tools, inconsistent processes, poor documentation = integration pain.

- Security risk. A history of incidents, weak internal controls, or unclear compliance posture can slow or kill a deal.

The good news: many of these are fixable quickly if you treat the next 6-12 months as “pre-sale operations,” not business as usual.

7. Valuation Example: A Managed IT Services Company (Fictional)

This is a worked example to show the logic - not a prediction, not investment advice, and not a formal valuation.

Fictional company: “NorthBridge Managed IT”

- Revenue: USD 10.0m (fictional)

- Business: Core MSP serving SMB-mid market, with a growing security bundle

- Mix (illustrative): 70% managed services, 20% projects, 10% resale

- Gross margin: mid-30s

- EBITDA margin: currently 6%, with a plan to return to 10% via repricing and delivery efficiency

Step 1: Choose the right comp logic

The key is to avoid “software envy.” MSPs should not benchmark to software vendor multiples. In the provided data, software/security vendors can trade at very high EV/Revenue, but that’s driven by high gross margins and IP-led models - not people-delivered services.

So for NorthBridge, we anchor to MSP and services comps:

- Private MSP transactions show ~0.9x median and ~1.2x average EV/Revenue, with meaningful spread.

- Public MSP groups show EV/Revenue often clustering sub-1.0x to ~1.8x depending on quality.

- A practical “core band” for a mid-market MSP without extreme premium traits is often around 0.8x-1.4x EV/Revenue in the provided logic example.

Step 2: Apply scenarios to USD 10m revenue

What moves NorthBridge into the premium case?

- Security bundle is packaged, measurable, and renewing (not ad hoc projects).

- EBITDA margin trend is improving and believable.

- Vertical focus or strong differentiation reduces churn.

- Competitive tension: multiple strategics see clear synergies.

Step 3: The founder takeaway

Two MSPs with the same USD 10m revenue can be worth very different amounts because buyers are buying confidence. Your job is to make confidence obvious in your numbers and your story - before you run a process.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as a simple diagnostic. Score each factor 0-2:

- 0 = weak / unclear

- 1 = decent but inconsistent

- 2 = strong and provable

Interpreting your score (simple bands)

- High band (mostly 2s): You’re closer to premium outcomes because risk feels low.

- Mid band (mix of 1s and 2s): “Fair market” MSP valuation - process quality and buyer competition matter a lot.

- Low band (many 0s): Expect buyers to price in risk unless you fix the biggest gaps before going to market.

9. Common Mistakes That Could Reduce Valuation

Rushing the sale

If you go to market before your numbers and story are clean, buyers will anchor low and stay there.

What to do instead:

- Spend 6-12 weeks getting reporting tight and your narrative consistent.

Hiding problems

Buyers will find them in diligence. If they find them before you disclose them, trust collapses and price follows.

What to do instead:

- Surface issues early with a clear mitigation plan (buyers respect that).

Weak financial records

If your financials don’t cleanly separate managed services vs projects vs resale, or you can’t explain margin swings, buyers assume the worst.

What to do instead:

- Clean revenue categorization.

- Build a simple bridge: “here’s why margins changed and what we’re doing about it.”

Not running a structured, competitive process with an advisor

Structured processes typically lead to meaningfully higher prices - research is often cited around ~25% higher purchase prices when a competitive process is run well (vs a single-buyer negotiation).

Revealing what price you’re after too early

If you say “we want USD 10m,” many buyers will come back with USD 10.1m, USD 10.2m-type offers. You just killed price discovery.

What to do instead:

- Let the market tell you what you’re worth, then negotiate from strength.

MSP-specific mistake: letting tool sprawl and documentation slide

In MSPs, buyers fear operational chaos. Tool sprawl, tribal knowledge, and undocumented processes translate directly into integration risk and value discounts.

10. What Managed IT Services Founders Can Do in 6-12 Months to Increase Valuation

Here’s a realistic plan that matches what buyers actually reward.

Improve the numbers (without “financial engineering”)

- Reprice legacy accounts at renewal with clear packaging and tiering.

- Reduce low-margin resale emphasis in your story; protect it operationally, but don’t let it define you.

- Track and improve delivery efficiency: ticket volume per endpoint, resolution time, utilization.

- Stabilize EBITDA margin and show at least 2-3 quarters of consistent performance.

Improve revenue quality and proof

- Calculate and report churn (logo churn and revenue churn).

- Build a renewal calendar and run renewal discipline like a sales process.

- Increase managed services share through packaging and contract migration.

- Add contract indexation or structured annual price review.

Make security real (and measurable)

- Define 2-3 security bundles (good/better/best).

- Track attach rate and security recurring revenue separately.

- Build basic proof: incident metrics, response times, compliance outcomes.

Reduce buyer fear

- Build a leadership bench: who runs service desk, who owns key accounts, who owns security.

- Document core processes: onboarding, offboarding, escalations, incident response.

- Tighten customer concentration by upselling mid-tier accounts and reducing reliance on the biggest customer.

Prepare the deal story

- Your “why buy us” should be 3 crisp points: vertical, delivery maturity, security + retention.

- Build a buyer-specific synergy narrative: why a strategic would pay more than a financial buyer.

11. How an AI-Native M&A Advisor Helps

Selling an MSP is a market process, not a math exercise. The best outcomes usually come from creating competition among the right buyers while controlling the story and reducing diligence surprises.

An AI-native M&A advisor helps you reach more relevant buyers. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, synergy fit, financial capacity, and other signals. More relevant buyers means more competitive tension, stronger offers, and a higher chance the deal closes even if one buyer drops.

It can also compress timelines. With AI-driven buyer matching, faster outreach, and support in creating marketing materials and managing diligence, initial conversations and offers can often be reached in under 6 weeks compared to slower manual-only approaches.

Finally, it combines speed with credibility. You still get expert human M&A advisors driving the process, but enhanced by AI for research, positioning, and buyer targeting - resulting in Wall Street-grade advisory quality without traditional bulge bracket costs.

If you’d like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.