What's Different About French Small-Cap M&A Valuations?

French small-cap M&A is a market where majority of transactions remain purely domestic. It's a separate ecosystem. And the valuation picture is counterintuitive.

I've been doing deep-dives into M&A markets across Europe recently and one stands out as operating by different rules entirely. Not Germany, with its Mittelstand dynamics. Not the UK, despite its post-Brexit recalibration. France.

Specifically: French small-cap M&A, below €10 million in turnover. A market where majority of transactions remain purely domestic, and where the conventions around how deals get structured, documented, and priced diverge meaningfully from what cross-border buyers and sellers typically expect.

This isn't a well-known arbitrage opportunity waiting to be exploited. It's subtler than that - and more useful once you understand it.

The 5-Page Memo Problem

A French M&A advisor we spoke with recently described his typical deal process: for a €3.5 million transaction, he produces a 5-page memo. Quick, business-oriented, focused on the fundamentals needed for a straightforward transition.

By international standards - particularly the UK or US-influenced processes - this would be considered radically thin. A comparable deal elsewhere might generate 20-50 pages of analysis: quality of earnings work, detailed customer concentration breakdowns, three-year projections with sensitivity cases. The full mid-market treatment.

Neither approach is wrong. But they reflect fundamentally different market expectations.

The French advisor noted that 80% of his deals are simple business transitions - retirement scenarios, straightforward management buyouts, founders moving on. He also noted 90-95% of the transactions remain purely domestic and only 5-10% have any European or international scope. These transactions don't require the analytical infrastructure designed for growth-equity deals. They need efficient matching between ready sellers and qualified buyers, with enough documentation to close.

What the Multiples Actually Show

Given this isolation, you might expect French small-cap valuations to be dramatically cheaper than European peers. The reality is more nuanced.

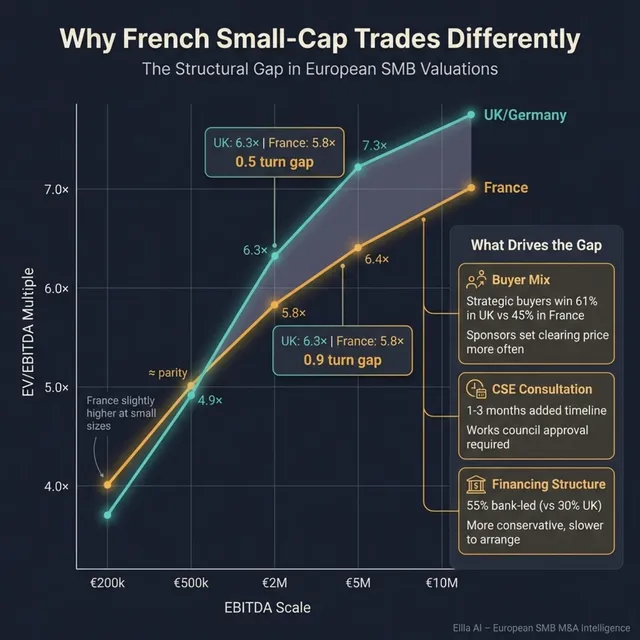

Looking at cross-border data from market surveys covering Western European mid-market transactions, the picture varies significantly by deal size:

At the smaller end - companies with around €500k in EBITDA - France actually trades slightly higher than the UK and on par with Germany. At this scale, the simplified French process may be an advantage: less friction, faster closes, buyers comfortable with the methodology.

The gap opens at larger small-cap deals. By the time you reach €2 million in EBITDA, UK deals clear at roughly 6.3x while French deals clear at 5.8x - about half a turn lower. At €5 million EBITDA, the gap widens to nearly a full turn: UK at 7.3x versus France at 6.4x.

The overall market averages look even closer: France at 5.25x versus UK at 5.30x versus German-speaking markets at 5.55x. But these averages mask the size-based divergence that matters for specific deals.

Why the Gap Widens as Deals Get Larger

Three structural factors explain why French small-cap valuations compress relative to peers as transaction size increases.

The buyer universe shifts. In the UK, strategic acquirers - corporations looking for synergies - top the winning bid in roughly 61% of competitive processes. In France, that figure drops to 45%, with financial buyers (sponsors constrained by leverage and return targets) more frequently setting the clearing price. Strategic buyers can pay more because they underwrite synergies; financial buyers are disciplined by their fund economics. More sponsor-driven competition tends to compress headline multiples.

Process friction increases with complexity. French employment law requires works council (CSE) consultation before any binding agreement in many change-of-control situations, with typical timelines of one to three months depending on complexity. The Loi Hamon provisions require employee notification at least two months before signing for smaller companies. These requirements create legitimate protection for workers - and also add timeline uncertainty, leak risk, and negotiating complexity that international buyers factor into their bids. For simple succession deals, this matters less. For larger, more complex transactions, it compounds.

Financing is structured differently. French M&A financing remains more bank-dominated than the UK or Benelux markets. Market data suggests banks account for roughly 55% of financing in French mid-market transactions versus 30% in the UK. Bank-led financing tends to be more conservative on leverage and slower to arrange than private credit, which can cap how aggressively sponsors bid.

These structural features shape how deals clear. Understanding them matters whether you're buying or selling.

What This Means If You're Selling to French Buyers

If you're a founder considering French acquirers for your business, the simplified documentation expectations cut both ways.

On one hand, French corporate buyers accustomed to domestic processes may find standard international information packages excessive. A 60-page CIM and detailed data room may signal "this is going to be complicated" rather than "this seller is well-prepared." Matching the documentation to buyer expectations isn't dumbing down - it's appropriate calibration.

On the other hand, French buyers operating cross-border have often adapted to international norms. The cultural and language expectations remain, though. Documentation in French isn't a courtesy; for many French buyers, it's a requirement. Materials that assume English fluency may narrow your buyer universe without you realizing it.

The practical implication: if French buyers are in your target set, understand that you may be dealing with different process expectations, not just different valuation benchmarks. An advisor who understands both conventions can help you navigate the gap.

The Counterargument Worth Considering

A reasonable skeptic would point out that if French small-cap were genuinely undervalued, cross-border capital would have already corrected the gap. Markets are competitive. Obvious mispricings get traded away.

This is largely correct. The French discount, where it exists, is compensation for real complexity - and when high-quality assets go through properly run processes with international outreach, the gap tends to shrink or vanish entirely. You're not going to find a great French company trading at half UK multiples because advisors forgot to call international buyers.

What remains is a structural feature: a market where domestic conventions create friction for cross-border participants on both sides. Sellers accustomed to international processes may find French buyers unfamiliar. Buyers accustomed to UK-style execution may find French processes slower and more contingent.

The value isn't in the mispricing. It's in the translation.

What We Take from This

French small-cap M&A isn't a hidden gem or a market failure. It's a distinct ecosystem operating by its own conventions, connected to but separate from the broader European M&A market.

For founders weighing exit options, this means understanding which buyers require which processes - and which advisors genuinely know both systems versus which are guessing.

If you're considering selling your business, we'd welcome a conversation about how the process actually works.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.