Why Baltic Founders Are Exiting Earlier

The reality of the Baltic M&A market is reshaping how Baltic founders think about exits - and in many cases, making earlier exits is a smarter strategic choice.

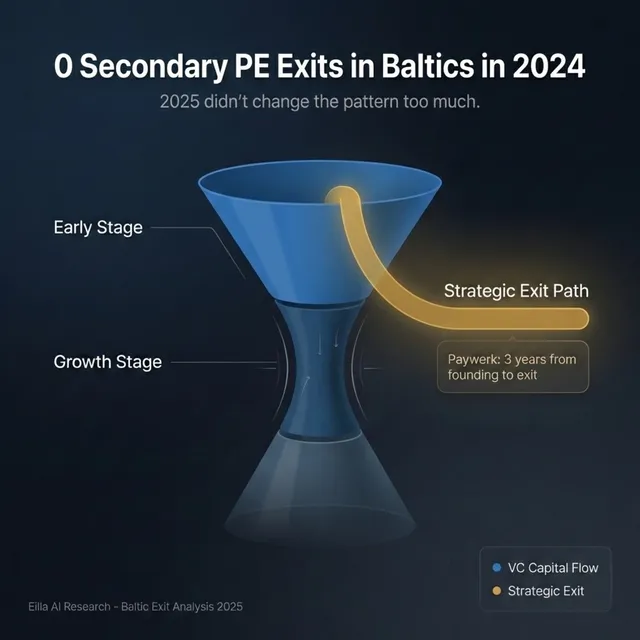

In 2024, something notable happened in Baltic venture capital: for the first time since 2017, there were zero secondary PE exits. Not a slowdown - zero. Meanwhile, trade sales rebounded, and growth-stage funding hit its lowest level since 2019.

2025 didn't change the pattern too much. Total PE and VC investment across the Baltics fell 56% through October according to S&P data. The share of startups raising €300k to €1m dropped from 41% to 24%, while smaller seed checks and larger rounds for proven companies held steady. Investors avoided the in-between.

Yes, there are headlines. Lithuania saw €168m in H1 (5x the prior year), but that was driven by a few massive rounds like Cast AI (€95m). Latvia's funding jumped 190%, but Aerones alone accounted for 72% of the total. Estonia was down 28%. A few big wins, but not a broad rebound.

These aren't disconnected data points. They're the structural reality that's reshaping how Baltic founders think about exits - and in many cases, making earlier exits the smarter strategic choice.

The math that changes the calculus

The traditional venture narrative assumes a clear progression: raise seed, raise A, raise B, scale to dominance, exit via IPO or major acquisition. It's a compelling story. It's also increasingly disconnected from what's actually available to founders building in smaller ecosystems.

Consider the Baltics: three countries with a combined population of around 6 million people. For context, that's smaller than the San Francisco Bay Area. The domestic market isn't a runway - it's a launchpad you're forced to leave almost immediately.

This creates a specific capital dynamic. According to KPMG's Baltic PE/VC market data, early-stage VC funds now hold around €800 million of the region's €1.08 billion in dry powder. Early-stage activity is healthy. But when you look at growth-stage funding, the picture shifts dramatically - the Change Ventures and FIRSTPICK funding report noted that H2 2024 growth funding hit its lowest point since 2019.

The gap matters because it shapes what's actually possible. When Series A and growth rounds are structurally harder to close - not because your company isn't good, but because the capital formation at that stage is thinner - the expected value calculation for "hold and raise more" changes.

What founders are actually choosing

The clearest articulation of this logic came from a recent Baltic fintech exit. When Swedbank acquired Paywerk in 2024, the founders were direct about their reasoning: building distribution independently was "complex and expensive," the standalone strategy was "very capital-intensive," and they couldn't find an investor to support that approach in the current environment.

This isn't a story about failure. Paywerk was founded in 2021 and acquired in 2024 - a three-year path to liquidity with a strategic buyer who could solve the distribution problem that would have required years of additional capital and execution risk to build independently.

The Nordigen acquisition tells a similar story from a different angle. When GoCardless acquired the Latvian open banking company in 2022, both co-founders transitioned into senior leadership roles - one as VP of Bank Account Data, the other as VP of Product. They didn't exit the game. They gained access to GoCardless's distribution, brand, and resources while continuing to build.

These aren't outliers. They're increasingly the template for how rational founders in capital-constrained ecosystems are thinking about outcomes.

What "smarter" actually means

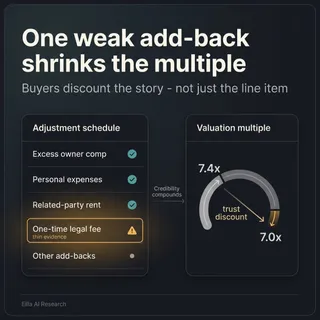

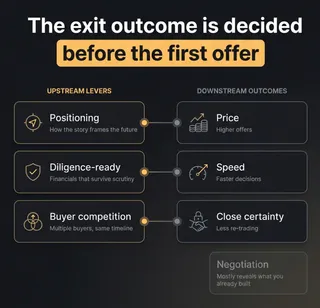

Earlier exits aren't automatically smarter. What makes them smarter is when founders have clear-eyed information about three things: what their realistic alternatives are, what acquirers are actually willing to pay, and how deal structures affect their actual liquidity.

The first question is about capital availability. In the Baltics, foreign investors accounted for 70% of capital raised by fund managers in 2024, with over half coming from outside the EU entirely. That's not inherently problematic, but it means the ecosystem is more exposed to global risk-on/risk-off cycles. When global growth capital tightens, the effects hit disproportionately hard.

The second question is about valuation. What we do know is that most European exits where values are disclosed fall below €25 million, and the larger exits remain concentrated in Western European markets with deeper capital bases.

The third question - deal structure - is where many founders underestimate complexity. A CMS's European M&A study from 2023 shows that earn-outs appear in around 23% of European deals, but they're "most frequently used on small deals below €25 million." That's exactly the category where most Baltic exits fall. Understanding whether you're getting cash at close versus performance-contingent payments over two to three years is the difference between liquidity and an extended bet on integration going well.

Smarter exits happen when founders have visibility into all three of these dimensions before making decisions, not after.

When holding is the right call

None of this means earlier exits are always the right choice. Some Baltic companies are building in categories where the strategic acquirer universe is small, where the product advantage compounds dramatically with scale, or where the team has specific access to growth capital that changes the expected value calculation.

The relevant question isn't "should Baltic founders exit earlier?" - it's "what does this specific founder's realistic outcome distribution look like, and how does an exit offer today compare to that distribution?"

For a company with a clear Series B lead, strong unit economics, and a differentiated position in a large market, passing on a €30 million acquisition to pursue a €150 million outcome in three years might be entirely rational. For a company facing a thin pipeline of growth investors, high distribution costs, and a buyer offering a clean structure today, the calculation looks different.

What makes this decision hard is that the inputs are often unclear. Founders know their product better than anyone. They usually have less visibility into what acquirers in their space are actually paying, how deal structures are trending, and what the realistic timeline and terms for their next funding round would be.

The information asymmetry problem

Strategic acquirers - whether Nordic, European, or American - have significant advantages in these conversations. They've done dozens of similar deals. They know what they've paid for comparable assets. They understand how to structure earn-outs and retention packages to align incentives in their favor.

Founders doing their first or second exit are often operating with far less information. They may not know that a buyer's initial offer is 40% below where recent comparable deals closed. They may not realize that the earn-out structure being proposed has terms that make achieving the targets significantly harder than the headline number suggests.

This asymmetry is where earlier exits go from "smart" to "smarter." The difference isn't about whether to exit - it's about exiting with accurate information about what you should be getting.

The data supports this: foreign buyers accounted for 43% of Baltic deals in 2024, with Sweden, the US, Germany, the UK, and Finland among the most active. These are sophisticated acquirers who do this regularly. Founders meeting them with equivalent information about market pricing and deal structures negotiate different outcomes than founders operating in the dark.

What this means practically

If you're a Baltic founder - or any founder in a smaller ecosystem with constrained growth capital - the strategic question isn't whether earlier exits are good or bad, but what that market conditions means for your company.

If you're currently considering and exit for your company, speak with one of our M&A advisors and we can further discuss how we can support.

Are you considering an exit?

Meet one of our M&A advisors and find out how our AI-native process can work for you.