The Real Cost of a Slow M&A Process Is the Drift

Most people describe M&A as a valuation problem. We think it’s just as often a time problem. The time before you get a real market signal creates drift and drift changes outcomes.

A founder gets an inbound offer and suddenly every week has a shadow attached to it.

You still have to run the business, but you also start living in a parallel world: “Are we selling? At what price? To whom? What happens if this drags on?” If you have a leadership team, they feel it too, even if you never say it out loud.

Most people describe M&A as a valuation problem. We think it’s just as often a time problem.

Not because “closing fast” is inherently good, but because the time before you get a real market signal creates drift, and drift changes outcomes.

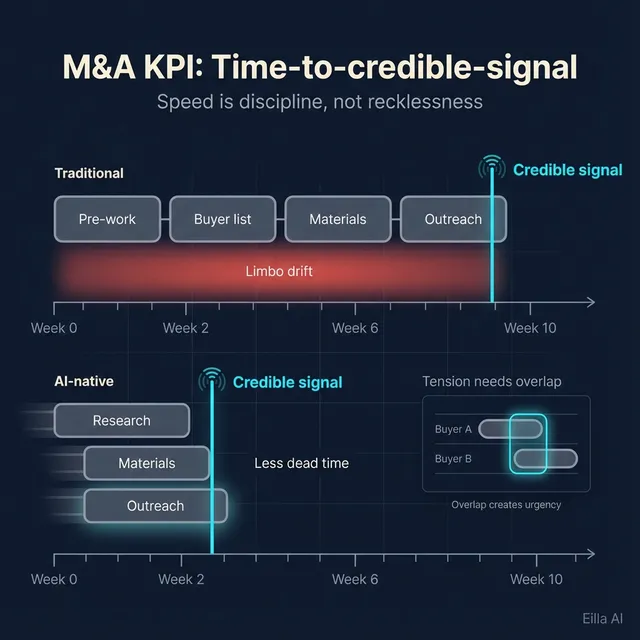

That's why I believe one of the most important KPIs in a sale process is the time-to-credible-signal.

What we mean by "signal"

A signal is not a polite email from a corp dev team saying they “love the space.”

A signal is one of three things:

- A serious buyer conversation that turns into diligence behavior (specific questions, data requests, internal resourcing)

- A non-binding offer with a number and clear terms

- Or a clear early “no,” with enough context to understand what would need to change for “yes”

When founders wait months for that, they pay for it twice: once in distraction, and again in leverage.

Most deals are not slow because of closing mechanics

Here’s a pattern we see across the market, and it shows up in public data too.

For many private deals, the end of the process can move relatively quickly once an LOI is signed. In some brokered markets, most deals that make it to LOI close in under 120 days. Meanwhile, small-business sale processes often average around 7-9 months end-to-end.

That gap matters because it tells you where the waste lives.

The slow part is frequently:

- the pre-work before outreach begins

- the manual build of a buyer list and actual outreach

- the back-and-forth of creating materials

- and the operational grind of running a process through decks, spreadsheets, inboxes, and a data room

Meanwhile, diligence itself has expanded in many corners of the market. In one large data-room-based analysis, pre-announcement diligence periods increased from around 124 days to around 203 days over the last decade. Whether you are selling a private company or a public one, the direction is the same: more stakeholders, more questions, more documentation, more cycles.

If the burden is rising, “waiting to start” becomes even more expensive.

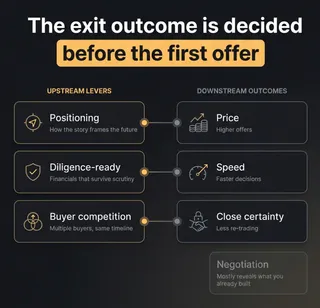

Why slow execution quietly kills competitive tension

Founders often assume competitive tension is created by “having many buyers.”

In practice, tension is created by overlap.

If Buyer A engages in March and Buyer B engages in May, you do not have tension. You have two separate negotiations where each buyer behaves like they are alone, because functionally they are.

When buyers believe time is abundant, a few predictable things happen:

- Your deal becomes a "background project"

- It competes with board meetings, quarterly planning, hiring fires, and ten other priorities. Background projects move at background speed.

- Diligence expands to fill the available time

- When there is no clear cadence, internal diligence becomes a never-ending list of "nice-to-haves."

- The buyer learns they can wait you out

- If the seller's process looks slow, the buyer assumes you will tolerate slow, which eventually leaks into price and terms.

A slow start also increases the odds that your process collapses into a single-buyer path, which is where leverage quietly disappears.

Fast execution changes the geometry because it creates overlap. Overlap creates urgency, and urgency changes buyer behavior.

What “AI-native execution” actually changes

When people hear "AI in M&A," they often imagine a chatbot writing a deck.

That's not what matters.

The bottleneck in traditional advisory workflows is operational: research, list-building, formatting, chasing inputs, assembling materials, and running Q&A through spreadsheets and inboxes. The "manual logistics" can consume weeks before the market even hears a whisper.

Traditional advisory operating models were built in a world where that manual effort was the only option. Great people can still run great processes inside that model, but the model itself is sequential and labor-heavy.

Our bet at Eilla is that the future of advisory is AI-native because it makes the process parallel.

Here's one concrete example: we can start outreach to a list with highly relevant buyers a company has approved in under 24 hours.

Practically, that means:

- We maintain a broad company universe dataset enriched from multiple sources, including structured signals on products, target markets, USPs, positioning and many others.

- An AI system that evaluates millions of signals to propose a buyer set based on patterns that matter in real deals: transaction history, strategic fit, financial characteristics, ownership context (including whether they're PE-backed), and more.

- Once the list is confirmed, we can start anonymous outreach quickly using a no-name teaser, so the seller can test the market without broadcasting. This outreach is highly tailored to address the synergies the buyer has with the target.

- Marketing materials like a teaser and a CIM can be drafted in days, then refined with human judgment rather than rebuilt from scratch for every revision.

This is not “AI replaces advisors.” It is “AI removes dead time so advisors can focus on judgment, negotiation, and process integrity.”

A short story: 2.5 weeks to a non-binding offer

We’re currently running a process for a digital marketing agency in Central and Eastern Europe.

We started outreach and received a non-binding offer 2.5 weeks later.

That number is not a promise, but it demonstrates what changes when dead time disappears. The seller got a real signal while momentum was high, which created options:

- Double down and accelerate with a tight timeline

- Use that offer as a benchmark to widen the market

- Or pause with clarity, rather than spending months in an expensive guessing game

Even a “no” is useful when it arrives early enough to act on.

The business cost of limbo is measurable

Founders often treat time as a soft cost because it does not show up as a fee line item.

But uncertainty has operating consequences.

Employees notice when something is happening, top performers get recruited, and leadership time shifts from building to explaining.

A slow sale process is not only a financing event. It is an operating environment, and it can become a drag on performance if it lasts too long without clarity.

“You can’t rush M&A” - agreed, so here’s what we actually control

There are real constraints you cannot compress:

- regulatory approvals and cross-border requirements

- third-party consents (leases, key customer contracts)

- buyer investment committee cycles

- genuine diligence issues that require cleanup

If someone tells you every deal can close in 45 days, skepticism is healthy.

What we can control is the dead space between steps, and the lack of cadence that turns a process into a slow bleed.

A fast, high-integrity process looks less like “skipping” and more like:

- parallelizing research, materials, and outreach

- setting a clear timetable for first indications of interest

- maintaining overlap so buyers feel the cost of waiting

- and running diligence with tight ownership and response cycles

Speed is not recklessness. Speed is discipline.

A simple founder diagnostic

Fast execution matters disproportionately if any of these are true:

- You received an opportunistic inbound offer and you need to know if it’s fair.

- The business is in a fragile moment (cash pressure, key contract renewal, founder burnout) and you cannot afford a six-month limbo.

- You suspect there are strategic buyers, but you are not sure who they are or how they think about your category.

- You want clarity quickly, even if the decision ends up being “not right now.”

In those situations, time-to-signal is not a nice-to-have. It is risk management.

A calm next step

If you’re considering a sale, or you are staring at an inbound offer and wondering what it’s really worth, we’re happy to talk.

Book a meeting with one of our M&A advisors and we’ll map out a process that aims to get you a credible market signal quickly, while protecting the business you worked so hard to build.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.