The Complete Valuation Playbook for Roofing Services Businesses

A practical, buyer-focused guide to what roofing services businesses actually sell for and the concrete levers that can lift your multiple.

If you are thinking about selling your roofing services business in the next 1-12 months, valuation is not just a number - it is the output of how buyers perceive your risk, your durability, and how “transferable” your profit is without you.

Roofing is also in a particularly active moment: consolidation is real (strategics and PE keep buying scale), and buyers have become more allergic to “messy” businesses - especially ones that rely on heroic owner effort, vague job costing, or lumpy project work.

This playbook is built to be practical. It will show what roofing services businesses actually sell for, what drives higher vs lower multiples, and how to self-assess your likely range - plus a realistic 6-12 month action plan to improve it.

1. What Makes Roofing Services Unique

Roofing services is not valued like a generic “services company” because the economics are shaped by weather, labor, safety, project risk, and the mix of one-off installs vs recurring maintenance.

The main business types buyers group you into

Most buyers mentally sort roofing services into a few buckets:

- Commercial and institutional contractors: re-roofing, new installs, repairs, and planned maintenance for warehouses, offices, schools, hospitals, public estates.

- Residential roofing contractors: replacements, storm work, insurance-driven jobs, plus repairs and maintenance.

- Building envelope specialists: roofing plus facade, waterproofing, insulation, cladding, windows - often broader “envelope” scope.

- Hybrid models: installation plus a meaningful maintenance program, sometimes with light distribution or branded materials relationships.

Even if you do “a bit of everything,” buyers will value you based on what your profit mostly comes from.

Unique valuation considerations in roofing

Roofing valuations swing hard based on a few sector-specific realities:

- Project risk and job-costing quality: Buyers pay more when they trust your margin is real, repeatable, and measured job-by-job.

- Labor and safety: Roofing is labor-constrained and safety-sensitive. A strong safety record is not “nice to have” - it is a valuation input.

- Recurring vs one-off: A business with repeat maintenance and compliance-driven work feels safer than one that lives and dies by replacements and storms.

- Working capital and cash flow timing: Roofing often has deposits, progress payments, retainage, and seasonal swings. Buyers will normalize this, but only if your reporting is clean.

Key risk factors buyers always check

Buyers will almost always pressure-test:

- Customer concentration (especially one GC, one public agency, one property manager network).

- Backlog quality (signed work vs “handshake pipeline”).

- Warranty exposure (who holds risk, how claims are tracked, and whether reserves are realistic).

- Subcontractor dependence (and whether crews will stay post-close).

- Licensing, insurance, and safety compliance (one major issue can kill a deal late).

2. What Buyers Look For in a Roofing Services Business

Buyers do not pay for “revenue.” They pay for durable, transferable cash flow - and they pay more when they can underwrite the next 3-5 years with confidence.

The basics (still matter a lot)

Across almost every deal, buyers care about:

- Scale: Larger businesses usually get better multiples because they feel less fragile.

- Growth: Not just growth, but repeatable growth that doesn’t require the owner to personally sell every job.

- EBITDA margin: Roofing is typically not a 30% EBITDA industry. But buyers do reward businesses that consistently hold solid margins through cycles.

- Clean financials: Monthly close, credible job-costing, consistent add-backs, clear owner comp.

Roofing-specific “this is what they really mean”

When a buyer says “quality,” they’re often looking for:

- A predictable sales engine: leads, bids, close rates, and a CRM that isn’t in someone’s head.

- Repeatable delivery: foremen depth, standardized estimating, disciplined change order process.

- A defensible niche: public sector frameworks, healthcare, industrial, heritage work, complex waterproofing - something that is harder to commoditize.

- A real service base: maintenance contracts, recurring inspections, compliance-driven work orders.

How private equity thinks (in plain English)

Private equity (PE) buyers usually care about three things:

- What multiple they pay today vs what they can sell at later

- They want confidence they can sell to a larger buyer (strategic or bigger PE) in 3-7 years.

- What they can improve

- Typical levers in roofing:

- Increasing maintenance and re-roofing mix (less “one-and-done”)

- Improving estimating discipline and job margins

- Building branch density (more crews, tighter geography, better utilization)

- Better procurement and manufacturer rebate economics

- Typical levers in roofing:

- How risky the earnings are

- If EBITDA is volatile, poorly tracked, or overly dependent on one person, PE will either price it lower or structure it with earn-outs and holdbacks.

3. Deep Dive: The Valuation Power of Recurring Maintenance vs One-Off Projects

In roofing, one question quietly drives a lot of valuation outcomes:

How much of your revenue is “must-do, repeatable work” vs “optional, competitive projects”?

Buyers care because recurring work makes your future feel more predictable - and predictability is what multiples are buying.

How this shows up in real deal patterns

In the deal data, businesses tied to non-discretionary compliance, safety, and lifecycle maintenance tended to earn stronger buyer interest than pure project contractors. Buyers also paid up when companies could show stable revenue through cycles, not just peak-year growth.

Why buyers pay more for maintenance-heavy models

Maintenance revenue is valuable because:

- It repeats (annual inspections, planned capex cycles, service calls).

- It’s harder to cut (compliance and safety issues do not politely wait for better macro conditions).

- It can be operationally efficient (route density, recurring customer relationships, smaller ticket but higher frequency).

- It creates a moat (if you are already the trusted service provider, you often win the replacement project later).

Moving from “project-driven” to “maintenance-weighted” in 6-12 months

You do not need to reinvent your company. You need to package what you already do in a way buyers can underwrite.

Practical steps:

- Create service tiers (inspection-only, minor repairs bundle, full annual maintenance).

- Make renewals measurable: track renewal rate, service contract gross margin, attach rate after inspections.

- Sell maintenance at the point of install: every new roof should come with a structured maintenance offer.

- Build a dedicated service team: even 1-2 crews that only do service can dramatically improve responsiveness and margin tracking.

Lower-value vs higher-value profiles (what buyers see)

If you look more like the left column today, you can still sell - but you will usually get a lower multiple, more buyer skepticism, and more deal friction.

4. What Roofing Services Businesses Sell For - and What Public Markets Show

This is the heart of valuation reality: roofing services is usually valued more modestly than product manufacturers, because services tend to be more labor-heavy, more competitive, and harder to scale with the same margin structure.

That said, there are clear patterns in the data for what “typical” looks like - and what premium looks like when a company reaches platform scale.

5.1 Private Market Deals (Similar Acquisitions)

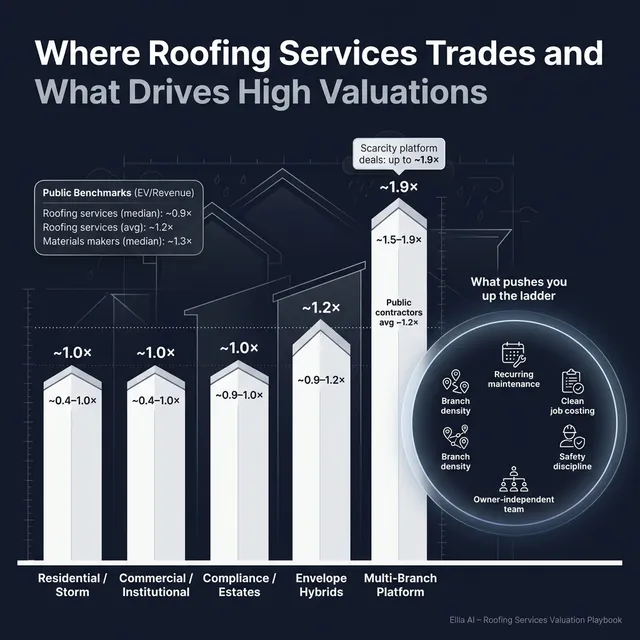

For private deals in roofing and closely adjacent building envelope contracting, the data clusters around about 0.4x-1.0x revenue for many contractor-style businesses, with a meaningful premium possible for scaled, multi-branch platforms.

A useful second lens is EV/EBITDA: contractor-style deals in the dataset cluster around mid-single-digit EBITDA multiples, while larger, scaled platforms can clear higher single digits when margins and integration readiness are strong.

Illustrative private deal ranges (roofing services oriented):

These ranges are illustrative. Your actual outcome depends on margin quality, revenue visibility, risk profile, and how competitive your sale process is.

5.2 Public Companies

Public markets give you a “reference band,” not a private sale price. Public multiples are influenced by liquidity, scale, and market sentiment - and they are generally higher for bigger, cleaner, more diversified businesses.

As of late 2025, public comps around roofing and building services show:

- Roofing and building services contractors: around ~1.2x average EV/Revenue and ~0.9x median EV/Revenue, with EV/EBITDA averages in the low 20s but a much lower median (reflecting outliers and volatility).

- Roofing and building materials manufacturers: around ~2.0x average EV/Revenue and ~1.3x median EV/Revenue, generally higher than contractors due to product margin structure and IP/brand effects.

Public market group multiples (late 2025 snapshot):

How to use these public multiples (correctly)

- Use them as rails, not a price tag.

- Most private roofing services businesses sell below public leaders because they are smaller, less diversified, and more owner-dependent.

- You can still get above “typical” ranges if your business has scarcity value (scale), strong recurring maintenance, and durable margins that feel defensible.

5. What Drives High Valuations (Premium Valuation Drivers)

Here’s what the deal patterns consistently reward - written in founder language. In this section, focus on the themes buyers pay up for, not the exact numbers.

Theme 1: Proven pricing power (margin that holds up)

Buyers pay more when they believe you can keep margins strong even when input costs rise or bidding gets competitive.

What this looks like in roofing:

- Consistent, repeatable job margins (not “one great year”)

- Disciplined estimating and change order capture

- A niche where you are not the cheapest bidder - you’re the trusted one

Theme 2: Recurring, non-discretionary service revenue

A meaningful maintenance base re-rates how buyers view your risk.

Practical examples:

- Multi-year maintenance frameworks with property portfolios

- Inspection programs that reliably convert into repair/replacement work

- Work tied to safety, compliance, or critical infrastructure uptime

Theme 3: Stable revenue through cycles (quality of growth)

Buyers pay for growth, but they pay even more for steady growth.

Signals that help:

- A backlog you can explain clearly

- Diversification across end markets (industrial, institutional, public estates, property managers)

- Less dependence on storms, insurance spikes, or one mega-client

Theme 4: Scale and “platform readiness”

There is a real scarcity premium for roofing businesses that look like a platform a larger buyer can build on.

What platform readiness looks like:

- Multiple branches or dense coverage in a region

- A management bench that can run operations without the founder

- Standardized systems (estimating, safety, procurement, job costing)

Theme 5: Technical differentiation in a specialty envelope niche

Premium outcomes show up when you are a recognized specialist in a category that is harder to replicate.

Examples:

- Complex waterproofing systems

- High-spec industrial roofs

- Heritage or regulated environments requiring specialized certifications

- Envelope scope that lets you control more of the project

Theme 6: Clear synergy fit with strategic buyers

Strategic buyers pay more when they can credibly make more money with your business than you can alone.

In roofing, synergies often come from:

- Procurement leverage and manufacturer economics

- Cross-selling across a broader services portfolio

- Branch density (shorter drive times, better crew utilization)

- Expanding into adjacent envelope services

Always-premium fundamentals (even if “boring”)

- Clean financial statements and job costing

- Diversified customer base

- Predictable cash flow and working capital discipline

- A team that will stay post-sale (and contracts/incentives that support that)

6. Discount Drivers (What Lowers Multiples)

Discounts are usually not about one flaw - they’re about uncertainty. Anything that makes buyers think “I can’t trust the earnings” pushes you toward the low end.

The most common value reducers in roofing services

- Thin or volatile margins: especially if margins dropped recently and you cannot clearly explain why (and how it is fixed).

- No measurable recurring revenue: “We do maintenance” is not the same as “40% of revenue is contracted maintenance with a tracked renewal rate.”

- Customer concentration: one GC, one public client, or one property manager network controlling the pipeline.

- Owner dependence: if the founder is the estimator, salesperson, and relationship-holder, buyers price in transition risk.

- Weak job costing and financial visibility: if you can’t answer “what jobs made money and why,” buyers assume risk.

- Safety incidents or compliance issues: even if insurable, it signals operational risk and can scare off institutional buyers.

- Subcontractor fragility: if labor capacity is “rent-a-crew” with no loyalty, buyers worry the workforce evaporates after closing.

Deal-structure discounts you should expect

If risk is real but the buyer still wants the business, they often push:

- Earn-outs tied to future performance

- Deferred consideration or holdbacks (often tied to warranty claims or working capital true-ups)

- Heavier representations and warranties (more legal risk for you)

7. Valuation Example: A Roofing Services Company

This section is a worked example to show the logic - not a promise, not a formal valuation.

The fictional company

SummitShield Roofing (fictional)

- Roofing services contractor (commercial-focused)

- USD 10.0m annual revenue (fictional)

- Mix: re-roofing + repairs + an emerging maintenance program

- EBITDA margin: “solid but not elite” (think high single digits)

Step 1: Pick the right comparable bands (plain English)

You start by separating “services contractors” from “product manufacturers,” because product companies often trade higher due to structurally higher margins and defensible IP.

For a roofing services contractor, the most applicable revenue-multiple bands in the data are roughly:

- Private contractor transactions: ~0.4x-1.0x revenue (typical range)

- Public services contractors reference band: roughly ~0.6x-1.1x revenue for relevant comps

You also keep a “premium ceiling” in mind: a truly scaled, multi-branch platform deal can reach around ~1.8x revenue in the dataset - but that is not the norm and requires platform-like characteristics.

Step 2: Apply the multiples to USD 10.0m revenue

Here’s what that logic looks like when translated into enterprise value (EV). (EV is the value of the business operations - not the same as what you personally take home after debt, cash, and transaction costs.)

Step 3: What moves SummitShield up or down?

How you land in the core range (~0.7x-1.1x)

- Solid margins with credible job costing

- Reasonable customer diversification

- Some maintenance revenue, even if not dominant

- A management team that can operate without founder heroics

What pushes you toward the premium case (~1.3x-1.8x)

- Multi-branch or dense regional presence (integration-ready)

- Meaningful, measurable recurring maintenance with renewals

- Strong safety and operational discipline

- A niche positioning buyers can believe is defensible

What drags you toward the discounted case (~0.5x)

- Margin compression with unclear causes

- No real visibility (no backlog tracking, weak job costing)

- Heavy customer concentration or owner dependence

The punchline: two roofing businesses can both be “USD 10m revenue,” but one is worth USD 5m and another is worth USD 15m+ depending on how buyers view risk and durability.

8. Where Your Business Might Fit (Self-Assessment Framework)

This is a simple tool to estimate where you might land in the valuation spectrum. Score yourself honestly. The goal is not bragging rights - it’s to find the highest-payoff improvements.

How to score

Give each factor a 0 / 1 / 2:

- 0 = weak / not in place

- 1 = partially in place

- 2 = strong and provable in data

Interpreting your total (rough guide)

- High band: You look like a premium candidate (buyers can underwrite you with confidence).

- Middle band: You are sellable at fair market, but the deal may be more price-sensitive.

- Low band: Expect lower multiples and/or tougher terms unless you fix 2-3 core issues first.

9. Common Mistakes That Could Reduce Valuation

These are avoidable - and they routinely cost founders real money.

Rushing the sale

If you go to market before your numbers and story are clean, buyers will anchor on uncertainty. You almost never get paid for “potential” if you can’t prove the base case.

Hiding problems

Every issue comes out in diligence: margin drops, safety incidents, customer churn, warranty claims, messy add-backs. If buyers feel misled, they either retrade price or walk.

Weak financial records

Roofing is especially sensitive to this because job-level margin matters. If your books can’t reconcile revenue, gross margin, and job profitability cleanly, buyers assume your EBITDA is overstated.

Low-hanging fixes that matter:

- job costing discipline

- clear segmentation (install vs service vs maintenance)

- consistent monthly close and forecasting

No structured, competitive sale process

A single-buyer negotiation usually produces a “good enough” price, not the best price. Running a structured, competitive process with an advisor is repeatedly associated with meaningfully higher purchase prices - a commonly cited figure is around 25% uplift because competition forces real price discovery.

Revealing what price you want too early

If you tell a buyer “I want USD 10m,” do not be surprised when you get offers clustered around USD 10.0-10.2m instead of what they might have paid in a true competitive process.

Roofing-specific mistakes that hurt

- Ignoring the maintenance story: doing maintenance work but not packaging, measuring, and selling it as a real recurring engine.

- Treating safety as paperwork: buyers treat safety performance like a proxy for operational discipline. Poor safety signals poor control.

10. What Roofing Services Founders Can Do in 6-12 Months to Increase Valuation

You do not need a complete transformation. You need targeted upgrades that reduce buyer fear and increase buyer conviction.

A) Improve the numbers buyers trust

- Lock down job costing: job-level margin by type, estimator, crew, and customer.

- Separate revenue streams: installs vs repairs vs maintenance vs warranty.

- Normalize EBITDA credibly: consistent owner comp, clean add-backs, and documentation.

B) Build real revenue visibility

- Track backlog (signed jobs), pipeline (quoted), and conversion (win rate).

- Turn maintenance into a product:

- standard packages

- renewal tracking

- attach rate after inspections

- service response-time KPIs

C) Reduce key-person risk

- Move estimating, sales, and ops knowledge out of one head.

- Put a second layer in place: ops lead, service manager, controller.

- Document the “how we run jobs” playbook (estimating, change orders, closeout, warranty).

D) Strengthen the risk profile buyers worry about

- Tighten safety processes and reporting (and be ready to show it).

- Review warranty history and reserves - be proactive rather than defensive.

- Reduce customer concentration where possible (or lock in longer-term frameworks).

E) Prepare like a buyer will diligence you

- Build a simple data room: contracts, insurance, safety logs, top customers, backlog, job costing reports.

- Write the “buyer narrative” in plain English:

- why you win

- why customers stick

- what is recurring

- why margins are durable

11. How an AI-Native M&A Advisor Helps

A strong exit is usually less about finding a buyer and more about creating a competitive process where multiple buyers see your business clearly and bid with confidence.

Higher valuations through broader buyer reach. AI can expand the buyer universe to hundreds of qualified acquirers based on deal history, synergies, financial capacity, and other signals. More relevant buyers means more competition and stronger offers - and a higher chance the deal actually closes because you have options if one buyer drops.

Initial offers in under 6 weeks. With AI-driven buyer matching and outreach, plus faster creation of marketing materials and diligence support, you can often reach initial conversations and offers far faster than a manual-only process.

Expert advisory, enhanced by AI. The best outcomes still need experienced human advisors who know how buyers think, how to frame the story, and how to run a disciplined process. AI improves speed and coverage, while expert M&A leadership ensures credibility, clean positioning, and negotiation strength - delivering Wall Street-grade advisory quality without traditional “bulge bracket” costs.

If you’d like to understand how an AI-native process like Eilla AI can support your roofing services exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.