The Complete Valuation Playbook for Retail Software Businesses

A valuation playbook showing what retail software businesses actually sell for and what drives premiums.

If you run a Retail Software business and you might sell in the next 1-12 months, your valuation is not a mystery - but it is not automatic either. Retail Software is in a “buyers are picky” moment: lots of consolidation, plenty of competitors, and acquirers that will pay up for the right workflow ownership - and quietly discount everything else.

This playbook is built from real-world deal data and public-market multiples in and around Retail Software. It will show what businesses like yours actually sell for, what pushes multiples up or down, and how to pressure-test where you sit today - plus a practical 6-12 month action plan to move your outcome.

1. What Makes Retail Software Unique

Retail Software is not one category. It’s a stack - and valuation depends heavily on where you sit in that stack and how close you are to “the money” (orders, inventory, pricing, fulfillment, payments).

The main types of Retail Software businesses buyers group together:

- Ecommerce operations and retail enablement SaaS: order management (OMS), inventory, multichannel listings, marketplace management, product feeds

- Commerce platforms: storefront, checkout, composable commerce layers

- Retail POS + payments platforms: in-store transaction stack, often blended with hardware and payments economics

- Supply chain and retail execution software: planning, orchestration, EDI, visibility, logistics networks

- Retail pricing and optimization: dynamic pricing, promotions, merchandising optimization

- Ecommerce managed services: agency-like or fulfillment-heavy “done-for-you” commerce operations with software tooling (often lower multiple profiles)

Unique valuation considerations in Retail Software:

- “System of record” vs “add-on tool” matters more than almost anything. Buyers pay for software that becomes hard to remove from daily operations.

- Integration depth can be a moat. Retail stacks are messy: POS, marketplaces, ERPs, 3PLs, carriers, tax engines, payments, ad platforms. Buyers value the businesses that already did the hard work.

- Services mix can quietly cap your multiple. Implementation and managed services can drive growth - but heavy services often pull you toward lower revenue multiples.

Key risk factors buyers will always check:

- Customer concentration and channel dependence (one marketplace, one POS partner, one mega-retailer)

- Churn and “stickiness” of revenue (how often customers cancel or downgrade)

- Product brittleness: too many custom deployments, too many one-off integrations

- Gross margin structure (high-margin software tends to be valued very differently than blended services/hardware)

- Security and compliance expectations (especially for payments-adjacent or enterprise retail customers)

2. What Buyers Look For in a Retail Software Business

Most buyers - strategics and private equity - are trying to answer the same question: “Is this business a durable, growing software layer we can scale, or is it a fragile services-heavy operation with churn risk?”

The obvious basics still matter:

- Revenue scale and growth rate

- Gross margin and EBITDA margin (or a believable path to profitability)

- Revenue quality: recurring contracts, renewals, upgrades, and predictable expansion

Retail-specific “nuances” that often decide the multiple:

- Workflow ownership: Are you in the daily path of orders, inventory, pricing, shipping, or reconciliation? Buyers pay more for software that controls operational decisions.

- Integration maturity: Not just “we integrate,” but “we integrate fast, reliably, and repeatedly.”

- Proof that you move real KPIs: conversion, stock-outs, order accuracy, time-to-ship, return rates, margin lift.

- Multi-vertical or multi-geo resilience: if one retail vertical slows down, do you still grow?

How private equity thinks about your business (in plain English)

Private equity (PE) is buying with a resale in mind, usually in 3-7 years. They’re underwriting:

- Entry multiple vs exit multiple: If they buy at a high multiple, they need a credible path to sell at a similar or higher multiple later.

- “Who buys us next?”: bigger strategics, larger PE funds, or occasionally public markets.

- Levers they expect to pull:

- Price increases (if you have pricing power and low churn)

- Cross-sell (more modules, more seats, more locations)

- Operational cleanup (reduce services load, improve gross margin, improve onboarding efficiency)

- Targeted add-on acquisitions (buy a smaller adjacent tool and bundle it)

If your story is “we’re growing, but it’s messy,” PE will push you down the range. If your story is “we’re sticky, integrated, and scalable,” PE can pay toward the top - because they can see a clean resale path.

3. Deep Dive: Workflow Ownership vs Integration Depth - Which Drives Value More?

In Retail Software, “good product” is not enough. The valuation question buyers obsess over is closer to: Do you own a mission-critical workflow, and is your product deeply embedded in the ecosystem around it?

Why it matters: in retail, switching costs are real. If your software touches orders, inventory, pricing, shipping rules, or settlement logic, ripping you out is painful. If you also have deep integrations (marketplaces, POS, 3PL, carriers, ERP), switching becomes even harder. That combination is where premium outcomes tend to show up in the deal narratives and data.

How it shows up in the data:

- Higher-multiple outcomes are associated with high gross margin software layers attached to mission-critical workflows and ecosystem integration breadth (e.g., marketplace/feed orchestration, pricing optimization, returns, and operational systems). The “premium driver” patterns explicitly call out mission-critical function, category leadership in specialized workflows, and integration readiness.

- By contrast, categories that are more services-heavy or hardware/payments blended tend to show materially lower average EV/Revenue in both public and private group data.

A simple way to think about your position:

How to move from “worse” to “better” in 6-12 months:

- Pick one workflow to “own” and make it undeniable (orders, inventory, pricing, returns, fulfillment orchestration).

- Standardize onboarding so integrations feel repeatable, not bespoke.

- Publish 3-5 hard KPI case studies (before/after) tied to money outcomes: margin lift, labor saved, faster shipping, fewer stock-outs.

- Reduce “professional services heroics” by turning common requests into productized modules.

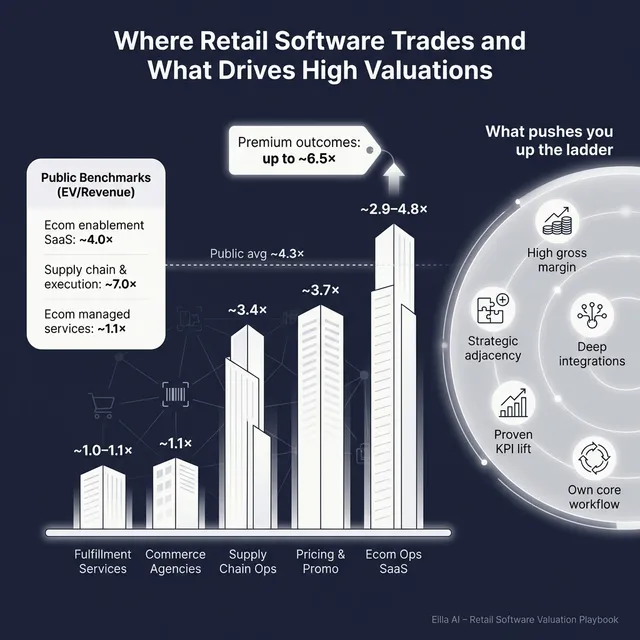

4. What Retail Software Businesses Sell For - and What Public Markets Show

Here’s the most founder-useful truth: private valuations are anchored by public markets, but priced with a discount for smaller scale and higher risk - and sometimes a premium for scarcity and strategic fit.

The data below provides the reference bands. Your actual outcome depends on your growth, margins, retention, product defensibility, and deal competitiveness.

4.1 Private Market Deals (Similar Acquisitions)

Across precedent transactions, the overall average EV/Revenue is around 3.1x, with meaningful variation by category. Ecommerce operations SaaS deals show higher revenue multiples than services-heavy commerce enablement, and software categories tied to core commerce operations tend to cluster higher than agencies or fulfillment-heavy models.

A simple way to interpret the private comps:

- If you are clean SaaS in a mission-critical retail workflow, you’re typically competing in the higher private bands.

- If you are services-heavy (managed store ops, fulfillment ops, agency), you usually trade closer to services-like multiples.

Illustrative private market ranges by segment (from the grouped data):

Two important founder notes:

- These are “category” anchors, not your personal price tag.

- A competitive process and strong story can move you materially up within your category band.

4.2 Public Companies

Public markets give a live “reference band” for what scaled, transparent versions of your category trade at. In the provided data, the overall public average EV/Revenue is about 4.3x (median also ~4.3x), and the overall EV/EBITDA is about 25.2x (median ~25.2x).

But the spread by segment is wide:

These public multiples are best used like this:

- They set an upper and lower reference band, not an automatic valuation for a private company.

- Private companies are often priced lower due to scale, liquidity, and execution risk.

- You can still earn a strategic premium if you’re scarce, deeply integrated, and a clear fit for an acquirer’s roadmap.

5. What Drives High Valuations (Premium Valuation Drivers)

The deal data shows a clear pattern: premium outcomes cluster around businesses that are high-margin, mission-critical, category-leading in a painful workflow, and easy to plug into bigger ecosystems.

Below are the core premium themes observed in the data, translated into what you can actually do and say in a process.

5.1 High gross margin software attached to mission-critical workflows

Premium deals are consistently linked to high gross margin software layers that run core operational processes (not “nice to have” tools). In the observed set, mission-critical software layers with strong gross margins supported premium outcomes.What buyers hear: “This is durable. Customers won’t rip it out.”

Practical examples:

- Your OMS reduces shipping errors and late deliveries measurably.

- Your inventory logic reduces stock-outs and improves sell-through.

- Your pricing engine improves gross margin, not just “automation.”

5.2 Category leadership in a specialized retail workflow

Buyers pay more when your product is the default solution in a narrow but painful niche - product feed management, returns, vertical commerce workflows, regulated traceability, etc. Category leadership shows up as a premium driver because it reduces go-to-market risk for the buyer.

Practical examples:

- You’re the “standard” in a retail vertical (auto parts, specialty grocery, beauty, regulated goods).

- Partners and agencies recommend you by default.

- You have defensible data or workflow depth competitors struggle to match.

5.3 Integration readiness into large ecosystems

Integration breadth and repeatability show up directly in premium narratives. In the observed deals, ecosystem integration (marketplaces, ads, POS, 3PL, carriers) was central to the acquirer rationale.What buyers hear: “We can plug this in quickly and get synergies fast.”

Practical examples:

- Pre-built connectors with documented onboarding timelines.

- Integration templates that make implementations predictable.

- Partner go-to-market that already works (co-sell, referrals, app marketplaces).

5.4 Demonstrable data and automation leverage that improves KPIs

Premium drivers repeatedly connect to products that lift measurable KPIs - conversion, margin, efficiency, accuracy. Buyers will pay more when your product makes money or saves money in a provable way.

Practical examples:

- “We cut time-to-ship by 18% for multi-warehouse merchants.”

- “We reduced returns handling cost by $X per order.”

- “We lifted gross margin by Y basis points via pricing recommendations.”

5.5 Strategic adjacency: the buyer can unlock new revenue streams

Some of the highest-multiple stories are about adjacency: payments, supplier networks, advertising monetization, marketplace expansion. This is not about hype - it’s about a buyer seeing a clear path to monetize your footprint.

Practical examples:

- You can attach payments, lending, or settlement products to the workflow.

- You can cross-sell into a larger installed base (POS locations, ERP customers, carriers).

- Your product becomes the “control layer” for other monetization.

5.6 Global and multi-vertical reach

Diversification lowers perceived risk and can support higher valuation. A global customer base and multiple verticals can make revenue feel more durable.

Practical examples:

- No single geography drives growth.

- You have repeatable wins across 2-3 retail verticals.

- Your product roadmap is not hostage to one platform partner.

Also worth stating plainly: even if it’s not “sexy,” buyers pay for clean financials, predictable recurring revenue, a diversified customer base, and a leadership bench that can run without the founder.

6. Discount Drivers (What Lowers Multiples)

Low-end outcomes usually aren’t because the product is “bad.” They happen because buyers see risk, complexity, or weak revenue quality - and they protect themselves by paying less, demanding earn-outs, or walking away.

Common discount drivers in Retail Software:

- Services-heavy revenue mix: if a big portion of revenue is implementation, agency work, or managed operations, you drift toward services multiples (the public and private group data shows this clearly).

- Weak retention or unclear churn: if customers don’t stick, your revenue is not durable.

- Customer concentration: one mega-customer or one channel partner can spook buyers.

- “Custom shop” product delivery: too many bespoke deployments means scaling is harder than your revenue suggests.

- Low gross margin: signals either services drag, infrastructure inefficiency, or weak pricing power.

- Unproven KPI impact: “customers like us” is not enough - buyers want proof that you move dollars (margin, labor, conversion, shipping cost).

- Competitive positioning that feels replaceable: if you look like one of 20 similar tools, scarcity premium disappears.

The good news: most of these can be improved meaningfully in 6-12 months with focused execution.

7. Valuation Example: A Retail Software Company

This is a worked example to show how the logic works. The company is fictional, and the numbers are illustrative - not investment advice or a formal valuation.

Step 1: The logic (in plain English)

- Start with relevant category comps, not the whole universe. For retail software, that usually means comparing yourself to:

- Ecommerce operations SaaS and retail enablement SaaS

- Supply chain and retail execution software

- Commerce infrastructure platforms (as a sanity check)And treating services-heavy categories as a lower-bound check, not a true peer group.

- Build a core revenue multiple band from public and private references. In the provided data, a defensible “core SaaS band” for a retail operating workflow profile clusters around ~3.5-5.5x revenue, with upside into the ~6.5x area when premium drivers are present.

- Adjust up or down based on premium and discount drivers:

- Premium: mission-critical workflow, category leadership, integration maturity, KPI proof, strategic adjacency (payments/financial flows), global reach

- Discount: services mix, churn risk, concentration, custom deployments, weak gross margins

- Cross-check with reality:

- Avoid mega-platform outliers as direct comps.

- Avoid hardware/services comps as direct comps.

Step 2: Apply it to a fictional company

Meet “NorthBridge Retail Ops” (fictional):

- USD 10m last-twelve-month revenue (fictional)

- SaaS platform for OMS + inventory + shipping rules + analytics for mid-market omnichannel retailers

- 75% gross margin, recurring subscription-led revenue

- Solid integration library (marketplaces, 3PLs, carriers), but not a global “platform giant”

- Some implementation services, but not dominant

Illustrative valuation scenarios (on USD 10m revenue):

What drives each scenario:

- Discounted case: higher services mix, unclear churn, customer concentration, weak KPI proof

- Core case: clean SaaS profile, solid retention, reasonable growth, credible workflow ownership

- Premium case: strong KPI case studies, proven integrations at scale, category leadership in a vertical, and a clear strategic adjacency (for example payments or settlement flows)

Step 3: What this means for you

Two companies can both have USD 10m revenue - and one can be worth USD 25m while the other is worth USD 65m. The gap is usually not “hype.” It’s revenue quality, defensibility, and buyer confidence.

If you want the top-of-range outcome, you need to make it easy for buyers to believe:

- Customers stick around

- The product is hard to replace

- Integrations and onboarding are repeatable

- You can grow without heroic services effort

- There is optionality for a strategic buyer to do more with the asset

8. Where Your Business Might Fit (Self-Assessment Framework)

This is a quick way to pressure-test your likely valuation positioning. Score each factor 0/1/2:

- 0 = weak or unclear today

- 1 = okay but not proven

- 2 = strong and provable

How to interpret your total score (rough guide):

- Mostly 2s: you’re closer to premium outcomes if you run a competitive process

- Mixed 1s and 2s: you’re in the “fair market” zone - improvements can pay off quickly

- Many 0s: you’re likely to see discounts, earn-outs, or buyer hesitancy unless you fix the basics

The point is not to judge yourself. The point is to identify the 2-3 upgrades that move your multiple the most.

9. Common Mistakes That Could Reduce Valuation

Rushing the sale

If you start a process without clean numbers, a clear story, and the right buyer list, you’ll attract opportunistic bids - and you won’t know what you left on the table.

Hiding problems

Churn issues, customer concentration, security gaps, or margin problems will surface in diligence. If buyers feel surprised, they lose trust - and the price drops fast (or the deal dies).

Weak financial records

Even for SaaS, many private Retail Software companies have messy reporting:

- Blended services and software revenue

- Unclear gross margin by product line

- Inconsistent churn and retention trackingFixing this can materially improve buyer confidence - and reduce “risk discounts.”

Not running a structured, competitive process with an advisor

A structured process creates competition. Competition raises price. There’s well-cited research in M&A that competitive processes with advisors can drive meaningfully higher outcomes - often referenced as around 25% higher purchase prices versus non-competitive, self-run processes.

Revealing what price you want too early

If you tell buyers “we’re looking for USD 10m,” you kill price discovery. Many buyers will come back with USD 10.1m, USD 10.2m style offers instead of showing what they would truly pay.

Retail Software-specific mistake: under-selling “integration proof”

Founders often list integrations like a checklist. Buyers care about:

- Time-to-onboard

- Reliability at scale

- Repeatability across customersIf you can’t show that, your integrations look like liabilities, not assets.

10. What Retail Software Founders Can Do in 6-12 Months to Increase Valuation

Think in three buckets: improve the business fundamentals, reduce buyer-perceived risk, and sharpen the story so buyers can underwrite a premium.

10.1 Improve the numbers buyers pay for

- Raise recurring revenue quality: shift packaging toward subscriptions and productized tiers

- Improve gross margin: reduce services intensity, standardize onboarding, prune low-margin delivery work

- Make retention undeniable: track logo churn and revenue retention monthly and explain movements clearly

- Tighten customer concentration: even small steps (new logo wins) can change perception

10.2 Make workflow ownership and KPI impact provable

- Produce 3-5 “before/after” case studies tied to money: labor saved, margin lift, shipping cost reduction, fewer stock-outs

- Instrument your product so KPI reporting is native, not manual

- Create a clear “system of record” narrative: where do you sit in the daily operating loop?

10.3 Productize integrations and onboarding

- Turn your top integrations into repeatable playbooks with timelines and templates

- Measure and improve time-to-value (from signed to live)

- Reduce custom work by creating configuration layers and standard connectors

10.4 Build strategic adjacency without boiling the ocean

You don’t need a massive pivot. But you can create credible adjacency:

- Payments or settlement partnerships (even referral economics can help if attach is real)

- Marketplace expansion tooling

- Supplier enablement modulesThe goal is to show buyers a believable “more upside” path.

10.5 Prepare for diligence like a pro

- Clean up revenue recognition and segment reporting (software vs services)

- Document security posture and customer data handling

- Organize contracts, pricing, and customer cohortsA smoother diligence process reduces risk discounts and keeps buyers confident.

11. How an AI-Native M&A Advisor Helps

A great outcome is usually not just about your product - it’s about running a process that creates real competition among the right buyers. An AI-native M&A advisor can change the size and quality of your buyer universe.

Higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, strategic fit, financial capacity, and synergy signals. More relevant buyers means more competition and stronger offers - and if one buyer drops out, you have real backups.

Initial offers in under 6 weeks. AI-driven buyer matching and outreach, faster creation of marketing materials, and structured diligence support can compress timelines dramatically compared to manual-only processes - helping you reach serious conversations and initial offers faster.

Expert advisory, enhanced by AI. The best outcomes still require experienced human advisors who know how to frame your story, manage the process, and negotiate. AI enhances this by improving buyer targeting, speeding up execution, and keeping diligence organized. The result is Wall Street-grade advisory quality without traditional “bulge bracket” costs.

If you’d like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.