The Complete Valuation Playbook for Marketing Automation Businesses

A data-backed valuation playbook for marketing automation founders on what drives valuation multiples.

If you run a marketing automation business and you are considering a sale in the next 1-12 months, valuation is not just a math problem - it is a story problem backed by data.

This playbook is built specifically for marketing automation founders. It shows what similar businesses have sold for, how public markets value the category (as of late 2025), what drives higher vs lower multiples, and how to pressure-test your own likely valuation range with a simple framework and a worked example.

You will not get a single "correct" price. You will get the logic buyers use, and a practical plan to move your outcome up.

1. What Makes Marketing Automation Businesses Unique

Marketing automation is not one single business model. Buyers value it differently depending on what you actually are: a core automation platform, a CRM + automation suite, a messaging or conversational layer, a vertical-specific platform (for a regulated or niche industry), or a services-heavy agency that happens to use automation tools.

A few things make valuation in this sector uniquely nuanced:

- Your product sits on top of other platforms. Integrations with CRM, e-commerce, ad platforms, and data tools are not "nice-to-haves" - they are often the product. Buyers will test how dependent you are on APIs and partner policies you do not control.

- Deliverability and compliance are hidden moats. Email, SMS, WhatsApp, and push performance is part science, part reputation, part compliance. Problems here can kill retention fast.

- Data privacy is a real operating constraint. Consent, GDPR-style requirements, and customer data handling create both risk and defensibility. Done well, it becomes a reason to pay more.

- There is constant consolidation pressure. Suites keep bundling features (CRM, marketing, customer support, analytics). That creates two paths: become a strong suite yourself, or be a valuable module that a suite wants to tuck in.

Key risk factors buyers will always check in marketing automation:

- Customer retention (do customers stay and expand, or churn when budgets tighten?)

- Channel dependency (are you at the mercy of Google, Meta, Apple, email inbox providers, or a messaging carrier?)

- Integration and API risk (how hard is it to maintain integrations and how exposed are you to policy changes?)

- Spam, consent, and compliance posture (especially in messaging-heavy businesses)

- Services drag (how much of "software revenue" is really people doing manual work?)

2. What Buyers Look For in a Marketing Automation Business

Buyers generally put you in one of two mental buckets:

- A scalable software asset with repeatable revenue, or

- A services business with some tech, where growth requires hiring more people.

Your valuation multiple depends heavily on which bucket you land in.

The obvious fundamentals (that still matter)

- Revenue scale and growth: Bigger and growing faster usually means higher multiples.

- Recurring revenue quality: Subscription revenue is valued more than one-time setup fees or project work.

- Gross margin: High gross margins signal scalability. Low gross margins often signal services or heavy delivery cost.

- Profitability or a clear path to it: Even in growth businesses, buyers want to see that profit is achievable without magical thinking.

Marketing-automation-specific signals buyers care about

- Retention driven by outcomes: Buyers pay more when you can show that customers stick around because they get measurable ROI (leads, conversions, retention), not because switching is annoying.

- Data and workflow stickiness: If your product becomes the system of record for campaigns, audiences, and journey logic, churn tends to be lower.

- Integration depth: "We integrate with X" is cheap. "We are embedded in workflows across X, Y, Z and customers would lose history, attribution, and automation logic if they left" is valuable.

- Channel reliability: Messaging deliverability, compliance, and reputation are value drivers, not just ops details.

How private equity buyers think (in plain English)

Private equity (PE) buyers usually ask three questions:

- What multiple am I paying today and what multiple can I sell it for in 3-7 years? If they pay a high price today, they need confidence the business will still look premium later.

- Who can buy this later? Another larger PE fund, a strategic suite buyer, or (rarely) public markets.

- What levers can I pull? Common PE levers in marketing automation:

- Price increases (if your product is sticky and underpriced)

- Cross-sell (adding SMS, referrals, sales engagement, reviews, loyalty, analytics)

- Cost discipline (especially reducing services drag and improving gross margin)

- Bolt-on acquisitions (buying small tools to expand the suite)

PE likes marketing automation when it looks like a durable subscription engine with clear expansion paths. They get nervous when it looks like a collection of features propped up by paid acquisition and founder heroics.

3. Deep Dive: Suite Adjacency and Channel Trust - The Two Biggest Multiple Movers

A practical way to understand valuation in this sector is to focus on two questions buyers obsess over:

- Are you a must-have module inside a bigger suite?

- Do buyers trust your ability to send messages reliably and compliantly?

These two factors show up repeatedly in deal narratives and in where multiples cluster.

Why suite adjacency matters so much

In private deals, small marketing automation and adjacent tools often sell because they fill a capability gap for a larger platform. When the acquirer already has distribution (thousands of customers), adding a new module can create fast cross-sell and higher average revenue per customer.

This is why "feature adjacency" can matter more than raw size. A smaller tool can still be strategically valuable if it plugs cleanly into a suite and expands what the suite can sell.

Why channel trust (deliverability + compliance) can justify a premium

Messaging and customer communications assets often get valued differently because compliance, consent management, and deliverability are difficult to build and easy to break. Buyers do not want to inherit a reputational or regulatory mess.

When you can show mature consent handling, strong deliverability, and operational reliability, you reduce perceived risk - and risk reduction is one of the simplest ways to increase valuation.

Lower-value vs higher-value profile (what buyers are really comparing)

How to move right on this table in 6-12 months

- Pick a sharper positioning (either "core suite for X customer" or "best-in-class module for Y use case").

- Turn integrations into workflows (templates, playbooks, prebuilt journeys tied to connected tools).

- Build compliance proof (audits, documentation, consent workflows, deliverability monitoring).

- Track and publish the outcomes customers get (case studies tied to metrics, not vibes).

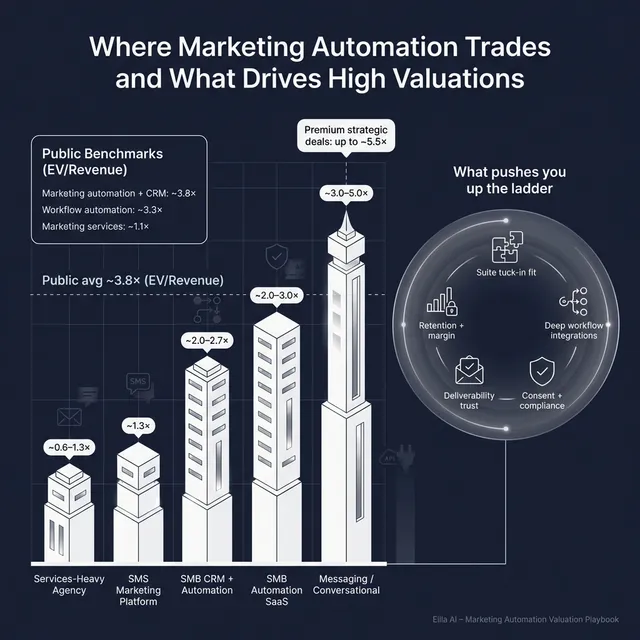

4. What Marketing Automation Businesses Sell For - and What Public Markets Show

Valuation multiples are not rewards for effort. They are prices for a package of cash flow potential and risk.

The data below gives you two anchor points:

- Private market deals: What similar companies actually sold for.

- Public market multiples (late 2025): What the market pays for scaled, liquid versions of similar businesses.

Use both as reference bands, then adjust for your reality: size, growth, margins, risk, and strategic value.

4.1 Private Market Deals (Similar Acquisitions)

Across precedent transactions in this space, the overall private market clusters around ~2.5x EV/Revenue on average. But marketing automation is a multi-model category, and the spread is wide.

At the segment level in the deal data:

- SMB CRM + marketing automation SaaS tends to cluster around ~2.0x to ~2.7x EV/Revenue on average, with higher outcomes when there is clear strategic fit or strong profitability.

- Messaging and conversational engagement platforms show higher revenue multiples in the data (often ~3.1x to ~4.3x, with some deals higher), reflecting strategic value when messaging revenue is scalable and defensible.

- SMS marketing platforms show lower revenue multiples on average (around ~1.3x EV/Revenue) but can still command solid EBITDA multiples when cash flow is real.

- Services-heavy marketing agencies tend to sit much lower on revenue multiples (around ~0.9x EV/Revenue), because revenue is tied to headcount and project delivery.

A simple way to interpret this: the more your revenue looks like scalable software subscription revenue, the more buyers talk in revenue multiples. The more it looks like services and project delivery, the more buyers talk in EBITDA multiples - and those multiples tend to be lower.

These are illustrative ranges, not price tags. Your specific growth, margins, retention, and deal process will move you around inside (or outside) them.

4.2 Public Companies

Public markets are not a perfect comparison for private companies - but they are still useful as "gravity."

As of late 2025, public trading multiples across relevant groups show:

- SaaS marketing automation and CRM platforms average around ~3.8x EV/Revenue (median ~3.6x). EBITDA multiples are noisy because many high-growth businesses report low or negative EBITDA, which inflates averages.

- Adjacent software categories that often overlap with marketing automation also trade in the low-to-mid single digit revenue multiple range (for example, workflow automation, SEO/presence platforms, and vertical marketing platforms).

- Services and lower-margin marketing businesses trade much lower, often around or below ~1.0x revenue.

How to use this as a private founder:

- Treat public multiples as reference bands, not targets.

- Adjust downward for smaller scale, customer concentration, weaker retention, or higher integration risk.

- Adjust upward only when you have something scarce and strategically valuable (clear tuck-in value, compliance moat, or unusually strong growth with retention).

5. What Drives High Valuations (Premium Valuation Drivers)

The premium outcomes in this sector tend to come from a small set of repeatable themes. The data points to a few drivers again and again, and the buyer logic is consistent.

5.1 Clear tuck-in value into a broader suite

Buyers pay more when your product is an obvious module they can sell to their existing customer base.

What founders can do:

- Show overlap in customer profile (same type of SMB, same use case).

- Prove the "attach" story: customers who buy your module increase their spend or retention.

- Make integration easy: clean APIs, clear documentation, fast time-to-value.

Practical examples:

- A sales engagement add-on that plugs into an SMB CRM suite.

- A referral engine that increases ROI for an existing email automation platform.

- A reviews or messaging layer that turns campaigns into two-way engagement.

5.2 High gross margin structure that stays high as you grow

Deals with very high gross margins tend to feel "safer" because buyers believe revenue can scale without margin collapsing. In the data, high gross margin profiles show resilience even when EBITDA moves around.

What founders can do:

- Separate true software revenue from services.

- Productize onboarding and reduce implementation labor.

- Track gross margin by customer segment so you can show buyers where the scalable growth is.

5.3 Compliance, consent, and deliverability as defensibility

In messaging and communications-heavy assets, compliance and reliability are premium levers. Buyers value "boring excellence" here because it reduces downside risk.

What founders can do:

- Document your consent flows, audit trails, and data handling policies.

- Maintain deliverability dashboards and show trend stability.

- Build reputation protection into the product (templates, guardrails, list hygiene tools).

5.4 Strong growth with retention - even if EBITDA is not perfect

At the top end of the market, buyers will tolerate low or negative EBITDA if growth is strong and the business looks like a future cash flow machine. But this is usually reserved for assets with real momentum and credible moats.

What founders can do:

- Prove that growth is not just paid ads - show partner growth, organic, expansion revenue.

- Tell a clean retention story: churn, expansion, and cohort behavior.

- Avoid "growth at any cost" if your retention does not support it.

5.5 Profitability that is durable and improving

In SMB-focused software, strong EBITDA margins can drive meaningful premium outcomes, especially when margins are rising and the cost structure looks disciplined.

What founders can do:

- Show a clear bridge from today to stronger margins (productization, pricing, reduced support burden).

- Avoid "founder add-backs" as the whole story - buyers want real operational profitability.

5.6 Clean fundamentals that de-risk diligence

Some drivers are not sexy, but they move valuation because they reduce friction:

- Clean financials and predictable revenue recognition

- Customer diversification

- Strong leadership bench (not everything depends on you)

- Clear KPIs and reporting cadence

- Low technical debt and stable uptime

Premium valuation is often "less about magic" and more about buyers feeling confident they can own your business without surprises.

6. Discount Drivers (What Lowers Multiples)

Low-end outcomes usually have the same root cause: buyers see higher risk or lower scalability, so they pay less (or require earn-outs to protect themselves).

Common discount drivers in marketing automation:

- High churn or weak retention: If customers leave quickly, buyers assume revenue is fragile.

- Services-heavy delivery masked as software: If onboarding, campaigns, or integrations require a lot of people, margins and scalability suffer.

- Channel dependency risk: Overreliance on one channel (email deliverability, a single messaging provider, one ad platform integration) creates platform risk.

- Unclear differentiation: If you look like a commodity automation tool, buyers price you like one.

- Customer concentration: A few customers driving a big portion of revenue increases downside risk.

- Compliance and consent gaps: Missing documentation, weak consent flows, or prior deliverability issues create fear of future restrictions.

- Messy metrics: If you cannot explain ARR, churn, and cohorts cleanly, buyers assume the worst.

- Founder dependence: If sales, product decisions, and customer success run through you, buyers discount for transition risk.

A useful mindset: buyers do not punish you for having weaknesses - they punish you for hiding them, or for not having a credible plan.

7. Valuation Example: A Marketing Automation Company (Fictional)

This example is designed to show the logic, not to predict a sale price. The company and numbers are fictional.

Step 1: Build a reasonable multiple range from market data

A sensible approach for an SMB-focused marketing automation SaaS business is:

- Start with relevant public SaaS marketing automation and adjacent software categories (often low-to-mid single digit EV/Revenue).

- Cross-check with private market deals in SMB marketing automation (often clustering around ~2.0x-3.0x EV/Revenue).

- Decide whether you deserve to lean up (strategic tuck-in, strong margins, compliance moat) or down (services drag, churn, unclear differentiation).

- Consider deal structure: earn-outs can increase headline value when growth is credible, but they do not fix weak fundamentals.

For a $10m revenue marketing automation SaaS company, a base range of ~2.5x-4.0x EV/Revenue is often defensible in this dataset-driven framework, with higher outcomes requiring unusually strong strategic value or growth.

Step 2: Apply it to a fictional company

Meet FlowHarbor, a fictional marketing automation business:

- USD 10m trailing twelve month revenue (fictional)

- Mostly subscription revenue, but with some onboarding services

- Strong integrations with e-commerce and SMB CRM tools

- Email + SMS automation with solid deliverability practices

- Mid-market-ish SMB focus (customers pay enough to care, but still churn if value is unclear)

- Decent growth, not a rocket ship

Now apply scenarios.

What moves FlowHarbor up?

- Clear tuck-in logic for a suite buyer (proof they can cross-sell it)

- High gross margin with minimal services drag

- Strong retention and expansion (customers stay and spend more)

- Proven compliance and stable deliverability

What moves it down?

- Customers churning after 6-12 months

- Heavy implementation work hiding inside "software revenue"

- Reliance on one channel or fragile deliverability

- Weak reporting and unclear KPIs

Step 3: What this means for you

Two companies can both have USD 10m in revenue and be worth very different amounts. The multiple is basically the buyer saying: "How confident am I that this revenue will still be here, and can grow, under my ownership?"

This is why working on retention, margin structure, and risk reduction can matter as much as working on top-line growth.

Disclaimer: This is not investment advice, not a fairness opinion, and not a formal valuation. It is an illustrative example of how buyers often think.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as an honest mirror. Score each factor 0-2:

- 0 = weak or unclear

- 1 = decent but not proven

- 2 = strong and provable with data

How to interpret your total (roughly):

- Mostly 2s: You are closer to premium outcomes if you run a strong process.

- Mixed 0s and 1s: You can still sell, but you are likely in the core range unless you fix the highest-impact gaps.

- Many 0s in high-impact: Expect lower multiples or heavier earn-outs unless you take 6-12 months to improve.

The goal is not to "game" the score. The goal is to identify the few things that buyers will price aggressively.

9. Common Mistakes That Could Reduce Valuation

These are avoidable, and they show up constantly.

9.1 Rushing the sale

If you start a process before your numbers and story are ready, buyers will control the narrative. You want to enter the market when you can explain your metrics cleanly and confidently.

9.2 Hiding problems

Due diligence exists to find problems. If buyers discover issues you did not disclose, trust breaks - and valuation drops fast. You are better off saying: "Here is the issue, and here is what we are doing about it."

9.3 Weak financial records

Marketing automation buyers want clean revenue reporting and clear margins. In 6-12 months you can often improve:

- Revenue classification (subscription vs services)

- Gross margin reporting by segment

- KPI tracking (retention, churn, expansion)

This is not "finance polish." It is how buyers decide whether your revenue is durable.

9.4 No structured, competitive process

A structured sale process with an experienced advisor typically creates more buyer competition, which often leads to meaningfully higher purchase prices - commonly cited around ~25% higher outcomes versus one-off inbound negotiations.

Competition is valuation leverage.

9.5 Telling buyers your price too early

If you say "we want USD 10m," many buyers will come back with USD 10.1m or USD 10.2m. You just killed price discovery.

A better approach is to let the market bid first, then negotiate from strength.

9.6 Two marketing-automation-specific pitfalls

- Ignoring deliverability and consent hygiene: If a buyer suspects messaging risk, they will discount heavily or require strict earn-outs.

- Overstating integrations: Buyers will test whether integrations are real workflow drivers or just logos on a website.

10. What Marketing Automation Founders Can Do in 6-12 Months to Increase Valuation

You do not need a total strategy overhaul. You need targeted improvements that buyers pay for.

10.1 Improve the numbers buyers care about most

- Reduce churn in your most valuable cohort (even small improvements can change buyer confidence).

- Drive expansion revenue: get existing customers to adopt more seats, channels, or modules.

- Productize onboarding to reduce services drag and lift gross margin.

10.2 Reduce platform and compliance risk

- Build a clear consent and compliance package: policies, audit trails, documentation.

- Improve deliverability monitoring and show stability over time.

- Reduce dependency on any single integration or channel where possible.

10.3 Strengthen your "why us" positioning

- Pick a sharper customer profile and win that category (vertical focus often helps).

- Clarify whether you are a suite or a best-in-class module - and tell that story consistently.

- Build proof: case studies with metrics, not generic testimonials.

10.4 Get deal-ready operationally

- Clean up reporting: ARR (if applicable), churn, cohort retention, gross margin by segment.

- Build a simple KPI dashboard you can share with buyers.

- Reduce founder dependence: document key processes, hire or elevate leaders in sales and customer success.

10.5 Prepare for the process itself

- Build a buyer narrative that matches buyer logic: "Here is why this revenue is durable, here is how it grows, here is why risk is controlled."

- Start building your buyer list early. A strong process is not just "who shows up." It is who you deliberately bring in.

11. How an AI-Native M&A Advisor Helps

A strong exit is usually the result of process quality, not luck.

An AI-native M&A advisor increases outcomes in three practical ways:

First, higher valuations through broader buyer reach. AI can map your business to hundreds of qualified acquirers based on deal history, synergy fit, financial capacity, and product adjacency. More relevant buyers means more competition, stronger offers, and a higher chance the deal closes even if one buyer drops out.

Second, initial offers in under 6 weeks. AI-driven buyer matching, faster outreach, and accelerated creation of marketing materials and diligence support can compress timelines compared to manual-only processes.

Third, expert advisory, enhanced by AI. You still need experienced human advisors to run the process, position the story credibly, and negotiate. The AI layer enhances speed, coverage, and quality of preparation - delivering Wall Street-grade advisory output without traditional bulge bracket costs.

If you would like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.