The Complete Valuation Playbook for Project Management Software Businesses

A sector-specific playbook showing what project management software businesses sell for and what drives higher multiples.

If you’re a founder or CEO of a project management software business considering a sale in the next 1-12 months, valuation is not just a math problem - it’s a story problem backed by numbers.

This playbook is built for your sector and grounded in what we can observe in real private deals and public market comps. It will show what businesses like yours sell for, what actually drives higher vs lower multiples, and how to self-assess your likely valuation band - plus a practical 6-12 month action plan to move up the range.

1. What Makes Project Management Software Unique

Project management software looks simple on the surface - “tasks, timelines, dashboards” - but buyers don’t value it like generic SaaS. They value it based on where you sit in the workflow and how hard you are to replace.

The main types of project management software businesses

Most businesses in this category fall into a few recognizable models:

- Horizontal work management platforms: cross-industry tools used by marketing, operations, product teams, and more.

- Vertical project execution software: built for a specific industry with heavy real-world coordination needs (construction, industrial ops, infrastructure, professional services delivery).

- PPM (project portfolio management): higher-level planning and governance for enterprises (budgeting, capacity planning, prioritization).

- Adjacent workflow platforms that “include PM”: vendor management, job management, procurement, document control, asset lifecycle tools.

Why valuation is different here

Buyers are not paying for “features.” They pay for three things:

- Workflow control: Are you the place where work gets decided and tracked - or just a reporting layer?

- Multi-stakeholder stickiness: If you connect many parties (internal teams + contractors + clients), replacing you is painful.

- Embedded data: The more historical project data, templates, dependencies, and approvals live inside your product, the more durable your position becomes.

Risk factors buyers will always check (specific to PM software)

In diligence, PM buyers tend to obsess over:

- Adoption depth: Are people logging in daily and running projects end-to-end, or is usage shallow?

- Retention and expansion: Do customers renew and grow seats/projects over time?

- Implementation burden: Do customers need heavy services to succeed (and churn if they don’t get them)?

- Competitive exposure: Can a suite vendor bundle you away, or are you the “system-of-record” that suites must integrate with?

- Security and access control: PM tools often touch sensitive project, financial, and vendor data - weak controls can kill deals late.

2. What Buyers Look For in a Project Management Software Business

Most buyers - strategic or private equity - are trying to answer one simple question:

“If we own this business, will the revenue keep coming with low drama, and can we grow it?”

The universal fundamentals (still matter a lot)

- Scale: More revenue usually means more buyer options and better deal certainty.

- Growth rate: Growth is a shortcut signal for product-market fit and competitive strength.

- Gross margin: PM software should be high margin if it’s truly software-led.

- Revenue quality: Recurring subscriptions beat one-time licenses and services-heavy revenue.

- Customer concentration: A few big customers can inflate revenue but depress valuation.

The PM-specific nuance buyers care about

- “System-of-record” position: If you’re the source of truth for plans, handoffs, and accountability, buyers pay more.

- Workflow adjacency and expansion: PM tools that naturally expand into approvals, reporting, document control, and aftercare tend to sell better than “task-only” tools.

- Multi-stakeholder networks: If a project requires many external collaborators, you’re harder to rip out.

- Vertical compliance and specialization: In certain verticals, regulatory and operational complexity can create defensibility.

How private equity thinks (in plain English)

Private equity is usually underwriting a 3-7 year plan:

- Entry multiple vs exit multiple: They want to buy at a price that still leaves room to sell later at a similar or higher multiple.

- Who they can sell to later: Larger PE funds, strategics, or occasionally a public listing (rare for smaller PM businesses).

- Levers they expect to pull:

- Price increases (especially packaging and seat-based pricing discipline)

- Sales execution improvements (repeatable pipeline, better conversion)

- Cross-sell (more modules, more teams, more projects)

- Margin improvement (reduce services drag, tighten support and onboarding)

If your story only works with “massive synergies,” PE gets nervous. They prefer value creation that you can prove and measure.

3. Deep Dive: The Most Important Valuation Nuance in PM - “System-of-Record” vs “Point Tool”

In PM software, two businesses with identical revenue can sell for wildly different multiples based on one factor:

Are you the system where decisions and accountability live - or a tool that helps around the edges?

How this shows up in deal outcomes

In the deal data, platforms positioned as mission-critical planning and coordination layers can command strong revenue multiples even when profitability is not perfect - because buyers believe the revenue is durable and the platform can expand.

By contrast, tools that are “nice to have” (lightweight task layers, thin reporting add-ons, or heavily services-dependent implementations) tend to price closer to the middle or low end of private market ranges.

Why buyers pay up for “system-of-record” PM

A true system-of-record typically has:

- Daily/weekly usage by core roles (not just project admins)

- Standardization across projects (templates, workflows, governance)

- Embedded approvals, handoffs, and audit trails

- High switching costs because the organization “runs” inside the tool

This reduces churn risk - and churn risk is what compresses multiples.

How to move from “point tool” to “system-of-record” in 6-12 months

You do not need a total product rebuild. The shift usually comes from:

- Own one critical workflow end-to-end (planning -> execution -> closeout, or intake -> prioritization -> delivery)

- Prove adoption depth (weekly active users, projects created, key workflows used)

- Increase data gravity (templates, structured reporting, approvals, document linkage)

- Integrate into the stack (SSO, Slack/Teams, BI, ERP/finance, field tools where relevant)

A simple way to frame it for buyers: “We are where the plan lives, not where reports get copied.”

Lower-value vs higher-value profile (mini-table)

4. What Project Management Software Businesses Sell For - and What Public Markets Show

Valuation is best understood as a range. Public comps set the “ceiling” reference band, while private deals (especially sub-scale deals) show what actually clears in the market for businesses closer to your size.

The key is interpreting the ranges based on segment fit, scale, growth, and risk.

4.1 Private Market Deals (Similar Acquisitions)

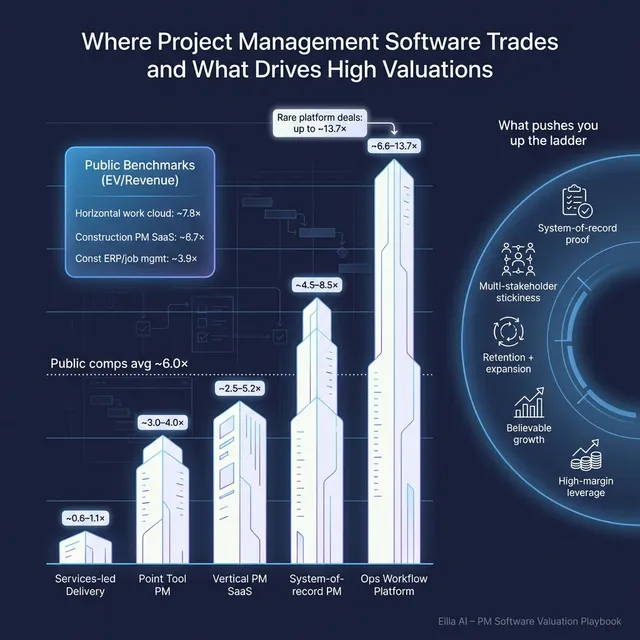

From the private precedent deal data, you can see clear segmentation:

- Vertical construction project management SaaS at modest scale often transacts around 2.5-5.2x EV/Revenue.

- Broader industrial/operations software platforms (often more expansive and mission-critical) can reach 6.6-13.7x EV/Revenue, but those are typically not “pure PM” tools and may reflect broader platform scope.

- Services-heavy project consultancies sit far lower, around 0.6-1.1x EV/Revenue, because buyers value them more like people-based revenue.

Here’s a simple way to translate that into founder-friendly ranges:

These are illustrative ranges, not a price tag. In practice, growth, retention, and “system-of-record” status determine whether you land near the bottom or top of your segment.

4.2 Public Companies

Public markets (as of mid-to-end 2025) show meaningful spread between PM-adjacent categories:

- Horizontal content & productivity cloud platforms trade at the high end on revenue multiples.

- Construction project management SaaS also trades strongly, reflecting workflow criticality.

- Construction-focused ERP/vendor/job management platforms tend to trade lower on average, often because of slower growth, services mix, or more operational complexity.

- AEC/BIM design and infrastructure software sits in the middle, often supported by deep domain value and strong customer lock-in.

How to use this as a private founder: public multiples are a reference band, not a direct valuation. Private companies typically get adjusted downward for smaller scale and higher risk - but adjusted upward when the asset is scarce, deeply embedded, or strategically “must-have.”

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes in PM software are rarely about one magic metric. They’re about stacking believable reasons a buyer can underwrite low churn risk and future growth.

Below are the premium drivers most consistently associated with strong outcomes in this sector, grounded in observed deal patterns and standard buyer psychology.

1) Mission-critical workflow ownership (system-of-record)

Buyers pay more when you can credibly claim: “projects don’t run without us.”

Practical signals:

- High weekly active usage among core roles

- Standardized workflows across many projects

- Proof you reduce delays, rework, or coordination failures

2) Category leadership and ecosystem leverage

Premium valuations show up when buyers believe you are (or can become) the control point in an ecosystem - not just another app.

What helps:

- Strong integrations into the tools your customers already live in

- A platform story: modules that naturally expand across teams

- Partner channels that can scale distribution

3) Durable unit economics (high gross margin + operating leverage)

In vertical PM, distribution and onboarding can be expensive. Buyers reward businesses that prove they can grow without margins collapsing.

What buyers love:

- Gross margins trending toward software-like levels

- Clear path to profitability (or already profitable)

- Declining support burden per customer over time

4) Revenue momentum (growth inflection buyers can believe)

Buyers often “pay for proof of acceleration,” especially in smaller PM businesses.

Strong proof includes:

- Net retention improving (customers expanding)

- Conversion away from spreadsheets/manual processes

- Clear segment focus with repeatable sales motion

5) Workflow extension beyond “planning”

PM tools that expand into adjacent lifecycle stages become stickier and easier to upsell.

Common high-value adjacencies:

- Closeout and handover documentation

- Aftercare and operational follow-through

- Reporting layers that become executive visibility (without becoming “just BI”)

6) Founder alignment and clean dealability

Some premium deals include structures like rollovers or earn-outs that keep founders aligned and reduce buyer fear.

Separately, “dealability” matters more than founders expect:

- Clean financials

- Predictable revenue recognition

- A leadership bench that can run the business post-close

6. Discount Drivers (What Lowers Multiples)

Most valuation disappointment comes from avoidable risk signals that make buyers protect themselves with a lower multiple, an earn-out, or both.

The big PM-specific discount drivers

- Shallow adoption: Lots of accounts, but low real usage. Buyers see churn risk.

- Implementation-dependent retention: If customers only succeed with heavy services, buyers discount the “software multiple.”

- Feature-level positioning: If you’re one layer inside a larger suite workflow, buyers assume you can be bundled away.

- High churn or weak expansion: Even if you’re growing, weak customer stickiness compresses multiples.

- Customer concentration: One or two “whales” can dominate PM deployments.

- Security and permission gaps: PM tools touch sensitive project and vendor data - deficiencies increase perceived risk.

The universal M&A discount drivers (still apply)

- Messy financials and unclear KPI tracking

- Founder is the only salesperson or product brain

- Unresolved legal/IP issues

- Weak contracts (no clear renewals, cancellations too easy)

The good news: many of these are fixable in 6-12 months if you focus.

7. Valuation Example: A Project Management Software Company (Fictional)

This section is a worked example to show the logic, not to predict your outcome.

Step 1: The logic (plain English)

For PM software, you typically:

- Pick the closest public peer segment (vertical PM SaaS, horizontal productivity, or adjacent infrastructure software).

- Cross-check private deal ranges at your scale (because small private deals often clear below public comps).

- Set a base multiple band that reflects your risk and scale discount.

- Move up or down based on premium and discount drivers (system-of-record proof, retention, profitability path, services mix).

Step 2: Apply it to a fictional company

Meet BuildBoard (fictional):

- Vertical project planning and collaboration software for a complex, multi-stakeholder industry

- Subscription-led, light professional services for onboarding

- USD 10.0m in annual revenue (fictional)

- Strong integrations and growing usage, but not yet “category leader at scale”

Using observed comps logic, a defensible core EV/Revenue band for a business like this can be ~4.5-8.5x (anchored between private vertical PM outcomes and public vertical PM SaaS references, with a realistic scale discount).

What pushes BuildBoard toward the top end?

- Clear evidence it is the planning system-of-record (deep usage + outcomes)

- Strong retention and expansion

- High gross margin and visible operating leverage

- Strategic “control point” value for a buyer’s ecosystem

What pushes it down?

- Services-heavy delivery

- Weak adoption proof (logins, workflows used, projects run end-to-end)

- High churn or reliance on a few large customers

Step 3: What this means for you

Two businesses can both be “USD 10m revenue PM software” and be valued very differently. The gap is usually not a mystery - it’s the buyer’s confidence that your revenue is durable and can grow.

This is not investment advice or a formal valuation - it’s an illustrative example to make the mechanics tangible.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this to locate yourself roughly on the valuation spectrum and identify the highest ROI improvements.

How to score it: give yourself 0 / 1 / 2 for each factor:

- 0 = weak / unproven

- 1 = decent but not best-in-class

- 2 = strong, provable, buyer-ready

Self-assessment table

How to interpret your total

- High band: You likely look like a premium PM SaaS asset (buyers compete, fewer structure penalties).

- Middle band: You can get a fair outcome, but your process and positioning matter a lot.

- Low band: Expect discounts or heavy earn-outs unless you fix the biggest risk flags first.

The point is not to “get a perfect score.” It’s to spot the 2-3 changes that most directly shift buyer confidence.

9. Common Mistakes That Could Reduce Valuation

1) Rushing the sale

If you go to market before your numbers and story are tight, buyers will anchor on uncertainty - and uncertainty lowers price.

2) Hiding problems

Due diligence will surface issues. When buyers discover surprises late, they don’t just discount valuation - they lose trust, which can kill the deal.

3) Weak financial records

Even great PM products get punished if:

- Revenue is hard to reconcile

- Services vs software margins are unclear

- You can’t explain retention, churn, and expansion cleanly

4) Not running a structured, competitive sale process (often the biggest mistake)

A competitive process is how you unlock price discovery. When only one buyer is at the table, you usually get “their price,” not the market price.

Research on private-company M&A suggests sellers using advisors can see meaningfully higher valuations; one synthesis cited by Axial describes 6%-25% higher sale prices with advisor involvement in private deals.

Also, market commentary notes that auctions can fetch higher prices when quality assets attract competition.

5) Revealing what price you’re after too early

If you say “we’re looking for USD 50m,” buyers will often cluster offers around that - instead of revealing the maximum they’d really pay. This kills price discovery.

6) PM-specific avoidable mistake: no proof of adoption depth

Founders often talk features and logos. Buyers want usage evidence. If you can’t prove depth, you invite “it’s a nice tool” discounting.

10. What Project Management Software Founders Can Do in 6-12 Months to Increase Valuation

Think in three tracks: improve the numbers, improve the proof, improve the process.

Track A: Improve the numbers buyers pay for

- Retention and expansion: reduce churn, increase seat/project expansion, tighten renewals.

- Pricing and packaging: simplify tiers, reduce bespoke deals, create clear upgrade paths.

- Gross margin: push services toward standard onboarding packages; reduce custom work.

- Predictability: clean up revenue recognition and make KPI reporting consistent month-to-month.

Track B: Improve “system-of-record” proof (this moves multiples)

- Instrument and report:

- Weekly active users by role

- Projects run end-to-end in product

- Workflow completion rates (approvals, handoffs, closeout)

- Build 2-3 case studies with hard outcomes:

- Reduced cycle time

- Fewer coordination failures

- Better on-time delivery metrics

Track C: Reduce buyer fear

- Security basics: SSO, roles/permissions, audit logs, data residency clarity

- Contract hygiene: tighter renewal terms, clear pricing, standard MSAs

- Leadership bench: reduce single-founder dependency (sales, product, customer success)

Track D: Prepare for a clean process

- Build a simple data room early

- Draft a clear equity story and segment positioning

- Identify your most likely buyer types and why they would care

- Decide in advance what you’d accept in structure (cash vs rollover vs earn-out)

11. How an AI-Native M&A Advisor Helps

Selling a PM software business is not just finding “a buyer.” It’s finding the right set of buyers who will compete - and who can underwrite your story at the high end of the range.

Higher valuations through broader buyer reach: AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, synergy fit, and capacity. More relevant buyers means more competition, stronger offers, and better deal certainty if one buyer drops.

Initial offers in under 6 weeks: AI-driven buyer matching and outreach, faster creation of process materials, and structured diligence support can compress timelines dramatically versus manual-only processes - without sacrificing rigor.

Expert advisory, enhanced by AI: You still need experienced human advisors who can frame the business, guide negotiations, and manage buyer psychology. AI strengthens that work by improving targeting, speeding execution, and keeping the process disciplined - closer to Wall Street-grade quality without traditional bulge bracket costs.

If you’d like to understand how our AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.