What Documents Are Required in an M&A Process? A Practical Guide for Founders

A stage-by-stage breakdown of the documents founders need in an M&A process.

Every founder who's been through a sale remembers the moment. You've built something valuable, you're exploring a transaction, and then your advisor sends over the first document request list. Sixty, eighty, sometimes over a hundred line items. Legal entity documents. Cap table reconciliation. Three years of board minutes. Customer contracts with all amendments and SOWs. A data room index. And that's before due diligence even starts.

The instinct is to feel behind. But the truth is simpler and more useful: M&A documents follow a predictable arc, and if you understand what's needed at each stage - and why - you can prepare months in advance instead of scrambling under deal pressure.

An M&A process typically requires documents across five stages: pre-marketing, marketing, due diligence, signing, and closing. The document set evolves from narrative (teasers and information memoranda that tell your company's story) to evidence (financial records, contracts, IP proof, and compliance artifacts that validate that story) to binding legal instruments (purchase agreements, disclosure schedules) to closing deliverables (funds flow, transfer documents, consents). The most common documentation gaps - messy financials, incomplete contract files, unclear IP ownership, and poorly structured data rooms - are also the most preventable.

How M&A Documents Evolve Across the Five Deal Stages

The simplest way to understand M&A document requirements is to follow the deal itself. Each stage has a different audience, a different level of depth and a different purpose - and the documents reflect that.

Pre-marketing is about internal readiness. You're assembling the raw material: corporate records, baseline financials, your cap table, key contracts and a clean NDA template. This is also when the marketing materials - the teaser and the Confidential Information Memorandum (CIM) - start getting built. If you're going to commission a vendor Quality of Earnings (QoE) report, this is when it happens.

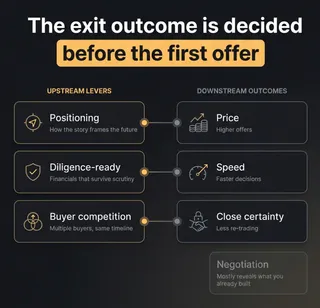

Marketing is about creating competitive tension. The document set is deliberately curated: an anonymized teaser goes out first, followed by the CIM and early data room access for buyers who sign NDAs. Process letters set bid deadlines and instructions. The goal is to generate enough interest to produce multiple indicative offers, which gives you leverage going into the next phase.

Due diligence is where documents shift from selling the story to proving it. The buyer's advisors drive a structured request list, often hundreds of items across financial, legal, tax, HR, IP, IT and compliance workstreams. Everything flows through the virtual data room (VDR), with a tracked Q&A log that becomes part of the deal record.

Signing converts diligence findings into binding terms. The definitive agreement (share purchase agreement or shareholders' agreement), disclosure schedules and ancillary agreements like transition services or escrow arrangements all come together here.

Closing is about execution: satisfying conditions, transferring ownership and moving money. Funds flow memos, payoff letters, lien releases, closing certificates, regulatory clearances and third-party consents all need to land on time.

The pattern worth remembering is that each stage narrows the audience and deepens the scrutiny. In marketing, hundreds of buyers might see your teaser. By due diligence, two or three are in the data room. By closing, it's one buyer, their lender and a stack of lawyers making sure every deliverable is in order.

What Is the Difference Between a Teaser and a CIM in M&A?

The teaser and the Confidential Information Memorandum are both marketing documents, but they serve fundamentally different purposes - and confusing them is a common mistakes founders make early in a process.

A teaser is a 3 or 4 page document, typically anonymized, that gives prospective buyers just enough information to decide whether they want to learn more. It describes the business at a high level - sector, geography, approximate size, growth trajectory and the investment thesis - without revealing the company's name. The teaser goes out before any NDA is signed, which is why anonymity matters. Its job is to generate interest efficiently across a broad buyer universe.

A CIM (sometimes called an Information Memorandum or IM) is the primary marketing document of the deal. It's detailed, typically 30-60 pages, and covers the company's history, products or services, market positioning, financial performance, growth strategy, team, and key risks. The CIM is only shared after buyers execute an NDA, and it's the document that buyers use to formulate their initial bids.

The distinction matters for three reasons:

- Information control. Releasing detailed information without an NDA in place is a serious process risk. The teaser-first approach lets you reach hundreds of potential buyers without exposing sensitive data.

- Competitive tension. A well-crafted teaser generates a wide initial funnel. A compelling CIM converts that interest into serious bids. Skipping the teaser and going straight to CIM conversations often means fewer buyers see the opportunity, which weakens your negotiating position.

- Narrative quality. The CIM is where you control the story of your business. A strong CIM doesn't just report numbers; it explains why the business performs the way it does, what drives growth, and why this is the right time for a transaction. Founders who treat it as a data dump rather than a strategic narrative consistently leave value on the table.

One practical note: the CIM should be consistent with what buyers will find in due diligence. If the CIM claims 40% revenue growth but the data room shows 32% on a like-for-like basis, trust erodes fast - and trust is the currency of deal momentum.

Why the Financial Model Matters More Than Most Founders Expect

Most founders preparing for an M&A process focus on historical financials - audited statements, tax returns, management accounts. Those are table stakes. What often gets underestimated is the financial model: a forward-looking projection that shows how the business is expected to perform under various assumptions.

A well-built financial model does three things in an M&A context that historical financials cannot do alone.

First, it anchors the valuation conversation. Buyers don't pay for what your business did last year; they pay for what they believe it will do going forward (adjusted for risk). Your financial model is where those assumptions live - revenue growth rates, margin expansion, customer retention, capital expenditure, and working capital needs. If you don't provide a credible model, the buyer will build their own, and their assumptions will almost always be more conservative than yours.

Second, it exposes your understanding of your own business. A model that can't explain its own assumptions - "why does gross margin improve from 62% to 68% in year three?" - signals that the founder doesn't fully understand their unit economics. Buyers notice. Conversely, a model that clearly ties assumptions to operational drivers (pricing changes, headcount plan, contract renewals, expansion revenue) builds confidence and reduces the "risk premium" that buyers bake into their offers.

Third, it becomes the basis for earn-out and working capital negotiations. If part of your purchase price is deferred or contingent on future performance, the definitions and targets in that earn-out will often trace back to the financial model's assumptions. Getting those assumptions right - and documented - before negotiations start gives you a much stronger position than trying to negotiate them reactively.

How to Structure a Data Room for an M&A Transaction

A virtual data room is not a file repository. It's the operational backbone of your deal process, and its quality directly affects how quickly buyers can complete diligence, how much confidence they have in your business, and ultimately how competitive the final bids are.

The UK government's guidance on selling a business explicitly notes that a well-organized data room is a strong signal of management quality and readiness. Industry practitioners consistently reinforce that poor data room organization stalls momentum and reduces leverage. That's not abstract: a disorganized data room can add two to four weeks to a diligence process, and by that point, you may have lost a bidder or two.

Data room structure best practices come down to five principles:

Mirror the diligence workstreams. Organize your top-level folders to match the categories buyers expect: corporate/entity, financial, tax, legal/contracts, HR, IP/technology, IT/cybersecurity, regulatory/compliance, and commercial. This isn't about being rigid - it's about making sure a buyer's legal team, financial advisors, and technical diligence providers can each find what they need without asking you to reorganize mid-process.

Use staged disclosure. Not every document should be available from day one. A common approach is to open a "Phase 1" data room during marketing (enough to support initial bids), then expand to "Phase 2" with more sensitive material (customer-level revenue data, employment contracts, detailed IP records) once you've shortlisted serious buyers. This protects sensitive information and maintains leverage.

Version control is non-negotiable. Every document should have a clear date, version number, and owner. Mixing draft and final versions, or leaving outdated financials alongside current ones, is a surprisingly common mistake that creates confusion and undermines credibility. The data room should feel like a curated information architecture.

Name files consistently. This sounds trivial, but it isn't. A naming convention like [Category]_[Document Type]_[Date]_[Version] saves hours of confusion. When a buyer's lawyer is reviewing 400 documents at midnight before a bid deadline, findability matters.

Founders who treat their data room like a product launch - with clear information architecture, deliberate sequencing, and quality control - tend to run faster processes. The data room is the first "product" the buyer experiences from your management team, and first impressions carry into negotiations.

The Documentation Gaps That Actually Delay Deals and Erode Value

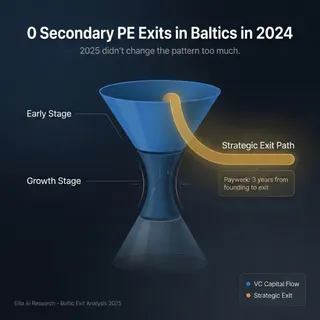

Not all documentation gaps are equal. Some are inconveniences; others are deal-threatening. McKinsey has observed that deal delays have affected roughly 30% of major acquisitions over a recent two-year period, and those delays shift leverage, invite re-trades, and sometimes kill transactions entirely.

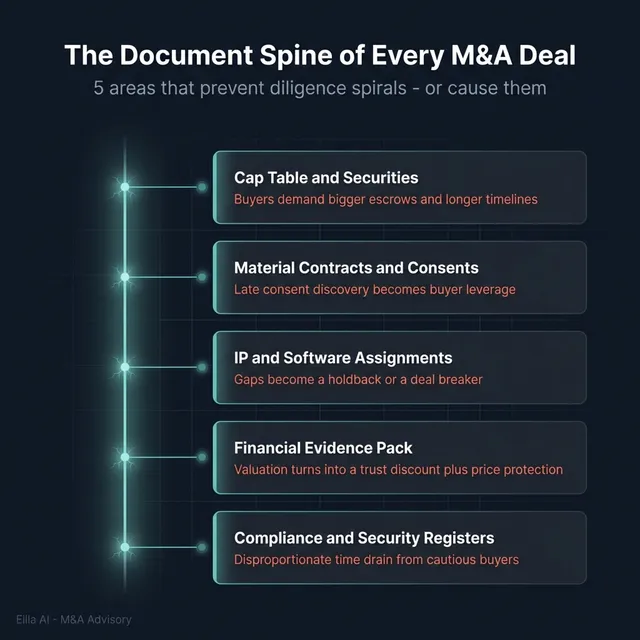

Based on what we've seen and consistent with what warranty and indemnity (W&I) insurance claims data shows, the documentation problems that cause the most damage cluster around a few recurring categories.

Financial records that don't survive scrutiny

This is where re-trades are born. If the buyer's QoE provider can't validate your earnings quality - because there's no reliable monthly close, revenue recognition isn't documented, or there's no clear bridge from reported to normalized EBITDA - the valuation conversation reopens. Claims data from W&I insurers consistently shows financial statement issues as one of the leading categories of post-close disputes. The fix isn't complicated: maintain a monthly close calendar, keep a commercial pack you regularly update and build your EBITDA bridge before you go to market.

Cap table and equity record mismatches

If your cap table doesn't reconcile with your stock ledger, board minutes, and signed equity agreements, the buyer's legal team will flag it immediately. SAFEs and convertible notes that aren't modeled cleanly, option grants missing signed agreements or board approvals, and phantom equity without proper documentation all create the same problem: the buyer can't confirm who owns what. This expands legal diligence, increases escrow or indemnity demands, and delays signing. A quarterly cap table audit, reconciling charter documents with the actual ledger, is one of the highest-ROI preparation activities a founder can undertake.

Missing contract amendments and SOWs

"Here are our contracts" is not the same as "here is the full contract stack." Missing amendments, side letters, SOWs, order forms, and pricing exhibits mean the buyer can't validate revenue durability or margin structure. Material contracts are consistently among the top categories in W&I claims reports, alongside financial statements. Build a contract repository with a schedule that includes term, renewal date, termination provisions, pricing mechanics, and change-of-control clauses - and make sure it matches what's actually in effect.

Change-of-control and consent requirements discovered late

This is a surprisingly common deal-breaker. Many commercial contracts, leases, and financing agreements contain change-of-control provisions that require third-party consent before a transaction can close. If nobody identifies these until late in diligence, the consent process becomes a closing condition that counterparties can use to delay, renegotiate or extract concessions. The solution is clause extraction early in the process: draft notice templates and sequence outreach well before you need the consents in hand.

IP chain-of-title gaps

For technology businesses especially, unclear ownership of key intellectual property - missing invention assignment agreements from early employees or contractors, unclear domain ownership, joint development agreements with universities or partners - can be severe. Buyers who fear they're not acquiring what they think they're acquiring will either reduce the price, expand holdbacks or in some cases walk away. Building an IP "chain-of-title binder" with signed assignments, contractor agreements, an IP schedule and registration records is essential preparation.

Data room hygiene

This one doesn't get enough attention. A data room with no clear index, inconsistent naming, old versions mixed with current documents, and no Q&A audit trail doesn't just slow things down - it signals to buyers that the management team may not be detail-oriented, which colors their perception of everything else they find.

A Note on Regional Differences: Europe vs. the United States

Document requirements shift meaningfully depending on jurisdiction. A few differences are worth flagging because they affect both the scope and the timing of your preparation.

Marketing materials and tone vary more than most founders expect. US deal materials - particularly CIMs - tend to be more narrative-driven and sales-forward, leading with the growth story, TAM projections, and a clear investment thesis. European materials, especially in the DACH market, typically lean more conservative: heavier on detailed financials, more measured in tone, and less comfortable with aggressive positioning. If you're running a cross-border process, your materials may need to work for both audiences - which usually means building a strong factual foundation that can support a more assertive narrative layer, rather than choosing one style and hoping it translates.

Privacy and data sharing operates differently under GDPR compared to the US patchwork of state laws. In Europe, what you can show in the data room - especially HR and customer data - is constrained by GDPR requirements around lawful basis, minimization, and documentation. The UK's ICO explicitly addresses M&A as a scenario where data sharing must be governed during diligence. In practice, this means European deals often require redaction protocols, clean team arrangements, and specific privacy documentation (data maps, records of processing, DPAs) earlier in the process than US deals typically do.

Employee consultation is structurally heavier in Europe. Works council and union notification requirements can change timing and disclosure strategy. In asset deals, "transfer of undertakings" protections (TUPE-style) mean employee rights and certain liabilities transfer with the business, which requires specific diligence and documentation.

Regulatory approvals can stack up differently. EU deals may require parallel merger control filings (EU and/or national), Foreign Direct Investment (FDI) screening, and since relatively recently, Foreign Subsidies Regulation (FSR) filings for larger deals. US deals typically center on HSR (Hart-Scott-Rodino) premerger notification and, for sensitive sectors, CFIUS review. Worth noting: the FTC's expanded HSR form requirements, finalized in 2024, were vacated by a federal court in February 2026, so deal teams should confirm current filing requirements at launch.

The practical takeaway is that if your business operates across borders, document preparation needs to account for the most demanding jurisdiction in your footprint, not just your home market.

Founder M&A Document Preparation Checklist

The best time to start preparing M&A documents is six to twelve months before you plan to go to market. The second-best time is now. Here's a practical checklist organized by the five "source-of-truth schedules" that reduce buyer confusion and force internal consistency.

1. Corporate and Equity Package

- Cap table fully reconciled with stock ledger, signed agreements, and board minutes

- All SAFE/convertible instruments modeled with conversion mechanics documented

- Option grants matched to signed agreements, board approvals, and vesting schedules

- Entity structure documented (org chart with ownership percentages)

- Charter/formation documents current, with all amendments collected

- Three to five years of board and shareholder minutes/consents assembled

2. Financial Evidence Pack

- Monthly close process in place (even if informal) with documented accounting policies

- Profit and loss statements (monthly, for at least 24 months) with clear categorisation of revenue streams, cost of goods sold, and operating expenses

- Revenue broken down by customer, product, and geography

- EBITDA bridge built (reported to normalized, with adjustments documented)

- Working capital history (24-36 months) with AR/AP aging and deferred revenue schedules

- Budget/forecast with clearly stated assumptions tied to operational drivers

3. Material Contracts Schedule

- Complete contract repository with all amendments, SOWs, order forms, and side letters

- Contract schedule with term, renewal, termination, pricing, and key clauses

- Change-of-control and assignment provisions flagged for every material contract

- Top customer and supplier concentration documented

4. IP and Technology Package

- IP schedule (registrations, applications, prosecution status)

- Signed invention assignment agreements from all employees and contractors

- Inbound and outbound license inventory

- Open-source component inventory (SBOM) with license compliance status

- Domain and trademark ownership confirmed and documented

5. Compliance and HR Package

- Employee census (role, location, start date, compensation, equity)

- Contractor list

- Benefits documentation (plan docs, vendor contracts, summaries)

- License and permit register with renewal dates and change-of-control triggers

- Tax filing index (income, payroll, sales tax/VAT) with returns and notices assembled

If you have the runway, three additional "sell-side diligence" investments tend to have the highest ROI in preventing re-trades during the process: a sell-side Quality of Earnings report (or QoE-lite for smaller deals), an open-source and security scan and a tax health check on payroll, sales tax/VAT, and known exposures. These target the exact areas where post-close disputes and W&I insurance claims tend to cluster.

Key Takeaways

- M&A document requirements follow a predictable five-stage arc: pre-marketing, marketing, due diligence, signing, and closing - each stage narrowing the audience and deepening scrutiny.

- The teaser and CIM serve fundamentally different purposes: the teaser generates broad interest anonymously, while the CIM is the detailed marketing document that drives initial bids after NDA execution.

- A well-built financial model anchors valuation, demonstrates operational understanding, and shapes earn-out and working capital negotiations - historical financials alone are not enough.

- Data room structure directly affects deal speed and bid quality: mirror diligence workstreams, use staged disclosure, enforce version control, and track Q&A formally.

- The documentation gaps that cause the most deal delays and value erosion are predictable: messy financials, cap table mismatches, incomplete contract files, late-discovered consent requirements, and unclear IP ownership.

- Regional differences between Europe and the US (especially around privacy, employee consultation, and regulatory approvals) can meaningfully change both the scope and timeline of document preparation.

- Founders who build well outlined "source-of-truth schedules" (corporate/equity, financial evidence, contracts, IP/technology and compliance/HR) early on or before the process starts dramatically reduce process friction and protect deal value.

- Treat the data room like a product launch: the quality of your document preparation is the first signal buyers receive about the quality of your management team.

Frequently Asked Questions

What is the difference between a teaser and a CIM in M&A? A teaser is a short, typically anonymized document (one to two pages) designed to generate initial buyer interest before any NDA is signed. A CIM is the detailed marketing document (usually 20-40 pages) shared after NDA execution, covering financials, operations, growth strategy, and team - it's what buyers use to formulate their first bids.

What should a data room include when selling a company? A well-structured M&A data room typically includes 10-15 top-level folders covering corporate/entity documents, financials, tax, legal/contracts, HR, IP/technology, IT/cybersecurity, data privacy, regulatory compliance, insurance and commercial information. The key is staged disclosure - not everything needs to be available from day one - and a clean folder structure that mirrors how buyer advisors conduct diligence.

What are the most common M&A document mistakes that delay deals? The highest-frequency issues are financial records that can't support the story in the CIM (especially around revenue recognition and EBITDA adjustments), cap table mismatches, missing contract amendments and SOWs, late-discovered change-of-control consent requirements and IP ownership gaps. These problems don't just slow diligence - they shift leverage to the buyer and often result in price adjustments.

Do M&A document requirements differ between Europe and the US? Yes, meaningfully. European deals typically require additional privacy documentation and data room controls under GDPR and potentially employee consultation procedures (works councils, TUPE) and regulatory filings (EU merger control, FDI screening, Foreign Subsidies Regulation). US deals focus more on HSR premerger notification, state-level privacy compliance, and CFIUS review for sensitive sectors. Even the marketing materials differ in style - US CIMs tend to be more narrative-driven and sales-forward, leading with the growth story and investment thesis, while European materials (particularly in DACH market) lean more conservative, with heavier emphasis on detailed financials and more measured positioning. Cross-border processes often need materials that work for both audiences.

Why is a financial model important when selling a company? Buyers price businesses based on expected future performance, not just historical results. A credible financial model with clearly documented assumptions anchors the valuation conversation, demonstrates that you understand your own business, and provides the framework for negotiating earn-outs and working capital adjustments. Without one, the buyer builds their own model with more conservative assumptions.

If you're a founder considering a sale in the next 12-24 months and want to understand where your documentation stands, our M&A advisory team is happy to walk through what preparation looks like for your specific situation.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.