The Complete Valuation Playbook for Plumbing Services Businesses

A practical guide to what plumbing services businesses sell for and what drives your multiple.

If you run a plumbing services business and are thinking about selling in the next 1–12 months, valuation suddenly becomes very real. You might only sell once in your life. Buyers, on the other hand, do deals every year.

This playbook is built to rebalance that. It is based on real transaction and trading data from plumbing, HVAC and building services businesses, plus practical M&A experience in this sector.

You will see:

- What plumbing services businesses actually sell for.

- What pushes you toward the top vs bottom of the range.

- A simple self-assessment and a 6–12 month action plan to improve your outcome.

Everything here is illustrative, not investment advice or a formal valuation. But it should give you a clear, founder-friendly map of how buyers think.

1. What Makes Plumbing Services Unique

Plumbing is not a generic “services” category. Buyers look at it differently from software, manufacturing or generic construction. A few things make it stand out:

1.1 Typical business models

Most privately held plumbing services businesses fall into a mix of:

- Residential service and emergency call-out

- Blocked drains, leaks, water heater failures, small bathroom works.

- Lots of small tickets, high urgency, strong brand/word-of-mouth impact.

- Commercial and industrial service

- Servicing offices, retail, hospitals, food plants, warehouses.

- Often contract-based with service-level agreements (SLAs).

- New build / renovation contracting

- Plumbing fit-out for developers, general contractors and HVAC partners.

- Larger jobs, more cyclical, often tender-based.

- Maintenance contracts and compliance work

- Backflow testing, water hygiene, valves, pumps, boiler inspections.

- Recurring revenue, often mandated by regulation or insurance.

1.2 Revenue model and cost structure

Most plumbing businesses share a similar economic backbone:

- Revenue drivers:

- Hourly labor + call-out fees.

- Materials and equipment margin (pipes, fittings, boilers, pumps).

- Annual service contracts and compliance checks.

- Cost structure:

- High labor share: plumbers, apprentices, supervisors.

- Vehicles, tools, insurance, fuel, dispatch / office.

- Materials cost, often passed through with a margin.

- Capacity is people:

- If trucks and technicians are idle, profit collapses.

- If you overbook and under-resource, quality and safety suffer.

1.3 Sector-specific risks that buyers always check

Buyers of plumbing services will carefully look at:

- Cyclicality of work mix

- Heavy reliance on construction/new build = more cyclical and tender-driven.

- A strong base of recurring service and maintenance = more resilient.

- Key-man risk

- Does everything depend on you, the founder, knowing every customer and job?

- Safety and compliance

- Plumbing touches water quality, fire suppression, heating and gas.

- A poor safety record or weak documentation is a real valuation drag.

- Working capital and cash flow

- Are you constantly funding general contractors for 90+ days?

- Or are you getting paid quickly by residential and facilities clients?

- Regulatory exposure

- Backflow testing, water hygiene, boiler inspections and similar can be highly valuable recurring work - but only if contracts and documentation are properly structured.

This mix of people, contracts and compliance is why plumbing businesses are valued differently from generic “construction companies” and why buyers drill into your service mix, margin profile and contract base.

2. What Buyers Look For in a Plumbing Services Business

From the outside, a lot of plumbing businesses look similar: vans, technicians, tools. From a buyer’s lens, they are not.

2.1 The obvious levers

Buyers will always check the basics:

- Scale

- Annual revenue level, typically in USD.

- Number of technicians, geographic footprint.

- Growth

- Are you growing 5–15 percent per year, flat, or shrinking?

- Is growth driven by one-off projects or a growing service base?

- Profitability

- EBITDA margin (EBITDA = earnings before interest, tax, depreciation and amortization).

- For plumbing, buyers often view:

- 5 percent EBITDA margin as weak.

- 10–15 percent as solid.

- 15 percent+ as strong, especially if recurring.

- Customer concentration

- Over-reliance on one or two general contractors or facility managers is a risk.

- A broad base of small and mid-sized customers is safer.

2.2 Industry-specific nuances

For plumbing services, several extra questions matter:

- Service mix

- What percent of revenue is:

- New build / project work.

- Ongoing maintenance contracts.

- Emergency call-outs.

- Compliance and testing.

- What percent of revenue is:

- Contract quality

- Do you have 1–3 year service agreements with automatic renewal and indexed pricing?

- Or just informal “we’ll call you when we need you” arrangements?

- Energy efficiency and sustainability

- Are you installing heat pumps, hybrid systems, efficient boilers, solar thermal and other energy-saving solutions?

- Businesses in the data that offered such solutions often showed stronger margins and healthier multiples.

- Mission-critical environments

- Do you keep hospitals, data centers, food plants or other high-stakes sites running?

- Buyers pay more when plumbing failure means serious safety, regulatory or economic damage.

2.3 How private equity buyers think

Private equity (PE) investors are increasingly active in building services and plumbing. Their mindset is very specific:

- Entry multiple vs exit multiple

- If they buy you at, say, 6x EBITDA, they need a credible story to sell at the same or higher multiple in 3–7 years.

- Who they sell to later

- Larger strategic buyers or bigger PE funds.

- Sometimes an IPO if the platform gets big enough, but for plumbing that is rare.

- Value levers they expect to pull

- Price optimization and upselling of energy-efficient solutions.

- Cross-selling plumbing and HVAC across a larger customer base.

- Acquiring smaller plumbing firms to build regional scale.

- Improving scheduling and technician productivity.

- Debt capacity

- PE often uses leverage (debt) to improve returns.

- Strong recurring cash flow and predictable margins support more debt, and therefore potentially higher valuations.

In simple terms, a buyer is asking: “If I buy this plumbing business now, how sure am I that the cash will keep coming in, and who can I sell it to for more later?”

3. Deep Dive: Project Work vs Recurring Maintenance - The Biggest Valuation Swing Factor

One of the biggest valuation nuances in plumbing is your mix of project-driven construction work vs recurring maintenance and compliance contracts.

This shows up clearly in the data:

- Transactions for HVAC and building energy services contractors with strong maintenance portfolios often trade at:

- Around 0.6–0.7x revenue and 5.9–7.0x EBITDA on average.

- A niche water hygiene and compliance business in the data was acquired at around 1.4x revenue and 6.4x EBITDA, helped by mission-critical, regulatory-driven contracts and ~21 percent EBITDA margin.

- Smaller contractors focused mainly on projects and installs often sit closer to 0.3–0.5x revenue with mid-single-digit EBITDA multiples.

3.1 Why buyers care

From a buyer’s perspective:

- Project-heavy plumbing:

- Revenue is lumpy and bid-based.

- Margins swing with project execution.

- When construction slows, you feel it quickly.

- Maintenance and compliance-heavy plumbing:

- Revenue is more predictable and tied to annual contracts.

- Work is mandated by law, landlords, or insurers.

- It is easier to model cash flow and justify a higher price.

3.2 Moving from lower-value to higher-value mix

If your business is currently mostly project work, you can move the mix over time:

- Package maintenance into contracts

- Turn ad hoc call-outs into 1–3 year service agreements.

- Include yearly inspections, emergency response times and small repairs.

- Formalize compliance services

- Backflow tests, water hygiene, boiler/plant inspections.

- Build recurring schedules, automated reminders and documented reports.

- Introduce performance and indexation

- Add response-time SLAs and indexed pricing based on inflation or labor indices.

- This reduces margin erosion over time.

3.3 Lower-value vs higher-value profiles

Use this as a simple mental comparison:

If today you look more like the left column, you do not need to flip overnight. Even shifting 10–20 percent of revenue toward recurring maintenance and compliance can start to move your multiple.

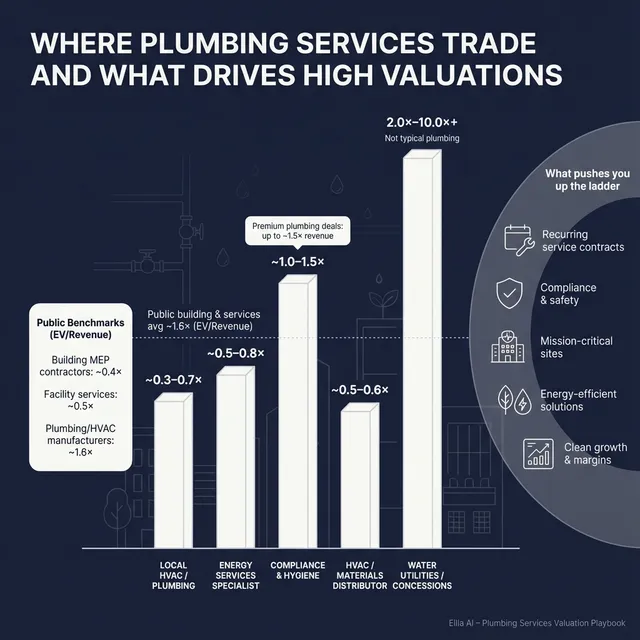

4. What Plumbing Services Businesses Sell For - and What Public Markets Show

This section links the data to plain English. We will look at:

- What similar private companies actually sold for.

- How public companies in related segments trade.

- How to interpret both if you run a privately held plumbing business.

4.1 Private Market Deals (Similar Acquisitions)

Looking across completed transactions in HVAC, building energy services and water/compliance services, we see the following patterns:

- Core HVAC & building services contractors (similar to many plumbing firms):

- Average EV/Revenue around 0.7x, median around 0.6x.

- Average EV/EBITDA around 5.9x, median around 6.3x.

On a grouped basis, you can summarize private deal ranges relevant to plumbing services as:

Key messages for you:

- For a typical local plumbing contractor, 0.3–0.7x revenue and 4–7x EBITDA is a realistic broad range.

- You gravitate toward the top of the range if you:

- Have strong EBITDA margins (low double-digit or better).

- Have a high share of recurring maintenance and compliance contracts.

- You gravitate toward the bottom of the range if:

- Profitability is weak.

- The business is project-heavy and highly dependent on a few customers.

4.2 Public Companies

Publicly listed companies in related sectors give another reference point. They are generally larger, more diversified and less risky than a typical private plumbing firm, so they usually trade at higher multiples.

From the grouped public data:

- Building MEP contracting & technical services (HVAC/plumbing/electrical):

- Average EV/Revenue ~0.4x, median ~0.4x.

- Average EV/EBITDA ~7.7x, median ~6.6x.

- Maintenance-focused facility services (HVAC/plumbing/equipment upkeep):

- Average EV/Revenue ~0.5x, median ~0.5x.

- Average EV/EBITDA ~7.2x, median ~7.2x.

- Plumbing/HVAC equipment & materials manufacturers and distributors:

- Average EV/Revenue ~1.6x, median ~1.3x.

- Average EV/EBITDA ~13.1x, median ~15.5x.

- Industrial services & EPC (pipelines, industrial maintenance):

- Average EV/Revenue ~0.9x, median ~0.7x.

- Average EV/EBITDA ~8.6x, median ~10.1x.

Specific names in this universe include large MEP contractors and facility services groups, as well as major plumbing/HVAC distributors and manufacturers.

A simple summary:

Remember:

- Public company multiples are not what your private business will trade at.

- They act as a ceiling and context, adjusted:

- Downwards for smaller scale, lower margins, higher risk.

- Sometimes upwards for very scarce, strategic assets with strong contracts.

For a typical plumbing services business, buyers will usually anchor on private deal metrics and use public multiples mainly as a cross-check.

5. What Drives High Valuations (Premium Valuation Drivers)

Now to the positive side: what actually pushes you toward the top of the 0.3–0.7x revenue / 4–7x EBITDA range, and beyond in some cases.

Drawing from the deal data and broader sector insight, premium drivers cluster into a few themes.

5.1 Recurring maintenance and lifecycle contracts

- Multi-year service contracts for plumbing, heating, hot water and related systems.

- Maintenance of pumps, boilers, valves, backflow devices, etc.

- Contracts with indexation and built-in annual increases.

Why buyers pay more:

- Predictable revenue and cash flow.

- Less exposure to construction cycles.

- Easier to finance with debt.

What you can do:

- Convert as many ad hoc jobs as possible into annual service plans.

- Offer “gold/silver/bronze” packages with clear inclusions and SLAs.

- Track and present:

- Percentage of revenue under contract.

- Renewal rate and average contract length.

5.2 Compliance and mission-critical positioning

The data shows that compliance-driven water hygiene and testing businesses can trade at higher revenue multiples because clients have no choice but to follow the rules.

In plumbing, this translates into:

- Backflow testing, water safety, Legionella control, boiler safety checks.

- Plumbing for critical facilities:

- Hospitals and care homes.

- Food and pharmaceutical plants.

- Data centers, where cooling and humidity matter.

Why buyers pay more:

- Work is non-discretionary and often recurring by law or insurance.

- Customers are highly sticky once you are embedded.

What you can do:

- Build and promote a compliance offering (hygiene, certifications, reporting).

- Train technicians and gain recognized certifications.

- Present case studies where you help clients stay compliant and avoid fines.

5.3 Energy efficiency and sustainability solutions

The data highlights businesses that integrate energy efficiency (heat pumps, hybrid systems, solar thermal, smarter building controls) as having:

- Higher gross margins (for example, above 55–60 percent).

- Moderate to strong EBITDA margins.

- Reasonable to attractive multiples even on relatively small scale.

In plumbing, this means:

- High-efficiency boilers and hot water systems.

- Heat pump and hybrid installations.

- Smart controls and optimization of water and heat usage.

Why buyers pay more:

- These solutions save clients money and reduce emissions.

- There is often government push and subsidy support.

- Opportunities for long-term performance-based contracts.

What you can do:

- Build a clear “energy efficiency” line of business.

- Document actual energy savings achieved for customers.

- Bundle installation with multi-year monitoring and maintenance.

5.4 Strong margins and asset-light structure

Across the data, businesses with high gross margins and decent EBITDA get better multiples, even with similar revenue:

- High-gross-margin consulting and management firms tend to trade closer to 0.9x revenue and 7x EBITDA.

- Within building services, those that emphasize design, advisory and lifecycle management (rather than pure labor-only install) tend to see margin uplift.

For plumbing:

- Design and advisory work (e.g., system design, value engineering).

- Project management and coordination.

- Remote diagnostics, monitoring and support.

What you can do:

- Introduce design/advisory fees instead of giving them away for free.

- Track gross margin by service type and focus on high-margin lines.

- Raise prices where you are clearly undercharging relative to value.

5.5 Scale, brand and diversification

Data on large distributors and multi-branch building services groups shows that:

- Scale and network reach support resilience and buyer appetite, even when margins are modest.

- Bigger groups can better absorb shocks and invest in systems.

For a plumbing services business, relevant scale effects are:

- Multiple branches in a region.

- Coverage across residential and commercial clients.

- Ability to serve multi-site customers.

What you can do:

- Expand regionally in a controlled way, ideally following existing customers.

- Build brand recognition with consistent quality and response times.

- Show that no single person or client is “too important to lose”.

5.6 Clean financials and professional operations

Not glamorous, but hugely important:

- Reliable, up-to-date accounts.

- Clear separation of personal vs business expenses.

- Proper job costing and tracking of technician productivity.

- Documented health and safety procedures.

These do not show up as specific “premium drivers” in the dataset but are basic hygiene for getting any premium a buyer is willing to pay.

6. Discount Drivers (What Lowers Multiples)

On the flip side, there are clear reasons why some plumbing businesses end up at the low end - or below - the headline multiples.

Short version: buyers discount for anything that makes cash flows less predictable or harder to hand over.

Key discount drivers:

- Thin or volatile profitability

- EBITDA margin under ~5 percent with big swings year to year.

- Indicates pricing or cost control issues.

- Project-heavy, tender-driven revenue

- 70–90 percent of revenue from one-off construction or renovation jobs.

- Limited recurring maintenance or compliance work.

- Customer concentration

- One general contractor or facility manager is 30–50 percent+ of revenue.

- Buyers worry: “What if that relationship disappears when the founder leaves?”

- High key-man risk

- Founder personally handles all key relationships, pricing and technical decisions.

- No clear second tier of management.

- Weak contract documentation

- Informal agreements, no clear service terms, no indexation.

- Harder to prove revenue durability to a buyer or their lenders.

- Poor safety or compliance track record

- Accidents, fines or insurance issues.

- Missing documentation for the work done.

- Messy finances

- Blending personal and business expenses.

- Inconsistent revenue recognition on long projects.

- No clear view of job-by-job profitability.

- Aging fleet and underinvestment

- Old vehicles and equipment, rising breakdowns and call-back rates.

- Buyers see near-term capex that will eat into cash flow.

- No growth story

- Flat or declining revenue with no clear plan to change trajectory.

- Buyers may still proceed but anchor to lower multiples, “just buying cash flow.”

The good news: many of these can be improved in 6–12 months. None of them are fatal on their own, but they add up.

7. Valuation Example: A Plumbing Services Company

To make this concrete, let’s walk through an example using the logic from the data, but with a fictional company and numbers.

Meet “NorthFlow Plumbing Services” (completely fictional):

- Regional plumbing and HVAC contractor.

- Mix of:

- 50 percent commercial service and maintenance.

- 30 percent residential service and emergency call-outs.

- 20 percent project/new build work.

- Annual revenue: USD 10m (fictional).

- EBITDA margin: 12 percent → USD 1.2m EBITDA.

- Solid safety record, good brand, moderate customer concentration.

Step 1 - Choosing relevant multiples

Based on the sector data:

- Private deals for similar contractors:

- EV/Revenue: ~0.3–0.7x, with better businesses sometimes near 0.8x.

- EV/EBITDA: ~4–7x; niche, compliance-heavy businesses can be a little higher.

- Public building services companies:

- EV/Revenue: ~0.4–0.5x.

- EV/EBITDA: ~7–8x.

- But these are larger, less risky and more diversified.

For a USD 10m-revenue local/regional contractor like NorthFlow, we would typically:

- Anchor on EV/EBITDA of ~5–7x.

- Cross-check with EV/Revenue of ~0.4–0.8x.

Step 2 - Apply base, discount and premium scenarios

Using that logic for NorthFlow:

Conservative / lower-end scenario

- Assume:

- Some weaknesses: a bit more project exposure, weaker contracts, minor customer concentration.

- EBITDA multiple towards the low end: 5.0x.

- Revenue multiple cross-check around 0.4x.

- Implied values:

- EV from EBITDA: 5.0x × USD 1.2m = USD 6.0m.

- EV from revenue: 0.4x × USD 10m = USD 4.0m.

- Buyers would likely converge somewhere in the USD 5–6m EV range in this case.

Core range scenario

- Assume:

- Mix of project and maintenance like described, no major red flags.

- Reasonable growth and a clean financial picture.

- EBITDA multiple: 5.5–7.0x.

- Revenue multiple: 0.5–0.7x.

- Implied values:

- EV from EBITDA: 5.5–7.0x × USD 1.2m = USD 6.6–8.4m.

- EV from revenue: 0.5–0.7x × USD 10m = USD 5.0–7.0m.

- Overlap suggests a core valuation range of roughly USD 6.5–8.0m EV.

Premium scenario

- Assume NorthFlow has several premium drivers:

- 60–70 percent recurring maintenance and compliance revenue.

- Strong EBITDA margin of 15 percent+.

- Very low churn and multi-year contracts with indexation.

- Clear second-tier management and good systems.

- In this case, some buyers might stretch to:

- EV/EBITDA of 7.5–8.0x (still below top public company levels).

- EV/Revenue of 0.8–1.0x.

- Implied values (if EBITDA also higher, say USD 1.5m on 15 percent margin):

- EV from EBITDA: 7.5–8.0x × USD 1.5m = USD 11.3–12.0m.

- EV from revenue: 0.8–1.0x × USD 10m = USD 8.0–10.0m.

- Overlap suggests premium cases could reach USD 9–11m EV, if the profile is clearly above-average.

Here is a simple summary table using our original 10m/1.2m base case:

Again, this is illustrative only. Actual valuation depends on detailed due diligence, market conditions and deal structure.

What this means for you

Two plumbing businesses with the same USD 10m revenue can realistically be worth USD 5–6m or USD 9–10m, depending on:

- Profitability and margin quality.

- Recurring vs project revenue.

- Contract strength and customer concentration.

- Operational maturity and team depth.

Your job in the 6–12 months before a sale is to shift your profile as far as possible toward the premium drivers.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this framework to place yourself roughly within the valuation spectrum and see where improvements matter most.

8.1 How to use it

- For each factor group, score yourself:

- 0 = weak.

- 1 = okay/middle.

- 2 = strong.

- Be brutally honest - you are not showing this to a buyer.

8.2 Interpreting your score

Add your three scores:

- 0–3 points:

- You are likely at the low end of typical multiples.

- Focus first on fixing profitability, concentration and basic systems before selling.

- 4–7 points:

- You are in the fair market zone.

- With focused work on recurring contracts and margins, you can push toward the upper-middle of typical ranges.

- 8–10 points:

- You are approaching premium territory.

- A structured, competitive process with the right positioning can create strong buyer tension and pricing.

The goal is not to obsess over the exact number, but to see where the biggest gaps are and where 6–12 months of focused effort will move the needle most.

9. Common Mistakes That Could Reduce Valuation

A lot of value is lost not because the business is bad, but because the sale is handled badly. Here are the main avoidable mistakes.

- Rushing the sale

- Going to market without clean numbers, clear story or prepared data room.

- Buyers sense urgency and push harder on price and terms.

- Hiding problems

- Papering over safety incidents, customer disputes or warranty issues.

- These almost always surface in due diligence; when they do, trust and valuation drop sharply.

- Weak financial records

- Incomplete management accounts, no job-level profitability, no clear EBITDA calculation.

- This gives buyers a reason to assume the worst and price in extra risk.

- Not cleaning up “low-hanging fruit” beforehand

- Obvious underpricing, unprofitable customers or sloppy purchasing.

- Many of these can be improved in 6–12 months, directly lifting EBITDA and your valuation.

- Lack of a structured, competitive sale process

- Only talking to one or two buyers informally.

- Research consistently shows that running a structured, competitive process with an advisor tends to lead to meaningfully higher prices, often on the order of around 25 percent compared to one-off approaches.

- Revealing the price you are “after” too early

- Saying “I’d be happy with USD 10m” anchors the buyer.

- Instead of offering what they might have been willing to pay (maybe USD 12m), they will often come back with USD 10.1m or 10.2m offers.

- Over-relying on the founder

- Not delegating relationships or operations before the sale.

- Buyers worry the business will collapse when you step back, and discount accordingly.

- Under-documenting recurring contracts

- Lots of “handshake agreements” instead of signed contracts.

- Makes it hard for buyers to trust the durability of revenue.

- Letting service quality slip during the sale process

- If you mentally “check out” and NPS, reviews or repeat business drop, buyers notice.

- They will adjust price or ask for more protections.

10. What Plumbing Founders Can Do in 6–12 Months to Increase Valuation

You do not need a five-year transformation plan. Many valuation drivers can be improved meaningfully within 6–12 months if you are focused.

Think in four buckets.

10.1 Improve the numbers (profit and cash)

- Review pricing on low-margin customers and jobs.

- Introduce minimum call-out fees and review discounting policies.

- Track job-by-job profitability and cut or re-price unprofitable work.

- Tighten purchasing: negotiate better deals with key suppliers.

- Improve invoicing speed and collections to show stronger cash conversion.

Even moving EBITDA margin from, say, 7 percent to 10–11 percent can justify a significantly higher price at the same multiple.

10.2 Improve revenue quality and resilience

- Convert frequent customers into annual service contracts.

- Formalize compliance services:

- Backflow testing, water hygiene, boiler checks, valve inspections.

- Use schedules and automated reminders.

- Push for multi-year agreements with key commercial clients, including indexation.

- Reduce customer concentration by:

- Developing more smaller and mid-sized accounts.

- Cross-selling to existing clients in new sites or services.

If you can increase the share of revenue from recurring maintenance/compliance by even 10–20 percentage points, you move closer to the profiles that trade at higher multiples in the data.

10.3 De-risk the business operationally

- Build a clear second tier of leadership:

- Service manager, operations lead, key account managers.

- Document core processes:

- Safety procedures, job workflows, quality checks.

- Invest in basic systems:

- Scheduling, CRM, financial reporting.

- Strengthen your safety record:

- Training, toolbox talks, incident logging, corrective actions.

These steps directly tackle key-man risk and operational risk that buyers worry about.

10.4 Upgrade your narrative and data room

- Prepare a simple but clear information pack before going to market:

- 3–5 year financials (historic and forecast).

- Revenue breakdown by segment, customer and contract type.

- Key KPIs: margins, churn, contract renewal, average response time.

- Highlight premium drivers:

- Share of recurring revenue.

- Compliance and mission-critical work.

- Energy-efficiency projects and documented savings.

When buyers see that you understand what drives valuation and have the data to back it up, they are more willing to pay toward the top of the range.

11. How an AI-Native M&A Advisory Helps

Selling a plumbing services business is not just about knowing a fair multiple. It is about finding the right buyers, creating competition and telling your story in their language.

An AI-native advisor like Eilla AI combines experienced human bankers with modern technology to do exactly that.

11.1 Higher valuations through broader buyer reach

- AI tools can scan global deal history, ownership structures and strategic fit to identify hundreds of qualified acquirers, not just the dozen you already know.

- This includes trade buyers, regional platforms and multiple private equity funds with an interest in building services and plumbing.

- More relevant buyers means:

- More competition.

- Stronger offers.

- Higher chance the deal closes even if one buyer drops out.

11.2 Initial offers in under 6 weeks

- AI accelerates:

- Buyer mapping and outreach.

- Drafting of teasers, information memorandums and management presentations.

- Preparation for due diligence.

- The result: initial conversations and offers can typically be reached much faster than with manual-only processes, keeping momentum high and reducing the risk of “deal fatigue”.

11.3 Expert advisory, enhanced by AI

- Behind the technology are human M&A advisors with decades of experience in service and industrial sectors.

- AI helps those advisors:

- Benchmark your business against hundreds of comps.

- Frame your financials and story in a way that resonates with sophisticated buyers.

- Prepare Wall Street-grade materials without “bulge bracket” fees.

- You get the best of both worlds:

- Deep sector and process expertise.

- Enhanced by data, speed and reach that would be hard to match manually.

If you would like to understand how an AI-native process could support your own exit - from clarifying valuation to running a competitive process with the right buyer universe - you can book a demo with one of Eilla AI’s expert M&A advisors and explore what a tailored sale process might look like for your plumbing services business.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.