The Complete Valuation Playbook for Warehouse Management Software Businesses

A data-driven playbook for WMS founders on what buyer actually pay and how to improve in the next 6-12 months.

If you run a Warehouse Management Software (WMS) business and you might sell in the next 1-12 months, valuation stops being a theoretical topic and becomes a practical one: what will buyers actually pay, and what can you do (quickly) to move toward the top end of the range?

This playbook is built for WMS founders. It shows what similar businesses sell for (private deals), what public markets imply (as of late 2025), what consistently drives higher vs lower multiples, and how to translate that into a simple self-assessment and a 6-12 month action plan.

1. What Makes Warehouse Management Software Unique

WMS is “software”, but it is not “generic SaaS”. Buyers value it differently because it lives in the physical world: labor, inventory, service levels, and automation. When it fails, shipments stop. That changes what buyers fear, what they pay for, and how they diligence you.

The main types of WMS businesses (and why they price differently)

Most WMS companies fall into a few patterns:

- Pure-play WMS SaaS: subscription-first product with configuration, onboarding, and light services.

- WMS + adjacent execution modules: parcel/shipping, carrier rate shopping, yard management, labor planning, slotting, returns, or lightweight TMS.

- WMS + automation orchestration: software that sits between the WMS and automation (robots, conveyors, AS/RS, sorters) to coordinate work.

- Services-heavy WMS: significant revenue from implementation projects, customizations, and ongoing managed services.

- Vertical WMS: purpose-built for niches like 3PLs, cold chain, pharma/serialization, food and beverage, apparel/e-commerce fulfillment, or industrial distribution.

The more your revenue behaves like predictable subscription software (high gross margins, renewals, low churn), the more buyers are willing to price you like “software”. The more your revenue behaves like projects and people, the more buyers price you like “services”.

Unique valuation considerations in WMS

- Implementation risk is valuation risk. Buyers care about how reliably you can go live, how long it takes, and whether deployments blow up.

- Switching costs cut both ways. WMS can be sticky because switching is painful, but churn can be catastrophic when it happens (big customer events).

- Integrations are part of the product. ERP, e-commerce platforms, carriers, automation systems, and EDI are not “nice to have”.

- The buyer’s synergy story matters more than usual. If you “fill a product gap” for a suite buyer, you can get paid for strategic value, not just your current profits.

Key risk factors buyers will always check

- Customer concentration and contract structure (especially if a single enterprise or 3PL drives a large share of revenue).

- Retention and expansion (renewals, upsells, add-on module attach, site expansions).

- Delivery scalability (implementation playbooks, partner ecosystem, services margins, backlog quality).

- Product and security posture (uptime history, disaster recovery, SOC2-type controls, data handling).

- Technical debt (custom forks, legacy on-prem code, brittle integrations).

2. What Buyers Look For in a Warehouse Management Software Business

Think of buyers as paying for two things:

- The reliability of your future cash flows (will customers keep paying and expand?), and

- The strategic usefulness of your product (does it make the buyer’s broader platform stronger?).

The obvious basics (that still matter)

- Scale: buyers pay more for businesses that can absorb diligence and integration without “key person” fragility.

- Growth: faster growth usually supports higher revenue multiples.

- Profitability: not always required (especially for strategic assets), but poor profitability forces harder questions.

- Recurring revenue: predictability is king - buyers discount project-heavy revenue.

The WMS-specific nuances buyers obsess over

- Mission-criticality and downtime impact: do you have evidence that operations depend on you?

- Go-live track record: on-time implementations, time-to-value, referenceable customers.

- Automation readiness: are you “robot-friendly” and automation-agnostic, or do you require painful integration work?

- Multi-site expansion: can you land at one warehouse and expand to many?

- Integrations as leverage: strong ERP, carrier, and e-commerce connectors reduce buyer fear and increase synergy potential.

How private equity (PE) thinks about your WMS business

PE is usually underwriting an outcome 3-7 years ahead. Their mental model is simple:

- What multiple do we pay today (entry)?

- What multiple can we sell at later (exit)?

- What can we do to improve the business in between?

The levers PE expects to pull in WMS are typically:

- Raise prices (especially if ROI is provable and switching costs are real).

- Reduce services drag (standardize implementations, improve utilization, partner-enable).

- Expand modules and sites inside the same customer base.

- Add tuck-in acquisitions (adjacent modules, niche vertical capability, geography).

If your business already looks “clean” (recurring revenue, stable retention, scalable delivery), PE competition can increase - and competition is what lifts price.

3. Deep Dive: The Valuation Nuance That Most WMS Founders Underestimate

The question: Are you selling a software product - or a delivery engine wrapped around software?

In WMS, this is one of the biggest drivers of where you land on the multiple range because it directly changes buyer confidence and margin structure.

Why it matters in plain terms

Two WMS companies can each have USD 10m of revenue and still be worth radically different amounts. The gap usually comes from:

- how much of that revenue is truly recurring software,

- how expensive it is to “deliver” the revenue (people-heavy services vs scalable product),

- and how risky implementations are.

How it shows up in market data

Across similar logistics software deals, software-oriented platforms commonly transact at materially higher revenue multiples than software-plus-managed-services models. In precedent deal groupings, “enterprise supply chain and logistics software” transactions cluster around mid-single-digit revenue multiples (median around 4.6x, average around 5.8x), while “warehouse, inventory, and mobility solutions” that include managed services cluster meaningfully lower (median around 1.4x, average around 2.0x).

Why buyers care (and what they assume when they see services)

Buyers don’t “hate services”. They hate unscalable services and unpredictable delivery.

When services are high:

- Gross margin usually drops.

- Growth becomes harder because hiring becomes the bottleneck.

- Customer success becomes harder because projects get delayed.

- The buyer worries they are buying a staffing problem.

When services are controlled and repeatable:

- Buyers often accept them as a necessary “activation engine”.

- Some strategics even like them because they deepen customer relationships.

- But they still won’t pay top-of-market software multiples for project-like revenue.

How to move from the lower-value profile to the higher-value profile

You rarely need a reinvention. You need discipline:

- Productize your implementation: standard templates, fixed scopes, fewer one-off customizations.

- Separate “software revenue” from “services revenue” cleanly in reporting.

- Build partner capacity (SIs, 3PL consultants) so growth is not limited by your own headcount.

- Prove time-to-value with real customer metrics (weeks, not quarters, when possible).

A simple way to see your current profile:

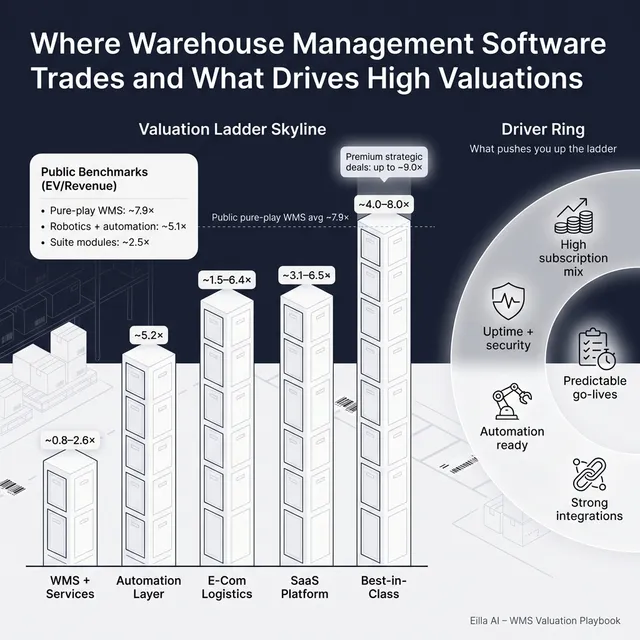

4. What Warehouse Management Software Businesses Sell For - and What Public Markets Show

Here’s the right way to use market multiples: not as a price tag, but as a reference band. Your actual multiple depends on your growth, margin, retention, and risk profile - plus how badly a specific buyer wants what you have.

4.1 Private Market Deals (Similar Acquisitions)

Private deal data in and around WMS shows a clear pattern: software-first platforms earn higher revenue multiples than services-heavy models, with robotics/automation adjacency sometimes supporting strong outcomes even when profitability is weak.

A practical way to translate the private market patterns:

These ranges are illustrative. Where you land depends on whether you look like a software platform (repeatable, high-margin, sticky) or a project business with software inside it.

4.2 Public Companies

Public markets provide an “upper reference band” for what scaled, liquid, lower-risk businesses trade at. As of late 2025, pure-play WMS and supply chain software trades at meaningfully higher multiples than logistics services and most platform suites with diluted module exposure.

A founder-friendly snapshot of public segment averages:

A few important interpretations:

- Public multiples are for larger, more liquid companies. Private companies often trade at a discount because they are smaller, riskier, and less diversified.

- Sometimes private assets trade higher than public comps when they are scarce, fast-growing, or strategically perfect for a buyer.

- Outliers exist (especially in small-cap “platform” names), so you should anchor to the most comparable segment - not the overall market average.

5. What Drives High Valuations (Premium Valuation Drivers)

Premium outcomes in WMS tend to come from a small number of themes that consistently show up in deal narratives.

5.1 Mission-critical stickiness (proved, not claimed)

Buyers pay more when you can show that customers can’t live without you:

- High renewal rates and multi-year retention

- Strong usage depth (your workflows are embedded, not optional)

- Evidence of downtime impact (what breaks when you go down)

Practical proof beats adjectives. A simple “warehouse stopped shipping” story (with metrics) is more valuable than generic claims of being “mission critical”.

5.2 Software economics that look like software

High gross margins and a clear subscription mix change what buyers are willing to pay. In similar deals, ultra-high software gross margins are associated with premium outcomes, even when the company is not enormous.

What to emphasize:

- Subscription vs services mix (cleanly separated)

- Attach rates of add-ons (analytics, labor, parcel, returns)

- Deployment model that scales without proportional headcount growth

5.3 Platform fit and synergy for suite buyers

Some buyers pay up because you fill a gap:

- You extend their suite into warehouse execution

- You add parcel/carrier execution inside a broader platform

- You expand their visibility across logistics workflows

Premiums tend to appear when the asset is integration-ready: clear APIs, proven ERP/carrier connectors, and a roadmap that makes sense inside a larger suite.

5.4 Automation and robotics adjacency (strategic value can outweigh current profits)

In the data, automation-adjacent assets can receive strong strategic valuation even when current profitability is weak, because large ecosystem buyers want the capability and the “right to win” in automation-enabled warehouses.

What helps you capture this premium:

- Orchestration across multiple automation vendors (not tied to one OEM)

- Case studies that quantify throughput gains and labor savings

- Faster integration time and lower vendor lock-in for customers

5.5 Execution-edge control: parcel, telemetry, payments, and real-time decisions

Buyers value assets that control “execution moments” - labels, routing, tracking, telemetry, payment endpoints - because they create defensible data and monetizable workflows.

If your WMS drives carrier decisions, picks/pack priorities, labor allocation, or automation tasking, make that explicit with measurable ROI.

5.6 The “boring” fundamentals that still create premium outcomes

Even great products get discounted if basics are messy:

- Clean financials with clear revenue recognition

- Predictable pipeline and churn reporting

- Diversified customer base

- A leadership bench that can run without the founder in every meeting

6. Discount Drivers (What Lowers Multiples)

Discounts usually come from buyer fear: fear the revenue is less recurring than it looks, fear the tech won’t scale, or fear the customer base is fragile.

The most common WMS-specific valuation drags

- Services-heavy revenue and unclear marginsIf buyers can’t see software gross margin clearly, they assume the worst.

- Implementation volatilityLong go-lives, inconsistent delivery, or heavy customization signals risk and slows growth.

- Customer concentration and “single whale” dependencyOne big customer can dominate revenue, roadmap, and referenceability.

- Weak retention storyEven if churn is low, buyers want to understand why it’s low (real switching costs vs customer apathy).

- Integration fragilityIf every deal requires bespoke ERP, carrier, or automation work, buyers model higher cost and lower scalability.

- Technical debt and security gapsLegacy architecture, limited observability, or weak controls turn into purchase price chips during diligence.

The general M&A discounts that still apply

- Messy financial statements, delayed closes, or missing KPI history

- Founder-only relationships for sales and delivery

- Unresolved legal issues (IP ownership, customer disputes)

- A weak data room (slow process = lower competitive tension)

7. Valuation Example: A Warehouse Management Software Company (Fictional)

This is a worked example to show how the logic works. The company and numbers below are fictional, and the valuation ranges are illustrative - not investment advice or a formal valuation.

Step 1: Pick the right multiple band

For a software-first WMS business, the most relevant reference band is:

- Public pure-play WMS/supply chain software: roughly mid-to-high single-digit EV/Revenue on average (with a wide spread), and

- Private supply chain software deal ranges: commonly mid-single-digit EV/Revenue, with services-heavy models materially lower.

A practical “core band” many founders can use as a starting point is ~4.0-8.0x revenue for a solid, mid-sized WMS SaaS profile, with downside toward services multiples and upside toward the stronger public-software ranges when the business is exceptional.

Step 2: Apply it to a fictional business at USD 10m revenue

Meet IronGate WMS (fictional):

- USD 10m revenue

- 80% subscription, 20% implementation/services

- Good retention with multi-site expansion

- Strong ERP and carrier integrations

- Early automation orchestration partnerships (but not fully proven at scale)

Now the scenarios:

Step 3: What this means for you

The point is not that “USD 10m equals USD 60m”.

The point is that two WMS companies with the same revenue can be worth 3x apart because buyers pay for:

- recurring predictability,

- scalability of delivery,

- and strategic fit (automation, parcel, suite synergy).

Your job in the next 6-12 months is to make your business easier to underwrite and easier to integrate.

8. Where Your Business Might Fit (Self-Assessment Framework)

Use this to get honest about where you likely sit today. Score each factor 0-2:

- 0 = weak / unclear

- 1 = acceptable

- 2 = strong / proven

Quick scoring table

How to interpret your total

- Mostly 0s: expect lower multiples until risks are addressed.

- Mix of 1s with a few 2s: solid “fair market” outcome is realistic if the process is run well.

- Many 2s: you’re closer to premium territory - and should prioritize a competitive process with a broad buyer set.

9. Common Mistakes That Could Reduce Valuation

9.1 Rushing the sale

If you start a process before your numbers and story are ready, buyers will do the “valuation work” for you - and they will do it conservatively.

9.2 Hiding problems

Implementation failures, churn events, security incidents, customer disputes - these come out in diligence. When buyers discover surprises late, trust breaks and value drops.

9.3 Weak financial records

You do not need perfect accounting, but you do need:

- clean separation of subscription vs services,

- clear gross margin by revenue type,

- consistent retention metrics,

- and a credible forecast.

9.4 Skipping a structured, competitive process

Competition is what drives price. Academic research on private-company acquisitions finds that hiring sell-side M&A advisers is associated with significantly higher valuations for private sellers, based on a large sample of private deals. (Harvard Law Corporate Governance Forum) Practitioner summaries of this research often cite valuation uplifts “around 25%” (depending on methodology and deal context). (Benchmark International)

Even if your outcome is not exactly “25% higher”, the direction is right: more buyers, better process, better leverage.

9.5 Revealing what price you’re after too early

If you tell buyers “we want USD 50m”, you often cap your own upside. Buyers anchor to your number and come back with USD 50.1m, USD 50.2m offers - instead of showing you what they would have paid in a competitive environment.

9.6 Two WMS-specific mistakes founders make

- Over-customizing for one big customer: it creates tech debt and scares off buyers who want a scalable product.

- Not documenting delivery and integrations: buyers fear what they can’t understand. A clean implementation playbook and integration map can move value meaningfully.

10. What WMS Founders Can Do in 6-12 Months to Increase Valuation

You do not need a massive pivot. You need to reduce buyer fear and sharpen your premium story.

10.1 Improve the “quality of revenue”

- Increase subscription mix where possible (or at least show it clearly).

- Standardize packaging and pricing for add-on modules.

- Track and report retention and expansion cleanly (renewals, upsells, site additions).

10.2 Make implementations predictable

- Create a “standard go-live” blueprint by customer type (shipper vs 3PL, complexity tiers).

- Reduce one-off custom work; push configuration over code changes.

- Build a partner bench (SIs, specialized integrators) so growth is not capped by your own team.

10.3 Prove mission-critical ROI with real data

- Publish 3-5 case studies that quantify labor savings, throughput, and error reduction.

- Track time-to-value and make it part of your sales narrative.

- Document downtime impact and your reliability posture (monitoring, DR, incident response).

10.4 Strengthen your strategic adjacency story (without boiling the ocean)

Pick 1-2 adjacency wedges and go deep:

- Automation orchestration proof with multiple OEMs

- Parcel/carrier execution economics (rate shopping, label automation, savings)

- Analytics layer that improves decisions, not just dashboards

10.5 Prepare for diligence like you’re already in it

- Clean financial model with revenue split, margin split, retention history.

- Customer list with ARR, tenure, modules, sites, churn reasons.

- Product roadmap linked to buyer value (not just features).

- A tidy data room and reference customers ready to speak.

11. How an AI-Native M&A Advisor Helps

A strong valuation outcome usually comes down to two things: the right buyers and a process that creates leverage.

An AI-native advisor can expand your buyer universe far beyond the “usual suspects” by identifying hundreds of qualified acquirers based on deal history, synergy fit, and financial capacity. More relevant buyers means more competitive tension, stronger offers, and more options if one buyer drops late in the process.

AI can also compress timelines. With AI-driven buyer matching, faster creation of core materials, and structured support through diligence, founders can often reach initial conversations and early offers much faster than a manual-only approach - sometimes in under 6 weeks.

Finally, the best outcomes still require expert human judgment. The advantage is combining experienced M&A leadership with AI-enabled execution: credible positioning, clean numbers, and a process that speaks the buyer’s language - without the cost structure of a traditional bulge bracket.

If you’d like to understand how Eilla AI’s AI-native process can support your exit, book a demo with one of our expert M&A advisors.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.