The Complete Valuation Playbook for Vehicle Rental Management Businesses

A guide to how vehicle rental management businesses are valued today and how to lift your multiple.

If you run a vehicle rental management business - whether you own the fleet, manage it, provide the software, or some mix of all three - the next 1-12 months are a very important window to think seriously about valuation.

Across the mobility space, you can see three big forces at work:

- Consolidation - larger rental platforms, fleet operators, and software groups are buying up specialists.

- Technology and data - telematics, rental management software, and compliance tools are reshaping what “good” looks like.

- Capital costs - higher interest rates make the difference between asset-heavy and asset-light models even more visible in valuations.

This guide is built specifically for founders and CEOs in vehicle rental management. It will:

- Show what businesses like yours actually sell for (both operators and software-led platforms).

- Decode what pushes you toward higher vs lower multiples.

- Give you a simple self-assessment and a 6-12 month action plan to improve your outcome.

1. What Makes Vehicle Rental Management Unique

“Vehicle rental management” covers a few distinct but related models:

- Asset-heavy rental operators

- Car, van, truck, or equipment rental companies

- Corporate mobility fleets, long-term rental, subscription models

- Often own or lease a large fleet, with branches, depots, and operations staff

- Fleet management, telematics, and AIoT platforms

- SaaS platforms that track vehicles, optimize routes, manage drivers, and monitor compliance

- Revenue is largely recurring subscription, with high gross margins

- Rental management and vertical ERP software

- Systems that run the rental operation itself - bookings, contracts, damage, billing, workshop, inventory

All of these sit inside the vehicle rental value chain, and buyers often look at them together when building platforms. But the valuation logic is not the same for all three.

Why valuation is different in this sector

Compared to a generic software or services business, vehicle rental management has some unique features:

- Capital intensity and fleet risk

- Asset-heavy operators carry big fleets, financed with debt, leases, or both.

- Buyers care deeply about residual values, utilization, and how cyclical your demand is.

- Small changes in resale prices or utilization can swing cash flows dramatically.

- Regulation and compliance

- Driver safety, insurance, electronic logging, emissions, and municipal rules are real risk areas.

- Software and telematics platforms that embed compliance workflows tend to earn premium multiples.

- Operational complexity

- You are juggling reservations, maintenance, damage, insurance claims, fines, and customer service while keeping vehicles moving.

- Tools that genuinely reduce complexity and risk become “mission critical” and command higher valuations.

- Revenue mix and visibility

- Mix of B2B contracts, corporate fleet agreements, and walk-up or online consumer rentals.

- Longer contracts with sticky B2B customers are worth more than highly seasonal, price-sensitive tourist rentals.

Key risk factors buyers always check

Buyers will nearly always dig into:

- Fleet structure

- Own vs lease vs asset-light (managed fleets only)

- Age profile and brand mix of vehicles

- Residual value and remarketing strategy

- Customer and contract quality

- % of revenue under long-term contracts vs short-term rentals

- Concentration - do 5 customers drive 50 percent of revenue?

- Renewal patterns and churn

- Operational metrics

- Utilization rates and downtime

- Damage and claims rates

- On-time performance and service levels

- Technology and integration

- Depth of your rental management / telematics stack

- Integrations with OEMs, insurers, regulators, and partners

- How hard it is for a customer to rip you out

If you understand how your business looks on these dimensions, you are already halfway to understanding your valuation range.

2. What Buyers Look For in a Vehicle Rental Management Business

Valuation in this sector is not random. Most sophisticated buyers - both strategic and private equity - look through a similar lens.

The obvious (but still critical) levers

These apply whether you are an operator or a software platform:

- Scale

- Larger revenue bases usually attract more bidders and higher multiples.

- For operators, that can mean regional or national fleet density.

- For software platforms, it often means thousands of vehicles or locations on the platform.

- Growth

- Buyers pay more for businesses growing at healthy double digits.

- Low or no growth will pull you toward the lower end of the multiple range, even if margins are good.

- Profitability and cash generation

- EBITDA (profit before interest, tax, depreciation, and amortization) still matters.

- For asset-heavy operators, this is about efficient fleet use and cost control.

- For software platforms, high gross margins and strong EBITDA margins show a scalable model.

- Revenue quality

- Recurring or highly repeatable revenue is more valuable than one-off projects.

- In this sector, that often means corporate rental contracts, subscription telematics, or SaaS rental management fees.

Sector-specific nuances buyers care about

Beyond the basics, serious buyers focus on vehicle-rental-specific features:

- Predictability vs seasonality

- Heavy reliance on summer leisure travel or tourism is risky.

- Strong corporate, insurance replacement, or long-term rental contracts smooth out seasonality and are valued higher.

- Utilization and yield

- For operators: how often vehicles are on rent, and at what daily rate.

- For software/telematics: how embedded your platform is in day-to-day workflows (login frequency, API usage, automated decisions).

- Compliance and risk management

- Platforms that reduce accidents, fines, and insurance losses are strategic.

- Rental operators with excellent safety and claims records are more attractive.

- Data moat

- Buyers like businesses that get better with scale - for example, more vehicles and trips create better benchmarks and predictive models.

- Telematics and rental platforms that can prove “data network effects” often receive premium multiples.

How private equity buyers think

Private equity (PE) investors will usually frame your business using a few key ideas:

- Entry vs exit multiple

- They might buy you at, say, 3.5x revenue or 9x EBITDA.

- They need a realistic story for selling at a higher multiple in 3-7 years - for example, by scaling into a platform, adding software, or improving margins.

- Who they can sell to later

- Larger rental groups

- Bigger software or telematics platforms

- Larger PE funds building a mobility platform

- Occasionally, a public listing if you become large enough

- Levers they expect to pull

- Price: modest rate increases, better segmentation, or new fees.

- Mix: shift more revenue into recurring corporate contracts or subscription software.

- Cost: better fleet procurement, refinancing leases, route optimization, automation of manual processes.

- M&A: bolt-on acquisitions of smaller rental operators or niche software tools.

If your business already has a clear path for these levers, PE buyers will see more upside and can justify paying a higher multiple.

3. Deep Dive: Asset-Heavy vs Software-Led - Why Structure Drives Multiples

One of the biggest valuation nuances in vehicle rental management is where you sit on the spectrum from asset-heavy operator to software-led platform.

In the data, this split is stark:

- Vehicle rental operators and car sharing marketplaces in private deals usually trade around 1.7-1.9x revenue and about 10x EBITDA on average.

- Fleet telematics and IoT SaaS platforms in private deals usually trade closer to 3.0-4.3x revenue and 12-15x EBITDA.

- Rental ERP / vertical SaaS platforms for rental and logistics operations have individual deals around 2.3-3.5x revenue and 10-13x EBITDA, with some category leaders above 5x revenue.

Why buyers pay different multiples

- Asset-heavy operators

- Need capital to buy and turn over the fleet.

- Exposed to interest rates, residual values, and macro demand.

- Returns can be excellent, but risk is higher, and a lot of cash is tied up in vehicles.

- Software-led and asset-light platforms

- Less capital tied up in hard assets.

- High gross margins (often 60-80 percent).

- Revenue is usually recurring, with strong visibility.

- Easier to scale internationally without owning more vehicles or branches.

Because of this, buyers are often comfortable with higher revenue multiples for software-led businesses than for pure rental operators - even if the software business is smaller in absolute revenue.

Moving from lower-value to higher-value profiles

Most real businesses are hybrids. Maybe you:

- Run a rental operation, and

- Have built your own rental management or telematics platform, and

- Sell that platform (even lightly) to others.

Or you might manage fleets on behalf of corporates, using a mix of your vehicles and theirs.

Founders who want to move toward a higher-multiple profile typically:

- Increase the recurring, contract-based part of revenue (B2B fleets, subscription software).

- Separate and highlight the software / telematics revenue and its margins from pure rental revenue.

- Systematically document their data and compliance edge - for example, safety improvements, reduced claims, or regulatory advantages.

Lower-value vs higher-value profiles

Use this as a quick mental model:

If you honestly sit closer to the left-hand column today, you can still sell. But your multiple will more likely be at or below sector averages. Shifting even one or two dimensions toward the right can make a material difference.

4. What Vehicle Rental Management Businesses Sell For - and What Public Markets Show

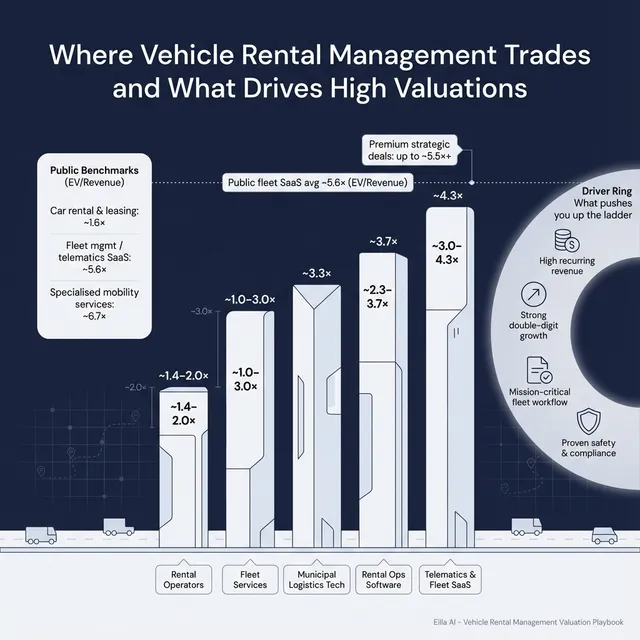

At a high level, the data shows three clusters:

- Asset-heavy rental operators trade on lower revenue multiples, but can still achieve solid EBITDA multiples.

- Telematics and fleet management SaaS businesses trade on higher revenue and EBITDA multiples.

- Vertical rental / logistics ERP software sits in between, with upside for true category leaders.

Remember: these are enterprise value (EV) multiples - the value of the business including debt and equity, divided by either revenue or EBITDA.

4.1 Private Market Deals (Similar Acquisitions)

From the transaction data, approximate group averages look like this:

What affects where you land in these ranges?

- Deal size - larger, more scalable businesses often get better multiples.

- Growth - higher growth pushes you toward the upper end.

- Margins - strong gross and EBITDA margins are rewarded, especially for software.

- Moat - category leadership, integrations, and compliance/data depth are key premium drivers.

These ranges are illustrative, not promises. Two businesses in the same segment and revenue size can still end up at very different multiples because of their profile.

4.2 Public Companies

Public markets give a sense of how “best in class” and scaled players are valued. For vehicle rental management, the most relevant groups are:

Within those averages, individual companies vary a lot:

- Asset-heavy names usually cluster in the low single-digit EV/Revenue range and mid to low double-digit EV/EBITDA.

- Software-heavy names sit mainly between low single-digit and mid-teens EV/Revenue, and low to high teens EV/EBITDA, depending on growth and profitability.

The key takeaway: public SaaS and telematics platforms trade at a meaningful premium to asset-heavy rental operators.

How founders should use public multiples

You should treat public multiples as:

- An upper reference band, adjusted down for:

- Smaller scale

- Lower growth

- Customer or geographic concentration

- Higher risk profile

- A sanity check, not a price tag

- If you are an asset-heavy rental operator doing USD 20m of EBITDA, expecting 16x EBITDA just because some SaaS player trades there is unrealistic.

- If you are a niche SaaS platform with USD 5-15m revenue, high growth, and strong margins, you may still transact below the EV/Revenue of a large public SaaS leader - but comfortably above pure rental operator levels.

- Occasional upside

- Scarce, highly strategic assets with strong moats, integrations, and data advantages can still command very strong multiples, especially if there is a clear buyer who can extract synergies.

5. What Drives High Valuations (Premium Valuation Drivers)

Now to the good news: many of the things that push you toward the top of the multiple range are within your control over a 6-24 month horizon.

Based on the transaction data and broader sector experience, the main premium themes are:

5.1 Category-leading vertical platform with deep integrations

- These platforms sat at the core of their vertical - for example, dealers and textile rental plants literally ran their operations on them.

- They integrated deeply with OEMs, equipment, and other core systems.

- This drove very high EBITDA multiples and strong EV/Revenue.

For a vehicle rental management business, this means:

- Your software is the primary operating system for reservations, fleet, damage, billing, and reporting.

- You plug into OEM systems, registration databases, insurers, telematics devices, and accounting/ERP.

- Switching away from you would be painful and risky for customers.

Practical moves:

- Document your integrations and highlight which ones are unique or hard to replicate.

- Show uptime, data accuracy, and the operational impact of your platform.

- Track and present customer retention and expansion metrics clearly.

5.2 High-margin, recurring software economics

Certain relatively small vertical SaaS deals show that businesses combining the following characteristics tend to achieve premium revenue multiples relative to peers:

- 70-80 percent gross margins

- Strong recurring revenue

- Solid EBITDA margins

Buyers pay more for:

- Predictable subscription or platform fees

- Multi-year contracts and auto-renewals

- Net revenue retention above 100 percent (customers paying more over time)

Practical moves:

- Increase the share of your revenue that is subscription-based or on long-term contracts.

- Reduce one-off projects or short-term pilots without a clear conversion path.

- Cleanly separate SaaS/recurring revenue from rental or transactional revenue in your reporting.

5.3 Embedded compliance and safety workflows

In other deals, compliance features (ELD, HOS, inspections, RFID tracking) supported premium valuation outcomes relative to peers without these capabilities.

Why buyers like this:

- Compliance is hard to do manually and expensive to get wrong.

- If your platform helps customers avoid fines, accidents, and legal issues, you are less likely to be swapped out.

Practical moves:

- Build or highlight modules that manage driver checks, vehicle inspections, insurance documentation, and evidence for claims.

- Quantify impact: fewer incidents, faster claim resolutions, lower insurance costs.

- Get case studies that show regulators, insurers, or large corporate customers relying on your processes.

5.4 Data network effects and asset tracking at scale

Platforms use RFID and telemetry to track assets and feed analytics. Fleet telematics platforms do similar things at scale.

Valuations are higher when:

- The more vehicles or assets you track, the better your benchmarking and predictions become.

- You can show customers clear ROI from your data - for example, reduced idle time, optimized routes, or lower damage.

Practical moves:

- Increase the penetration of telematics or tracking devices in your customer base.

- Build simple dashboards that show customers how much money they save with you.

- Aggregate anonymized benchmarks (“our customers see X percent higher utilization than peers”).

5.5 Cross-vertical expansion and integration synergies

Integration-ready platforms that can be cross-sold into a larger logistics or mobility stack get a premium.

Buyers pay more if they can:

- Plug your solution into their existing suite quickly.

- Sell more modules to your customers and vice versa.

- Use your product to deepen wallet share with fleets they already serve.

Practical moves:

- Invest in a clear API strategy and documentation.

- Build a few well-chosen integrations with popular telematics, TMS, or ERP systems.

- Track and present evidence of customers using multiple modules and growing their spend.

5.6 Enterprise-grade profitability and discipline

EBITDA margins in the 20-30 percent range support strong EV/EBITDA multiples.

For both operators and software platforms, buyers pay up for:

- Consistent multi-year margins (not just one lucky year)

- Sensible customer acquisition costs

- Limited dependence on a single contract or one-off windfall

Practical moves:

- Identify and fix obviously loss-making segments, customers, or products.

- Show a 3-5 year margin history with explanations for any swings.

- Build a simple, credible plan to improve margins by a few points over the next 2-3 years.

5.7 Hygiene factors that still matter

Even though every investor knows this, many deals still suffer from weak basics:

- Clean, accurate financials and KPIs

- Clear revenue recognition policies

- Proper separation of owner expenses vs business expenses

- A leadership team that is not “just you”

These don’t usually give you a premium, but they protect you from avoidable discounting.

6. Discount Drivers (What Lowers Multiples)

Just as there are premium drivers, there are clear patterns in what drags valuations down. The goal is not to scare you, but to make these visible so you can tackle them.

Key discount drivers in vehicle rental management:

- Heavily transactional, seasonal revenue mix

- Over-reliance on tourist rentals or a single season.

- No meaningful base of corporate or contract customers.

- Thin or volatile margins

- EBITDA margins low or negative in normal years.

- Big swings year to year with weak explanations.

- No real technology or data moat

- Commodity rental software or telematics with many direct substitutes.

- Limited integrations, low user engagement, no clear ROI story.

- Customer concentration and weak contracts

- A few large customers drive most of the revenue.

- Contracts that can be cancelled quickly or heavily renegotiated.

- High fleet and financing risk

- Aggressive residual value assumptions.

- Weak remarketing capabilities.

- Very short-term funding of long-lived assets.

- Regulatory or safety issues

- Poor accident or claims history.

- Compliance gaps, unresolved regulatory disputes.

- Messy financials and unclear metrics

- No clear split between rental, software, and services revenue.

- Owner salaries and benefits not normalized.

- Lack of good data on utilization, churn, or customer lifetime.

- Key-man risk

- Founder does everything, from sales to key customer relationships.

- No succession or leadership layer in place.

Each of these is fixable to some degree, but buyers will price them in if you do not address them before going to market.

7. Valuation Example: A Vehicle Rental Management Company

To make all this concrete, let’s walk through a simple example.

We will use a fictional company called FleetLane OS, a vertical SaaS platform for mid-market vehicle rental operators. The numbers here are illustrative only and are not a valuation of any real company or investment advice.

7.1 The fictional business

Assume FleetLane OS has:

- Annual revenue of USD 10m (fictional)

- Pure software revenue (no hardware or rental revenue)

- Customers that are mostly vehicle rental and fleet operators

- A long operating history and 11-50 employees

- No detailed growth or margin data disclosed

7.2 The valuation logic (football field approach)

We start by looking at relevant multiple ranges:

- Vehicle rental operators and car sharing marketplaces

- Private deals around 1.4-2.0x revenue and 10x EBITDA.

- FleetLane is software-only, so we treat this as a floor check, not the main benchmark.

- Fleet telematics and IoT SaaS platforms

- Private deals around 1.8-5.2x revenue.

- FleetLane is software-only, similar end market, but maybe without hardware devices, so middle of this range is relevant, high end reserved for category leaders with strong growth.

- Rental and automotive ops software (ERP / vertical)

- Deals like Applirent, ABS Laundry, and others indicate 2.5-3.7x revenue for solid vertical SaaS, with category leaders going above 5x.

- This is the closest set of comps for FleetLane.

- Waste and municipal logistics tech

- Businesses with similar compliance and logistics features, like c-trace, around 3.3x revenue.

- Good supporting evidence for the upper-mid part of the range.

- Public companies (context, not direct benchmarks)

- Fleet management SaaS around 5.6x EV/Revenue on average.

- Smaller private companies usually transact below this, unless they are exceptional.

Given FleetLane’s limited disclosed data (no clear high growth or exceptional margins), we avoid giving it a “category leader” premium by default.

7.3 Building a reasonable range

From the above, we can build three scenarios on USD 10m of revenue:

- Conservative / lower-end scenario

- Apply multiples closer to asset-heavy or lower SaaS peers: around 2.0-2.5x revenue.

- Implied EV: USD 20-25m.

- This might reflect modest growth, average margins, and limited moat.

- Core range (closest private SaaS comps)

- Anchor on rental and automotive ops software comp group: 2.5-3.7x revenue.

- Implied EV: USD 25-37m.

- This matches what we see for solid, mature vertical SaaS serving rental and fleet customers, without extreme growth or scarcity.

- Premium scenario

- If FleetLane showed:

- Strong double-digit growth

- High gross and EBITDA margins

- Deep integrations and clear data/compliance moat

- Then a multiple pushing into the 4.5-5.5x revenue range could be justified.

- Implied EV: USD 45-55m.

- If FleetLane showed:

Put in a simple table:

7.4 What this means for you

Two businesses, each with USD 10m revenue, could realistically be worth:

- One at USD 20m if it is low growth, thin-margin, and easy to replace.

- Another at USD 50m if it is growing well, highly recurring, deeply integrated, and clearly reduces risk for its customers.

The revenue line is not the whole story. The mix, quality, and defensibility of that revenue - plus margins and growth - are what really move your multiple.

Disclaimer: The numbers above are illustrative and for educational purposes only. They are not a fairness opinion, valuation, or investment advice.

8. Where Your Business Might Fit (Self-Assessment Framework)

Here is a simple way to roughly place your business on the valuation spectrum.

How to use this

- For each factor group, score yourself 0, 1, or 2.

- Be brutally honest - this is for you.

- Add up the total.

To make this more concrete:

High impact (0-2 points each, but think of the overall group)

- Are you growing revenue at a healthy double-digit rate?

- Is >60 percent of your revenue recurring or under contract?

- Do customers stay for years and expand usage?

Medium impact

- Are your gross margins strong relative to your model (operators vs SaaS)?

- Are EBITDA margins stable or improving?

- Do you have good fleet utilization (for operators) or strong unit economics (for SaaS)?

Bonus factors

- Do regulators, insurers, or OEMs rely on your workflows?

- Do you provide benchmarks, predictive analytics, or unique data to customers?

- Is your product integrated deeply into customers’ systems?

- Is there a solid leadership team beyond the founder?

Interpreting your score

As a rough rule of thumb:

- 8-12 points

- You are likely toward the upper end of the typical multiple range in your segment.

- Focus on polishing your story, cleaning up financials, and running a structured process.

- 4-7 points

- You are probably in the “fair market” zone.

- There is meaningful upside if you can improve one or two high-impact areas before selling.

- 0-3 points

- You may be at risk of trading at the lower end of the range, or struggling to attract strong bidders.

- Consider whether you can patiently improve fundamentals for 12-24 months before a sale.

This is not a scoring system you share with buyers; it is a private tool to help you decide when and how to go to market.

9. Common Mistakes That Could Reduce Valuation

A lot of valuation damage is self-inflicted. Here are some avoidable traps.

- Rushing the sale

- Going to market without prepared numbers, a clear story, or cleaned-up contracts forces you to negotiate from a weak position and gives buyers excuses to discount.

- Hiding problems

- Every serious buyer will run deep due diligence. If you hide issues (like major customer churn, safety incidents, or accounting quirks), they will usually surface later and destroy trust - often killing the deal or causing a sharp price cut.

- Weak financial records

- Inconsistent revenue recognition, mixed personal and company expenses, no clear SaaS vs rental split, or missing KPIs (utilization, churn, ARPU) all make buyers nervous.

- Many of these are fixable in 6-12 months with better bookkeeping and reporting.

- Not running a structured, competitive process with an advisor

- Approaching one or two buyers informally rarely maximizes value.

- Research suggests that running a structured, competitive process with a professional advisor generally leads to meaningfully higher purchase prices - often on the order of 25 percent or more.

- Revealing your target price too early

- If you tell buyers “we are looking for USD 10m,” you anchor the conversation there.

- Offers of USD 10.1m or 10.2m feel “generous” to buyers, even if the business could have supported USD 15m.

- Let the market speak first wherever possible.

- Vehicle-rental-specific mistake: ignoring fleet and contract transparency

- Hiding problems with residual values, maintenance records, or fleet ownership structures will backfire.

- Buyers will do their own math on your fleet and contracts; if your story and their findings do not match, multiples fall fast.

- Vehicle-rental-specific mistake: overstating technology differentiation

- Claiming to be a unique platform when you are using off-the-shelf tools or templates dilutes your credibility.

- Better to be honest about where you are today and how the buyer can help you accelerate.

Avoiding these mistakes does not guarantee a premium, but it does protect you from unnecessary discounts.

10. What Vehicle Rental Management Founders Can Do in 6-12 Months to Increase Valuation

You cannot completely reinvent your business in 6-12 months. But you can meaningfully improve your positioning and move up within the valuation range.

Think in three buckets:

10.1 Improve the numbers

- Tighten margins

- For operators: revisit pricing on underpriced accounts, optimize fleet purchasing and remarketing, and reduce unbilled damage.

- For SaaS: cut low-ROI marketing, rationalize overlapping tools, and tune hosting costs.

- Shift mix toward recurring revenue

- Convert key customers to longer-term contracts where possible.

- Introduce subscription modules or service plans on top of pure transactional revenue.

- Tackle obvious loss-makers

- Exit unprofitable geographies, customer segments, or product lines that drag down margins and distract management.

10.2 Improve revenue quality and defensibility

- Deepen key relationships

- Extend contract terms with top customers.

- Lock in multi-year renewals with modest built-in price escalators.

- Add or highlight compliance and data features

- Even simple additions like better inspection workflows, driver checks, or damage evidence can strengthen your story.

- Start measuring and documenting safety, claims, and compliance outcomes now.

- Clarify your technology moat

- Build at least a handful of valuable integrations (OEMs, insurers, ERPs, telematics partners).

- Standardize your APIs and document them.

10.3 Fix the story and the data room

- Clean up financials

- Get 3-5 years of historical financials prepared in a consistent format.

- Clearly split revenue by type: rental, services, recurring software, one-off projects.

- Normalize owner compensation and non-recurring items.

- Get your KPIs in order

- Operators: utilization, average daily rate, fleet age, damage rates, contract mix.

- SaaS: ARR, net retention, churn, cohort behavior, gross margin, EBITDA margin.

- Prepare a clear, honest narrative

- Where you have done well.

- Where you have struggled (and how you have fixed or are fixing it).

- Why now is a logical time to bring in a buyer.

10.4 De-risk leadership and operations

- Build or highlight a leadership bench

- Identify key managers in operations, finance, product, and sales.

- Show that the business can run without you in every detail.

- Document processes

- Rental workflows, fleet policies, customer onboarding, incident handling.

- The more “institutionalized” the business feels, the less key-man risk buyers see.

If you pick a few of these actions and execute well over 6-12 months, you are likely to see a real impact on both multiple and buyer interest, even if headline revenue does not explode.

11. How an AI-Native M&A Advisory Helps

Running a great exit process is its own full-time job. Doing it while also running a vehicle rental management business is hard - especially in a market where the buyer universe is global and complex.

An AI-native M&A advisor like Eilla AI combines experienced human advisors with AI-powered tooling to improve outcomes for founders.

11.1 Higher valuations through broader buyer reach

- AI can map and rank hundreds of potential acquirers across rental operators, fleet management groups, mobility platforms, and software consolidators.

- Matching is based on actual deal history, strategic fit, financial capacity, and other signals - not just who happens to be in someone’s contacts.

- More relevant buyers means more competition and stronger offers, and a higher chance the deal still closes if one buyer drops out.

11.2 Initial offers in under 6 weeks

- AI accelerates the heavy lifting:

- Identifying and prioritizing buyers

- Drafting process materials and data-backed positioning

- Supporting due diligence preparation

- Result: you can move from “thinking about selling” to serious conversations and initial offers in under six weeks, rather than spending months just getting organized.

11.3 Expert advisory, enhanced by AI

- You still work with human M&A experts who have spent years doing deals in and around your sector.

- AI helps them:

- Benchmark your numbers and narrative against real transactions.

- Prepare clear, compelling materials that speak the buyer’s language.

- Keep track of all conversations, feedback, and process dynamics.

- You get Wall Street-grade advisory quality and process discipline without traditional “bulge bracket” costs.

If you are considering a sale in the next 1-12 months and want to understand where your vehicle rental management business might sit on the valuation spectrum - and how to move it upward - an M&A advisor can make a real difference.

If you would like to see how our AI-native process can support your exit, book a demo with one of Eilla AI’s expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.