The Consolidation Wave of Digital Marketing Agencies in Europe

Not every digital agency is in demand. The market is clearly segmenting between agencies that are becoming more attractive consolidation targets and those at risk of being left behind.

Something interesting is happening in the digital marketing agency space.

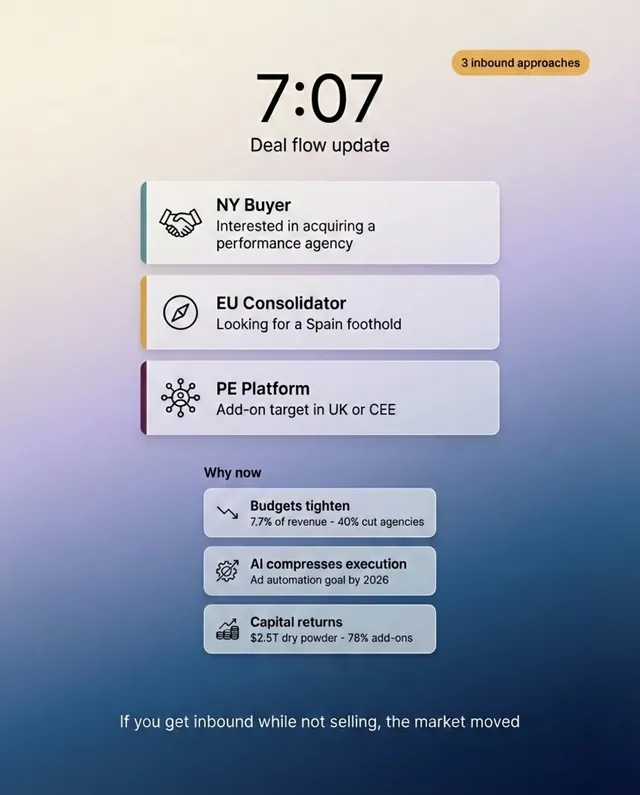

A Spanish digital agency we spoke with - focused on performance marketing, never publicly listed, never shopped themselves - received two separate acquisition approaches in a single month. Both came from New York. The founders had never talked to anyone about selling. They were, in their words, "just focused on growing the company."

When we asked if they'd seen anything like this before, the answer was unambiguous: never. Not in five years of running the business.

This pattern keeps repeating. A UK performance agency that's been fielding buyer interest for years told us the pace has changed - three contacts in the past month alone, most from outside their home market.

We're not drawing dramatic conclusions from a handful of conversations. But when founders who aren't selling start getting approached by buyers who are, it suggests something structural is shifting.

What's Actually Driving This

The consolidation wave in digital marketing isn't mysterious. It's the predictable result of three forces colliding.

First, brands are cutting agency rosters. Gartner's 2025 data shows marketing budgets have flatlined at around 7.7% of company revenue for two consecutive years. Nearly 40% of CMOs plan to reduce agency allocations. When clients want fewer partners with broader capabilities, agencies respond by acquiring what they're missing - or getting acquired by someone who can assemble a fuller offering.

Second, AI is compressing the value of manual execution. Campaign setup, iterative creative versions, basic reporting - the work that traditionally justified agency headcount is increasingly automatable. Meta has publicly stated its goal of fully automating ad creation and targeting by the end of 2026. Platform-native AI tools are making it easier for brands to handle performance marketing in-house. This doesn't eliminate agencies, but it changes which ones remain valuable.

Third, financing conditions have improved. Interest rates are declining, and private equity has significant dry powder - industry estimates put it around $2.5 trillion. Buyers who paused during tighter conditions are now back in market. Add-on acquisitions (where a PE-backed platform buys smaller agencies to bolt on capabilities) accounted for nearly 78% of private equity buyouts in digital marketing in 2024, according to industry tracking.

The combination isn't subtle: clients want consolidated solutions, AI is pressuring commoditized work, and capital is available to fund roll-ups. The result is a market where mid-sized agencies - especially those with differentiated capabilities - are suddenly getting attention they didn't seek.

Who's Actually Buying

The buyer universe has expanded in ways that catch many founders off guard.

The obvious acquirers are still active - agency holding companies like WPP, Publicis, and Omnicom continue making strategic acquisitions, often focused on data infrastructure, identity assets, and commerce capabilities. Omnicom's recent merger with Interpublic, targeting over $750 million in annual cost synergies, reflects the scale-driven logic at the top of the market.

But the more interesting shift is happening in the middle market. We're seeing three buyer profiles show up repeatedly.

Cross-border consolidators seeking European entry points. US-based groups and non-European buyers are explicitly targeting UK and CEE agencies as beachheads. The logic is straightforward: buy a local agency with established client relationships and delivery capabilities, then use it to expand across the region. One founder we work with in CEE was approached by a buyer who wanted the whole ecosystem - the core agency, related entities, even the founder's personal brand.

PE-backed roll-up platforms. These aren't traditional private equity buyers looking for a quick flip. They're portfolio companies with a mandate to assemble full-funnel offerings through serial acquisitions. We're seeing them pursue performance agencies, creative shops, SEO specialists, and analytics firms - often in the same geography, often with aggressive timelines.

Corporate acquirers outside traditional advertising. IT services firms, consulting groups, and tech companies see digital agencies as cross-sell engines for their existing client bases. For them, the value isn't just the agency's revenue - it's access to client relationships and delivery expertise that can be leveraged across a broader service offering.

The common thread is that buyers increasingly want agencies as strategic assets, not just revenue streams. They're looking at client relationships, delivery models, data capabilities, and founder networks as components of a larger play.

What Makes an Agency Attractive Now

Not every digital agency is in demand. The market is clearly segmenting between agencies that are becoming more attractive consolidation targets and those at risk of being left behind.

The agencies drawing buyer interest tend to share certain characteristics.

Proprietary data or measurement capabilities. As privacy changes make third-party targeting harder, agencies with clean first-party data, robust attribution frameworks, or privacy-safe measurement infrastructure become more valuable. Buyers understand that AI-driven marketing depends on data quality, and they're willing to pay for agencies that have solved this problem.

Productized delivery models. Agencies that have moved beyond time-and-materials billing toward repeatable workflows, internal tooling, and outcome-based pricing are easier to integrate and scale. One agency we're working with developed an internal AI tool that automatically resizes creatives across formats - a capability that's attracted interest from enterprise clients and strategic buyers alike.

Specialized vertical focus. Generalist performance shops are more exposed to automation than agencies with deep expertise in specific sectors (healthcare, education, fintech) or channels (retail media, social commerce). Specialization creates defensibility that pure execution doesn't.

Founder-led networks and reputational assets. Buyers aren't just acquiring revenue - they're acquiring capabilities, relationships, and sometimes the founder's personal brand. Buyers use earn-outs, equity stakes, and retention structures specifically because they need the founder to make the integration work.

On the other side, agencies most at risk are those competing primarily on manual execution - campaign management, creative production at volume, basic optimization work. When platforms can automate this work and clients can self-serve, the value proposition erodes. Small performance shops without data assets, measurement IP, or vertical specialization are particularly exposed.

The Counterargument Worth Considering

Not every agency should be thinking about a sale right now. There are legitimate reasons to wait.

If your growth trajectory is steep and your margins are expanding, waiting allows you to capture more value. Selling into a consolidation wave means competing with other sellers; the buyers who approach you now will still be in market in two or three years. If you're mid-transition - shifting your service mix, building out a product capability, or expanding into new verticals - completing that work before going to market typically improves outcomes.

There's also the question of buyer fit. A founder we spoke with had an experience with a multinational acquirer stifled his local autonomy and made him wary with future acquisitions about buyers that don’t really get the process‑driven nature of performance marketing. The right buyer matters as much as the right price.

The point isn't that every founder should sell. It's that the market conditions creating buyer interest are structural, not cyclical - AI pressure, client roster simplification, available capital, cross-border expansion strategies. Founders who want to be thoughtful about timing have room to be selective. Founders who are completely ignoring the market may be leaving options unexplored.

What We're Seeing Play Out

The agencies we work with that are navigating this well share a few practices.

They're treating inbound interest as information, not pressure. When buyers approach, they're asking questions: What's driving your interest? What would an acquisition look like structurally? These conversations reveal what buyers are actually valuing and how your agency fits into their thesis.

They're preparing before they need to. The founders planning exits in 2028 aren't waiting until 2027 to get organized. They're optimizing operations, clarifying ownership structures, documenting processes and productizing their agencies early. Preparation done early is leverage preserved later.

They're being realistic about what they offer. The agencies attracting serious interest can articulate their differentiation clearly - the specific capabilities, client relationships, and operational advantages that make them valuable to a particular type of buyer. Generic positioning doesn't cut it when buyers are comparing targets across a consolidating market.

The consolidation wave in digital marketing isn't speculative. It's visible in the deal flow, in the buyer behavior, and in the conversations we're having every week. Whether that creates opportunity or pressure depends largely on how prepared you are to engage with it.

If you're running a digital agency and considering an exit in the next few years - or just trying to understand what the market looks like from the buyer's perspective - we're happy to have a conversation. A candid discussion about what we're seeing and how your agency might fit into the current landscape.

gn will protect your time while preserving leverage.

If you want, book a meeting with one of our M&A advisors. We will pressure-test your post-close use-case, map a realistic cross-border buyer universe for your category, and help you decide whether you should run a competitive process or a controlled bilateral path - with eyes open and less wasted motion.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.