The Complete Valuation Playbook for Supplements Businesses

A valuation guide for supplements founders showing what real buyers pay and what drives premium multiples.

If you are considering selling your supplements business in the next 1-12 months, valuation stops being a theory exercise and becomes a practical one: what will real buyers pay, and why?

This playbook is built for supplements founders. It uses real market data (private deals and public trading multiples), then translates it into the simple logic buyers use - plus a self-assessment and a 6-12 month action plan to help you move up the valuation range.

1. What Makes Supplements Businesses Unique

Supplements is not “just consumer.” It is consumer demand plus regulatory scrutiny, manufacturing risk, and trust. Buyers don’t just underwrite your brand - they underwrite your claims, your quality system, and your ability to keep customers coming back without endless discounting.

The main types of supplements businesses (and why they value differently)

Most privately held supplements companies fall into a few repeatable models:

- Branded DTC vitamins/minerals/supplements (VMS) – sold via Shopify/Amazon/subscription, sometimes with retail expansion.

- Sports/performance nutrition – higher-velocity categories (protein, RTD, pre-workout) with stronger retail and “occasion” frequency.

- Direct selling/MLM wellness – distributor-led growth, often valued differently due to channel risk and volatility.

- Science-led preventive/specialty nutraceuticals – clinically positioned, condition-targeted, sometimes with IP, patents, trials, or practitioner channels.

- Ayurvedic/traditional herbal portfolios – often regionally anchored with strong brand heritage.

- CBD/hemp-derived wellness – category-specific regulatory and demand cycles.

- B2B ingredients/probiotics suppliers – manufacturing/ingredient economics, patents, customer concentration, longer sales cycles.

- Contract manufacturing/OEM – valued more like manufacturing services than like a brand.

Unique valuation considerations buyers apply in supplements

Compared to many other industries, supplements valuation is disproportionately shaped by:

- Trust and repeat purchase – supplements are bought on belief + experience. Buyers pay for evidence that customers return without heavy promos.

- Claims and compliance risk – what you say (ads, packaging, influencers) can create legal and financial exposure.

- Quality system strength – buyers fear recalls, contamination, inconsistent potency, and supplier failures.

- Channel fragility – Amazon concentration, paid media dependence, or a single retail partner can change your risk profile overnight.

- Inventory and working capital – shelf life, batch sizes, MOQs, and write-offs matter more than founders expect.

Key risks buyers always check (and you should pre-empt)

- GMP and quality documentation (COAs, batch records, testing cadence, supplier qualification)

- Claims substantiation and marketing compliance (especially before a buyer scales spend)

- Customer concentration by channel (Amazon, one retailer, one affiliate network)

- SKU sprawl and slow movers (cash trapped in inventory)

- Returns, chargebacks, and subscription churn dynamics

- Supplier dependency (single-source ingredients, proprietary blends, contract manufacturer lock-in)

2. What Buyers Look For in a Supplements Business

Buyers are not “buying your past.” They are paying for confidence in your next 2-5 years.

The universal fundamentals still matter

Even in supplements, buyers start with a few basics:

- Scale (revenue size and consistency)

- Growth (and whether it’s organic vs promo-driven)

- Gross margin (pricing power, COGS discipline, channel mix)

- EBITDA margin (profitability and ability to self-fund growth)

- Cash conversion (inventory discipline and working capital needs)

Supplements-specific “valuation lens” buyers use

This is where supplements gets different. Buyers will pressure test:

- Repeat and retention: Do customers reorder because they love it, or because you retargeted them aggressively?

- Brand strength vs performance marketing: If you cut ad spend by 30%, does demand hold up or collapse?

- Product credibility: Is your differentiation real (formulation, efficacy, sourcing, clinical support), or mostly marketing language?

- Channel resilience: Are you one algorithm change away from a bad quarter?

- Operational readiness: Can the business scale without quality incidents, stockouts, or margin erosion?

How private equity thinks about your business (in plain English)

Private equity (PE) is usually asking:

- “What do I pay now, and what can I sell it for later?”They care about entry multiple vs exit multiple. If they buy you at a high multiple, they need a credible path to sell at an equal or higher multiple in 3-7 years.

- “Who is the next buyer?”Often a larger PE fund, a strategic buyer (bigger brand house, beverage company, consumer health group), or occasionally public markets.

- “What levers can we pull?”Common PE levers in supplements include:

- Improve contribution margin (pricing discipline, mix shift, COGS renegotiation)

- Reduce promo reliance (stronger retention, better bundles, higher AOV)

- Expand channels (retail, international, practitioner, marketplaces)

- Professionalize ops (forecasting, inventory turns, QA, SKU rationalization)

3. Deep Dive: The Highest-Impact Valuation Nuance in Supplements - Trust That Converts Into Repeatable Demand

Here’s the question buyers are really asking:

Is your growth built on durable trust (repeat purchase), or on fragile acquisition (constant new customer buying)?

This matters because the market data shows huge dispersion in multiples across supplements sub-segments. The highest-multiple pockets tend to be the ones where differentiation and repeatability reduce uncertainty.

How this shows up in deal outcomes

Across supplements M&A, premium outcomes tend to be associated with combinations of:

- Documented efficacy or science-led positioning (not just “clean label” language)

- A scaled DTC/subscription engine (large active customer base, repeatable acquisition across markets)

- High EBITDA conversion (profitability that de-risks growth)

In other words: buyers pay more when they believe your next dollars of revenue will be cheaper, more predictable, and less legally risky.

Why buyers care (buyer psychology, not banker math)

- Trust reduces marketing risk. If customers reorder, the buyer is less exposed to rising ad costs.

- Trust reduces regulatory risk. Strong substantiation and disciplined marketing lowers “surprise liabilities.”

- Trust increases pricing power. Brands with credibility can hold price and protect margin.

- Trust improves channel expansion. Retailers and strategics prefer brands that won’t trigger compliance issues.

How to move from the “lower-value” version to the “higher-value” version

You do not need to become a pharmaceutical company in 12 months. But you can become a more defensible supplements business:

- Tighten claims and substantiation (what you say, where you say it, and how you support it)

- Upgrade proof points: trials, studies, practitioner endorsements, quantified outcomes, or rigorous QA transparency

- Build repeat mechanisms: subscriptions that customers actually keep, bundles, replenishment journeys, community, habit formation

- Reduce promo addiction: show stable demand even when discounts are moderated

4. What Supplements Businesses Sell For - and What Public Markets Show

This section is the anchor. The numbers below are not a promise - they are a reality check.

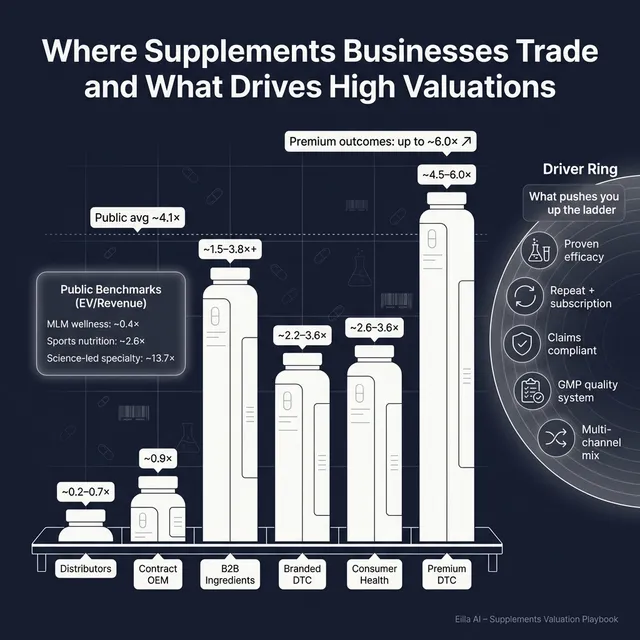

The key takeaway: supplements valuations are not one market. They are several markets. Your business model and risk profile determine which “lane” you fall into.

5.1 Private Market Deals (Similar Acquisitions)

In the precedent deals data, overall private transactions average around 2.5x EV/Revenue and 13.7x EV/EBITDA.

But the more useful view is by deal type:

- Branded DTC vitamins/supplements deals cluster around roughly 2.2x-3.6x EV/Revenue, with EBITDA multiples often in the low-to-mid teens for profitable brands.

- Marketplaces/distributors trade much lower (around 0.5x EV/Revenue on average) because they resemble lower-margin distribution businesses.

- B2B ingredients/probiotics can trade higher on EBITDA (often 20x+ EV/EBITDA in the averages) when there’s defensible IP, patents, and long-term customer value - but revenue multiples vary widely.

How to interpret this as a founder: if you are a branded supplements company, private comps often value you more like a “brand with repeat demand” than like a retailer - but only if your economics and risk profile support it.

5.2 Public Companies (Reference point, not a price tag)

Public markets show the same dispersion - and they are often harsher on risk.

Across the public set, the overall average is about 4.1x EV/Revenue and 12.4x EV/EBITDA, but that “overall” number hides huge category differences. These figures are best treated as late-2025 reference bands, not a direct private valuation tool.

How to use public multiples correctly:

- Use them as a sanity check for what “low-risk scale” can be worth.

- Adjust down for smaller scale, higher customer acquisition risk, channel concentration, or weaker compliance readiness.

- Adjust up only when you have something scarce: defensible science, unusually sticky demand, or a strategic fit that a buyer can monetize fast.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium multiples are rarely “because the buyer liked the brand.” They happen when the buyer can defend the future with confidence.

Here are the most consistent premium drivers in supplements, including patterns observed in recent deals:

1) Documented efficacy and science-led credibility

Buyers pay more when your differentiation is provable, not poetic.

Practical examples:

- Clear substantiation for claims (and consistency across ads, packaging, influencer scripts)

- Clinically supported ingredients, quantified outcomes, practitioner endorsement

- Transparency that builds trust (testing, sourcing, traceability)

2) A scaled, repeatable DTC/subscription engine

“Subscription” only helps valuation if it is real and sticky.

Practical examples:

- Large active customer base with healthy re-order behavior

- Repeatability across geographies or cohorts (not one viral moment)

- Strong retention signals: low churn, growing subscription penetration, stable reorder intervals

3) High EBITDA conversion (profitable growth)

In the deals data, the highest EV/EBITDA outcomes cluster around businesses with strong profitability and durable margins.

Practical examples:

- EBITDA margin that stays healthy even when you reduce discounting

- Growth that isn’t purely “buying revenue” through ads

- Clean contribution margin by channel and SKU

4) Category adjacency and strategic “fit”

Strategic buyers pay more when you sit in their highest-velocity lanes.

Practical examples:

- Formats that expand occasions (RTD, powders, snacks, bundles) vs capsules-only

- Channel overlap a strategic can scale quickly (big-box, convenience, global distribution)

- Portfolio that fills whitespace for the acquirer

5) De-risking structures and leadership continuity

Premium prices often come with mechanisms that protect the buyer: earn-outs, seller retention, and operator continuity.

Practical examples:

- You have a second layer of leadership that can stay post-close

- You can credibly commit to KPIs (and track them cleanly)

- You are open to structures that align incentives without feeling like “moving the goalposts”

6) Operational and compliance readiness

In supplements, operational excellence is not a back-office detail - it’s a valuation lever.

Practical examples:

- Strong QA/QC, supplier qualification, audit readiness

- Forecasting and inventory discipline (less expiry risk)

- Claims and marketing governance (lower regulatory surprise)

6. Discount Drivers (What Lowers Multiples)

Discounts happen when buyers see fragility. The good news: many discount drivers are fixable in 6-12 months.

The most common value-killers in supplements

- Paid media dependence with weak organic repeatIf growth collapses when CAC rises, buyers price that risk.

- Channel concentration (Amazon, one retailer, one affiliate network)Buyers discount businesses that can be “turned off” by an algorithm or a buyer decision.

- Claims and compliance exposureRisk is not just fines - it’s forced label changes, ad restrictions, returns, and reputational damage.

- Weak quality system / supply chain fragilityRecalls, inconsistent potency, supplier concentration, or poor documentation spook buyers.

- Low gross margin from discounting and SKU sprawlToo many SKUs, too many promos, too much inventory cash trap.

- Founder dependencyIf you are the brand, the product developer, and the growth engine, buyers will push for earn-outs or lower price.

7. Valuation Example: A Fictional Supplements Company (USD 10m Revenue)

To make the valuation logic concrete, here is a worked example. This company is fictional. The USD 10m revenue is fictional. The valuation ranges are illustrative - not investment advice or a formal valuation.

Step 1: The logic (plain English)

- Start with “what are you most similar to?”If you are a branded DTC supplements business, the most relevant private comps cluster around roughly 2.2x-3.6x revenue. Public branded VMS DTC trades lower on average, while science-led specialty players can trade far higher - but only with real differentiation.

- Pick a core multiple range that fits your risk profile.For a small but solid branded supplements company, a reasonable “base” reference band is often around 2.0x-4.0x revenue, depending on growth, margins, and channel risk.

- Move up or down based on drivers.

- Premium case: sticky subscription base, strong margins, defensible differentiation, strong compliance posture, multi-channel resilience.

- Discount case: channel concentration, promo addiction, weak proof/claims governance, low margin, messy financials.

Step 2: Apply it to “NorthPeak Nutrition” (fictional)

Assume:

- Revenue: USD 10.0m

- Business model: DTC supplements brand with a meaningful subscription program

- Base economics: 70% gross margin, 14% EBITDA margin

- Channel mix: Shopify + Amazon (Amazon is meaningful but not dominant)

Step 3: What this means for you

Two USD 10m supplements businesses can be worth wildly different amounts because buyers are not paying for revenue - they are paying for confidence in future profit and durability.

If you want to move up the range, focus less on “growing faster at any cost” and more on growing in a way buyers believe will continue after you exit.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this to locate yourself honestly. Score each factor 0-2:

- 0 = weak / inconsistent / unproven

- 1 = decent but not buyer-grade yet

- 2 = strong and defensible

Interpreting your score (directionally):

- High band: you look like a premium-quality asset in your segment

- Mid band: fair market outcomes likely, but some fixable risks

- Low band: you may want 6-12 months to address the biggest discounts before selling

9. Common Mistakes That Could Reduce Valuation

1) Rushing the sale

A rushed process forces you to accept the first “good enough” offer. It also reduces competitive tension, which is where valuation expands.

2) Hiding problems

Buyers will find issues in diligence. If they feel surprised, trust breaks and value leaks - through price cuts, tougher terms, or deal collapse.

3) Weak financial records

Messy numbers don’t just slow diligence - they create doubt. In supplements, you should be able to clearly explain:

- Revenue by channel

- Gross margin by SKU and channel

- Ad spend efficiency and what happens when spend changes

- Inventory aging and expiry risk

4) Not running a structured, competitive process with an advisor

Structured processes increase buyer coverage and force buyers to sharpen pencils. Practitioner datasets often cite meaningfully higher sale prices (sometimes up to ~25%) when sellers run a competitive process with professional sell-side support, versus “one-buyer” negotiations. (Axial)

5) Revealing what price you’re after too early

If you tell buyers “I’m looking for USD 10m,” many offers will cluster just above that - instead of discovering what the market would truly pay. Price discovery dies when you anchor the negotiation for them.

6) Supplements-specific mistake: ignoring claims and influencer governance

Many founders underestimate how aggressively buyers will diligence marketing claims. If your influencer scripts, ads, and landing pages are not controlled, buyers see future liability.

7) Supplements-specific mistake: SKU sprawl without profitability clarity

More SKUs can look like growth, but buyers often see operational complexity, slow-moving inventory, and margin fog.

10. What Supplements Founders Can Do in 6-12 Months to Increase Valuation

Think of this as moving from “founder-built” to “buyer-grade” - without a massive strategic pivot.

A) Improve the numbers buyers pay for

- Lift EBITDA margin by focusing on pricing discipline, promo strategy, and SKU profitability

- Reduce inventory cash trap: rationalize SKUs, improve forecasting, tighten MOQs

- Show stable contribution margin even when discounting is moderated

B) Make demand more predictable

- Improve retention: subscription experience, replenishment flows, bundles, habit formation

- Diversify acquisition: grow organic, partnerships, retail, and community channels

- Reduce Amazon risk: build a stronger owned-channel base or diversify marketplaces

C) De-risk the business (supplements-specific)

- Tighten claims governance: substantiation file, approved claims library, influencer compliance rules

- Upgrade quality posture: supplier qualification, testing cadence, audit readiness, documentation hygiene

- Build a “diligence-ready” data room: COAs, batch records, recall procedures, complaint tracking

D) Upgrade the story buyers will believe

- Define your “why you win” in one sentence (not “premium quality” - everyone says that)

- Show proof: customer cohorts, retention, repeat rates, practitioner endorsements, studies, outcomes

- Clarify strategic pathways: channel expansion, adjacent formats, international playbook

E) Reduce founder dependency

- Strengthen your #2 layer: ops, growth, finance, QA

- Document key processes (product dev, claims review, forecasting, channel playbooks)

- Prepare for reasonable retention expectations (especially in premium outcomes)

11. How an AI-Native M&A Advisor Helps

Selling a supplements business is not just about “finding a buyer.” It’s about finding the right set of buyers and running a process that creates competition, confidence, and speed - without losing control of your story.

Higher valuations through broader buyer reach. AI can expand your buyer universe to hundreds of qualified acquirers based on deal history, synergy patterns, financial capacity, and strategic fit. More relevant buyers creates more competition, better terms, and more options if one buyer drops.

Initial offers in under 6 weeks. AI-driven buyer matching, faster outreach, and streamlined creation of marketing materials can compress timelines - while still running a professional process that supports serious offers.

Expert advisory, enhanced by AI. You still want experienced human bankers driving strategy, messaging, and negotiations. AI strengthens that work: tighter positioning, cleaner materials, faster diligence support, and “Wall Street-grade” process quality without traditional bulge bracket costs.

If you’d like to understand how an AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.