The Complete Valuation Playbook for Property Management Software Businesses

A voluation playbook on what property management software businesses sell for and what drives higher multiples.

If you run a property management software business, the next 1-12 months are an important window. The real estate world is consolidating, interest rates have reset what buyers are willing to pay, and both strategic acquirers and private equity funds are actively re-shaping their proptech stacks.

This guide is built to help you answer a simple but uncomfortable question: “What is my business likely to be worth - and what could move that number up or down before I sell?”

Below, we will:

- Show what property management software and closely related businesses actually sell for (private deals and public markets).

- Decode what drives higher vs lower revenue multiples in this space.

- Give you a practical self-assessment and a 6-12 month action plan to improve valuation before you run a process.

All numbers are illustrative, in USD terms, and are not a formal valuation or fairness opinion - but they should give you a grounded, data-based way to think about your exit.

1. What Makes Property Management Software Unique

Property management software is not just “another SaaS vertical.” It sits in the middle of messy, offline-heavy workflows between owners, property managers, residents, lenders, brokers, and service vendors. That creates both upside (stickiness and network effects) and risk (slow buying cycles, conservative customers).

Most businesses in this space fall into a few buckets:

- Core property management SaaS for landlords / property managers

- Rent rolls, accounting, work orders, inspections, compliance, reporting.

- Often priced per unit, per building, or per portfolio, with add-on modules.

- Resident experience and smart-building / smart-home platforms

- Mobile apps, access control, IoT devices, amenity booking, community engagement.

- Sometimes a mix of software plus hardware, which impacts margins and multiples.

- Managed rental networks and marketplaces

- Platforms that connect renters to units or landlords and often provide marketing, lead-gen, and sometimes full “managed renting” services.

- Adjacent vertical SaaS and back-office tools

- Accounting, AP/AR, payments, or ERP-style platforms that integrate deeply with property workflows.

From a valuation perspective, a few things make this category different:

- Multi-party workflow and data-sharingYour product is often used by several different groups at once (property managers, leasing teams, accounting, residents, service vendors). When you truly sit in the middle of that, you can build strong network effects and switching costs. When you are just another “tab” open in the browser, you do not.

- Mix of software, services, and sometimes hardwareBuyers value pure recurring software revenue most highly. Implementation-heavy services, one-off customization, and hardware drag down gross margin and usually drag down the multiple.

- Real estate cycle exposure, but rent is always dueProperty markets are cyclical, but rent collections and building operations are always needed. Buyers like that defensive element, but they worry about slowdown in new unit growth and churn during down-cycles.

- Data and compliance sensitivityYou often hold tenant data, payments flows, and documents that have legal or regulatory weight. Security, uptime, and auditability are not “nice-to-have” - they directly affect how strategic a buyer views your platform.

Key risk factors buyers will always check:

- How dependent is your business on a small number of big clients?

- How hard is it, really, for a customer to switch away?

- How much of your revenue is true recurring SaaS vs services, projects, or hardware?

- How exposed are you to a slowdown in units under management or new developments?

- Can your financials actually show all of the above clearly?

2. What Buyers Look For in a Property Management Software Business

Buyers broadly fall into two camps: strategic acquirers (proptech platforms, large property managers, marketplace operators) and private equity funds. Both care about the same core pillars, but for slightly different reasons.

The obvious pillars (that still matter a lot)

Most buyers start with the basics:

- Scale

- Total revenue, number of units under management, number of customers.

- Larger platforms are easier to plug into an existing group or take public later.

- Growth

- Historical revenue growth and expected growth over the next 2-3 years.

- Property management SaaS platforms that look like “normal” vertical SaaS (healthy double-digit growth) get more attention than flat or shrinking ones.

- Profitability and gross margin

- High gross margins (70-90% for pure SaaS) and a credible path to strong EBITDA are highly valued.

- If your margin looks more like a services firm, buyers will value you like a services firm.

- Revenue quality

- Recurring vs one-off.

- Contract length and renewal rates.

- Churn (how many customers leave each year) and expansion (do existing customers pay more over time).

Property-management-specific nuances

On top of that, there are some sector-specific filters:

- Where you sit in the stack

- “System-of-record” for rent, accounting, and compliance is much more valuable than a thin UX layer or a single-point feature.

- Platforms that are deeply integrated into the daily workflow of property managers (rent posting, trust accounting, inspections, maintenance) are harder to rip out.

- Breadth of stakeholders

- Buyers love platforms that connect landlords, property managers, agents, residents, and service vendors in a single workflow.

- This is where network effects start to show up and justify higher multiples.

- Mix of property types and geographies

- A platform concentrated in one city or one market segment (say, student housing in a single country) feels riskier than a diversified base across regions and asset types.

- Attachment to payments and financial flows

- If your platform touches rent payments, deposits, utilities, and vendor payments, you are closer to a financial infrastructure play, which can support stronger valuations.

How private equity thinks

Private equity funds look at all of the above, but always through three extra lenses:

- Entry multiple vs exit multiple

- If they buy you at, say, a mid-single-digit revenue multiple, they need to believe they can sell you (to a larger PE fund, a strategic, or public markets) at equal or higher multiples in 3-7 years.

- They will underwrite what needs to be true in terms of growth, margin, and scale for that to happen.

- Who they can sell to next

- Potential buyers: large proptech platforms, global property managers, RE services firms, or larger software funds.

- If your business is clearly valuable to many next-round buyers, PE can pay more today.

- Levers they expect to pull

- Price increases per unit or per feature.

- Cross-sell (resident apps, payments, IoT, analytics).

- Cost efficiency (centralizing support, rationalizing tech, reducing low-margin services).The more realistic upside they see, the more comfortable they are stretching on the entry valuation.

3. Deep Dive: Workflow Control, Network Effects, and “System-of-Record” Status

One of the biggest valuation swings in property management software is whether you are:

- A true operating system for property managers, or

- A nice-to-have tool that can be turned off in a budget review.

This shows up clearly in the deal data.

On the private markets side, deals grouped as Property Management SaaS Platforms have cleared at high EV/Revenue multiples on average (around 10.5x, with an approximate 7.2-13.8x interquartile range). These are platforms that sit at the core of the property workflow and often have deep integrations and high stickiness.

By contrast, businesses grouped as Real Estate Visualization & Sales Enablement Software - tools focused on marketing, visualisation, and sales support rather than operations - have transacted at much lower levels, around 0.6x revenue on average. That is a huge gap, and it is mostly about how critical the software is to day-to-day operations.

Similarly, a property information-sharing platform in the Property Management SaaS bucket that connects tens of thousands of agencies in a fragmented brokerage market demonstrates the power of multi-party network effects. But even there, the realized revenue multiple was in the mid-single digits, which suggests buyers will not automatically pay a “winner-takes-most” premium unless they see clear monetization and pricing power today, not just theoretical network value.

In practical terms:

- Buyers pay up when you are the source of truth for rent, occupancy, and financials, and when many actors depend on your data being right and up-to-date.

- Buyers discount when you are mainly a marketing, lead-gen, or visual layer, or when only one side of the workflow really cares if you exist.

A simple way to think about where you sit:

If today you are more on the left-hand side, you do not need to pivot your whole business to move right. Over 6-24 months, you can:

- Build or strengthen modules that touch rent, accounting, inspections, and compliance.

- Integrate more deeply with accounting, payments, and access control providers.

- Make it easier for brokers, service vendors, and residents to interact inside your platform (not by email or spreadsheets).

The goal is simple: become the place where work actually happens, not just where reports are viewed.

4. What Property Management Software Businesses Sell For - and What Public Markets Show

This section is about what the numbers actually say.

We will look at:

- Private M&A transactions in and around property management software.

- Public trading multiples for relevant sectors as of roughly 2025.

Remember: these are enterprise value (EV) multiples - what a buyer pays for the whole business (equity plus debt, minus cash) divided by revenue or EBITDA.

4.1 Private Market Deals (Similar Acquisitions)

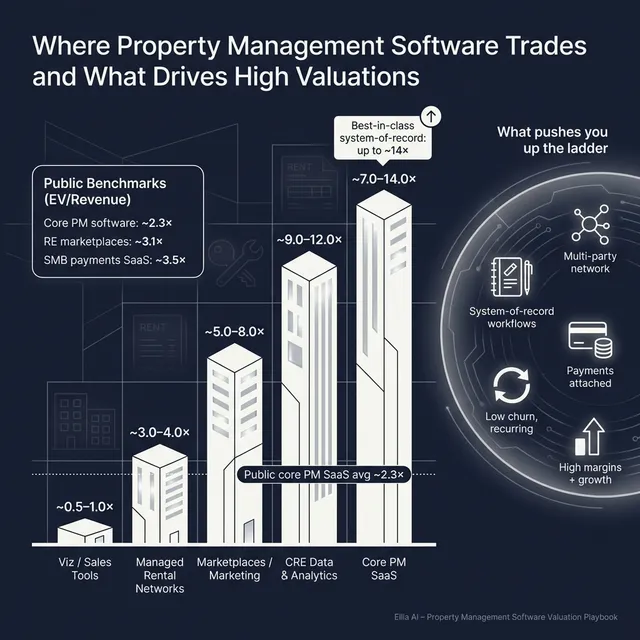

Across the private deal data, the average EV/Revenue multiple is about 6.8x, but this hides big differences by segment.

For property management and adjacent software, the grouped patterns look roughly like this:

A few important takeaways:

- Property management SaaS platforms sit at the top of the software stack by revenue multiple in the private data, with group averages around 10.5x EV/Revenue and very high EV/EBITDA where EBITDA is positive (group average about 87.5x, heavily influenced by high-growth, low-EBITDA deals).

- Data and analytics platforms also attract strong revenue multiples (around 10.8x EV/Revenue on average), because buyers see unique proprietary data and pricing power.

- Marketplaces tend to sit in the mid-to-high single digits on revenue, with average multiples around 6.1x and median around 7.3x. Their value is driven by traffic, conversion, and monetization levers.

- Visualization and marketing-focused tools are at the bottom of the range, with group averages around 0.6x revenue, even when EBITDA margins are positive.

For your own business, remember:

- These are illustrative ranges, not promises.

- Where you land depends heavily on where you sit on the “system-of-record vs nice-to-have” spectrum, your growth, margins, and revenue quality.

4.2 Public Companies

Publicly traded companies in and around this space set an important reference point. They show how scaled, listed businesses are valued, which becomes the “ceiling” or “anchor” for many private deals.

Group-level public trading data (approximate averages) looks like this:

*That 59.8x average EV/Revenue for resident-experience/smart-building is largely a math artifact driven by very small, volatile companies. The median in that group is closer to 1.5x EV/Revenue, which is a more realistic reference.

What should you do with this?

- Treat public EV/Revenue multiples as an upper reference band if you are smaller, private, and less diversified. A private business with, say, USD 10m revenue will normally transact at a discount to its closest public peers because of scale, liquidity, and risk.

- Treat public EV/EBITDA multiples (say, 10-15x for many RE-related services and software, higher for top-tier SaaS) as a check against overly aggressive revenue multiples when you are already profitable.

- In a few cases, if your business is particularly scarce, mission-critical, and growing quickly, you may justify valuation in line with (or slightly above) where public vertical SaaS trades. But that is the exception, not the norm.

5. What Drives High Valuations (Premium Valuation Drivers)

Now we turn the data into something practical: what actually moves you toward the top of the multiple range.

We will group the premium drivers observed in the deals and public comps into a handful of themes, all written in plain English.

5.1 Being the system-of-record and a true workflow hub

Buyers pay more when your software is where work actually happens:

- You are the primary ledger for rent, deposits, and owner statements.

- Maintenance tickets, inspections, and compliance checks all live and move through your platform.

- Teams keep your browser tab open all day because they cannot do their job without it.

In the private data, the Property Management SaaS Platforms group (which reflects this kind of role) sits substantially above marketing and visualization tools by revenue multiple. Acquirers are willing to stretch when they know ripping you out is risky and expensive.

Practical examples:

- Expanding from basic rent tracking into full trust accounting and owner reporting.

- Moving from “ticket tracker” to full maintenance workflow, including vendor dispatch, SLAs, and invoicing.

- Becoming the default place where compliance documents are stored and audited.

5.2 Network density and multi-party coordination

Another observed premium driver is at-scale distribution and network density in a fragmented, multi-party workflow.

Platforms that connect tens of thousands of agencies or property managers in a market create:

- Strong switching costs (everyone else is already on the network).

- Better data (vacancy, pricing, demand), which can be monetized.

- A natural moat, because new entrants face a cold-start problem.

Even so, the data shows that having a network on paper is not enough. If buyers believe you have not yet fully monetized or that your pricing power is unproven, they will still price your business more like “normal SaaS.”

Practically, you increase your value by:

- Proving that more participants make the product better (more accurate data, faster leasing, fewer errors).

- Introducing features where network density itself is monetized (benchmarking, premium placements, data products).

5.3 Strong unit economics and “Rule-of-40” style profiles

Several acquired vertical SaaS companies in the broader rental and construction ecosystem show a pattern:

- Very high gross margins (often 80-90%+).

- Positive EBITDA or a clear path to profitability.

- Continuing revenue growth.

This is sometimes summarized as a “Rule-of-40” profile: if your growth rate plus your EBITDA margin is above 40, buyers feel very good about the business. Even if you are smaller, they know that each extra dollar of revenue will drop nicely to the bottom line.

In the data, vertical SaaS businesses with strong margins and profitable growth attracted higher earnings multiples, even when their revenue multiples were not extreme. Buyers could underwrite quick payback on the purchase price.

For your business, focus on:

- Increasing gross margin (e.g. reducing low-margin services, improving support efficiency).

- Avoiding heavy discounting that undermines unit economics.

- Showing a credible plan to become meaningfully EBITDA-positive in the next 1-3 years.

5.4 Clean, recurring revenue and low churn

Buyers will always favor businesses where:

- A high percentage of revenue is recurring (subscriptions, per-unit fees, usage that repeats every month).

- Churn is low, and ideally, existing customers pay more over time (expansion revenue).

- Contract terms give good visibility (annual or multi-year commitments, not purely month-to-month, unless churn is proven very low).

Even if this is “obvious”, in property management software it is especially important because:

- Many platforms still mix project work, onboarding fees, and consulting into the top line.

- Some revenue may depend on marketing budgets, which are more variable.

Showing a clean revenue bridge with recurring vs non-recurring clearly separated is a premium driver in itself.

5.5 Founder continuity and aligned deal structures

Several premium outcomes in the broader vertical SaaS and proptech space involve:

- Founders and key management agreeing to stay on post-close, and

- Deals that include earn-outs or reinvestment tied to future performance.

For buyers, this shifts some risk into contingent consideration and keeps the people who understand the product, market, and customers leading the charge. That makes them more comfortable paying up on headline valuation.

As a founder, being open to:

- Rolling a sensible portion of equity into the buyer’s structure, or

- Accepting an earn-out linked to clear, achievable targets

can unlock a higher upfront valuation than a strict “cash-out now” mindset.

5.6 Governance simplicity and control

Finally, most of the observed deals in the dataset are majority or full-control acquisitions. That matters because:

- Full control lets the buyer drive pricing, bundling, and integration decisions quickly.

- Complex cap tables, minority veto rights, or shareholder disputes reduce a buyer’s willingness to pay.

You do not need a perfect legal structure to get a good outcome, but:

- Cleaning up option plans,

- Resolving shareholder issues, and

- Being clear on who has to approve a sale

all help remove “governance risk” and support stronger offers.

6. Discount Drivers (What Lowers Multiples)

Just as there are patterns behind high outcomes, there are common reasons why some property management software businesses transact at the low end of the range (or below it).

6.1 “Nice-to-have” tools and shallow workflows

If your platform mainly:

- Provides marketing pages, visualization, or basic reporting, and

- Does not control core workflows or financials,

buyers will naturally compare you to the Real Estate Visualization & Sales Enablement group, where revenue multiples around 0.6x are common.

This does not mean your product is bad. It just means buyers see it as easier to switch off in a downturn.

6.2 Heavy services, hardware, or custom work

When a large share of your revenue comes from:

- Implementation projects,

- Bespoke integrations, or

- Hardware (locks, sensors, devices),

your gross margin drops and your revenue becomes less predictable. Buyers then compare you more to services operators (often trading around 1-2x revenue) than to pure SaaS platforms.

This kind of revenue can be very valuable in the short term, but it usually drags your multiple down unless you can show clear, high-margin recurring revenue sitting on top of it.

6.3 Weak unit economics and messy financials

Common red flags:

- High churn masked by strong new sales.

- Support and onboarding costs that make small customers unprofitable.

- No clear breakdown of revenue by product, cohort, or region.

In due diligence, buyers will rebuild your numbers. If they discover that the headline story is driven by unsustainable discounts, expensive customer acquisition, or churn, they will:

- Push the multiple down,

- Change the structure (more earn-out, less cash), or

- Walk away.

6.4 Customer concentration and narrow markets

If more than, say, 20-30% of your revenue comes from one or two customers (or one narrow niche, like a single developer group), buyers will apply a discount. The risk that those customers churn or renegotiate is too high.

Similarly, if you are confined to one geography with limited room for expansion, buyers may see less upside and price accordingly.

6.5 Process and governance issues

Even strong businesses can see lower multiples if:

- They rush into a process without preparation.

- There are unresolved legal, IP, or shareholder disputes.

- The sale is reactive (e.g. triggered by distress) rather than planned.

In short: the more risk, complexity, or uncertainty a buyer has to absorb, the more they will push down the price or insist on heavy earn-outs.

7. Valuation Example: A Property Management Software Company

To bring this all together, let’s walk through a fictional example.

We will use a made-up company, AtlasRent Cloud, with USD 10m in annual revenue. The company and the numbers are purely illustrative, designed to show the logic, not to predict any specific outcome.

7.1 Who is AtlasRent Cloud?

Assume:

- Pure-play, cloud-based property management SaaS.

- Serving mid-market residential and mixed-use property managers.

- Operating in 3 European countries.

- Revenue: USD 10m, about 90% recurring subscriptions and per-unit fees.

- Growth: 30% year-on-year.

- Gross margin: 85%.

- EBITDA: roughly break-even (reinvesting in growth).

- 1,000 customers, with low logo churn and positive net revenue retention.

7.2 Step 1 - Selecting relevant peer groups

We first choose the right comparables:

- Public property management / proptech software

- A basket of listed property management software and related proptech names gives a 25th-75th percentile EV/Revenue band of roughly 1.0-6.5x.

- Group-level averages for core property management software are around 2.3x EV/Revenue and 14.2x EV/EBITDA.

- Private property management SaaS platforms

- Group data shows average EV/Revenue of about 10.5x, with an interquartile range roughly 7.2-13.8x.

- These are businesses closest to AtlasRent Cloud in model and positioning.

- Adjacent categories (for triangulation)

- Real estate marketplaces and marketing platforms: around 5.0-8.0x EV/Revenue.

- Commercial real estate data & analytics: around 9.0-12.0x EV/Revenue.

- Rental ops & ERP (non-real estate): around 3.0x EV/Revenue.

We ignore most services-heavy property management operators and REITs as primary comps, because their economics are very different, though their EV/EBITDA ranges (often around 10-20x) can be a helpful sense-check.

7.3 Step 2 - Narrowing to a credible multiple range

AtlasRent Cloud is:

- A pure-play SaaS platform.

- Early-scale (USD 10m revenue, not yet a giant).

- Growing well, with strong gross margin and healthy revenue quality.

- Not yet a category-dominant public company or a unique data monopoly.

Given that, we might build a “football field” like this:

- Public proptech / property management software:

- Rough band: 1.0-6.5x EV/Revenue.

- AtlasRent is smaller and riskier, so it should usually trade at or above this range only if buyers are very bullish.

- Private property management SaaS platforms:

- Rough band: 7.2-13.8x EV/Revenue.

- AtlasRent looks like a solid but not yet dominant player, so we should not assume the very top of this range.

- Adjacent SaaS and marketplaces:

- Midpoint around 5.0-8.0x EV/Revenue.

Putting this together, a sensible core valuation band might be:

5.5x-9.0x EV/Revenue for a business like AtlasRent Cloud.

This aligns with:

- The upper half of public SaaS trading for proptech.

- The lower-middle of private SaaS deal multiples.

- Acknowledging the business is attractive, but not yet a once-in-a-generation asset.

7.4 Step 3 - Applying premium and discount scenarios

Now we apply this to the USD 10m revenue base.

We will look at three scenarios:

How might each scenario arise?

- Discount case (3.5x)

- Growth has slowed (say, under 15%).

- Churn has ticked up, or net revenue retention is weak.

- Heavy services or hardware dilute margins.

- Buyer sees execution risk and insists on a lower entry point or a heavy earn-out.

- Core case (5.5-7.0x)

- Growth in the 20-30% range, with strong gross margins and mostly recurring revenue.

- Product is clearly mission-critical for customers, with proven low churn.

- Clean financials and a well-run, competitive sale process that brings several motivated buyers to the table.

- Premium case (8.0-9.0x)

- All of the core case plus:

- Evidence of network effects (e.g. many parties interacting on the platform).

- Strong unit economics (near “Rule-of-40” profile).

- Clear strategic value to a particular buyer (for example, a large proptech wanting to own your geography or segment).

- Founder and team committing to stay on, with an aligned earn-out or reinvestment.

- All of the core case plus:

Two companies with the same USD 10m revenue can land anywhere from USD 35m to USD 90m in enterprise value based on these factors.

Again, this is an illustrative framework, not a price prediction. But it should show how buyers think, and why focusing on the right levers before you sell can move the needle dramatically.

8. Where Your Business Might Fit (Self-Assessment Framework)

Here is a simple, honest way to locate yourself on the valuation spectrum.

For each factor group, give yourself a score:

- 0 = weak

- 1 = average

- 2 = strong

How to think about this:

- High-impact factors

- Growth: Are you growing at <15%, 15-30%, or >30%?

- Recurring %: Is 70-80%+ of your revenue subscription-like?

- Churn / net retention: Are you losing many customers each year, or does revenue from existing customers grow?

- Workflow depth: Are you a peripheral tool, or the system-of-record?

- Medium-impact factors

- Gross margin: Are you close to SaaS norms (70-90%), or weighed down by services/hardware?

- Services mix: How much of your revenue is project-based?

- Concentration: Do a handful of clients drive a big chunk of revenue?

- Geography: Are you stuck in one city, or reasonably diversified?

- Bonus factors

- Real network effects: Does each new landlord, resident, or vendor make the platform better?

- Payments and financial workflows: Are you close to the money flows?

- Integrations: Are you tightly integrated into accounting, access control, IoT, and other key systems?

- Team: Is there a bench beyond the founder that buyers can trust?

Interpreting your score

Add up your three scores (max = 6):

- 0-2 points

- You are likely closer to the lower end of the valuation range, maybe nearer comparable services or visualization tools than the top-tier SaaS platforms.

- If you can wait 12-24 months, it might be worth improving fundamentals before selling.

- 3-4 points

- You are in the “fair market” zone.

- A well-run, competitive process should deliver a solid outcome, roughly in line with core SaaS and marketplace comps adjusted for your scale.

- 5-6 points

- You have the ingredients for premium multiples.

- The key will be telling the story clearly, backing it with data, and reaching the right strategic and PE buyers.

The goal of this framework is not to label you “good” or “bad”, but to highlight where improvements will have the biggest payoff before you go to market.

9. Common Mistakes That Could Reduce Valuation

Many valuation problems are avoidable. Here are the ones that show up again and again in property management software deals.

9.1 Rushing the sale

Deciding to sell and immediately starting outbound conversations, without:

- Clean financials,

- A clear narrative, or

- A prepared data room,

is one of the fastest ways to leave money on the table.

Buyers sense when a sale is rushed. They assume something is wrong, or they exploit the lack of preparation to push price and structure in their favor.

9.2 Hiding problems

Every business has issues: churn spikes, outages, legal disputes, failed experiments.

Trying to hide them:

- Almost always fails in due diligence.

- Destroys trust when buyers inevitably find out.

- Often leads to aggressive price chips or deal collapse late in the process.

The better approach is to own the problems with data, show what you have done to fix them, and explain how residual risk is contained.

9.3 Weak financial records

Inadequate financial reporting hurts you in two ways:

- Buyers have to spend more time and money to understand your business, which they resent.

- They assume the worst where data is unclear.

Typical issues:

- No clear mapping of revenue to products, regions, or customer cohorts.

- Poor separation between recurring and non-recurring revenue.

- Unclear or inconsistent cost allocation (especially around services vs R&D).

These are often fixable in 6-12 months with better bookkeeping, simple dashboards, and support from an outsourced CFO or advisor.

9.4 No structured, competitive process

Founders sometimes:

- Engage in bilateral talks with one or two obvious buyers.

- Let those conversations drag on.

- Accept the first “reasonable” offer.

Research across M&A markets consistently shows that structured, competitive processes run by experienced advisors typically result in meaningfully higher prices - often around 25% more than bilateral, uncompetitive negotiations.

More importantly, a proper process:

- Creates time pressure on buyers.

- Surfaces unexpected bidders (including international strategics and PE funds).

- Gives you options if a preferred buyer drops out.

9.5 Revealing the price you are “looking for”

Another classic mistake is telling buyers “we are looking for about USD X million.”

If you say “we would be happy with USD 10m”, most rational buyers will:

- Anchor their offers above that but not by much (10.1m, 10.2m, etc.),

- Even if they might have been willing to pay 12m or 15m in a competitive situation.

Letting buyers compete and show you what the business is worth to them is almost always better than naming your number up front.

9.6 Industry-specific mistakes

Two sector-specific pitfalls:

- Over-indexing on custom work for one big client

- You become more like a custom development shop than a platform.

- Buyers will see risk and discount accordingly.

- Ignoring your payments / financial infrastructure story

- If you touch rent, deposits, or vendor payments but do not track or present it as a strategic asset, you may be valued like a simple workflow tool.

- In reality, tying into cash flows is a powerful lever that many buyers care deeply about.

10. What Property Management Software Founders Can Do in 6-12 Months to Increase Valuation

You do not need to transform your business to improve your valuation. In 6-12 months, you can make targeted moves that materially change how buyers see you.

10.1 Improve the numbers that matter

Focus on a few high-impact metrics:

- Churn and net revenue retention

- Run simple win/loss interviews to understand why customers leave.

- Invest in onboarding and customer success for the highest-risk segments.

- Review pricing so that expansion (new modules, more units) is easy for satisfied clients.

- Gross margin and services mix

- Standardize implementations and reduce low-margin, custom work.

- Turn repeated “custom” work into a productized package with better economics.

- Be deliberate about hardware - only include it where it clearly unlocks high-margin software revenue.

- Profitable growth path

- Even if you stay near breakeven to grow, show a clear levered plan to reach strong EBITDA margins (for example, at USD 15m or 20m revenue).

If you can say, “We reduced churn by 3-5 percentage points and improved gross margin by 5-10 points in the last year,” your narrative becomes much more compelling.

10.2 Deepen your workflow role and product moat

Using the premium drivers:

- Strengthen modules tied to rent collection, accounting, inspections, and compliance.

- Add or tighten integrations with accounting software, payment processors, and access control providers.

- Encourage cross-stakeholder usage: get residents, vendors, and owners to interact inside your app.

These investments move you from “tool” to “operating system” in buyer minds, which is exactly where the higher multiples live.

10.3 Clean up financials and KPIs

A 6-12 month clean-up can include:

- Producing monthly P&Ls with clear splits by:

- Recurring vs non-recurring revenue

- Product line (e.g. core PMS, resident app, payments)

- Region or segment

- Implementing simple KPI tracking:

- ARR or MRR

- Churn (logo and revenue)

- Net revenue retention

- Gross margin

- Cohort retention by customer start year

These are not “nice-to-have dashboards” - they are the language buyers speak. Having them ready means you control the story instead of letting buyers guess.

10.4 Prepare for a proper process

Even if you are not sure you will sell, in the next year you can:

- Identify and build relationships with a handful of potential strategic and PE buyers (without showing your hand on timing or price).

- Start assembling a lightweight data room (financials, product docs, key contracts, HR info).

- Talk to advisors early to understand timing, positioning, and likely buyer universe.

Then, when you decide to run a process, you are not starting from zero.

11. How an AI-Native M&A Advisor Helps

Selling a property management software business is not just about finding “a buyer.” It is about finding the right set of buyers, telling the right story, and running a disciplined process - all while you keep running the business.

An AI-native advisory like Eilla AI combines expert human bankers with modern technology to tilt this in your favor.

11.1 Higher valuations through broader buyer reach

Eilla AI uses AI to scan and match your business against hundreds of potential buyers worldwide, based on:

- Deal history in proptech and vertical SaaS.

- Strategic fit (portfolio, geography, product gaps).

- Financial capacity and appetite.

That means more qualified acquirers at the table, more real competition, and a higher chance that someone who truly values your strategic position shows up. It also de-risks the process because you have options if one party drops out.

11.2 Initial offers in under 6 weeks

AI helps compress the early stages of a sale:

- Drafting and refining process materials (teasers, information memoranda, management presentations).

- Identifying and prioritizing the best-fit buyers.

- Handling much of the data organization and due diligence support.

The result is that initial conversations and offers can come together much faster than in a traditional, purely manual process - often within a few weeks of launching formally, not months.

11.3 Expert advisory, enhanced by AI

Technology does not replace human judgment; it amplifies it.

With Eilla AI, you still get:

- Experienced M&A advisors who understand software, proptech, and investor psychology.

- Wall Street-grade materials and positioning that tell your story in the language buyers use internally.

- Credibility with acquirers who know they are dealing with a professional, structured process.

The difference is that AI takes care of the heavy lifting on research, buyer mapping, and documentation, so more time goes into strategy, negotiation, and protecting your interests - without the traditional “bulge bracket” fee structure.

If you would like to understand how Eilla AI’s AI-native process could support your own exit, the next simple step is to book a demo with one of our expert M&A advisors. You will get a confidential, data-driven view on where your property management software business might sit today - and what you can do to move it up the valuation range before you sell.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.