The Complete Valuation Playbook for Payroll Software Businesses

A data-driven guide to what payroll software businesses sell for today - and how revenue mix, retention, and compliance credibility drive higher multiples.

If you run a payroll software business and you are thinking about a sale in the next 1-12 months, valuation is not a mystery - but it is a game of evidence, positioning, and risk removal.

Payroll is also in a very “buyer-active” phase: platform HCM suites keep consolidating the market, private equity still likes sticky recurring revenue, and regulation keeps raising the value of compliance-grade workflows. That combination rewards the best assets - and punishes messy ones.

This playbook shows what payroll software businesses actually sell for, what drives higher vs lower multiples, and how to assess (and improve) your likely outcome in the next 6-12 months.

1. What Makes Payroll Software Unique

Payroll software looks like “just another SaaS category” from far away - but buyers don’t value it like generic SaaS.

Why? Because payroll is both mission-critical and compliance-heavy. One missed pay run or a tax filing error damages trust instantly. Buyers obsess over reliability, auditability, and support quality in a way they might not for, say, a marketing tool.

Typical payroll businesses also cluster into a few “valuation personalities”:

- Pure payroll SaaS (SMB or mid-market) - subscription revenue, low services, strong gross margin potential.

- HCM suites - payroll plus HR, time and attendance, benefits, talent modules (broader platform story).

- Payroll bureau / outsourced payroll (services-led) - revenue may be recurring, but delivery is people-heavy.

- Hybrid software + bureau - software plus managed payroll, implementation, and compliance support.

- Adjacencies - time and attendance, workforce management, compliance workflows that touch payroll.

Unique valuation considerations buyers will always test:

- Regulatory exposure - tax filings, local labor rules, data privacy, audit trails, penalties, and who “owns” compliance risk (you vs the customer).

- Switching costs vs switching pain - payroll switching is painful, but buyers want proof that customers still renew and expand.

- Data and integrations - payroll is a hub: accounting, time tracking, HRIS, benefits, banking rails. Integrations can be a moat or a liability.

- Support and service delivery - payroll support is not optional. If your model depends on experts, buyers price in that cost and execution risk.

2. What Buyers Look For in a Payroll Software Business

Most founders assume valuation is mainly about growth rate. In payroll, growth matters, but risk and durability matter almost as much.

Here’s how buyers typically “see” your business.

The obvious fundamentals

- Revenue scale and trend - consistent growth beats spiky growth.

- Gross margin - payroll can hide services costs; buyers will normalize it.

- Retention - churn is the loudest signal of product weakness or customer concentration risk.

- Profitability (or a credible path) - many payroll buyers still care about EBITDA because the category often includes service delivery.

The payroll-specific lens

- Compliance credibility - do you reliably handle filings, reporting, audits, and country/state rules (if relevant)?

- Implementation friction - long, messy implementations create customer dissatisfaction and support burden.

- Integration depth - real workflows (time, accounting, banking, benefits), not just “we have an API.”

- Customer profile quality - industry focus, company size, and how complex payroll is for your customers.

How private equity thinks about your payroll business

Private equity is not allergic to payroll - they like sticky processes. But their model is disciplined:

- Entry multiple vs exit multiple: They buy at today’s multiple and plan to sell in 3-7 years. They care whether your business can become “more valuable later” (bigger, more SaaS-like, more profitable).

- Who buys it next: A larger PE fund, a strategic HCM suite, or a regional roll-up. Your job is to look like a clean platform asset for that next buyer.

- Levers they expect to pull:

- Raise prices where value is clear (compliance, automation, reduced errors).

- Improve retention and expansion (add modules like time tracking or HR workflows).

- Reduce services dependency through automation and standardized onboarding.

- Tighten cost structure and reporting so performance is provable.

3. Deep Dive: The Single Biggest Valuation Nuance in Payroll - Your Revenue Mix (Pure SaaS vs Hybrid vs Services)

If you remember one thing from this playbook, make it this:

In payroll, your revenue mix often determines whether buyers anchor on a “software multiple” or a “services multiple.”

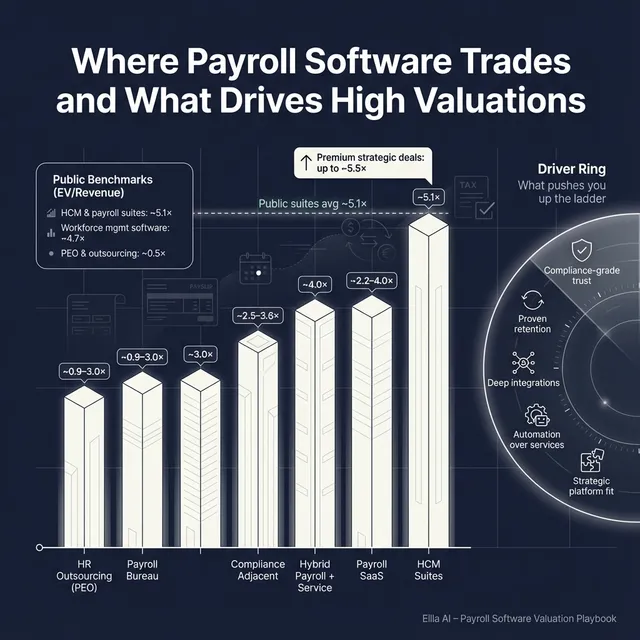

Why it matters: the data shows payroll-related businesses can trade anywhere from sub-1.0x revenue (services-heavy) to mid-single-digit revenue multiples (software/platform-like). In other words, two businesses with the same revenue can land in very different valuation worlds.

How this shows up in market evidence

Across payroll/HCM public comps, software-forward suites trade around ~5.1x EV/Revenue on average in the “Global HCM & Payroll SaaS Suites” group, while more services-heavy HR outsourcing models trade closer to ~0.5x EV/Revenue on average in the “PEO & HR Outsourcing Platforms” group. In private deals, HR and payroll software transactions cluster more around ~2.2x-4.0x revenue, while services-led outcomes often anchor much lower.

Why buyers pay more for “software purity”

- Software revenue scales without linear headcount.

- Product quality is easier to defend as a moat than service delivery.

- Margins are more resilient in downturns.

- Buyers can integrate software into their platform with less operational complexity.

How to move from “lower-value mix” to “higher-value mix” over time

You do not need to abandon services overnight. But you do need to show that services are shrinking as a percentage of revenue and becoming more repeatable.

A simple framing buyers understand:

Practical steps that matter in the next 6-12 months:

- Repackage “managed payroll” into tiered, productized plans.

- Automate the highest-volume support issues (runbooks, in-app checks, AI-assisted support).

- Standardize onboarding so it’s measurable: time-to-go-live, error rate, first-pay-run success.

- Track and present margins by revenue type (subscription vs implementation vs bureau).

4. What Payroll Software Businesses Sell For - and What Public Markets Show

This section is the valuation anchor. You should use it the way buyers do:

- Private deal ranges show what acquirers have actually paid for businesses like yours.

- Public multiples show what scaled companies trade for - a reference band, not a price tag.

The key is to match your business to the right “valuation peer group” based on revenue mix, growth, and scale.

4.1 Private Market Deals (Similar Acquisitions)

Based on precedent transactions in payroll/HR software and adjacent HR/compliance assets, the software-forward payroll deals tend to cluster in a more contained range, while services-heavy and context-driven deals can look noisy.

A founder-friendly way to interpret it:

- If your product is clearly HR/payroll software, private outcomes cluster around ~2.2x-4.0x revenue.

- If you are a hybrid (software + bureau), your multiple is usually blended: below pure SaaS, above pure services - depending on how “software-like” the model is.

- Earn-outs and deferred consideration show up often in this space, especially when buyers underwrite integration and future performance.

Illustrative private range table (by business type)

Two important cautions:

- Small deals can show odd multiples when EBITDA is low or when the reported period is inconsistent. Don’t mistake “math artifacts” for real premiums.

- Many payroll buyers price on forward performance, using earn-outs to bridge uncertainty (especially with service-heavy models).

4.2 Public Companies

Public markets (as of mid-to-end 2025) give you the clearest “what is this category worth at scale?” benchmark. But you must adjust for the fact that your business is smaller, less liquid, and often less diversified.

Public group averages (EV/Revenue and EV/EBITDA)

How to use these public multiples correctly:

- Treat public multiples as an outer reference band, not your likely sale multiple.

- Adjust downward for:

- Smaller scale

- Higher customer concentration

- Higher services mix

- Less proven retention

- Adjust upward only if you are scarce and strategic (for example: a compliance-critical niche with unusually strong retention and clear integration value).

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes in payroll are rarely about “a cool feature.” They happen when buyers believe your business is durable, defensible, and scalable - and they can underwrite that belief with evidence.

Here are the premium drivers that show up most consistently in payroll/HR deals and deal narratives.

5.1 Compliance-critical positioning (risk reduction)

Buyers pay more when your product is clearly “must-have” for avoiding regulatory pain.

What that looks like:

- Strong audit trails and reporting

- Built-in rule updates

- Clear ownership of compliance outcomes

- Customers stay because switching feels risky

Practical examples:

- Automating filings and validations that reduce penalties

- Country/state-specific workflows that competitors don’t cover well

- Compliance dashboards customers rely on weekly

5.2 Proof of scale and a sticky installed base

In payroll, installed base is one of the strongest proxies for defensibility because payroll is embedded in daily operations.

What buyers want to see:

- Customer count or employee count processed

- Multi-year renewal behavior

- Evidence that customers expand usage (more employees, more modules)

Practical examples:

- “We process payroll for X employees” (if accurate and defensible)

- Expansion revenue that is predictable (not one-off services)

5.3 Profitability - or a credible path to it

This sector often clears on EBITDA logic, especially for mature or hybrid models. Buyers reward cash generation and believable margin expansion (automation, standardization, shared services under a platform).

Practical examples:

- Services becoming more efficient over time

- Support costs dropping per customer as tooling improves

- Clear segment margins (subscription vs services)

5.4 Synergy-underwritten strategic fit

When a buyer has a platform and can clearly integrate you (cross-sell, bundle, consolidate operations), they may pay more - often via earn-outs or deferred consideration tied to performance.

Practical examples:

- Your payroll integrates cleanly into a buyer’s HCM suite

- Your niche unlocks a new geography or regulated vertical

- Your customer base overlaps with their target segment

5.5 “Good M&A hygiene” that reduces buyer fear

Even great payroll products sell for less if buyers feel the diligence will be painful.

Premium hygiene signals:

- Clean financial statements and consistent KPIs

- Cohort retention data (even basic)

- Clear product roadmap and resourcing plan

- A leadership bench that can run post-close

6. Discount Drivers (What Lowers Multiples)

Discounts in payroll are usually about risk, complexity, or lack of proof.

Here are the most common valuation killers - and what they signal to a buyer.

A blunt truth: buyers will often assume the worst when data is missing. If you can’t prove retention, margins, and compliance posture, you will get priced like a riskier business.

7. Valuation Example: A Payroll Software Company (Fictional)

Below is a worked example to show the logic - not a prediction.

Fictional company: AtlasPay

Fictional revenue level: USD 10.0m (illustrative)

Business model: Hybrid payroll software + managed payroll (subscription is meaningful, but services still present)

Step 1: The plain-English logic

- Pick the right peer group. AtlasPay is not a global HCM suite. It is also not pure services. So you triangulate between software comps and services comps.

- Anchor on private market reality. Private HR/payroll software deals cluster around ~2.2x-4.0x revenue for software-heavy assets.

- Use public markets as a sanity check. Scaled HCM suites trade higher (around ~5x revenue on average), but small hybrid businesses should not assume those multiples.

- Adjust for mix and risk.

- More software, better retention, stronger compliance posture - move up.

- More services, weaker proof, customer concentration - move down.

Step 2: Apply multiples to USD 10.0m revenue

A reasonable blended outcome for a mature hybrid payroll business often lands around ~2.0x-4.0x revenue as an illustrative core range.

What earns the premium-leaning case (even for a hybrid)?

- Subscription clearly dominates total gross profit

- Retention is provably strong

- Compliance posture is credible and documented

- Implementation is repeatable and not founder-dependent

Step 3: What this means for you

Two payroll businesses can both have USD 10m of revenue and still be worth very different amounts because buyers are buying future certainty:

- Certainty that customers renew

- Certainty that compliance risk is controlled

- Certainty that margins can hold or improve

- Certainty that the business can run without heroic effort

Disclaimer: This is not investment advice, not a fairness opinion, and not a formal valuation. It is an illustrative framework to show how multiples get applied.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this to locate yourself on the spectrum. Score each factor 0 / 1 / 2:

- 0 = weak or unproven

- 1 = decent but improving

- 2 = strong and evidenced

Quick scoring table

How to interpret your total

- Mostly 2s on high-impact factors: you are closer to premium outcomes in your peer group.

- Mixed 0s and 1s on high-impact factors: you will likely land in the “blended” middle unless you fix the biggest risks.

- Several 0s on high-impact factors: expect buyers to price defensively (and use earn-outs more aggressively).

This framework is most useful to decide: What can I improve in 6-12 months that buyers will actually pay for?

9. Common Mistakes That Could Reduce Valuation

These are avoidable. And in payroll, they get punished fast.

- Rushing the sale

- If you start the process before your numbers and story are tight, buyers will control the narrative.

- Payroll buyers especially want proof: retention, compliance posture, support capacity.

- Hiding problems

- Issues always surface in diligence (tax exposure, customer churn, service delivery weaknesses).

- Hiding destroys trust - and trust is value in a deal.

- Weak financial records

- If your revenue definitions, margins, or customer metrics change every time someone asks, buyers will assume risk.

- In the next 6-12 months, you can usually improve:

- Subscription vs services reporting

- Gross margin segmentation

- Recurring revenue tracking and churn metrics

- Not running a structured, competitive sale process with an advisor

- A real process with multiple credible buyers is how you get price discovery.

- Market research is often cited to show that competitive processes can drive materially higher outcomes (commonly referenced around ~25%) because buyers must compete, not negotiate in a vacuum.

- Revealing what price you’re after

- If you say “we want USD 10m,” many buyers will anchor offers around USD 10m (USD 10.1m, USD 10.2m).

- You kill the chance to learn what they would have paid without that anchor.

Payroll-specific mistakes worth calling out:

- Unclear compliance ownership (who is responsible for filings, penalties, rule changes) - buyers hate ambiguous liability.

- Founder-as-support-desk - if escalations rely on you personally, it reads as operational fragility.

10. What Payroll Software Founders Can Do in 6-12 Months to Increase Valuation

You do not need a full reinvention. You need to increase proof and reduce buyer fear.

Improve the numbers buyers anchor on

- Track and present retention clearly (logo retention and revenue retention if you can).

- Separate reporting for subscription vs services revenue and margins.

- Show a simple “cohort view” (customers by start year and how they behave over time).

- Tighten pricing: remove legacy underpriced plans and move toward tiering.

Reduce payroll-specific risk

- Document compliance processes: updates, checks, audit trails, escalation paths.

- Strengthen security and data policies (payroll data sensitivity is a deal issue, not just an IT issue).

- Reduce single points of failure in payroll operations (people, tools, manual steps).

Make services more scalable (even if you keep them)

- Productize onboarding and managed payroll into packages with clear scope.

- Automate repetitive work (validations, payroll run checklists, exception handling).

- Measure delivery: time-to-go-live, error rates, support tickets per customer.

Improve your deal story (without hype)

- Pick a clear “lane”: SMB payroll SaaS, mid-market payroll + HR, vertical payroll, global payroll, etc.

- Build a buyer-ready narrative:

- Why customers stick

- Why switching is hard

- Why your compliance posture is credible

- What growth looks like with more resources (not just founder effort)

Prepare for diligence like you mean it

- Create a clean KPI pack (monthly revenue bridge, churn, ARR if relevant, margins, customer concentration).

- Clean up contracts and renewal terms.

- Make sure key team members can present their areas (product, operations, compliance, finance).

11. How an AI-Native M&A Advisor Helps

A strong sale outcome in payroll usually comes from two things: the right buyers and a process that forces them to compete.

An AI-native M&A advisor like Eilla AI helps expand your buyer universe beyond the handful everyone already knows. AI can map hundreds of relevant acquirers based on deal history, synergies, and capacity - which increases competition, improves leverage in negotiation, and reduces the risk that your deal dies if one buyer drops.

AI also compresses timelines. With AI-driven buyer matching and outreach, plus faster creation of marketing materials and diligence support, you can often reach initial conversations and early offers in under 6 weeks - instead of dragging out a manual-only process.

Most importantly, it does not replace expertise. You still need experienced human advisors to frame the story, run the process, and handle the hard moments. AI enhances that expertise by speeding up the work, broadening reach, and keeping the process tight - delivering Wall Street-grade execution without traditional bulge bracket costs.

If you’d like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.