The Complete Valuation Playbook for Web Hosting Businesses

A guide to how web hosting businesses are valued today and the levers founders can pull in the next 6-12 months to secure premium multiples.

If you own a web hosting business, the next few years are likely to be very active for M&A. The global web hosting market is growing fast - high teens CAGR in many forecasts - and private equity funds are actively rolling up regional hosts, domain registrars, and cloud infrastructure providers.

Large deals like CVC’s majority investment in Namecheap, and prior buyouts of Squarespace and other web-presence platforms, underline a simple point: scaled, recurring internet infrastructure is exactly the kind of asset financial buyers want to own.

This playbook is designed to help you, as a founder or CEO of a privately held web hosting business, understand how buyers think about valuation. We will:

- Show what web hosting businesses actually sell for (private deals and public markets).

- Decode what drives higher vs lower multiples.

- Give you a practical self-assessment and 6–12 month action plan so you can position your company toward the top of the range.

1. What Makes Web Hosting Unique

Valuing a web hosting business is not the same as valuing a generic software or services company. Hosting sits at the intersection of infrastructure, software, and recurring services.

Main types of web hosting businesses

Most private companies fall into one or more of these buckets:

- Shared/VPS hosting providers - Cheap, standardized hosting sold at scale to lots of small businesses and individuals, with low revenue per customer.

- Managed / premium hosting - Higher-priced “we handle everything” hosting (performance/security/app-specific) with heavier support and higher revenue per customer.

- Cloud IaaS / developer-centric VPS - Developer-focused infrastructure where customers rent virtual servers, storage, and networking on demand.

- Domain-led platforms - Domain registration as the entry point, bundled with simple hosting/site builders plus add-ons like email, security, and marketing tools.

- Regional infrastructure / colocation-led hosts - Data-center-space and power providers that layer hosting and managed services on top of owned/leased infrastructure.

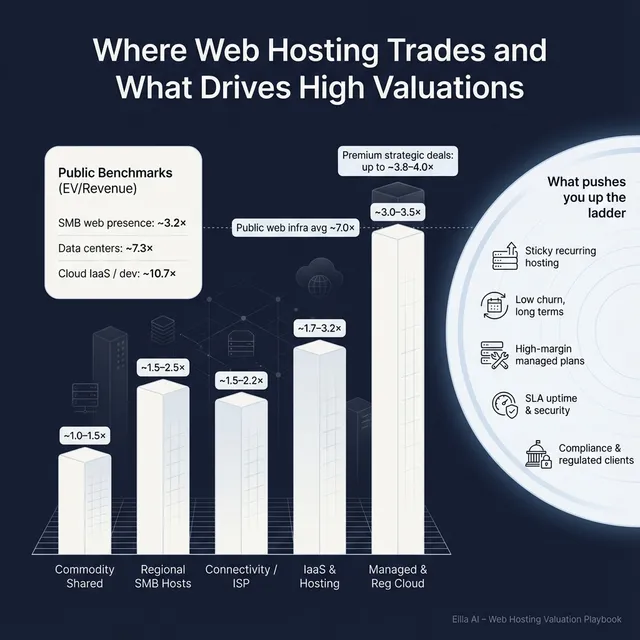

Your valuation will lean closer to one of these public “clusters” from the data:

- Global SMB web presence platforms (domains, site builders, shared/VPS hosting).

- Colocation & data center operators.

- Cloud IaaS & developer-centric compute.

Unique valuation considerations in web hosting

A buyer is not just buying your revenue - they are buying:

- Underlying infrastructure and contracts

- Data center leases or owned facilities.

- Hardware refresh cycles and capex requirements.

- Network contracts, transit and peering.

- Customer stickiness and switching costs

- How easy is it for a customer to move to another host?

- Are they locked in through control panels, email, custom stacks, or managed services?

- Product mix

- One-size-fits-all shared hosting vs higher-margin managed plans, add-ons (backups, SSL, security, CDN).

- Each product line has a different margin and churn profile.

- Exposure to hyperscalers

- Are you competing head-on with AWS/Azure/GCP, or riding on top of them as a managed layer?

- Buyers will worry about being commoditized if your offer looks like a thin wrapper on a big cloud provider.

Key risk factors buyers will always check

- Churn and contract length - are customers month-to-month with coupon-driven signups, or on annual multi-year contracts (especially B2B)?

- Customer concentration - do you have a few huge resellers that could leave, or a broad base of small accounts?

- Price competition - are you in a race to the bottom on pricing, or differentiated enough to command a premium?

- Security and uptime track record - serious incidents (data loss, repeated downtime, breaches) can heavily discount value.

- Regulatory and data residency - especially for hosts serving EU, government, healthcare, or financial clients.

2. What Buyers Look For in a Web Hosting Business

At a high level, buyers care about the same basics across industries:

- Scale - revenue, EBITDA, and number of customers.

- Growth - historic and projected; are you growing 5%, 15%, or 30% per year?

- Profitability - especially EBITDA margin and gross margin.

- Cash conversion - how much of EBITDA turns into actual cash after capex and working capital.

But in web hosting, they translate these basics through a very specific lens.

The web hosting “valuation lens”

Buyers will dig into questions like:

- How recurring and predictable is revenue?

- What % is truly recurring (subscriptions, renewals) vs one-off migration or project work?

- What is logo churn and revenue churn by cohort?

- What does the customer base look like?

- Mix of SMB vs mid-market vs enterprise.

- Share of revenue from resellers, agencies, and IT partners vs direct end customers.

- Any dependency on a single large reseller or affiliate.

- What is the product and margin mix?

- Shared hosting might have fine gross margin but often high churn and support burden.

- Managed hosting, security add-ons, and premium support often have higher ARPU and better retention.

- Buyers like businesses - high gross margins (~60%+), strong EBITDA margins (20–30%+), and steady growth, which supported EV/EBITDA multiples ~9x.

- How robust is the infrastructure?

- Data center footprint, redundancy, and SLAs.

- Automation in provisioning, monitoring, and support.

- Whether the business is ready to scale with limited incremental capex.

- Strategic fit and synergy

- For strategic buyers: how easily can your customers be cross-sold domains, builders, security, or productivity tools?

- For PE-backed roll-ups: how well do you plug into an existing portfolio of hosts and control panels?

How private equity thinks about your business

A PE buyer is usually running a simple mental model:

- Entry multiple vs exit multiple

- “If we buy this business at, say, 2.5x revenue or 8x EBITDA today, can we sell it at the same or higher multiple in 3–7 years?”

- They know scaled public comps often trade anywhere from ~2x to 6x revenue, sometimes higher for fast growers. That sets a soft upper bound for exits.

- Who they can sell to later

- A larger PE fund rolling up hosting and infrastructure.

- A strategic - for example, a global web presence platform or infrastructure provider.

- In rare cases, an IPO if growth and scale become large enough.

- Value creation levers

- Raising prices or reducing discounting where customers are clearly underpaying.

- Cross-selling higher-margin managed hosting, security, or email to your base.

- Consolidating overlapping brands and infrastructure.

- Improving support efficiency through better tooling and automation.

If they can see a clear path to grow EBITDA and de-risk the business, they will stretch on the multiple. If not, they will price conservatively or walk away.

3. Deep Dive: Shared SMB Hosting vs Managed & B2B Hosting

One of the biggest valuation nuances in web hosting is who you serve and how “critical” your service is.

A 10,000-customer shared hosting business with high churn can easily be worth less per dollar of revenue than a 2,000-customer managed hosting provider with sticky B2B contracts - even if revenue is the same.

How this shows up in the data

- Higher-margin, stickier, more “infrastructure-like” revenue → higher multiples.

- Smaller, more commoditized, less differentiated providers → lower multiples.

Why buyers care so much

Buyers do not just care about how much revenue you have; they care about how hard it will be to lose or replace that revenue.

Managed and B2B-heavy hosts typically have:

- Deeper integrations (custom stacks, databases, email, CI/CD).

- More complex migrations (harder to switch away).

- Higher ARPU and lower churn.

- More scope to sell added services (monitoring, backups, DDoS protection).

Shared-only providers with heavily discounted entry pricing often see:

- High first-year churn when promo periods end.

- Heavy support loads from low-paying customers.

- Greater exposure to Google/Amazon/Microsoft shifting the market.

Moving from “lower-value” to “higher-value” profile

You do not need to rebuild your business from scratch, but you can gradually tilt your mix:

- Introduce managed plans (managed WordPress, managed stacks) and proactively migrate suitable customers.

- Package security, backups, and monitoring into premium bundles and make them the default for business customers.

- Build strong agency/reseller channels - they often bring more stable, higher-value customers.

- Move key accounts to longer contract terms (annual or multi-year) with sensible discounting.

A simple way to think about it:

If your business looks more like the left column today, you can still improve. The key is to start shifting the mix 12–24 months before a sale, so the numbers have time to show up in your trailing financials.

4. What Web Hosting Businesses Sell For - and What Public Markets Show

Let’s look at what the data says, in plain English.

We will use:

- Private deals in IaaS & web hosting, telecom/connectivity, and IT services as proxies for what similar private companies sell for.

- Public company multiples for web presence platforms, colocation/data centers, and cloud IaaS as a reference band.

4.1 Private Market Deals (Similar Acquisitions)

From the grouped transaction data:

- Across all deals, the average multiple is about 2.6x revenue and 8.6x EBITDA.

- For IaaS & Web Hosting Providers, the average is around 2.2x revenue and 6.6x EBITDA.

- Telecom connectivity & managed networks (often ISP/hosting hybrids) are roughly 1.7x revenue and 6.1x EBITDA.

- Custom software & IT services sometimes tied to hosting show 2.7x revenue and 17.7x EBITDA, but that higher EBITDA multiple tends to reflect very high margins and specialist capabilities.

Putting this into a founder-friendly table:

For a typical privately held hosting business at sub-USD 50m revenue, realistic deal multiples often cluster around:

- ~1.5–2.5x revenue, and

- ~5–8x EBITDA,

with the top end reserved for businesses showing strong growth, high margins, and sticky, B2B-heavy customer bases.

These ranges are illustrative, not a quote for your business, but they anchor the conversation.

4.2 Public Companies

On the public side, as of around 2025, the grouped data shows:

- Global SMB Web Presence Platforms (domains, site builders, shared/VPS hosting):

- Average EV/Revenue ~3.2x

- Average EV/EBITDA ~22.5x

- Colocation & Data Center Operators:

- Average EV/Revenue ~7.3x

- Average EV/EBITDA ~23.6x

- Cloud IaaS & Developer-Centric Compute:

- Average EV/Revenue ~10.7x

- Average EV/EBITDA ~27.4x

What this tells founders

- Public markets are willing to pay higher revenue multiples (often 2–6x revenue) for large, diversified, and often faster-growing platforms with strong margins.

- Within that, hosting-heavy platforms trade above smaller regional hosts because they have:

- Global scale and brand.

- Very diversified customer bases.

- Strong free cash flow and efficient infrastructure.

For private, sub-scale businesses, public multiples are a ceiling, not a promise. Buyers will usually:

- Discount public multiples for smaller size, lower growth, and higher perceived risk.

- Occasionally stretch toward public multiples - or even beyond - for a scarce, highly strategic asset (unique compliance positioning, a must-have developer brand, or a perfect bolt-on with heavy synergies).

5. What Drives High Valuations (Premium Valuation Drivers)

Now we turn to the fun part: what actually moves you from 1.5x revenue toward 3x+ revenue, or from 5x EBITDA toward 9x+.

Based on the premium drivers in the data and broader M&A practice, the main themes for web hosting are:

5.1 High-margin, sticky infrastructure subscriptions

In the data, high-value deals show:

- High gross margins (~60% to ~90%).

- Healthy EBITDA margins (20–30%+).

- Sustained revenue growth.

Those economics supported EBITDA multiples around 9x, above the IaaS & hosting average.

Buyers pay up when your hosting revenue looks like utility-like infrastructure:

- Customers renew year after year.

- Upsell to higher-tier plans, storage, or security is visible in the numbers.

- Support and infrastructure are efficient enough to keep margins strong at scale.

Practical steps:

- Shift customers onto annual or multi-year contracts where possible.

- Build bundles (hosting + security + backup + email) that make your service sticky.

- Track and showcase cohort retention and margin trends over several years.

5.2 Explicit value and cost savings for customers

One premium driver in the data is explicit cost-out and value-to-customer.

In hosting terms, this could be:

- Helping agencies or SMBs reduce total IT spend vs maintaining on-prem servers or juggling multiple providers.

- Bundling services (hosting, email, DNS, security) in a way that simplifies operations for customers and reduces their internal workload.

If you can clearly show “our customers save USD X per year compared to their previous setup” and your pricing is aligned to that value, buyers will be more comfortable paying a higher multiple.

Practical steps:

- Collect case studies where a customer reduced IT or infrastructure costs after migrating to you.

- Build a simple ROI calculator used in sales - then reuse that data in your sale process.

5.3 SLA-backed reliability and resilience

Another driver is SLA-backed infrastructure with low churn and visible cash flows.

Hosts like Intergrid highlight 100% uptime SLAs across multiple data centers. While its multiple was modest, the broader pattern is clear: where reliability is proven and well-documented, buyers discount risk.

Premium hosts:

- Track uptime and incident metrics carefully.

- Offer clear SLAs with credits.

- Have well-documented disaster recovery and backup processes.

Practical steps:

- Start publishing uptime and incident metrics internally, even if not yet on your website.

- Make sure SLAs are consistent, understandable, and actually monitored.

- Document renewal rates and show how few customers leave due to downtime.

5.4 Compliance, sovereignty, and regulated customer bases

One specific deal in the data at modest scale highlights how compliance and sovereignty can be a powerful moat.

In hosting, that translates to:

- Serving government, healthcare, financial services, or other regulated sectors.

- Holding specific certifications: ISO, SOC 2, local data residency approvals, etc.

- Offering sovereign cloud or region-specific data residency guarantees.

Buyers see this as:

- A barrier to entry for competitors.

- A reason churn and price pressure will remain low.

Practical steps:

- If you already serve regulated clients, organize and highlight your certifications and compliance posture.

- Where realistic, pursue focused certifications that matter to your customer base rather than generic badges.

5.5 Exceptional profitability at small scale

In the data, another small size deal shows a decent multiple because of high profitability.

In hosting, a small but extremely profitable niche provider can command a premium:

- High ARPU managed clients.

- Specialized knowledge (e.g. high-performance hosting for large stores).

- Very efficient operations and automation.

Practical steps:

- Identify your most profitable customer segments and lean into them.

- Cleanly segment your P&L by product to show where profits really come from.

- Consider trimming highly unprofitable, support-heavy segments ahead of a sale.

5.6 “Table stakes” premium drivers

Finally, the obvious but vital:

- Clean, accurate financials (ideally with a quality set of management accounts).

- Predictable, recurring revenue clearly separated from one-off projects.

- Diversified customer base without a handful of key accounts dominating.

- Strong second line of management, not a business that collapses if you step away.

These may not win you a trophy multiple on their own, but without them, you will rarely see the top of the range.

6. Discount Drivers (What Lowers Multiples)

Now the uncomfortable part: what pulls you toward the bottom of the range or below it.

Common discount drivers in web hosting

- High churn and promo-driven signups

- If a large portion of your customers churn after the first discounted year, buyers will see revenue as fragile.

- Low or declining margins

- Rising bandwidth or data center costs without pricing power.

- Too much low-end support work relative to ARPU.

- Too much non-recurring revenue

- One-off migration, setup, or development projects that are not likely to repeat.

- Buyers will haircut this and often apply lower multiples to such revenue.

- Concentrated reseller or enterprise exposure

- If 30–50% of revenue sits with a small number of resellers or key accounts, losing a couple of them can materially change the business.

- Outdated or fragile infrastructure

- Aging hardware, single data center, weak redundancy, and a history of downtime.

- Buyers will price in capex to fix issues and potential churn from outages.

- Poor security posture

- Unresolved or repeated security incidents.

- Weak processes around patches, backups, and access control.

- Messy financials

- No clear separation of recurring vs one-off revenue.

- Personal or side businesses mixed into the same infrastructure and accounts.

- Owner-dependence

- You as the founder are the key salesperson, top engineer, and the person everyone calls when something breaks.

- This increases perceived risk and can reduce both multiple and deal structure quality (more earnout, less cash up front).

The good news: many of these can be improved over 6–18 months if you know what to focus on.

7. Valuation Example: A Web Hosting Company

Let’s walk through a simplified, fictional example to make this concrete.

We will create a fictional business called AtlasHost:

- Purely fictional company and numbers.

- Revenue: USD 10m (last twelve months).

- Business mix: 60% shared/VPS hosting, 40% managed hosting and add-ons.

- EBITDA margin: 22%.

- Reasonable growth: 15% per year.

Step 1: Choosing the relevant multiples

We look at several “lanes” of data:

- Private IaaS & web hosting deals:

- Around 2.2x revenue on average and 6.6x EBITDA.

- Range of roughly 1.7–3.2x revenue and 4–9x EBITDA, depending on quality and size.

- Connectivity/ISP hybrids:

- Roughly 1.5–2.2x revenue, 6–9x EBITDA.

- Custom IT services with hosting:

- Wider spread, up to 3x+ revenue and 10–18x EBITDA, but more relevant for specialist, high-margin providers.

- Public SMB web presence platforms:

- Average around 3.2x revenue and 22.5x EBITDA.

For a USD 10m-revenue private host, we discount public multiples for size and risk. A reasonable core revenue multiple band might be:

- 1.8–2.5x revenue as a base range,

- With potential to stretch up to ~3.5x in a premium case,

- And to fall to 1.0–1.5x in a discounted case.

We cross-check this with EBITDA:

- At 22% EBITDA margin, USD 10m revenue → USD 2.2m EBITDA.

- 6.6x EBITDA (IaaS average) would imply ~USD 14.5m EV.

- 9x EBITDA would imply ~USD 19.8m EV.

These math checks suggest that for AtlasHost, revenue multiples above ~3x require truly strong margins, growth, and stickiness to be credible.

Step 2: Applying the logic to AtlasHost

We consider three scenarios.

1) Discounted case - issues present

Assume:

- Churn is high in the shared segment.

- Limited managed or B2B revenue.

- Weak documentation around uptime and financials.

We might apply 1.0–1.5x revenue:

- EV = 1.0–1.5 × USD 10m = USD 10–15m

On EBITDA, that is roughly 4.5–6.8x (on USD 2.2m EBITDA), in line with lower-end hosting deals.

2) Core case - solid, but not exceptional

Assume:

- Balanced product mix, decent margins (~22% EBITDA).

- Moderate churn, some managed/B2B exposure.

- Reasonably clean financials, but limited “wow” factors.

We might apply 1.8–2.5x revenue:

- EV = 1.8–2.5 × USD 10m = USD 18–25m

On EBITDA, that’s 8.2–11.4x - the upper end of this would need to be justified by clear growth and margin trends.

3) Premium case - strong drivers in place

Assume:

- High share of revenue (say 60–70%) from managed hosting and higher-ARPU B2B clients.

- Gross margins ~60–70%, EBITDA margin 25–30%.

- Low churn, strong cohort retention, clear SLAs and uptime history.

- Some compliance or niche positioning (e.g. regulated vertical focus).

We might stretch to 3.0–3.5x revenue:

- EV = 3.0–3.5 × USD 10m = USD 30–35m

On EBITDA (say USD 2.7m at 27% margin), this implies 11–13x EBITDA, which is high but defensible for a niche, high-quality hosting platform.

A simple summary:

Important: This is a hypothetical example, not investment advice or a formal valuation of your business. Real buyer pricing will depend on detailed analysis and a competitive process.

Step 3: What this means for you

Two web hosting businesses with the same USD 10m revenue can realistically be worth:

- One: USD 12m (high churn, messy numbers, commodity shared hosting).

- Another: USD 32m+ (high-margin managed hosting, sticky B2B clients, clean metrics).

Your job over the next 6–12 months is to move your profile from the first toward the second.

8. Where Your Business Might Fit (Self-Assessment Framework)

Here is a simple way to roughly place yourself on the valuation spectrum.

Score each factor 0, 1, or 2:

- 0 = weak / not in place

- 1 = okay / mixed

- 2 = strong

How to interpret your score

Add up your points (max 18):

- 0–6 points - “Work in progress”

- Likely toward the lower end of market multiples.

- Focus first on fixing churn, margins, and customer concentration before selling.

- 7–12 points - “Solid mid-market”

- Likely to trade within the middle of the range if you run a good process.

- Pick 2–3 high-impact improvements to push closer to premium territory.

- 13–18 points - “Premium-ready”

- You likely have a strong case for above-average multiples.

- The focus shifts to storytelling, buyer selection, and process quality to extract that value.

Be brutally honest. This is not for a pitch deck; it is for you to see where improvements will pay off the most.

9. Common Mistakes That Could Reduce Valuation

There are a few classic mistakes that repeatedly cost web hosting founders real money at exit.

- Rushing the sale

- Going to market without 12–24 months of clean numbers and clear KPIs.

- Buyers will either bid low or ask for heavy earnouts to “wait and see.”

- Hiding problems

- Downtime incidents, security breaches, or major customer conflicts will surface in due diligence.

- Hiding them damages trust, which often hurts price more than the issue itself.

- Weak financial records

- No clear split of recurring vs one-off revenue.

- Poor margin reporting by product or segment.

- This makes it hard for buyers to underwrite the business and pushes them toward conservative multiples.

- Ignoring easy 6–12 month improvements

- Obvious upsell opportunities, simple price increases, or support efficiencies left on the table.

- Fixing these before a sale lets you claim the uplift rather than giving it to the buyer for free.

- Lack of a structured, competitive sale process with an advisor

- Quietly negotiating with one buyer usually leads to a lower price and weaker terms.

- Market data and advisory experience show that running a structured auction with multiple bidders often increases achievable EBITDA multiples by around a quarter compared to one-to-one processes.

- Revealing your “number” too early

- If you tell buyers you “need USD 10m,” expect offers at USD 10–11m, even if the business could support more.

- Let the market speak first - then negotiate based on data and competitive tension.

- Industry-specific pitfalls

- Mixing personal projects, side hosting, or friends-and-family discounts into the same infrastructure and accounts, making it hard to separate true business economics.

- Poor contract hygiene (missing data processing addendums, unclear SLAs) making compliance and risk hard to assess.

Avoiding these mistakes alone can be worth years of incremental profit in deal value.

10. What Web Hosting Founders Can Do in 6–12 Months to Increase Valuation

You do not need to transform your company overnight. But there is a lot you can do in 6–12 months.

Think in three buckets: numbers, risk, and narrative.

10.1 Improve the numbers

- Tilt revenue toward higher-quality products

- Push existing customers toward managed hosting and bundled services.

- Introduce “good/better/best” plans that nudge customers to higher-margin tiers.

- Reduce churn in key segments

- Identify at-risk cohorts (e.g. promo-year shared hosting) and build retention programs.

- For your best B2B clients, consider longer terms and success check-ins.

- Tighten pricing and discounting

- Review discounts given to resellers, agencies, and large clients; adjust where you are underpricing.

- Remove legacy “forever deal” plans that are clearly out of market.

- Focus on gross margin and EBITDA margin

- Rationalize underused infrastructure and optimize cloud usage or colocation contracts.

- Automate support where possible; invest in tools that reduce manual ticket handling.

10.2 Reduce risk and clean up

- Separate recurring vs one-off revenue in your accounting and reporting.

- Document uptime, incidents, and security posture clearly.

- Clean your customer concentration where possible - diversify key accounts or secure longer contracts.

- Strengthen your management bench, so the business is less founder-dependent.

10.3 Sharpen the narrative and data room

- Prepare a clear metrics pack: MRR/ARR by segment, churn, ARPU, gross margin, EBITDA trends.

- Build a simple cohort analysis showing how long customers stay and how their revenue evolves.

- Capture case studies of cost savings or business impact for key customers.

- If you have compliance or sovereignty advantages, put them front and center.

10.4 Plan the process

- Decide roughly when you want to sell and what you’d like your life to look like afterward.

- Talk to an advisor early - not to start the sale tomorrow, but to make sure you’re pointing your efforts at the right valuation drivers.

- Start mapping a likely buyer universe (regional hosts, PE-backed platforms, infrastructure providers, etc.) and where you fit in their strategy.

Even 6–12 months of focused work on the right levers can make a noticeable difference in both multiple and deal structure (more cash, less earnout).

11. How an AI-Native M&A Advisory Helps

Finally, how does an AI-native advisor like Eilla AI actually change your outcome?

Higher valuations through broader buyer reach

Traditional processes often tap a relatively small set of obvious buyers. AI changes that:

- AI can scan hundreds of potential acquirers and investors globally, based on deal history, product fit, customer overlap, and financial capacity.

- That means more relevant buyers at the table, stronger competition, and a higher chance that someone sees your business as strategic, not just nice to have.

- If one buyer stalls, there are others already engaged - reducing deal failure risk.

Initial offers in under 6 weeks

A lot of the slow, manual work in M&A is:

- Building buyer lists and doing research.

- Drafting teasers, decks, and data summaries.

- Answering repeated questions during early due diligence.

AI can automate large parts of this, so:

- Matching and outreach to buyers starts quickly, not months later.

- Marketing materials and numbers are drafted using your data, then refined by human experts.

- You can often get to first conversations and offers much faster than with purely manual processes.

Expert advisory, enhanced by AI

AI is not a replacement for judgment - it is a force multiplier.

- You still get expert human M&A advisors who understand your sector and how buyers think.

- AI helps them:

- Position your business in a way that resonates with each buyer type.

- Prepare Wall Street-grade materials without Wall Street-level fees.

- Back up your valuation story with data and comps, not just words.

The end result is a process that combines:

- Deep human expertise, and

- Powerful AI tooling,

to give you a better shot at the right buyer, stronger terms, and a higher price.

If you’d like to understand how Eilla AI’s AI-native process could support your exit, book a demo with one of our expert M&A advisors and we can walk through what this might look like for your specific web hosting business.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.