The Complete Valuation Playbook for Occupational Health Businesses

A valuation guide for occupational health founders preparing to sell - showing what businesses actually trade for and what drives premiums or discounts.

If you run an occupational health business and you might sell in the next 1-12 months, you are stepping into a market that is quietly consolidating. Strategic buyers want scale and network coverage. Private equity wants predictable cash flow they can grow. And both are far more selective than they were a few years ago.

This playbook is built to be practical and data-based. You will see what occupational health businesses actually sell for, what pushes multiples up or down, and how to pressure-test where you might land - plus a 6-12 month action plan to improve your outcome.

1. What Makes Occupational Health Unique

Occupational health sits in a hybrid world: part healthcare delivery, part compliance, part employer services. That mix is exactly why valuation in this sector is different from “normal” healthcare and different from “normal” business services.

The main business types in occupational health

- Clinic-led occupational medicine: work injury treatment, urgent care, physicals, drug testing, RTW (return-to-work) programs.

- Employer OH services: health surveillance, case management, absence management, fitness-for-work, vaccinations, on-site services.

- H&S and compliance adjacencies: training, risk assessments, occupational hygiene, audits, documentation.

- Software-led employer health platforms: absence/work ability tracking, health-check administration, wellbeing and employee experience tools (some are pure software, many are “software + services”).

Unique valuation considerations

- Service vs software mix matters more here than in many sectors. A “service-led with a portal” business is priced very differently from a “platform-led with services as an add-on.”

- Regulatory exposure is real: clinical governance, data privacy, record keeping, and licensure are not optional - and buyers will underwrite them like risk, not like “admin.”

- Network coverage is a moat: geographic density, clinician supply, and the ability to serve multi-site employers reliably can be more valuable than any single contract.

Key risks buyers always check

- Clinical quality and governance: incident history, supervision model, protocols, complaints, and audit readiness.

- Data security and privacy: how you handle employee medical data, consent, storage, access control, and breach history.

- Customer concentration and contract fragility: one big employer can represent a scary percentage of revenue.

- Clinician dependency: “If your medical director leaves, does the engine stop?”

2. What Buyers Look For in an Occupational Health Business

Buyers are not buying “revenue.” They are buying future cash flow with manageable risk. In occupational health, they translate that into a handful of practical questions.

The universal basics (still matter a lot)

- Scale: bigger tends to be safer (more diversification, more management depth, more buyer options).

- Growth: not just “up and to the right,” but why (new clients, higher wallet share, new services, geographic expansion).

- Profitability: especially for clinic-led or services-heavy models where EBITDA is a key yardstick.

- Clean financials: if your numbers are messy, buyers price uncertainty as a discount.

Industry-specific things they care about

- Employer stickiness: do customers renew? do they expand to more sites/services? do you have multi-year agreements?

- Clinical capacity and utilization: how reliably can you deliver exams, screenings, and appointments without backlog?

- Speed-to-service: response time, appointment availability, turnaround times for reports - these drive renewal more than most founders think.

- Outcomes proof: can you show reduced lost-time incidents, faster RTW, fewer absence days, better compliance pass rates?

How private equity thinks about your business

Private equity (PE) typically buys with a 3-7 year exit in mind. Their valuation lens is shaped by three questions:

- Can we exit at a similar or higher multiple than we paid?If the business can become more “platform-like” (recurring revenue, software-enabled workflows, multi-site coverage), PE is more confident.

- Who buys this after us?

- Larger PE funds like scaled, repeatable platforms.

- Strategic acquirers like geographic coverage, employer relationships, and cross-sell potential.

- What levers can we pull?In occupational health, PE commonly underwrites:

- Pricing discipline and contract clean-up

- Cross-sell (drug testing → surveillance → absence management → onsite clinics)

- Clinic utilization improvements

- Standardized clinical operations and centralized scheduling/triage

- Selective tuck-in acquisitions to build density

3. Deep Dive: The Valuation Nuance That Matters Most - Services vs Platform (and “Proof of Outcomes”)

Most occupational health founders underestimate how strongly buyers separate service-led businesses from platform-led businesses - even if both “use software.”

Here’s the core question buyers are really asking:

“Is this a healthcare services business with some tech, or a defensible workflow platform that happens to deliver services?”

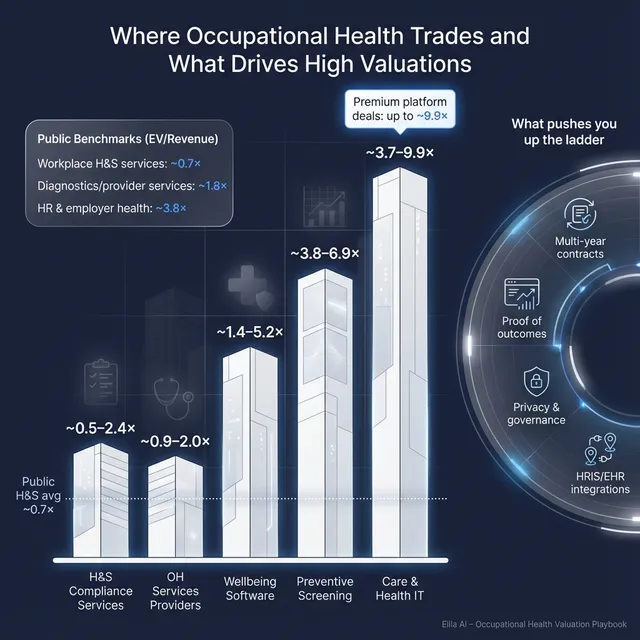

How this shows up in the data

- Public “workplace health & safety services” businesses trade around 0.6x-0.7x EV/Revenue on average/median.

- Private occupational health services deals cluster around ~1.3x EV/Revenue on average and ~1.6x on median, with scaled clinic networks able to reach roughly ~2.0x revenue in disclosed examples.

- Meanwhile, platform-like health IT and care coordination assets have cleared much higher revenue multiples in private markets (often multiple turns of revenue above services), but those outcomes are tied to real software traits: integration, data moats, and recurring revenue.

Why buyers care

- Services scale linearly: more clinicians, more sites, more scheduling complexity.

- Platforms can scale non-linearly: the product and data compound, margins expand, and switching costs rise.

What “proof of outcomes” changesIn occupational health, buyers pay up when you can connect your work to outcomes employers care about:

- reduced absence days

- faster RTW timelines

- lower incident rates

- improved audit/compliance performance

Outcomes proof does two things:

- makes renewals less price-sensitive, and

- turns your service into a “must-have workflow,” which is how you climb the multiple range.

Lower-value vs higher-value profile

If you look more like the left column today, the goal is not a massive pivot in 6 months. It is to shift the mix and reduce perceived risk enough that buyers price you closer to the right.

4. What Occupational Health Businesses Sell For - and What Public Markets Show

Valuation in this sector is best understood as a set of reference bands, not a single “right multiple.” Private deals show what acquirers have actually paid. Public markets show what investors will pay for similar risk profiles at scale (and public markets can be volatile).

4.1 Private Market Deals (Similar Acquisitions)

From the deal data, occupational health and closely adjacent categories show wide dispersion. The key pattern: services-heavy businesses trade in lower bands; software-like platforms trade in higher bands; hybrid models sit in between depending on proof of recurring revenue and defensibility.

A practical way to use the private data is to match yourself to the closest “deal type,” then adjust up or down based on your growth, margins, and risk.

These are illustrative ranges, not a price tag. Two businesses with the same revenue can land very differently based on risk, recurring revenue, and buyer fit.

4.2 Public Companies

Public comps help answer: “What do scaled, liquid market investors pay for these models?” As of late 2025, the grouped public multiples show a clear separation:

- Workplace health & safety services trade low on revenue multiples (roughly ~0.6x-0.7x) with EBITDA multiples around ~10x.

- Diagnostics and scaled provider services sit higher on revenue (around ~1.8x-1.9x) with EBITDA multiples around ~10x.

- Telehealth/digital care and HR/employer health solutions show much higher averages, but medians are far lower - a sign of outliers and investor skepticism.

How to actually use this as a private founder

- Treat public multiples as outer reference rails, not your valuation.

- Adjust down for smaller scale, customer concentration, and key-person risk.

- Adjust up only if you can credibly show platform traits: recurring revenue, high gross margin, deep workflow integration, and measurable outcomes.

5. What Drives High Valuations (Premium Valuation Drivers)

Across the deals, premium outcomes cluster around a few repeatable themes. These are the “stories” buyers are willing to pay for - because they reduce risk or increase upside.

5.1 Integrated, defensible workflow platforms (not just a portal)

Buyers pay more for businesses that sit inside employer or clinical workflows in a way that is hard to remove.

- Examples in occupational health terms:

- Absence management that becomes the system of record for HR decisions

- Surveillance workflows that automate scheduling, compliance reminders, and reporting

- RTW coordination that ties clinicians, managers, and insurers into one process

5.2 Deep workflow embedment with measurable outcomes

Premium valuations show up when outcomes are clear and repeatable.

- Practical examples:

- “We reduced average absence duration by X% across Y clients”

- “We cut time-to-appointment from A days to B days”

- “Our compliance pass rate is consistently above Z%”

5.3 Strategic buyer synergies and cross-sell readiness

Strategic buyers pay up when you clearly expand their footprint.

- In this sector, that often means:

- clinic density that fills gaps in coverage

- employer relationships that can take additional services immediately

- standardized offerings that are easy to roll out across a larger installed base

5.4 Network effects and “scarcity”

If your coverage is hard to replicate - geographic density, clinician network, or payer/TPA connectivity - buyers treat you as scarcer.

- Especially valuable for multi-site employers who need one provider across regions.

5.5 High gross margins and recurring revenue

Even in services-heavy occupational health, buyers will reward anything that looks more recurring and scalable:

- subscription-based modules (dashboards, analytics, compliance tracking)

- multi-year employer contracts with auto-renew terms

- standardized service bundles with predictable volume

5.6 Regulated data compliance and interoperability as a moat

Proven security and compliance reduces buyer fear and speeds integration:

- ISO/SOC2-type readiness, strong audit trails, and privacy governance

- integrations/APIs into HR systems, scheduling, EHRs, insurers/TPAs

5.7 Scale and density in clinic networks

When clinic networks reach meaningful density, buyers can justify stronger EBITDA multiples (and sometimes better revenue multiples) because utilization and routing improve.

6. Discount Drivers (What Lowers Multiples)

Discounts happen when buyers see uncertainty or fragility. In occupational health, a few red flags show up repeatedly.

Business model discounts

- Too much one-off revenue (no contracts, no repeatable programs)

- Low visibility pipeline (work comes from relationships, not a repeatable engine)

- High clinician dependence without a bench (or with contractor instability)

Customer and contract risk

- Customer concentration (one employer = a big chunk of revenue)

- Weak retention evidence (renewals not tracked, contracts short, scope creep unmanaged)

- Unfavorable terms (no price escalators, unclear SLAs, termination-for-convenience risk)

Operational and compliance risk

- Inconsistent clinical governance or documentation gaps

- Data security immaturity (no clear policies, access controls, incident process)

- Delivery bottlenecks (long wait times, uneven capacity by geography)

Financial quality discounts

- Messy revenue recognition (especially with mixed services and subscriptions)

- Unclear margin by service line (buyers can’t see what’s actually profitable)

- “Adjusted EBITDA” that depends on aggressive add-backs buyers won’t accept

7. Valuation Example: A Fictional Occupational Health Company (USD 10m Revenue)

Below is a worked example to show the logic. The company and numbers are fictional and simplified. The goal is to help you see how buyers think - not to predict your exact outcome.

Step 1: The logic (plain English)

- Start with the closest comp set by business model:

- If you are services-led OH, private OH services comps suggest roughly ~0.9x-2.0x revenue as a starting band, with the median around ~1.6x.

- If you have meaningful platform traits, you may triangulate to slightly higher reference bands - but you only “earn” that if the platform is real (recurring, sticky, outcomes, integrations).

- Use public markets as a sanity check:

- Service-heavy workplace H&S trades around ~0.6x-0.7x revenue.

- Scaled diagnostics/services trade around ~1.8x-1.9x revenue.This helps you avoid magical thinking and choose a defensible base range.

- Adjust for premium and discount drivers:

- Outcomes proof, recurring modules, dense coverage, and clean governance push up.

- Concentration, weak retention, and compliance gaps push down.

Step 2: Apply it to “NorthBridge Occupational Health” (fictional)

NorthBridge profile (fictional)

- USD 10.0m revenue

- 2 clinics + mobile/on-site capability

- 60% recurring contracted employer programs, 40% one-off services

- Growing 12% year-over-year

- Solid clinical governance, basic reporting portal, limited integrations

Illustrative valuation scenarios (EV based on revenue multiples)

Why the base case is ~1.2x-2.2xThat range is a reasonable triangulation for a mid-sized, service-led occupational health provider with some digital workflow - above pure low-multiple service comps, but below true software/platform premiums.

What would justify the premium case

- Multi-year contracts with clear renewal history

- Proven outcomes (absence reduction, RTW speed, compliance metrics)

- Denser geographic coverage (or a clearly scalable delivery model)

- Real recurring software revenue (not just access to a portal)

Step 3: What this means for you

Two occupational health businesses can both do USD 10m revenue and still be worth very different amounts. The difference is usually not “hype.” It is:

- how predictable the revenue is,

- how defendable the delivery engine is,

- how risky the customer base looks,

- and whether the buyer can clearly scale it.

This is not investment advice or a formal valuation - it is an illustrative framework.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this as an honest diagnostic. Score each factor 0-2:

- 0 = weak / not present

- 1 = mixed

- 2 = strong / proven

Self-assessment table

Interpreting your score (roughly)

- High band: You will likely be closer to the top of your relevant range (more buyer confidence, more competitive tension).

- Mid band: Fair market outcomes - still sellable, but you are leaving upside on the table.

- Low band: Not “bad,” but higher perceived risk. If you can wait 6-12 months, improvement work can pay back fast.

9. Common Mistakes That Could Reduce Valuation

Rushing the sale

The fastest way to lose value is to start a process before your numbers, story, and risk picture are ready. Buyers price uncertainty as a discount, and rushed sellers lose leverage.

Hiding problems

Every real business has issues. The mistake is hiding them. Problems surface in diligence, and when trust breaks, value drops (or deals die). A better approach: disclose early, quantify impact, show a fix plan.

Weak financial records

In occupational health, buyers want to see:

- revenue by service line (and by client)

- gross margin and EBITDA by service line (even directional)

- clinician cost structure clearly separated (employee vs contractor)

- normalization of one-time items that is reasonable and well-supported

No structured, competitive sale process

A structured process creates price discovery. When multiple credible buyers are engaged in parallel, you tend to get stronger terms and better price.

Industry data and practitioner evidence commonly suggests advisors can drive meaningfully higher outcomes - with some studies and summaries citing roughly 6%-25% higher purchase prices when sellers run a well-managed process rather than an ad hoc approach. (Axial)

Revealing your price too early

If you tell buyers “I want USD 10m,” you often get USD 10.1m, USD 10.2m… instead of discovering what the market might really pay. Your goal is to let offers come in first, then negotiate from strength.

One industry-specific mistake: treating compliance as “back office”

In occupational health, clinical governance, documentation, and data handling are part of the product. If those are shaky, buyers see existential risk.

Another industry-specific mistake: not measuring outcomes that employers pay for

If you can’t show RTW speed, absence reduction, or compliance performance, you are asking buyers to “believe.” Belief is discounted. Proof is paid for.

10. What Occupational Health Founders Can Do in 6-12 Months to Increase Valuation

Think of this as improving two things: the numbers and the buyer’s confidence.

A) Improve revenue quality (not just revenue)

- Move key clients onto multi-year agreements with clear scope and renewal terms.

- Add simple price escalators (annual indexation or pre-agreed increases).

- Bundle services into repeatable programs (surveillance + reporting + manager training + RTW pathways).

B) Build measurable outcomes

- Pick 3-5 metrics you can track consistently:

- average time-to-appointment

- average RTW duration by case type

- absence days reduced (where measurable)

- compliance completion and pass rates

- client retention and expansion

- Turn these into case studies that are specific and believable.

C) Strengthen delivery and reduce key-person risk

- Build a clear clinical governance structure and document it.

- Create a true second line: ops lead, clinical lead, commercial lead.

- Standardize scheduling, triage, and reporting so quality is consistent across clinicians and sites.

D) Make your financial story clean and buyer-ready

- Build a simple “management P&L” that matches how buyers underwrite:

- revenue by service line

- direct costs and gross margin by service line

- overhead allocated reasonably

- Normalize EBITDA conservatively (buyers will push back on aggressive add-backs).

E) Upgrade trust signals (fast)

- Tighten data access controls and policies.

- Document privacy and consent handling clearly.

- If you already have security certifications - highlight them. If not, show a credible roadmap and interim controls.

11. How an AI-Native M&A Advisor Helps

A strong exit outcome usually comes down to two things: the right buyers and a process that creates competition without creating chaos. An AI-native M&A advisor can improve both.

First, higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers by matching on deal history, synergy logic, and financial capacity. More relevant buyers means more real competition, stronger offers, and more options if one buyer drops late.

Second, initial offers in under 6 weeks. AI-driven buyer matching, faster outreach, and accelerated preparation of marketing materials can compress timelines without cutting corners - and keep momentum through diligence.

Third, expert advisory, enhanced by AI. You still want experienced human deal leaders negotiating and positioning the business. The difference is you get that credibility - plus faster execution and broader reach - without traditional “bulge bracket” costs.

If you’d like to understand how our AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.